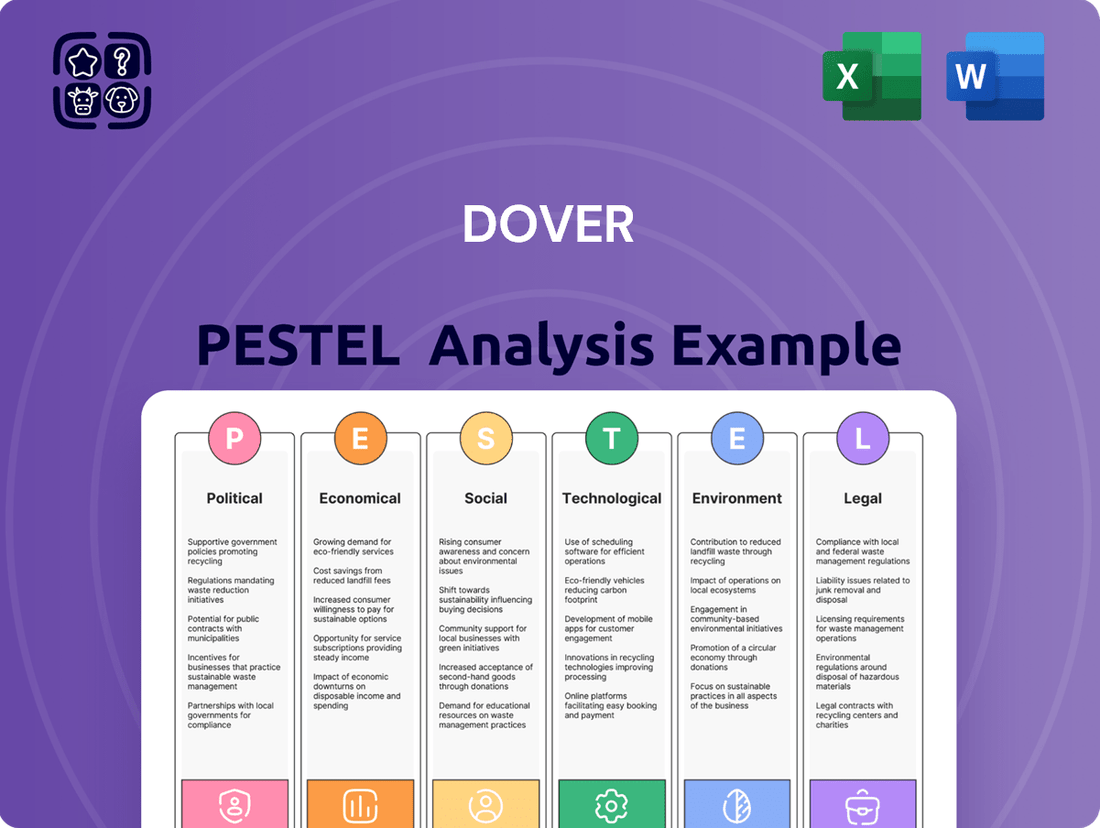

Dover PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dover Bundle

Gain a strategic advantage by understanding the external forces shaping Dover's future. Our comprehensive PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with actionable intelligence to navigate challenges and capitalize on opportunities. Download the full version now for a complete, in-depth understanding.

Political factors

Dover Corporation's diverse operations mean it navigates a complex web of government policies and regulations worldwide. Shifts in trade agreements, tariffs, and industry-specific rules directly impact its cost structures, ability to enter markets, and overall competitiveness. For example, potential tariffs on imported steel, a key material for its vehicle services segment, could increase operational expenses.

Dover's extensive global operations are significantly influenced by international trade agreements and evolving geopolitical landscapes. Changes in trade policies, tariffs, and sanctions can directly affect its cost of goods sold and market access, impacting its profitability across various segments like Engineered Products and Imaging & Identification. For instance, the ongoing trade tensions between major economies in 2024 could necessitate adjustments in Dover's supply chain strategies to mitigate potential disruptions and increased duties on components or finished goods.

Political stability in Dover's operating regions is a critical factor. For instance, as of early 2024, geopolitical tensions in Eastern Europe continue to pose risks to global supply chains, potentially impacting Dover's sourcing and manufacturing operations. Dover's diversified presence across North America, Europe, and Asia helps to buffer against localized political instability, ensuring greater operational continuity.

Industry-Specific Regulations

Dover's business segments, including Clean Energy & Fueling and Climate & Sustainability Technologies, are significantly influenced by industry-specific regulations. These regulations often focus on energy efficiency, emissions control, and broader environmental standards, directly impacting the demand for Dover's specialized solutions.

Stricter environmental mandates can create opportunities for Dover by increasing the need for its innovative and sustainable technologies. However, navigating these evolving regulatory landscapes also necessitates substantial research and development investments and diligent compliance management. For instance, the increasing global focus on decarbonization, exemplified by the European Union's Fit for 55 package aiming for a 55% net greenhouse gas emission reduction by 2030, directly boosts demand for solutions in Dover's climate and sustainability portfolio.

- Regulatory Tailwinds: Growing environmental regulations worldwide are a key driver for Dover's clean energy and sustainability offerings.

- Compliance Costs: Adhering to evolving emissions and efficiency standards requires ongoing investment in R&D and operational adjustments.

- Market Opportunities: Stricter rules often translate into increased market demand for companies like Dover that provide compliant technologies.

- Energy Transition: Policies supporting the transition to cleaner energy sources directly benefit Dover's relevant business units.

Government Incentives for Green Technologies

Government incentives for green technologies present a substantial tailwind for Dover, particularly in its Clean Energy & Fueling and Climate & Sustainability Technologies divisions. These initiatives are designed to spur the adoption of eco-friendly solutions, directly benefiting companies like Dover that offer such products. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers significant tax credits for clean energy manufacturing and deployment, potentially driving demand for Dover's offerings. The European Union's Green Deal also aims to mobilize investment in sustainable technologies, creating a favorable market environment.

These incentives can dramatically accelerate market penetration for Dover's environmentally conscious products, leading to increased revenue and a stronger market position. By reducing the upfront cost for consumers and businesses, governments encourage a faster transition to cleaner alternatives, directly impacting Dover's sales volumes. For example, subsidies for electric vehicle charging infrastructure could boost demand for Dover's fueling solutions, while tax credits for energy-efficient building retrofits might increase uptake of its climate technologies.

- IRA Tax Credits: The U.S. Inflation Reduction Act provides substantial tax credits for clean energy manufacturing and deployment, directly supporting Dover's clean energy segment.

- EU Green Deal: The European Union's commitment to sustainability through its Green Deal fosters a supportive market for Dover's climate and sustainability technologies.

- Market Acceleration: Government support mechanisms can significantly speed up the adoption of Dover's green products, translating into higher sales and market share growth.

Political factors significantly shape Dover Corporation's operating environment through regulations, trade policies, and government incentives. Stricter environmental mandates, like the EU's Fit for 55 package targeting a 55% emission reduction by 2030, create demand for Dover's clean energy solutions. Conversely, trade tensions and tariffs, such as those impacting steel in 2024, can increase costs for its vehicle services segment.

Government incentives, including the U.S. Inflation Reduction Act (IRA) offering clean energy tax credits, directly boost Dover's relevant divisions. These financial supports accelerate the adoption of eco-friendly products, potentially increasing sales for its fueling and climate technologies. Political stability across Dover's global operational regions, from North America to Asia, remains crucial for supply chain continuity and mitigating disruptions.

| Political Factor | Impact on Dover | Example/Data (2024-2025) |

|---|---|---|

| Environmental Regulations | Drives demand for clean energy and sustainability solutions. | EU's Fit for 55 package aims for 55% emissions reduction by 2030. |

| Trade Policies & Tariffs | Affects cost of goods sold and market access. | Potential tariffs on imported steel could increase operational expenses for vehicle services. |

| Government Incentives | Accelerates adoption of green technologies. | U.S. Inflation Reduction Act (IRA) offers tax credits for clean energy manufacturing. |

| Geopolitical Stability | Impacts supply chain continuity and operational risks. | Ongoing geopolitical tensions in Eastern Europe in early 2024 pose supply chain risks. |

What is included in the product

This Dover PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the business, providing a comprehensive overview of the external landscape.

The Dover PESTLE Analysis provides a clean, summarized version of the full analysis, making it easy to reference during meetings or presentations and eliminating the pain of sifting through extensive data.

Economic factors

Dover's diversified business model means its performance is intrinsically linked to the health of the global economy. When economies are robust, businesses across various sectors tend to invest more in new equipment and solutions, directly benefiting Dover's sales.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, signaling a generally supportive, albeit moderate, economic environment for companies like Dover that cater to industrial and commercial clients.

However, economic headwinds can quickly dampen demand. A slowdown in key markets or a global recession would likely lead Dover's customers to postpone or reduce capital expenditures, impacting sales volumes and overall revenue.

Rising inflation presents a significant challenge for Dover, potentially inflating expenses for essential inputs like raw materials, labor, and logistics. For instance, the US Producer Price Index (PPI) for finished goods saw a notable increase in early 2024, indicating broad inflationary pressures that could squeeze profit margins if not effectively managed. This necessitates a strong focus on cost control and operational efficiency.

Fluctuations in interest rates also directly impact Dover's financial landscape. Higher interest rates, as seen with the Federal Reserve's policy adjustments throughout 2022-2023, increase the cost of capital for borrowing, affecting both the company's investment capacity and its customers' purchasing power. This can dampen demand for Dover's products and services, underscoring the importance of a robust balance sheet.

Dover's strategy of disciplined cost management and maintaining strong cash flow is paramount in mitigating these economic headwinds. As of the latest reports, Dover has demonstrated resilience through strategic pricing and operational improvements, enabling it to navigate the complexities of an inflationary environment and fluctuating interest rate scenarios effectively.

Currency exchange rate fluctuations present a significant economic factor for Dover, a global manufacturer. When Dover converts revenue and expenses earned in foreign currencies back to its reporting currency, the value of those transactions can change. For instance, if the US dollar strengthens against other currencies, foreign sales will translate into fewer dollars, potentially impacting reported revenues.

In 2023, Dover reported that foreign currency translation had a negative impact on its net sales. Specifically, unfavorable currency movements reduced net sales by approximately $80 million for the full year. This highlights the direct financial consequences of currency volatility on Dover's top-line performance.

The company actively manages this risk through hedging strategies, aiming to mitigate the adverse effects of significant currency shifts. However, even with these measures, substantial movements in major currency pairs, such as EUR/USD or USD/JPY, can still lead to material impacts on Dover's reported earnings per share.

Consumer Spending and Industrial Investment

While Dover's core business is business-to-business, consumer spending still plays an indirect role. For instance, robust consumer demand in retail can translate into increased need for Dover's refrigeration solutions. In 2024, global retail sales were projected to grow by 3.5%, indicating potential for indirect uplift in related sectors.

More significantly, industrial investment directly impacts Dover's performance. Business confidence, heavily influenced by the economic outlook, dictates capital expenditure. For example, a strong manufacturing sector, often fueled by investment in new equipment and infrastructure, directly benefits Dover's engineered solutions. In Q1 2024, U.S. nonresidential fixed investment saw a 3.2% increase, signaling positive momentum for industrial capital goods.

- Consumer spending indirectly supports Dover through retail sectors.

- Industrial investment is a primary driver for Dover's product demand.

- Business confidence and economic outlook shape industrial investment levels.

- Projected global retail sales growth for 2024 suggests indirect market support.

Supply Chain Costs and Disruptions

Fluctuations in raw material prices, energy costs, and logistics expenses directly impact Dover's supply chain operations. For instance, the average cost of shipping a 40-foot container globally saw significant volatility through 2024, with some routes experiencing cost increases of over 10% compared to early 2023 due to port congestion and increased demand.

Disruptions stemming from geopolitical tensions, such as ongoing trade disputes or regional conflicts, can exacerbate these cost pressures and introduce delays. Natural disasters or unexpected trade imbalances further complicate production and delivery schedules. These factors collectively can lead to increased operational expenses and impact Dover's ability to meet customer demand efficiently, ultimately affecting profitability and customer satisfaction.

- Raw Material Price Volatility: Global commodity prices, including metals and chemicals essential for Dover's products, experienced an average increase of 5-7% in the first half of 2024, driven by supply constraints and robust industrial demand.

- Energy Cost Impact: European industrial energy prices, a key component of manufacturing costs, remained elevated in 2024, with natural gas prices fluctuating between $10-$15 per MMBtu, impacting production overheads.

- Logistics Expense Increases: Freight rates for ocean shipping saw a resurgence in late 2024, with the Shanghai Containerized Freight Index (SCFI) climbing by approximately 20% in the final quarter, reflecting renewed global trade activity and capacity management.

- Supply Chain Resilience Investments: Many manufacturing firms, including those in Dover's sector, reported increasing their investment in supply chain resilience by an average of 15% in 2024, focusing on diversification of suppliers and inventory management strategies to mitigate disruption risks.

Dover's financial health is closely tied to global economic trends. Stronger economic growth generally translates to increased demand for Dover's industrial products and solutions, as businesses invest more. Conversely, economic downturns or recessions can lead to reduced capital expenditures by Dover's customers, negatively impacting sales.

Inflationary pressures, such as rising raw material and energy costs, directly affect Dover's operational expenses. For example, the US Producer Price Index (PPI) for intermediate goods saw a 4.5% year-over-year increase in April 2024. This necessitates efficient cost management to maintain profit margins.

Interest rate changes also play a crucial role. Higher rates increase borrowing costs for Dover and its customers, potentially slowing investment and purchasing decisions. The Federal Reserve's monetary policy adjustments continue to influence this landscape, impacting the cost of capital.

Currency exchange rate volatility can impact Dover's reported revenues and profits, given its global operations. For instance, a stronger US dollar can reduce the value of foreign earnings when converted back to dollars, as seen with Dover reporting an $80 million negative impact from currency translation in 2023.

| Economic Factor | 2024 Projection/Trend | Impact on Dover | Supporting Data/Example |

| Global Economic Growth | Projected 3.2% (IMF) | Generally supportive, but moderate growth limits upside | IMF Global Economic Outlook (April 2024) |

| Inflation (Producer Prices) | Elevated, with potential moderation | Increases operating costs, squeezes margins | US PPI for finished goods up 2.2% YoY in April 2024 |

| Interest Rates | Mixed signals, potential for cuts later in 2024 | Affects cost of capital and customer investment | Federal Reserve maintaining target range |

| Currency Exchange Rates | Volatile, USD strength a factor | Negative impact on reported foreign earnings | Dover's 2023 reported $80M negative currency impact |

What You See Is What You Get

Dover PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Dover PESTLE Analysis provides a comprehensive overview of the external factors impacting the business. You'll gain insights into political, economic, social, technological, legal, and environmental influences.

The content and structure shown in the preview is the same document you’ll download after payment, offering a clear and actionable framework for strategic planning.

Sociological factors

Changes in workforce demographics, like the increasing average age of workers and potential shortages of specialized skills in key areas, could affect Dover's capacity to find and keep qualified employees, possibly driving up wages. For instance, in the US, the Bureau of Labor Statistics projected that by 2031, about 16.3% of all jobs will be held by workers aged 65 and over, a significant increase from 2021.

Dover's strategic emphasis on drawing in new talent, fostering employee growth, and cultivating an inclusive workplace environment are crucial elements in navigating these evolving labor market dynamics and ensuring a stable, skilled workforce.

Societal expectations are increasingly prioritizing sustainable products and environmentally conscious business operations. Dover's focus on clean energy and sustainability technologies directly addresses this trend, positioning its innovative solutions to help clients achieve their own environmental targets.

Societal pressure for companies like Dover to act ethically and responsibly is growing. Consumers and investors increasingly favor businesses that demonstrate strong corporate social responsibility (CSR) and adhere to environmental, social, and governance (ESG) principles. For instance, by 2024, over 90% of S&P 500 companies were expected to issue sustainability reports, highlighting this trend.

Dover's proactive approach to ESG disclosures, ethical compliance, and community involvement directly addresses these rising expectations. By actively engaging in these areas, Dover aims to bolster its brand image and foster stronger relationships with customers, employees, and investors, ultimately contributing to sustained long-term value creation.

Health, Safety, and Wellbeing of Employees

Societal expectations increasingly prioritize the health, safety, and overall wellbeing of employees, directly influencing how companies like Dover structure their operations and internal policies. A proactive approach to these concerns not only boosts employee morale and reduces workplace accidents but also significantly bolsters a company's reputation. For instance, Dover has publicly stated its commitment to improving safety by setting targets to lower its Total Recordable Incident Rate (TRIR). In 2023, Dover reported a TRIR of 0.24, a figure they aim to further decrease in the coming years.

This societal shift translates into tangible business considerations:

- Enhanced Employee Retention: Companies demonstrating a strong commitment to employee wellbeing often experience lower turnover rates, saving on recruitment and training costs.

- Productivity Gains: Healthier, safer, and happier employees are generally more productive and engaged in their work.

- Risk Mitigation: Robust safety protocols and wellbeing programs help mitigate the financial and reputational risks associated with workplace incidents and employee burnout.

- Attracting Top Talent: A positive reputation for employee care makes a company more attractive to skilled professionals in a competitive labor market.

Community Engagement and Local Impact

Dover Corporation's commitment to community engagement is crucial for its long-term success, particularly given its global manufacturing footprint. In 2024, the company continued its focus on supporting local initiatives and fostering positive relationships within the communities where it operates. This includes investments in education and local economic development programs.

Minimizing negative environmental and social impacts is a key aspect of Dover's operational strategy. For instance, in 2024, Dover reported a 5% reduction in waste generation across its North American facilities compared to 2023, demonstrating a tangible effort to be a responsible corporate citizen. This proactive approach helps maintain their social license to operate.

- Community Investment: Dover's philanthropic efforts in 2024 focused on STEM education, with over $2 million donated to programs supporting underprivileged youth in science and technology fields globally.

- Local Employment: As of Q3 2024, Dover directly employed over 15,000 individuals worldwide, contributing significantly to local economies through job creation and associated spending.

- Environmental Stewardship: The company's 2024 sustainability report highlighted a 7% decrease in water consumption across its manufacturing sites compared to the previous year, underscoring its commitment to resource conservation.

- Stakeholder Relations: Dover actively engages with local community leaders and organizations, participating in over 50 community events and forums in 2024 to address concerns and build trust.

Societal expectations are increasingly focused on ethical business practices and corporate social responsibility. Consumers and investors alike are gravitating towards companies that demonstrate strong ESG commitments. By 2024, a significant majority of large corporations were expected to publish sustainability reports, reflecting this growing demand for transparency.

Dover's commitment to ethical operations and ESG principles is evident in its proactive reporting and community engagement. This focus not only enhances its brand reputation but also strengthens relationships with stakeholders, crucial for long-term value creation.

The increasing emphasis on employee wellbeing and safety directly impacts operational strategies. Companies prioritizing these aspects often see improved retention and productivity. Dover's public commitment to reducing its Total Recordable Incident Rate (TRIR), aiming for a figure below its 2023 reported 0.24, underscores this focus.

| Sociological Factor | Dover's Response | Impact/Data Point (2023-2024) |

|---|---|---|

| Workforce Demographics | Talent acquisition and development strategies | US projected 16.3% of jobs held by workers 65+ by 2031. |

| Sustainability Demand | Focus on clean energy and sustainability tech | Dover's solutions help clients meet environmental targets. |

| CSR & ESG Expectations | Proactive ESG disclosures, ethical compliance | Over 90% of S&P 500 companies expected to issue sustainability reports by 2024. |

| Employee Wellbeing & Safety | Commitment to reducing TRIR | Dover reported TRIR of 0.24 in 2023, with plans for further reduction. |

| Community Engagement | Support for local initiatives, STEM education | Over $2 million donated to STEM programs in 2024. |

Technological factors

Dover is actively integrating advanced digital and software solutions across its portfolio. For instance, their recent initiatives include AI-powered 3D visual experiences and digital platforms designed to streamline vehicle services and industrial product assembly.

These technological upgrades are not just about modernizing; they directly boost product capabilities and elevate the customer journey. This strategic digital push is also opening up entirely new avenues for revenue generation, demonstrating a forward-thinking approach to market engagement.

Dover's integration of automation and AI is transforming its operations. For instance, in manufacturing and supply chains, AI-driven predictive maintenance can reduce downtime, a critical factor for efficiency. The company is actively using AI for compliance monitoring, ensuring adherence to regulations, and has invested in liquid cooling technologies for data centers, showcasing a commitment to advanced technological solutions.

Dover's commitment to innovation in clean energy is a significant technological driver. Their Clean Energy & Fueling segment, for instance, is actively developing advanced CO2 refrigeration systems and highly efficient heat exchangers. These technologies are crucial for customers aiming to lower their greenhouse gas emissions.

The company's Climate & Sustainability Technologies segment further exemplifies this focus. By engineering products that enhance energy efficiency, Dover is directly addressing the growing demand for solutions that reduce environmental impact. This innovation pipeline positions Dover to capitalize on the global shift towards sustainable energy practices.

Research and Development (R&D) Investments

Dover's dedication to research and development is paramount for creating new products and solutions that keep pace with market changes and ensure a competitive advantage. These investments are crucial for staying ahead in its various sectors.

In fiscal year 2023, Dover reported R&D expenses of $365 million, representing a 5% increase from the previous year, underscoring its focus on innovation. This commitment allows the company to pioneer advancements across its diverse operating segments.

- Innovation Pipeline: Dover's R&D efforts are geared towards developing next-generation technologies in areas like advanced filtration, specialized pumps, and energy-efficient climate control solutions.

- Competitive Edge: By investing in R&D, Dover aims to differentiate its offerings, capture emerging market opportunities, and maintain its leadership position against competitors.

- Productivity Gains: Significant R&D spending often translates into more efficient manufacturing processes and higher-performing products, ultimately benefiting customers and the bottom line.

Data Security and Connectivity Technologies

As Dover increasingly embeds digital and software capabilities into its offerings and expands its global reach, the importance of robust data security and advanced connectivity technologies cannot be overstated. These elements are foundational for safeguarding proprietary information and customer data against evolving cyber threats. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the significant investment and focus on these areas.

Ensuring dependable network operations is critical for Dover's international business, facilitating seamless communication and data exchange across its diverse operations. This reliance on connectivity means that disruptions can have far-reaching consequences. According to recent reports, the average cost of a data breach in 2024 exceeded $4.5 million, underscoring the financial imperative for strong security measures.

- Data Security: Protecting sensitive intellectual property and customer information against cyberattacks is paramount for maintaining trust and operational continuity.

- Connectivity: Reliable and high-speed network infrastructure is essential for global operations, enabling efficient data transfer and real-time communication.

- Cybersecurity Investment: Companies like Dover are expected to continue increasing investments in cybersecurity solutions to mitigate risks associated with digital transformation and global operations.

- Compliance: Adhering to various international data privacy regulations, such as GDPR and CCPA, necessitates sophisticated data security protocols and technologies.

Dover is actively integrating advanced digital and software solutions, including AI for predictive maintenance and compliance monitoring, enhancing operational efficiency and regulatory adherence. Their investment in liquid cooling technologies for data centers further demonstrates a commitment to cutting-edge solutions.

The company's focus on clean energy technologies, such as CO2 refrigeration systems and efficient heat exchangers, directly addresses the growing market demand for sustainability and reduced environmental impact.

Dover's robust research and development pipeline, evidenced by a 5% increase in R&D expenses to $365 million in fiscal year 2023, is crucial for developing next-generation products and maintaining a competitive edge in filtration, pumps, and climate control.

The increasing reliance on digital platforms and global operations necessitates strong data security and connectivity, with the global cybersecurity market projected to exceed $200 billion in 2024, and the average cost of a data breach surpassing $4.5 million.

| Technological Factor | Description | Impact on Dover | 2024/2025 Data Point |

| AI & Automation | Integration of AI for predictive maintenance, compliance, and operational efficiency. | Reduces downtime, improves regulatory adherence, enhances productivity. | AI in manufacturing can boost productivity by up to 40%. |

| Digital Transformation | Adoption of digital platforms and AI-powered experiences. | Streamlines services, creates new revenue streams, improves customer engagement. | Digital transformation initiatives are expected to add $1.5 trillion to global GDP by 2025. |

| Clean Energy Technology | Development of CO2 refrigeration and efficient heat exchangers. | Addresses demand for sustainable solutions, reduces greenhouse gas emissions. | The global market for green technology and sustainability is projected to reach $40.5 billion by 2025. |

| Cybersecurity | Emphasis on data security and network operations for global reach. | Protects intellectual property and customer data, ensures operational continuity. | Global cybersecurity spending is estimated to reach $230 billion in 2025. |

Legal factors

Dover Corporation, a global manufacturer of equipment and components, navigates a complex web of product liability and safety regulations across its operating regions. Failure to adhere to these mandates, which cover everything from design to post-market surveillance, can result in significant financial penalties and operational disruptions. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.7 billion in recalls, highlighting the potential cost of non-compliance.

Maintaining rigorous compliance is paramount for Dover to mitigate risks such as costly lawsuits, product recalls, and severe reputational damage. The company's commitment to safety standards directly impacts consumer trust and its ability to operate smoothly in diverse markets. In 2024, regulatory bodies worldwide are expected to increase scrutiny on manufacturing safety, particularly in sectors like food processing and energy, where Dover has a significant presence.

Dover's operations, particularly in clean energy and sustainability, necessitate strict adherence to environmental compliance laws. These regulations, which govern emissions, waste disposal, and hazardous material handling, are crucial for maintaining operational legitimacy and avoiding penalties.

For instance, the U.S. Environmental Protection Agency (EPA) continually updates standards. In 2024, the EPA proposed stricter rules for greenhouse gas emissions from power plants, impacting sectors that Dover serves. Failure to comply could result in significant fines, with environmental violations costing companies millions annually.

The increasing global focus on climate change means these regulations are likely to become more stringent. Dover's investment in sustainable technologies positions it well, but ongoing monitoring and adaptation to evolving environmental mandates, such as those concerning battery recycling for electric vehicles, remain critical for 2025 and beyond.

Intellectual property laws are paramount for Dover to safeguard its innovations. Protecting patents, trademarks, and trade secrets is key to maintaining its competitive edge and preventing the unauthorized replication of its advanced products and solutions. For instance, in 2023, Dover reported significant investments in research and development, underscoring its commitment to creating proprietary technologies that require robust IP protection.

Data Privacy and Cybersecurity Laws

Dover operates in an environment where data privacy and cybersecurity are paramount, necessitating strict adherence to regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Protecting sensitive customer and proprietary company data is not just a legal obligation but also crucial for maintaining brand reputation and customer loyalty in the face of increasing digital threats.

The evolving landscape of digital operations means Dover must continuously adapt its practices to meet new cybersecurity standards and data protection mandates. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the substantial financial implications of security failures. Proactive investment in robust cybersecurity measures and transparent data handling policies are therefore essential for mitigating risks and ensuring ongoing operational integrity.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Impact: Provides consumers with rights regarding their personal information.

- Data Breach Costs: Global average cost of a data breach was $4.45 million in 2023.

- Trust Factor: Data protection is critical for maintaining customer trust and brand reputation.

International Trade and Anti-Corruption Laws

Operating globally means Dover must adhere to a complex web of international trade laws and sanctions. For instance, the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act impose strict penalties for corrupt business practices. In 2023, the U.S. Department of Justice collected over $2.5 billion in fines related to FCPA enforcement actions, highlighting the significant financial risks involved.

Dover's commitment to a strong ethics and compliance program is therefore critical. This includes comprehensive anti-corruption training for employees worldwide. Such programs are not just about avoiding penalties; they are fundamental to maintaining business integrity and fostering trust with international partners.

- Global Reach, Global Rules: Dover's international operations necessitate strict adherence to diverse trade regulations and anti-corruption statutes like the FCPA and UK Bribery Act.

- Compliance as a Shield: A robust ethics and compliance program, featuring mandatory anti-corruption training, is vital for mitigating legal risks and ensuring ethical conduct across all Dover's global activities.

- Financial Ramifications: The significant financial penalties associated with violations, evidenced by billions collected in FCPA fines in recent years, underscore the importance of proactive compliance.

Dover's global operations expose it to a wide array of legal frameworks, from product safety and environmental regulations to intellectual property and data privacy laws. Navigating these complexities is crucial, as non-compliance can lead to substantial fines, operational disruptions, and reputational damage. For example, the increasing focus on cybersecurity, with the global average cost of a data breach reaching $4.45 million in 2023, necessitates robust data protection measures.

The company must also contend with international trade laws and anti-corruption statutes like the FCPA, where violations can incur billions in penalties, as seen in recent enforcement actions. Proactive compliance and ethical conduct are therefore not just legal necessities but also foundational to maintaining trust with international partners and ensuring sustained business integrity in the evolving global market.

In 2024, regulatory bodies continue to heighten scrutiny, particularly concerning environmental standards and digital operations. Dover's commitment to sustainable technologies and data security is vital for mitigating risks associated with evolving mandates and maintaining its competitive edge. Failure to adapt to these changing legal landscapes could significantly impact its financial performance and market standing.

Environmental factors

Dover Corporation views climate change as a significant challenge, actively pursuing science-based targets to slash its greenhouse gas (GHG) emissions across Scope 1, 2, and 3 categories. This proactive stance fuels substantial investments into enhancing energy efficiency and adopting renewable energy sources throughout its global operations and product design.

In 2023, Dover achieved a 13% reduction in Scope 1 and 2 GHG emissions compared to its 2019 baseline, a tangible step towards its ambitious goal of a 30% reduction by 2030. The company is also targeting a 15% reduction in Scope 3 emissions by 2030, focusing on supply chain and product use impacts.

Increasing global concerns about resource scarcity, particularly for water and essential raw materials, are directly impacting Dover Corporation's operational strategies. These pressures necessitate a proactive approach to ensure long-term viability and supply chain stability.

Dover is actively implementing sustainable sourcing practices and robust waste reduction initiatives. For instance, in 2023, the company reported a 5% reduction in water consumption across its manufacturing facilities, demonstrating a commitment to enhancing resource efficiency and minimizing its environmental footprint.

The global market for sustainable products is experiencing robust growth, with projections indicating continued expansion. For instance, the market for green building materials alone was valued at over $250 billion in 2023 and is expected to grow at a compound annual growth rate of approximately 10% through 2030. This trend directly benefits companies like Dover, particularly in its Climate & Sustainability Technologies segment.

Dover's Clean Energy & Fueling business is also well-positioned to capitalize on this demand. As of early 2024, investments in renewable energy infrastructure and alternative fueling solutions are accelerating worldwide, driven by government mandates and corporate ESG (Environmental, Social, and Governance) commitments. Dover's offerings in this area directly address the need for cleaner energy sources and more efficient fuel delivery systems.

Waste Management and Circular Economy Principles

Dover Corporation's operations, spanning diverse manufacturing sectors, inherently produce various waste streams. Effective waste management is paramount not only for regulatory adherence but also for enhancing environmental stewardship. For instance, in 2023, Dover reported a continued focus on reducing waste generation across its facilities, with specific initiatives targeting manufacturing byproducts.

The company's commitment to circular economy principles is evident in its strategies to divert waste from landfills. This includes exploring opportunities for material reuse, recycling, and the development of more sustainable product lifecycles. Dover's 2024 sustainability report highlights progress in increasing the percentage of waste recycled or repurposed, aiming to align with broader industry trends towards resource efficiency.

- Waste Diversion Goals: Dover aims to increase its waste diversion rate from landfills by a targeted percentage by the end of 2025, building on 2023 achievements.

- Circular Economy Initiatives: The company is actively investigating and implementing circular economy models, such as product take-back programs and the use of recycled materials in manufacturing.

- Environmental Compliance: Robust waste management systems ensure compliance with local and international environmental regulations, mitigating risks of penalties and reputational damage.

- Operational Efficiency: Reducing waste often leads to improved operational efficiency and cost savings through better resource utilization and reduced disposal fees.

Regulatory Pressure for Environmental Performance

Dover Corporation faces escalating regulatory pressure concerning its environmental impact. This means the company must actively enhance its environmental management systems and be more transparent in its reporting to meet evolving standards. Failure to do so could jeopardize its reputation and ability to operate.

For instance, in 2024, the U.S. Securities and Exchange Commission (SEC) proposed new rules requiring climate-related disclosures, which will likely affect companies like Dover. This trend is global, with many nations implementing stricter environmental regulations and carbon pricing mechanisms.

- Increased Scrutiny: Public and governmental focus on corporate sustainability is intensifying, demanding greater accountability from industrial manufacturers.

- Compliance Costs: Adapting operations to meet new environmental regulations can incur significant capital expenditures and ongoing operational costs for Dover.

- Reputational Risk: Non-compliance or poor environmental performance can lead to negative publicity, impacting brand image and customer loyalty.

- Market Opportunities: Proactive environmental management can also present opportunities, such as developing more sustainable products and processes that appeal to environmentally conscious markets.

Dover Corporation is actively addressing climate change by setting science-based targets for greenhouse gas (GHG) emission reductions across all scopes. The company achieved a 13% decrease in Scope 1 and 2 emissions in 2023 compared to a 2019 baseline, aiming for a 30% reduction by 2030.

Resource scarcity, particularly concerning water and raw materials, is a key environmental factor influencing Dover's strategy, prompting investments in efficiency and sustainable sourcing. In 2023, water consumption across its manufacturing sites was reduced by 5%.

The growing market for sustainable products presents a significant opportunity for Dover, especially within its Climate & Sustainability Technologies segment. The global green building materials market, valued over $250 billion in 2023, exemplifies this trend.

Dover is enhancing its waste management practices, focusing on diversion from landfills and circular economy principles. In 2023, the company reported continued efforts in reducing manufacturing byproduct waste and increasing recycling rates.

Escalating environmental regulations, such as proposed SEC climate disclosure rules in 2024, necessitate robust environmental management systems and transparency from Dover to mitigate compliance costs and reputational risks.

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a comprehensive review of government publications, reputable news outlets, and industry-specific market research. We ensure each factor considered is grounded in current, verifiable information.