Dover Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dover Bundle

Dover's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Dover’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dover's diverse operating segments, such as Engineered Products, Clean Energy & Fueling, and Climate & Sustainability Technologies, mean supplier concentration varies significantly across its business units. In markets where Dover relies on a limited number of specialized component manufacturers, such as advanced materials for its engineered products or specific control systems for fueling equipment, these suppliers can wield considerable bargaining power. For instance, if a critical semiconductor or a unique alloy for a high-performance pump is sourced from only a handful of global providers, those suppliers are in a strong position to dictate terms, potentially impacting Dover's cost of goods sold and profit margins.

Dover faces significant switching costs across its diverse product segments, particularly for specialized components. For instance, the biopharma sector demands highly specific, validated parts, making supplier changes complex and time-consuming. Similarly, the thermal management solutions for data centers often involve intricate designs and rigorous testing, further increasing the difficulty and expense of switching.

These high switching costs, which can include substantial investments in re-tooling manufacturing processes or undergoing lengthy re-qualification procedures, directly enhance the bargaining power of Dover's suppliers. When it is costly and disruptive for Dover to find and implement alternative suppliers, existing suppliers are in a stronger position to dictate terms, potentially impacting Dover's cost structure and operational flexibility.

Suppliers who provide highly specialized or proprietary components and technologies, especially in rapidly expanding sectors such as single-use biopharma components or cutting-edge liquid cooling systems, tend to wield more significant bargaining power. Dover's dependence on these unique inputs directly influences the leverage suppliers can exercise.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Dover's operations significantly bolsters their bargaining power. This means suppliers could potentially start manufacturing the products or offering the solutions that Dover currently provides to its customers.

This risk is particularly elevated when suppliers possess substantial intellectual property or maintain control over critical raw materials, giving them a strategic advantage to move up the value chain.

For instance, if a key component supplier for Dover's electronics division also has proprietary technology for advanced chip manufacturing, they could threaten to produce finished electronic devices themselves, directly competing with Dover.

- Supplier Forward Integration: Suppliers may enter Dover's market, directly competing with their existing product lines.

- Intellectual Property & Raw Material Control: Suppliers with unique technology or essential material access are more likely to integrate forward.

- Increased Leverage: This threat forces Dover to potentially offer better terms to suppliers to prevent them from becoming competitors.

Importance of Dover to Suppliers

The proportion of a supplier's revenue that comes from Dover's business significantly influences their bargaining power. If Dover is a major client, a supplier might be more inclined to offer better terms to keep that business, thus diminishing their leverage.

Conversely, if Dover accounts for a small fraction of a supplier's overall sales, that supplier holds more sway. For instance, in 2024, companies heavily reliant on Dover for a substantial percentage of their income would likely find it challenging to dictate terms, whereas those with diversified customer bases could exert greater influence.

- Supplier Revenue Dependence: A supplier's reliance on Dover's business directly correlates with their bargaining power.

- Customer Significance: When Dover represents a large portion of a supplier's revenue, the supplier's power is reduced as they prioritize maintaining the relationship.

- Market Diversification: Suppliers with many clients have greater leverage over individual customers like Dover, as losing one customer has less impact on their overall business.

The bargaining power of suppliers for Dover is influenced by the concentration of suppliers within its diverse segments. In areas where Dover relies on a few specialized manufacturers, such as for advanced materials or specific control systems, these suppliers can exert significant influence over pricing and terms. For example, if a critical component for Dover's engineered products is sourced from a limited number of global providers, those suppliers are positioned to dictate terms, potentially impacting Dover's cost of goods sold.

Dover's suppliers hold considerable power when switching costs are high, which is common for specialized components in sectors like biopharma or data centers. The expense and time involved in re-qualifying new suppliers, or re-tooling manufacturing processes, strengthens the position of existing suppliers to negotiate favorable terms. This can directly affect Dover's operational flexibility and profitability.

Suppliers who provide unique or proprietary technologies, especially in growing markets such as single-use biopharma components, possess greater leverage over Dover. This is amplified if these suppliers control critical raw materials or have the potential to integrate forward into Dover's business, directly competing with its offerings.

The degree to which Dover represents a significant portion of a supplier's revenue is a key factor in their bargaining power. If Dover is a major client, suppliers are more likely to offer favorable terms to retain that business, thereby reducing their leverage. Conversely, suppliers with diversified customer bases can exert more influence over Dover, as losing Dover's business would have a less substantial impact on their overall operations.

| Factor | Impact on Supplier Bargaining Power | Dover Segment Example | 2024 Data Relevance |

|---|---|---|---|

| Supplier Concentration | High when few suppliers exist for critical components. | Specialized semiconductors for engineered products. | N/A (Specific data not publicly available for all segments). |

| Switching Costs | Increases supplier power when costs to change are high. | Validated parts for biopharma, complex thermal management systems. | N/A (Qualitative assessment based on industry standards). |

| Supplier Forward Integration Threat | Elevated when suppliers control IP or raw materials. | Proprietary technology suppliers in electronics. | N/A (Strategic risk assessment). |

| Dover's Revenue Share for Supplier | Decreases supplier power if Dover is a large customer. | N/A (Specific supplier revenue data not public). | N/A (Analysis based on general market dynamics). |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Dover's diverse industrial segments.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of all five forces.

Customers Bargaining Power

Dover Corporation's customer bargaining power is significantly shaped by its diverse global customer base across various industrial and commercial sectors. The degree of customer concentration, meaning how many customers account for a large portion of Dover's sales, directly impacts this power.

For instance, if a few major clients represent a substantial percentage of Dover's revenue, those large customers can wield considerable influence. In 2023, Dover reported that its largest customer accounted for approximately 3% of its total net sales, indicating a relatively fragmented customer base, which generally mitigates individual customer bargaining power.

The volume of purchases is also a critical factor. Customers who buy in large quantities often have more leverage to negotiate favorable pricing or terms. This is particularly relevant in industries where Dover's components are essential and switching suppliers would be costly or complex for the customer.

The bargaining power of customers is significantly influenced by the availability of substitute products. When customers have numerous alternatives, whether direct competitors or different solutions to the same need, their ability to negotiate better terms with a company like Dover increases. For instance, if a customer can easily find a similar engineered product from another manufacturer or even a different type of solution that addresses their core requirement, they are less dependent on Dover's offerings.

Dover's strategy to counter this involves its diversified portfolio, which aims to offer unique and differentiated products. By providing specialized solutions across various industries, Dover seeks to reduce the substitutability of its offerings. For example, in the refrigeration market, while there are other manufacturers, Dover's specific energy-efficient compressor technologies might be harder for customers to replace with readily available alternatives, thereby strengthening Dover's position.

Customer price sensitivity is a key driver of their bargaining power. When customers are highly sensitive to price, they have more leverage to demand lower costs from Dover. This sensitivity is influenced by how much Dover's products contribute to their own expenses, the overall health of the economy, and whether they have readily available alternatives.

For instance, in industries that experience significant economic downturns, customers often become more focused on cost savings. This increased price sensitivity can put pressure on Dover's profit margins, especially if its products are not considered mission-critical or if there are many competing suppliers offering similar solutions. For example, in 2024, many manufacturing sectors faced inflationary pressures, leading to heightened customer scrutiny of all input costs, including those from suppliers like Dover.

Threat of Backward Integration by Customers

Dover's customers, especially large industrial clients with substantial in-house manufacturing expertise, possess a significant threat of backward integration. This means they could potentially produce the equipment, components, or solutions that Dover currently supplies, thereby increasing their bargaining power.

For instance, if a major customer in the semiconductor manufacturing sector, a key market for Dover's engineered systems, has the technical know-how and financial resources, they might opt to develop and produce their own specialized machinery. This capability directly challenges Dover's market position and pricing power.

The incentive for such integration is often cost reduction or greater control over their supply chain. In 2024, many large manufacturers were actively exploring ways to enhance efficiency and reduce reliance on external suppliers, making backward integration a more attractive strategic option.

- Customer Capability: Large industrial clients often possess the engineering talent and capital to replicate Dover's product offerings.

- Incentive for Integration: Cost savings and supply chain control are primary drivers for customers considering backward integration.

- Market Dynamics: The prevailing economic climate in 2024, marked by a focus on operational efficiency, amplified this threat.

- Impact on Dover: Successful backward integration by customers directly erodes Dover's sales volume and pricing leverage.

Information Asymmetry

Information asymmetry significantly influences customer bargaining power. When customers possess less knowledge about Dover's production costs, pricing strategies, and the availability of competing products, their ability to negotiate favorable terms is diminished. Conversely, a market characterized by high transparency, where customers can easily access and compare information, empowers them to exert greater pressure on Dover.

For instance, in 2024, industries with readily available online pricing comparisons and detailed product specifications often see customers with stronger bargaining positions. This increased customer awareness directly translates to a greater likelihood of demanding lower prices or better service terms from suppliers like Dover. The digital age has, in many sectors, dramatically reduced information asymmetry, leveling the playing field.

- Customer Awareness: In 2024, the proliferation of online review platforms and price comparison websites means customers are often better informed about product costs and market alternatives than ever before.

- Market Transparency: Industries where Dover operates with high transparency, allowing customers to easily understand value propositions and compare offerings, tend to see customers with more leverage.

- Negotiating Leverage: Greater access to information directly enhances a customer's ability to negotiate price, quality, and delivery terms, potentially impacting Dover's profit margins.

The bargaining power of Dover's customers is a key factor in its profitability. Customers with significant purchasing volume and access to viable alternatives can demand lower prices and better terms. For example, in 2024, many industrial sectors experienced cost pressures, leading customers to scrutinize supplier pricing more intensely.

Dover's relatively fragmented customer base, with its largest customer representing only about 3% of net sales in 2023, generally limits the power of any single buyer. However, customers with strong technical capabilities may consider backward integration, especially when seeking cost savings or greater supply chain control, a trend observed in 2024.

Increased market transparency, fueled by digital platforms, further empowers customers in 2024 by providing easy access to price comparisons and product information. This can heighten price sensitivity and pressure Dover to maintain competitive pricing and demonstrate clear value.

| Factor | Impact on Dover | 2023/2024 Relevance |

|---|---|---|

| Customer Concentration | Low individual customer power | Largest customer ~3% of sales (2023) |

| Availability of Substitutes | Increases customer leverage | Differentiated products aim to mitigate this |

| Price Sensitivity | Drives negotiation for lower prices | Heightened in 2024 due to economic pressures |

| Backward Integration Threat | Potential loss of sales/pricing power | Increased customer incentive in 2024 for efficiency |

| Information Asymmetry | Lower asymmetry empowers customers | Reduced by online comparison tools in 2024 |

What You See Is What You Get

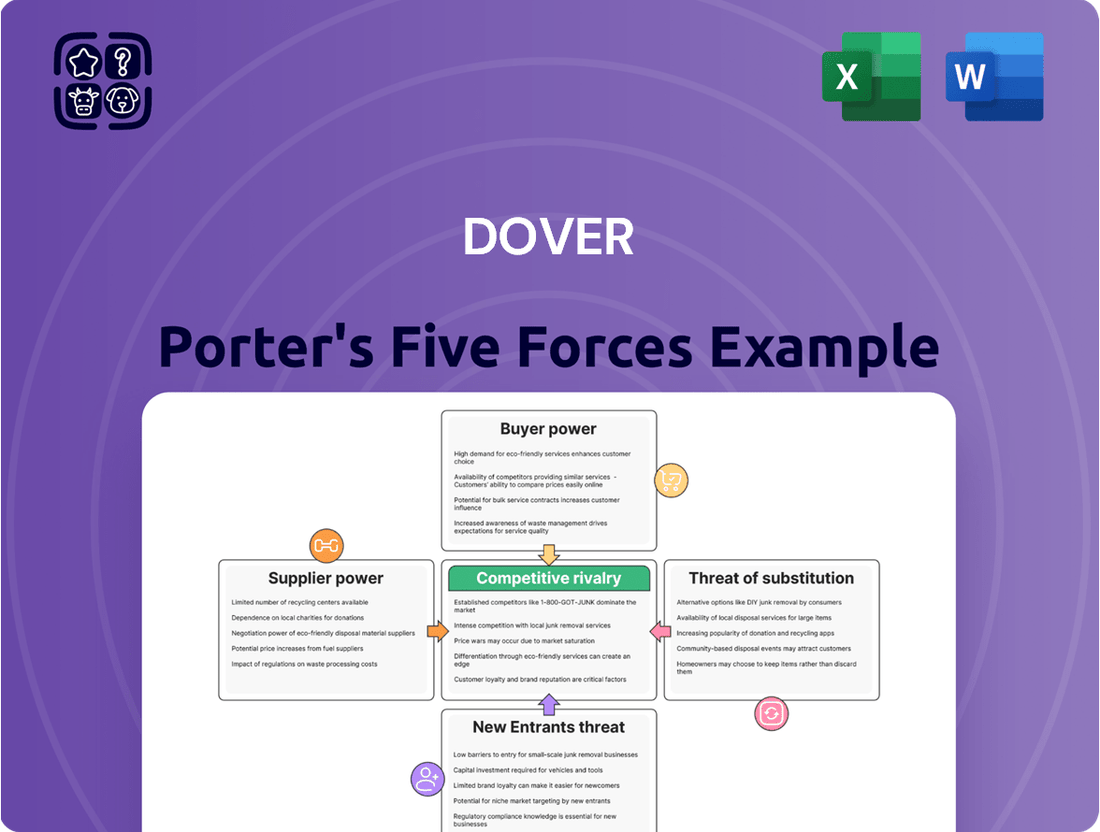

Dover Porter's Five Forces Analysis

This preview showcases the complete Dover Porter's Five Forces Analysis you'll receive, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report that will be instantly available to you upon purchase, ensuring no discrepancies or missing information. You can confidently expect to download this comprehensive analysis, ready for immediate use in your strategic planning.

Rivalry Among Competitors

Dover's diverse portfolio benefits from strong tailwinds in sectors like clean energy and biopharma, which are projected for robust expansion. For instance, the global clean energy market was valued at approximately $1.1 trillion in 2023 and is expected to grow significantly. This high growth environment can temper direct competitive rivalry as the pie is expanding, allowing multiple players to capture market share without directly cannibalizing each other's existing business.

Dover operates in markets populated by a broad array of competitors, ranging from large, diversified industrial conglomerates to highly specialized niche manufacturers. This extensive and varied competitive landscape, encompassing companies with differing strategic priorities and market focuses, intensifies the rivalry across Dover's business segments.

Dover Corporation actively pursues product differentiation by investing heavily in innovation. In 2023, the company reported $337 million in research and development expenses, a testament to its commitment to developing unique technologies and enhanced functionalities across its diverse business segments. This focus on advanced solutions, such as their specialized fluid handling technologies or advanced printing solutions, allows Dover to stand apart from competitors.

The extent to which Dover's products are perceived as distinct from those of its rivals significantly influences competitive intensity. For instance, in the engineered systems segment, Dover's custom-engineered solutions for niche industrial applications often face less direct price-based competition compared to more commoditized offerings. This differentiation strategy enables Dover to maintain stronger pricing power and reduce the pressure of head-to-head battles with competitors.

Exit Barriers

High exit barriers in industrial manufacturing, stemming from specialized assets and substantial capital investments, can trap companies in declining markets. This forces even unprofitable firms to remain active, thereby increasing competitive intensity. For instance, in 2024, the average capital expenditure for new manufacturing facilities in the United States remained significantly high, often exceeding tens of millions of dollars, making divestment a costly proposition.

These barriers mean that even when demand falters or profit margins shrink, companies may continue operating due to the inability to easily liquidate specialized machinery or recoup sunk costs. This situation is exacerbated by long-term supply contracts that obligate manufacturers to continue production, even at a loss, to avoid penalty clauses. In 2023, reports indicated that several large industrial conglomerates faced challenges in exiting certain legacy product lines due to these contractual obligations.

Consequently, the presence of high exit barriers directly fuels competitive rivalry by preventing a natural consolidation or exit of weaker players. This can lead to price wars and reduced profitability across the industry as all participants fight for market share, regardless of their financial health. The industrial manufacturing sector, as of early 2024, continues to grapple with the effects of these entrenched exit barriers.

- Specialized Assets: Industrial manufacturers often possess highly specific machinery and tooling that have limited resale value outside their particular niche.

- Capital Investments: The initial outlay for plants and equipment represents a significant sunk cost, making it difficult to recover investment if exiting the market.

- Long-Term Contracts: Commitments to customers or suppliers can lock companies into production and operational requirements, hindering a swift exit.

- Workforce Commitments: Severance packages and the need to maintain operations for contractual reasons can add to the cost of exiting.

Switching Costs for Customers

The costs customers incur when switching from one industrial equipment supplier to another significantly shape the competitive landscape for companies like Dover. When these switching costs are low, customers can more readily move to a competitor, which naturally intensifies rivalry. This ease of transition means suppliers must constantly strive to offer competitive pricing, superior product quality, and excellent service to retain their customer base.

For instance, if a manufacturing plant can switch its hydraulic pump supplier with minimal disruption and cost, it creates an environment where Dover faces pressure from numerous competitors. In 2024, the industrial equipment sector saw an average customer acquisition cost increase by approximately 8%, partly due to the need for more aggressive marketing and sales efforts to overcome low switching barriers. This highlights how easily customers can change providers, forcing companies to innovate and differentiate to maintain market share.

- Low Switching Costs: Customers can easily change industrial equipment suppliers, increasing competitive intensity.

- Impact on Rivalry: Suppliers must focus on price, quality, and service to retain customers.

- 2024 Data: Average customer acquisition costs in the industrial equipment sector rose by about 8% in 2024, reflecting increased competition driven by low switching barriers.

Competitive rivalry within Dover's diverse markets is a significant factor, influenced by the broad spectrum of competitors and the company's own innovation strategies. While Dover invests heavily in R&D, with $337 million in expenses in 2023, to differentiate its offerings, the presence of numerous rivals, from large conglomerates to niche players, intensifies competition across its segments.

The industrial manufacturing sector, where Dover operates, is characterized by high exit barriers, meaning companies often remain active even in less profitable markets. This persistence, coupled with substantial capital investments required for new facilities, which can run into tens of millions of dollars in 2024, fuels ongoing rivalry. Additionally, low customer switching costs in many of Dover's markets, evidenced by an approximate 8% rise in customer acquisition costs in 2024, force companies to compete intensely on price, quality, and service.

| Factor | Impact on Rivalry | Dover's Strategy/Context |

|---|---|---|

| Number and Diversity of Competitors | Intensifies rivalry across segments | Dover faces both large conglomerates and specialized niche manufacturers. |

| Product Differentiation | Mitigates direct rivalry | Dover's $337 million R&D investment in 2023 aims to create unique offerings. |

| Exit Barriers | Sustains rivalry even in weaker markets | High capital costs for new plants (millions of dollars in 2024) and long-term contracts limit company exits. |

| Customer Switching Costs | Increases competitive pressure | Low switching costs necessitate constant focus on price, quality, and service; customer acquisition costs rose ~8% in 2024. |

SSubstitutes Threaten

The threat of substitutes for Dover is significant, especially when these alternatives offer a superior price-performance ratio. For instance, the burgeoning market for electric vehicle charging infrastructure presents a direct substitute for traditional fueling stations, a core area for Dover's customers. In 2024, the global EV charging market was valued at approximately $30 billion, with projections indicating substantial growth, suggesting a shift in energy consumption patterns that could diminish demand for conventional fuel handling systems.

Customer willingness to switch to alternatives is a major consideration. For instance, in the electric vehicle market, the increasing range and decreasing cost of EVs, coupled with growing charging infrastructure, significantly boosts customer propensity to substitute internal combustion engine vehicles. By mid-2024, the global EV market share was projected to reach over 15%, indicating a strong shift.

Rapid technological advancements are a significant threat of substitutes for Dover. New technologies can quickly emerge, offering alternative ways for customers to meet their needs, potentially bypassing Dover's existing product lines. For instance, breakthroughs in material science could lead to lighter, stronger, or more cost-effective materials that substitute for components Dover currently supplies.

Dover's commitment to research and development, evidenced by its significant R&D investments, is crucial for mitigating this threat. In 2023, Dover's R&D spending was approximately $300 million, a key strategy to stay ahead of disruptive technologies. Emerging digital solutions in areas like predictive maintenance or advanced analytics could also offer substitutes for traditional service models, impacting revenue streams.

Changes in Customer Needs or Preferences

Evolving customer needs, particularly a growing emphasis on sustainability, can significantly boost the appeal of substitute products. For instance, a heightened demand for eco-friendly packaging solutions might push consumers away from traditional plastic options, favoring biodegradable or recyclable alternatives.

Efficiency demands are also a major driver. Businesses seeking to reduce operational costs might readily adopt new technologies that offer superior performance or lower energy consumption compared to existing solutions. In 2024, many companies are prioritizing energy efficiency, with reports indicating that over 60% of businesses are actively exploring or implementing energy-saving technologies to combat rising utility costs.

Regulatory changes can also accelerate the adoption of substitutes. Stricter environmental regulations, for example, could make existing products or processes obsolete, forcing industries to seek out compliant alternatives. This has been evident in the automotive sector, where emissions standards have driven a substantial shift towards electric vehicles.

- Sustainability Focus: Consumer preference for sustainable products is a key driver for substitutes.

- Efficiency Gains: Businesses are actively seeking substitutes that offer improved operational efficiency and cost savings.

- Regulatory Impact: New regulations can quickly render existing offerings less attractive, promoting substitute adoption.

- Technological Advancements: Continuous innovation introduces new substitutes that may outperform established products.

Indirect Substitutes

Indirect substitutes can emerge from shifts in broader industry trends or evolving business models, presenting a less obvious but significant competitive threat to Dover. For example, the rise of service-based models that allow customers to access functionality without owning equipment outright could diminish the demand for Dover's traditional product sales.

Consider the burgeoning trend of equipment-as-a-service (EaaS) in various industrial sectors. In 2024, the global EaaS market was projected to reach over $100 billion, indicating a substantial shift away from outright purchase. This model allows companies to pay for usage or outcomes rather than capital investment, potentially bypassing the need for Dover's core offerings.

- Emerging Service Models: The growth of leasing, rental, and pay-per-use arrangements for industrial equipment poses a direct threat to capital equipment sales.

- Technological Advancements: Innovations enabling greater efficiency or integration within existing customer infrastructure could reduce the necessity for new equipment purchases.

- Digitalization and Software Solutions: Software platforms that optimize asset utilization or provide predictive maintenance could extend the lifespan of current equipment, delaying or eliminating the need for replacements.

- Circular Economy Initiatives: Increased focus on refurbishment, remanufacturing, and extended product lifecycles can also act as indirect substitutes by reducing the demand for new manufactured goods.

The threat of substitutes for Dover is amplified by evolving customer preferences towards sustainability and operational efficiency. Many businesses in 2024 are prioritizing energy-saving technologies, with over 60% actively exploring or implementing them to manage rising utility costs. Furthermore, regulatory shifts, such as stricter environmental standards, can accelerate the adoption of compliant alternatives, as seen in the automotive industry's move towards electric vehicles.

Technological advancements continuously introduce new substitutes that may offer superior price-performance ratios or bypass existing product lines entirely. For instance, breakthroughs in material science could yield components that are more cost-effective than those Dover currently supplies.

The growing popularity of equipment-as-a-service (EaaS) models represents a significant indirect substitute. By 2024, the global EaaS market was projected to exceed $100 billion, indicating a trend where customers opt for usage-based access rather than outright equipment ownership, potentially reducing demand for Dover's capital goods.

| Industry Trend | Impact on Dover | Key Data Point (2024) |

|---|---|---|

| Sustainability Focus | Drives demand for eco-friendly alternatives | Growing consumer preference for sustainable packaging |

| Energy Efficiency Demands | Promotes substitutes with lower energy consumption | >60% of businesses exploring energy-saving tech |

| Regulatory Changes | Accelerates adoption of compliant substitutes | Emissions standards driving EV adoption |

| Equipment-as-a-Service (EaaS) | Reduces demand for capital equipment sales | Global EaaS market projected >$100 billion |

Entrants Threaten

The capital requirements for entering Dover's industrial manufacturing and solutions sectors are considerable. Establishing the necessary research and development capabilities, state-of-the-art manufacturing facilities, and robust global distribution networks demands significant upfront investment. For instance, building a new advanced manufacturing plant can easily run into hundreds of millions of dollars, a substantial hurdle for potential competitors.

Dover's expansive global manufacturing footprint and its diverse product lines create significant economies of scale. This means they can produce goods more cheaply per unit due to high volume, a hurdle for any newcomer trying to match their cost efficiency.

Furthermore, Dover benefits from economies of scope, leveraging its existing infrastructure and expertise across different business segments. For instance, in 2023, Dover reported revenues of $8.5 billion, demonstrating the sheer scale of its operations, which makes it incredibly challenging for new entrants to replicate their broad market reach and cost advantages.

Dover has cultivated significant brand loyalty and deep-seated customer relationships, a testament to its consistent performance, robust track record, and unwavering commitment to safety and compliance. This established trust is a formidable barrier for potential new entrants, making it challenging for them to capture market share.

For instance, in 2023, Dover's Energy segment, a key area where brand loyalty is paramount, continued to demonstrate resilience. While specific customer retention figures aren't publicly disclosed, the segment's consistent revenue generation, exceeding $2 billion in 2023, suggests a high degree of customer stickiness and reliance on Dover's proven solutions.

Proprietary Technology and Intellectual Property

Dover's robust investment in research and development, often exceeding industry averages, translates into a significant portfolio of proprietary technology and intellectual property. This focus on innovation creates substantial barriers for potential new entrants, as replicating Dover's advanced solutions requires considerable time, capital, and specialized expertise. For instance, in 2024, Dover reported R&D expenditures of over $300 million, a testament to its commitment to maintaining a technological edge.

The company's patents and trade secrets are not easily circumvented, making it difficult for newcomers to offer comparable products or services. This technological moat is a critical factor in deterring new entrants.

- Proprietary Technology: Dover holds numerous patents across its various business segments, particularly in areas like fluid management and engineered systems.

- Intellectual Property: The company actively protects its innovations through strategic patent filings and trade secret management.

- R&D Investment: Dover's consistent R&D spending, which has seen a steady increase year-over-year, fuels the development of next-generation technologies.

- Barriers to Entry: The complexity and cost associated with replicating Dover's established technological infrastructure and patent portfolio present a significant hurdle for new competitors.

Regulatory Barriers and Government Policy

Stringent industry regulations, certifications, and government policies in sectors like clean energy, fueling, and climate technologies can pose significant hurdles for new entrants. These requirements often necessitate substantial upfront investment in compliance, obtaining necessary approvals, and adhering to complex operational standards, effectively raising the barrier to entry.

For instance, in the U.S. clean energy sector, new companies seeking to operate solar farms or wind power facilities must navigate a labyrinth of federal, state, and local permitting processes, environmental impact assessments, and grid interconnection standards. In 2024, the average time to secure all necessary permits for a utility-scale solar project could extend over 18-24 months, with associated costs potentially reaching millions of dollars depending on project size and location.

- Regulatory Hurdles: New entrants must invest heavily in understanding and complying with existing and evolving regulations.

- Certification Costs: Obtaining industry-specific certifications, crucial for market acceptance, can be time-consuming and expensive.

- Government Policy Impact: Shifting government policies, such as tax incentives or emissions standards, can dramatically alter the economic viability for new players.

The threat of new entrants for Dover is generally considered moderate, primarily due to high capital requirements and established brand loyalty. Significant upfront investment in R&D and manufacturing facilities, coupled with the need to replicate Dover's extensive distribution networks, presents a substantial barrier. For example, Dover's 2023 revenue of $8.5 billion underscores its scale, making it difficult for newcomers to achieve comparable cost efficiencies and market reach.

Dover's substantial investment in proprietary technology and intellectual property, exemplified by over $300 million in R&D spending in 2024, creates a strong technological moat. This focus on innovation, protected by numerous patents, makes it challenging for new competitors to offer comparable products or services without significant investment in their own R&D and patent acquisition.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, manufacturing, and distribution networks. | Significant hurdle, requiring substantial upfront funding. |

| Economies of Scale & Scope | Dover's large-scale operations lead to lower per-unit costs. | New entrants struggle to match cost competitiveness. |

| Brand Loyalty & Customer Relationships | Established trust and consistent performance. | Difficult for new players to gain market share and customer adoption. |

| Proprietary Technology & IP | Extensive patents and trade secrets from consistent R&D investment. | Replication is costly and time-consuming, creating a technological barrier. |

| Regulatory & Certification Hurdles | Complex compliance requirements in key sectors. | Requires significant investment in time and resources for market entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and publicly available financial filings to meticulously assess competitive intensity.