Doro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doro Bundle

While Doro excels in its niche, understanding the full scope of its market position requires a deeper dive. Our comprehensive SWOT analysis reveals the strategic advantages and potential challenges that shape Doro's future.

Want the complete picture behind Doro's strengths, risks, and growth drivers? Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Doro's unwavering dedication to the senior market is a significant strength. This exclusive focus allows them to cultivate an intimate understanding of their target demographic's unique needs, from ease of use to essential safety features. This deep insight translates into highly specialized and user-friendly technology, setting Doro apart from broader market competitors.

Doro commands significant brand recognition, holding a leading position in the European market for senior-focused mobile phones and accessible technology. This strong market presence is a direct result of its long-standing reputation for user-friendly, reliable devices tailored specifically for older adults. In 2023, Doro continued to leverage this brand equity, a crucial asset in building trust and ensuring customer loyalty within its niche.

Doro consistently pushes the boundaries of senior-focused technology, evidenced by its regular introduction of new products. Recent launches include the Leva feature phones and Aurora smartphones, demonstrating a commitment to core mobile offerings. This innovation extends to a broader smart device ecosystem, featuring products like the Doro Hemma Doorbell, HearingBuds, Watch, and Tablet, catering to a wider array of daily needs.

This strategic diversification ensures Doro stays ahead of evolving user requirements and maintains its market position. The company's focus on integrating proprietary technologies, such as Doro ClearSound™ for enhanced audio clarity and the Doro Secure Button™ for immediate assistance, further differentiates its product line and adds significant value for its target demographic.

Robust Gross and Operating Margins

Doro has shown impressive resilience in its profitability, maintaining robust gross and operating margins even when sales figures have seen some ups and downs. This suggests the company is adept at managing its expenses and setting prices effectively.

Looking at the numbers, the company's financial performance remains solid. For the full year 2024, Doro reported a gross margin of 45.9% and an EBIT margin of 9.8%. This trend continued into early 2025, with the first quarter of 2025 seeing the gross margin climb to 53.3% and operating profit also experiencing growth.

- Consistent Profitability: Doro's ability to maintain strong margins highlights operational efficiency.

- Q1 2025 Performance: Gross margin reached 53.3%, with a notable increase in operating profit.

- Full Year 2024 Results: Achieved a 45.9% gross margin and a 9.8% EBIT margin.

- Effective Cost Management: Strong margins indicate successful control over the cost of goods sold and operating expenses.

Extensive Distribution Network

Doro benefits significantly from an extensive distribution network, enabling its specialized products to reach seniors effectively. The company operates through telecom operators and retailers across more than 20 countries, ensuring broad market accessibility. This wide geographical presence is a key strength for a company catering to a specific demographic.

This established network is vital for Doro’s market penetration, particularly in reaching its target senior audience who may rely on traditional retail channels or specific telecom partnerships. For instance, in 2023, Doro reported a continued focus on strengthening partnerships with key telecom operators in Europe, a strategy that directly leverages its distribution infrastructure.

The breadth of Doro's distribution means its user-friendly mobile phones and related services are available in numerous key markets. This wide reach not only supports current sales but also provides a solid foundation for introducing new products and services to its existing customer base.

Doro's financial health is a notable strength, characterized by consistent profitability and robust margins. The company has demonstrated an ability to manage its expenses effectively, translating into strong financial performance even amidst fluctuating sales. This operational efficiency underpins its market position.

| Financial Metric | Full Year 2024 | Q1 2025 |

|---|---|---|

| Gross Margin | 45.9% | 53.3% |

| EBIT Margin | 9.8% | N/A* |

| Operating Profit | N/A* | Increased |

*Data for Q1 2025 EBIT margin and specific operating profit figures were not detailed in the provided context, but an increase was noted.

What is included in the product

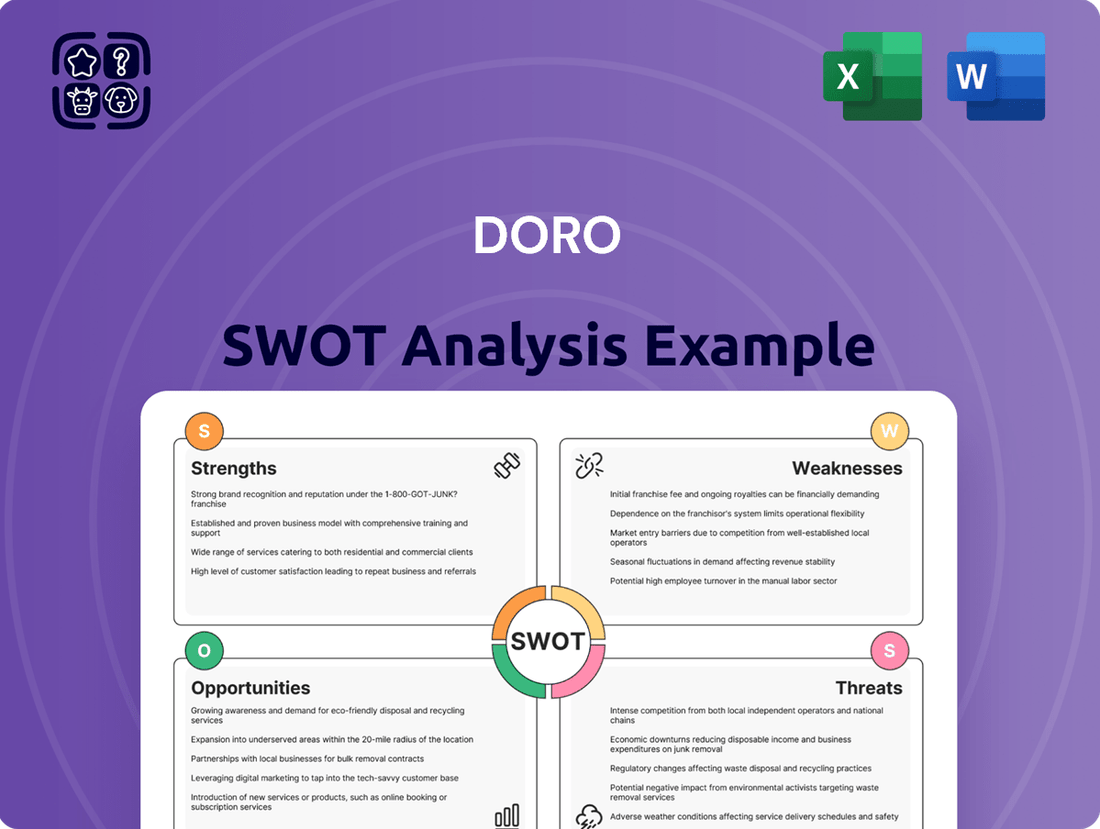

Analyzes Doro’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Doro's SWOT analysis offers a clear, actionable framework that simplifies complex strategic thinking, reducing the pain of indecision and guiding focused action.

Weaknesses

Doro's annual net sales saw a significant drop in 2024, declining by 9.4% to SEK 882.3 million compared to SEK 973.6 million in 2023. This contraction in top-line revenue, even with healthy profit margins, points to potential difficulties in expanding market reach or facing intensified competition.

The decrease in overall sales revenue for Doro in 2024, falling from SEK 973.6 million to SEK 882.3 million, highlights a key weakness. This 9.4% decline suggests that the company may be struggling to attract new customers or retain existing ones in a competitive landscape.

Despite reporting increased sales and operating profit in Q1 2025, Doro experienced a net loss of SEK 3.2 million. This marks a notable decline from the SEK 6.1 million net income recorded in the first quarter of 2024. This shift into a net loss suggests potential short-term profitability challenges or significant investment activities that are currently impacting the company's bottom line, requiring careful observation regarding financial resilience.

While Doro is expanding its offerings, a significant chunk of its revenue and market position still comes from feature phones. This reliance presents a potential vulnerability if consumer tastes quickly pivot to more sophisticated smartphones or if the feature phone market itself faces increased competition.

For instance, in the first half of 2024, feature phones still constituted a notable percentage of Doro's sales volume, even as the company pushed its 4G feature phone models. This continued dependence on a segment that is gradually being overshadowed by smartphones could pose a long-term risk to market share and profitability.

Decline in Employee Satisfaction

Doro's employee satisfaction saw a downturn in 2024. The Employee Net Promoter Score (eNPS) dropped, and there was a slight decrease in reported commitment and overall work situation compared to the previous year.

This decline in employee morale could translate into tangible business challenges. Lower satisfaction often correlates with reduced productivity, higher staff turnover, and difficulties in attracting skilled new hires, all of which can hinder operational efficiency and growth.

- Employee Net Promoter Score (eNPS): Experienced a decline in 2024 compared to 2023.

- Commitment and Work Situation: Showed a slight decrease in reported satisfaction levels.

- Potential Impact: Risk of decreased morale, productivity, and retention.

- Talent Management: Challenges in attracting and retaining talent due to lower satisfaction.

Integration Challenges Post-Acquisition

The ongoing acquisition by Xplora Technologies AS, which solidified an 88.32% ownership stake by January 2025, introduces significant integration challenges. Successfully merging Doro's operations and culture with Xplora's could prove difficult, potentially leading to friction and inefficiencies. This complex transition phase might also divert critical management attention and financial resources away from core business functions, impacting day-to-day operations and the execution of future growth strategies.

Key integration hurdles include:

- System Compatibility: Aligning disparate IT systems and data management platforms between Doro and Xplora is crucial for seamless operations.

- Cultural Harmonization: Bridging potential cultural differences between the two organizations to foster collaboration and employee buy-in.

- Process Standardization: Developing unified operational processes across all departments to ensure efficiency and consistent service delivery.

- Resource Allocation: Managing the allocation of financial and human capital effectively during the integration period to avoid impacting ongoing business performance.

Doro's reliance on feature phones, despite efforts to diversify, remains a notable weakness. In the first half of 2024, feature phones still represented a significant portion of sales volume, even as the company promoted its 4G models. This continued dependence on a market segment gradually being overshadowed by smartphones poses a long-term risk to market share and profitability.

Furthermore, Doro's employee satisfaction declined in 2024, with a drop in Employee Net Promoter Score (eNPS) and reported commitment. This dip in morale could negatively impact productivity, increase staff turnover, and make it harder to attract skilled talent, thereby hindering operational efficiency and growth.

The ongoing acquisition by Xplora Technologies AS, which achieved an 88.32% ownership stake by January 2025, presents substantial integration challenges. Successfully merging Doro's operations and culture with Xplora's could be difficult, potentially leading to friction and inefficiencies, and diverting management attention and resources from core business functions.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Net Sales (SEK million) | 973.6 | 882.3 | -9.4% |

| Q1 2024 Net Income (SEK million) | 6.1 | -3.2 (Q1 2025 Net Loss) | N/A |

| Employee Net Promoter Score (eNPS) | Higher | Lower | Decline |

Preview the Actual Deliverable

Doro SWOT Analysis

This preview reflects the real Doro SWOT analysis document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Doro SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual Doro SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The growing global population of seniors is a significant opportunity for Doro. By 2030, all baby boomers will be over 65, and the 85+ age group is also seeing substantial increases. This demographic trend directly translates into a larger, sustained market for Doro's senior-focused technology, designed to enhance independent living and connectivity.

Seniors increasingly prefer to age in place, fueling a surge in demand for smart home tech, remote patient monitoring, and telehealth. This trend, evident in the growing adoption rates of connected health devices, presents a substantial opportunity for companies like Doro.

Doro can leverage this by enhancing its CareTech and mHealth products, such as the Doro Hemma Doorbell and its Doro 3.0 app. Integrating these into cohesive ecosystems will bolster safety, promote independence, and improve the overall well-being of seniors in their homes. The global remote patient monitoring market alone was valued at approximately USD 30.1 billion in 2023 and is projected to grow significantly.

Doro can significantly boost its revenue by moving beyond its traditional hardware focus and expanding into digital services, mHealth applications, and CareTech IT solutions. This diversification offers the potential for attractive recurring revenue streams, enhancing customer loyalty and lifetime value. For instance, by 2024, the global digital health market reached an estimated $350 billion, with a significant portion driven by services tailored to specific demographics like seniors.

Developing more advanced mobile-based health services, such as remote monitoring or medication management apps, alongside IT outsourcing and web products specifically designed for the elderly, represents a substantial growth opportunity. These offerings can solidify Doro's image as a comprehensive technology partner for seniors, not just a device provider. The demand for such specialized senior-focused tech solutions is projected to grow, aligning with an aging global population and increasing comfort with digital tools.

Leveraging AI and Advanced Technologies

Doro can capitalize on the swift evolution of AI and predictive analytics to significantly enhance its product and service offerings. By embedding AI, Doro can deliver more tailored user experiences, bolster safety functionalities, refine care strategies, and boost overall operational efficiency. This includes developing smarter voice interfaces and predictive health monitoring systems, making technology more intuitive and valuable for older adults.

The integration of AI presents a clear path for Doro to differentiate itself in the market. For instance, AI-powered predictive analytics could anticipate potential health issues for users, allowing for proactive interventions and improved well-being. This aligns with the growing demand for smart home solutions that actively support independent living.

Consider these specific AI-driven opportunities:

- Personalized Reminders and Assistance: AI can manage medication schedules, appointments, and daily routines with greater accuracy and adapt to individual user patterns.

- Enhanced Safety Monitoring: AI can analyze sensor data to detect falls or unusual activity, triggering immediate alerts to caregivers or emergency services. For example, in 2024, the global AI in healthcare market was valued at approximately $20.9 billion and is projected to grow substantially, indicating strong market appetite for such innovations.

- Predictive Health Insights: By analyzing user data (with consent), AI can identify early signs of health decline, enabling timely medical consultations and interventions.

- Streamlined Customer Support: AI-powered chatbots can provide instant, 24/7 support for common queries, freeing up human agents for more complex issues and improving customer satisfaction.

Geographic Expansion and Market Penetration

Doro's existing presence in over 20 countries highlights a strong foundation for further geographic expansion. The company can target new markets, especially those experiencing significant demographic shifts with aging populations and a nascent demand for senior-focused technology solutions. For instance, emerging economies in Southeast Asia and Latin America, with their growing elderly demographics, present considerable untapped potential.

By leveraging its proven European business model and product offerings, Doro can effectively penetrate these new regions. This strategy allows Doro to address specific market needs and capture market share in underserved segments. For example, adapting product features and marketing strategies to local cultural nuances and economic conditions will be crucial for success in diverse new markets.

The potential for increased global footprint and revenue is substantial. As of early 2025, the global population aged 65 and over is projected to reach nearly 1.1 billion, a significant increase from previous years, indicating a growing addressable market. Doro's ability to replicate its success in these expanding markets could lead to a considerable uplift in its international sales figures and overall market position.

- Targeting emerging markets with rapidly aging populations, such as parts of Asia and Latin America.

- Adapting the successful European product portfolio and sales strategies for new cultural and economic contexts.

- Capitalizing on the growing global senior demographic, estimated to exceed 1.1 billion individuals aged 65+ by early 2025.

- Expanding market penetration in regions where technology adoption among seniors is still in its early stages.

Doro's strategic expansion into digital services and CareTech IT solutions offers a significant avenue for recurring revenue growth, moving beyond its traditional hardware sales. The global digital health market, estimated at $350 billion in 2024, provides a vast landscape for these service-oriented offerings. By enhancing its mHealth applications and CareTech platforms, Doro can foster stronger customer loyalty and increase lifetime value.

The integration of AI and predictive analytics presents a substantial opportunity for Doro to innovate and differentiate its product suite. AI can personalize user experiences, improve safety features through fall detection, and offer predictive health insights, aligning with the growing demand for proactive senior care solutions. The global AI in healthcare market, valued at approximately $20.9 billion in 2024, underscores the market's readiness for such technological advancements.

Doro can leverage its established presence in over 20 countries to expand into new geographic markets, particularly those with rapidly aging populations and a growing need for senior-focused technology. Emerging economies in Asia and Latin America, with their increasing senior demographics, represent significant untapped potential for Doro's proven business model and product offerings.

| Opportunity Area | Key Driver | 2024/2025 Data Point | Doro's Action |

|---|---|---|---|

| Digital Services & CareTech | Aging Population & Health Tech Demand | Global Digital Health Market: ~$350 billion (2024) | Expand mHealth apps, IT outsourcing, and CareTech solutions. |

| AI & Predictive Analytics | Demand for Proactive Care & Personalization | Global AI in Healthcare Market: ~$20.9 billion (2024) | Integrate AI for enhanced safety, personalized assistance, and health monitoring. |

| Geographic Expansion | Growing Global Senior Population | Global 65+ Population: ~1.1 billion (early 2025) | Target new markets in Asia and Latin America with adapted offerings. |

Threats

Mainstream tech giants like Apple and Samsung are increasingly targeting the senior demographic, presenting a significant competitive threat to Doro. These companies possess substantial R&D budgets and established brand loyalty, allowing them to develop sophisticated features and marketing campaigns that resonate with older adults.

For instance, Apple's iPhone accessibility features are widely recognized and adopted, and Samsung's Galaxy devices often include user-friendly modes. This broad appeal, coupled with their vast economies of scale, enables them to potentially offer competitive pricing or more feature-rich products that could dilute Doro's specialized market share.

The rapid pace of technological advancement, especially in mobile and smart device markets, forces Doro into continuous, substantial investment in research and development. Keeping products competitive requires staying ahead of evolving hardware and software trends, a challenge that demands significant and ongoing financial commitment to avoid obsolescence.

Geopolitical tensions and trade disputes continue to pose a significant risk. For instance, the ongoing conflicts in Eastern Europe and the Middle East have already led to increased energy prices and shipping costs, impacting global supply chains. Doro, with its international manufacturing presence, faces higher production expenses and potential delivery delays, which could affect its ability to meet demand, especially for technology products that seniors might view as discretionary.

Evolving Regulatory Landscape and Compliance Burden

The increasing complexity of regulations, such as the Corporate Sustainability Reporting Directive (CSRD) and Taxonomy for sustainability, will become mandatory for Doro in fiscal year 2025. This shift will undoubtedly elevate compliance requirements and consequently, operational expenses.

Furthermore, the dynamic nature of healthcare regulations, particularly concerning telecare, data privacy, and assisted living services, poses a significant challenge. Doro may need to undertake substantial modifications to its existing product and service offerings to align with these evolving standards.

- CSRD and Taxonomy: Mandatory for Doro from FY2025, increasing compliance costs.

- Telecare Regulations: Evolving rules on data privacy and service delivery require adaptation.

- Assisted Living Standards: Potential need for product and service adjustments to meet new healthcare regulations.

Cybersecurity Risks and Data Privacy Concerns

Doro's growing reliance on digital platforms for its mHealth and CareTech solutions exposes it to significant cybersecurity risks. A data breach could compromise sensitive user information, leading to severe reputational damage and loss of trust, particularly among its core demographic of older adults. In 2024, the average cost of a data breach globally reached $4.45 million, a figure Doro would aim to avoid.

The company faces potential financial and legal repercussions if it fails to adequately protect user data. Regulatory bodies like the GDPR impose strict penalties for privacy violations, with fines potentially reaching 4% of annual global turnover. Ensuring robust data privacy measures is therefore critical for Doro's operational integrity and financial stability.

Protecting the personal health information of its users is not just a regulatory requirement but a fundamental ethical obligation for Doro. Incidents of data theft or misuse could have devastating consequences for individuals, further amplifying the need for stringent security protocols.

Doro faces intense competition from major tech players like Apple and Samsung, whose extensive R&D and brand loyalty allow them to offer advanced features and attract a broad customer base, potentially eroding Doro's niche market share. The rapid evolution of technology necessitates significant, ongoing investment in R&D to prevent product obsolescence.

Geopolitical instability and trade disputes contribute to rising operational costs and supply chain disruptions, impacting Doro's production expenses and delivery timelines. Furthermore, increasingly stringent regulations, including the CSRD and Taxonomy from FY2025, will elevate compliance requirements and associated operational costs.

Evolving healthcare regulations, particularly concerning telecare and data privacy, may require substantial product and service modifications. Cybersecurity risks are also a major threat; a data breach could lead to severe reputational damage and financial penalties, with global data breaches costing an average of $4.45 million in 2024.

| Threat Category | Specific Threat | Impact on Doro | Example/Data Point |

|---|---|---|---|

| Competition | Mainstream Tech Giants | Market share erosion, reduced pricing power | Apple's iPhone accessibility features widely adopted. |

| Technological Change | Rapid Advancement | Need for continuous R&D investment, risk of obsolescence | Constant hardware and software updates required. |

| Geopolitical & Economic | Trade Disputes/Conflicts | Increased production costs, supply chain delays | Higher energy and shipping costs impacting global supply chains. |

| Regulatory Compliance | CSRD & Taxonomy (from FY2025) | Elevated compliance requirements and operational expenses | Mandatory reporting increases administrative burden. |

| Regulatory Compliance | Healthcare Regulations (Telecare, Data Privacy) | Need for product/service adaptation, potential non-compliance penalties | GDPR fines up to 4% of annual global turnover for privacy violations. |

| Cybersecurity | Data Breaches | Reputational damage, loss of trust, financial/legal repercussions | Average cost of data breach in 2024 was $4.45 million. |

SWOT Analysis Data Sources

This Doro SWOT analysis is built upon a foundation of robust data, including Doro's official financial reports, comprehensive market research, and expert analyses of the telecommunications and assistive technology sectors.