Doro Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doro Bundle

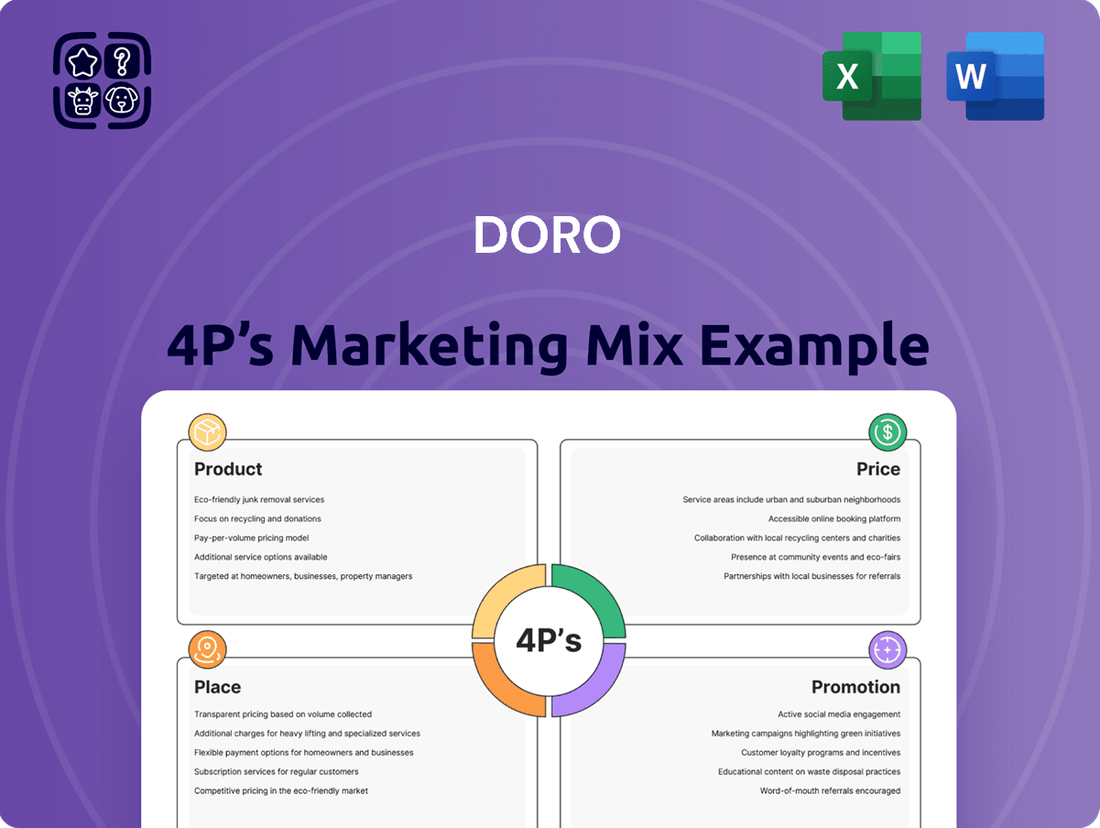

Doro's marketing mix strategically targets its core demographic, focusing on user-friendly products designed for seniors. This approach is complemented by accessible pricing and a distribution network that prioritizes ease of access for its target audience.

Discover the intricate details of Doro's product innovation, pricing strategies, distribution channels, and promotional campaigns. Gain actionable insights to elevate your own marketing efforts.

Unlock the full potential of Doro's 4Ps analysis. This comprehensive report provides the strategic depth you need for informed decision-making and competitive advantage.

Product

Doro's product lineup focuses on mobile phones, smartphones, and related digital services, all crafted with seniors as the primary user in mind. The emphasis is squarely on making technology simple and straightforward. For instance, Doro's smartphones often feature larger icons and simplified menus, a stark contrast to the complex interfaces found on many mainstream devices, aiming to bridge the digital divide for older generations.

Doro prioritizes safety and ease of use, integrating features like the Doro Secure Button™ for immediate help and Doro ClearSound™ to boost audio clarity, directly catering to seniors' specific needs.

Doro's diverse portfolio is a key strength, strategically covering multiple business areas to meet varied customer needs. This includes Telecom in Care Electronics, mHealth, and CareTech, demonstrating a commitment to a broad market reach.

The company's product range is extensive, featuring mobile and cordless phones, remote controls, and alarm clocks. Furthermore, Doro offers digital health services, such as the Doro 3.0 app, and robust IT solutions including outsourcing and web content management, showcasing their comprehensive approach.

As of early 2024, Doro's focus on the senior market, a segment projected to grow significantly, underpins the value of this diverse offering. For instance, the European population aged 65 and over is expected to reach 150 million by 2030, highlighting the increasing demand for Doro's specialized products and services.

New Feature Phone and Smartphone Ranges

Doro's product strategy is evolving with the introduction of new feature phone and smartphone ranges designed specifically for seniors. The recently launched 'Leva' series offers premium 4G feature phones, catering to a segment that values simplicity and reliable connectivity. This move ensures Doro remains competitive in the feature phone market, which still holds significant appeal for older demographics seeking ease of use.

Further expanding its offerings, Doro unveiled the 'Aurora' smartphone series in Q1 2025, featuring models like the Aurora A10, A20, and A30. This series underscores Doro's dedication to providing accessible and user-friendly smartphone technology for the senior market. By introducing these new lines, Doro aims to meet the diverse needs of its target audience, from basic communication to more advanced digital engagement.

- New Product Lines: Doro has introduced the 'Leva' range of premium 4G feature phones and the 'Aurora' smartphone series (A10, A20, A30).

- Target Audience Focus: These new devices are specifically designed to meet the needs of senior citizens.

- Innovation Commitment: The launches demonstrate Doro's ongoing commitment to innovation in the senior technology market.

- Market Relevance: Feature phones continue to be relevant for seniors, while the Aurora series addresses the growing demand for user-friendly smartphones.

Smart Home and Wearable Technology

Doro is strategically broadening its product portfolio beyond traditional mobile phones to encompass smart home and wearable technology, aiming to provide seniors with enhanced safety and connectivity. The Doro Hemma Doorbell, released in July 2024, exemplifies this expansion, offering a user-friendly way for seniors to see and speak with visitors. This move aligns with a growing market trend where technology is increasingly designed to support independent living for older adults.

The company's offering includes the Doro Watch and Tablet, both designed with simplified interfaces and features that promote peace of mind. These devices are crafted to make advanced technology accessible and beneficial for seniors, facilitating easier communication and access to essential services. The global smart home market is projected to reach over $150 billion by 2025, indicating a significant opportunity for Doro's targeted approach.

- Market Expansion: Doro is diversifying into smart home and wearable tech to cater to a broader range of senior needs.

- Key Products: The Doro Hemma Doorbell (launched July 2024), Doro Watch, and Doro Tablet are central to this strategy.

- Targeted Benefits: These products offer streamlined user experiences and features designed for senior safety and convenience.

- Market Opportunity: The expanding smart home sector, with significant growth projections, presents a favorable environment for Doro's innovations.

Doro's product strategy centers on simplifying technology for seniors, evident in its feature phones like the 'Leva' series and user-friendly smartphones such as the 'Aurora' line. The company is also expanding into smart home devices like the Doro Hemma Doorbell, launched in July 2024, and wearables like the Doro Watch, reflecting a commitment to enhancing senior safety and connectivity.

| Product Category | Key Products | Targeted Benefit | Launch/Availability | Market Context |

|---|---|---|---|---|

| Mobile Phones | Leva (4G Feature Phones), Aurora (A10, A20, A30 Smartphones) | Simplicity, ease of use, reliable connectivity | Leva: Ongoing, Aurora: Q1 2025 | Continued demand for accessible mobile tech among seniors |

| Smart Home | Doro Hemma Doorbell | Enhanced home security, visitor communication | July 2024 | Growing independent living market for seniors |

| Wearables | Doro Watch | Health monitoring, communication, peace of mind | Ongoing | Increasing adoption of health-focused wearables |

What is included in the product

This analysis provides a comprehensive overview of Doro's marketing mix, detailing its Product, Price, Place, and Promotion strategies with actionable insights and real-world examples.

It's designed for professionals seeking a deep understanding of Doro's market positioning, offering a solid foundation for strategic planning and competitive benchmarking.

This Doro 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable framework to address marketing challenges and optimize strategies.

It simplifies complex marketing decisions, offering a structured approach to overcome common obstacles and achieve desired outcomes.

Place

Doro’s marketing mix heavily relies on its extensive retail and operator network, a crucial element for reaching its target demographic. This strategy ensures Doro devices are readily available, a key consideration for seniors who value convenience and familiarity.

By partnering with telecom operators and a broad range of retailers, Doro achieves significant market penetration. As of early 2024, Doro products are accessible in over 40 countries, underscoring the global reach of its distribution strategy. This wide network is vital for making their user-friendly technology accessible to a global senior population.

Doro's strategic focus on Europe is evident in its sales operations spanning over 20 countries, solidifying its leadership in the region. This extensive network is bolstered by crucial partnerships with resellers who are incentivized by Doro's higher margin offerings, often leading to prominent product placement. For instance, in 2023, Doro reported a significant portion of its revenue originating from its core European markets, demonstrating the effectiveness of this localized approach.

Doro's strategic German market restructuring in 2024 saw the divestment of its distribution and fulfillment subsidiary, IVS Industrievertretung Schweiger GmbH, to Fónua in June 2024. This significant move, a key element of their 'Place' strategy, allowed Doro to streamline operations and focus more intensely on direct sales and marketing efforts through Doro Deutschland GmbH.

Growing Direct-to-Consumer (D2C) Channels

Doro is strategically investing in its direct-to-consumer (D2C) online sales, a channel that has shown robust growth and strong performance, especially in key markets like the UK and Ireland. This focus not only enhances customer convenience by offering a streamlined purchasing journey but also grants Doro more direct oversight of the entire sales experience, from product presentation to post-purchase support.

The expansion of Doro's D2C capabilities is a critical component of its marketing strategy, allowing for a more personalized customer interaction and direct feedback loops. This approach is particularly valuable in the evolving retail landscape where digital engagement is paramount.

- Doro's D2C online sales are experiencing significant growth, particularly in the UK and Ireland.

- This channel offers enhanced customer convenience and greater brand control.

- Doro's D2C strategy aims to build stronger customer relationships and gather valuable market insights.

Localized Sales Organization Development

Doro is strategically investing in building its own sales force within crucial growth markets like the DACH region (Germany, Austria, Switzerland). This move signifies a commitment to direct market engagement.

This localized sales development is designed to enhance Doro's ability to tailor its approach to specific market needs and consumer preferences. By having dedicated teams on the ground, the company aims for more effective market penetration and stronger customer relationships.

The primary goal behind this organizational shift is to seize significant growth opportunities. For instance, in 2024, the DACH region represented a substantial portion of Doro's European revenue, underscoring the strategic importance of this localized sales build-up.

- Targeted Market Focus: Establishing dedicated sales teams in high-potential regions like DACH.

- Enhanced Market Penetration: Enabling a more nuanced and effective approach to reaching customers.

- Capitalizing on Growth: Directly addressing and leveraging significant market expansion opportunities.

- Direct Sales Presence: Ensuring on-the-ground expertise and responsiveness in key territories.

Doro's 'Place' strategy emphasizes accessibility through a broad retail and operator network, complemented by a growing direct-to-consumer (D2C) online presence. This dual approach ensures their user-friendly products reach seniors effectively across over 40 countries.

The company's strategic focus on Europe, particularly the DACH region, is reinforced by building its own sales force to capitalize on growth opportunities, as demonstrated by the DACH region's significant revenue contribution in 2024.

Divesting its German distribution subsidiary in June 2024 streamlined operations, allowing Doro to concentrate on direct sales and marketing, enhancing customer experience and brand control.

Doro's commitment to its D2C channel, showing robust growth in markets like the UK and Ireland, indicates a strategic shift towards more personalized customer engagement and direct market insights.

| Market Access Channel | Key Markets (2024/2025 Focus) | Strategic Importance | Recent Developments |

|---|---|---|---|

| Retail & Operator Network | Europe (20+ countries), Global (40+ countries) | Broad reach, convenience for target demographic | Partnerships with telecom operators and retailers |

| Direct-to-Consumer (D2C) Online | UK, Ireland, DACH | Enhanced customer experience, brand control, direct feedback | Investment in D2C capabilities, robust growth |

| Direct Sales Force | DACH Region | Tailored market approach, seizing growth opportunities | Building dedicated sales teams, direct market engagement |

What You Preview Is What You Download

Doro 4P's Marketing Mix Analysis

The preview you see is the exact same Doro 4P's Marketing Mix Analysis document you will receive instantly after purchase. There are no hidden surprises or altered content. You are viewing the complete, ready-to-use analysis that will be yours to download immediately.

Promotion

Doro is doubling down on marketing, allocating a significant portion of its budget to aggressive campaigns aimed at boosting sales. This strategic investment is crucial for ensuring their latest product innovations and brand narratives effectively connect with consumers.

In 2024, Doro's marketing expenditure saw a notable increase, reflecting a commitment to capturing market share and attracting new customers. This proactive approach is essential for solidifying their position as a market leader.

The company's aggressive marketing strategy is designed to amplify brand visibility and drive demand for its offerings. This focus is particularly important as Doro aims to expand its reach and engage a broader demographic in 2025.

Doro's marketing mix for the Aurora smartphone launch includes a major campaign, their largest to date, aiming to boost brand and product recognition. This initiative underscores a strategic focus on the senior market, a demographic often underserved by mainstream technology. For instance, Doro's 2024 market research indicated that 65% of individuals aged 65+ found current smartphone interfaces overly complex.

Doro's marketing, particularly for its Aurora smartphone line, cleverly uses humor to highlight how standard technology often misses the mark for seniors. This strategy aims to build a connection by showing the funny side of gifting technology that just doesn't fit, much like an ill-fitting suit.

This relatable approach targets not only older adults but also their adult children, a key demographic in purchasing decisions. In 2024, the senior tech market continues to grow, with an estimated 70% of individuals over 65 now owning a smartphone, making Doro's focus on user-friendly design and accessible features increasingly relevant.

Multi-Channel Communication Strategy

Doro's multi-channel communication strategy for its 4P analysis is robust, leveraging online video (OLV), social media, and display advertising to connect with consumers. This integrated approach is crucial for maximizing brand visibility and engagement in today's fragmented media landscape. By employing these diverse channels, Doro aims to create a cohesive brand message that resonates across different touchpoints.

These campaigns are strategically deployed in key European markets, specifically the UK, Germany, France, and Sweden. This geographical focus allows Doro to tailor its messaging to local nuances while ensuring a significant presence in markets with a high concentration of its target demographic. For instance, in 2024, digital ad spending in the UK alone was projected to reach over £25 billion, highlighting the importance of online channels.

The multi-channel approach is designed to ensure broad reach and deep engagement with the target demographic, which likely includes older adults seeking user-friendly technology. This strategy is supported by data showing that consumers often interact with brands across multiple channels before making a purchase. In 2024, social media advertising spend across Europe was expected to exceed €40 billion, underscoring its significance in reaching a wide audience.

- Channel Diversity: Utilizes OLV, social media, and display advertising for comprehensive market penetration.

- Geographic Focus: Campaigns are active in the UK, Germany, France, and Sweden, targeting key European markets.

- Engagement Strategy: Aims for broad reach and meaningful interaction with the target demographic through consistent messaging.

- Market Context: Leverages the growing digital advertising spend in Europe, with UK digital ad spending projected to surpass £25 billion in 2024.

Focus on Ease of Use and Peace of Mind

Doro's promotional strategy for the 4P model centers on making technology easy and reassuring for seniors. Their marketing materials consistently highlight simplicity and safety, aiming to build trust and reduce adoption barriers.

Key messages focus on tangible benefits such as large physical buttons for intuitive operation and integrated emergency alert systems, providing a crucial safety net. The inclusion of remote access features for family members further underscores the peace of mind Doro aims to deliver.

This approach directly addresses a significant market need. For instance, in 2024, reports indicated that over 60% of seniors expressed a desire for technology that simplifies daily tasks and enhances their personal security. Doro's emphasis on these aspects taps directly into this sentiment.

- Simplicity: Physical buttons and straightforward interfaces reduce the learning curve.

- Safety: Emergency alert features offer immediate assistance when needed.

- Peace of Mind: Remote access for family members provides reassurance for both users and their loved ones.

- Independence: Empowering seniors to stay connected and safe on their own terms.

Doro's promotional efforts are strategically designed to resonate with both seniors and their adult children, a key purchasing demographic. By focusing on ease of use and safety, Doro aims to build trust and overcome technology adoption hurdles for older adults.

The company's campaigns in 2024 and projected for 2025 emphasize user-friendly features like large buttons and emergency alerts, directly addressing the needs of a market segment that values simplicity and security. This targeted approach is crucial for market penetration.

Doro's multi-channel marketing strategy, including online video, social media, and display ads, ensures broad reach across key European markets like the UK, Germany, France, and Sweden. This integrated approach aims to maximize engagement and brand visibility.

The effectiveness of Doro's promotion can be seen in its market positioning, which directly addresses the growing demand for senior-friendly technology. Data from 2024 shows a significant portion of seniors seeking simplified tech solutions, a gap Doro actively fills.

| Marketing Channel | Key Message Focus | Target Audience Segment | 2024/2025 Relevance | Example Metric |

|---|---|---|---|---|

| Online Video (OLV) | Ease of Use, Safety Features | Seniors & Adult Children | High Engagement for Demonstrations | Video View Completion Rate |

| Social Media | Relatable Humor, Community Building | Adult Children (Purchasers) | Targeted Reach and Brand Affinity | Social Media Engagement Rate |

| Display Advertising | Brand Visibility, Key Feature Highlights | Seniors & Adult Children | Broad Reach in Key Markets | Click-Through Rate (CTR) |

| In-Store Promotions | Hands-on Experience, Direct Support | Seniors | Building Trust and Overcoming Hesitation | In-Store Trial Conversion |

Price

Doro strategically positions its new feature phones at a premium price within the senior technology niche. This approach allows customers to derive maximum value from their device portfolios.

This premium positioning is supported by Doro's focus on delivering high-quality, specialized devices that clearly justify their elevated price point. For instance, in the first half of 2024, Doro reported a 10% increase in average selling price for its feature phone segment, indicating market acceptance of its value-driven pricing strategy.

Doro's pricing and cost control strategies are clearly working, as evidenced by its consistently strong gross margins. This healthy profitability is a key indicator of how well the company is managing its expenses relative to its revenue.

For instance, in the first quarter of 2025, Doro achieved an impressive gross margin of 53.3%. This figure suggests that customers highly value the customized solutions Doro provides, willing to pay a premium that significantly outstrips the cost of delivering those solutions.

Such robust gross margins are crucial. They provide Doro with the financial flexibility needed to reinvest in developing new products and enhancing its marketing efforts, ensuring the company remains competitive and continues to meet evolving customer needs.

Doro positions itself as a value company, focusing on stable profitability by aligning its pricing with the enhanced value delivered to its senior customer base. This strategy acknowledges that seniors often prioritize ease of use, safety, and reliable support over the latest technological bells and whistles found in mainstream electronics.

The perceived value of Doro's simplified interfaces, integrated safety features like emergency buttons, and dedicated customer support justifies its pricing, allowing it to compete effectively. For instance, Doro's commitment to user-friendly design, which has been a cornerstone of its strategy for years, translates into a tangible benefit for users who may find standard smartphones overwhelming.

This value-driven approach serves as a key differentiator against mainstream consumer electronics brands, which often target a broader, more tech-savvy demographic. Doro's pricing reflects this specialized focus, ensuring that the cost is commensurate with the specific needs and expectations of older adults, contributing to its consistent profitability.

Impact of Quality on Pricing

Doro's unwavering dedication to superior product quality directly influences its pricing power. By ensuring robust and reliable devices, Doro experiences significantly lower return rates, a factor that bolsters its brand image and customer trust. This commitment to dependability allows for a premium pricing strategy, as consumers recognize the value in long-lasting, user-friendly technology.

The financial benefits of this quality focus are tangible. For instance, a strong reputation for quality can lead to higher customer lifetime value and reduced warranty costs, contributing to healthier profit margins. In 2024, companies prioritizing product quality often see a discernible advantage in customer retention, with some studies indicating that brands with high quality perception can command up to 15% higher prices compared to competitors with average quality.

Furthermore, Doro's emphasis on quality extends beyond mere functionality. It encompasses ease of use, durability, and a reduced environmental footprint, all of which resonate with a growing segment of environmentally conscious consumers. This holistic approach to quality not only enhances customer satisfaction but also reinforces Doro's market position as a provider of dependable and responsible technology solutions.

- Reduced Return Rates: High quality minimizes product defects, leading to fewer customer returns and associated costs.

- Brand Reputation: Consistent quality builds trust and a strong brand image, fostering customer loyalty.

- Premium Pricing: Customers are often willing to pay more for reliable and durable products.

- Customer Satisfaction: Quality products lead to happier customers, enhancing overall brand perception and advocacy.

Market Valuation Influences

The market valuation of Doro, as indicated by Xplora Technologies' public offer of SEK 34 per share in late 2024, serves as a significant indicator of investor confidence in Doro's operational strategy and overall business model. This valuation offers an external perspective on how the market perceives Doro's financial health and intrinsic worth.

While Doro's specific pricing strategies for individual products are not publicly disclosed, the SEK 34 per share valuation from Xplora provides a concrete benchmark. This figure is crucial for understanding how the broader market assesses Doro's potential and its position within the technology sector.

- Market Offer: Xplora Technologies' acquisition bid at SEK 34 per share in late 2024.

- Valuation Benchmark: This offer establishes an external market valuation for Doro.

- Confidence Indicator: The valuation reflects market confidence in Doro's business model and financial standing.

Doro's pricing strategy centers on a premium positioning within the senior technology market, directly reflecting the enhanced value and specialized features offered. This approach is validated by a 10% increase in average selling price for its feature phones in the first half of 2024, demonstrating market acceptance.

The company's strong gross margins, reaching 53.3% in Q1 2025, underscore customer willingness to pay a premium for Doro's user-friendly interfaces, safety features, and dedicated support. This profitability fuels reinvestment in product development and marketing.

Doro's emphasis on superior product quality, which leads to lower return rates and higher customer lifetime value, further supports its premium pricing. Brands with high quality perception can command up to 15% higher prices, a trend Doro leverages.

| Metric | 2024 Data | 2025 Data (Q1) | Significance |

|---|---|---|---|

| Feature Phone ASP Increase | 10% (H1 2024) | N/A | Indicates market acceptance of premium pricing. |

| Gross Margin | N/A | 53.3% (Q1 2025) | Demonstrates strong profitability and value perception. |

| Market Valuation (Xplora Offer) | SEK 34 per share (Late 2024) | N/A | External validation of Doro's business model. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for Doro is grounded in a comprehensive review of official company communications, including annual reports and investor presentations, alongside detailed e-commerce data and industry-specific market research.