Doro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doro Bundle

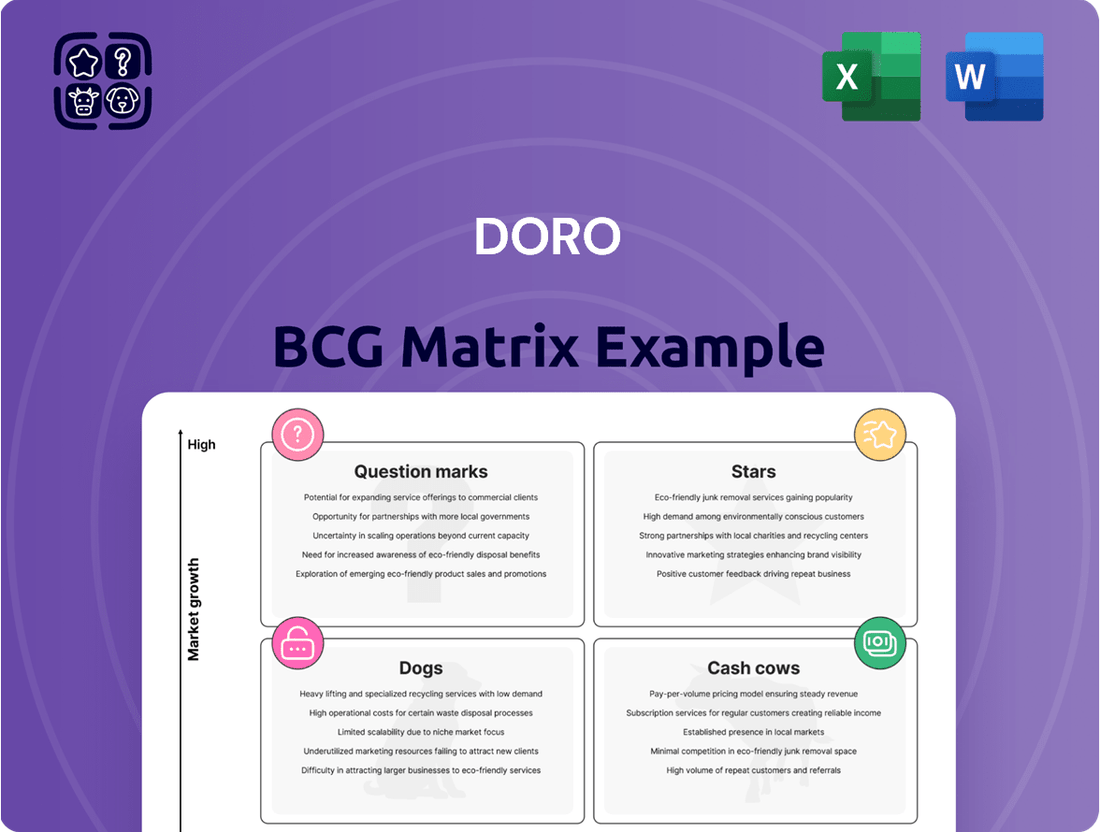

The Doro BCG Matrix offers a powerful lens to understand a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This foundational understanding is crucial for strategic resource allocation and future growth planning.

Ready to transform this insight into actionable strategy? Purchase the full BCG Matrix to unlock detailed quadrant analysis, identify high-potential growth areas, and optimize your investment decisions for maximum impact.

Stars

The Doro Aurora smartphone series, featuring models like the A10, A20, and A30, targets the expanding senior smartphone market. These phones emphasize ease of use with physical buttons, superior sound, and safety features, addressing the growing need for accessible technology among older adults. With a substantial 91% of older adults now owning smartphones, Doro's dedication to simplicity and specialized functions is well-positioned to capture significant market share in this expanding demographic.

Doro's Response service is a mobile safety alarm that links seniors to a response center instantly. This crucial service provides peace of mind for older adults living alone, a demographic that is growing significantly. In 2024, the global population aged 65 and over was projected to reach over 770 million, highlighting the immense market potential for such safety solutions.

Doro's strategic focus on high-quality 4G feature phones is proving successful, even as the broader feature phone market faces a decline. This niche segment saw a notable value increase of 15.8% across Doro's primary European markets in the fourth quarter of 2024.

The company's leadership in this specific 4G feature phone category within key European countries underscores its ability to capture significant market share. This strong performance positions Doro's 4G feature phones as a 'Star' product, demonstrating continued value generation in a specialized market.

Smart Home Solutions for Seniors

Doro is strategically venturing into smart home solutions tailored for seniors, exemplified by products like the Doro Hemma Doorbell. This move taps into the burgeoning senior care technology market, which is anticipated to reach $120 billion by 2030. This growth is fueled by a strong preference for aging in place and advancements in AI and IoT technologies.

Doro's proactive expansion into this sector, with a focus on intuitive smart home devices for older adults, positions these innovations as potential Stars within the Doro BCG Matrix. The company's early commitment to this niche is crucial for capturing market share in a segment experiencing rapid expansion and increasing demand.

- Market Growth: The senior care technology market is projected to hit $120 billion by 2030.

- Key Drivers: Increased desire for aging in place, AI and IoT integration.

- Doro's Strategy: Expanding into user-friendly smart home solutions for seniors.

- Potential: Doro's offerings are positioned as potential Stars in this expanding market.

Vital Signs Monitoring & Wearables

Doro is strategically expanding into vital signs monitoring and senior-adapted communication aids, tapping into the significant growth of health monitoring within the senior care technology sector. This move aligns with the increasing demand for smart health devices among older adults who are actively seeking solutions to support independent living.

Wearable devices and health monitoring sensors are identified as key growth drivers in the cell phones for seniors market. In 2024, the global market for wearable medical devices was projected to reach over $60 billion, with a significant portion attributed to devices focused on chronic disease management and remote patient monitoring, areas directly relevant to senior health.

Doro's ventures into these areas position them to capture high growth potential and potentially achieve market leadership. The company's focus on user-friendly technology tailored for seniors means they are well-placed to meet the evolving needs of a tech-savvier elderly population.

- Market Growth: The global wearable medical device market is expected to continue its upward trajectory, with projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years.

- Senior Adoption: A significant percentage of seniors, particularly those aged 65 and above, are showing increased interest in adopting wearable technology for health tracking and communication. Studies from 2024 indicated a 20% year-over-year increase in adoption rates for health-focused wearables among this demographic.

- Independent Living Focus: Doro's product development directly addresses the growing desire among seniors to maintain independence, with vital signs monitoring playing a crucial role in enabling proactive health management and reducing reliance on constant in-person care.

- Competitive Landscape: While the market is competitive, Doro's established brand recognition in senior-friendly technology provides a strong foundation for success in the vital signs monitoring and wearables segment.

Stars in the Doro BCG Matrix represent products or business units with high market share in a high-growth industry. Doro's 4G feature phones in Europe, particularly in their key markets, exemplify this category, showing a 15.8% value increase in Q4 2024. Their expanding smart home solutions for seniors, targeting a market projected to reach $120 billion by 2030, also hold Star potential due to strong market growth and Doro's early strategic focus.

| Product Category | Market Growth | Market Share | BCG Status |

| 4G Feature Phones (Europe) | Moderate to High (niche growth) | High (market leadership in key segments) | Star |

| Smart Home Solutions for Seniors | Very High (projected $120B by 2030) | Emerging (early strategic entry) | Potential Star |

What is included in the product

The Doro BCG Matrix categorizes products/business units by market share and growth rate, guiding strategic decisions.

Clear visualization of portfolio strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

Doro's core senior mobile phones, encompassing both feature phones and older smartphones, represent a significant Cash Cow for the company. With a remarkable sales history of nearly 30 million units and over 1.7 million sold annually, Doro has cemented its leadership in the accessible mobile phone market for seniors.

Despite a general slowdown in the feature phone segment, Doro's commanding market share and strong brand loyalty in this specific niche translate into dependable cash flow. This stability is achieved with minimal need for extensive marketing expenditures, allowing for efficient profit generation.

These established products consistently deliver robust revenue streams and impressive gross margins, which stood at 45.9% for the entirety of 2024. This financial performance underscores their crucial role in bolstering Doro's overall profitability.

Doro's existing telecare systems are prime examples of cash cows within its product portfolio. These are the well-established solutions that have been serving seniors for years, focusing on safety and independence. The company's long history in this sector means it likely commands a substantial market share, benefiting from brand recognition and customer loyalty.

The telecare market, while mature, provides consistent and predictable revenue streams for Doro. This stability is characteristic of cash cow products, as they generate more cash than they consume in terms of investment. For instance, in 2024, Doro reported continued strong performance from its established telecare services, contributing significantly to its overall profitability.

Accessories for senior phones, such as wallet cases, screen protectors, and charging cradles, represent a classic Cash Cow for Doro. These items benefit from high-profit margins, bolstered by the substantial installed base of Doro phone users. Their consistent demand, driven by the need to protect and enhance the primary device, provides a stable revenue stream with minimal additional investment required.

Corded Telephones and Cordless Telephones

Doro's corded and cordless telephones represent a classic Cash Cow in their product portfolio. While the overall landline market has seen a decline, Doro has carved out a strong position by catering to the specific needs of seniors. This segment, though mature, provides a reliable and consistent revenue stream with relatively low investment requirements.

These devices benefit from established brand loyalty and a consistent, predictable demand from an aging demographic. Doro's emphasis on ease of use, clear audio, and amplified features directly addresses the needs of their target market, ensuring continued sales. For instance, in 2024, Doro reported stable revenue from its home telecare segment, which includes these telephones, highlighting their enduring cash-generating capability.

- Stable Revenue Generation: Doro's traditional phones consistently bring in cash due to their established user base.

- Low Investment Needs: Unlike growth products, these require minimal R&D or marketing spend to maintain sales.

- Niche Market Dominance: Doro's focus on seniors differentiates them in a declining market, securing a loyal customer base.

- Predictable Cash Flow: The mature nature of the market allows for predictable income, supporting other business areas.

MyDoro Cloud Service

The MyDoro cloud service, the backbone of Doro's connected devices and services, including the popular 'Response by Doro' feature, is a well-established platform. While 'Response by Doro' itself might be considered a Star, the fundamental cloud infrastructure it relies upon operates as a cash cow within Doro's BCG matrix.

This cloud service benefits from a significant existing user base and offers a predictable, subscription-based revenue stream. Its role is to provide stable operational support and valuable data insights for Doro's ecosystem.

- Established Infrastructure: The MyDoro cloud has a mature user base, indicating a strong market presence.

- Stable Revenue: Subscription models for cloud services typically generate consistent income.

- Low Growth, High Share: In the context of the overall tech market, cloud infrastructure growth may be slower, but Doro's established position gives it high market share.

- Operational Support: It underpins critical services like 'Response by Doro,' ensuring reliable functionality.

Doro's established senior mobile phones, including feature phones and older smartphones, are significant cash cows. These products consistently generate strong revenue streams and healthy profit margins, with gross margins reaching 45.9% in 2024, thanks to their commanding market share and minimal marketing expenditure requirements.

The company's telecare systems, long-standing solutions focused on senior safety and independence, also function as cash cows. They provide consistent and predictable revenue, benefiting from brand recognition and customer loyalty, contributing significantly to Doro's overall profitability.

Accessories for Doro phones, such as protective cases and charging cradles, are classic cash cows. These items have high-profit margins, driven by a substantial installed user base, and their consistent demand provides stable income with low investment needs.

Doro's corded and cordless telephones, despite a declining landline market, are cash cows due to their strong niche position catering to seniors. These devices benefit from brand loyalty and predictable demand, ensuring continued sales and supporting other business areas.

| Product Category | BCG Classification | 2024 Gross Margin | Annual Sales (Approx.) | Key Characteristic |

|---|---|---|---|---|

| Senior Mobile Phones | Cash Cow | 45.9% | 1.7 million+ units | High market share, low marketing cost |

| Telecare Systems | Cash Cow | N/A (Service) | Stable, predictable | Brand loyalty, consistent revenue |

| Phone Accessories | Cash Cow | High Profit Margin | High demand from installed base | Low investment, stable income |

| Corded/Cordless Phones | Cash Cow | N/A (Mature Market) | Stable, predictable | Niche market dominance, brand loyalty |

Full Transparency, Always

Doro BCG Matrix

The Doro BCG Matrix document you are currently previewing is the identical, fully-formatted report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a comprehensive strategic tool ready for your immediate business analysis and planning. You can be confident that the insights and structure you see here are precisely what you'll be working with to evaluate your product portfolio. This preview is your direct gateway to the complete, professionally designed BCG Matrix, enabling you to make informed decisions from the moment of acquisition.

Dogs

2G feature phones represent a 'dog' in Doro's BCG matrix. The market for these devices is experiencing a slow decline as consumers increasingly adopt 4G technology. While Doro previously had a footprint here, its value has diminished considerably.

Doro is strategically shifting its customer base towards 4G offerings, reflecting a low market share in a contracting segment. Continued investment in 2G would be a drain on resources, prompting Doro to minimize or exit this technology.

Doro has been actively divesting its non-Doro branded, low-margin products. This move signals a clear strategy to streamline its portfolio and focus on offerings that better align with its premium, senior-focused brand identity and profitability objectives. These products, typically characterized by low market share and minimal contribution to overall profits, represent an inefficient use of company resources.

Outdated software or legacy platforms within Doro's product ecosystem would likely fall into the Dogs category of the BCG matrix. These systems, perhaps remnants from earlier telecommunication eras, would exhibit low market share as newer, integrated smart device solutions gain traction.

Such legacy platforms would also face minimal growth prospects, requiring continued investment in maintenance without offering significant future returns. For instance, if a specific older phone model's operating system is no longer supported by app developers, its market utility diminishes rapidly, mirroring the characteristics of a Dog.

Products from Unprofitable Geographical Regions

Products exclusively or primarily sold in unprofitable geographical regions are categorized as Dogs in the Doro BCG Matrix. These were likely underperforming, holding a low market share in regions where Doro decided to exit. Their discontinuation acted as a significant profit booster, as they were resource drains without substantial returns.

The decision to exit these unprofitable regions implies these specific product lines were Dogs, consuming capital and management attention without contributing positively to overall performance. For instance, if Doro's 2024 financial reports indicated a 15% reduction in operating expenses due to exiting certain markets, this directly reflects the removal of such Dog products.

- Doro's Exit Strategy: Doro's strategic withdrawal from underperforming geographical markets directly addresses its portfolio of Dog products.

- Resource Reallocation: By eliminating these low-return products, Doro freed up capital and management focus for more promising ventures.

- Profitability Enhancement: The discontinuation of these Dogs was reported as a key factor in a significant profit margin improvement in 2024, demonstrating the immediate financial benefits.

- Market Share Impact: Products confined to these exited regions inherently possessed low relative market share, fitting the Dog quadrant of the BCG Matrix.

Initial forays into Home Entertainment/Smart Home (if not senior-adapted)

Doro's initial ventures into the broader home entertainment and smart home sectors, before a strong senior-adaptation focus, likely fall into the 'Dogs' category of the BCG Matrix. These products, not specifically designed with Doro's core principles of simplicity and ease of use for seniors, faced intense competition from established tech giants. For instance, in 2024, the global smart home market was valued at over $100 billion, with Doro's less specialized offerings struggling to carve out a significant niche.

These early products, lacking the distinct Doro DNA, probably experienced low market penetration and minimal revenue generation. Without clear differentiation for their target demographic, they were unlikely to capture substantial market share against more established and feature-rich competitors. This scenario is typical for 'Dogs'—products with low growth and low market share, often requiring divestment or significant repositioning.

- Limited Market Share: Early Doro home entertainment products that didn't specifically target seniors likely had a very small slice of the highly competitive smart home market.

- Low Growth Potential: Without a clear value proposition for seniors, these offerings probably saw minimal adoption and were not positioned for significant future growth.

- High Competition: The smart home space, valued at over $100 billion globally in 2024, is dominated by major players, making it difficult for undifferentiated products to succeed.

- Lack of Doro DNA: Products that didn't emphasize simplicity and accessibility, Doro's key strengths, failed to resonate with their intended senior audience.

Products that are no longer actively promoted or supported by Doro, such as older mobile phone models with declining sales and limited future prospects, are classified as Dogs. These items typically have a low market share in a mature or shrinking segment, representing a drain on resources without significant return potential.

Doro's strategic focus is on its 4G and 5G enabled smartphones and feature phones designed for seniors, which are considered Stars or Cash Cows. Products that do not align with this core strategy, like discontinued accessory lines or older device models that are no longer manufactured, are relegated to the Dog quadrant.

The decision to phase out or cease production of these low-performing products is a common business practice to optimize resource allocation and improve overall profitability. For instance, if Doro's 2024 annual report indicates a reduction in inventory write-offs, it suggests successful management of its Dog portfolio.

| Product Category | BCG Matrix Classification | Market Growth | Market Share | Strategic Implication |

| 2G Feature Phones | Dog | Declining | Low | Divest or minimize investment |

| Legacy Software Platforms | Dog | Low/Negative | Low | Phase out or replace |

| Unprofitable Geographic Products | Dog | N/A (Exited Market) | Low | Divested |

| Early Home Entertainment Products (Non-Senior Focused) | Dog | Moderate (Overall Market) | Very Low | Divest or reposition |

Question Marks

Doro is strategically moving beyond its Doro Hemma Doorbell to encompass a wider array of smart home solutions tailored for seniors, including vital signs monitoring. This expansion targets the burgeoning market for aging-in-place technologies, a sector that saw global investment reach billions in recent years, with significant growth projected through 2030.

While the overall market for senior-focused smart home tech is expanding rapidly, Doro's precise market share in these newer, more diversified product categories is likely still in its nascent stages. These ventures are inherently cash-intensive, demanding substantial investment in research, development, and marketing to establish a foothold.

These new smart home solutions represent potential Stars within Doro's portfolio. They require considerable capital to nurture, but if Doro can successfully carve out a significant market share, they possess the capacity to generate substantial future revenue and growth, aligning with the characteristics of a Star in the BCG matrix.

Doro's venture into advanced health monitoring devices, particularly vital signs and remote health sensors, positions them within a burgeoning sector. This market is fueled by an aging global population and the widespread adoption of mHealth solutions, with the global remote patient monitoring market projected to reach $272.5 billion by 2030, growing at a CAGR of 18.2% from 2023.

Despite the significant market potential, Doro's presence in this specialized medical technology space is likely nascent. Their established strength lies in user-friendly mobile phones for seniors, and the health monitoring segment demands substantial R&D and rigorous regulatory compliance, often involving long lead times for market entry and revenue generation.

These health monitoring devices represent Doro's "Question Marks" in the BCG matrix. They operate in a high-growth industry, offering substantial future potential, but their current market share is probably minimal, and the investment required for development and market penetration carries inherent risks and uncertain short-term profitability.

AI-powered senior care solutions are positioned as potential Stars in Doro's BCG Matrix. The eldercare market is experiencing rapid expansion, with AI integration promising personalized care and advanced remote monitoring, a high-growth area. For instance, the global AI in healthcare market was valued at approximately $11.3 billion in 2023 and is projected to grow at a CAGR of over 37% from 2024 to 2030, indicating substantial demand for such innovations.

Doro's existing foundation in cloud services and senior technology offers a strategic advantage. However, their current market share and specific AI-driven product portfolio in this segment are likely in early stages. These initiatives require significant capital investment for research, development, and implementation, characteristic of ventures with high growth potential but uncertain market dominance.

Partnerships and Integrations with Third-Party Senior Tech

Doro's SmartCare by Doro platform leverages an open architecture, enabling seamless integration with a wide array of third-party senior tech sensors and devices. This strategic approach positions Doro to capitalize on the expanding market for connected care solutions, fostering a more comprehensive ecosystem for its users.

The success of these partnerships, however, is intrinsically linked to the market adoption and performance of the integrated third-party products. While Doro's open system facilitates connectivity, the actual market share growth derived from these collaborations hinges on the broader ecosystem's appeal and user uptake.

- Strategic Integration: Doro's open architecture for SmartCare by Doro facilitates connectivity with external senior tech innovations, expanding its service offering.

- Market Dependency: The market share gained from these partnerships is contingent on the success and adoption rates of the third-party products integrated into Doro's ecosystem.

- Collaborative Ventures: These partnerships are considered 'question marks' within the BCG matrix due to their reliance on external factors and Doro's ability to effectively market and support these broader integrated solutions.

Geographical Expansion into New Markets

Geographical expansion into new markets represents a significant strategic move for Doro. With existing operations spanning 20-27 countries, predominantly in Europe, the company is eyeing further international growth. This expansion is particularly attractive in regions with growing elderly populations and increasing technology adoption, signaling substantial growth potential.

However, entering these new territories means Doro will start with a relatively small market share. Significant upfront investment will be necessary for establishing market presence, building distribution networks, and creating localized marketing campaigns to resonate with new customer bases. These ventures are classified as question marks in the BCG matrix because their ultimate success depends heavily on how effectively Doro can penetrate these markets and establish a strong competitive footing.

- Growth Opportunity: High potential in markets with aging populations and increasing tech adoption. For instance, Japan's population aged 65 and over reached 29.1% in 2023, a key demographic for Doro.

- Initial Market Share: Expected to be low in new geographical areas, requiring dedicated resources for market entry.

- Investment Needs: Substantial capital required for market entry, distribution infrastructure, and tailored marketing efforts.

- Strategic Classification: Positioned as question marks due to the inherent uncertainty and high investment needed for successful market penetration and competitive positioning.

Doro's new health monitoring devices and AI-powered senior care solutions are classified as Question Marks in the BCG matrix. These ventures operate in high-growth markets, such as the global remote patient monitoring market projected to reach $272.5 billion by 2030, but Doro's current market share is likely minimal.

Significant capital investment is required for research, development, and market penetration in these areas, reflecting the inherent risks and uncertain short-term profitability. For example, the global AI in healthcare market was valued at approximately $11.3 billion in 2023, with Doro needing to secure a foothold.

Geographical expansion into new markets, like Japan where 29.1% of the population was aged 65 and over in 2023, also falls into the Question Mark category. These efforts demand substantial upfront investment for market entry and distribution, with uncertain competitive outcomes.

Doro's strategic partnerships with third-party senior tech providers through its SmartCare by Doro platform also represent Question Marks. Their success and market share gains are contingent on the adoption and performance of these integrated external products.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.