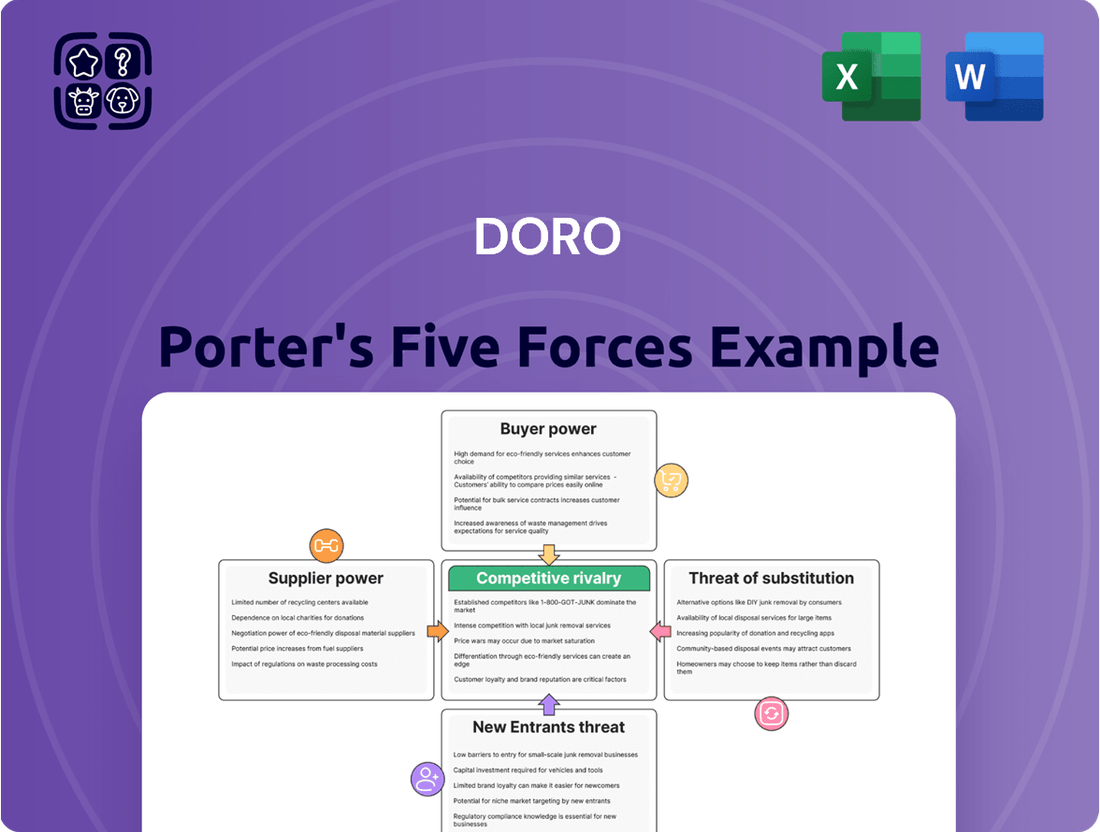

Doro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doro Bundle

Understanding Doro's competitive landscape requires a deep dive into the five forces that shape its industry. From the bargaining power of buyers to the threat of new entrants, each element plays a crucial role in defining Doro's strategic position. This brief overview only scratches the surface of these critical dynamics.

Unlock the full Porter's Five Forces Analysis to explore Doro’s competitive dynamics, market pressures, and strategic advantages in detail. Gain actionable insights to drive smarter decision-making and stay ahead of the curve.

Suppliers Bargaining Power

The bargaining power of component manufacturers is a crucial factor for Doro. Companies supplying essential parts like chipsets, displays, and batteries can exert considerable influence, especially when Doro depends on them for the fundamental hardware of its products. For instance, if a supplier controls proprietary technology or if there are few alternatives for a specialized component, their leverage naturally grows.

However, the situation shifts for more common, standardized components. In these cases, Doro can benefit from the highly competitive global electronics supply chain, potentially giving it more negotiating power. The availability of multiple suppliers for these parts allows Doro to source them from various vendors, mitigating the risk of any single supplier dictating terms.

Software and platform providers, such as those supplying operating systems or specialized applications, can exert significant bargaining power. Doro's reliance on Android, a common platform, mitigates some of this risk, but dependence on niche software or unique service integrations from a few suppliers can increase their leverage over pricing and terms. For instance, in 2024, the global mobile operating system market was dominated by Android and iOS, with Android holding a substantial majority share, underscoring the concentrated power of these foundational providers.

The bargaining power of Doro's manufacturing and assembly partners hinges significantly on the scale of its production. If Doro relies on specialized, niche manufacturing processes or operates at lower production volumes, these partners likely wield more influence due to fewer alternatives. For instance, in 2024, the global contract manufacturing market saw increased demand for specialized electronics assembly, potentially strengthening the position of suppliers offering such capabilities.

However, Doro's ability to switch manufacturing partners in a competitive global landscape can serve as a crucial countermeasure. If Doro's production requirements are not overly specialized and the market offers a sufficient number of capable contract manufacturers, Doro can leverage this to negotiate more favorable terms, thereby reducing the bargaining power of any single supplier.

Logistics and Distribution Services

Suppliers of logistics and distribution services typically hold moderate bargaining power. This is largely because these services are often seen as commodities, with a considerable number of providers competing in the market. This widespread availability naturally limits the ability of any single logistics company to unilaterally impose unfavorable terms. For instance, in 2024, the global logistics market was valued at approximately $9.7 trillion, indicating a highly competitive landscape.

However, the bargaining power can shift depending on the specific nature of the services required. When a business needs highly specialized logistics, such as for international freight, cold chain management, or intricate supply chain solutions, the leverage of the logistics provider can increase. These niche services often involve fewer qualified providers, allowing them to negotiate from a stronger position. For example, a report from late 2024 highlighted that companies requiring specialized hazardous material transport faced an average of 15% higher costs due to limited supplier options.

- Market Size: The global logistics market reached an estimated $9.7 trillion in 2024, underscoring a competitive environment.

- Commoditization: Many logistics services are commoditized, reducing the power of individual suppliers.

- Specialization Impact: Niche logistics, like international or hazardous goods transport, can increase supplier bargaining power.

- Cost Implications: Specialized logistics services in late 2024 saw average cost increases of up to 15% due to limited provider availability.

Telecommunication Network Operators

Telecommunication network operators hold significant bargaining power over Doro. Their networks are essential for Doro's devices to function, making operators critical suppliers. In 2024, major telecom providers globally continued to consolidate their market positions, often leading to fewer, larger players with greater leverage in negotiations with hardware manufacturers like Doro. This concentration means operators can dictate terms for network access, service integration, and even device specifications, impacting Doro's profitability and market access.

These operators, with their vast infrastructure and substantial customer bases, can influence distribution channels and marketing efforts for Doro's products. For instance, a major European operator might demand specific features or pricing for Doro devices to be prominently featured in their sales channels. The reliance on established networks and the need for seamless integration means Doro often has limited alternatives, further amplifying the suppliers' power.

- Network Dependency: Doro's devices require access to telecommunication networks, making operators indispensable suppliers.

- Market Concentration: The telecom sector often features a few dominant players, enhancing their negotiating strength.

- Distribution Influence: Operators can significantly impact Doro's product visibility and sales through their retail and online channels.

Suppliers can significantly impact Doro's profitability and operational flexibility. When suppliers offer unique or critical components, or when there are few alternatives, their bargaining power increases, allowing them to command higher prices or dictate terms. Conversely, a competitive supplier market with many options for standardized components empowers Doro to negotiate more favorable conditions.

The bargaining power of suppliers is a key consideration in Doro's cost structure and product development. For essential hardware like chipsets, where a few manufacturers dominate, Doro faces strong supplier leverage. However, for more common parts, Doro can leverage a wide supplier base. In 2024, the semiconductor industry continued to see consolidation, particularly in advanced chip manufacturing, which could increase supplier power for Doro's high-end devices.

Software and platform providers, especially those offering operating systems or specialized applications, also wield considerable influence. Doro's reliance on platforms like Android in 2024, a market dominated by Google, highlights this. While Android's widespread adoption offers some benefits, dependence on specific software integrations or updates from a limited number of providers can amplify their bargaining power, affecting pricing and feature roadmaps.

| Supplier Type | Bargaining Power Factor | 2024 Trend/Data Point |

|---|---|---|

| Component Manufacturers (e.g., chipsets) | Uniqueness of technology, number of suppliers | Consolidation in advanced chip manufacturing increased supplier leverage. |

| Software/Platform Providers (e.g., OS) | Market dominance, integration dependency | Android's continued market dominance in 2024 amplified platform provider power. |

| Manufacturing & Assembly Partners | Production volume, specialization requirements | Increased demand for specialized electronics assembly in 2024 favored capable suppliers. |

| Logistics & Distribution Services | Service commoditization, specialization needs | Global logistics market size ($9.7 trillion in 2024) indicates competition, but specialized services saw up to 15% cost increases. |

| Telecommunication Network Operators | Network essentiality, market concentration | Telecom operator consolidation in 2024 enhanced their negotiating power with device manufacturers. |

What is included in the product

This analysis dissects the five competitive forces impacting Doro's market, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of industry pressures.

Customers Bargaining Power

For individual senior users, their bargaining power when buying a single Doro phone is typically low, as they usually pay the listed retail price. However, their collective influence is substantial. Doro actively listens to their demand for user-friendly features such as large buttons, clear audio, and emergency call capabilities, which directly shapes product design and marketing strategies.

The satisfaction of these users is paramount. Positive word-of-mouth among seniors is a powerful driver for Doro's brand awareness and market expansion. For instance, Doro's focus on ease of use has resonated strongly, contributing to their significant market share in the senior-focused mobile market in Europe.

Family members and caregivers are significant influencers in purchasing decisions for seniors, wielding considerable bargaining power. They actively compare Doro's offerings against competitors, seeking the best value and prioritizing features that ensure safety and user-friendliness for their loved ones. This scrutiny can push Doro to innovate and maintain competitive pricing.

When Doro sells through large retailers or mobile network operators, these channels wield considerable bargaining power. Their substantial order volumes and direct consumer insights allow them to negotiate favorable pricing and demand specific product features or marketing assistance. For instance, major electronics retailers often account for a significant percentage of a manufacturer's total sales, giving them leverage to dictate terms.

Doro's dependence on these key distribution partners for widespread market reach directly amplifies the bargaining power of these customers. In 2024, the top 10 global electronics retailers collectively represented over $500 billion in annual revenue, illustrating the scale of influence these entities possess in the supply chain.

Price Sensitivity and Brand Loyalty

Doro's customer base exhibits a mixed price sensitivity. While some seniors prioritize essential features and user-friendliness, potentially overlooking the absolute lowest price, others are more budget-driven. This means that while price can be a factor, it's not always the sole determinant for Doro's target demographic.

However, a significant factor mitigating customer bargaining power is the strong brand loyalty Doro often cultivates. Once seniors find a Doro product that reliably meets their needs and is easy to navigate, they tend to stick with the brand. This loyalty reduces their immediate inclination to switch for minor price differences, thereby lessening their bargaining leverage on subsequent purchases.

- Price Sensitivity: Varies among seniors; some prioritize features and ease of use, others are budget-conscious.

- Brand Loyalty: High once needs are met and usability is established, reducing switching propensity.

- Impact on Bargaining Power: Loyalty slightly decreases immediate bargaining power on future purchases.

- Doro's Strategy: Focus on user-friendly design and reliable performance to foster this loyalty.

Switching Costs

Switching costs for Doro's customers are generally low, especially for their basic mobile phones. Consumers can readily switch to a competitor's device without significant hassle or expense. This ease of transition empowers customers, giving them leverage to demand better prices or features.

However, the situation changes for users who have deeply integrated Doro's specialized digital services or unique emergency features into their daily lives. For these customers, the effort to learn a new system or transfer personalized data can create a higher perceived switching cost. This inertia, while not absolute, offers Doro a slight advantage in mitigating direct customer bargaining power.

- Low Switching Costs: For basic Doro phone users, switching to a competitor is typically straightforward, allowing customers to easily compare and choose alternatives.

- Increased Costs for Integrated Services: Customers utilizing Doro's specific digital services or emergency features may face higher switching costs due to the learning curve and data transfer involved in adopting a new platform.

- Impact on Bargaining Power: While low switching costs generally favor customers, the added complexity of Doro's specialized offerings can create a degree of stickiness, slightly reducing their absolute bargaining power.

The bargaining power of customers in the senior mobile market, particularly for a company like Doro, is multifaceted. While individual seniors may have limited power when buying a single device, their collective voice significantly influences product development, with Doro prioritizing user-friendly features. Family members and caregivers often act as key decision-makers, actively comparing options and pushing Doro towards competitive pricing and feature innovation.

Large distribution channels, such as major electronics retailers and mobile network operators, possess substantial bargaining power due to their high sales volumes and direct customer insights. These partners can negotiate favorable pricing and demand specific product features, as evidenced by the significant revenue generated by top global retailers in 2024. While Doro benefits from strong brand loyalty among its senior user base, which mitigates price sensitivity and reduces immediate bargaining leverage, the generally low switching costs for basic devices can empower customers to seek better deals.

| Customer Segment | Bargaining Power Factors | Impact on Doro | 2024 Data/Context |

|---|---|---|---|

| Individual Senior Users | Low individually, high collectively | Influences product design (ease of use) | Doro's market share in Europe driven by senior focus. |

| Family Members/Caregivers | High (influencers, price/feature comparison) | Drives competitive pricing and feature innovation | Prioritize safety and user-friendliness. |

| Large Retailers/Network Operators | High (volume, customer data) | Negotiate pricing, demand features, marketing support | Top 10 global electronics retailers exceeded $500 billion in 2024 revenue. |

| Price Sensitivity | Varies (feature-focused vs. budget-conscious) | Price is a factor, but not always the sole determinant | Doro's target demographic balances needs with cost. |

| Brand Loyalty | Moderate to High (once needs met) | Reduces immediate switching and bargaining leverage | Reliability and ease of use foster long-term customer relationships. |

| Switching Costs | Low (basic phones), Moderate (integrated services) | Empowers customers for basic devices, creates some stickiness for advanced users | Ease of switching can pressure Doro on pricing. |

Same Document Delivered

Doro Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis. The document you see here is precisely the same professionally written and formatted analysis you'll receive immediately after purchase, offering a clear understanding of competitive forces within an industry.

Rivalry Among Competitors

Competitive rivalry in the senior tech market is quite active. Companies like Emporia and TTfone directly challenge Doro with their own simplified mobile devices and associated services, making the landscape moderately to highly competitive. This rivalry often centers on differentiating factors such as specific user-friendly features, competitive pricing strategies, and the strength of brand loyalty within this niche demographic.

Mainstream smartphone makers like Apple and Samsung present a significant, albeit indirect, competitive threat to Doro. Their devices are increasingly featuring accessibility options, such as larger text displays and simplified user interfaces, which can attract senior users seeking ease of use.

For instance, Apple's iOS has robust accessibility features, and Samsung's One UI offers a "Easy Mode." This broader appeal of mainstream smartphones could siphon off potential Doro customers who might prefer the versatility and wider app ecosystem of standard devices, even with added accessibility settings.

Competitive rivalry isn't just from other senior-focused brands; basic feature phone manufacturers also present a challenge. Many seniors find these simpler, more affordable devices perfectly adequate for essential communication like calls and texts, bypassing the need for complex smartphone features.

These basic phones represent a cost-effective choice, often priced significantly lower than Doro's specialized devices. For instance, entry-level feature phones from brands like Nokia or Alcatel can be found for under $50 in 2024, compared to Doro's premium pricing which reflects its added safety and usability features.

To counter this, Doro must strongly emphasize its unique selling propositions. Differentiating through advanced safety features, dedicated customer support services, and a demonstrably superior, intuitive user experience is crucial for justifying its premium price point and retaining its target market.

Companies Offering Smart Home & Health Monitoring

The competitive landscape for Doro extends beyond traditional phone manufacturers to include companies offering smart home and health monitoring solutions. These companies, while not directly selling phones, cater to the same desire for safety and independence among seniors. For instance, companies like Google Nest offer smart home devices that can monitor activity and provide alerts, while specialized PERS providers such as Life Alert and Medical Guardian focus solely on emergency response systems.

Doro's strategy involves integrating communication with these safety features, aiming to create a more comprehensive solution. This approach directly challenges the fragmented market where seniors might need separate devices for communication and health monitoring. The market for connected health devices is growing rapidly; for example, the global market for remote patient monitoring was valued at approximately $27.3 billion in 2023 and is projected to reach over $100 billion by 2028, indicating a significant opportunity and competitive pressure.

- Smart Home Integration: Companies like Amazon Alexa and Google Assistant are increasingly incorporating health and safety features into their smart home ecosystems, offering voice-activated assistance and monitoring capabilities.

- Personal Emergency Response Systems (PERS): Established players like Medical Guardian and Life Alert continue to innovate with wearable devices and mobile PERS, providing direct competition in the safety and peace of mind segment.

- Wearable Health Trackers: The proliferation of smartwatches and fitness trackers from companies such as Apple and Fitbit offers advanced health monitoring features, including fall detection and irregular heart rhythm notifications, which overlap with Doro's target demographic's needs.

- Integrated Safety Platforms: Some companies are developing platforms that combine smart home automation with health monitoring and emergency services, creating a holistic safety net that Doro aims to replicate or surpass.

Technological Innovation and Feature Parity

The rapid pace of technological advancement across the mobile industry significantly fuels competitive rivalry. Competitors, from established giants to emerging players, are consistently rolling out new features, impacting Doro's need to keep up. For instance, in 2024, the smartphone market saw continued upgrades in camera technology, processing power, and battery efficiency, making it harder for niche players to differentiate solely on basic functionality.

As mainstream smartphones become more affordable and incorporate user-friendly interfaces, Doro faces increased pressure. Many competitors are now integrating senior-friendly features, such as enhanced accessibility options and simplified navigation, directly into their standard offerings. This trend means Doro must not only innovate but also ensure its unique selling propositions remain compelling against a backdrop of improving general usability elsewhere.

The pursuit of feature parity by rivals directly intensifies price competition and can erode Doro's profit margins. When competitors offer similar or even superior senior-focused functionalities at competitive price points, Doro is compelled to either match those prices, potentially sacrificing profitability, or risk losing market share. For example, reports in late 2023 and early 2024 highlighted aggressive pricing strategies from several mid-range smartphone manufacturers, putting pressure on all market segments.

- Pace of Innovation: Competitors are rapidly upgrading core smartphone technologies like processors and cameras, forcing Doro to invest in R&D to maintain relevance.

- Feature Parity Threat: Mainstream brands are increasingly adopting user-friendly interfaces and accessibility features, diminishing Doro's unique advantage.

- Pricing Pressure: Rivals offering comparable senior-friendly features at lower price points can force Doro to reduce prices, impacting margins.

- Market Dynamics: The average selling price of smartphones globally continued a slight downward trend in some segments during 2024, exacerbating pricing challenges for specialized brands.

Competitive rivalry for Doro is intense, coming from both direct competitors focused on seniors and indirectly from mainstream smartphone manufacturers. Brands like Emporia and TTfone offer similar simplified devices, while Apple and Samsung are enhancing their accessibility features, making standard phones more appealing to seniors. Basic feature phone makers also pose a threat with their low cost and essential functionality.

The market for connected health and safety solutions is also a competitive arena, with companies like Google Nest and specialized PERS providers offering integrated services. This broad competitive landscape necessitates that Doro clearly articulate its value proposition, emphasizing its unique safety and user-experience advantages.

The rapid pace of technological advancement means Doro must continually innovate to stay relevant. Competitors are constantly upgrading core smartphone technologies, and the increasing affordability and user-friendliness of mainstream devices put pressure on Doro's market position. This can lead to price competition, potentially impacting Doro's profit margins if it needs to match rival pricing.

| Competitor Type | Key Competitors | Competitive Tactics | Impact on Doro |

|---|---|---|---|

| Senior-Focused Brands | Emporia, TTfone | Simplified devices, competitive pricing, user-friendly features | Direct challenge for market share, requires strong differentiation |

| Mainstream Smartphone Makers | Apple, Samsung | Enhanced accessibility features, vast app ecosystems, brand loyalty | Indirect threat, potential to attract seniors seeking versatility |

| Basic Feature Phone Manufacturers | Nokia, Alcatel | Low cost, essential communication features | Price-sensitive segment attraction, bypasses need for advanced features |

| Smart Home & Health Solutions | Google Nest, Life Alert, Medical Guardian | Integrated safety and monitoring, emergency response systems | Competition in the safety and independence segment, requires holistic solutions |

SSubstitutes Threaten

The most substantial threat of substitution for Doro devices comes from mainstream smartphones that are increasingly incorporating robust accessibility features. Many standard smartphones now offer options like enlarged text, simplified home screens, voice commands, and even dedicated emergency contact functions, directly competing with Doro's core value proposition for less tech-savvy users.

This growing capability within the mass market means that even seniors who might have previously found smartphones too complex can now find them manageable, especially if they have support from family or friends who are already familiar with these platforms. For instance, Apple's iOS and Google's Android operating systems have made significant strides in user-friendliness and accessibility settings, making them viable alternatives.

For some seniors, especially those less familiar with newer technology, traditional landline telephones still serve as a dependable communication method. These phones, while not offering the portability or advanced safety functions of mobile devices, are valued for their straightforward operation and consistent reliability.

Doro must effectively showcase the advantages of its mobile phones, particularly their enhanced safety features and greater connectivity, to encourage this segment of users to transition or at least consider a Doro mobile as a complementary device. For instance, in 2024, a significant portion of the senior population still relies on landlines, though mobile adoption is steadily increasing, creating a clear opportunity for Doro.

Dedicated Personal Emergency Response Systems (PERS) pose a significant threat of substitution for Doro's phones. These devices, typically worn as pendants or bracelets, offer a focused emergency alert function without the complexity of a full mobile phone, directly competing with Doro's safety features.

For seniors whose primary concern is immediate emergency assistance, a standalone PERS device can be a more appealing and straightforward solution. This can diminish the perceived value of Doro's integrated safety functionalities when a simpler, specialized alternative exists.

The market for PERS devices is substantial and growing. For instance, the global PERS market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating a strong demand for these dedicated safety solutions.

Tablets and Smart Displays

The threat of substitutes for Doro's smartphones comes from devices like tablets and smart displays. These products often provide similar communication and entertainment features, but with larger screens and more user-friendly interfaces, making them appealing alternatives for seniors who prioritize ease of use for activities like video calls or web browsing within their homes.

For instance, the global tablet market saw shipments reach approximately 39.1 million units in the first quarter of 2024, indicating a robust demand for these larger-screened devices. Similarly, smart display adoption continues to grow, with many households integrating them as central hubs for information and communication.

These substitutes can directly compete with Doro's core value proposition, especially for users who may not require the full portability of a smartphone but still desire convenient digital interaction. The growing familiarity with these devices among the target demographic could lead to a shift in preference away from traditional mobile phones.

- Market Penetration: As tablets and smart displays become more commonplace, their accessibility and perceived value increase.

- User Experience: Larger screens and simplified operating systems on these substitutes can be more appealing to seniors than compact smartphone interfaces.

- Feature Overlap: Key functionalities like video calling and internet browsing are readily available on tablets and smart displays, reducing the need for a dedicated smartphone for some users.

- Cost Considerations: While initial costs vary, the perceived utility-to-price ratio of these alternative devices can influence purchasing decisions.

In-Home Care Services and Human Support

The threat of substitutes for Doro's technology-based solutions is significant, particularly from traditional in-home care services and human support networks. For individuals prioritizing safety and peace of mind, the option of professional caregivers or the comfort of relying on family and community members can fulfill the fundamental need for monitoring and assistance. This human element can directly address the perceived necessity for Doro's advanced safety features and digital services, offering an alternative that may feel more personal and less reliant on technology.

In 2024, the elder care market continued to see robust demand for human-centric services. For instance, the home healthcare services sector in the United States was projected to grow, with an estimated market size of over $150 billion, indicating a strong preference for in-person support. This growth highlights that many seniors and their families still view human interaction and direct care as the primary means of ensuring well-being and security, potentially bypassing the need for Doro's connected devices.

- Human Support as an Alternative: Family members and community networks often provide informal care, fulfilling the need for check-ins and emergency contact, directly substituting the monitoring functions of Doro devices.

- Professional Caregiver Market Growth: The increasing demand for professional in-home care services, with market growth rates often exceeding 7% annually, demonstrates a strong preference for human assistance over technological solutions for many.

- Perceived Value of Human Interaction: For many seniors, the emotional and social benefits derived from human interaction with caregivers or loved ones are irreplaceable by technology, reducing the perceived value of Doro's digital services.

The threat of substitutes for Doro's offerings is substantial, primarily from mainstream smartphones that are increasingly integrating user-friendly accessibility features. Dedicated Personal Emergency Response Systems (PERS) also present a direct challenge, offering focused emergency alerts without the complexity of a full mobile device. Furthermore, devices like tablets and smart displays, with their larger screens and intuitive interfaces, appeal to seniors seeking easier digital interaction, while traditional in-home care services and human support networks fulfill the fundamental need for safety and monitoring through personal interaction.

| Substitute Category | Key Features Competing with Doro | Market Data (2023-2024) |

|---|---|---|

| Mainstream Smartphones | Enhanced accessibility (enlarged text, simplified modes, voice commands) | iOS and Android OS improvements making them more accessible. |

| Personal Emergency Response Systems (PERS) | Focused emergency alert function, wearable form factor | Global PERS market valued at approx. $3.5 billion in 2023; projected CAGR >7% through 2030. |

| Tablets & Smart Displays | Larger screens, simplified interfaces, video calling, web browsing | Global tablet shipments ~39.1 million units in Q1 2024. |

| In-Home Care & Human Support | Direct personal monitoring, emotional/social benefits | US home healthcare services market projected >$150 billion. |

Entrants Threaten

The senior telecommunications market is a niche, demanding a deep understanding of specific user needs and preferences, which naturally creates a barrier for newcomers. Doro has cultivated strong brand recognition and trust within this segment over decades, making it challenging for new entrants to quickly build credibility and gain a foothold. For instance, Doro reported a 7.2% increase in its net sales for the first quarter of 2024, reaching SEK 475 million, indicating sustained demand and brand loyalty.

Developing user-friendly hardware and software specifically for seniors demands substantial investment in research and development. This includes creating accessible interfaces, reliable safety features, and health-monitoring integrations, a niche requiring specialized expertise.

Companies like Doro, a leader in mobile phones for seniors, consistently invest heavily in R&D to meet this demand. For instance, Doro reported its R&D expenses in 2023 were approximately €17.6 million, highlighting the significant capital required to innovate in this sector.

The substantial capital expenditure and specialized knowledge needed to develop these products act as a significant barrier to entry, deterring general technology firms from easily entering this market.

For new companies wanting to enter Doro's market, securing effective distribution channels presents a significant hurdle. Doro has spent years building strong relationships with mobile network operators and major retail chains, giving them established pathways to reach customers. A new entrant would face considerable costs and time in replicating these partnerships, or be forced to rely on less direct and potentially less successful distribution methods.

Regulatory Compliance and Certifications

The threat of new entrants in the senior-focused product market is significantly impacted by regulatory compliance and necessary certifications. For products specifically designed for seniors, particularly those with health or safety functionalities, adherence to stringent regulations and obtaining relevant certifications across different geographical markets is paramount. This process can be intricate, demanding considerable time, and incurring substantial costs, presenting a formidable barrier for nascent companies lacking prior experience within these regulated sectors.

For instance, in the United States, medical devices, including those aimed at seniors, often fall under the purview of the Food and Drug Administration (FDA). Obtaining FDA clearance or approval can be a lengthy and expensive undertaking. In 2024, the average time for FDA 510(k) clearance, a common pathway for medical devices, could range from several months to over a year, with associated costs potentially reaching tens of thousands of dollars, depending on the device's complexity and risk classification.

- FDA Approval Timelines: In 2024, FDA 510(k) clearance for medical devices, relevant to senior care products, could take 6-12 months on average.

- Certification Costs: The expenses for obtaining necessary certifications and navigating regulatory pathways can range from $20,000 to $100,000 or more for new entrants.

- Market-Specific Regulations: Compliance requirements vary significantly by region, with Europe's Medical Device Regulation (MDR) and similar frameworks in Asia adding further complexity and cost.

- Impact on Innovation: High regulatory hurdles can stifle innovation by making it prohibitively expensive for smaller, newer companies to bring essential senior-focused products to market.

Economies of Scale in Manufacturing and Supply Chain

Achieving significant economies of scale in manufacturing and supply chain operations is a major barrier for new entrants in the consumer electronics sector. Doro, as an established player, benefits from high production volumes, which translate into more favorable pricing from component suppliers and logistics providers. For instance, in 2024, major electronics manufacturers often secured discounts of 5-10% on bulk component orders compared to smaller, new companies. This cost advantage allows Doro to maintain competitive pricing for its products.

New entrants typically start with lower production volumes, meaning they cannot negotiate the same preferential rates. This results in higher per-unit manufacturing and procurement costs. Unless a new entrant possesses substantial capital to subsidize these initial higher costs or targets a niche, ultra-premium market segment where price is less sensitive, competing directly on price with established firms like Doro becomes exceedingly challenging.

- Established players like Doro leverage high production volumes to achieve lower per-unit costs in manufacturing and procurement.

- In 2024, bulk component orders offered discounts of 5-10% for large manufacturers, a benefit new entrants struggle to access.

- New entrants face higher initial costs, making price-based competition difficult without significant financial backing or a premium market focus.

The threat of new entrants into Doro's market is relatively low due to significant barriers. These include the high capital investment needed for specialized R&D in user-friendly senior technology and the substantial costs associated with navigating complex regulatory landscapes and obtaining certifications, particularly for health-related features. Furthermore, established players like Doro benefit from economies of scale in manufacturing and established distribution networks, which are difficult and expensive for newcomers to replicate.

| Barrier Type | Description | Example Data (2024) |

| Capital Requirements | Significant investment in R&D for specialized senior products. | Doro's 2023 R&D expenses were approx. €17.6 million. |

| Regulatory Hurdles | Complex compliance and certification processes for senior-focused devices. | FDA 510(k) clearance can take 6-12 months and cost $20k-$100k+. |

| Distribution Channels | Establishing partnerships with network operators and retailers. | Replicating Doro's established channels requires significant time and capital. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Bulk component orders in 2024 offered 5-10% discounts for large manufacturers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including public company filings, industry-specific market research reports, and expert interviews. This comprehensive approach ensures a nuanced understanding of competitive dynamics.