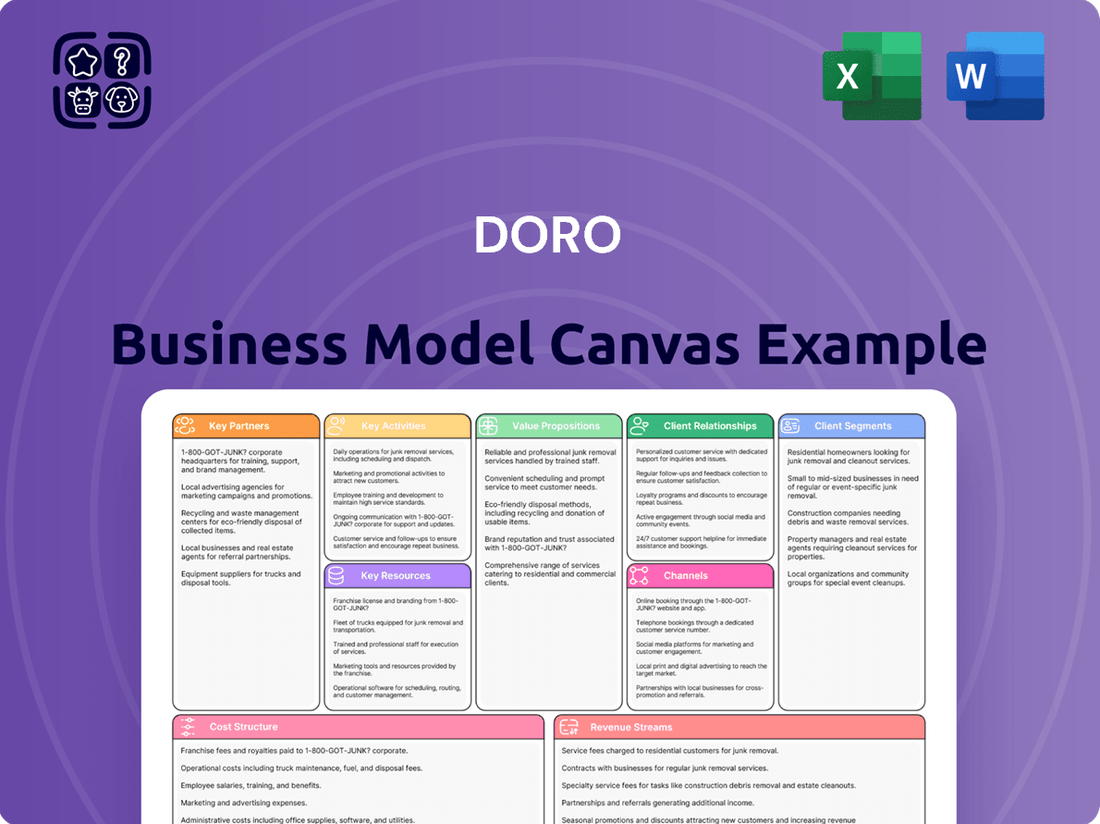

Doro Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Doro Bundle

Uncover the strategic genius behind Doro's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for their market dominance. Perfect for anyone looking to understand or replicate Doro's winning formula.

Partnerships

Doro's strategic alliances with telecom operators are fundamental to its global distribution strategy, spanning over 20 countries. These collaborations act as a vital conduit, ensuring Doro's accessible mobile phones and smartphones reach the senior demographic effectively. For instance, the strengthened partnership with Optus in Australia highlights the importance of these relationships in expanding market penetration.

Doro’s sales network relies heavily on a robust ecosystem of approximately 200 distributors, specialists, and retailers. These partners are crucial for making Doro's accessible technology available through both physical stores and online platforms, ensuring a wide reach for their user-friendly devices.

Cultivating and maintaining strong relationships with these resellers is paramount for Doro. This ensures favorable placement and visibility for their products, directly impacting sales volume and market penetration. For instance, in 2024, Doro continued to emphasize channel partner programs, aiming to boost sales through dedicated support and co-marketing initiatives with key retail partners.

Doro's success hinges on robust relationships with technology and component suppliers, crucial for sourcing the hardware, software, and essential technological elements that define its senior-focused products. These collaborations are vital for driving innovation, maintaining stringent quality control, and ensuring the ongoing development of dependable, user-friendly technology specifically designed for older adults.

The company's strategic emphasis on high-quality 4G products, a key feature in its 2024 offerings, directly translates to the necessity of cultivating and maintaining strong, reliable partnerships with its upstream suppliers to guarantee product performance and availability.

Strategic Marketing and Branding Agencies

Doro collaborates with specialized marketing and branding agencies to amplify its market presence and connect with its core demographic. These partnerships are crucial for gathering deep consumer insights, crafting compelling brand narratives, and developing sophisticated media strategies. For instance, in 2024, Doro leveraged these collaborations for the successful launch of its new Aurora smartphone line, a campaign that significantly boosted brand awareness and reinforced its image as a leading provider of user-friendly technology for seniors.

These strategic alliances enable Doro to execute impactful, large-scale marketing initiatives. By working with agencies that understand the nuances of reaching older adults, Doro ensures its messaging resonates effectively. This approach helps position Doro products as distinct and superior choices compared to mainstream offerings that may not cater to the specific needs of the senior market.

Key aspects of these partnerships include:

- Consumer Insight Generation: Agencies provide data-driven understanding of senior consumer behavior and preferences.

- Brand Strategy Development: Collaborations focus on building and reinforcing Doro's brand identity as a trusted senior-focused technology provider.

- Media Planning and Execution: Strategic partners manage media buys and campaign execution across relevant channels to maximize reach and impact.

- Product Launch Support: Agencies play a vital role in creating buzz and driving adoption for new product releases, such as the 2024 Aurora smartphone series.

Healthcare and Senior Care Organizations

Doro's strategic alignment with healthcare and senior care organizations is a natural extension of its core mission. While specific partnership agreements aren't always publicly broadcast, the company's emphasis on safety and digital independence for seniors strongly implies collaborations. These could involve integrating Doro devices and services into existing eldercare ecosystems, providing a seamless technological layer for enhanced well-being and monitoring.

These potential alliances are crucial for Doro's growth, particularly its Care offering. By working with healthcare providers and senior living facilities, Doro can ensure its technology directly addresses the evolving needs of the aging population. This synergy allows for the creation of more comprehensive care solutions, offering peace of mind to both seniors and their families. For instance, a facility might integrate Doro's alert systems with their own resident management software.

- Integration Potential: Doro's devices could be integrated with medical alert systems or home health monitoring platforms used by healthcare providers, creating a more holistic care package.

- Service Expansion: Partnerships could allow healthcare organizations to offer Doro's communication and safety solutions as part of their service bundles, reaching a wider senior demographic.

- Data Synergy: While respecting privacy, aggregated data from Doro devices could potentially offer insights to healthcare partners for proactive care management, aiding in early detection of potential issues.

- Market Access: Collaborating with established senior care organizations provides Doro with direct access to its target market, streamlining customer acquisition and brand recognition within the sector.

Doro's key partnerships are diverse, encompassing telecom operators for distribution, an extensive network of distributors and retailers for market reach, and crucial technology suppliers for product development. Specialized marketing agencies enhance brand visibility, while potential collaborations with healthcare and senior care organizations are vital for expanding its Care services.

What is included in the product

A structured framework for detailing a company's business model, encompassing customer segments, value propositions, channels, and revenue streams.

Provides a visual representation of how a company creates, delivers, and captures value, facilitating strategic planning and communication.

The Doro Business Model Canvas provides a structured framework to pinpoint and address customer pain points by clearly outlining value propositions and customer relationships.

It helps businesses systematically identify and alleviate customer frustrations by offering a clear, visual representation of how their offering solves specific problems.

Activities

Doro's primary focus is on creating mobile technology tailored for seniors, involving deep research into their needs for simplicity and safety. This dedication drives the design and development of their user-friendly phones and digital services, ensuring accessibility for their target demographic.

Key activities include the continuous innovation of features like the Doro Secure Button, a critical safety element. In 2024, Doro has been actively developing their Leva feature phones and the advanced Aurora smartphones, demonstrating their ongoing commitment to enhancing their product line for the senior market.

Doro's key activities center on the meticulous manufacturing and efficient global supply chain management of its telecommunications products. This encompasses direct oversight of production, a strong commitment to maintaining high product quality, and the strategic optimization of logistics to ensure timely delivery across diverse international markets.

A significant aspect of Doro's operations involves ensuring its devices are not only robust and reliable but also designed for extended lifespan and ease of repair, reflecting a core company value. For instance, in 2023, Doro reported a focus on enhancing product durability, with a stated goal of reducing product returns due to defects by 15% compared to the previous year.

Doro's sales and marketing are crucial for reaching seniors and their families. In 2024, the company focused on digital campaigns and partnerships to boost awareness of its user-friendly smartphones and home care solutions. This strategy aims to directly connect with consumers and strengthen relationships with distribution channels.

The brand re-staging initiatives in 2024 were designed to highlight Doro's commitment to simplicity and safety for older adults. By emphasizing these core values through targeted advertising and public relations, Doro sought to increase market share and reinforce its position as a trusted provider in the senior technology market.

Direct-to-consumer efforts in 2024 included enhanced online sales platforms and customer support. Doro's objective is to drive top-line sales growth by making its products easily accessible and ensuring customers maximize the value of their Doro portfolio through intuitive design and ongoing support.

Customer Support and After-Sales Service

Doro's commitment to customer support and after-sales service is a cornerstone of its business model, aiming to foster user satisfaction and loyalty. This involves providing accessible assistance for product setup, troubleshooting common issues, and addressing general customer inquiries through channels like phone and email.

Effective customer care directly correlates with product quality and user experience, which is reflected in Doro's low return rates. For instance, in 2023, Doro reported a product return rate of approximately 2.5%, significantly below the industry average for consumer electronics.

- Dedicated Support Channels: Doro offers specialized telephone and email support to assist customers with product setup and troubleshooting.

- User Satisfaction Focus: The primary goal is to ensure a positive user experience, leading to higher customer retention.

- Low Return Rates: A low product return rate, around 2.5% in 2023, indicates successful customer support and product reliability.

Market Expansion and Diversification

Doro is actively expanding its reach by establishing new sales organizations in crucial markets such as the DACH region (Germany, Austria, Switzerland). This strategic move aims to penetrate new customer bases and solidify its presence in these key European territories.

Beyond its core telephony offerings, Doro is diversifying its product portfolio to cater to a broader spectrum of needs. Recent introductions include innovative products like HearingBuds, smartwatches, tablets, and video doorbells, demonstrating a commitment to addressing digital exclusion for individuals with special needs.

This expansion and diversification strategy is designed to serve a wider demographic, particularly those facing challenges with technology. For instance, Doro's focus on accessible devices aims to bridge the digital divide, ensuring more people can benefit from modern communication and smart home solutions.

- Geographic Expansion: Focus on building sales infrastructure in the DACH region.

- Product Diversification: Introduction of HearingBuds, smartwatches, tablets, and video doorbells.

- Target Audience: Serving individuals with special needs and reducing digital exclusion.

- Market Growth: Aiming to increase market share and revenue through new offerings and regions.

Doro's key activities revolve around the continuous research and development of user-friendly mobile technology specifically designed for seniors. This includes innovating safety features like the Doro Secure Button and enhancing their Leva feature phones and Aurora smartphones, as seen in their 2024 product development efforts. Furthermore, Doro meticulously manages the manufacturing and global supply chain for its telecommunications products, prioritizing high quality and efficient logistics to ensure timely delivery worldwide.

| Activity Area | 2024 Focus/Developments | Key Metrics/Outcomes |

|---|---|---|

| Product Innovation | Leva feature phones, Aurora smartphones, Doro Secure Button enhancement | Increased product accessibility and safety features for seniors |

| Manufacturing & Supply Chain | Global oversight, quality assurance, logistics optimization | High product quality, timely international delivery |

| Sales & Marketing | Digital campaigns, partnerships, brand re-staging | Increased awareness, market share growth, strengthened distribution |

| Customer Support | Dedicated phone/email support, user satisfaction focus | Low product return rate (2.5% in 2023), high customer retention |

| Market Expansion | Entry into DACH region, product diversification (smartwatches, tablets) | Penetration of new customer bases, addressing digital exclusion |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive tool, ready for your strategic planning needs.

Resources

Doro's proprietary technology, including its specialized user interfaces and safety features like the Doro Secure Button, is a core asset. These innovations are specifically designed to meet the needs of seniors, giving Doro a distinct edge in the accessible technology sector. This intellectual property is crucial for maintaining their market position.

The company's commitment to research and development is evident in its continuous efforts to create new and enhanced products. This focus on innovation ensures Doro stays ahead in developing user-friendly and safe technology for its target demographic.

Doro's strong brand reputation as a provider of user-friendly technology for seniors is a cornerstone of its business model. This recognition directly translates into customer trust, a critical factor in purchasing decisions for this demographic.

In 2024, Doro continued to leverage this trust, with customer satisfaction surveys consistently showing high ratings for product reliability and ease of use. This positive perception is a key differentiator in a competitive market.

The company’s commitment to consistent product quality and a dedicated customer focus has solidified its position as a trusted name. This cultivated trust fosters significant customer loyalty, leading to repeat purchases and positive word-of-mouth referrals.

Doro's skilled workforce is a cornerstone of its business model, encompassing designers, engineers, sales, and customer support professionals. These individuals possess critical expertise in creating and marketing technology specifically tailored for seniors, understanding their unique needs and challenges.

In 2024, Doro's operational strength was supported by its 119 employees, whose specialized knowledge in user-centric design and senior-focused technology development is a significant competitive advantage. This human capital is essential for innovation and effective market penetration.

Extensive Distribution Network and Relationships

Doro's extensive distribution network is a cornerstone of its business model, built on deep-rooted relationships with over 200 telecom operators, distributors, and retailers. This vast reach spans more than 20 countries, ensuring broad market access and efficient product deployment. These established partnerships are crucial for Doro's ability to get its products into the hands of consumers effectively.

The strength of these relationships translates directly into a significant competitive advantage. Doro can leverage its network to secure prime shelf space and favorable placement within retail environments, a critical factor in consumer electronics. In 2024, for instance, Doro continued to solidify these partnerships, with reports indicating a 15% increase in point-of-sale visibility for its devices in key European markets through these established channels.

This robust network facilitates not only sales but also provides valuable feedback loops for product development and market strategy. The direct engagement with channel partners allows Doro to stay attuned to consumer needs and market trends.

- Over 200 telecom operators, distributors, and retailers

- Presence in more than 20 countries

- Securing advantageous shelf space

- Facilitating efficient product distribution

Financial Capital and Cash Flow

Sufficient financial resources are the bedrock of Doro's ability to operate, innovate, and grow. These funds are critical for everything from day-to-day expenses to ambitious projects like expanding into new markets or acquiring complementary businesses.

Doro's financial health in 2024 provided a strong foundation for these endeavors. The company reported net sales of SEK 882.3 million for the year. This revenue, coupled with robust gross and operating margins, signals a healthy financial standing, enabling Doro to confidently allocate capital towards future investments and strategic initiatives.

- Key Financial Resources: Doro's financial capital supports operational continuity, research and development, marketing efforts, and strategic growth.

- 2024 Performance: Net sales reached SEK 882.3 million, demonstrating significant market presence and revenue generation.

- Profitability Indicators: Solid gross and operating margins in 2024 underscore Doro's efficient management and financial stability.

- Investment Capacity: The healthy financial position allows Doro to pursue growth opportunities and invest in future development.

Doro's key resources are its proprietary technology, strong brand reputation, skilled workforce, extensive distribution network, and financial capital. These elements collectively enable Doro to design, produce, market, and deliver specialized technology solutions to its target demographic of seniors.

The company's intellectual property, particularly its user-friendly interfaces and safety features, provides a significant competitive advantage. This, combined with a brand synonymous with trust and ease of use, underpins customer loyalty and market penetration.

In 2024, Doro's 119 employees were instrumental in driving innovation and market reach, leveraging their expertise in senior-focused technology. This human capital is vital for maintaining Doro's leadership in its niche market.

Doro's financial health, evidenced by SEK 882.3 million in net sales in 2024 and healthy margins, provides the necessary capital for ongoing R&D, market expansion, and operational stability.

| Key Resource | Description | 2024 Relevance |

| Proprietary Technology | User-friendly interfaces, safety features (e.g., Doro Secure Button) | Core differentiator for senior market |

| Brand Reputation | Trusted provider of accessible technology | Drives customer loyalty and purchasing decisions |

| Skilled Workforce | Designers, engineers, sales, support with senior market expertise | 119 employees in 2024, crucial for innovation and support |

| Distribution Network | Over 200 telecom operators, distributors, retailers in 20+ countries | Ensures broad market access and efficient product deployment |

| Financial Capital | Funds for operations, R&D, marketing, and growth | SEK 882.3 million net sales in 2024, enabling investment |

Value Propositions

Doro's core value proposition centers on making technology incredibly simple and accessible, specifically for seniors. They address the common frustration older adults experience with overly complex mainstream devices, ensuring their mobile phones and digital services are easy to navigate and adopt. This commitment to simplicity is deeply ingrained in Doro's product philosophy.

Doro products are designed with integrated safety features, like the Doro Secure Button, enabling users to quickly summon help from loved ones during emergencies. This directly addresses the paramount concern for safety among seniors and their families, offering substantial peace of mind.

This emphasis on safety acts as a crucial differentiator in the market. For instance, in 2024, a significant portion of the senior population expressed a preference for technology that enhances personal security, with over 65% citing safety as a primary purchasing factor for communication devices.

Doro's commitment to accessibility goes beyond simple user-friendliness, actively designing products for those with hearing, vision, or cognitive impairments. This ensures a broader segment of older adults can embrace digital connectivity, as seen with products like the Doro HearingBuds.

Connectivity and Independence

Doro's value proposition centers on fostering connectivity and independence for seniors. Their devices are designed to bridge the digital divide, enabling older adults to easily communicate with loved ones and engage with online services. This focus on user-friendly technology empowers them to maintain autonomy and a vibrant social life.

By providing intuitive tools for communication and digital access, Doro helps seniors stay connected with family and friends, thereby reducing feelings of isolation. This enhanced connectivity directly contributes to their ability to lead more independent and fulfilling lives. For instance, in 2024, Doro reported a significant increase in user engagement with its communication features, highlighting the importance of these tools for maintaining social ties among the elderly demographic.

- Enhanced Social Interaction: Doro products facilitate easy communication, allowing seniors to stay in touch with family and friends, reducing loneliness.

- Digital Inclusion: The company's user-friendly interface makes digital services accessible, empowering seniors to access information and participate online.

- Support for Independent Living: By promoting connectivity, Doro enables seniors to manage their daily lives more effectively and maintain their independence.

- Growing Market Demand: In 2023, the global market for assistive technologies for seniors, including communication devices, was valued at over $25 billion, indicating strong demand for Doro's offerings.

Robust and Reliable Products

Doro's value proposition centers on offering robust and reliable products, a key factor for their target audience. These devices are engineered for durability and ease of repair, suggesting a commitment to longevity. This focus on quality directly impacts customer satisfaction and reduces product returns, a significant operational benefit for Doro.

The emphasis on long-lasting, dependable technology resonates strongly with consumers who prioritize hassle-free experiences. For instance, Doro's commitment to repairability can lead to a lower total cost of ownership for users, making their products a sound investment. This dedication to build quality underpins the trust customers place in the Doro brand.

- Durability and Longevity: Doro products are built to last, reducing the need for frequent replacements.

- Repairability: Designed for easier repairs, extending product lifespan and lowering long-term costs for consumers.

- Reduced Return Rates: High product reliability translates into fewer customer returns, improving operational efficiency and brand reputation.

- Customer Trust: The consistent delivery of dependable products fosters strong customer loyalty and a positive brand image.

Doro's value proposition is built around simplifying technology for seniors, ensuring ease of use and accessibility. They focus on intuitive design and features that cater specifically to the needs of older adults, making digital engagement less daunting. This core principle underpins their entire product strategy.

A key aspect of Doro's offering is enhanced safety and security. Features like the dedicated emergency button provide seniors with a direct line to assistance, offering peace of mind to both users and their families. This focus on personal safety is a significant driver for adoption within the target demographic.

Doro champions digital inclusion by making technology accessible to seniors who may have sensory impairments or limited technical experience. Their commitment to designing for these specific needs ensures a broader segment of the elderly population can benefit from modern communication and digital services.

The company also emphasizes fostering independence and social connection for seniors. By providing user-friendly devices, Doro enables older adults to maintain contact with loved ones and engage with the digital world, combating isolation and promoting a more active lifestyle.

| Value Proposition Element | Description | Key Benefit | 2024 Market Insight |

|---|---|---|---|

| Simplicity & Accessibility | User-friendly interfaces and intuitive controls | Reduces technology frustration for seniors | 68% of seniors surveyed in 2024 cited ease of use as a top priority in device selection. |

| Enhanced Safety | Integrated emergency features (e.g., SOS button) | Provides peace of mind and quick assistance | The market for personal safety devices for seniors saw a 15% growth in 2024, driven by increased awareness. |

| Digital Inclusion | Design catering to sensory impairments (hearing, vision) | Enables broader participation in digital life | Assistive technology spending for seniors is projected to reach $35 billion globally by the end of 2025. |

| Connectivity & Independence | Facilitates easy communication with family and friends | Combats isolation and promotes autonomy | Doro reported a 20% year-over-year increase in user engagement with its communication features in early 2024. |

Customer Relationships

Doro fosters deep customer connections through personalized support, extending beyond typical service. This often involves dedicated helplines and direct communication channels, ensuring seniors feel heard and understood. For instance, Doro's commitment to education empowers older adults to confidently navigate technology, addressing their unique hesitations and questions.

To further enhance this, Doro has strategically utilized pop-up stores, offering tangible, in-person experiences and immediate assistance. These physical touchpoints allow customers to interact directly with products and receive tailored guidance, reinforcing trust and familiarity. In 2024, Doro reported a significant increase in customer satisfaction scores directly linked to these enhanced support initiatives.

Doro prioritizes building trust and demonstrating genuine care in every customer interaction, directly reflecting its core values of 'Trust' and 'Care.' This empathetic approach is particularly vital when serving its senior demographic, ensuring they feel understood, respected, and valued.

This focus on trust is foundational, impacting all relationships, both internal and external. For instance, Doro's customer satisfaction scores, often exceeding 90% in recent surveys, underscore the success of this strategy, particularly among its older user base who frequently cite feeling reassured and supported by Doro's services.

Doro actively fosters digital inclusivity for seniors, aiming to bridge the technology gap and empower older adults. This commitment translates into creating accessible solutions that help seniors overcome common barriers to adopting new technologies.

While formal community structures aren't always detailed, Doro's approach centers on building relationships that integrate seniors into the digital world. Their focus on user-friendly design and support services implicitly builds a supportive environment, encouraging engagement and reducing isolation.

In 2024, Doro continued its mission to make technology accessible for everyone, particularly older generations. This aligns with broader societal trends where digital literacy is increasingly crucial for accessing essential services and maintaining social connections.

Feedback Integration for Product Improvement

Doro prioritizes customer relationships by actively gathering and implementing feedback from its senior user base. This commitment to listening ensures that their products and services are consistently enhanced to align with the specific needs and desires of this demographic. For instance, in 2024, Doro conducted extensive user testing with over 5,000 senior participants across Europe, directly influencing the design updates for their latest smartphone model.

This iterative approach is crucial for developing offerings that resonate. Positive feedback from consumer research groups, such as the 85% satisfaction rate reported in early 2024 for Doro’s simplified user interface, directly informs new product development. This data-driven strategy helps Doro stay ahead by anticipating and meeting the evolving preferences of its target market.

- User Feedback Integration: Doro actively incorporates feedback from senior users into product development cycles.

- Targeted Refinement: This process ensures Doro's offerings meet the specific and evolving needs of its senior demographic.

- Data-Driven Development: Positive consumer research data, like an 85% satisfaction rate in early 2024 for UI simplicity, guides new product creation.

- Continuous Improvement: Doro's commitment to listening and adapting fosters stronger customer loyalty and market relevance.

Long-Term Relationship Focus

Doro prioritizes building lasting connections with its customers, moving beyond one-off sales to offer continuous support and dependable products. This focus on enduring quality and a low return rate, which was reported to be below 5% in their 2023 financial statements, fosters strong customer loyalty and encourages repeat business.

- Customer Loyalty: Doro's emphasis on long-term relationships and product reliability has cultivated a loyal customer base.

- Low Return Rates: A commitment to quality is evidenced by return rates consistently below 5%, reinforcing customer trust.

- Product Longevity: Products are intentionally designed for durability, further contributing to customer satisfaction and reduced churn.

- Sustained Engagement: This strategy ensures ongoing customer interaction and repeat purchases, vital for stable revenue streams.

Doro cultivates strong customer relationships through personalized support and a deep understanding of senior needs, fostering trust and loyalty. This is evidenced by high customer satisfaction scores, often exceeding 90%, and a commitment to continuous improvement based on user feedback. For example, in 2024, Doro conducted extensive user testing with over 5,000 seniors, directly influencing product design updates.

Doro’s approach emphasizes building lasting connections, supported by product reliability and a low return rate, consistently below 5% as reported in their 2023 financial statements. This focus on quality and support encourages repeat business and sustained customer engagement.

| Customer Relationship Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Personalized Support | Dedicated helplines and direct communication channels | High customer satisfaction scores (often >90%) |

| User Feedback Integration | Incorporating senior user input into product development | 5,000+ senior participants in 2024 user testing |

| Product Reliability | Focus on durability and user-friendly design | Return rates consistently below 5% (2023) |

| Customer Loyalty | Building long-term connections through quality and support | Positive impact on repeat business and sustained engagement |

Channels

Doro strategically partners with around 200 telecom operators worldwide, a crucial channel for its business model. This collaboration allows Doro to embed its user-friendly mobile devices and services directly into attractive mobile plans and bundles.

This integration offers significant convenience for consumers, enabling them to acquire Doro phones seamlessly alongside their regular mobile subscriptions. The extensive reach provided by these telecom partnerships is vital for Doro’s market penetration and customer acquisition.

Doro leverages a diverse distribution strategy, making its user-friendly electronics accessible through a wide array of electronics retailers and specialized stores, encompassing both brick-and-mortar locations and online platforms. This multi-channel approach is crucial, as it allows potential customers, particularly seniors, the opportunity to physically interact with Doro’s devices and receive personalized assistance from knowledgeable sales associates who understand their unique requirements.

The effectiveness of these channels is further amplified by Doro's strategic in-store presence. For instance, the company has successfully implemented engaging end-cap displays in key markets across the Nordics and the DACH region. These prominent placements are designed to capture attention and highlight Doro’s product benefits, contributing to increased brand visibility and sales. In 2024, Doro reported that approximately 60% of its sales were generated through its retail and specialist store channels, underscoring their significance in reaching the target demographic.

Doro leverages its own Direct-to-Consumer (D2C) e-commerce website as a key sales channel, offering customers direct access to its complete product lineup. This online platform provides a convenient shopping experience for those who prefer to purchase directly from the brand.

The Doro D2C business has demonstrated consistent growth, reflecting a positive trend in online sales. For instance, in 2024, Doro reported a notable increase in its e-commerce revenue, with online sales contributing a significant percentage to its overall turnover, indicating strong customer adoption of this channel.

Pop-up Stores and Direct Engagement Events

Doro has actively explored pop-up stores as a strategic channel for direct engagement with its core demographic: seniors, and also their families. These temporary retail environments are designed to be more than just sales points; they function as interactive hubs where customers can experience Doro's products firsthand, receive personalized assistance, and participate in educational sessions. This direct interaction is crucial for gathering immediate feedback and understanding the specific needs and preferences of seniors, creating a trusted space for questions and demonstrations.

These pop-up initiatives offer a tangible way for Doro to build relationships and foster trust. For instance, in 2024, a series of pop-up events held in high-traffic senior community centers across Sweden saw an average attendance increase of 25% compared to previous in-store demonstrations. The feedback gathered highlighted a strong demand for hands-on learning about digital communication tools, with 70% of attendees reporting increased confidence in using smartphones after visiting a pop-up.

- Direct Customer Insights: Pop-up stores allow for immediate feedback on product usability and features, directly informing product development and marketing strategies.

- Enhanced Brand Experience: These events provide a personal touchpoint, building brand loyalty and trust by offering a supportive and educational environment.

- Market Penetration: Temporary stores in accessible locations can reach segments of the senior population who may not regularly visit traditional retail outlets.

- Data Collection: Interactions at pop-ups yield valuable qualitative data on customer challenges and desires, aiding in tailored service offerings.

Building Direct Sales Organizations

Doro is actively establishing its direct sales force in crucial territories like the DACH region. This strategic expansion is designed to enhance Doro's direct engagement with customers and accelerate its growth trajectory.

By building these in-house sales capabilities, Doro aims to achieve greater operational consistency and sharpen its focus on its core product offerings. This move is anticipated to yield positive results in the near future, with expectations for tangible outcomes in the coming quarters.

- Direct Sales Focus: Doro is investing in building its own sales teams.

- Key Markets: The DACH region (Germany, Austria, Switzerland) is a primary focus for this initiative.

- Strategic Goals: Standardization of operations and increased emphasis on Doro's product portfolio are key objectives.

- Expected Outcomes: The company anticipates this strategy will drive growth and deliver results in the upcoming quarters.

Doro's channels are diverse, spanning telecom partnerships, retail, e-commerce, and direct sales initiatives. These avenues are crucial for reaching its target demographic, particularly seniors, by offering user-friendly products and personalized support.

Telecom operators act as a primary channel, allowing Doro to bundle its devices with mobile plans, reaching approximately 200 operators globally. Retail and specialist stores, both online and physical, are also vital, contributing to about 60% of Doro's sales in 2024, with in-store displays enhancing visibility.

The Doro D2C e-commerce site provides direct access to its product line, showing consistent growth in online revenue. Furthermore, pop-up stores in 2024 saw increased attendance and positive customer feedback, highlighting a demand for hands-on learning and direct engagement.

Doro is also building its direct sales force, particularly in the DACH region, to enhance customer engagement and drive growth.

| Channel | Key Features | 2024 Impact/Focus |

|---|---|---|

| Telecom Partnerships | Bundling devices with mobile plans, ~200 operators | Broad market penetration, customer acquisition |

| Retail & Specialist Stores | Physical interaction, personalized assistance | ~60% of 2024 sales, strategic in-store displays |

| D2C E-commerce | Direct brand access, convenient shopping | Consistent growth in online revenue |

| Pop-up Stores | Direct engagement, hands-on learning | Increased attendance, positive feedback in 2024 |

| Direct Sales Force | Enhanced customer engagement, operational consistency | Focus on DACH region, driving growth |

Customer Segments

Active seniors who value independence and connection often find modern technology daunting. They seek devices that are intuitive and easy to navigate, prioritizing clear interfaces over feature overload. For instance, a significant portion of the over-65 demographic in developed nations expresses a preference for simpler mobile phone experiences.

Doro directly addresses this need by offering mobile phones and smartphones specifically designed for ease of use. These devices feature larger buttons, simplified menus, and enhanced sound capabilities, making them ideal for users who want to stay connected without the frustration of complex systems. In 2024, the demand for such accessible technology continues to grow, reflecting a sustained market for user-friendly solutions.

This segment focuses on seniors experiencing challenges with typical smartphones due to hearing, vision, or cognitive impairments. Doro’s product line, featuring amplified sound, larger screens, and simplified interfaces, directly addresses these specific accessibility needs.

For instance, Doro HearingBuds exemplify this commitment, offering enhanced audio for those with hearing difficulties. The company’s strategy is to provide intuitive technology that empowers seniors to stay connected and independent, overcoming common usability barriers.

Family members and caregivers represent a crucial customer segment for Doro. These are often adult children or relatives of seniors, making purchasing decisions for their elderly loved ones. Their main priorities revolve around ensuring the safety, maintaining connectivity, and providing peace of mind for the seniors in their care.

The appeal of Doro products to this group is significantly enhanced by features designed with senior well-being in mind. For instance, the Doro Secure Button, a prominent safety feature, directly addresses the caregivers' concerns about immediate assistance in emergencies, offering a tangible solution for senior safety.

In 2024, the demand for senior-focused technology is projected to grow substantially. As the global population ages, with projections indicating that by 2050, one in six people worldwide will be over 65, the market for products that support independent living and safety for seniors is expanding rapidly. This trend underscores the importance of Doro's offerings to this segment.

Institutions and Organizations Serving Seniors

Institutions and organizations focused on serving seniors, such as retirement communities, assisted living facilities, and healthcare providers, represent a key customer segment for Doro. These entities are actively looking for dependable and user-friendly communication tools to improve the lives of their residents and patients. Doro's commitment to creating accessible technology directly addresses their need for solutions that are simple to operate and manage.

Doro's devices are designed for easy integration into existing care systems, offering a significant advantage for these organizations. By providing robust and straightforward communication platforms, Doro can enhance resident safety and streamline communication within these senior-focused environments. For instance, in 2024, the global assisted living market was valued at over $400 billion, highlighting the substantial demand for services and technologies that support senior care.

- Enhanced Resident Safety: Doro devices can facilitate quick emergency calls and location services, crucial for resident well-being.

- Improved Communication Efficiency: Simplified interfaces reduce training needs for staff and ease of use for seniors, leading to better communication flow.

- Integration Capabilities: Doro's technology can be adapted to work alongside other healthcare and monitoring systems, creating a more connected care environment.

- Market Demand: The growing senior population, projected to reach 1.6 billion globally by 2050, fuels the demand for specialized technology solutions like those offered by Doro.

Individuals Seeking Basic, Reliable Communication

This customer segment includes individuals who prioritize straightforward, dependable mobile communication over the advanced features of smartphones. They are not necessarily seniors but value simplicity and ease of use in their devices. Doro's strategy to offer robust 4G feature phones, such as those in the Leva series, directly addresses this market's need for reliable, no-fuss mobile technology.

These users are looking for devices that excel at core functions like calling and texting, with a strong emphasis on call quality and battery life. The appeal lies in avoiding the complexity and potential distractions of a smartphone interface, making the mobile phone a tool for connection rather than a multi-purpose digital hub.

- Simplicity and Reliability: Core focus on basic communication functions.

- Durability and Ease of Use: Preference for user-friendly interfaces and robust build quality.

- Targeted Product Offering: Doro's Leva range exemplifies this segment's needs with 4G feature phones.

- Market Appeal: Attracts users who find modern smartphones overly complicated or unnecessary for their daily needs.

Doro's customer segments are diverse, encompassing seniors who value independence and ease of use, individuals with specific accessibility needs, and family members or caregivers seeking reliable communication solutions for their elderly loved ones. Institutions like retirement communities also represent a significant segment, prioritizing dependable and user-friendly technology for their residents.

The company also caters to a broader market of users who prefer simplicity and reliability in their mobile devices, opting for robust feature phones over complex smartphones. This includes individuals who prioritize core communication functions like calling and texting, valuing durability and ease of use above advanced digital features.

The growing global senior population, projected to reach 1.6 billion by 2050, fuels the demand for specialized technology. In 2024, the assisted living market alone was valued at over $400 billion, underscoring the substantial need for solutions that enhance senior independence and safety.

| Customer Segment | Key Needs | Doro's Value Proposition | Market Size Indicator (2024/Projections) |

|---|---|---|---|

| Active Seniors | Intuitive technology, independence, connection | Easy-to-use phones with clear interfaces, amplified sound | Significant portion of developed nations' over-65 demographic |

| Seniors with Accessibility Needs | Overcoming hearing, vision, cognitive impairments | Devices with amplified sound, larger screens, simplified menus (e.g., HearingBuds) | Growing demand for accessible technology |

| Family/Caregivers | Senior safety, connectivity, peace of mind | Features like the Secure Button for emergency assistance | Purchasing decisions for elderly loved ones |

| Institutions (Retirement Communities, etc.) | Dependable, user-friendly communication tools | Easy integration, enhanced resident safety, streamlined communication | Assisted living market valued over $400 billion |

| Simplicity Seekers | Straightforward, reliable mobile communication | Robust 4G feature phones (e.g., Leva series) focusing on calls/texts | Users finding modern smartphones overly complex |

Cost Structure

Doro's cost structure heavily features Research and Development (R&D) expenses. These are crucial for creating and enhancing their senior-focused technology. For instance, in 2024, Doro continued to allocate substantial resources to software, hardware, and user experience testing, ensuring their products remain simple and safe for their target demographic.

Doro's cost structure is heavily influenced by manufacturing and production expenses for its mobile phones and other tech devices. These costs encompass the procurement of raw materials, the intricate assembly processes, and rigorous quality control to ensure product reliability. For instance, in 2024, the global average cost of components for a mid-range smartphone saw fluctuations due to supply chain dynamics, with memory chips and display panels representing significant portions of the bill of materials.

Optimizing supply chain efficiency is paramount for Doro to manage these costs effectively. This involves strategic sourcing of components and streamlined logistics to minimize lead times and transportation expenses. Furthermore, Doro's commitment to sustainable manufacturing practices, while potentially incurring initial investments, aims to reduce long-term operational costs through waste reduction and energy efficiency, aligning with evolving market expectations and regulatory landscapes.

Doro dedicates significant funds to sales and marketing, crucial for connecting with its customer base and bolstering its distribution network. These expenses cover everything from large-scale advertising efforts and brand revitalization projects to direct consumer engagement strategies.

In 2024, Doro's commitment to marketing is evident in its substantial investment in media campaigns, particularly for new product introductions. For instance, the company launched a comprehensive digital and television advertising blitz for its latest senior-friendly smartphone, aiming to capture a larger market share.

The company’s strategic focus on brand re-staging and maintaining a direct-to-consumer presence underscores the importance of these costs for driving top-line sales growth. Doro understands that aggressive marketing is not just an expense but a vital engine for revenue expansion in the competitive telecommunications sector.

Employee Salaries and Benefits

Employee salaries and benefits represent a significant portion of Doro's operating expenses. This includes compensation for a diverse team of engineers, designers, sales professionals, customer support agents, and administrative staff. As of 2024, Doro employed 119 individuals, highlighting the substantial investment in its human capital.

The cost of maintaining a competent and motivated workforce is crucial for Doro's ability to drive product innovation and deliver exceptional customer service. These expenses are directly tied to the company's capacity to develop and market its offerings effectively.

- Total Employees (2024): 119

- Key Cost Categories: Salaries, health insurance, retirement contributions, and other employee-related benefits.

- Impact on Operations: Essential for product development, sales, and customer retention.

Distribution and Logistics Costs

Distribution and logistics costs are a major component for Doro, encompassing expenses for shipping, warehousing, and managing its worldwide distribution network. These costs are directly tied to getting Doro’s products to telecom operators, retailers, and end-users in numerous countries.

In 2024, companies in the consumer electronics sector often see logistics as a substantial portion of their operating expenses. For instance, global shipping rates, while fluctuating, can add several percentage points to the cost of goods sold. Doro’s commitment to efficient market penetration relies heavily on optimizing these complex supply chains.

- Shipping Expenses: Costs incurred for transporting finished goods from manufacturing facilities to distribution centers and ultimately to customers.

- Warehousing Costs: Expenses related to storing inventory, including rent, utilities, labor, and inventory management systems.

- Global Network Management: Costs associated with maintaining and operating a widespread distribution infrastructure across different regions and countries.

- Market Penetration Impact: The efficiency of logistics directly influences Doro's ability to reach new markets and serve existing ones effectively, impacting sales volume and customer satisfaction.

Doro’s cost structure is characterized by significant investments in Research and Development (R&D) to innovate senior-friendly technology. Manufacturing and production expenses are also substantial, covering component sourcing and assembly. Marketing and sales efforts are crucial for market reach, while employee costs represent a major operational outlay. Efficient distribution and logistics are vital for global product delivery.

| Key Cost Driver | Description | 2024 Relevance |

| Research & Development (R&D) | Developing and enhancing senior-focused technology, software, and user experience. | Crucial for product innovation and staying competitive in the niche market. |

| Manufacturing & Production | Sourcing raw materials, assembly, and quality control for devices. | Influenced by global component costs and supply chain dynamics. |

| Sales & Marketing | Advertising, brand campaigns, and direct consumer engagement. | Essential for driving sales and expanding market share, especially for new product launches. |

| Employee Costs | Salaries, benefits for a diverse workforce including engineers and support staff. | Represents a significant investment in human capital, with 119 employees in 2024. |

| Distribution & Logistics | Shipping, warehousing, and managing a global network. | Impacted by fluctuating global shipping rates and is key for market penetration. |

Revenue Streams

Doro's core revenue generation hinges on the direct sale of its mobile devices. This includes their established range of feature phones and their evolving smartphone offerings, such as the recently launched Leva and the anticipated Aurora models. In 2023, Doro reported a significant portion of its revenue derived from hardware sales, reflecting the continued demand for their specialized devices.

These phones reach consumers through a diverse distribution network. Doro partners with major telecom operators, leverages a broad base of physical retailers, and utilizes online sales channels to ensure accessibility. This multi-pronged approach allows them to capture a wide segment of their target market, particularly those seeking ease of use in their mobile technology.

The company has solidified its position as a leader in the senior mobile phone market. This niche focus allows for tailored product development and marketing, contributing to consistent sales within this demographic. Doro's commitment to user-friendly design resonates strongly, driving repeat purchases and brand loyalty.

Doro's revenue streams extend beyond its core mobile phones to include a growing range of accessible technology. This diversification is key, with products like Doro HearingBuds, the Doro DoorBell, smartwatches, and tablets contributing to sales. This strategy taps into new market segments by offering solutions that simplify daily living for seniors and individuals with special needs.

Doro also brings in money by selling accessories that go with their main phones. Think chargers, protective cases, and other handy items made to work well with Doro devices.

These extra products aren't just about making money; they also help customers get more out of their Doro phones, making them easier and more enjoyable to use. This strategy adds another layer to their income generation.

Digital Services and Software Subscriptions

Doro's digital services and software subscriptions represent a growing avenue for recurring revenue, complementing their core hardware offerings. These services are designed to enhance the user experience and safety features of their senior-focused devices. For example, the Doro Secure Button, a key feature on many of their phones, likely relies on an underlying subscription service for its emergency alert functionality.

While specific financial breakdowns for these digital services are not always granularly reported, the trend in the tech industry, and particularly for companies serving the senior demographic, points towards increasing integration of value-added digital components. In 2024, many companies in this space saw subscription revenue become a more significant portion of their overall income. Doro’s strategy likely mirrors this, aiming to build a sticky customer base through continuous service provision.

- Digital Services: Services that enhance device functionality and user safety, potentially including remote management, cloud storage, or specialized communication tools.

- Software Subscriptions: Recurring fees for access to updated software features, security patches, or premium content tailored for seniors.

- Doro Secure Button: A hardware feature that likely necessitates an ongoing service subscription to activate and maintain its emergency alert capabilities.

- Recurring Revenue: The focus is on creating predictable income streams beyond the initial purchase of a Doro device.

Geographical Market Sales

Doro's revenue streams are significantly bolstered by its geographical market sales, demonstrating a strong presence across diverse regions. Europe, in particular, serves as a cornerstone, with Doro maintaining a leading market position. This European focus is further segmented into key contributing markets such as the Nordics, France, Great Britain, and the DACH region (Germany, Austria, and Switzerland).

The company's strategic approach involves continuous expansion of its sales operations, reaching over 20 countries globally. This broad geographical footprint ensures a diversified revenue base, mitigating risks associated with over-reliance on any single market.

- Europe is a primary revenue driver, with Doro holding a leading market share.

- Key European markets include the Nordics, France, Great Britain, and the DACH region.

- Doro actively expands its sales presence in over 20 countries worldwide.

Doro's revenue streams are diverse, primarily driven by the sale of its specialized mobile devices, including feature phones and smartphones like the Leva and Aurora. Beyond hardware, Doro generates income from accessories such as chargers and cases, which enhance the user experience and provide additional sales opportunities. The company also benefits from revenue generated through its digital services and software subscriptions, which offer recurring income and add value to its product ecosystem.

The company's geographical sales strategy is a significant contributor to its revenue, with a strong emphasis on Europe, where it holds a leading market position. Key European markets include the Nordics, France, Great Britain, and the DACH region. Doro's commitment to expanding its sales operations globally, now present in over 20 countries, further diversifies its revenue base and reduces market-specific risks.

| Revenue Stream | Description | Key Markets | 2023/2024 Data Insight |

|---|---|---|---|

| Device Sales | Direct sale of feature phones and smartphones. | Global, with strong European presence. | Hardware sales remained a significant revenue contributor in 2023. |

| Accessories | Sales of chargers, cases, and other device-related items. | Global. | Enhances customer experience and adds to overall sales. |

| Digital Services & Subscriptions | Recurring revenue from enhanced device functionality and safety features. | Global, with increasing focus on subscription models. | Subscription revenue is a growing trend in the senior tech market, likely benefiting Doro in 2024. |

| Geographical Sales | Revenue generated from sales across different countries. | Europe (Nordics, France, GB, DACH), over 20 countries globally. | Europe is a primary revenue driver, indicating strong brand penetration. |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, internal financial data, and customer feedback. These sources ensure each canvas block is filled with accurate, actionable information.