Donegal Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donegal Group Bundle

Navigate the complex external environment affecting Donegal Group with our comprehensive PESTLE analysis. We delve into the political, economic, social, technological, legal, and environmental factors that are crucial for understanding the company's strategic positioning and future growth. Gain a competitive edge by leveraging these expertly researched insights to inform your own market strategies and investment decisions.

Our PESTLE analysis of Donegal Group provides a critical look at the forces shaping its industry. Understand how evolving regulations, economic shifts, and technological advancements present both challenges and opportunities for the insurer. This in-depth report is your essential guide to making informed strategic choices.

Unlock actionable intelligence on Donegal Group's operating landscape. Our PESTLE analysis dissects the key external drivers impacting its performance, from socio-cultural trends to environmental considerations. Empower your strategic planning and forecasting by downloading the full version today.

Gain a deeper understanding of Donegal Group's market dynamics through our thorough PESTLE analysis. Explore the critical political, economic, and technological forces at play, and how they influence the company's trajectory. Purchase the complete report to access these vital strategic insights instantly.

Don't miss out on crucial market intelligence for Donegal Group. Our PESTLE analysis meticulously examines the political, economic, and legal factors influencing the insurance sector. Equip yourself with the knowledge to anticipate trends and capitalize on opportunities by securing the full analysis now.

Political factors

Government policies and the regulatory landscape critically shape the insurance sector, affecting everything from how premiums are set to the capital insurers must hold and how they interact with customers. For Donegal Group, this means that shifts in federal or state insurance departments' directives can directly impact how the company operates and its ability to generate profits across different states. For instance, in 2024, discussions around solvency requirements for property and casualty insurers, like those Donegal Group operates within, continue to be a focus for regulators aiming to ensure financial stability in the face of increasing climate-related risks.

Changes in corporate tax rates, such as the federal corporate tax rate which currently stands at 21%, can directly impact Donegal Group's profitability. State-level tax policies, which vary significantly, also play a crucial role in shaping the company's overall tax burden and investment decisions.

Specific tax incentives or increases related to the insurance industry, for instance, a potential shift in how certain insurance-related deductions are treated, could influence Donegal's product development and pricing strategies. These policy shifts are vital for effective financial planning and forecasting.

While Donegal Group is primarily focused on property and casualty insurance, significant healthcare policy reforms can indirectly influence its operating environment. For instance, shifts in how employers provide health benefits, a trend potentially accelerated by ongoing policy discussions, could alter business expenditure priorities. This could lead to changes in the demand for commercial insurance lines, such as workers' compensation or business liability, as companies reallocate resources.

As of early 2025, legislative proposals continue to explore various avenues for healthcare cost containment and coverage expansion. These reforms, even if not directly targeting the insurance sector Donegal operates in, create a ripple effect across the broader economy. For example, changes in healthcare affordability for individuals and businesses can impact overall economic stability, which in turn affects consumer spending and business investment, both crucial for insurance demand.

Donegal Group needs to closely observe how policy adjustments impact the financial health of its policyholders, both individuals and businesses. A stronger economic footing for policyholders generally translates to more consistent premium payments and a lower likelihood of claims arising from economic hardship. Monitoring these macro-level economic trends driven by healthcare policy is therefore a strategic necessity.

Trade and International Relations

While Donegal Group is primarily focused on the U.S. market, international trade policies and global relations still cast a shadow. Shifts in these areas can alter the overall economic landscape, potentially affecting the investment portfolios held by Donegal and the financial health of its business clients.

Geopolitical tensions or trade disputes can disrupt supply chains and impact specific industries. For instance, tariffs imposed in 2023 on certain goods could have indirectly affected businesses within Donegal's commercial insurance portfolio, altering their operational risks and profitability.

A more stable international environment generally fosters broader economic expansion and boosts demand for insurance services. Countries that experienced significant economic growth in 2024, such as India and Vietnam, contribute to a more robust global economy, which can indirectly benefit U.S. businesses and their insurers.

- Global Trade Agreements: Changes in trade pacts can influence the cost of goods and services for U.S. businesses, impacting their financial stability and insurance needs.

- Geopolitical Stability: Conflicts or political instability in key regions can disrupt global markets and supply chains, leading to increased economic uncertainty.

- International Investment Flows: The movement of capital across borders can affect interest rates and investment returns, areas of importance for insurance companies like Donegal.

Political Stability and Elections

The political landscape in the United States, particularly concerning the stability of governance and the results of federal and state elections, directly impacts Donegal Group. Shifts in political power can introduce periods of uncertainty or provide a clearer path for future regulatory and economic strategies within the insurance industry. For instance, a new administration might re-evaluate consumer protection laws or alter the approach to industry oversight, which could affect operational costs and market dynamics for insurers like Donegal Group.

Changes in legislative priorities following elections can have significant ripple effects. If a new government focuses on economic stimulus, this could boost demand for insurance products as consumer confidence rises and businesses expand. Conversely, a focus on increased regulation could lead to higher compliance burdens. Donegal Group must remain agile, anticipating these potential policy shifts and adapting its business model accordingly to navigate the evolving political environment. For example, the 2024 US Presidential election and subsequent congressional shifts will be crucial in shaping the regulatory and economic climate for the insurance sector through 2025.

- 2024 US Presidential Election: The outcome will determine the direction of federal regulatory policy impacting the insurance sector.

- Congressional Control: The party controlling Congress will influence the passage of legislation affecting economic stimulus and industry oversight.

- State-Level Elections: Gubernatorial and legislative races in key states where Donegal Group operates will shape state-specific insurance regulations and market access.

Government stability and legislative agendas directly influence Donegal Group's operational environment. Shifts in political power, like those anticipated following the 2024 US elections, can lead to changes in regulatory focus and economic policy. For instance, potential changes in federal oversight or state-level insurance regulations introduced by newly elected officials will require adaptation from Donegal Group.

Legislative priorities concerning economic stimulus or fiscal policy can impact consumer confidence and business investment, indirectly affecting insurance demand. A stable political climate generally supports predictable business conditions, aiding Donegal Group's strategic planning and financial forecasting through 2025.

Donegal Group must monitor key elections, such as the 2024 US Presidential race and relevant state races, as their outcomes will shape the future regulatory and economic landscape. The specific legislative and regulatory direction set by new administrations and congressional compositions will be critical for the company's market strategy.

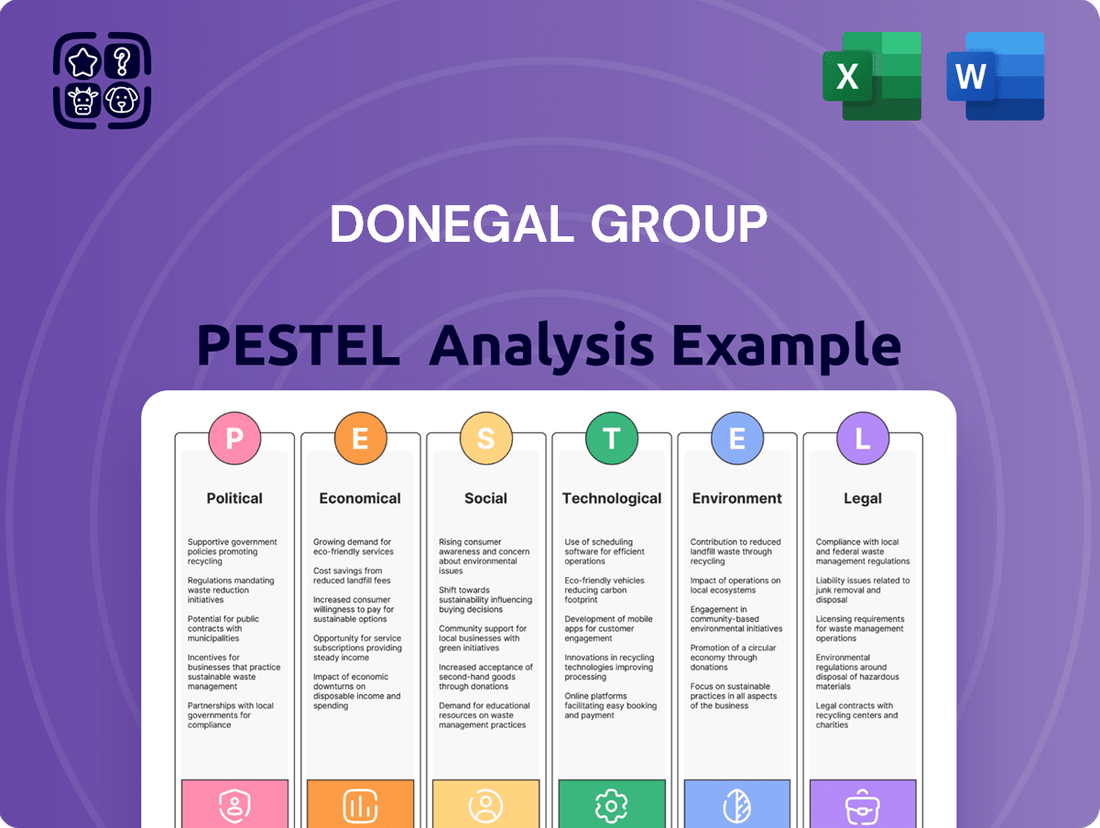

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Donegal Group, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights to identify potential threats and opportunities, guiding strategic decision-making for the company's future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Donegal Group.

Easily shareable summary format ideal for quick alignment across teams or departments, demystifying complex PESTLE analysis for Donegal Group's strategic discussions.

Economic factors

Interest rate fluctuations significantly affect Donegal Group's earnings. As of early 2024, the Federal Reserve maintained a target range of 5.25%-5.50% for the federal funds rate, a level that generally benefits insurers by increasing investment income on their substantial reserves. However, any downward adjustment in rates, as some forecasts suggested for late 2024 or 2025, would likely reduce Donegal's investment returns, potentially necessitating pricing strategy reviews to maintain profitability.

Inflationary pressures significantly impact property and casualty insurers like Donegal Group by increasing the cost of claims. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating throughout 2024 and early 2025, impacting the cost of vehicle parts, building materials, and medical services. Donegal Group must meticulously forecast these rising costs when setting premiums to ensure they can cover future claims and maintain profitability. Failure to accurately price policies in an inflationary environment can lead to eroded underwriting margins, as premium income may not keep pace with the escalating expenses of claims settlement.

The overall health of the economy, as indicated by GDP growth and employment figures, directly impacts consumer and business demand for insurance. For instance, in 2023, the U.S. GDP saw an estimated growth of 2.5%, contributing to a more robust market for insurance products as businesses expanded and individuals' disposable incomes rose.

Periods of economic expansion, characterized by rising employment and increased consumer spending, generally translate to higher insurance sales for companies like Donegal Group. With unemployment rates hovering around 3.7% in late 2023 and early 2024, this suggests a stable environment for generating new business.

Conversely, economic downturns or recessions can dampen demand for insurance, as businesses may cut costs and individuals face reduced disposable income. Furthermore, recessions can sometimes lead to an increase in claims frequency in specific insurance lines, putting pressure on profitability.

Donegal Group's performance is intrinsically linked to the economic vitality of the regions it serves. Strong regional economic growth in its key markets, often reflected in local GDP and employment figures, directly supports the company's ability to grow its premium volume and maintain healthy claims ratios.

Unemployment Rates

High unemployment rates significantly impact Donegal Group's market by reducing consumer spending power. When more people are out of work, their disposable income shrinks, making it harder for them to maintain or renew personal insurance policies such as auto and homeowners coverage. This directly affects Donegal Group's revenue streams from these segments.

For businesses, rising unemployment often signals economic downturns, leading to closures or scaled-back operations. This can decrease the demand for commercial insurance products like general liability and workers' compensation policies, areas where Donegal Group also operates. The overall demand for insurance services is closely tied to the health of the employment market.

Recent data from the U.S. Bureau of Labor Statistics indicates that the national unemployment rate remained remarkably low, hovering around 3.7% in late 2024 and projected to stay near this level through mid-2025. While this indicates a generally robust labor market, even minor upticks could signal challenges for Donegal Group.

- National Unemployment Rate (Late 2024 - Mid 2025 Projection): Approximately 3.7%.

- Impact on Personal Lines: Reduced disposable income can lead to policy lapses for auto and homeowners insurance.

- Impact on Commercial Lines: Business contractions due to economic slowdowns decrease demand for liability and workers' compensation insurance.

- Client Sensitivity: Donegal Group's client base, both individual and commercial, is highly sensitive to employment fluctuations.

Consumer Spending and Disposable Income

Consumer spending and disposable income are crucial for Donegal Group, especially its personal lines of insurance. When households have more money left after essential expenses, they are more likely to buy and keep insurance policies. A strong economy means people can afford to invest in better coverage, leading to higher retention rates for Donegal. For instance, in early 2024, reports indicated continued resilience in US consumer spending, though some analysts flagged potential shifts in spending patterns as inflation persisted.

This trend directly affects Donegal Group's personal lines, which include auto and homeowners insurance. Higher disposable income allows individuals to maintain these policies and potentially upgrade to more comprehensive plans. As of late 2024, real disposable personal income in the US showed modest growth, a positive sign for insurers like Donegal Group. This economic environment supports the demand for the types of products Donegal offers.

- Consumer Spending Impact: Higher consumer spending directly translates to increased demand for insurance products, as individuals have more discretionary income to allocate.

- Disposable Income Levels: Growth in disposable income enables policyholders to afford and maintain their insurance coverage, positively impacting Donegal Group's retention rates.

- Personal Lines Sensitivity: Donegal Group's personal lines segment, particularly auto and homeowners insurance, is highly sensitive to changes in consumer economic well-being.

- Economic Data (2024): Reports from late 2024 showed continued, albeit sometimes uneven, growth in real disposable personal income in the US, supporting the insurance market.

Economic growth directly fuels demand for Donegal Group's insurance products. As of early 2024, the US economy demonstrated resilience, with GDP growth projected around 2.5% for 2023, indicating a favorable environment for both personal and commercial insurance uptake. Increased business activity and consumer confidence during periods of expansion typically translate to higher premium volumes for Donegal.

Interest rate policies by the Federal Reserve, holding steady in the 5.25%-5.50% range through early 2024, generally benefit insurers by boosting investment income on reserves. However, a potential rate decrease anticipated later in 2024 or 2025 could temper these returns, prompting strategic adjustments for Donegal Group.

Inflationary pressures, evidenced by fluctuating CPI rates in 2024, escalate claim costs for property and casualty insurers like Donegal. Managing rising expenses for vehicle parts, materials, and medical services is critical for maintaining underwriting profitability through accurate premium pricing.

| Economic Factor | 2023 Data/Early 2024 Trend | Impact on Donegal Group | 2024/2025 Outlook Considerations |

| GDP Growth (US) | Estimated 2.5% (2023) | Supports increased demand for insurance products. | Continued moderate growth expected to sustain demand. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Boosts investment income on reserves. | Potential rate cuts could reduce investment returns. |

| Inflation (CPI) | Fluctuating annual rates in 2024 | Increases claim costs (auto, construction, medical). | Requires careful premium adjustments to offset rising expenses. |

| Unemployment Rate (US) | Approx. 3.7% (Late 2024) | Low rates support consumer spending and business stability. | Slight upticks could reduce disposable income and business demand. |

| Disposable Personal Income (US) | Modest growth (Late 2024) | Enhances ability to purchase/maintain insurance. | Sustained growth supports personal lines performance. |

Preview Before You Purchase

Donegal Group PESTLE Analysis

The Donegal Group PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Donegal Group.

Understand the external forces shaping Donegal Group's strategy and competitive landscape.

This detailed report is your turnkey solution for informed business planning.

Sociological factors

Demographic shifts significantly impact Donegal Group's market. For instance, the U.S. population aged 65 and over is projected to reach 73.1 million by 2030, a substantial increase that could drive demand for health and life insurance products tailored to seniors. Conversely, migration patterns, such as increased urbanization, can concentrate risk in certain areas, requiring adjustments to underwriting and pricing models. Household formation rates also play a role; fewer multi-generational households might mean more demand for individual home insurance policies.

Shifting consumer lifestyles, such as changes in driving habits and recreational pursuits, directly influence the risk profiles that insurers like Donegal Group need to assess. For example, the increasing adoption of electric vehicles (EVs) by a growing segment of the population in 2024 presents new considerations for auto insurance pricing and coverage.

The widespread embrace of remote and hybrid work models, a trend that solidified significantly in 2024, is altering how people use their vehicles, potentially reducing annual mileage for many. This behavioral change necessitates a re-evaluation of traditional auto insurance underwriting to ensure accurate risk assessment and competitive product offerings.

Donegal Group must remain attuned to evolving consumer behaviors, including the growing interest in shared mobility services and the impact of aging populations on healthcare and life insurance needs. As of early 2025, data indicates a continued uptick in demand for travel insurance, reflecting a resurgence in leisure activities post-pandemic.

Societal attitudes toward insurance significantly shape consumer behavior. For Donegal Group, a key factor is the public's trust in insurance providers and their understanding of policy details. When people feel confident in insurers and grasp what their policies cover, they are more inclined to buy and keep their coverage. In 2023, J.D. Power reported that customer satisfaction with auto insurance providers averaged 779 on a 1,000-point scale, highlighting that while many are satisfied, there's still room for improvement and building deeper trust.

Negative public perceptions, such as a belief that insurance is overly complex or that claims are difficult to process, can lead consumers to focus more on price rather than value. This price sensitivity can erode customer loyalty. A 2024 survey by Policygenius found that 40% of respondents had considered switching insurance providers in the past year, with price being the primary driver for 65% of those considering a switch.

Donegal Group's ability to cultivate a positive public image through strong customer service and transparent communication is therefore paramount. A good reputation can mitigate the impact of negative sentiment and foster a more loyal customer base. For instance, companies with high customer satisfaction scores often see lower customer churn rates, which directly benefits their bottom line.

Social Awareness of Risk

Public awareness of risks, from cyber threats to climate events, is a significant driver for specialized insurance. This growing consciousness means people are more likely to seek protection for emerging dangers. For instance, a 2024 survey indicated that over 70% of small businesses now consider cybersecurity a top operational risk, a notable increase from previous years.

This heightened social awareness translates into a stronger demand for tailored insurance solutions. Donegal Group can capitalize on this by developing and promoting policies that directly address these evolving concerns. As an example, the market for cyber insurance alone was projected to reach $20 billion globally by the end of 2024, demonstrating substantial growth driven by increased awareness.

Furthermore, this trend encourages policyholders to be more proactive in managing their own risks. This shift benefits insurers like Donegal Group by fostering a more risk-aware customer base.

- Increased Demand: Growing public understanding of risks like climate change and data breaches fuels the need for specialized insurance products.

- Proactive Mitigation: Heightened awareness encourages policyholders to implement preventative measures, potentially reducing claims.

- Tailored Solutions: Donegal Group can leverage this trend by offering insurance products that directly address specific, widely recognized risks.

- Market Growth: The cyber insurance market, for example, experienced significant expansion in 2024, reflecting heightened public and business awareness of digital threats.

Digital Adoption and Expectations

Societal trends show a growing dependence on digital platforms for everyday services, significantly shaping customer expectations within the insurance sector. This means people anticipate straightforward online interactions for everything from getting insurance quotes to filing claims.

In 2024, it's clear that consumers, across all age groups, demand seamless digital experiences and robust mobile accessibility. For instance, a recent survey indicated that over 70% of insurance customers prefer to manage their policies online or via mobile apps, a figure expected to climb higher by 2025.

To stay competitive and meet these evolving sociological demands, Donegal Group needs to prioritize investments in its digital infrastructure. This includes enhancing its online quoting systems and streamlining its mobile claims processing capabilities.

Key areas for digital enhancement include:

- Online Policy Management: Providing user-friendly portals for policy updates and inquiries.

- Mobile Claims Submission: Enabling customers to file and track claims entirely through their smartphones.

- Digital Customer Support: Offering chatbots and live chat options for immediate assistance.

- Personalized Digital Engagement: Leveraging data to offer tailored policy recommendations and communication.

Societal attitudes toward insurance significantly influence consumer engagement, with trust and transparency being paramount for Donegal Group. In 2023, customer satisfaction in auto insurance averaged 779 out of 1000, indicating room for growth in building deeper trust. A 2024 survey revealed 40% of respondents considered switching insurers, primarily due to price, highlighting the impact of perceived value over cost.

Growing public awareness of risks like climate change and cyber threats is driving demand for specialized insurance products. By the end of 2024, the cyber insurance market was projected to reach $20 billion globally, a testament to this heightened awareness. This trend encourages policyholders to be more proactive in risk management, benefiting insurers by fostering a more risk-aware customer base.

Technological factors

Donegal Group's embrace of digital transformation and automation is pivotal. By integrating AI in underwriting and claims processing, the company can boost efficiency and slash operational expenses. This technological shift is not just about cost savings; it's about sharpening accuracy and reallocating human capital to higher-value activities.

The insurance sector, in general, saw significant investment in technology during 2024. For instance, a significant portion of insurers reported increased spending on AI and machine learning to improve risk assessment and customer experience. Donegal Group's strategic implementation of these technologies directly addresses the need to remain competitive in this evolving landscape.

Donegal Group's strategic advantage is increasingly tied to its ability to harness data analytics and big data. By processing extensive datasets, the company can uncover granular insights into customer preferences, allowing for highly personalized insurance products and targeted marketing campaigns. This data-driven approach is crucial for staying competitive in a rapidly evolving market.

The application of advanced analytics significantly sharpens Donegal Group's risk assessment capabilities and improves the accuracy of claims pattern identification. For instance, by analyzing historical claims data alongside external economic and behavioral indicators, Donegal can refine its underwriting models, leading to more precise pricing strategies and a stronger financial position. This analytical rigor is a cornerstone of effective risk management in the insurance sector.

In 2024, the insurance industry saw a significant uptick in the adoption of AI and machine learning for fraud detection, with some reports indicating a potential reduction in fraudulent claims by as much as 15-20% when these technologies are effectively implemented. Donegal Group's investment in these areas positions it to benefit from such efficiencies, directly impacting profitability and operational cost savings.

Artificial intelligence (AI) and machine learning (ML) are transforming the insurance landscape, and Donegal Group is positioned to leverage these advancements. These technologies are streamlining processes like predictive risk modeling, enabling more accurate underwriting and pricing. For instance, AI can analyze vast datasets to identify emerging risk patterns that might be missed by traditional methods, potentially improving loss ratios. The automation of claims adjustment through AI-powered tools can also lead to faster payouts and increased operational efficiency.

Furthermore, AI and ML are critical for enhancing customer engagement. Chatbots powered by AI can provide instant support and personalized interactions, improving customer satisfaction and freeing up human agents for more complex issues. Donegal Group can utilize these capabilities to offer tailored product recommendations and proactive service, thereby strengthening customer loyalty. The ability to analyze customer data with ML algorithms allows for a deeper understanding of needs and preferences, driving the development of innovative insurance solutions that cater to evolving market demands.

To remain competitive, continuous investment in AI and ML capabilities is paramount for Donegal Group. The insurance industry saw significant AI investment globally in 2024, with many firms allocating substantial budgets to develop and implement these technologies. For example, industry reports from early 2025 indicate that insurers are increasingly adopting AI for fraud detection, with some reporting a reduction in fraudulent claims by up to 15%. This ongoing commitment ensures Donegal Group can harness the full potential of AI to optimize operations, personalize customer experiences, and drive future growth.

Cybersecurity Risks and Solutions

Cybersecurity risks are a paramount concern for Donegal Group, as its increasing reliance on digital platforms and the storage of extensive sensitive customer data expose it to significant operational and reputational threats. The company's commitment to robust cybersecurity measures, including advanced threat detection and prevention systems, is crucial for safeguarding its assets and customer trust.

Investing in and offering cyber insurance products is becoming increasingly vital, not only as a risk mitigation strategy for Donegal Group but also as a valuable service to its clients navigating their own digital security challenges. This dual focus addresses both internal vulnerabilities and external market demands.

The landscape of cyber threats is constantly evolving, necessitating continuous adaptation and investment in defenses. For instance, the global cybersecurity market was projected to reach $300 billion in 2024, highlighting the significant and growing investment required to stay ahead of sophisticated attacks.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2024, underscoring the financial impact of security failures.

- Ransomware Attacks: Ransomware attacks continue to be a major threat, with their frequency and sophistication on the rise.

- Regulatory Compliance: Stricter data privacy regulations, such as GDPR and CCPA, impose significant penalties for non-compliance, making robust cybersecurity essential.

- Reputational Damage: Beyond financial costs, cybersecurity incidents can severely damage customer trust and brand reputation, impacting long-term business viability.

Telematics and IoT Devices

The increasing adoption of telematics in auto insurance, alongside the spread of Internet of Things (IoT) devices in homes, is a significant technological factor. These technologies facilitate the real-time collection of data concerning risk exposure. For instance, usage-based insurance (UBI) programs, powered by telematics, allow insurers to tailor premiums based on actual driving behavior, rewarding safer drivers. By mid-2024, industry reports indicated a steady rise in UBI adoption, with projections suggesting continued growth as consumers become more comfortable sharing data for potential cost savings and enhanced safety features.

Donegal Group can strategically integrate these advancements to refine its product offerings. By leveraging telematics and IoT, the company can develop more dynamic pricing models, directly linking policy costs to observable risk factors and user behavior. This also presents an opportunity to actively encourage safer practices among policyholders through incentives and personalized feedback, thereby improving overall risk management and potentially reducing claims frequency and severity. This shift fundamentally reshapes traditional underwriting, moving towards a more data-driven and predictive approach.

- Telematics adoption: Projections for 2025 indicate that a substantial percentage of new vehicle sales will be equipped with telematics capabilities, providing a rich data source for insurers.

- IoT in homes: The number of connected IoT devices in households is expected to surpass billions by 2025, offering opportunities for insurers to assess home-related risks more accurately.

- Data analytics: Advanced analytics platforms are crucial for processing and interpreting the vast amounts of data generated by telematics and IoT devices, enabling more sophisticated risk assessment and personalized insurance products.

- Behavioral incentives: Insurers can use data to offer discounts or rewards for demonstrating safe driving habits or implementing home security measures, fostering a proactive risk mitigation culture.

Donegal Group's strategic focus on AI and machine learning continues to drive efficiency and accuracy in underwriting and claims processing. In 2024, the insurance industry saw substantial investment in these areas, with many firms reporting significant improvements in risk assessment and customer experience through AI implementation. Donegal's proactive adoption positions it to benefit from these technological advancements, enhancing its competitive edge.

The company's ability to leverage data analytics and big data is crucial for creating personalized insurance products and targeted marketing. By processing extensive datasets, Donegal can gain granular insights into customer preferences, a capability that is increasingly vital in the rapidly evolving insurance market. This data-driven approach is central to staying ahead.

Advanced analytics significantly sharpen Donegal Group's risk assessment and claims pattern identification. By integrating historical claims data with external economic and behavioral indicators, the company refines its underwriting models for more precise pricing strategies. This analytical rigor is fundamental to effective risk management and financial stability in the insurance sector.

The increasing adoption of telematics and IoT devices offers significant opportunities for Donegal Group to refine product offerings and pricing. Usage-based insurance programs, powered by telematics, allow for premiums tailored to actual driving behavior. Industry reports from mid-2024 indicated a steady rise in UBI adoption, with continued growth projected as consumers embrace data sharing for potential cost savings.

| Technological Factor | Description | Impact on Donegal Group | 2024/2025 Data/Projections |

| AI & Machine Learning | Automating underwriting, claims, fraud detection, customer service | Increased efficiency, reduced costs, improved accuracy, enhanced customer experience | Industry investment in AI surged in 2024; projected 15-20% reduction in fraudulent claims with effective AI implementation. |

| Data Analytics & Big Data | Gaining insights into customer behavior and preferences | Personalized products, targeted marketing, improved risk assessment | Crucial for competitive advantage in an evolving market. |

| Telematics & IoT | Real-time data collection on risk exposure (driving, home) | Dynamic pricing, behavioral incentives, improved risk management | Telematics expected in substantial new vehicle sales by 2025; billions of IoT devices in homes by 2025. |

| Cybersecurity | Protecting digital platforms and customer data | Mitigating operational and reputational risks, offering cyber insurance | Global cybersecurity market projected to reach $300 billion in 2024; average data breach cost $4.45 million in 2024. |

Legal factors

Donegal Group navigates a labyrinth of state-specific insurance regulations covering everything from licensing and solvency to product approvals and how they interact with customers. Staying on the right side of these varied rules is crucial for avoiding fines and keeping their business running smoothly. For instance, in 2024, states like California continued to update their cybersecurity requirements for insurers, directly affecting how Donegal Group must manage data protection.

Data privacy laws, like the California Consumer Privacy Act (CCPA) and potential federal regulations, significantly impact how Donegal Group handles customer information. These regulations govern the collection, storage, and utilization of sensitive personal and financial data, making compliance a paramount concern for maintaining customer trust and avoiding costly legal penalties.

Donegal Group must continuously monitor and adapt to evolving data privacy standards, which may include enhanced consent requirements and data access rights for consumers. Failure to adhere to these mandates could result in substantial fines; for instance, the CCPA allows for civil penalties of up to $7,500 per intentional violation.

Consumer protection legislation, such as unfair claims practices acts and disclosure requirements, significantly shapes how Donegal Group engages with its policyholders. These laws mandate fair treatment and transparent communication, directly impacting operational procedures and customer relations. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize robust consumer protection measures across its member states, influencing state-level regulatory frameworks that Donegal Group must navigate.

Compliance with these regulations is paramount to avoid costly legal disputes and maintain customer trust. Donegal Group invests in ongoing training programs to ensure its employees are well-versed in current consumer protection standards. This commitment is essential, especially as regulatory bodies refine guidelines, like those updated in late 2024 regarding data privacy in insurance disclosures, to better safeguard policyholder information.

Anti-Trust and Competition Law

Anti-trust and competition laws are crucial for Donegal Group, as they ensure a level playing field in the insurance sector by preventing monopolistic behavior. These regulations directly influence how Donegal Group can approach mergers, acquisitions, and pricing, requiring careful adherence to avoid penalties and maintain market integrity.

The enforcement of competition law significantly shapes the market structure and the competitive dynamics Donegal Group navigates. For instance, the US Department of Justice and the Federal Trade Commission actively monitor mergers and acquisitions to ensure they do not harm competition. In 2023, the FTC reported reviewing over 1,000 premerger notifications, indicating a robust regulatory environment.

- Market Concentration: Regulators scrutinize the insurance market for excessive concentration that could stifle competition.

- Pricing Practices: Anti-trust laws prohibit price-fixing and other collusive behaviors that would unfairly disadvantage consumers.

- Mergers and Acquisitions: Donegal Group must ensure any M&A activity does not create a dominant market position or reduce consumer choice.

- Compliance Costs: Adhering to these complex legal frameworks incurs ongoing compliance costs for the group.

Contract Law and Policy Interpretation

The core of Donegal Group's operations hinges on how insurance contracts and policy wording are legally interpreted. Court decisions and established legal precedents directly influence how claims are paid and what liabilities the company faces. For instance, a 2023 ruling in a neighboring state regarding ambiguous auto policy language led to unexpected payouts for a similar insurer, highlighting the financial risk of unclear terms.

Maintaining clear and unambiguous policy language is paramount for Donegal Group. This clarity helps prevent disputes with policyholders and ensures that coverage is applied consistently across all claims. Ambiguity can lead to costly litigation and damage to the company's reputation, as seen when a competitor faced significant legal fees in 2024 due to poorly worded commercial property endorsements.

Legal counsel is indispensable for Donegal Group, actively involved in both the initial drafting of policies and the subsequent resolution of claims. Their expertise ensures policies comply with evolving regulations and that potential legal pitfalls are navigated effectively. This proactive legal engagement is crucial for risk management, especially as regulatory landscapes shift.

Key legal considerations for Donegal Group include:

- Contractual Clarity: Ensuring policy wordings are precise to minimize litigation risk.

- Regulatory Compliance: Adhering to all state and federal insurance laws and updates.

- Precedent Awareness: Monitoring court rulings that could impact claims interpretation and financial exposure.

- Legal Counsel's Role: Leveraging legal expertise in policy development and claims management.

Donegal Group must strictly adhere to state-specific insurance regulations covering licensing, solvency, and product approvals. For example, in 2024, states intensified scrutiny on cybersecurity measures for insurers, directly impacting data handling protocols.

Data privacy laws, such as the CCPA, mandate careful handling of customer information, with violations potentially leading to fines of up to $7,500 per intentional infraction, as noted in 2024 updates.

Consumer protection laws, including those against unfair claims practices, require transparent communication and fair treatment of policyholders. The NAIC's continued focus on these measures in 2024 influences state-level frameworks Donegal Group must follow.

Environmental factors

Climate change is a significant environmental factor for Donegal Group. The increasing frequency and intensity of extreme weather events, such as hurricanes, floods, and wildfires, directly translate into higher claims for their property and casualty insurance lines. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, according to NOAA, highlighting the growing exposure.

These escalating environmental risks compel Donegal Group to continuously re-evaluate their risk models and actuarial assumptions. This might involve adjusting premiums in regions more susceptible to these events and potentially restricting coverage in areas identified as having exceptionally high risk profiles to maintain profitability and solvency.

Environmental regulations are constantly evolving, impacting businesses and, consequently, the insurance market. New rules concerning pollution, waste management, and land use can directly translate into increased liabilities for commercial policyholders, driving demand for specialized insurance products. Donegal Group needs to stay abreast of these shifts, as they directly influence the risk assessment and pricing for their commercial lines of business.

For instance, stricter emissions standards or mandates for renewable energy adoption can alter the operational risks for companies in sectors like manufacturing or energy. This requires insurers like Donegal Group to adapt their underwriting models to accurately reflect these changing environmental exposures. In 2024, global spending on environmental protection measures reached an estimated $1.1 trillion, highlighting the significant impact of these regulations.

Understanding the complexities of environmental compliance is therefore paramount for Donegal Group. By staying informed about regulatory trends, the company can better serve its clients by offering relevant coverage and proactively managing potential risks within its portfolio. This proactive approach ensures that Donegal Group remains competitive and responsive to the evolving needs of the commercial insurance sector.

Resource scarcity, such as limited availability of water or raw materials essential for construction and vehicle repair, directly impacts Donegal Group's claims settlement process. For instance, a shortage of specific lumber or specialized automotive parts can significantly slow down repairs, leading to prolonged claims cycles and increased costs for policyholders and the company. The UN estimates that by 2040, nearly half of the world's population could be living in water-stressed areas, a trend that will likely escalate challenges for industries reliant on water for production and maintenance.

Public and Investor Pressure for ESG

There's a significant and increasing push from the public, investors, and even regulators for companies, including insurance providers like Donegal Group, to embrace Environmental, Social, and Governance (ESG) principles. This means scrutinizing how their operations and investments align with sustainability goals.

Donegal Group is particularly under the spotlight concerning the environmental footprint of its investment portfolio and its own day-to-day operational sustainability. For example, many institutional investors are now actively divesting from fossil fuels, a trend that could impact insurance companies with substantial holdings in these sectors.

As of early 2024, ESG-focused funds saw continued inflows, with global sustainable investment assets reaching over $37 trillion in 2022 according to the Global Sustainable Investment Alliance. This indicates a strong investor preference for companies demonstrating robust ESG commitments.

- Investor Demand: A growing number of investors prioritize ESG factors, influencing capital allocation towards more sustainable businesses.

- Reputational Benefits: Implementing strong ESG policies can significantly boost a company's public image and attract ethically-minded customers and partners.

- Risk Mitigation: Addressing environmental and social risks proactively can prevent future liabilities and operational disruptions.

- Regulatory Scrutiny: Evolving regulations worldwide are increasingly mandating ESG disclosures and performance standards for corporations.

Catastrophe Modeling and Risk Assessment

Advances in environmental science are significantly enhancing catastrophe modeling, allowing insurers like Donegal Group to more precisely quantify risks from natural disasters. This improved understanding directly impacts financial planning, enabling more accurate reserve setting and policy pricing. For instance, the increasing frequency and severity of events like hurricanes and wildfires, as evidenced by NOAA data showing 2023 as the third-costliest year for weather and climate disasters in the US at $179 billion, underscore the necessity of sophisticated modeling.

Donegal Group's ability to leverage these advanced catastrophe models is crucial for developing effective risk mitigation strategies for its policyholders. By understanding potential impacts, the company can guide customers on preparedness and loss prevention. This proactive approach not only benefits policyholders but also strengthens Donegal Group's financial resilience against unforeseen events.

Continuous refinement of these models is paramount. As climate patterns shift and new data emerges, the models must adapt to maintain their predictive accuracy. This ongoing improvement ensures Donegal Group can navigate the evolving risk landscape and maintain its financial stability. For example, the increasing use of AI and machine learning in risk assessment promises even greater precision in future modeling efforts.

- Enhanced Risk Quantification: Sophisticated models allow for better assessment of natural disaster impacts.

- Accurate Financial Planning: Improved data supports precise reserve setting and policy pricing.

- Risk Mitigation Strategies: Insights enable the development of effective policyholder preparedness plans.

- Financial Resilience: Continuous model improvement is vital for long-term stability against increasing climate risks.

Climate change significantly impacts Donegal Group through more frequent and intense extreme weather events, leading to higher insurance claims. For instance, the U.S. faced 28 billion-dollar weather and climate disasters in 2023, as reported by NOAA, underscoring this growing exposure.

Evolving environmental regulations, such as stricter emissions standards, can create new liabilities for commercial policyholders, influencing demand for specialized insurance products and requiring Donegal Group to adapt its underwriting. Global spending on environmental protection measures reached an estimated $1.1 trillion in 2024, demonstrating the widespread effect of these regulations.

Resource scarcity, like limited water availability, can prolong claims settlement processes and increase costs for Donegal Group due to slower repairs. By 2040, nearly half the world's population may face water-stressed conditions, according to UN estimates, exacerbating these challenges.

Donegal Group faces increasing pressure to align with ESG principles, particularly regarding its investment portfolio's environmental footprint. Investor demand for sustainable investments is strong, with global sustainable investment assets exceeding $37 trillion in 2022, as per the Global Sustainable Investment Alliance.

| Factor | Impact on Donegal Group | Supporting Data |

| Climate Change (Extreme Weather) | Increased property and casualty claims | 28 billion-dollar disasters in U.S. in 2023 (NOAA) |

| Environmental Regulations | Changes in commercial liability, need for specialized products | $1.1 trillion global spending on environmental protection (2024 est.) |

| Resource Scarcity | Prolonged claims, increased repair costs | Nearly 50% global population in water-stressed areas by 2040 (UN est.) |

| ESG Push | Scrutiny of investments and operations, investor preference | Over $37 trillion in global sustainable investment assets (2022) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Donegal Group is informed by a comprehensive review of official government data, financial market reports, and reputable industry publications. We integrate insights from economic forecasts, regulatory updates, and technological trend analyses to provide a well-rounded perspective.