Donegal Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donegal Group Bundle

The Donegal Group operates in a competitive insurance landscape where buyer power can be significant, especially for commercial clients seeking tailored policies. The threat of new entrants, while moderate due to regulatory hurdles, could disrupt market share. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Donegal Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of reinsurance providers is substantial for Donegal Group. These providers absorb a significant portion of the insurer's risk, a vital function for handling large claims and ensuring financial stability.

When specialized reinsurance is scarce or the market is consolidated, reinsurers gain leverage. This can directly impact Donegal Group's ability to underwrite policies and ultimately influence its profitability.

For instance, in early 2024, the global reinsurance market continued to see capacity constraints, particularly for catastrophe coverage, leading to increased pricing. This dynamic means that insurers like Donegal Group must negotiate harder and potentially accept less favorable terms.

The concentration of major reinsurers means that Donegal Group may have fewer options for securing the necessary coverage, thereby amplifying the reinsurers' ability to dictate terms and pricing.

Technology and software vendors, particularly those supplying core insurance platforms, data analytics, and AI solutions, exert significant bargaining power. Donegal Group, like many insurers, relies on these specialized systems to modernize operations and boost efficiency, creating a dependency that can weaken negotiation leverage.

In 2024, the insurance technology market saw continued investment, with spending on digital transformation initiatives projected to reach substantial figures. Companies heavily reliant on proprietary systems from a limited number of vendors face higher costs and less flexibility in adapting to new technologies.

Independent insurance agents, while acting as distributors, hold significant bargaining power over Donegal Group by controlling customer access and sales channels. Their ability to represent multiple insurance carriers allows them to direct business to the company offering the most favorable terms, commissions, and support. In 2024, the independent agent channel remained a vital distribution network for many property and casualty insurers. This collective power can pressure Donegal Group to offer competitive commission rates and robust support services to retain their business.

Data and Information Providers

The bargaining power of data and information providers is a significant consideration for Donegal Group. Access to accurate, timely, and specialized data, such as demographic trends, historical claims data, and even granular weather patterns, is absolutely crucial for effective underwriting and precise pricing of insurance policies. Companies that offer these essential datasets, particularly those possessing unique or proprietary information, can wield considerable influence. This power often manifests through their ability to dictate pricing or enforce exclusive access agreements, directly impacting Donegal Group's capacity to accurately assess and manage risk.

For instance, in 2024, the demand for advanced analytics and AI-driven insights in the insurance sector continued to surge, increasing the leverage of data providers offering these sophisticated solutions. Providers with extensive, well-curated datasets, especially those that are difficult to replicate, can command higher prices. Donegal Group, like other insurers, must therefore carefully manage relationships with these key suppliers to ensure continued access to vital information without disproportionately increasing operational costs.

- Data Dependency: The insurance industry's reliance on data for risk assessment and pricing makes data providers indispensable.

- Proprietary Datasets: Providers with unique or exclusive data sources can exert significant influence over pricing and terms.

- Market Trends: The growing emphasis on advanced analytics and AI in 2024 has amplified the importance and bargaining power of specialized data providers.

- Cost Impact: Higher data costs from powerful suppliers can directly affect Donegal Group's profitability and competitiveness.

Capital Providers and Financial Markets

For Donegal Group, capital providers in financial markets act as suppliers, and their bargaining power significantly influences the company's operations. The cost and availability of debt and equity are directly tied to market conditions, interest rates, and investor confidence. In 2024, for instance, the Federal Reserve's monetary policy decisions continued to shape borrowing costs, impacting how easily insurers could access capital for growth or to shore up their balance sheets.

The ability of capital providers to demand higher returns or impose stricter terms on Donegal Group translates to increased operating costs. This can constrain investment in new products, technology, or expansion initiatives. For example, a rising interest rate environment in 2024 would generally mean higher costs for issuing new debt, thus increasing Donegal Group's leverage expenses.

- Investor Sentiment: Positive investor sentiment in 2024 could lead to lower equity issuance costs for Donegal Group, reflecting a reduced risk premium demanded by shareholders.

- Interest Rates: As of mid-2024, benchmark interest rates remained a key determinant of the cost of debt financing for companies like Donegal Group.

- Credit Ratings: A strong credit rating from agencies like AM Best or S&P in 2024 would give Donegal Group more favorable access to capital markets, mitigating supplier power.

- Market Liquidity: The ease with which Donegal Group can raise capital in 2024 is also influenced by overall market liquidity, affecting the number and type of capital providers willing to participate.

Donegal Group's reliance on reinsurers and technology vendors significantly shapes supplier bargaining power. In 2024, capacity constraints in reinsurance, particularly for catastrophe risks, led to increased pricing, forcing insurers like Donegal to negotiate harder. Similarly, the growing demand for digital transformation solutions in the insurance sector in 2024 empowered technology providers, potentially increasing costs for Donegal.

The independent agent channel also holds considerable sway, as agents control customer access and can direct business to carriers offering better terms. In 2024, this channel remained crucial, pressuring Donegal to offer competitive commissions and support.

Data providers, offering essential information for underwriting and pricing, wield significant influence, especially those with unique datasets or advanced analytics capabilities. The surge in demand for AI-driven insights in 2024 amplified their leverage, impacting Donegal's operational costs.

Capital providers also exert power; in 2024, monetary policy influenced borrowing costs, directly affecting Donegal's access to and cost of capital. Market conditions and investor sentiment in 2024 played a key role in determining the terms and availability of funding.

| Supplier Type | Bargaining Power Factor | 2024 Relevance | Potential Impact on Donegal |

|---|---|---|---|

| Reinsurers | Capacity Constraints, Market Consolidation | Increased pricing for catastrophe coverage | Higher operating costs, potential limits on underwriting |

| Technology Vendors | Demand for Digital Transformation, Proprietary Systems | Surge in spending on AI and analytics | Increased costs for modernization, less flexibility |

| Independent Agents | Control over Distribution Channels, Customer Access | Vital distribution network for P&C insurers | Pressure on commission rates and support services |

| Data Providers | Unique/Proprietary Datasets, Advanced Analytics | Growing demand for AI-driven insights | Higher data costs, impact on risk assessment accuracy |

| Capital Providers | Monetary Policy, Investor Sentiment, Credit Ratings | Benchmark interest rates shaping borrowing costs | Increased cost of debt, potential constraints on growth |

What is included in the product

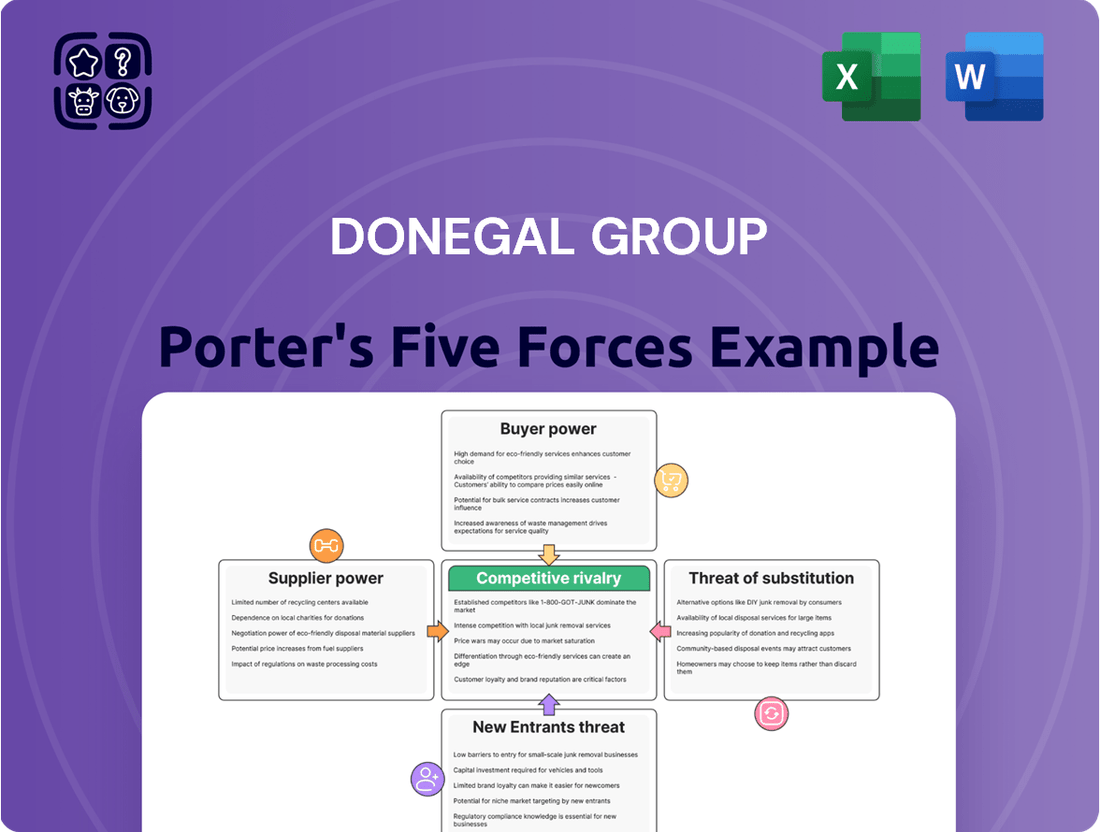

This Porter's Five Forces analysis is tailored exclusively for Donegal Group, dissecting the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the property and casualty insurance industry.

Easily identify and prioritize competitive threats by visualizing the intensity of each of Porter's Five Forces for Donegal Group.

Customers Bargaining Power

Policyholders, particularly for common insurance types like auto and home, are very sensitive to price. They can readily obtain quotes from various insurers, which significantly boosts their leverage. This means Donegal Group must keep its premiums competitive to draw in and keep customers.

In 2024, the average annual premium for full coverage auto insurance in the US was around $2,000, with significant variations by state. For homeowners insurance, the national average premium was approximately $1,700 annually. This high degree of price comparison among consumers directly influences insurer pricing strategies.

Donegal Group, like its peers, faces pressure to maintain attractive pricing to avoid customer attrition. A small increase in premiums without a perceived increase in value can lead policyholders to switch. This dynamic underscores the intense competition within the personal lines insurance market.

The widespread availability of online comparison tools significantly boosts customer bargaining power. In 2024, platforms like Insurify and ValuePenguin allow consumers to easily compare quotes and coverage from multiple insurance providers, including those offering similar products to Donegal Group. This transparency makes it challenging for Donegal to command premium pricing if its offerings are perceived as comparable to competitors.

For many standard personal and small commercial insurance products, customers face minimal hurdles when deciding to switch providers. This means they can easily move to another insurer if they find better rates or superior service, which significantly boosts their bargaining power. Donegal Group must therefore focus on delivering consistent value and competitive pricing to retain its customer base.

Demand for Tailored Solutions

The demand for tailored solutions can significantly influence customer bargaining power. While many customers are sensitive to price for standard insurance products, a segment of commercial and specialized personal lines clients actively seeks highly customized coverage. This pursuit of bespoke solutions means these customers might be less focused on the lowest price and more on the insurer's ability to meet unique risk management needs, potentially reducing their price sensitivity but increasing demands on Donegal Group's flexibility and service offerings.

For instance, in 2024, the commercial insurance market continued to see a growing demand for specialized policies addressing emerging risks like cyber threats and supply chain disruptions. Insurers capable of offering adaptable underwriting and unique risk mitigation strategies found themselves in a stronger position with these discerning clients. Donegal Group's ability to provide such tailored products directly impacts its leverage against these customer segments.

- Demand for Customization: Certain customer segments, particularly in commercial and specialized personal lines, prioritize bespoke insurance solutions over standard, price-driven offerings.

- Reduced Price Sensitivity: Customers seeking tailored coverage are often willing to pay a premium for customized policies and specialized risk management services, diminishing their focus on price alone.

- Increased Flexibility Demands: The need for customized solutions places a greater onus on insurers like Donegal Group to demonstrate flexibility in underwriting, policy design, and claims handling.

- Competitive Differentiation: Donegal Group's capacity to deliver these tailored solutions can serve as a key differentiator, enhancing customer loyalty and potentially mitigating the bargaining power of less demanding clients.

Influence of Independent Agents on Customer Choice

Donegal Group's reliance on independent agents as intermediaries means that while customers make the final decision, these agents significantly shape that choice. Agents, often driven by commission structures, the quality of service they receive from Donegal, or how well Donegal's products align with their clients' needs, can steer customers towards specific offerings. This dynamic somewhat buffers Donegal from direct customer bargaining power by introducing an influential third party.

The influence of these agents can be seen in how they present policy options. For instance, if an agent receives higher incentives from Donegal for selling specific products, or if Donegal provides superior training and support to agents, this can lead to a more favorable recommendation for Donegal policies. This creates a situation where the agent's recommendation, rather than solely direct customer negotiation, becomes a key factor in sales.

- Agent Influence: Independent agents act as gatekeepers, advising customers and potentially guiding their purchasing decisions based on factors like commission, service levels, and product suitability.

- Mediation of Bargaining Power: The agent's recommendation can moderate the direct bargaining power of customers, as they may rely on the agent's expertise and preferred product selection.

- Incentive Structures: Commission rates and other incentives offered by Donegal to independent agents can directly impact the agents' willingness to promote specific Donegal Group products.

- Service and Product Fit: The agent's perception of Donegal's service quality and the alignment of its products with customer needs are crucial drivers of their recommendations.

The bargaining power of customers within the insurance sector is substantial, primarily driven by price sensitivity and the ease of switching providers. For standard insurance products, customers can easily compare quotes from multiple insurers, forcing companies like Donegal Group to maintain competitive pricing. This is particularly evident in 2024, with average auto insurance premiums around $2,000 annually and homeowner premiums near $1,700, making price a key decision factor.

The proliferation of online comparison tools in 2024, such as Insurify and ValuePenguin, further amplifies customer leverage by providing transparent access to pricing and coverage details across various providers. This makes it difficult for Donegal Group to differentiate solely on price without offering a clear value proposition. For many policyholders, the low cost and minimal effort associated with switching insurers mean that Donegal must consistently deliver value and competitive rates to retain its customer base.

| Factor | Impact on Donegal Group | 2024 Data/Context |

|---|---|---|

| Price Sensitivity | High pressure to offer competitive rates | Avg. auto premium ~$2,000/yr; Avg. homeowner premium ~$1,700/yr |

| Ease of Switching | Requires strong value proposition for retention | Low switching costs for standard policies |

| Information Availability | Empowers customers to compare easily | Growth of online comparison platforms |

Preview the Actual Deliverable

Donegal Group Porter's Five Forces Analysis

This preview showcases the complete Donegal Group Porter's Five Forces Analysis, offering a deep dive into industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any missing sections or placeholders. This detailed examination will equip you with crucial insights into the competitive landscape of the insurance sector. You're looking at the actual document, ready for download and immediate application to your strategic planning.

Rivalry Among Competitors

Donegal Group operates within a property and casualty insurance market that is both fragmented and concentrated. This means there are many companies competing, but a few large ones often dominate. For instance, in 2024, the U.S. P&C insurance industry continued to see strong competition from both regional insurers like Donegal and national giants.

The presence of numerous smaller, regional players creates a diverse competitive landscape. However, the market's concentrated nature means that a handful of the largest insurers can wield significant market power. This dynamic intensifies the struggle for market share and customer loyalty among all participants.

This intense rivalry forces companies like Donegal to focus on differentiating their offerings and maintaining strong customer relationships. The ability to retain existing customers and attract new ones is paramount in an environment where market leadership can shift based on pricing, service, and product innovation.

Many property and casualty (P&C) insurance products are viewed as similar, leading customers to focus heavily on price. This perception transforms insurance into a commodity, intensifying competition. Donegal Group, like its peers, faces this reality where price becomes a crucial factor in attracting and retaining policyholders. This intense price rivalry can put pressure on profit margins, highlighting the need for operational efficiency.

The commoditized nature of many P&C insurance products fuels significant price competition across the industry. For Donegal Group, this means that the cost of coverage is often a primary driver for consumers when selecting an insurer. This dynamic can lead to a scenario where insurers must constantly monitor and adjust their pricing strategies to remain competitive, potentially impacting their profitability if not managed carefully. For instance, in 2023, the average P&C insurance premium saw fluctuations based on line of business and region, underscoring the sensitivity to pricing.

The insurance industry, including players like Donegal Group, is characterized by substantial fixed costs. These stem from essential operations such as underwriting, managing claims, and adhering to stringent regulatory frameworks. For instance, in 2024, major insurers continued to invest heavily in technology to streamline these processes, adding to their fixed cost base.

This high fixed cost structure creates a strong incentive for companies to achieve high levels of capacity utilization. By writing more policies, insurers can spread these fixed expenses over a larger revenue base, thereby improving profitability. This drives intense competition as companies strive to maximize policy volume and gain market share.

Consequently, the pursuit of greater capacity utilization fuels aggressive rivalry among insurers. Companies often engage in price competition and innovative product offerings to attract and retain policyholders. This dynamic is particularly evident in a competitive landscape where market share gains are crucial for long-term financial health.

Brand Loyalty and Customer Service as Differentiators

While price remains a critical factor in the insurance industry, Donegal Group can cultivate a significant competitive advantage by focusing on brand loyalty and superior customer service. In 2024, customer retention is increasingly tied to an exceptional experience beyond just the premium paid. This means efficient and empathetic claims handling, alongside accessible and responsive customer support, are paramount.

Donegal Group's established regional presence and its reliance on an independent agency network are key assets for building trust and differentiating itself. These relationships allow for personalized service and a deeper understanding of local customer needs, moving the focus beyond mere price competition. By nurturing these connections, Donegal can foster loyalty that withstands competitive pricing pressures.

- Brand Reputation: A strong, trusted brand built on consistent service delivery can command customer loyalty.

- Customer Service Excellence: Responsive and helpful customer interactions, especially during claims, are vital differentiators.

- Efficient Claims Handling: Streamlined and fair claims processing directly impacts customer satisfaction and retention.

- Independent Agency Network: Leveraging this network provides a personal touch and regional expertise that national carriers may struggle to replicate.

Regulatory Environment and Geographic Focus

The insurance sector is heavily regulated, with differing state-by-state requirements acting as significant barriers to entry. This regulatory landscape shapes how companies like Donegal Group operate and compete. For instance, in 2023, state insurance departments issued numerous new regulations impacting everything from pricing to product development, directly affecting competitive strategies.

Donegal Group's strategic focus on specific geographic regions, particularly its strong presence in the Mid-Atlantic and Midwest, intensifies rivalry within those local markets. Success in these areas often hinges on deep local market understanding and established relationships with agents and policyholders. In Pennsylvania, a key state for Donegal, the company faces intense competition from both national insurers and strong regional players.

- State-Specific Regulations: Insurance is regulated at the state level, creating a complex and varied operating environment.

- Barriers to Entry: Regulatory hurdles and capital requirements can limit new entrants, though established players must continuously adapt.

- Regional Competition: Donegal's targeted geographic approach means it contends with insurers possessing intimate knowledge of local market conditions and customer needs.

- Importance of Relationships: In its core operating regions, building and maintaining strong relationships with independent agents is critical for market share.

Competitive rivalry within the property and casualty insurance sector is fierce, driven by a fragmented market with dominant national players and numerous regional insurers like Donegal Group. Many insurance products are perceived as commodities, leading to intense price competition and pressure on profit margins, as seen with fluctuating average premiums in 2023. Donegal's strategy of focusing on regional strengths and an independent agency network aims to build loyalty beyond price, a crucial differentiator in this environment.

| Metric | Donegal Group (2023/2024 Estimate) | Industry Average (2023/2024 Estimate) | Notes |

|---|---|---|---|

| Net Written Premiums | Approx. $1.7 billion | Varies by insurer size | Reflects market presence and growth |

| Combined Ratio | Targeting low 90s | Industry average fluctuated around 95-100% | Lower is better; indicates underwriting profitability |

| Customer Retention Rate | Above 85% (Target) | Industry average varies | Key indicator of service and product appeal |

SSubstitutes Threaten

Larger organizations increasingly leverage self-insurance or establish captive insurance companies to directly manage their risks and potentially lower overall costs. This trend presents a significant threat to Donegal Group's commercial insurance offerings, especially when targeting sophisticated corporate clients who can absorb or directly finance a portion of their own risk.

The growing adoption of self-insurance and captives means that a segment of Donegal's potential customer base, particularly those with substantial financial resources and robust risk management capabilities, may opt out of traditional commercial policies. For instance, in 2023, the global captive insurance market continued its expansion, with many large corporations actively exploring or implementing these alternative risk financing structures to gain greater control over their insurance programs and premiums.

Government-backed insurance programs present a significant threat of substitution for private insurers like Donegal Group. For instance, the National Flood Insurance Program (NFIP) directly competes in an area where private insurers might otherwise operate, thereby shrinking the potential market. In 2023, the NFIP provided coverage for over 5 million policies across the United States, illustrating the substantial reach of such government initiatives.

Furthermore, certain forms of crop insurance are also heavily subsidized and administered by government entities. While Donegal Group primarily focuses on standard property and casualty lines, any expansion of government involvement into new insurance sectors could directly curtail its addressable market. This encroachment by government programs can limit growth opportunities and put downward pressure on pricing for private insurers.

The growing sophistication of risk management and prevention technologies presents a significant threat of substitutes for traditional insurance products. For instance, advancements in IoT and telematics, particularly in the automotive sector, allow for real-time monitoring and proactive interventions, potentially reducing the likelihood of claims and thus the perceived need for comprehensive collision or theft coverage. In 2024, the global telematics market was valued at over $30 billion, demonstrating substantial investment in these preventative solutions.

Similarly, smart home devices equipped with leak detection, advanced security systems, and automated fire suppression can mitigate property damage, thereby diminishing the demand for homeowners insurance coverage for these specific perils. This shift towards prevention-based services rather than pure risk transfer could fundamentally alter the revenue streams for insurers like Donegal Group, as customers may opt for technology subscriptions and maintenance over traditional premiums.

Alternative Risk Transfer Mechanisms

Beyond traditional insurance policies, sophisticated financial instruments present alternative avenues for risk transfer. Instruments such as catastrophe bonds, derivatives, and various securitized risk products allow large corporations and governments to offload substantial risks, particularly those related to natural disasters. For instance, the catastrophe bond market saw significant activity in 2024, with new issuances totaling tens of billions of dollars to cover perils like hurricanes and earthquakes. While these offerings might not directly compete with Donegal Group's primary customer base, they highlight a broader trend in how significant financial risks are managed and financed globally.

These alternative risk transfer mechanisms, while not direct substitutes for Donegal Group's core insurance products for small to medium-sized businesses, do represent a growing segment of the overall risk management landscape. The increasing sophistication and accessibility of these financial tools mean that larger entities are less reliant on traditional insurance for certain types of catastrophic events. This trend could indirectly impact the market by shifting the focus of risk financing towards more complex, capital-market-based solutions for specific, large-scale risks.

Key aspects of alternative risk transfer include:

- Catastrophe Bonds: These are insurance-linked securities that transfer a specified set of risks from an issuer to investors.

- Derivatives: Financial contracts whose value is derived from an underlying asset, index, or rate, used for hedging or speculating on future price movements of risks.

- Securitization: The process of pooling various financial assets and repackaging them into securities that can be sold to investors.

- Collateralized Reinsurance: A form of reinsurance where the reinsurer posts collateral to secure its obligations, often used by captives or large self-insured entities.

Digital Platforms and Peer-to-Peer Models

Emerging insurtech platforms, particularly those embracing peer-to-peer (P2P) or on-demand insurance models, present a growing threat of substitutes for traditional insurers like Donegal Group. These digital-first approaches can offer more tailored and potentially cost-effective coverage options, catering to specific consumer needs that might be underserved by conventional policies.

While still in their early stages, these alternative models are gaining traction, fueled by advancements in technology and a desire for greater flexibility. For instance, the global insurtech market size was valued at approximately $10.6 billion in 2023 and is projected to grow, indicating increasing consumer adoption of digitally-enabled insurance solutions.

- Peer-to-Peer (P2P) Insurance: These platforms pool premiums from a group of policyholders to cover claims within that group, often leading to lower administrative costs and potentially lower premiums for participants.

- On-Demand Coverage: Digital platforms facilitate the purchase of insurance for specific, short-term needs, such as insuring a specific item for a weekend or a particular event, offering a stark contrast to annual policy structures.

- Erosion of Market Share: As these digital alternatives mature and gain broader acceptance, they could begin to chip away at the customer base of established insurers by offering competitive pricing and enhanced user experience.

- Technological Facilitation: The underlying digital infrastructure and data analytics capabilities of insurtech startups enable them to underwrite risks more dynamically and offer personalized products, a capability that traditional insurers are also working to enhance.

The rise of risk management technologies and alternative financial instruments represents a substantial threat of substitutes for Donegal Group. Advancements in telematics and smart home devices can reduce the need for traditional coverage by preventing losses. For example, the global telematics market exceeded $30 billion in 2024, highlighting a move towards proactive risk mitigation.

Furthermore, sophisticated financial products like catastrophe bonds allow large entities to transfer significant risks, as evidenced by tens of billions of dollars issued in this market during 2024. While these may not directly target Donegal's core customers, they signal a broader shift in risk financing away from conventional insurance for certain perils.

Emerging insurtech platforms offering peer-to-peer or on-demand insurance models also pose a threat. These digital solutions can provide more tailored and cost-effective options, potentially attracting customers seeking greater flexibility and a simpler user experience. The global insurtech market, valued around $10.6 billion in 2023, continues to expand, indicating growing consumer interest.

Entrants Threaten

The insurance industry demands significant capital. For instance, in 2024, property and casualty insurers needed to maintain substantial reserves to comply with solvency regulations and have the financial muscle to pay out claims. These requirements can run into millions, if not billions, of dollars.

This high capital threshold acts as a formidable barrier for potential new entrants. Startups simply cannot easily muster the vast sums necessary to establish adequate reserves and operational capacity. Donegal Group, already operating within this regulated environment, benefits from this inherent difficulty for newcomers to enter and compete effectively on a large scale.

The insurance industry, including companies like Donegal Group, faces significant barriers to entry due to stringent regulatory requirements. New entrants must navigate a complex web of state-specific laws and obtain numerous licenses and approvals before they can even begin operating, a process that is both time-consuming and costly. For instance, in 2024, the average time to obtain all necessary insurance licenses across multiple states could extend well over a year, with associated fees often running into tens of thousands of dollars.

Brand recognition is a significant barrier for new entrants in the insurance sector, as trust is foundational. Donegal Group, like many established insurers, has cultivated customer confidence over decades, making it difficult for newcomers to compete. For instance, in 2024, the insurance industry continues to emphasize customer loyalty programs and positive reviews, highlighting the long-term effort required to build a reputable brand. New companies must invest heavily in marketing and customer service to overcome the inherent advantage of established players like Donegal Group, which benefit from years of consistent service and claims handling.

Distribution Network Development

The threat of new entrants for Donegal Group is significantly mitigated by the substantial investment and time required to build an effective distribution network. Donegal Group relies on a wide-reaching network of independent insurance agencies, a system that is challenging and costly for newcomers to replicate.

Establishing these relationships and the necessary technological infrastructure demands considerable capital and strategic effort. Newcomers might be forced to pursue direct-to-consumer models, which often come with higher customer acquisition costs and may not offer the same breadth of market penetration as established agency networks.

For instance, building a comparable agency force could take years and millions in upfront investment, a barrier that deters many potential competitors. This existing infrastructure acts as a formidable moat.

- High Capital Investment: New entrants need substantial funds to establish and maintain relationships with a large number of independent agencies.

- Time and Relationship Building: Cultivating trust and loyalty with independent agents is a lengthy process.

- Technological Integration: Developing or acquiring the necessary technology to support a distributed sales force is costly.

- Alternative Channel Costs: Direct sales channels often incur higher marketing and customer acquisition expenses.

Data and Underwriting Expertise

New entrants often struggle to replicate the deep historical claims data and sophisticated underwriting expertise that established players like Donegal Group have cultivated over many years. This proprietary information is vital for accurately assessing risk and setting competitive prices, creating a significant barrier for newcomers. For instance, in 2024, the insurance industry continued to emphasize data analytics and AI-driven underwriting, areas where legacy insurers have a substantial head start.

The ability to leverage decades of claims history allows companies like Donegal Group to develop more precise predictive models, leading to better risk selection and potentially lower loss ratios. New entrants, lacking this extensive data pool, must rely on more generalized actuarial tables or purchase external data, which can be less granular and more expensive. This disparity in data assets directly impacts pricing accuracy and profitability.

Furthermore, the underwriting talent pool is not easily replicated. Seasoned underwriters possess an intuitive understanding of risk that goes beyond mere data points, developed through years of experience in evaluating diverse and often complex insurance applications. This human element of underwriting, combined with robust data analytics, provides incumbents with a crucial competitive edge.

Consider the impact on pricing: Donegal Group, with its rich data, can more confidently price policies for specific risk profiles. New entrants, on the other hand, might be forced to price more conservatively, potentially losing market share to incumbents who can offer more competitive rates due to superior risk assessment capabilities. This data and expertise gap is a significant deterrent for potential new entrants in the insurance market.

The threat of new entrants for Donegal Group is considerably low due to the substantial capital requirements inherent in the insurance industry. In 2024, property and casualty insurers needed significant reserves to meet solvency regulations and cover potential claims, often amounting to millions or billions of dollars. This high financial barrier makes it exceedingly difficult for startups to enter and compete effectively.

Stringent regulatory hurdles also deter new competitors, demanding extensive time and resources for licensing and compliance. Obtaining necessary insurance licenses across multiple states in 2024 could take over a year and incur tens of thousands of dollars in fees. Furthermore, established players like Donegal Group benefit from strong brand recognition and trust, built over years, which new entrants struggle to replicate without considerable marketing investment.

The challenge of building and maintaining a robust distribution network, such as Donegal Group's relationships with independent agencies, presents another significant barrier. Replicating this network requires years and substantial upfront investment, often millions of dollars. New entrants might be forced to use more expensive direct-to-consumer channels, limiting their market penetration.

Finally, established insurers like Donegal Group possess invaluable historical claims data and sophisticated underwriting expertise, crucial for accurate risk assessment and pricing. New entrants, lacking this extensive data and experienced talent, face an uphill battle in developing precise predictive models and offering competitive rates.

Porter's Five Forces Analysis Data Sources

Our Donegal Group Porter's Five Forces analysis is built upon a foundation of publicly available data, including the company's annual reports, SEC filings, and investor relations materials. We supplement this with industry-specific market research reports and data from reputable financial news outlets to provide a comprehensive view.