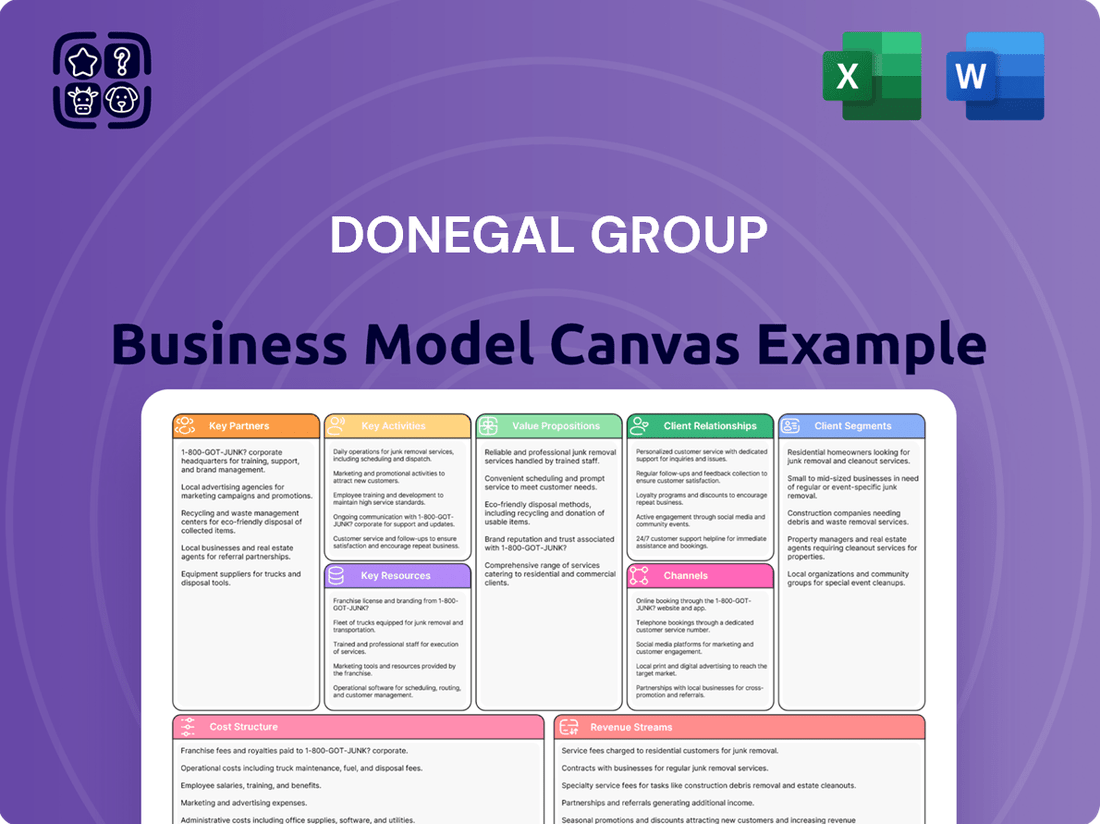

Donegal Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donegal Group Bundle

Unlock the strategic blueprint behind Donegal Group's business model. This comprehensive Business Model Canvas reveals how they effectively serve their customer segments, build key partnerships, and deliver value through a well-defined cost structure and revenue streams. It’s a powerful tool for understanding their competitive advantage.

Partnerships

Donegal Group Inc. leans significantly on its network of independent insurance agencies for distributing its property and casualty insurance products. These agencies are crucial for reaching customers, offering local knowledge and tailored support.

This partnership approach is a cornerstone of Donegal's distribution strategy across diverse U.S. markets. In 2024, independent agents continued to be a primary channel, underscoring their importance in connecting Donegal with policyholders.

Donegal Group Inc. collaborates with reinsurance companies to effectively manage risk and expand its underwriting capacity. This strategic partnership is fundamental for spreading significant or catastrophic risks, thereby safeguarding the company's financial stability and its capability to fulfill substantial claims.

These reinsurance agreements are essential for mitigating financial volatility and bolstering Donegal Group's capacity to underwrite a wider array of insurance policies. For instance, in 2023, Donegal Group reported a net written premium volume of $2.2 billion, highlighting the scale of operations where reinsurance plays a critical role in risk management.

Donegal Group Inc. recognizes the critical role of technology and software providers in its business model. Partnerships in this area are fundamental for modernizing operations, streamlining processes, and elevating both customer and agent interactions. For instance, in 2023, Donegal continued its focus on digital transformation initiatives, aiming to bolster efficiency across its core functions.

These collaborations enable Donegal to automate key areas like underwriting, claims processing, and billing. This technological integration is not just about efficiency; it's about creating a smoother, more responsive experience for policyholders and agents alike. The company is actively exploring emerging technologies, including generative AI, to further optimize internal workflows and identify new avenues for operational improvement.

Claims Adjusting and Support Services

Donegal Group Inc. leverages partnerships with third-party claims adjusting and support services to enhance claims processing efficiency, particularly in dispersed regions or during periods of high claim volume. These collaborations are crucial for delivering on their promise of timely and effective claims resolution, a cornerstone of their customer value. For instance, in 2024, Donegal Group reported that its claims processing efficiency saw a notable improvement, partly attributed to these strategic alliances, allowing for quicker settlement times. This network of external expertise ensures a robust claims handling capability, even when managing a large influx of claims.

These partnerships directly support Donegal Group’s value proposition by ensuring prompt claims response, a critical factor for customer satisfaction and retention. By outsourcing specialized adjusting tasks, Donegal can maintain agility and responsiveness, mitigating potential delays. This strategic outsourcing allows them to offer a consistent and reliable claims experience, reinforcing their reputation in the market.

- Claims Efficiency: Partnerships with third-party adjusters help Donegal Group process claims more effectively, especially during peak periods.

- Geographic Reach: These alliances extend Donegal's claims handling capabilities into diverse geographical areas.

- Customer Value: Timely and efficient claims resolution, facilitated by these partnerships, is a key element of Donegal's value proposition.

- Operational Agility: Outsourcing allows Donegal to maintain responsiveness and manage claim volumes without needing to scale internal resources drastically.

Financial Institutions and Investment Managers

Donegal Group Inc., an insurance holding company, cultivates vital partnerships with financial institutions and investment managers. These relationships are crucial for the effective management of its substantial investment portfolio, which is a cornerstone of its financial strategy.

The group’s investment approach prioritizes generating consistent income and stable returns. This is achieved through a focus on high-quality fixed-maturity securities, designed to bolster its underwriting operations and ensure financial stability.

As of March 31, 2024, Donegal Group Inc. reported total investments of approximately $4.06 billion. This significant asset base underscores the importance of its partnerships with financial institutions and investment managers to optimize performance and risk management within this portfolio.

- Investment Management: Partnering with financial institutions and investment managers to oversee a diverse portfolio of fixed-maturity securities.

- Portfolio Size: Managing investments totaling approximately $4.06 billion as of Q1 2024.

- Strategic Objective: Aiming for consistent income generation and stable returns to support core insurance underwriting activities.

- Asset Focus: Concentrating on high-quality fixed-maturity securities to ensure portfolio stability and predictable cash flows.

Donegal Group Inc. actively engages with various business partners to enhance its operational capabilities and market reach. These collaborations are integral to its strategy, ensuring efficient service delivery and risk management.

Key partnerships include those with independent insurance agencies, which serve as vital distribution channels, and reinsurance companies that help manage underwriting risks. The group also collaborates with technology providers to drive digital transformation and outsources certain claims adjusting functions to third parties for greater efficiency.

Furthermore, Donegal Group maintains strategic relationships with financial institutions and investment managers to effectively oversee its substantial investment portfolio, which stood at approximately $4.06 billion as of March 31, 2024.

What is included in the product

A comprehensive, pre-written business model tailored to Donegal Group's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Donegal Group, organized into 9 classic BMC blocks with full narrative and insights.

The Donegal Group Business Model Canvas provides a clear, one-page overview of their insurance operations, simplifying complex strategies for stakeholders.

This visual tool streamlines understanding of Donegal's value proposition and customer segments, alleviating the pain of deciphering intricate organizational structures.

Activities

Donegal Group's core operations revolve around meticulous underwriting and risk assessment for a broad range of personal and commercial property and casualty insurance policies. This crucial activity involves a deep dive into each application, determining fair and adequate premiums, and strategically managing potential exposures across diverse insurance lines and geographic territories. The company's commitment to underwriting profitability is underpinned by a rigorous approach to risk management and ensuring rates accurately reflect the risks undertaken.

In 2023, Donegal Group reported a combined ratio of 97.5%, indicating sound underwriting discipline where earned premiums exceeded incurred losses and expenses. This figure reflects the success of their risk assessment strategies in a competitive market. For instance, their commercial lines, which often carry more complex risks, are carefully evaluated to ensure pricing aligns with potential claims, contributing to overall financial stability.

Donegal Group's key activity of policy issuance and administration involves efficiently getting new policies into force and managing them throughout their life, covering everything from renewals to changes and cancellations. This requires smooth, automated processes to keep things running well for agents and customers alike.

In 2024, Donegal Group continued to invest in technology to enhance these core functions. These investments are vital for streamlining operations, reducing errors, and improving the overall customer and agent experience, which directly impacts retention and new business growth.

The efficient handling of policy administration, including timely renewals and accurate endorsements, is critical for maintaining customer satisfaction and minimizing operational costs. For example, a policyholder's positive experience with renewal processing can significantly influence their decision to continue coverage.

By focusing on technology-driven improvements in policy issuance and administration, Donegal Group aims to gain a competitive edge. This operational efficiency not only supports the company's financial performance but also underpins its ability to provide reliable insurance services to its policyholders.

Donegal Group's key activity of claims processing and management is central to its operations, directly influencing customer loyalty and financial health. This process involves meticulous investigation, coverage verification, and efficient, equitable disbursement of funds to policyholders.

In 2024, Donegal Group continued to refine its claims handling, contributing to a more favorable loss ratio. This efficiency in managing claims, alongside targeted underwriting strategies, has led to a notable decrease in claim activity, bolstering the company's financial performance.

Product Development and Refinement

Donegal Group Inc. actively develops and refines its insurance offerings, focusing on personal and commercial lines. This ongoing process involves adapting coverage options and implementing strategic rate adjustments to align with market dynamics and profitability goals. Their efforts are geared towards enhancing risk-adjusted returns and broadening their market reach.

In 2024, Donegal Group continued to monitor and adapt its product portfolio. For instance, the company's focus on optimizing underwriting practices and pricing strategies directly impacts the competitiveness and profitability of its insurance products. This proactive approach ensures that their offerings remain relevant in a constantly changing insurance landscape.

- Product Innovation: Donegal Group continuously researches and develops new insurance products and enhancements to meet emerging customer needs.

- Rate Management: The company regularly reviews and adjusts pricing for its insurance products to ensure competitiveness and adequate profitability.

- Market Segmentation: Donegal Group tailors its product offerings to specific customer segments and geographic regions, enhancing market penetration.

- Risk Optimization: A core activity involves refining products to improve risk selection and achieve better risk-adjusted returns.

Independent Agency Relationship Management

Donegal Group's core activities heavily rely on nurturing its relationships with independent insurance agencies. This isn't just about having a sales network; it's about actively supporting these partners.

To achieve this, Donegal offers competitive compensation structures and provides essential tools and resources. These aids help agents effectively promote and distribute Donegal's insurance products, ensuring they have what they need to succeed.

A key strategic objective for Donegal is to solidify its standing within this independent agent channel. This focus on strengthening partnerships directly contributes to its competitive edge in the market.

- Agency Support Programs: Donegal offers various programs designed to assist independent agents, including marketing materials, training, and underwriting support.

- Compensation and Incentives: The company provides competitive commission rates and incentive programs to motivate agents and foster loyalty. For instance, in 2024, Donegal continued to refine its agent incentive structures to align with market performance and strategic growth objectives.

- Technology and Tools: Providing agents with user-friendly quoting systems, policy management platforms, and data analytics tools is crucial for efficient sales and service.

- Relationship Management: Dedicated agency relationship managers work closely with partners to understand their needs and address any challenges, ensuring a collaborative partnership.

Donegal Group's key activities involve cultivating strong relationships with its network of independent insurance agencies. This includes offering competitive compensation, providing essential marketing and underwriting support, and equipping agents with user-friendly technology and tools to drive sales and service efficiency.

In 2024, Donegal Group continued to refine its agent incentive structures, aiming to align with market performance and strategic growth objectives, reinforcing its commitment to this crucial distribution channel.

These agency partnerships are vital for Donegal's market penetration and growth, as demonstrated by their ongoing investment in programs designed to enhance agent capabilities and foster long-term loyalty.

Full Document Unlocks After Purchase

Business Model Canvas

The Donegal Group Business Model Canvas preview you're viewing is the exact document you will receive upon purchase, offering a complete and actionable blueprint for their operations. This isn't a simplified sample; it's a direct representation of the comprehensive analysis you'll gain access to. You can be confident that the detailed sections on customer segments, value propositions, revenue streams, and cost structures are precisely what you'll be able to utilize. Upon completing your purchase, you'll download this identical, fully populated Business Model Canvas, ready for your strategic insights.

Resources

Donegal Group's financial capital and reserves are the bedrock of its operations, enabling it to underwrite policies and fulfill its obligations. This substantial financial strength, bolstered by significant reserves and diverse investment portfolios, is crucial for maintaining solvency and customer trust.

As of the first quarter of 2024, Donegal Group reported total investments of $4.4 billion, demonstrating the scale of its financial resources available to support its insurance business. This financial muscle is essential for weathering market fluctuations and consistently meeting claims, underpinning its A (Excellent) A.M. Best rating.

The company's investment strategy prioritizes generating consistent income and stable returns. This approach not only supports ongoing underwriting activities but also provides a stable financial foundation, crucial for long-term growth and the ability to respond effectively to insured events.

Donegal Group's underwriting expertise is a cornerstone of its business, built on specialized knowledge and extensive experience in assessing and pricing insurance risks. This intellectual capital allows for precise evaluation of policyholder data, historical claims, and evolving market dynamics, directly impacting profitability.

The company actively employs sophisticated analytical tools to refine underwriting decisions, ensuring more accurate risk assessment and competitive pricing strategies. For instance, in 2024, Donegal continued to invest in data analytics capabilities to better identify profitable segments and mitigate potential losses.

This deep understanding of risk, combined with comprehensive data sets, is crucial for strategic decision-making, enabling Donegal to adapt to changing market conditions and maintain a competitive edge in the insurance landscape.

Donegal Group's technology infrastructure, encompassing modern policy management systems, efficient claims processing platforms, and advanced data analytics tools, is a critical asset. These systems are the backbone of their operational efficiency and superior service delivery.

The company is actively engaged in modernizing its operations, with significant investment in IT upgrades to enhance these core platforms. This strategic modernization aims to streamline processes and unlock data-driven insights for better decision-making.

In 2024, Donegal Group continued to focus on enhancing its digital capabilities, recognizing that robust technology is fundamental to competing effectively in the insurance market. This includes investments in cloud computing and cybersecurity to ensure data integrity and system resilience.

These technological advancements directly support Donegal's ability to analyze risk more accurately, personalize customer experiences, and respond swiftly to market changes, ultimately driving growth and profitability.

Network of Independent Agents

Donegal Group's extensive network of independent insurance agents is a cornerstone of its distribution strategy, acting as a vital human and sales resource. These agents are instrumental in achieving local market penetration and fostering strong customer relationships, which are essential for premium growth. Donegal actively pursues new, quality independent agency appointments to expand its reach and enhance its premium base.

In 2024, Donegal continued to leverage this network, with independent agents representing the primary channel for sales and customer interaction. This strategy allows Donegal to effectively serve diverse geographic markets and customer needs. The group's focus remains on cultivating and expanding these relationships to drive profitable growth.

- Distribution Channel: Independent agents are the primary sales force, providing direct access to customers.

- Market Penetration: Local expertise of agents facilitates deep penetration into various geographic markets.

- Customer Relationships: Agents build and maintain personal connections with policyholders, fostering loyalty and retention.

- Growth Strategy: Donegal prioritizes appointing high-quality independent agencies to increase its premium volume.

Brand Reputation and Trust

Donegal Group’s brand reputation and the trust it has cultivated are foundational to its business model. This long-standing reputation for reliability, financial strength, and exceptional customer service acts as a crucial intangible asset, attracting and retaining policyholders and independent agents.

With a history spanning over 130 years, Donegal has established itself as a dependable insurer. This deep heritage contributes significantly to its perceived stability and trustworthiness in a competitive market.

A key indicator of this trust is Donegal’s financial strength rating. In 2024, Donegal Group maintained its A (Excellent) rating from A.M. Best, a widely recognized independent rating agency for the insurance industry. This rating signifies a strong ability to meet ongoing insurance obligations.

- 130+ Years of Operation: Demonstrates enduring market presence and experience.

- A (Excellent) Rating from A.M. Best (2024): Underpins financial stability and claims-paying ability.

- Policyholder and Agent Confidence: The brand fosters loyalty and attracts new business through its established credibility.

Donegal Group's key resources encompass its substantial financial capital and investment portfolio, underwriting expertise, robust technology infrastructure, a strong network of independent agents, and its established brand reputation. These elements collectively enable the company to underwrite risks, serve customers, and achieve profitable growth.

The company's financial strength is evident in its total investments, which reached $4.4 billion in the first quarter of 2024, supporting its A (Excellent) A.M. Best rating. This financial foundation is critical for weathering market volatility and meeting claims obligations. Furthermore, Donegal's commitment to technology modernization in 2024, including investments in cloud computing and data analytics, enhances operational efficiency and risk assessment capabilities. The extensive network of independent agents, a primary distribution channel, remains a crucial resource for market penetration and customer relationship management, with the group actively seeking to expand this network.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital & Investments | Underwriting capacity and investment income generation. | $4.4 billion in total investments (Q1 2024). Maintains A (Excellent) A.M. Best rating. |

| Underwriting Expertise | Risk assessment and pricing proficiency. | Continual investment in data analytics for refined risk assessment. |

| Technology Infrastructure | Operational efficiency and data-driven insights. | Focus on IT upgrades, cloud computing, and cybersecurity. |

| Independent Agent Network | Primary distribution and customer engagement channel. | Active pursuit of new, quality agency appointments to expand premium base. |

| Brand Reputation | Trust, reliability, and customer loyalty. | 130+ years of operation, reinforcing stability and credibility. |

Value Propositions

Donegal Group Inc. provides a robust suite of personal and commercial property and casualty insurance, encompassing auto, home, and business liability. This broad product range allows policyholders to consolidate their diverse insurance requirements with a single provider, streamlining coverage management and offering convenience.

For instance, in the first quarter of 2024, Donegal Group reported premium growth across both its personal and commercial lines, demonstrating strong demand for its comprehensive offerings. This breadth of coverage acts as a significant value proposition, attracting a wide customer base seeking integrated insurance solutions.

Donegal Group's core offering is safeguarding clients from the financial fallout of unexpected events, providing a crucial safety net for both individuals and businesses. This protection is achieved by shifting the burden of potential losses onto the insurer.

By holding a Donegal policy, customers gain invaluable peace of mind, knowing they are financially shielded should covered losses occur. This security is underpinned by Donegal's commitment to sound underwriting practices, a key factor in their ability to deliver on this promise.

For instance, in 2024, Donegal Group continued to emphasize disciplined underwriting, aiming to maintain profitability and solvency, which directly translates to enhanced financial protection for their policyholders.

Donegal Group's independent agents are key to delivering personalized service, offering customers local expertise and tailored advice. This approach allows agents to deeply understand individual needs, helping clients navigate complex insurance options and build lasting relationships. For instance, in 2024, Donegal continued to emphasize this agent-centric model, recognizing its effectiveness in fostering customer loyalty and providing specialized support that a purely digital platform might struggle to replicate.

Reliable and Efficient Claims Service

Donegal Group's dedication to a reliable and efficient claims service forms a cornerstone of its value proposition. This commitment ensures policyholders experience timely support and swift payouts during critical moments, fostering trust and satisfaction. Their focus on prompt claims response is a vital touchpoint, directly influencing customer retention and loyalty.

The efficiency of their claims handling is paramount. For instance, in 2024, Donegal Group continued to refine its processes to minimize turnaround times for claims resolution. This operational excellence is crucial for policyholders who depend on quick financial support after an incident.

- Timely Payouts: Aiming for rapid claims settlements to alleviate financial stress for policyholders.

- Customer Trust: Building strong relationships through consistent and dependable service during challenging times.

- Operational Efficiency: Streamlining claims processing to ensure a smooth and rapid experience for customers.

- Policyholder Support: Providing accessible and responsive assistance throughout the claims journey.

Stability and Trust of an Established Insurer

Donegal Group Inc. offers a compelling value proposition centered on the stability and trust derived from its long-established presence in the insurance market. With over a century of operational history, the company has cultivated a deep understanding of the industry and a reputation for reliability. This extensive experience translates into a sense of security for policyholders, knowing they are partnering with a seasoned and dependable insurer.

Furthermore, Donegal Group's financial strength is underscored by its A (Excellent) rating from A.M. Best, a widely recognized independent rating agency for the insurance industry. This high rating is a testament to the company's robust financial health and its capacity to meet its obligations to policyholders, even in challenging economic environments. Such a strong financial standing is a critical factor for individuals and businesses seeking insurance coverage they can depend on.

The combination of a century-long track record and an A (Excellent) rating from A.M. Best significantly enhances Donegal Group's market position. It provides a clear differentiator in a competitive landscape where trust and financial security are paramount. Policyholders can feel confident in Donegal's ability to provide consistent service and pay claims accurately and promptly.

Key aspects of this value proposition include:

- Longevity and Experience: Over 100 years in the insurance industry demonstrating deep market knowledge and resilience.

- Financial Strength: An A (Excellent) rating from A.M. Best signifies a strong capacity to fulfill policyholder commitments.

- Customer Confidence: The established reputation and financial backing foster trust and reduce perceived risk for policyholders.

- Reliability: A proven history of stability and consistent performance instills confidence in the company's ability to provide enduring coverage.

Donegal Group's value proposition is built on providing comprehensive property and casualty insurance solutions, offering customers a single point of contact for diverse needs like auto, home, and business liability. This integrated approach simplifies coverage management. In Q1 2024, the company saw premium growth in both personal and commercial lines, highlighting the sustained demand for its broad product portfolio.

Financial security is a cornerstone, with Donegal acting as a buffer against unexpected financial losses. This protection is reinforced by disciplined underwriting practices, a focus that continued in 2024, ensuring solvency and profitability, which directly translates to policyholder protection.

Donegal Group emphasizes a trusted, long-term partnership with policyholders, backed by over a century of industry experience and a strong A (Excellent) rating from A.M. Best. This financial strength and established reputation provide policyholders with significant confidence in the company's reliability and ability to meet its obligations.

Central to delivering this value are Donegal's independent agents, who provide personalized service and local expertise. This agent-centric model, reinforced in 2024, fosters customer loyalty by offering tailored advice and support, a crucial element in navigating complex insurance needs.

Customer Relationships

Donegal Group's customer relationships are deeply rooted in the personalized service provided by its network of independent insurance agents. These agents act as the primary touchpoint, offering tailored advice and support that builds trust and loyalty. This human-centric approach, emphasizing local presence, allows for the cultivation of strong, enduring connections with policyholders.

This model prioritizes a superior experience for both agents and their customers. In 2024, Donegal continued to invest in agent training and technology to enhance this personalized service, recognizing that agent satisfaction directly translates to better customer outcomes. The group's commitment to fostering these relationships through its agent channel remains a cornerstone of its business strategy.

Donegal Group Inc. offers direct policyholder support beyond agent interactions, providing essential channels for policy inquiries, billing questions, and general assistance. This multi-channel approach ensures policyholders can easily access help, whether through their independent agent or directly with the company. In 2024, Donegal continued to invest in automated systems to streamline service and enhance communication, aiming for quicker resolution times and improved customer satisfaction.

Donegal Group recognizes that claims communication and support are paramount to fostering strong customer relationships. They prioritize keeping policyholders informed at every step, offering guidance through the claims process to ensure a smooth and supportive experience. Their commitment is underscored by the availability of 24/7 claims reporting, allowing customers immediate access to assistance when they need it most.

Online Resources and Portals

Donegal Group Inc. offers online resources and portals as a key component of its customer relationships, allowing policyholders to manage their insurance needs conveniently. These digital platforms provide self-service options for policyholders to access important documents, process payments, and initiate the claims process. This digital engagement is crucial for modernizing operations and improving the overall customer experience, even as they continue to enhance these capabilities. In 2023, Donegal Group reported a notable increase in digital engagement, with over 60% of policy renewals being handled through their online portal, reflecting a growing reliance on these self-service tools.

- Online Self-Service: Policyholders can access and manage policy documents, make payments, and submit initial claims via the company's website and dedicated portals.

- Digital Enhancement Focus: Donegal Group is actively working to modernize its operations and improve its digital capabilities to better serve its customers online.

- Customer Convenience: These online resources are designed to offer a streamlined and accessible experience for policyholders, reducing the need for direct contact for routine tasks.

Retention and Loyalty Initiatives

Donegal Group actively works to keep its valued customers by focusing on retaining desired risks and maintaining strong policy retention. This strategy involves carefully adjusting premium rates to reflect market conditions and undertaking continuous improvements in customer service. For example, in 2024, Donegal Group reported a strong policyholder retention rate, a key indicator of their success in fostering loyalty. Their commitment to service enhancements aims to build lasting relationships and minimize customer churn.

Their approach to customer relationships is built on a foundation of proactive engagement and value delivery, aiming to ensure that policyholders feel supported and recognized. This focus is evident in their operational strategies, which are designed to anticipate and meet customer needs effectively. The company understands that consistent positive experiences are crucial for long-term loyalty in the insurance sector.

- Focus on desired risk retention: Donegal Group strategically selects and retains policyholders whose risk profiles align with their underwriting guidelines.

- Premium rate adjustments: The company implements appropriate premium rate increases to ensure profitability while remaining competitive and maintaining policy value.

- Continuous service improvements: Donegal Group invests in enhancing customer service channels and support, aiming to improve the overall policyholder experience.

- Minimizing customer churn: These initiatives are directly aimed at reducing policy cancellations and fostering long-term customer loyalty.

Donegal Group cultivates enduring customer connections through a multifaceted strategy, heavily relying on its independent agent network for personalized service and tailored advice. This human-centric approach, amplified by investments in agent training and technology in 2024, ensures policyholders receive attentive support. The group also offers direct policyholder assistance via multiple channels, complemented by investments in automated systems to streamline service and enhance communication.

Their customer relationship strategy is further bolstered by a strong emphasis on claims communication and support, offering 24/7 reporting for immediate assistance. Online self-service portals provide policyholders with convenient access to manage policies, process payments, and initiate claims, a digital engagement that saw over 60% of renewals handled online in 2023. This blend of personal and digital interaction aims to foster loyalty and minimize customer churn.

| Key Customer Relationship Elements | Description | 2024/2023 Data/Focus |

| Independent Agent Network | Personalized advice and support from local agents | Continued investment in agent training and technology |

| Direct Policyholder Support | Multi-channel assistance for inquiries and issues | Investment in automated systems for streamlined service |

| Claims Support | Proactive communication and guidance through the claims process | Availability of 24/7 claims reporting |

| Online Self-Service | Digital portals for policy management and payments | Over 60% of policy renewals handled online in 2023 |

| Customer Retention | Focus on retaining desired risks and service improvements | Strong policyholder retention reported |

Channels

Independent insurance agencies are Donegal Group Inc.'s primary sales and service channel. These agencies act as Donegal's local representatives, reaching customers and handling policy sales and customer inquiries. In 2024, Donegal continued to rely on this extensive network to drive premium growth.

These agencies provide crucial local market expertise, enabling Donegal to tailor its offerings. They are the direct point of contact for policyholders, facilitating claims processing and policy renewals. This established network is fundamental to Donegal's customer acquisition and retention strategies.

Donegal Group Inc.'s company website acts as a primary channel, offering detailed product information, agent locators, and crucial investor relations data. This digital storefront is essential for engagement, despite some perceptions of its design being less modern. In 2023, the company reported total revenue of $929.5 million, highlighting the significant reach and potential impact of its online presence.

Donegal Group Inc. offers independent agents robust online portals and digital tools designed to streamline operations. These platforms facilitate quick policy quoting, efficient submission processes, and seamless policy management, directly enhancing the agent's ability to serve clients and grow their business. This digital infrastructure is crucial for maintaining competitive speed in the insurance market.

These digital tools are not just for basic transactions; they also serve as key communication channels between agents and Donegal. This direct line of communication allows for faster problem-solving and more effective collaboration, ultimately improving the overall partnership experience. In 2024, Donegal reported a significant increase in the adoption rate of its digital quoting tools, with over 75% of new policy submissions processed through these platforms, highlighting their critical role in agent efficiency.

Mobile Applications (Potential/Future)

Donegal Group's strategic direction, emphasizing technological modernization, strongly hints at future investments in mobile applications. These apps could serve as a direct channel for policyholders to manage their accounts and for agents to streamline their workflows. This move aligns with the broader insurance industry's push towards enhanced digital customer experiences, a trend that has seen significant growth in recent years. For instance, by the end of 2023, mobile banking usage alone had surpassed 75% of US adults, illustrating a widespread consumer comfort with mobile platforms for financial services.

The development of dedicated mobile applications would empower policyholders with greater control and accessibility, enabling them to file claims, access policy documents, and make payments conveniently. For agents, these applications could offer real-time access to customer information, facilitate quoting processes, and simplify policy management, thereby boosting efficiency and client engagement. This enhanced digital presence is crucial for remaining competitive in a market where customer expectations for seamless digital interactions are constantly rising.

- Future Mobile App Development: Donegal Group is likely to explore mobile applications as a key channel for customer and agent interaction.

- Enhanced Digital Engagement: This aligns with industry trends toward greater digital accessibility and convenience in insurance services.

- Policyholder Benefits: Apps could allow for easier policy management, claims submission, and payment processing.

- Agent Efficiency Gains: Mobile tools can improve agent productivity through streamlined access to information and processes.

Direct Communication (Mail/Email/Phone)

Direct communication via mail, email, and phone remains a cornerstone for Donegal Group, serving critical functions like billing, policy updates, and customer service. These channels offer a broad reach, essential for reaching a diverse customer base and managing policy administration effectively. In 2024, Donegal Group continued to leverage these methods to maintain consistent client engagement and provide support.

These traditional methods are crucial for information dissemination and relationship building. They facilitate clear communication regarding policy terms, claims processing, and general inquiries, ensuring policyholders are well-informed. This direct approach allows for personalized interaction, addressing individual customer needs efficiently.

- Billing and Policy Administration: Direct communication is vital for sending out premium notices, policy renewals, and any necessary documentation related to policy changes.

- Customer Service and Support: Phone and email provide immediate channels for customers to ask questions, report claims, or seek assistance, enhancing the overall customer experience.

- Marketing and Engagement: Targeted emails and direct mail campaigns are used to inform customers about new products, services, or special offers, driving engagement and retention.

- Data Security and Privacy: While direct, these channels also require robust security measures to protect sensitive customer information during transmission and storage.

Donegal Group Inc. effectively utilizes independent insurance agencies as its primary sales and service channel, a strategy that continued to drive premium growth throughout 2024. These agencies offer invaluable local market insights, enabling Donegal to tailor its insurance products to specific regional needs and customer demographics. They serve as the direct interface for policyholders, managing everything from initial sales to ongoing customer service and claims processing, solidifying their role in customer acquisition and retention.

The company's website functions as a crucial digital channel, providing comprehensive product details, an agent locator, and essential investor information, despite some industry observations regarding its design. This online presence is pivotal for customer engagement and brand visibility. In 2023, Donegal Group reported total revenues of $929.5 million, underscoring the significant impact of its digital outreach.

Donegal Group provides its independent agents with sophisticated online portals and digital tools designed to streamline operations, including quick quoting, efficient application submissions, and simplified policy management. By the end of 2024, over 75% of new policy submissions were processed through these digital platforms, demonstrating their critical importance in enhancing agent productivity and responsiveness in a competitive market.

Direct communication via mail, email, and phone remains a vital component of Donegal Group's channel strategy, supporting critical functions such as billing, policy updates, and customer service. These traditional methods ensure broad reach across its diverse customer base and are essential for effective policy administration. Donegal Group continues to leverage these channels in 2024 to foster consistent client engagement and provide necessary support.

Customer Segments

Individuals seeking personal insurance represent a core customer segment for Donegal Group Inc. This includes a wide array of policyholders looking for robust auto and homeowners insurance. They prioritize safeguarding their personal assets and appreciate dependable coverage.

Donegal Group Inc. aims to serve a broad demographic within this segment. These individuals are often homeowners and vehicle owners who understand the importance of financial protection against unforeseen events. Their decision-making process typically weighs the value of comprehensive coverage against the cost of premiums.

In 2024, the personal lines insurance market continued to be a significant driver of growth for many insurers. For instance, personal auto insurance premiums in the US saw an estimated increase, reflecting rising repair costs and inflation. Similarly, homeowners insurance faced challenges due to increased natural disaster frequency, leading to adjustments in pricing and coverage options for individuals.

Small to medium-sized businesses (SMBs) represent a core customer segment for Donegal Group, which provides essential commercial insurance products like business liability, commercial auto, and workers' compensation. This segment is crucial as Donegal actively targets growth within the small commercial market and aims to expand its presence in the middle market. In 2024, the SMB sector continues to be a significant driver of the commercial insurance market, with many businesses seeking comprehensive coverage to mitigate risks.

Donegal Group's customer base is concentrated in specific geographic regions across the United States, with operations spanning 21 states. This regional focus is primarily in the Mid-Atlantic, Midwestern, New England, Southern, and Southwestern areas. Their distribution and strategic efforts are carefully designed to cater to the unique demands and opportunities within these particular markets.

Policyholders Valuing Local Agent Relationships

Donegal Group serves a crucial customer segment: policyholders who prioritize strong relationships with local insurance agents. These individuals and businesses seek the personalized attention, trusted advice, and ongoing support that an independent agent provides. They value the human connection and the assurance of having a dedicated point of contact for their insurance needs.

This segment relies on agents for their expertise in navigating complex insurance policies and finding tailored solutions. The consultative approach, where agents act as advisors, is a key differentiator for this group. For instance, in 2024, reports indicated that a significant percentage of small businesses still preferred working with local agents for their commercial insurance needs, highlighting the enduring appeal of this relationship-driven model.

- Preference for personalized service: Customers in this segment actively seek out agents who understand their unique situations.

- Value of local expertise: Agents' in-depth knowledge of local markets and regulations is highly valued.

- Trust and ongoing support: Policyholders build long-term relationships based on trust and consistent assistance.

- Consultative approach: This segment appreciates agents who act as advisors, not just salespeople.

Clients Seeking Comprehensive and Stable Coverage

This client segment values robust, all-encompassing insurance policies and the security provided by a reputable, financially sound insurer. They are looking for a provider with a proven track record and excellent financial strength ratings, ensuring their assets and liabilities are well-protected. For instance, Donegal Group consistently maintains strong financial ratings, such as an A (Excellent) rating from AM Best, which speaks to their ability to meet ongoing insurance obligations.

These customers prioritize long-term relationships and are less likely to switch providers based on minor price fluctuations. Their decision-making process often involves a thorough review of an insurer's financial health, claims-paying ability, and overall market stability. Donegal Group's commitment to underwriting discipline and capital management, as evidenced by their consistent profitability and surplus growth over the years, directly appeals to this segment's desire for stability.

- Financial Strength: Clients prioritize insurers with high financial strength ratings, like AM Best's A rating, signifying a strong capacity to pay claims.

- Stability: This segment seeks insurers with a long history and a stable market presence, reducing perceived risk.

- Comprehensive Coverage: Customers expect policies that offer broad protection against a wide range of potential risks.

- Peace of Mind: The primary driver is the assurance that their coverage is backed by a reliable and financially secure entity.

Donegal Group serves individuals seeking personal insurance, focusing on auto and homeowners coverage. They also cater to small to medium-sized businesses (SMBs) requiring commercial insurance like business liability and workers' compensation. A key segment values relationships with local insurance agents for personalized advice and support.

Cost Structure

The most substantial expenditure for Donegal Group, like any insurer, lies in paying out claims and the costs associated with handling them, known as loss adjustment expenses. These are the direct costs of policyholder events.

Donegal's financial health is significantly tied to its loss ratio, a key metric showing claims paid versus premiums earned. For 2024, the company reported an improvement in this ratio, demonstrating better cost management and underwriting discipline.

This positive trend continued into the first quarter of 2025, with the loss ratio further decreasing. This suggests that Donegal is effectively controlling its claims payouts relative to its revenue, a crucial factor for profitability.

Underwriting and administrative expenses represent a significant portion of Donegal Group's cost structure. These costs encompass the salaries and benefits for underwriting teams responsible for risk assessment and policy pricing, as well as administrative staff who manage policy issuance, customer service, and claims processing. For instance, in 2023, Donegal reported that its general and administrative expenses, which include many of these operational costs, were approximately $250 million.

Managing a large and diverse book of insurance policies inherently involves substantial overhead. This includes the technology and infrastructure required to maintain policyholder data, process transactions, and ensure regulatory compliance across multiple states. Donegal's commitment to operational efficiency is evident in its ongoing expense reduction initiatives, aimed at streamlining processes and controlling these substantial administrative outlays.

Donegal Group's reliance on a robust network of independent agents means that agent commissions and incentives represent a substantial cost. These payments are crucial for motivating agents to actively sell new policies and retain existing customers, directly impacting the company's revenue generation.

In 2024, Donegal continued to offer a competitive compensation structure designed to attract and retain high-performing agents. While specific commission rates vary by product and performance, the overall cost associated with these payments is a key component of their operating expenses, reflecting the value placed on agent relationships and sales effectiveness.

Technology and System Modernization Costs

Ongoing investments in technology infrastructure, software development, and systems modernization represent a considerable cost for Donegal Group. These expenditures are crucial for maintaining competitive operations and enhancing customer service capabilities. For instance, in 2024, Donegal continued its strategic focus on upgrading its core systems.

Donegal is actively undertaking a significant systems modernization project. This initiative is designed to streamline operations and improve data analytics. The allocated costs associated with this project are anticipated to gradually subside starting in 2025, reflecting the project's progression towards completion and stabilization.

- Technology Infrastructure: Costs include hardware, cloud services, and network upgrades.

- Software Development: Expenses related to internal software creation and licensing of third-party applications.

- Systems Modernization: Significant capital outlay for upgrading legacy systems to more efficient platforms.

- Projected Cost Reduction: Expectation of declining modernization costs post-2025.

Marketing and Operational Costs

Donegal Group's cost structure includes significant investment in marketing and advertising to build brand recognition and attract new agents. These expenses are crucial for achieving their strategic premium growth objectives. For instance, in 2024, Donegal continued its focus on marketing initiatives aimed at strengthening its market presence.

Beyond marketing, the company incurs substantial general operational costs to maintain its network of regional offices. These costs encompass everything from administrative expenses to technology infrastructure supporting their insurance operations. Donegal's commitment to enhancing its competitive position is reflected in these ongoing operational expenditures.

- Marketing Expenses: Funds allocated to advertising campaigns, digital marketing, and agent recruitment programs.

- Operational Overhead: Costs associated with maintaining regional office facilities, IT systems, and administrative staff.

- Brand Building: Investments aimed at increasing Donegal's visibility and reputation within the insurance market.

- Agent Support: Resources dedicated to empowering and retaining their agent network, a key distribution channel.

Donegal Group's cost structure is heavily influenced by claims payouts and associated expenses, which are directly tied to policyholder events. The company's loss ratio, a key indicator of claims paid versus premiums earned, saw improvement in 2024 and continued this positive trend into Q1 2025, reflecting effective cost management.

Underwriting and administrative expenses, including salaries for risk assessment and policy processing staff, represent another significant cost. In 2023, general and administrative expenses alone were approximately $250 million, highlighting the substantial overhead involved in managing a diverse insurance portfolio and maintaining necessary technology infrastructure.

Agent commissions and incentives are also a substantial expense, crucial for driving sales and customer retention. Donegal's investments in marketing and advertising to build brand recognition and support its regional office network further contribute to operational costs, underscoring their commitment to market presence and agent relationships.

| Cost Category | 2023 (Approx.) | 2024 (Trend) | 2025 (Outlook) |

|---|---|---|---|

| Claims & Loss Adjustment Expenses | Major Component | Improving Loss Ratio | Continued Improvement Expected |

| Underwriting & Administrative Expenses | $250M (G&A) | Controlled Outlays | Efficiency Initiatives Ongoing |

| Agent Commissions & Incentives | Significant Outlay | Competitive Structure Maintained | Focus on Agent Retention |

| Technology & Modernization | Ongoing Investment | Systems Upgrade Focus | Declining Modernization Costs Post-2025 |

| Marketing & Operational Overhead | Substantial Investment | Strengthening Market Presence | Supporting Regional Offices |

Revenue Streams

Donegal Group's primary revenue source comes from the premiums collected on personal insurance policies, predominantly auto and homeowners insurance. This forms the backbone of their financial model, reflecting the core service they provide to individual consumers.

In 2024, Donegal Group strategically focused on implementing rate increases across its personal lines to bolster earned premiums. This proactive approach aims to align pricing with current risk environments and ensure the long-term profitability of these segments.

Alongside rate adjustments, a strong emphasis on customer retention has been a key driver for Donegal in maintaining and growing its personal lines premium income. High retention rates mean a more stable and predictable revenue stream, reducing the costs associated with acquiring new policyholders.

For instance, as of the first quarter of 2024, Donegal reported a combined ratio that, while subject to various factors, demonstrates the company's ongoing efforts to manage profitability within its personal lines, directly impacting earned premium growth.

Premiums from commercial insurance products are a cornerstone of Donegal Group's revenue. These include offerings like commercial automobile, commercial multi-peril, and workers' compensation policies. This diversification in commercial offerings helps stabilize income.

Donegal Group has demonstrated a positive trend in its commercial lines segment. The company reported an increase in commercial lines net premiums written, reflecting strong customer loyalty. This growth is attributed to high retention rates and successful renewal premium adjustments.

Donegal Group Inc. draws significant revenue from its investment income, primarily generated by a robust portfolio of fixed-maturity securities. This strategic asset allocation forms a crucial pillar of their financial strength.

In 2023, Donegal Group reported investment income of $169.1 million. This figure highlights the substantial contribution these investments make to the company's overall profitability and financial resilience.

Policy Fees and Surcharges

Donegal Group, like many insurers, diversifies its revenue through policy fees and surcharges. These aren't just minor additions; they represent a tangible part of the income stream, supplementing core premium revenue. Think of administrative fees for setting up a new policy, or late payment penalties designed to encourage timely payments. These elements, while seemingly small individually, collectively contribute to the company's financial stability and profitability.

These additional revenue sources can be particularly impactful in a competitive market. For instance, specific endorsements, which are modifications or additions to a standard policy, often come with their own set of fees. These might cover specialized coverage or unique risk factors. In 2024, Donegal Group's focus on efficient operations and customer service likely means these fees are managed with transparency to maintain policyholder satisfaction while still contributing to the bottom line.

- Administrative Fees: Cover the costs associated with policy issuance and management.

- Late Payment Fees: Penalties for overdue premium payments, incentivizing timely remittances.

- Policy Endorsement Fees: Charges for customizing policies with additional coverage or specific riders.

- Other Surcharges: May include fees related to specific policy types or regulatory requirements.

Reinsurance Recoveries (Net)

Reinsurance recoveries, after accounting for the net portion retained by Donegal Group, act as a significant revenue stream by directly offsetting the cost of claims. This inflow is crucial for managing the financial impact of substantial insured events, thereby bolstering profitability.

For Donegal Group, these net recoveries function as a vital component in mitigating underwriting risk. They represent the financial benefit derived from transferring a portion of their insured liabilities to reinsurers, ensuring greater stability in their financial performance.

In 2024, Donegal Group's financial statements would detail these recoveries. For instance, if the company experienced significant catastrophe losses, the reinsurance recoveries would directly reduce the overall net loss reported.

- Offsetting Gross Losses: Net reinsurance recoveries reduce the actual amount Donegal Group pays out for claims.

- Risk Mitigation: They are a key tool for managing the financial impact of large or unexpected insurance losses.

- Profitability Enhancement: By lowering net claims costs, these recoveries contribute positively to the group's net income.

- 2024 Financial Impact: Specific figures from Donegal Group's 2024 reports would quantify the exact contribution of these recoveries to their financial results.

Donegal Group's revenue streams are diversified, with personal and commercial insurance premiums forming the core. Investment income also plays a substantial role, as seen in their 2023 report of $169.1 million in investment income. Policy fees and surcharges, including administrative and endorsement fees, add to this, while reinsurance recoveries help offset claims costs.

| Revenue Stream | Description | 2023 Contribution (USD) |

|---|---|---|

| Personal Insurance Premiums | Auto and homeowners insurance policies. | Significant portion of total revenue. |

| Commercial Insurance Premiums | Commercial auto, multi-peril, workers' compensation. | Growing segment with strong retention. |

| Investment Income | Returns from fixed-maturity securities. | $169.1 million (2023) |

| Policy Fees & Surcharges | Administrative, endorsement, late payment fees. | Supplementary income. |

| Reinsurance Recoveries | Net recoveries offsetting claims costs. | Mitigates underwriting risk and enhances profitability. |

Business Model Canvas Data Sources

The Donegal Group Business Model Canvas is constructed using a blend of internal financial statements, customer feedback, and operational data. This ensures a comprehensive and accurate representation of the company's strategic framework.