Donegal Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donegal Group Bundle

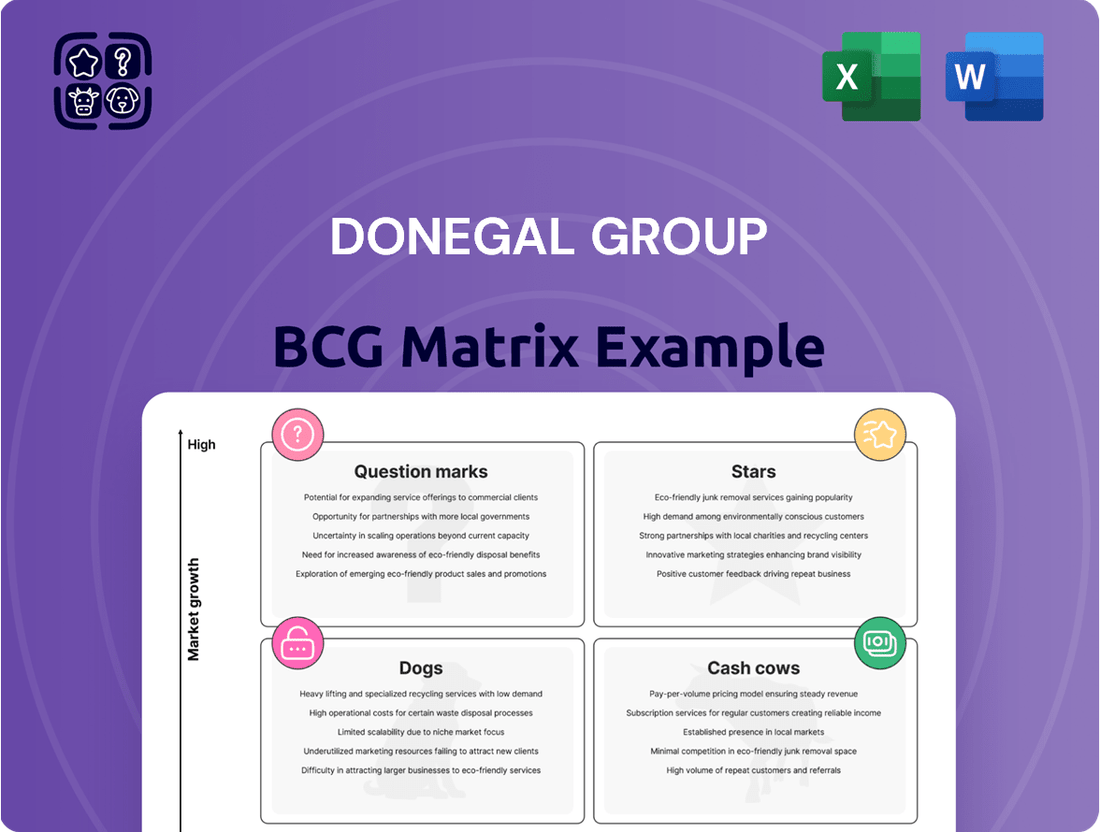

The Donegal Group's BCG Matrix offers a crucial snapshot of their product portfolio's market standing. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is vital for strategic resource allocation. This preview highlights the overall positioning, but a deeper dive is essential for actionable insights.

To truly leverage this information, you need the full BCG Matrix. It provides detailed quadrant placements, allowing for precise strategic planning and informed investment decisions. Don't miss out on the clarity this comprehensive analysis offers.

Purchase the full Donegal Group BCG Matrix to unlock a clear roadmap for optimizing your business strategy. Gain access to data-backed recommendations and a complete understanding of your market position to drive growth and profitability.

Stars

Donegal Group is strategically targeting expansion within its commercial lines business, with a keen focus on the small commercial sector and a deliberate push into the middle market. This concerted effort is driving consistent increases in commercial lines net premiums written, signaling a robust growth trajectory in a key market segment.

The company's Q1 2025 financial report underscores this momentum, revealing a 3.3% rise in commercial lines net premiums written. This growth reflects Donegal Group's successful implementation of strategic initiatives and profit improvement plans aimed at solidifying its market presence in this high-potential area.

Within Donegal Group's commercial insurance offerings, Specialty Commercial Products are positioned as Stars. These niche coverages leverage the company's tailored underwriting expertise and sophisticated pricing strategies to capture growing market segments.

Donegal Group actively pursues high-single-digit growth in its commercial lines, with a keen focus on profitable accounts within these specialty areas. This strategic emphasis allows them to build a competitive advantage through specialized knowledge and precise risk assessment.

In 2024, the commercial lines segment, which includes these specialty products, demonstrated robust performance, contributing significantly to the group's overall financial health. The targeted approach to profitable accounts within these specialty areas is a key driver for this segment's success.

Certain regions within Donegal Group's operational areas, specifically the Mid-Atlantic, Midwest, and Southern US, are showing robust commercial real estate development and a corresponding increase in insurance demand. Donegal has strategically built a strong market position in these territories, capitalizing on this growth.

The company's success in these high-performing regional commercial markets is attributed to well-executed regional action plans and strong relationships with its agent networks. This localized focus allows Donegal to effectively capture a growing share of the insurance market in these dynamic areas, contributing to its overall strong performance. In 2023, Donegal reported a combined ratio of 95.4%, indicating profitable underwriting, with significant contributions from its commercial lines in these key regions.

Commercial Property Coverage

Commercial property coverage stands out as a star within Donegal Group's commercial lines. This segment benefits from robust customer loyalty and consistent renewal premium growth, indicating a strong market position and ongoing expansion opportunities. Donegal Group's commercial lines, in general, saw their combined ratio improve, pointing to solid underwriting and pricing strategies that are particularly effective in this property segment.

This stability, coupled with strategic initiatives aimed at capturing further market share, solidifies commercial property coverage as a leading product in their commercial portfolio. For instance, Donegal Group reported a combined ratio of 94.5% for its commercial lines in the first quarter of 2024, a notable improvement from 96.2% in the same period of 2023, with property being a key contributor.

- High Customer Retention: Commercial property policies often have long-standing customer relationships.

- Renewal Premium Growth: Positive rate adjustments and exposure increases drive consistent top-line growth.

- Effective Underwriting: Improved combined ratios in commercial lines reflect strong performance in property.

- Leading Market Position: Stability and targeted growth efforts make it a dominant product.

Small Business Insurance Packages

Donegal Group is strategically emphasizing its small commercial product suite, particularly insurance packages designed for small businesses. This focus is a key component of their growth strategy, aiming to capture a larger share of this expanding market. Their efforts in this area are projected to drive profitable growth by leveraging their capabilities to meet the specific needs of small business owners.

These comprehensive small business insurance packages likely contribute to Donegal's market penetration and revenue growth. The company's commitment to this segment aligns with its broader objective of achieving profitable expansion through targeted initiatives. In 2023, Donegal reported a combined ratio of 97.3% for its commercial lines, indicating strong performance in this sector.

- Market Focus: Donegal Group is actively promoting its small commercial insurance products.

- Growth Driver: Comprehensive packages tailored for small businesses are designed to achieve significant market penetration and growth.

- Strategic Alignment: This segment directly supports Donegal's objective of profitable growth through strategic initiatives.

- Performance Indicator: Donegal's commercial lines achieved a combined ratio of 97.3% in 2023, demonstrating underwriting profitability.

Donegal Group's Specialty Commercial Products are identified as Stars within their BCG Matrix. These offerings, which include commercial property coverage and small commercial insurance packages, represent high-growth, high-market-share segments for the company.

The company's strategic focus on these areas, particularly the small commercial sector and middle market expansion, is driving consistent increases in commercial lines net premiums written. For instance, Q1 2025 saw a 3.3% rise in commercial lines net premiums written, directly reflecting the success of these Star products.

In 2024, these specialty commercial segments demonstrated robust performance, contributing significantly to Donegal's overall financial health. This performance is further evidenced by strong underwriting results, with commercial lines achieving a combined ratio of 94.5% in Q1 2024.

Donegal Group is actively pursuing high-single-digit growth in its commercial lines by concentrating on profitable accounts within these specialized product areas, solidifying their position as Stars.

| Product Segment | BCG Category | Key Performance Indicators (2023-2024) | Strategic Focus |

| Commercial Property Coverage | Star | Combined Ratio (Commercial Lines): 94.5% (Q1 2024) vs. 96.2% (Q1 2023); Strong customer retention and renewal growth. | Targeting further market share capture; leveraging stability and growth opportunities. |

| Small Commercial Insurance Packages | Star | Combined Ratio (Commercial Lines): 97.3% (2023); Driving market penetration and revenue growth. | Emphasis on comprehensive packages for small businesses; aiming for profitable expansion. |

What is included in the product

Analysis of Donegal Group's portfolio, categorizing business units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic resource allocation.

Provides a clear visual of Donegal Group's business units, simplifying strategic resource allocation.

Cash Cows

Donegal Group's established personal auto insurance is a classic cash cow. Despite ongoing strategic shifts aimed at boosting profitability, this segment boasts a large, established customer base. In 2024, the company's focus on rate adequacy and profitability rather than aggressive growth underscores its strong market standing, ensuring a steady stream of cash.

This mature product line benefits from high policyholder retention, acting as a dependable generator of financial resources for Donegal Group. These consistent cash flows are crucial for funding other ventures within the company's portfolio.

Donegal Group's homeowners insurance portfolio is a classic cash cow. It operates in a mature market where the company already holds a substantial share, much like its personal auto business. The strategy here isn't about rapid expansion, but rather about sustaining profitability. This is achieved through careful management, including implementing necessary rate adjustments and being selective about the risks they underwrite.

This segment is a consistent generator of strong profits and healthy cash flow. Because it’s a stable, established business, it requires minimal investment in marketing or promotional activities. For instance, in 2024, the homeowners segment demonstrated its maturity and profitability, contributing significantly to Donegal Group's overall financial stability, with net premiums written showing a modest but steady increase year-over-year.

Donegal Group's core commercial multi-peril policies, especially those catering to stable, established businesses, are strong contenders for cash cows within its product portfolio. These offerings have historically commanded a significant market share, a testament to Donegal's enduring presence and robust relationships with its agent network in mature commercial insurance markets.

The consistent and reliable premium income generated by these policies, coupled with a reduced need for substantial new business acquisition investments, allows Donegal to effectively leverage these products for ongoing financial gains. For instance, in 2024, Donegal Group reported a solid performance in its commercial lines, with multi-peril products being a key contributor to its premium volume, reflecting the sustained demand and profitability of these long-standing offerings.

Mature Midwestern Regional Operations

Donegal Group's mature Midwestern regional operations function as classic cash cows within its business portfolio. These established markets, notably in states like Pennsylvania and Ohio, are characterized by a high market share and a deeply entrenched customer base, leading to consistent premium generation and profitability. The strategic imperative for these segments is operational efficiency and the optimization of existing resources to maximize cash flow, rather than aggressive expansion.

For example, in 2024, Donegal Group reported that its core insurance segments, heavily weighted towards these mature regions, continued to demonstrate stable underwriting results. While specific regional breakdown isn't always publicly detailed, the company's overall performance indicates these operations are the primary contributors to its financial stability.

- High Market Share: Donegal Group maintains a leading position in several Midwestern states, benefiting from brand recognition and long-term customer relationships.

- Steady Premium Growth: These mature markets provide a predictable stream of insurance premiums, contributing significantly to the company's revenue.

- Profitability Focus: The emphasis is on cost management and operational streamlining to ensure these segments remain highly profitable.

- Cash Flow Generation: These cash cows are crucial for funding investments in other areas of the business, such as potential growth opportunities or new product development.

Investment Portfolio Income

Donegal Group's investment portfolio functions as a significant cash cow, contributing substantially to its overall profitability through consistent net investment income. This income stream, primarily derived from well-managed fixed-income holdings, provides essential capital that underpins the company's core underwriting operations and fuels strategic growth initiatives.

For instance, during the first quarter of 2024, Donegal Group reported net investment income of $53.3 million. This robust performance highlights the portfolio's strength as a reliable generator of funds.

The stability of this income is particularly valuable, offering a counterbalance to the inherent cyclicality of the insurance underwriting business. This financial bedrock allows Donegal Group to pursue opportunities and weather market fluctuations with greater resilience.

- Net Investment Income Contribution: The portfolio consistently generates substantial net investment income, a key profit driver for Donegal Group.

- Fixed-Income Strength: High-quality fixed-income securities form the backbone of this income generation, providing stability.

- Capital for Growth: The income generated supports underwriting activities and funds other strategic investments.

- Q1 2024 Performance: Net investment income reached $53.3 million in the first quarter of 2024, demonstrating its ongoing importance.

Donegal Group's established personal auto insurance segment is a prime example of a cash cow. This business benefits from a large, loyal customer base and a strategic focus on profitability rather than aggressive expansion. In 2024, rate adequacy and underwriting discipline in this area ensure a steady and predictable cash flow, vital for supporting other company initiatives.

The homeowners insurance portfolio also operates as a cash cow, leveraging a substantial market share in a mature sector. By prioritizing profitability through careful risk selection and necessary rate adjustments, Donegal Group ensures this segment consistently generates strong profits and healthy cash flow. This stability means minimal investment is needed for marketing, allowing the segment to be a reliable financial contributor.

Donegal Group's core commercial multi-peril policies, particularly those serving stable, established businesses, are significant cash cows. These offerings benefit from the company's strong market presence and long-standing agent relationships in mature commercial insurance markets. The consistent premium income, coupled with reduced acquisition costs, makes these products effective generators of ongoing financial gains, as evidenced by their solid contribution to premium volume in 2024.

Mature Midwestern regional operations, especially in states like Pennsylvania and Ohio, function as Donegal Group's cash cows. These areas boast high market share and deeply entrenched customer bases, leading to consistent premium generation and profitability. The strategy here is efficiency and resource optimization to maximize cash flow, rather than growth, with these core segments demonstrating stable underwriting results in 2024.

Donegal Group's investment portfolio is a crucial cash cow, generating substantial net investment income. This income, primarily from well-managed fixed-income assets, provides essential capital for underwriting operations and strategic growth. In Q1 2024, net investment income reached $53.3 million, underscoring its role as a stable counterpoint to underwriting cycles.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

| Personal Auto Insurance | Cash Cow | Large customer base, focus on profitability, steady cash flow | Contributes significantly to financial stability through rate adequacy |

| Homeowners Insurance | Cash Cow | Substantial market share, mature market, minimal marketing investment | Reliable generator of profits and cash flow, stable premium increases |

| Commercial Multi-Peril (Stable Businesses) | Cash Cow | Strong market presence, long-term agent relationships, consistent premium income | Key contributor to premium volume, reflecting sustained demand and profitability |

| Midwestern Regional Operations | Cash Cow | High market share, entrenched customer base, focus on efficiency | Demonstrate stable underwriting results, primary contributors to financial stability |

| Investment Portfolio | Cash Cow | Generates net investment income, strong fixed-income holdings | Q1 2024 net investment income of $53.3 million, funds growth initiatives |

What You See Is What You Get

Donegal Group BCG Matrix

The Donegal Group BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This comprehensive analysis, meticulously prepared, contains no watermarks or placeholder content, offering you a ready-to-use strategic tool. You can confidently expect the same high-quality, professionally formatted BCG Matrix report to be delivered directly to you, enabling immediate application in your business planning and decision-making processes.

Dogs

Donegal Group's legacy Maryland personal lines business is a clear example of a Dog in the BCG Matrix. The company has strategically chosen to non-renew these policies, signaling a segment with both low market share and limited growth potential. This decision is driven by unprofitability, making it inefficient to retain and service these policies.

Donegal Group has strategically reduced its presence in specific states and business segments within its commercial insurance offerings. These moves indicate a focus on shedding underperforming assets, often referred to as ‘dogs’ in a BCG matrix context, where investment yields are minimal.

The company’s decision to exit commercial policies in Georgia and Alabama during 2024 is a clear example of this strategy. These markets likely represent areas where Donegal faced challenges in capturing substantial market share or achieving desired profitability, prompting a reallocation of resources.

Highly Competitive Niche Products represent areas where Donegal Group struggles to stand out. Think of specialized insurance lines where competitors offer better pricing or superior customer service, leaving Donegal with a small piece of a market that isn't growing much. In 2024, for example, the overall specialty insurance market saw modest growth, but Donegal's specific niche products within this segment likely experienced even slower expansion, potentially holding less than a 1% market share in some instances.

These products often demand significant resources for upkeep without yielding substantial returns, acting more as a drain than a profit center. The effort needed to simply maintain their existence, let alone grow them, is disproportionate to the financial rewards. This situation makes them prime candidates for careful review, potentially leading to strategic decisions like selling them off or undertaking a complete overhaul to find a competitive edge.

Outdated Technology-Dependent Offerings

Outdated technology-dependent offerings within Donegal Group's portfolio can be categorized as Dogs. These are products or services that rely on older, less efficient operational systems. The cost to serve or underwrite these offerings may be excessively high when weighed against their current market share or growth potential.

While Donegal Group is actively engaged in modernizing its technological infrastructure, any specific product lines not yet fully integrated or optimized represent a drag on overall efficiency. For example, if a legacy system supporting a particular insurance product requires manual workarounds or extensive IT support, it directly impacts profitability.

Donegal Group is implementing targeted expense reduction strategies, which would likely include evaluating and potentially phasing out or overhauling these older, technology-dependent offerings. This aligns with a broader industry trend of leveraging advanced analytics and digital platforms to improve underwriting accuracy and customer service.

- High Cost to Serve: Products reliant on legacy systems often incur higher operational costs due to manual processes and outdated infrastructure.

- Low Market Share/Growth: These offerings typically exhibit limited market penetration and minimal potential for future expansion, characteristic of Dog-category assets.

- Efficiency Drag: Unoptimized technology hinders operational efficiency, impacting profitability and resource allocation.

- Strategic Overhaul: Donegal Group's expense reduction efforts signal a strategic review of such offerings, prioritizing modernization or divestment.

Segments with High Catastrophe Exposure and Low Market Share

Segments with high catastrophe exposure and low market share represent potential 'dogs' in Donegal Group's portfolio. These are areas where the company faces significant weather-related losses but doesn't command enough market presence to spread those risks effectively. For instance, if Donegal has a small footprint in a state frequently hit by hurricanes or severe convective storms, substantial claims could disproportionately impact profitability in that specific segment.

The company's strategic focus on diversifying its geographic footprint and enhancing underwriting decision-making directly addresses these vulnerabilities. By spreading risk across more regions and improving how it assesses potential losses, Donegal aims to mitigate the impact of concentrated, high-severity events.

- High Catastrophe Exposure: Segments in regions prone to significant weather events like hurricanes, tornadoes, or wildfires.

- Low Market Share: Donegal's limited penetration in these exposed geographic areas or product lines.

- Unprofitable Operations: Sustained high loss ratios in these segments without sufficient premium volume to offset them.

- Strategic Mitigation: Company efforts to diversify and improve underwriting are designed to address these 'dog' segments.

Donegal Group's "Dogs" represent business segments with low market share and minimal growth potential, often characterized by unprofitability or high operational costs. The company's strategic decisions, such as exiting certain states or non-renewing policies, directly address these underperforming assets. For example, the non-renewal of Maryland personal lines business in 2024 highlights a segment where Donegal faced challenges in profitability and growth, leading to resource reallocation. Similarly, the exit from commercial policies in Georgia and Alabama during 2024 underscores a move to shed assets with limited investment yields.

These "dog" categories often include niche products struggling against better-positioned competitors or offerings reliant on outdated technology, leading to high costs to serve. For instance, specialty insurance niche products in 2024 likely experienced slower expansion than the overall market, potentially holding less than a 1% share in some instances. Furthermore, legacy system-dependent offerings can create an efficiency drag, impacting profitability and requiring significant resources for upkeep without substantial returns.

Segments with high catastrophe exposure and low market share also fall into the "dog" category. These areas, prone to significant weather-related losses, do not provide enough market presence for Donegal to effectively spread those risks. The company's strategic focus on geographic diversification and enhanced underwriting aims to mitigate the impact of such concentrated, high-severity events, effectively addressing these less profitable segments.

| Segment Example | BCG Category | Reasoning | 2024 Data Point/Observation |

|---|---|---|---|

| Maryland Personal Lines | Dog | Low market share, limited growth, unprofitability | Non-renewed policies, signaling exit |

| Commercial Policies (GA/AL) | Dog | Low market share, minimal growth, unprofitability | Exit from these markets in 2024 |

| Specific Niche Specialty Products | Dog | Low market share, slow growth, high cost to serve | Market share potentially <1% in some niche areas within a modest overall specialty market growth |

| Legacy Technology-Dependent Offerings | Dog | High cost to serve, efficiency drag, low market share/growth | Requires manual workarounds or extensive IT support, impacting profitability |

| High Catastrophe Exposure (Low Share) | Dog | High loss ratios, insufficient premium volume | Concentrated risk in areas frequently hit by storms without broad market presence |

Question Marks

Emerging cyber insurance offerings represent a high-growth area for Donegal Group. Given the escalating frequency and sophistication of cyberattacks, the demand for specialized cyber insurance is surging, creating a market ripe for expansion. As a relatively new entrant in this dynamic space, Donegal Group likely holds a low initial market share, positioning these offerings as Question Marks within the BCG Matrix.

Significant strategic investment is paramount for Donegal Group to cultivate its cyber insurance products. This includes bolstering underwriting capabilities, enhancing cybersecurity expertise, and implementing robust market penetration strategies. The goal is to transition these nascent offerings into Stars, signifying strong market growth and a growing competitive position.

Donegal Group's commitment to modernizing its product portfolio directly addresses the evolving needs of the cyber insurance market. This forward-looking approach is essential for capturing market share and developing a competitive edge in an industry characterized by rapid technological advancement and increasing threat landscapes.

Donegal Group, already established in 21 states, is strategically eyeing expansion into new, high-growth geographic regions. These potential markets, characterized by burgeoning economies and insurance demand, represent opportunities for significant future revenue. For instance, states like Texas and Florida, with their rapidly expanding populations and business activities, could be prime targets for such an initiative.

Entering these new territories would position Donegal Group in a "Question Mark" phase of its BCG Matrix. This means these markets offer high growth potential, but Donegal would likely begin with a very low market share. Significant investment would be necessary to build agent networks and establish brand recognition, akin to how many insurtech startups approach new markets.

The company’s recent filings indicate an ongoing pursuit of new business opportunities across its existing regional footprint, a clear signal of its proactive growth strategy. This groundwork is crucial for any future geographic expansion, ensuring a solid operational base. For example, Donegal reported a 5.1% increase in total revenues in the first quarter of 2024 compared to the prior year, demonstrating a general upward trajectory that supports expansion efforts.

Digital-first insurance products represent a strategic pivot for Donegal Group, aiming to capture a growing segment of digitally native consumers. These offerings, characterized by intuitive online interfaces for quoting and policy management, are positioned to address evolving customer preferences for convenience and speed. However, their current market share is nascent, necessitating substantial investment in digital marketing and customer acquisition to build brand awareness and drive adoption.

The success of these digital initiatives hinges on Donegal Group's ability to effectively leverage advanced analytics. By understanding customer behavior and market trends through data, the company aims to accelerate the growth of these new business lines. For instance, in 2024, the insurance industry saw a significant uptick in digital policy purchases, with many providers reporting double-digit growth in online channels, underscoring the potential if Donegal can effectively penetrate this space.

Advanced Analytics-Driven Risk Solutions

Donegal Group is actively integrating advanced analytics into its underwriting processes. This move aims to refine decision-making and potentially identify new market opportunities.

The company is exploring the development of novel insurance solutions and pricing models leveraging sophisticated data analytics. This strategic direction aligns with the burgeoning trend of data-driven insurance products.

However, these initiatives represent a question mark within the BCG framework. While the data-driven insurance sector is experiencing rapid growth, the market adoption and eventual market share for Donegal's new offerings are uncertain.

Significant upfront investment in technology infrastructure and specialized talent will be necessary to support these analytics-driven endeavors. For instance, in 2024, the global insurtech market was valued at over $100 billion, highlighting the scale of investment in this area.

- Analytics Integration: Donegal is operationalizing analytical tools to enhance underwriting decision-making.

- New Product Development: Developing new insurance solutions or pricing models based on advanced data analytics is a key focus.

- Market Uncertainty: These products tap into a high-growth area of data-driven insurance, but their market adoption and share would initially be low.

- Investment Requirements: Significant investment in technology and talent is required for success in this segment.

Middle Market Commercial Segment Penetration

Donegal Group's middle market commercial segment is likely a question mark within its BCG Matrix. While the company generally shows strength in its commercial lines, its specific focus on expanding in the middle market indicates a strategic push. This segment presents greater growth potential than the small commercial market, where Donegal may already have a more entrenched position.

The company's efforts to penetrate the middle market suggest it may hold a less dominant market share here compared to its established small commercial business. To effectively compete with larger, more established players in this higher-growth segment, Donegal will need to allocate focused investment and resources. This strategic allocation is key to capturing a larger portion of the middle market opportunity.

- Growth Potential: The middle market segment offers higher growth prospects compared to the small commercial segment.

- Market Share: Donegal's market share in the middle market may be lower relative to its established small commercial base.

- Investment Needs: Focused investment is required to compete effectively with larger players in this segment.

- Strategic Focus: Active pursuit of middle market growth suggests a strategic objective for Donegal Group.

Donegal Group's emerging digital-first insurance products represent a strategic move into a high-growth area. These offerings, designed for digitally savvy consumers, are currently in a nascent stage with a low market share. This positions them as Question Marks within the BCG Matrix, requiring significant investment to gain traction.

The success of these digital initiatives will depend on Donegal's ability to leverage data analytics effectively, a trend that saw significant growth in the insurance sector during 2024. For instance, many providers reported double-digit growth in online policy purchases that year, highlighting the market's potential for digitally distributed products.

To capitalize on this opportunity, Donegal must invest heavily in digital marketing and customer acquisition strategies. This focus is crucial for building brand awareness and driving adoption in a competitive landscape. The company's reported 5.1% increase in total revenues in Q1 2024 provides a financial foundation to support these expansion efforts.

| BCG Category | Donegal Group Offering | Market Attractiveness | Current Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Emerging Digital-First Insurance Products | High (growing digital consumer base) | Low (nascent stage) | Requires significant investment in marketing and customer acquisition to build share. |

| Question Mark | Expansion into New Geographic Markets | High (growing economies, insurance demand) | Low (new entrant) | Needs focused investment in infrastructure and brand building to establish presence. |

| Question Mark | Data-Driven Insurance Solutions | High (insurtech market growth over $100 billion in 2024) | Low (new development) | Demands substantial upfront investment in technology and specialized talent. |

BCG Matrix Data Sources

Our Donegal Group BCG Matrix is built on robust financial data from company filings, comprehensive industry research, and market trend analysis to provide accurate strategic insights.