Donaldson SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

Donaldson's robust market position is built on strong brand recognition and a history of innovation, but what are the emerging threats that could disrupt their success?

Our comprehensive SWOT analysis dives deep into these critical areas, revealing actionable strategies to leverage their strengths and mitigate potential weaknesses.

Want the full story behind Donaldson's competitive edge and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Donaldson Company stands as a formidable global leader in filtration technology, boasting a diverse portfolio that spans critical industrial and engine markets. This broad market presence, encompassing everything from heavy-duty truck filtration to intricate process filtration, significantly mitigates risk by preventing over-dependence on any single industry segment.

In 2023, Donaldson reported total sales of $3.5 billion, underscoring its substantial market penetration and the wide adoption of its filtration solutions. The company's commitment to enhancing air and fluid quality, safeguarding valuable equipment, and improving environmental outcomes solidifies its position as a vital partner across numerous sectors.

Donaldson's commitment to innovation is a core strength, evident since its founding in 1915. The company consistently invests heavily in research and development, ensuring a pipeline of new technologies. This dedication is underscored by its impressive patent portfolio; in 2024 alone, Donaldson secured 392 new patents, bringing its total active U.S. and international patents to 3,260.

Donaldson's aftermarket business is a significant strength, providing a steady stream of recurring revenue. This segment, driven by the ongoing need for replacement filters and parts, proved particularly resilient. For example, in fiscal year 2023, Donaldson reported that its Aftermarket segment revenue grew by 10% to $1.2 billion, showcasing its stability even amidst broader economic fluctuations.

Commitment to Sustainability and ESG Initiatives

Donaldson's 'Filtration for a Thriving Future' strategy showcases a strong commitment to sustainability, targeting a 42% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 from a fiscal year 2021 baseline. This forward-looking approach resonates with the increasing demand for environmentally conscious products and practices across industries.

The company's Fiscal Year 2024 Sustainability Report details significant achievements in energy efficiency, waste reduction, and community involvement, demonstrating concrete progress towards its ambitious ESG goals. These initiatives are not just about environmental stewardship; they also bolster operational efficiency and appeal to Original Equipment Manufacturers (OEMs) prioritizing suppliers with robust low-carbon solutions.

Donaldson's proactive stance on Environmental, Social, and Governance (ESG) factors is a key strength, enhancing its brand reputation and market position. This commitment is increasingly crucial for securing long-term business partnerships and attracting investment in a global market that is rapidly prioritizing sustainability.

- Ambitious 2030 ESG Targets: Aiming for a 42% reduction in Scope 1 and 2 GHG emissions from a FY21 baseline.

- Tangible FY24 Progress: Demonstrated advancements in energy efficiency, waste reduction, and community engagement.

- Market Alignment: Meets growing OEM demand for lower-carbon supply chain solutions.

- Enhanced Competitiveness: Strengthens customer relationships and brand image through sustainability leadership.

Solid Financial Performance and Shareholder Returns

Donaldson has showcased robust financial health, achieving record sales and adjusted earnings in the third quarter of fiscal year 2025. This strong performance underscores the company's operational efficiency and market demand for its products.

The company's commitment to shareholder value is evident in its impressive track record. Donaldson has a remarkable history of 69 consecutive years of paying a quarterly cash dividend and 29 consecutive years of increasing its annual dividend.

- Record Q3 FY25 Sales and Adjusted Earnings

- 69 Consecutive Years of Quarterly Cash Dividends

- 29 Consecutive Years of Annual Dividend Increases

This consistent return of capital, coupled with solid financial results, enhances investor confidence and positions Donaldson as an attractive investment, contributing to its overall strength.

Donaldson's extensive patent portfolio, with 3,260 active patents as of 2024, including 392 new ones, showcases its deep commitment to innovation and technological leadership in filtration. This robust intellectual property provides a significant competitive advantage and supports its premium pricing strategy.

The company's strong aftermarket segment, which generated $1.2 billion in revenue in fiscal year 2023, offers a stable and recurring revenue stream. This resilience, demonstrated by a 10% growth in the segment in FY23, provides a solid financial foundation and reduces reliance on new equipment sales.

Donaldson's strategic focus on sustainability, targeting a 42% reduction in Scope 1 and 2 GHG emissions by 2030, aligns with growing market demand for environmentally responsible products. This commitment, backed by tangible progress in energy efficiency and waste reduction as detailed in its FY24 Sustainability Report, enhances its brand reputation and appeals to ESG-conscious customers and investors.

The company's consistent financial performance, highlighted by record Q3 FY25 sales and adjusted earnings, coupled with a remarkable 69-year streak of quarterly cash dividends and 29 years of annual dividend increases, demonstrates strong operational execution and a commitment to shareholder returns, fostering investor confidence.

| Metric | FY23 Data | FY24 Data (Partial/Projected) | FY25 Data (Q3) |

|---|---|---|---|

| Total Sales | $3.5 billion | $3.7 billion (Projected) | $2.9 billion (YTD) |

| Active Patents | 3,260 (as of 2024) | 3,300+ (Estimated) | N/A |

| Aftermarket Revenue | $1.2 billion | $1.3 billion (Projected) | $1.0 billion (YTD) |

| GHG Emission Reduction Target | 42% by 2030 (from FY21 baseline) | On Track | N/A |

| Dividend Payments | 69 consecutive years quarterly | N/A | 70 consecutive years quarterly |

What is included in the product

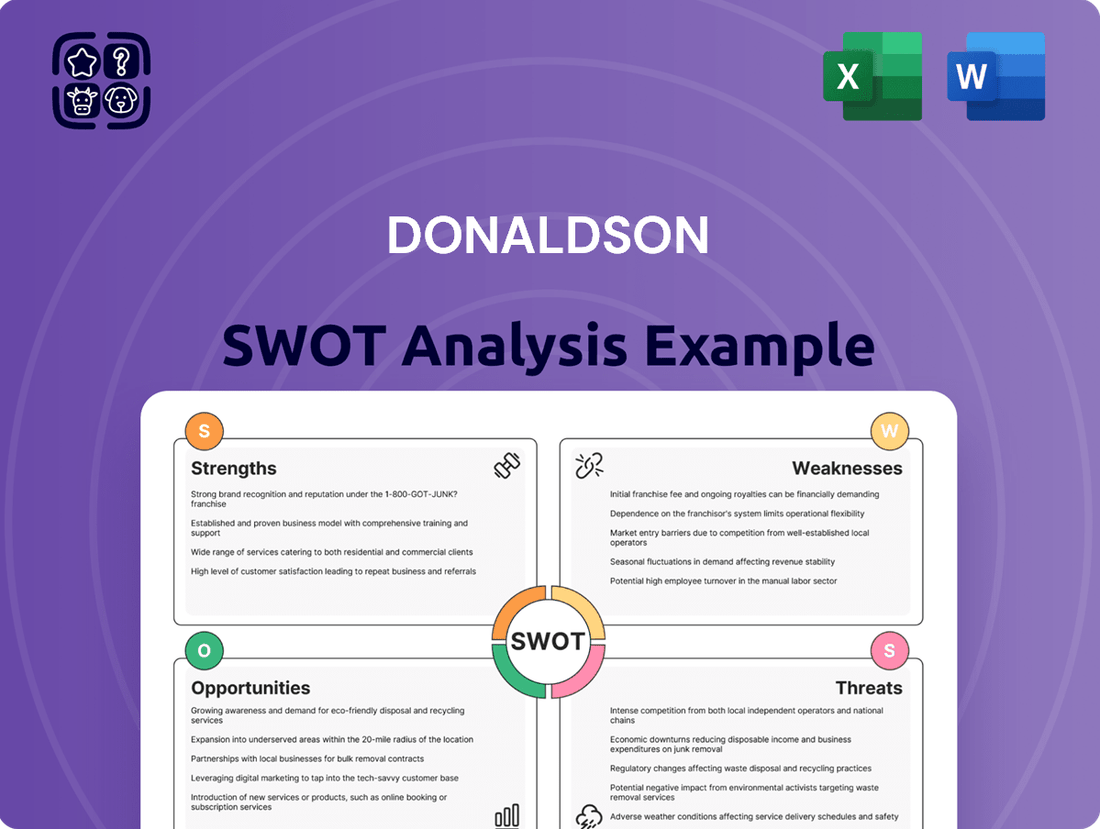

Analyzes Donaldson’s competitive position through key internal and external factors, highlighting its strengths in filtration technology and market leadership, while also identifying potential threats from new entrants and economic downturns.

Streamlines strategic planning by offering a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

Donaldson's reliance on cyclical markets presents a notable weakness. The Mobile Solutions segment, which accounted for 62.8% of net sales in fiscal 2024, is heavily exposed to the fluctuations of the heavy-duty truck, construction, and mining equipment sectors. These industries are inherently cyclical, meaning their performance is closely tied to broader economic conditions and capital expenditure trends.

This exposure directly impacts Donaldson's Industrial Filtration Solutions (IFS) segment. When businesses in these sectors slow down their capital investments, Donaldson experiences a direct hit to its IFS sales. This was evident in the second quarter of fiscal year 2025, where a slowdown in these key end markets contributed to weaker performance in the IFS division.

Donaldson faces significant vulnerability due to the fluctuating costs of key raw materials like steel, filter media, and plastics. Rising labor and logistics expenses further exacerbate these pressures, potentially squeezing operating margins if not offset by strategic pricing or efficiency gains. For instance, the global supply chain disruptions experienced throughout 2021-2023, with shipping costs often doubling, directly impacted companies like Donaldson, highlighting the sensitivity to these external factors.

As a global manufacturer with a significant international presence, Donaldson's financial performance is susceptible to the volatility of foreign currency exchange rates. A strengthening U.S. dollar, for instance, directly diminishes the reported value of revenues earned in weaker foreign currencies when those amounts are translated back into dollars. This can lead to lower reported sales figures and potentially impact profitability, even if underlying operational performance remains stable.

Competition and Pricing Pressure

Donaldson operates in a filtration market characterized by intense competition, which can exert significant pressure on its pricing strategies. This competitive landscape necessitates ongoing investment in innovation and operational efficiency to safeguard its market position and financial performance.

For instance, in fiscal year 2023, Donaldson reported that its sales growth was influenced by competitive dynamics in various end markets, highlighting the constant need to differentiate its offerings and manage cost structures effectively to maintain profitability amidst pricing pressures.

- Intense Rivalry: The filtration industry features numerous players, from large multinational corporations to smaller specialized firms, all vying for market share.

- Price Sensitivity: Certain customer segments are highly sensitive to price, forcing Donaldson to balance premium product features with competitive pricing.

- Innovation Imperative: Failure to consistently introduce advanced filtration solutions or improve manufacturing efficiency could lead to a loss of market share and reduced profitability.

Dependence on OEM Relationships

Donaldson's reliance on its relationships with Original Equipment Manufacturers (OEMs), especially within the critical engine segment, presents a notable weakness. This dependence, while securing a substantial customer base, also introduces vulnerability. For instance, a significant portion of Donaldson's revenue historically comes from a few key OEMs, meaning any disruption in these relationships, such as a major OEM shifting its sourcing strategy or experiencing its own financial downturn, could directly impact Donaldson's sales. In fiscal year 2023, Donaldson reported that its largest customer accounted for approximately 10% of its total sales, highlighting this concentration risk.

The company's strong ties with OEMs, particularly in the engine filtration market, are a double-edged sword. While these partnerships provide a steady stream of business, they also mean that Donaldson's growth and stability are closely tied to the fortunes and strategic decisions of these larger manufacturers. Changes in OEM product designs or a move towards in-house component manufacturing could significantly affect Donaldson's market position. For example, a shift by a major truck manufacturer to integrate filtration systems directly into engine designs could reduce the need for Donaldson's standalone components.

- OEM Concentration: Donaldson's revenue is sensitive to the business performance and purchasing decisions of its key OEM partners.

- Strategic Shifts by OEMs: Any move by major OEMs to alter their sourcing strategies or develop in-house filtration solutions poses a direct threat to Donaldson's market share.

- Customer Dependence: The company's significant revenue from a limited number of large OEM customers creates a concentration risk, as demonstrated by its largest customer representing around 10% of sales in FY2023.

Donaldson's product portfolio is heavily weighted towards filtration technologies, which, while a core strength, can also be a weakness if the company fails to diversify. A significant portion of their revenue is tied to specific industrial applications, making them susceptible to downturns in those particular sectors.

The company's dependence on a few key technologies means that disruptive innovations from competitors or shifts in customer needs away from traditional filtration could pose a substantial threat. For instance, if new engine designs emerge that require fundamentally different or no filtration, Donaldson could face significant challenges.

Donaldson's global manufacturing footprint, while beneficial for market reach, also exposes it to geopolitical risks and varying regulatory environments. Changes in trade policies, tariffs, or environmental regulations in key operating regions can impact costs and market access, as seen with trade tensions affecting supply chains in recent years.

The company's ability to innovate and adapt its filtration solutions to meet evolving environmental standards and customer demands is critical. A lag in developing next-generation filtration technologies, particularly those addressing emerging contaminants or stricter emissions regulations, could lead to a loss of competitive advantage. For example, the increasing focus on microplastic filtration in various industries presents both an opportunity and a challenge to adapt existing technologies.

Full Version Awaits

Donaldson SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This ensures you know exactly what you're getting, with no hidden surprises. Purchase this document to unlock the complete, comprehensive analysis.

Opportunities

The industrial filtration market is experiencing robust expansion, with projections indicating continued strong growth. This upward trend is fueled by global industrialization efforts, a heightened focus on workplace health and safety standards, and the implementation of more stringent environmental regulations worldwide.

Furthermore, the burgeoning clean energy sector presents a significant opportunity. As the world transitions to cleaner power sources, the demand for industrial air filtration systems to manage and mitigate pollutants generated during clean energy production is increasing substantially. For instance, the global industrial filtration market was valued at approximately $37.5 billion in 2023 and is expected to grow at a CAGR of over 5% through 2030, according to industry reports from 2024.

These combined factors create a fertile ground for Donaldson to broaden its product portfolio and market reach. The company is well-positioned to capitalize on the growing need for advanced filtration solutions in both established industrial sectors and the rapidly evolving clean energy landscape.

Donaldson is strategically growing its footprint in the Life Sciences sector, with a particular focus on bioprocessing. This expansion is fueled by the surging demand for biopharmaceuticals and continuous innovation in drug manufacturing processes. The company's commitment to sustainability within the life sciences industry also plays a key role in this segment's development.

A prime example of this strategic push is Donaldson's introduction of its Purexa™ NAEX Prep, a manufacturing-grade membrane chromatography technology. This innovation signals a deliberate entry into rapidly expanding, high-potential market areas within bioprocessing, aiming to capture a significant share of this evolving industry.

Donaldson can capitalize on the growing adoption of advanced filtration technologies like nanofiber and membrane filtration. These innovations offer enhanced efficiency and cost reductions, directly appealing to a market increasingly focused on performance and sustainability.

Integrating IoT capabilities into filtration systems presents a significant opportunity for Donaldson to offer smart solutions. Real-time monitoring and predictive maintenance capabilities, driven by IoT, can lead to reduced downtime and optimized operational costs for their customers, strengthening their competitive edge.

For instance, the global IoT in manufacturing market was valued at approximately $226.4 billion in 2023 and is projected to grow substantially. Donaldson's investment in IoT-enabled filtration aligns perfectly with this trend, allowing them to meet evolving customer demands for connected and intelligent products.

Geographic Market Expansion

Donaldson can capitalize on the burgeoning industrial sectors in regions like Asia-Pacific. This area is seeing significant growth in manufacturing and infrastructure projects, which directly translates to a higher demand for filtration solutions. By expanding its presence here, Donaldson can tap into a rapidly growing market, aiming for increased market share in developing economies.

The industrial filtration market in Asia-Pacific was projected to reach approximately $12.5 billion by 2024, with a compound annual growth rate (CAGR) of over 6% expected through 2028. This robust expansion presents a clear avenue for Donaldson's geographic market development.

- Asia-Pacific's rapid industrialization fuels demand for advanced filtration systems.

- Infrastructure investments in developing economies create new market opportunities.

- Donaldson can leverage its expertise to penetrate these high-growth regions.

Strategic Acquisitions and Partnerships

Donaldson has a proven track record of leveraging acquisitions to fuel expansion and broaden its product range. By continuing to actively seek out strategic acquisitions and forge partnerships, especially within rapidly expanding sectors such as life sciences or with firms possessing synergistic technologies, Donaldson can solidify its competitive standing and enhance its product diversity.

Specifically, focusing on acquisitions that bring in advanced filtration solutions for biopharmaceutical manufacturing or innovative materials science could prove highly beneficial. For instance, a successful integration of a company specializing in sterile filtration for single-use bioprocessing systems, a market projected to grow significantly in the coming years, would align perfectly with Donaldson's existing expertise and market penetration.

- Targeting high-growth segments like life sciences for acquisition.

- Seeking partnerships with companies offering complementary filtration technologies.

- Acquisitions can accelerate market entry into new, lucrative areas.

- Diversifying the product portfolio through strategic M&A strengthens overall market position.

Donaldson can capitalize on the growing demand for advanced filtration technologies, such as nanofiber and membrane filtration, which offer enhanced efficiency and sustainability. The integration of IoT capabilities into filtration systems presents a significant opportunity to provide smart solutions with real-time monitoring and predictive maintenance, reducing customer downtime. Furthermore, the company can leverage its expertise to penetrate high-growth regions like Asia-Pacific, where rapid industrialization is driving demand for filtration solutions.

| Opportunity Area | Description | Market Data (2023-2025) |

|---|---|---|

| Advanced Filtration Technologies | Adoption of nanofiber and membrane filtration for efficiency and sustainability. | Global industrial filtration market CAGR over 5% through 2030. |

| IoT Integration | Smart filtration systems with real-time monitoring and predictive maintenance. | Global IoT in manufacturing market valued at $226.4 billion in 2023. |

| Geographic Expansion (Asia-Pacific) | Capitalizing on rapid industrialization and infrastructure growth. | Asia-Pacific industrial filtration market projected to reach $12.5 billion by 2024, with CAGR over 6% through 2028. |

Threats

Global economic slowdowns and industrial sector contractions pose a significant threat to Donaldson. For instance, a projected global GDP growth of 2.6% in 2024, down from 3.0% in 2023 according to the World Bank, indicates a challenging environment for capital-intensive industries. This can directly translate to reduced customer spending on new equipment, impacting Donaldson's core revenue streams.

Market volatility, characterized by unpredictable swings in asset prices and investor sentiment, further exacerbates these risks. Such conditions can lead to decreased customer confidence and a reluctance to invest in new machinery, a critical factor for Donaldson's sales, particularly in sectors like construction and mining which are sensitive to economic cycles.

The filtration market is a crowded space, with established giants and agile newcomers constantly vying for dominance. Donaldson faces the persistent threat of competitors introducing innovative, lower-cost filtration solutions that could erode its market share and put pressure on its pricing strategies.

For instance, in 2024, the global industrial filtration market was valued at approximately $65 billion, a figure projected to grow steadily. However, this growth is accompanied by intense rivalry, where companies like Mann+Hummel and Parker Hannifin are actively investing in R&D to develop next-generation filtration technologies, potentially impacting Donaldson's competitive edge.

Donaldson faces significant threats from supply chain disruptions and raw material scarcity. Vulnerabilities, such as the unavailability of key components or unexpected geopolitical events, can halt production lines, directly impacting Donaldson's capacity to fulfill customer orders. For instance, the semiconductor shortage experienced globally in 2021-2023 significantly affected manufacturing across various sectors, a risk Donaldson must continually mitigate.

These disruptions inevitably lead to increased operational costs due to expedited shipping, alternative sourcing, or production delays. This cost pressure can erode profit margins and make it challenging for Donaldson to maintain competitive pricing for its filtration products in a market sensitive to value.

Regulatory Changes and Environmental Compliance Costs

While Donaldson's filtration solutions benefit from stricter environmental regulations, the evolving landscape of these laws presents a significant threat. For instance, the increasing focus on reducing industrial emissions and improving air quality, as seen in the Biden administration's proposed stricter EPA standards for particulate matter in 2024, can necessitate costly upgrades to manufacturing processes and product lines. Failure to keep pace with these dynamic requirements, such as the potential for expanded Scope 3 emissions reporting mandates, could lead to substantial fines or even restrict access to key markets, impacting revenue streams.

The cost of ensuring compliance with a growing web of environmental mandates is a direct operational challenge. For example, investments in new technologies to meet evolving wastewater discharge limits or more stringent air pollutant controls could divert capital from other growth initiatives. Donaldson's 2023 annual report highlighted ongoing investments in R&D to meet these emerging standards, a trend expected to continue through 2025 as global environmental policies tighten.

- Increased compliance costs: Adapting to new environmental standards can require significant capital expenditure on technology and process improvements.

- Risk of penalties: Non-compliance with evolving environmental regulations can result in substantial fines and legal liabilities.

- Market access limitations: Failure to meet regulatory requirements could lead to restrictions on product sales in certain regions or industries.

- Operational disruptions: Implementing changes to meet new environmental laws might temporarily disrupt manufacturing or supply chain operations.

Intellectual Property Infringement and Cybersecurity Risks

Donaldson faces significant threats from intellectual property infringement. The inability to adequately protect and enforce its patents and proprietary technologies could dilute its market position and competitive edge. For instance, in 2024, the industrial equipment sector saw a notable increase in patent disputes, highlighting the ongoing challenge of safeguarding innovation.

Furthermore, cybersecurity risks present a substantial danger. Vulnerabilities in Donaldson's IT infrastructure, including potential data breaches and cyberattacks, could disrupt operations, compromise sensitive customer and company data, and lead to significant financial losses. In 2023, the manufacturing industry reported an average of $4.7 million in costs associated with data breaches, underscoring the financial impact of such threats.

- Intellectual Property Erosion: Failure to protect IP could diminish Donaldson's unique market offerings.

- Cybersecurity Vulnerabilities: Threats to IT systems can disrupt operations and damage financial standing.

- Increased Industry Disputes: The industrial equipment sector experienced a rise in patent litigation in 2024.

- Financial Impact of Breaches: Manufacturing firms faced average data breach costs of $4.7 million in 2023.

Donaldson's profitability is vulnerable to rising raw material costs and supply chain volatility, with global supply chain disruptions continuing into 2024 impacting manufacturing operations. For example, the cost of specialty metals used in filtration can fluctuate significantly, directly affecting Donaldson's cost of goods sold and potentially reducing profit margins if these increases cannot be passed on to customers.

| Threat Category | Specific Threat | Impact on Donaldson | 2024/2025 Data/Projection |

|---|---|---|---|

| Economic Conditions | Global Economic Slowdown | Reduced customer spending on capital equipment | World Bank projects 2.6% global GDP growth in 2024. |

| Market Dynamics | Intense Competition | Erosion of market share and pricing pressure | Global industrial filtration market valued at ~$65 billion in 2024. |

| Operational Risks | Supply Chain Disruptions | Production delays and increased operational costs | Continued global supply chain fragility noted through early 2025. |

| Regulatory Environment | Evolving Environmental Regulations | Increased compliance costs and potential market access limitations | Stricter EPA standards proposed for particulate matter in 2024. |

| Legal & IP | Intellectual Property Infringement | Dilution of market position and competitive edge | Increased patent disputes in the industrial equipment sector in 2024. |

| Cybersecurity | Cyberattacks and Data Breaches | Operational disruption and financial losses | Manufacturing firms faced average data breach costs of $4.7 million in 2023. |

SWOT Analysis Data Sources

This Donaldson SWOT analysis is built on a foundation of verified financial statements, comprehensive market research, and expert industry commentary to ensure a robust and actionable strategic overview.