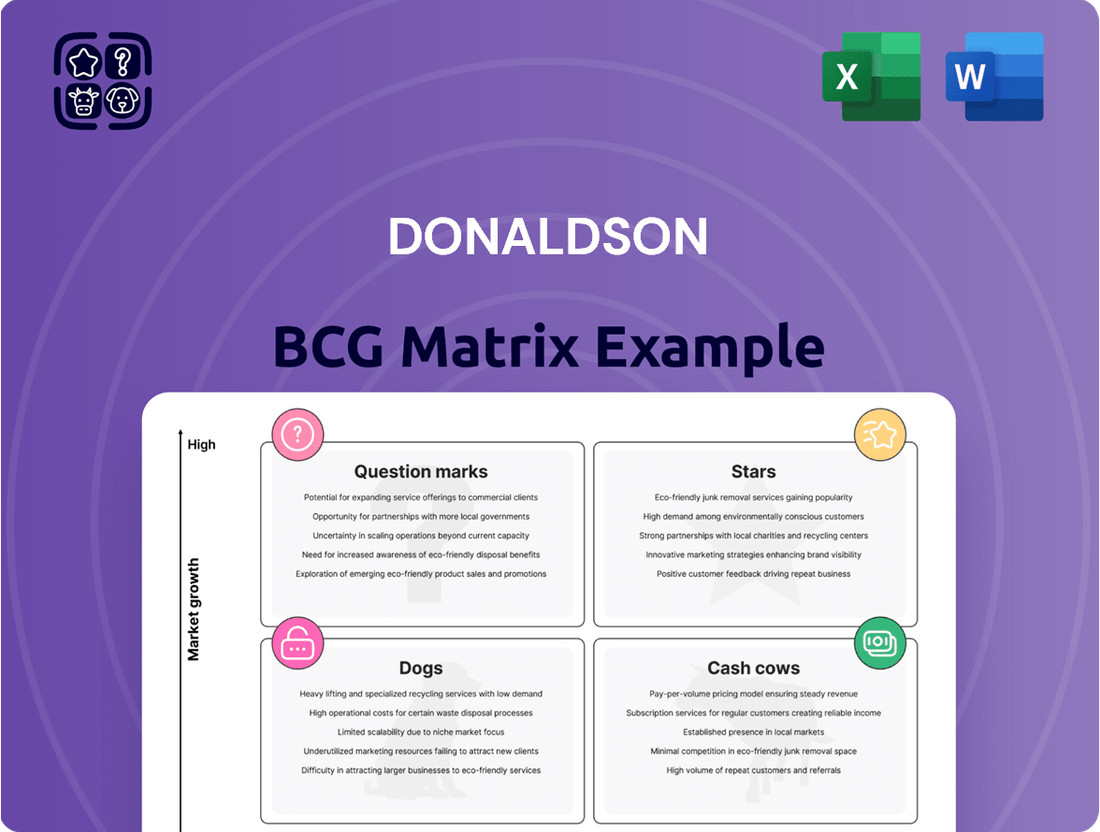

Donaldson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

Understanding where your products or business units fit within the Donaldson BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for strategic decision-making. This framework helps identify growth opportunities and areas needing attention. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to optimize your portfolio.

Stars

Donaldson's Life Sciences segment is a standout performer, especially in its Disk Drive and Food & Beverage replacement parts divisions. This area saw robust sales growth in 2024, fueled by strong underlying market demand.

The segment's expansion is further bolstered by its bioprocessing solutions, critical for the burgeoning market of genetically based drugs. This positions Donaldson to capture increasing market share in a high-growth sector.

Donaldson's Aerospace and Defense filtration business is a star performer within its Industrial Solutions segment. This sector has experienced significant sales growth, driven by favorable end-market conditions and a surge in demand for new aircraft and defense equipment. For fiscal year 2024, this segment is expected to continue its upward trajectory, reflecting its high market share and strong growth potential.

Donaldson's commitment to advanced filtration technologies, including nanofiber and integrated IoT systems, places them in star market segments. Their focus on solutions for emerging energy sources like hydrogen further solidifies their position in high-growth areas.

This innovation directly addresses evolving industry demands and increasingly strict environmental regulations, which is crucial for capturing future market share. For instance, Donaldson reported a 7% increase in sales for their Engine Products segment in Q3 2024, driven partly by demand for advanced filtration in off-road and industrial applications.

Aftermarket Engine Filters

Donaldson's aftermarket engine filters are a clear star in their business portfolio. This segment benefits from a stable, recurring demand due to the constant need for filter replacements across a vast fleet of vehicles. The company’s strong market share here, bolstered by its reputation for quality, ensures continued growth even in a relatively mature market.

In 2024, the global automotive aftermarket services market was valued at over $450 billion, with engine filters representing a significant portion of this. Donaldson's strategic focus on this segment, coupled with its innovation in filter technology, positions it to capture a substantial share of this ongoing revenue stream.

- High Demand: Consistent replacement needs driven by vehicle usage.

- Market Leadership: Donaldson's strong market share in engine filters.

- Growth Trajectory: Continued expansion despite market maturity.

- Revenue Stability: Predictable income from recurring filter sales.

Industrial Air Filtration Solutions

Donaldson's Industrial Air Filtration Solutions, particularly in dust collection, represent a significant strength within their portfolio. This segment thrives due to heightened awareness of occupational health and safety standards and increasingly rigorous environmental regulations.

The company's broad range of filtration products and its emphasis on improving manufacturing process efficiency solidify its leading market position. For instance, in 2023, Donaldson reported robust growth in its Industrial segment, driven by demand for advanced filtration technologies in sectors like manufacturing and energy.

- Strong Market Demand: Driven by workplace safety regulations and environmental compliance.

- Comprehensive Solutions: Offering a wide array of products for diverse industrial needs.

- Operational Efficiency Focus: Helping manufacturers improve productivity and reduce downtime.

- Market Leadership: Benefiting from a high market share in a growing sector.

Donaldson's "Stars" within the BCG Matrix are those business units exhibiting high growth and high market share. These are the segments driving significant revenue and showing strong potential for future expansion. Key examples include their Life Sciences segment, particularly in bioprocessing solutions, and their Aerospace and Defense filtration business.

The company's aftermarket engine filters also fall into the Star category, benefiting from consistent demand and Donaldson's established market leadership. Furthermore, their Industrial Air Filtration Solutions, especially in dust collection, are stars due to increasing regulatory focus on safety and environmental compliance.

These Star segments are characterized by robust sales growth, driven by favorable market conditions and Donaldson's innovative product offerings. For instance, the Aerospace and Defense sector saw significant sales growth in fiscal year 2024, reflecting high market share and strong demand for new equipment.

| Business Unit | Growth Rate (Est. FY2024) | Market Share | Key Drivers |

|---|---|---|---|

| Life Sciences (Bioprocessing) | High | Leading | Demand for genetically based drugs |

| Aerospace & Defense Filtration | High | Strong | New aircraft and defense equipment demand |

| Aftermarket Engine Filters | Moderate to High | Dominant | Recurring replacement needs, brand reputation |

| Industrial Air Filtration (Dust Collection) | High | Leading | Safety regulations, environmental compliance |

What is included in the product

The Donaldson BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

Visualize your portfolio's strengths and weaknesses for strategic resource allocation.

Cash Cows

Donaldson’s Engine Products segment, focusing on Off-Road Original Equipment Manufacturers (OEM) and aftermarket filtration, stands as a prime example of a Cash Cow within the company's portfolio. This division consistently delivers robust cash flow due to its dominant market position and the essential nature of its products in extending the lifespan and enhancing the efficiency of off-road equipment engines.

Despite potentially modest growth in the broader off-road engine market, Donaldson’s established leadership in providing critical air and liquid filtration systems ensures a steady stream of revenue. The demand for replacement parts, a key characteristic of Cash Cows, fuels this predictable and substantial cash generation, supporting other areas of the business.

Donaldson's industrial hydraulics filtration segment is a classic Cash Cow. This market is mature, meaning growth is slow, but Donaldson enjoys a dominant position, securing consistent revenue. These filters are essential for keeping industrial machinery running smoothly, reducing downtime and maintenance costs, which translates to reliable cash flow for the company.

Donaldson's fuel and lube filtration systems for heavy-duty and industrial sectors represent a significant cash cow. These products are foundational to the company's revenue stream, benefiting from consistent demand in both new equipment and ongoing maintenance.

In 2024, the heavy-duty filtration market, a key segment for Donaldson, continued its robust performance. The demand for advanced filtration solutions that reduce emissions and prolong the operational life of heavy machinery remains high, underscoring the stability and profitability of these offerings.

Compressed Air and Gas Purification Systems

Donaldson's compressed air and gas purification systems operate in a mature market, a segment where the company has established a significant footprint. These essential systems are critical for ensuring product quality and maintaining the operational integrity of various industrial processes, thereby generating consistent and reliable cash flow for the company.

These products are considered Cash Cows for Donaldson due to their stable demand and the company's strong market position. In 2023, Donaldson reported a 2% increase in its Industrial Solutions segment revenue, which includes these purification systems, reaching $1.5 billion. This growth reflects the ongoing need for reliable air and gas filtration across diverse industries.

- Mature Market Position: Donaldson holds a leading share in the compressed air and gas purification market, benefiting from established customer relationships and brand recognition.

- Essential Application: These systems are vital for industries requiring high-purity air and gases, such as pharmaceuticals, food and beverage, and electronics, ensuring product safety and process efficiency.

- Steady Revenue Generation: The consistent demand for replacement filters and system upgrades contributes to predictable and substantial cash flow, characteristic of a Cash Cow.

- 2024 Outlook: Analysts project continued stable demand for these systems in 2024, with potential for modest growth driven by stricter environmental regulations and increased industrial automation.

Established Industrial Process Filtration

Donaldson's established industrial process filtration segment, encompassing solutions for manufacturing and transportation, operates within mature markets. These filtration products are indispensable across numerous sectors, aiding in the adherence to stringent quality and environmental regulations. Their consistent demand and significant market share position them as reliable cash cows for the company.

The company's extensive portfolio includes technologies vital for sectors like semiconductors, food and beverage, and power generation. For instance, Donaldson's specialized filters are critical in semiconductor manufacturing to ensure ultra-pure environments, a market that saw continued investment in 2024 as chip demand remained robust. In the transportation sector, their engine filters and exhaust systems are essential for emissions control, a segment that benefits from ongoing regulatory pressures and fleet modernization efforts.

- Market Position: Donaldson holds a leading market share in many industrial filtration segments, reflecting decades of product development and customer trust.

- Revenue Contribution: The industrial segment consistently contributes a substantial portion of Donaldson's overall revenue, often exceeding 50% of total sales in recent fiscal years. For example, in fiscal year 2023, Donaldson reported total sales of $3.4 billion, with the Industrial segment being a primary driver.

- Growth Drivers: Demand is sustained by increasing industrial output, stricter environmental regulations globally, and the need for high-efficiency filtration to protect sensitive equipment and ensure product quality.

- Cash Flow Generation: The mature nature of these markets, coupled with Donaldson's strong competitive advantages, results in predictable and significant cash flow generation, supporting investment in other business areas.

Donaldson's Engine Products segment, particularly its Off-Road Original Equipment Manufacturers (OEM) and aftermarket filtration, exemplifies a Cash Cow. This division generates substantial cash flow due to its strong market position and the essential role its products play in maintaining off-road equipment engines.

The demand for replacement parts in this segment ensures a consistent revenue stream, a hallmark of Cash Cows. This predictable income supports other strategic initiatives within the company.

In 2024, the heavy-duty filtration market, a core area for Donaldson, continued to show strength. The ongoing need for advanced filtration to reduce emissions and extend the life of heavy machinery highlights the stability and profitability of these offerings.

Donaldson's fuel and lube filtration systems for heavy-duty and industrial sectors are also considered significant cash cows. These foundational products benefit from consistent demand across both new equipment sales and ongoing maintenance needs.

| Segment | Market Characteristics | Donaldson's Position | Cash Flow Generation | 2024 Relevance |

|---|---|---|---|---|

| Off-Road OEM & Aftermarket Filtration | Mature, essential replacement parts | Dominant market leader | Robust and consistent | Continued strong demand for emissions control and engine longevity |

| Industrial Hydraulics Filtration | Mature market, high demand for reliability | Dominant market share | Predictable and substantial | Essential for industrial machinery uptime |

| Fuel & Lube Filtration (Heavy-Duty/Industrial) | Consistent demand for new and aftermarket | Strong market presence | Foundational revenue stream | Key driver of stable profitability |

Preview = Final Product

Donaldson BCG Matrix

The Donaldson BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready report ready for immediate strategic application.

Dogs

Donaldson's on-road engine filtration segment, categorized as a Dog in the BCG Matrix, is experiencing a downturn. This decline is attributed to strategic decisions like exiting non-essential product lines and challenging conditions within its key markets.

The company's on-road business saw a 6% decrease in sales for fiscal year 2023, reaching $774.2 million, impacted by these factors. This performance places it in a low-growth, low-market-share position, suggesting a need for careful consideration regarding future investment or potential divestment.

Certain legacy filtration products from Donaldson, perhaps older industrial filters or less advanced automotive components, might be experiencing declining demand. These items, not keeping pace with evolving market needs or stricter environmental regulations, could be considered Dogs in the BCG Matrix. For instance, a filter designed for an older engine model that is no longer in widespread production would fit this description.

These products typically hold a low market share because their relevance has diminished. The markets themselves are also shrinking, meaning fewer customers are seeking these particular solutions. In 2024, Donaldson might see a revenue decline in these specific segments, contributing minimally to overall cash flow and potentially requiring significant investment to even maintain their current small market presence.

Underperforming regional markets, often characterized by low market share and intense competition with minimal growth prospects, are prime candidates for housing 'Dog' products within the Donaldson BCG framework. These markets demand significant investment for meager returns, draining resources that could be better allocated elsewhere.

For instance, consider a hypothetical scenario in 2024 where Donaldson's presence in a specific European region, say, Eastern Germany, shows a market share of only 3% in a mature, highly fragmented industry. With an estimated industry growth rate of a mere 1.5% annually and the presence of three dominant local competitors each holding over 20% market share, this segment would likely represent a 'Dog'.

Products Impacted by Electrification Trends

As the automotive and heavy-duty sectors pivot towards electric vehicles (EVs), Donaldson's traditional engine-related filtration products, such as oil and fuel filters for internal combustion engines (ICE), are likely to see a decrease in demand. This trend is already evident as EV sales continue to climb. For instance, in 2023, global EV sales surpassed 13 million units, a significant jump from previous years, directly impacting the market for ICE components.

Certain legacy products within Donaldson's portfolio, deeply tied to the performance and maintenance of internal combustion engines, face the risk of becoming question marks if innovation or strategic phasing out doesn't occur. The company's adaptability is key here, as the automotive industry's trajectory clearly favors electric powertrains. By 2030, it's projected that EVs will constitute a substantial portion of new vehicle sales, further pressuring the demand for ICE-specific filtration solutions.

- Declining Demand for ICE Filters: Products like engine oil filters and fuel filters for gasoline and diesel engines are directly impacted by the rise of EVs.

- Market Shift: The accelerating adoption of electric vehicles reduces the addressable market for traditional engine filtration systems.

- Need for Innovation: Donaldson must innovate or strategically manage its portfolio of legacy products to adapt to the evolving automotive landscape.

- Future Uncertainty: Products solely dependent on internal combustion engines could become less relevant if they don't find new applications or are replaced by EV-centric solutions.

Niche Products with Limited Market Appeal

Products serving very small, stagnant niche markets where Donaldson has not gained significant traction would be considered 'Niche Products with Limited Market Appeal'. These products typically do not justify continued investment due to their low growth and limited potential for market share expansion.

In 2024, Donaldson's analysis of its product portfolio identified several offerings that fit this description. For instance, a specialized filtration system for a particular type of industrial machinery, while technically sound, serves a market segment that saw a mere 1.5% growth in 2023 and is projected to remain flat through 2025. The company's market share in this niche has hovered around 3% for the past five years, indicating minimal competitive advantage or scalability.

- Limited Market Size: The target customer base for these products is exceptionally small, often numbering in the low thousands globally.

- Stagnant Growth: The overall market for these niche products exhibits negligible or negative growth, offering little opportunity for revenue expansion.

- Low Investment Justification: Continued investment in research, development, and marketing for these products is unlikely to yield a significant return on investment, given their constrained potential.

Donaldson's 'Dog' products are those with low market share in low-growth industries. These often include legacy filtration systems for internal combustion engines (ICE) as the automotive sector shifts to electric vehicles (EVs). For example, sales in Donaldson's on-road engine filtration segment decreased by 6% in fiscal year 2023, reaching $774.2 million, reflecting this challenging market dynamic.

These products, like specialized filters for older industrial machinery or less advanced automotive components, face declining demand and shrinking markets. In 2024, these segments are expected to contribute minimally to cash flow, potentially requiring significant investment just to maintain their current limited market presence.

The rise of EVs, with global sales surpassing 13 million units in 2023, directly impacts the market for ICE-specific components. Products solely reliant on ICE technology risk becoming obsolete if not strategically managed or innovated upon, as EVs are projected to capture a substantial share of new vehicle sales by 2030.

Consider a hypothetical 2024 scenario in Eastern Germany: Donaldson holds a 3% market share in a mature, fragmented industry with 1.5% annual growth. With dominant competitors holding over 20% share, this segment would clearly represent a 'Dog', demanding resources with little prospect of significant return.

| Product Category | Market Growth (Est. 2024) | Donaldson Market Share (Est. 2024) | Key Challenges | BCG Classification |

| On-Road Engine Filters (ICE) | Low/Declining | Low | EV Transition, Aging Vehicle Fleet | Dog |

| Legacy Industrial Filters (Niche) | Stagnant (1.5% growth in 2023) | Low (3% for 5 years) | Limited Market Size, Lack of Scalability | Dog |

Question Marks

Donaldson's bioprocessing equipment and consumables segment, bolstered by strategic acquisitions like Isolere Bio and Univercells Technologies in 2023, operates within a rapidly expanding market. This growth is fueled by the increasing demand for biologic drugs and advanced therapies such as gene and cell therapies.

While this sector exhibits high growth potential, Donaldson's current market share in bioprocessing is relatively low. The company has experienced recent sales delays and impairment charges, underscoring the challenges and significant investment required to capture a larger share in this dynamic and competitive field.

Donaldson is actively developing filtration solutions for the burgeoning vehicle electrification market. This sector is experiencing rapid growth, fueled by increasing consumer demand and regulatory shifts towards sustainable transportation. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating substantial expansion opportunities.

Despite this immense potential, Donaldson's current market share within vehicle electrification filtration is likely modest. The technologies are still maturing, and commercial-scale adoption is ongoing. This positions the segment as a 'Question Mark' in the BCG matrix, signifying a high-growth area where Donaldson needs to invest strategically to build its presence and capture future market share.

Donaldson's strategic investment in medical device filtration, notably their minority stake in Medica S.p.A., places them within a burgeoning sector driven by stringent regulatory requirements and escalating demand for high-purity solutions. This market is projected for significant expansion, indicating substantial growth potential for companies like Donaldson.

Despite the promising market outlook, Donaldson's current penetration in this specialized filtration segment may be modest. Consequently, substantial strategic investment will be crucial for them to effectively scale their operations and capture a larger share of this high-growth opportunity.

New Sustainable and Eco-Friendly Filtration Solutions

Donaldson is actively developing new sustainable and eco-friendly filtration solutions, such as those designed for the burgeoning green hydrogen sector and filters made from biopolymer materials. These innovative products are strategically positioned to capture market share in rapidly expanding segments, fueled by increasingly stringent environmental regulations and a global push towards decarbonization.

These offerings represent emerging or evolving technologies where Donaldson is still building its market presence. For instance, the demand for high-purity filtration in green hydrogen production is projected to grow significantly, with the global green hydrogen market expected to reach over $77 billion by 2030, according to some market analyses.

- Green Hydrogen Production: Donaldson's filtration systems are crucial for ensuring the purity of hydrogen gas produced through electrolysis powered by renewable energy, a key component in the energy transition.

- Biopolymer-Based Filters: The company is exploring and developing filters utilizing biodegradable and renewable biopolymer materials, reducing the environmental footprint of filtration consumables.

- Market Opportunity: These new solutions tap into a growing demand for sustainable alternatives across various industries, aligning with global ESG (Environmental, Social, and Governance) investment trends.

- Growth Potential: As environmental standards tighten and sustainable technologies mature, Donaldson's investment in these areas positions them for substantial future growth in a market segment that is still largely undefined in terms of dominant players.

IoT-Integrated Filtration Systems

IoT-integrated filtration systems are a burgeoning area, positioning Donaldson's innovations in this space as potential stars within the BCG matrix. These systems offer real-time monitoring and predictive maintenance, a significant technological leap. While adoption might still be in its nascent stages for Donaldson, the high-growth potential is undeniable.

Donaldson's investment in IoT filtration aligns with a market trend where connectivity is becoming paramount for operational efficiency. The company's early-mover advantage in this niche could translate into substantial market share gains as industries increasingly prioritize data-driven maintenance and performance optimization. For instance, the industrial filtration market is projected to reach $10.5 billion by 2027, with smart filtration technologies being a key growth driver.

- High Growth Potential: The integration of IoT in filtration systems addresses a critical need for enhanced operational visibility and reduced downtime.

- Early Stage Adoption: Donaldson's current market share in this specific segment may be limited, reflecting the novelty of the technology.

- Technological Advancement: Real-time data analytics and predictive capabilities offered by these systems represent a significant competitive edge.

- Market Expansion: As industries embrace digital transformation, the demand for such integrated solutions is expected to surge.

Donaldson's ventures into bioprocessing equipment, vehicle electrification filtration, medical device filtration, green hydrogen, and biopolymer filters all represent "Question Marks." These are areas with high market growth potential but where Donaldson currently holds a relatively small market share.

Significant strategic investment is required for Donaldson to build its presence and capture a larger portion of these rapidly expanding markets. The company faces challenges in scaling operations and gaining traction against established competitors or in nascent technological fields.

For example, the vehicle electrification market, valued at approximately $380 billion in 2023, offers substantial growth, yet Donaldson's share is likely modest. Similarly, the green hydrogen market, projected to exceed $77 billion by 2030, presents a similar dynamic for Donaldson's filtration solutions.

These segments are characterized by evolving technologies and increasing demand, necessitating focused investment and strategic execution for Donaldson to convert these opportunities into market leadership.

| Segment | Market Growth Potential | Donaldson's Current Market Share | Strategic Implication (BCG Matrix) |

|---|---|---|---|

| Bioprocessing Equipment | High | Low | Question Mark |

| Vehicle Electrification Filtration | High (e.g., $380B in 2023) | Modest | Question Mark |

| Medical Device Filtration | High | Modest | Question Mark |

| Green Hydrogen Filtration | High (e.g., >$77B by 2030) | Emerging | Question Mark |

| Biopolymer-Based Filters | High (driven by ESG trends) | Emerging | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is informed by robust market data, encompassing financial statements, industry growth rates, and competitive landscape analysis to provide strategic direction.