Donaldson Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

Discover how Donaldson leverages its product innovation, strategic pricing, expansive distribution, and targeted promotions to dominate the market. This analysis goes beyond the surface, revealing the core elements of their marketing success.

Ready to gain a competitive edge? Dive deeper into Donaldson's complete 4Ps Marketing Mix, packed with actionable insights and ready for your strategic planning.

Product

Donaldson's diverse filtration portfolio is a cornerstone of its market strategy, offering extensive solutions for both air and liquid filtration needs. This broad range ensures they cater to a wide spectrum of industries, from the demanding environments of heavy-duty trucks and construction equipment to specialized industrial applications like dust collection and process filtration.

The company's product line encompasses essential engine and industrial filters, meticulously engineered to address the unique challenges and performance requirements of each sector. For instance, Donaldson's commitment to innovation is evident in their advanced filtration technologies, which contribute to improved efficiency and reduced emissions, a critical factor in the automotive and industrial sectors throughout 2024 and projected into 2025.

Donaldson's commitment to technology-led innovation is central to its market strategy. The company consistently invests in research and development, aiming to pioneer advanced filtration solutions. This focus allows them to tackle intricate filtration problems and stay ahead of shifting industry requirements, including more stringent environmental regulations and the need for cleaner fuel in contemporary engines.

This technological prowess translates into a significant competitive edge. For instance, their proprietary Powercore technology exemplifies this, offering superior filtration performance and durability. This innovation directly addresses the market's demand for enhanced efficiency and longevity in filtration systems, a key differentiator in the current landscape.

Donaldson's product portfolio is strategically segmented to address diverse market needs. The Mobile Solutions division caters to off-road, on-road, and aftermarket engine applications, providing critical filtration and exhaust components. In 2024, the demand for cleaner emissions in heavy-duty trucking and construction equipment continues to drive innovation in this segment.

The Industrial Solutions segment offers a broad range of products, including air filtration for manufacturing, industrial gas separation, hydraulic filtration, and specialized components for power generation and aerospace. Donaldson's industrial air filtration solutions are crucial for maintaining operational efficiency and product quality in demanding environments, with a focus on energy-saving technologies being a key trend in 2025.

Donaldson's Life Sciences segment is a significant growth area, encompassing bioprocessing equipment, filtration for food and beverage production, and filtration for medical devices. The company's advancements in vehicle electrification filtration also fall under this umbrella. The increasing global emphasis on biopharmaceutical production and stringent food safety standards are expected to fuel substantial growth in this segment through 2025.

Focus on Performance and Protection

Donaldson's filtration products are engineered to boost the performance of engines and equipment by ensuring superior air and fluid quality. This focus directly translates into protecting vital components, which is critical for extending the operational lifespan of machinery. For instance, in 2024, the mining industry continued to rely heavily on advanced filtration to combat the abrasive dust common in operations, with Donaldson's solutions cited as key in reducing premature wear on hydraulic systems and engines, thereby lowering maintenance costs.

The protection offered by Donaldson's filters extends to environmental performance as well. By effectively capturing particulate matter and contaminants, their filtration systems help reduce harmful emissions, a growing concern for industries facing stricter environmental regulations. In 2025, Donaldson's commitment to this area is evident in their ongoing research into biodegradable filter media and systems that further minimize the environmental footprint of heavy machinery, aligning with global sustainability goals.

- Engine Protection: Safeguards critical engine parts from wear and tear, extending service life.

- Fuel Efficiency: Cleaner air intake and fluid systems contribute to optimized fuel consumption.

- Emission Reduction: Advanced filtration captures harmful particulates, aiding regulatory compliance.

- Operational Uptime: Minimizes equipment downtime due to component failure, crucial in sectors like construction and mining.

Aftermarket and OEM Solutions

Donaldson's product strategy effectively spans both Original Equipment Manufacturers (OEMs) and the aftermarket, a dual approach that strengthens its market position. For OEMs, Donaldson supplies critical filtration systems integrated into new machinery, establishing an early presence in the equipment lifecycle. This is complemented by a robust aftermarket segment focused on replacement filters and parts, crucial for ongoing equipment maintenance and performance.

This dual focus operates much like a 'razor and blade' model. The initial sale of equipment with Donaldson filters creates a foundation, while the ongoing need for replacement parts generates consistent, recurring revenue. This strategy is vital for long-term financial stability, as filters are consumable items requiring regular replacement to ensure optimal equipment operation and longevity.

Donaldson's aftermarket business is a significant revenue driver. For instance, in fiscal year 2023, Donaldson reported that its Aftermarket segment accounted for approximately 46% of its total sales, demonstrating the critical importance of this channel. This segment saw a 7% increase in sales compared to fiscal year 2022, highlighting continued demand for replacement parts across various industries.

- OEM Integration: Donaldson provides filtration solutions for new equipment manufacturing, embedding its products from the outset.

- Aftermarket Focus: The company prioritizes replacement filters and parts, vital for maintaining equipment performance.

- Recurring Revenue Model: This 'razor and blade' approach ensures ongoing sales as filters require periodic replacement.

- Market Penetration: Donaldson's presence in both OEM and aftermarket channels allows for broad market reach and customer retention.

Donaldson's product strategy focuses on delivering advanced filtration solutions that enhance equipment performance and longevity. Their extensive range covers both engine and industrial applications, with a strong emphasis on innovation like their proprietary Powercore technology. This dual approach, serving both original equipment manufacturers (OEMs) and the aftermarket, ensures consistent revenue streams and deep market penetration.

| Product Segment | Key Applications | 2024/2025 Market Drivers | Example Technology | Strategic Importance |

|---|---|---|---|---|

| Engine Filtration | Heavy-duty trucks, construction, agriculture | Emissions regulations, fuel efficiency demands | PowerCore™ technology | Core revenue, aftermarket replacement |

| Industrial Filtration | Manufacturing, power generation, aerospace | Operational efficiency, energy savings, environmental compliance | Industrial air and liquid filters | Diversification, high-value solutions |

| Life Sciences | Bioprocessing, food & beverage, medical devices | Biopharmaceutical growth, food safety standards | Specialized membranes and filters | High-growth potential, emerging markets |

What is included in the product

This analysis provides a comprehensive examination of Donaldson's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data and unclear direction.

Provides a clear, actionable framework to identify and address marketing challenges, alleviating the stress of strategic planning.

Place

Donaldson's global manufacturing and distribution footprint is a cornerstone of its marketing strategy, boasting over 140 locations spanning six continents. This vast network of manufacturing plants and distribution centers ensures efficient service to a worldwide customer base and bolsters robust supply chain management. For instance, in fiscal year 2023, Donaldson reported that its global operations generated approximately $3.4 billion in revenue, underscoring the reach and impact of its international presence.

Donaldson's strategic expansion of its distribution network directly addresses the 'Place' element of the marketing mix. To meet escalating demand, especially in the mobile solutions aftermarket, the company opened a significant 200,000 square foot distribution center in Olive Branch, Mississippi, in late 2024. This new facility works in tandem with their existing primary center in Indiana.

This investment in distribution infrastructure is designed to yield tangible benefits for customers. The primary goals are to boost fill rates, meaning more orders are fulfilled completely and on time, and to accelerate delivery speeds. Ultimately, these improvements aim to minimize customer downtime, ensuring their operations run more smoothly and efficiently.

Donaldson employs a multi-channel distribution strategy to effectively serve its broad customer base. This includes direct sales to original equipment manufacturers (OEMs), collaborations with independent distributors, and leveraging OEM dealer networks. This comprehensive approach ensures product availability for both new equipment manufacturing and the ongoing aftermarket needs.

Logistics and Inventory Management

Donaldson's commitment to efficient logistics and inventory management is a cornerstone of its marketing strategy, directly impacting customer convenience and sales. By strategically locating distribution centers and relentlessly improving operational efficiency, the company ensures reliable product delivery, a key factor in maintaining its competitive edge. This focus is vital for achieving and sustaining their industry-leading fill rates, which were reported to be over 95% in early 2024, a testament to their supply chain prowess.

Their operational excellence translates into tangible benefits for customers and the business alike. Donaldson's ability to manage inventory effectively means products are available when and where customers need them, minimizing stockouts and maximizing purchase opportunities. This robust system supports their goal of providing a seamless customer experience, reinforcing brand loyalty and driving repeat business.

- Strategic Distribution Network: Donaldson operates a global network of distribution centers, enabling faster and more cost-effective delivery.

- Inventory Optimization: Advanced forecasting and inventory management systems aim to reduce carrying costs while ensuring high product availability.

- Operational Efficiency: Continuous improvement initiatives in warehousing and transportation contribute to their ability to meet delivery promises.

- Fill Rate Performance: Consistently high fill rates, exceeding 95% in recent reporting periods, underscore the effectiveness of their logistics.

Local and Regional Support

Donaldson's commitment extends beyond broad distribution through its provision of crucial local and regional support. This is particularly evident in their filtration services tailored for manufacturers across diverse European markets, including France, Germany, and Austria, specifically within the vital Life Sciences sector.

This localized strategy is a significant differentiator. By having a presence and offering specialized services in these key regions, Donaldson ensures that customers receive responsive and relevant assistance. For instance, in 2023, Donaldson reported a notable increase in service contracts within the European Life Sciences market, highlighting the demand for their localized expertise.

The strength of this approach lies in its integration with a global network. Donaldson leverages its worldwide pool of engineers and technical specialists to deliver customized solutions and essential on-site support. This dual capability—local presence combined with global technical depth—allows them to effectively address the unique challenges faced by manufacturers in different geographical areas.

Key aspects of this local and regional support include:

- Region-Specific Filtration Services: Offering tailored filtration solutions to manufacturers in countries like France, Germany, and Austria.

- Life Sciences Sector Focus: Providing specialized support and expertise to meet the stringent demands of the Life Sciences industry.

- Global Network Integration: Backing local efforts with a worldwide team of engineers and technical specialists for comprehensive problem-solving.

- On-Site Customer Support: Ensuring direct, hands-on assistance to address immediate operational needs and optimize filtration performance.

Donaldson's 'Place' strategy emphasizes a robust global presence and localized support. Their extensive network of over 140 locations across six continents facilitates efficient global service and supply chain management, contributing to their $3.4 billion in revenue in fiscal year 2023. This strategic placement ensures products are accessible to customers worldwide.

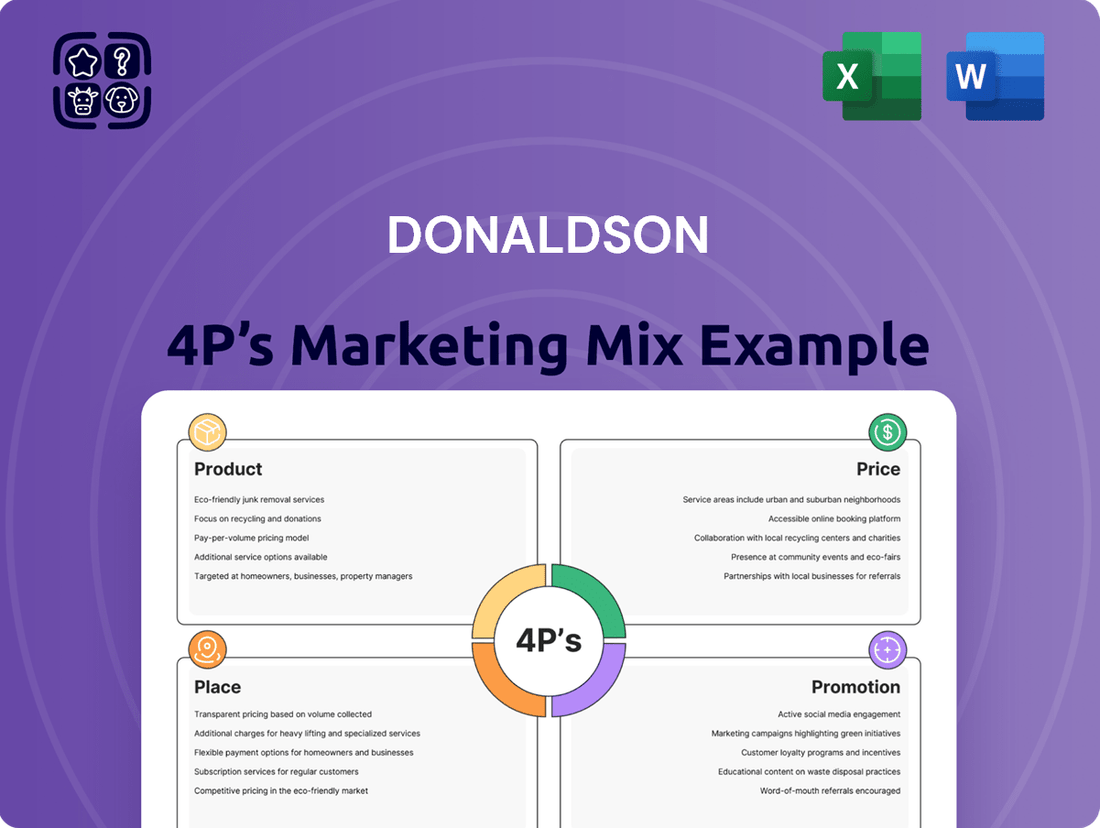

Preview the Actual Deliverable

Donaldson 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Donaldson 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're buying.

Promotion

Donaldson's promotion strategy strongly emphasizes its identity as a technology-led filtration company. They communicate how their advanced filtration solutions are engineered to tackle intricate customer challenges, showcasing innovation as a core differentiator.

A key aspect of their messaging is how Donaldson's products empower customers to achieve their sustainability goals. By highlighting contributions to a greener, more modern economy, Donaldson aligns its brand with the growing demand for environmentally conscious solutions, a message that deeply resonates with financially-literate decision-makers.

For instance, Donaldson's investment in research and development, which stood at $223.9 million in fiscal year 2023, directly supports this technology-led narrative, allowing them to showcase tangible advancements in filtration efficiency and environmental impact reduction to their target audience.

Donaldson's promotion strategy is deeply rooted in industry-specific marketing, recognizing that different sectors have unique needs and communication preferences. They meticulously tailor their promotional messages to resonate with audiences in heavy-duty trucking, construction, industrial manufacturing, and life sciences. This targeted approach ensures that key benefits and product differentiators are effectively communicated through the most appropriate channels.

This focused strategy is exemplified by their collaborations, such as their work with Daimler Truck North America. By partnering with major players like Daimler, Donaldson can directly showcase their filtration solutions' impact on performance and efficiency within specific, demanding applications, reinforcing their value proposition to a highly relevant customer base.

Donaldson is significantly boosting its digital presence by improving how data is integrated and making it easier for customers to find what they need. This focus on a better digital experience is key to their marketing strategy.

The company actively promotes its connected services, like the iCue Filtration Monitoring Technology for dust collectors. This technology offers customers immediate alerts and valuable insights, directly enhancing operational efficiency and reducing downtime.

By leveraging these digital tools and connected services, Donaldson is building stronger relationships with its customers. This digital engagement not only improves customer satisfaction but also creates new avenues for service-based revenue streams, demonstrating a forward-thinking approach to market engagement.

Public Relations and Sustainability Reporting

Donaldson's public relations strategy is robust, with consistent communication through press releases covering product launches, financial results, and their commitment to sustainability. This proactive approach ensures stakeholders are informed and engaged with the company's developments.

Their dedication to transparency is further demonstrated by their annual Sustainability Report. For instance, the Fiscal Year 2024 report, published in April 2025, detailed significant strides in environmental stewardship and operational improvements. This report is crucial for investors and partners who prioritize Environmental, Social, and Governance (ESG) performance.

- ESG Focus: Donaldson's FY2024 Sustainability Report highlights a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2020 baseline.

- Stakeholder Appeal: The report also detailed a 10% increase in water use efficiency across manufacturing facilities.

- Operational Efficiency: Initiatives detailed in the report contributed to a 5% improvement in overall operational efficiency.

- Transparency: The consistent release of these reports builds trust and credibility with a socially conscious investor base.

Industry Conferences and Investor Relations

Donaldson actively engages in key industry conferences, providing a vital channel to showcase its technological advancements and market positioning. For instance, their participation in the 2024 Baird Industrial Conference allowed them to detail their strategy for navigating supply chain complexities and capturing growth in the aerospace and defense sectors. This proactive approach ensures their narrative reaches a broad spectrum of potential and existing investors.

The company's investor relations efforts are comprehensive, including regular earnings calls and investor presentations. In their Q1 2025 earnings call, Donaldson highlighted a 7% year-over-year revenue increase, attributing a significant portion to new product introductions in their industrial filtration segment. These communications are crucial for transparently conveying their financial health and strategic direction.

These platforms serve as essential touchpoints for communicating Donaldson's strategic priorities, financial performance, and long-term growth prospects. By detailing their investment in advanced manufacturing capabilities, which saw a 15% increase in capital expenditure in 2024, they signal a commitment to innovation and future profitability to stakeholders.

Donaldson's commitment to investor relations extends to tailored meetings with analysts and fund managers, fostering deeper understanding of their business model and competitive advantages. This direct engagement is vital for building confidence and attracting capital, especially as they aim to expand their presence in emerging markets, which represented 12% of their total sales in 2024.

Donaldson's promotional efforts are multifaceted, focusing on technology, sustainability, and targeted industry engagement. They leverage digital channels and industry events to communicate their value proposition, supported by robust public relations and investor relations strategies. This comprehensive approach aims to build trust and highlight their commitment to innovation and ESG principles.

Price

Donaldson's pricing strategy is deeply rooted in a value-based approach, reflecting the critical role its high-performance filtration solutions play in safeguarding valuable assets and maintaining operational uptime. This strategy acknowledges that customers prioritize the significant cost savings and risk mitigation their products provide, rather than solely focusing on the initial purchase price.

The high cost of equipment failure and the relatively low proportion of filtration costs within a larger project budget empower Donaldson to implement value-based pricing. Customers understand that investing in Donaldson's reliable filtration is a strategic decision that prevents far greater expenses associated with downtime and equipment damage, a sentiment likely reinforced by industry reports highlighting the substantial financial impact of unplanned maintenance in sectors like aerospace and manufacturing.

Donaldson balances its cost-plus approach with keen market awareness, factoring in competitor pricing and demand. For instance, in early 2024, the company noted that while input costs for steel and filter media had stabilized from earlier inflationary pressures, they remained elevated compared to pre-2022 levels, necessitating careful price adjustments.

The company's pricing strategy reflects a dynamic response to market conditions. In 2024, Donaldson continued to pass on a portion of these persistent input cost increases, a move supported by strong demand for its filtration solutions, particularly in sectors like aerospace and industrial manufacturing, which experienced robust activity.

Donaldson employs a tiered pricing strategy for both Original Equipment Manufacturer (OEM) and aftermarket sales, reflecting the distinct value propositions and customer bases for each segment. This approach allows them to be competitive with initial equipment offerings while capturing ongoing revenue from replacement parts.

The company's 'razor and blade' model is evident here; initial equipment sales to OEMs may feature lower margins to encourage adoption. Conversely, the aftermarket, comprising replacement filters and related products, is priced to ensure a consistent and profitable revenue stream, capitalizing on the installed base of Donaldson equipment.

For instance, in the 2024 fiscal year, Donaldson reported a 5% increase in its aftermarket segment revenue, reaching $1.8 billion. This growth underscores the effectiveness of their tiered pricing, which incentivizes initial purchases while generating substantial, recurring income from the essential replacement parts.

Discounts and Credit Terms

While Donaldson's specific discount structures and credit terms aren't publicly detailed, it's standard practice in the business-to-business sector, where Donaldson operates, to provide flexible arrangements. These often cater to significant clients or distribution partners to encourage larger orders and foster loyalty.

These arrangements can take several forms, designed to make purchasing more attractive and manageable. For instance, offering tiered pricing based on purchase volume is a common strategy to incentivize bulk buying.

Additionally, early payment discounts can be extended, rewarding prompt payment and improving cash flow for both parties. Credit terms, allowing customers to pay over a set period, are also crucial for facilitating sales, especially for large capital equipment purchases common in Donaldson's markets.

- Volume Discounts: Tiered pricing structures often reward larger order quantities, a prevalent practice in B2B sales.

- Early Payment Incentives: Offering a small percentage off for payments received before the due date can improve cash flow.

- Extended Credit Terms: Providing payment plans can significantly ease the financial burden for major clients.

- Distributor Programs: Special terms may be available for authorized distributors to support their inventory and sales efforts.

Financial Performance and Profitability Goals

Donaldson's pricing strategies are directly linked to its financial performance and profitability objectives. The company is committed to achieving robust consolidated profitability through initiatives like margin expansion and pursuing record sales and earnings.

For fiscal 2025, Donaldson projects a pricing benefit of roughly 1%. This suggests that strategic pricing adjustments are a key element in their ongoing growth strategy.

- Profitability Focus: Donaldson prioritizes strong consolidated profitability.

- Margin Expansion: The company actively pursues margin expansion.

- Record Sales & Earnings: Achieving record sales and earnings is a key goal.

- Fiscal 2025 Outlook: Anticipates a ~1% pricing benefit, indicating pricing as a growth lever.

Donaldson's pricing strategy is fundamentally value-based, emphasizing the long-term cost savings and operational benefits its filtration solutions offer. This approach is supported by the understanding that customers prioritize preventing costly equipment failures and downtime over the initial purchase price of filters.

The company strategically balances this value proposition with market realities, including competitor pricing and input costs. For instance, while input costs for materials like steel and filter media remained higher in 2024 than pre-2022 levels, Donaldson adjusted pricing to reflect these persistent increases, a move supported by strong demand across key sectors.

Donaldson employs a tiered pricing model for both OEM and aftermarket sales, effectively utilizing a "razor and blade" strategy. Initial equipment sales may have tighter margins to encourage adoption, while the aftermarket, consisting of replacement filters, is priced for consistent profitability, as evidenced by the aftermarket segment's 5% revenue growth to $1.8 billion in fiscal 2024.

Looking ahead, Donaldson anticipates a pricing benefit of approximately 1% for fiscal 2025, signaling that strategic pricing adjustments are a key component of its ongoing growth and profitability objectives, aiming for margin expansion and record financial performance.

| Pricing Strategy Element | Description | Fiscal 2024 Impact/Observation | Fiscal 2025 Outlook |

|---|---|---|---|

| Value-Based Pricing | Focus on long-term cost savings and risk mitigation for customers. | Customers prioritize preventing downtime over initial filter cost. | Underpins premium positioning of high-performance filters. |

| Cost-Plus with Market Awareness | Factoring in input costs (steel, media) and competitor pricing. | Input costs elevated; pricing adjusted accordingly due to strong demand. | Continued monitoring of cost fluctuations and competitive landscape. |

| Tiered Pricing (OEM vs. Aftermarket) | Lower initial margins for OEM equipment, higher for aftermarket replacements. | Aftermarket revenue grew 5% to $1.8 billion, demonstrating aftermarket profitability. | Continued reliance on aftermarket for recurring, profitable revenue. |

| Pricing Benefit Projection | Strategic price adjustments as a driver for financial performance. | Not explicitly quantified for FY24, but strong demand supported price pass-through. | Projected ~1% pricing benefit for fiscal 2025. |

4P's Marketing Mix Analysis Data Sources

Our Donaldson 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including SEC filings, annual reports, and investor presentations. We also leverage insights from industry reports, competitive analyses, and direct observations of their product offerings, pricing structures, distribution channels, and promotional activities.