Donaldson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

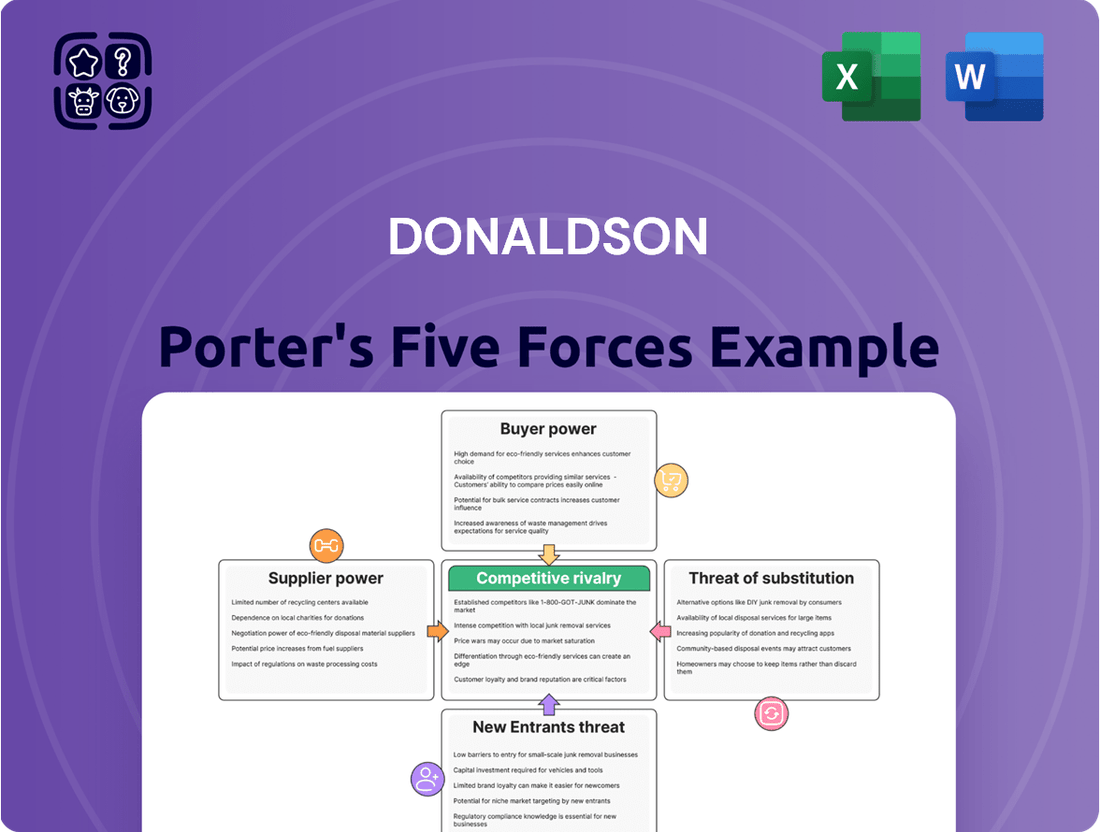

Donaldson's competitive landscape is shaped by five key forces: the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any business operating within or looking to enter Donaldson's market.

The complete Porter's Five Forces Analysis for Donaldson offers a comprehensive, data-driven examination of these forces, providing actionable insights into strategic advantages and potential threats. This detailed report is essential for informed decision-making and strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of Donaldson’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Donaldson's dependence on specialized filtration media, like oleophobic materials and advanced nanofiber technology, significantly bolsters supplier bargaining power. Suppliers possessing proprietary rights or unique manufacturing processes for these critical inputs can dictate terms due to limited alternatives.

In 2024, the increasing demand for high-performance filtration in sectors like aerospace and advanced manufacturing, where Donaldson is a key player, further amplifies the leverage of suppliers providing these niche materials. This reliance on few, specialized sources means Donaldson faces higher input costs and less flexibility in negotiating supply agreements, directly impacting its profit margins.

Supplier concentration significantly impacts Donaldson's bargaining power. If key raw materials or specialized components are sourced from a limited number of providers, those suppliers gain leverage. For instance, in 2024, the automotive filtration market, a key sector for Donaldson, saw consolidation among certain raw material suppliers, potentially increasing input costs for manufacturers like Donaldson.

A concentrated supplier base means Donaldson has fewer alternatives when negotiating prices or contract terms. This lack of choice can force Donaldson to accept less favorable conditions, directly impacting its profitability. The potential for supply chain disruptions also rises if these few suppliers face production issues.

The bargaining power of suppliers for Donaldson is significantly influenced by the switching costs involved in changing filtration component providers. These costs can be substantial, encompassing everything from retooling entire manufacturing lines to the rigorous process of re-qualifying new materials to meet strict performance and regulatory requirements. For instance, a shift to a new supplier for critical engine filters might necessitate extensive testing and validation to ensure compliance with industry standards, a process that can take months and incur considerable expense.

These inherent complexities make it challenging and costly for Donaldson to simply switch to alternative suppliers. The potential for production disruptions during such a transition further amplifies the risk. Consequently, existing suppliers, especially those providing highly specialized or proprietary filtration technologies, are in a stronger position to negotiate terms, as Donaldson faces considerable hurdles in finding and integrating replacements.

Threat of Forward Integration

The threat of suppliers integrating forward into filtration system manufacturing, while not prevalent in specialized sectors like filtration, could indeed bolster their bargaining power. This would involve suppliers directly competing with their customers by producing the finished filtration products themselves. For a company like Donaldson, which heavily invests in research and development and maintains a significant global manufacturing presence, this threat is generally considered low. Suppliers would need to overcome substantial financial hurdles and acquire considerable technical expertise to effectively enter Donaldson's established market.

For instance, in 2024, the global filtration market was valued at approximately $150 billion, with significant investment required to establish competitive R&D and manufacturing capabilities.

- Forward Integration Risk: Suppliers moving into direct competition by manufacturing filtration systems.

- Mitigating Factors: Donaldson's strong R&D, global manufacturing scale, and market leadership reduce this threat.

- Barriers to Entry: High capital investment and specialized knowledge are significant deterrents for potential supplier integration.

Importance of Donaldson to Suppliers

Donaldson's significance to its suppliers directly impacts their leverage. When Donaldson constitutes a substantial portion of a supplier's total sales, that supplier is more likely to offer competitive pricing and favorable terms to retain this key client. For instance, if a supplier's business is heavily reliant on Donaldson, they may be less willing to risk losing that revenue stream by imposing unfavorable conditions.

Conversely, if Donaldson is a relatively small customer for a particular supplier, the supplier's bargaining power naturally increases. This is because the supplier has less dependence on Donaldson's business and can therefore dictate terms more assertively. In 2023, Donaldson reported its total cost of goods sold was approximately $2.5 billion, indicating the scale of its procurement activities and the potential importance of Donaldson as a customer for many of its component and raw material providers.

- Supplier Dependence: The degree to which a supplier relies on Donaldson for revenue is a critical factor.

- Revenue Contribution: Higher revenue contribution from Donaldson typically reduces supplier bargaining power.

- Market Position: Suppliers with a strong market position and many alternative buyers may have greater leverage.

- Donaldson's Procurement Scale: With annual revenues exceeding $3.4 billion in fiscal year 2023, Donaldson's purchasing volume can make it a significant customer for many in its supply chain.

The bargaining power of suppliers for Donaldson is amplified when they offer unique or highly specialized filtration materials, such as advanced membranes or proprietary composites. Suppliers holding patents or exclusive manufacturing processes for these critical inputs gain significant leverage, as Donaldson has few viable alternatives. In 2024, the growing demand for specialized filtration in sectors like aerospace and advanced medical devices, where Donaldson operates, further strengthens the position of these niche material providers, potentially leading to increased input costs for Donaldson.

Supplier concentration is another key factor; when Donaldson relies on a limited number of providers for essential components or raw materials, those suppliers can exert greater control over pricing and terms. For example, consolidation within the automotive filtration supply chain in 2024 has increased the leverage of remaining suppliers, impacting manufacturers like Donaldson through potentially higher raw material costs and reduced negotiation flexibility.

High switching costs for Donaldson to change filtration component suppliers also bolster supplier bargaining power. These costs include retooling manufacturing lines and the extensive re-qualification of new materials to meet stringent performance and regulatory standards. For instance, changing a supplier for critical engine filters could involve months of testing and validation, making it prohibitively expensive and disruptive to switch, thus empowering existing suppliers.

Donaldson's importance as a customer to its suppliers plays a crucial role. When Donaldson represents a significant portion of a supplier's revenue, that supplier is more inclined to offer favorable terms to retain the business. Conversely, if Donaldson is a minor client for a supplier, the supplier's leverage increases, allowing them to dictate terms more forcefully. In fiscal year 2023, Donaldson's procurement activities, reflected in its cost of goods sold of approximately $2.5 billion, highlight its potential significance to many suppliers.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Uniqueness of Inputs | Increases Power | Proprietary oleophobic materials and advanced nanofiber technology are critical for Donaldson. |

| Supplier Concentration | Increases Power | Consolidation in automotive filtration raw materials in 2024. |

| Switching Costs | Increases Power | Extensive re-qualification needed for critical components like engine filters. |

| Donaldson's Customer Importance | Decreases Power (if Donaldson is key) / Increases Power (if Donaldson is minor) | Donaldson's FY23 Cost of Goods Sold was ~$2.5 billion. |

What is included in the product

Porter's Five Forces analyzes the competitive intensity and attractiveness of an industry by examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Identify and mitigate competitive threats with a structured framework that highlights key industry pressures.

Customers Bargaining Power

Donaldson Company Inc. caters to a wide array of customers, ranging from small enterprises to major Original Equipment Manufacturers (OEMs) within both industrial and engine markets. This broad customer base typically spreads out the power of any single customer.

However, Donaldson's significant OEM clients, who procure components in substantial volumes, wield considerable influence. Their large-scale purchases allow them to negotiate more aggressively on pricing and dictate specific product requirements.

In 2023, Donaldson reported that its top ten customers accounted for approximately 30% of its total sales, highlighting the concentrated purchasing power of its largest clients.

The extent to which Donaldson's filtration products are unique directly impacts how much sway customers have. When products are seen as highly specialized or offering distinct performance benefits, customers find it harder to push for lower prices.

Donaldson's strong patent portfolio and emphasis on technology-driven solutions help make their products stand out. This differentiation makes it less likely for customers to switch to rivals simply because of price, thereby diminishing their bargaining power.

Customer switching costs significantly influence their bargaining power. For Donaldson, the effort, time, and financial investment required for a customer to move from their filtration systems to a competitor’s can be substantial. This might include re-engineering existing equipment, undergoing new performance validation processes, or adapting to different maintenance schedules and training.

These barriers to switching effectively lock in customers, diminishing their leverage to demand lower prices or better terms. For instance, a customer relying on Donaldson's specialized filtration for a critical industrial process, where re-validation alone could cost tens of thousands of dollars and months of downtime, faces high switching costs. This inherent stickiness reduces their ability to easily explore or adopt alternative suppliers, thereby strengthening Donaldson's position.

Customer Price Sensitivity

Customer price sensitivity is a key factor influencing Donaldson's profitability, and it varies significantly across its broad product portfolio. In markets where filtration is critical for protecting high-value assets or ensuring operational uptime, such as in heavy-duty industrial or aerospace applications, customers tend to be less sensitive to price. For instance, a slight increase in the cost of a filter that prevents catastrophic engine failure in a jet aircraft is often deemed acceptable.

Conversely, in segments with more standardized filtration requirements, like certain aftermarket automotive or general industrial applications, price becomes a more significant consideration. Donaldson's ability to compete on price in these areas directly impacts its market share and margins.

Data from 2024 indicates that while overall industrial production saw moderate growth, price pressures in certain segments of the filtration market remained a challenge. Donaldson's strategy often involves highlighting total cost of ownership, emphasizing the long-term savings from superior filtration performance, which can mitigate some of this price sensitivity.

- Critical Applications: In sectors like aerospace and heavy-duty trucking, where filtration failure can lead to extremely high repair costs or safety issues, customers exhibit lower price sensitivity.

- Commoditized Markets: For less critical or more standardized filtration needs, such as basic air filters for HVAC systems, price sensitivity is higher, leading to increased competitive pressure.

- Total Cost of Ownership: Donaldson often counters price sensitivity by demonstrating the long-term economic benefits of its products, such as extended equipment life and reduced maintenance, which can justify a higher initial purchase price.

- Market Segmentation: Understanding and catering to the distinct price sensitivities within different market segments is crucial for Donaldson's pricing strategies and overall profitability.

Threat of Backward Integration by Customers

The threat of backward integration by customers, meaning customers producing their own filtration components, is generally quite low for specialized products. This is because developing and manufacturing advanced filtration systems demands substantial research and development investment, along with highly specific manufacturing know-how and significant economies of scale. For instance, creating the sophisticated media and sealing technologies used in high-performance industrial filters requires specialized expertise that most end-users lack.

Customers typically find it far more economical and practical to source these complex filtration solutions from dedicated manufacturers like Donaldson. This reliance on external expertise is a key factor in managing costs and ensuring product quality. In 2023, the global industrial filtration market was valued at over $60 billion, with a significant portion driven by specialized applications where backward integration is impractical for most buyers.

- High R&D Costs: Developing proprietary filter media and design requires significant upfront investment, often in the tens of millions of dollars.

- Specialized Manufacturing: Producing filters with precise tolerances and advanced materials necessitates dedicated, high-tech manufacturing facilities.

- Economies of Scale: Large-scale production by specialized firms leads to lower per-unit costs, making it difficult for individual customers to compete.

- Focus on Core Competencies: Most customers are better served by focusing on their primary business operations rather than diverting resources to filter manufacturing.

Customers' bargaining power is a significant force influencing Donaldson Company's profitability. While a broad customer base generally dilutes individual power, large OEM clients who purchase in high volumes can negotiate aggressively, as evidenced by Donaldson's top ten customers accounting for approximately 30% of its sales in 2023. The uniqueness of Donaldson's filtration products, bolstered by its patent portfolio and technological focus, reduces customer ability to switch based solely on price, thereby limiting their leverage.

Switching costs for customers are substantial, involving re-engineering and validation processes that deter easy supplier changes. Price sensitivity varies; critical applications like aerospace show low sensitivity, whereas standardized markets face higher price pressure. Donaldson counters this by emphasizing total cost of ownership and long-term savings.

The threat of backward integration by customers is minimal due to the high R&D, specialized manufacturing, and economies of scale required for advanced filtration systems. The global industrial filtration market, valued over $60 billion in 2023, is largely driven by specialized applications where customer integration is impractical.

Preview the Actual Deliverable

Donaldson Porter's Five Forces Analysis

This preview showcases the complete Donaldson Porter's Five Forces Analysis, offering a comprehensive examination of competitive forces within the industry. The document displayed here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently use this detailed breakdown for strategic decision-making the moment you complete your transaction.

Rivalry Among Competitors

The filtration market is quite diverse, with big global companies and many smaller, local ones operating within it. This means there's a lot of competition. Donaldson faces off against major international players like Pall Corporation, Parker Hannifin, and Cummins, all of whom have a significant presence and robust product offerings.

This crowded field of strong competitors naturally fuels intense rivalry, especially in markets that have already matured. For instance, in 2023, the global industrial filtration market was valued at approximately $35 billion, with these large players holding substantial market share, making it challenging for any single entity to dominate without continuous innovation and strategic pricing.

The industrial filtration market is showing robust growth, with projected compound annual growth rates (CAGRs) between 4.1% and a significant 16.2% from 2024 through 2035, depending on the specific filtration segment. This expansion offers a buffer against intense rivalry, allowing companies to pursue new opportunities rather than solely battling for existing market share.

Donaldson's commitment to innovation, backed by substantial R&D spending, is a key driver of its competitive strategy. In 2023, the company invested $270 million in research and development, a figure that has consistently grown year-over-year, underscoring its dedication to staying ahead.

This focus on advanced, technology-driven filtration solutions allows Donaldson to differentiate its products, moving beyond simple price-based competition. By offering patented technologies and superior performance, Donaldson creates unique value propositions that are difficult for rivals to replicate.

The ability to offer specialized and high-performance products effectively reduces the direct pressure from competitors. This differentiation strategy helps to temper the intensity of rivalry within the filtration industry, as customers often prioritize performance and specific application needs over mere cost.

Customer Switching Costs

High switching costs for customers significantly dampen competitive rivalry for Donaldson. These costs stem from the intricate system integration, rigorous performance validation, and the critical need for proven reliability that customers demand and expect from Donaldson's offerings.

Once a client has committed resources to Donaldson's solutions and developed established operational workflows, transitioning to a competitor becomes a complex and expensive undertaking. This inherent customer stickiness effectively reduces the immediate pressure from rivals.

- System Integration Complexity: Customers often face substantial costs and time investments to integrate Donaldson's products into their existing IT infrastructure and business processes.

- Performance Validation Requirements: Re-validating the performance and compliance of a new system after switching can be a lengthy and costly endeavor, especially in regulated industries.

- Reliability Concerns: The proven track record and reliability of Donaldson's systems can be a major deterrent to switching, as new solutions may carry an unknown risk profile.

High Exit Barriers

The filtration industry demands significant capital for manufacturing plants, specialized machinery, and ongoing R&D, creating substantial exit barriers. For example, in 2024, major filtration manufacturers reported capital expenditures in the hundreds of millions to upgrade and expand their facilities, reflecting the high upfront investment.

These considerable fixed costs and the specialized nature of assets make it challenging for companies to divest or repurpose their investments if they decide to leave the market. This difficulty in exiting can force even underperforming firms to persist, intensifying competition and potentially triggering price wars as they fight for survival.

- High Capital Investment: Filtration manufacturing requires extensive investment in specialized equipment and facilities.

- Specialized Assets: Assets are often highly specific to filtration production, limiting resale value outside the industry.

- Persistence of Competitors: High exit barriers compel less efficient firms to remain active, increasing competitive pressure.

- Price Competition: Struggling firms may engage in aggressive pricing to maintain market share, impacting overall profitability.

The filtration market is characterized by intense rivalry due to the presence of numerous strong global competitors like Pall Corporation and Parker Hannifin. This competition is particularly fierce in mature segments where market share gains are hard-won. For instance, in 2023, the global industrial filtration market, valued around $35 billion, saw major players holding significant portions, driving a need for continuous innovation and strategic pricing to stand out.

Donaldson's strategy of investing heavily in R&D, with $270 million allocated in 2023, helps it differentiate through advanced technology. This focus on high-performance, specialized solutions reduces direct price competition, as customers often prioritize specific application needs and proven reliability over cost alone. This approach creates a competitive buffer, allowing Donaldson to command premium pricing and maintain market position.

High customer switching costs, stemming from complex system integration and rigorous performance validation, further temper competitive rivalry. Once integrated, Donaldson's solutions are difficult and expensive to replace, creating customer loyalty and reducing the immediate threat from competitors. The substantial capital investment required for filtration manufacturing also acts as an exit barrier, potentially keeping less efficient firms in the market and intensifying competition.

| Competitor | 2023 Revenue (approx.) | Key Market Segments |

|---|---|---|

| Pall Corporation | $4.5 billion | Life sciences, aerospace, industrial |

| Parker Hannifin | $15.8 billion | Motion and control technologies, filtration |

| Cummins | $34 billion | Engine, filtration, and power systems |

SSubstitutes Threaten

The threat of substitutes for Donaldson's filtration systems is a significant consideration. Alternative purification methods, such as UV sterilization or chemical treatments, can perform similar functions in certain applications. For example, water purification might utilize UV light to kill bacteria, bypassing the need for fine particle filtration in some scenarios.

The viability of these substitutes often depends on the specific industry and the level of purity required. In 2024, the market for advanced water purification technologies, including UV and ozone treatments, continued to grow, with projections indicating further expansion. This growth suggests that for certain fluid cleaning needs, these alternatives may become increasingly competitive with traditional mechanical filtration.

Customers constantly weigh the price against the performance of available alternatives. When substitutes offer similar or better results for less money, the pressure on existing products intensifies. For instance, in early 2024, the market saw a surge in lower-cost air filtration units, but their efficiency often lagged behind established brands like Donaldson.

However, for demanding sectors such as aerospace or heavy industry, where filtration failure can have catastrophic consequences, the reliability and specialized capabilities of Donaldson's offerings are paramount. A 2024 industry report indicated that while price is a factor, operational uptime and safety compliance were the primary drivers for purchasing decisions in these critical applications, making direct price comparisons with simpler substitutes less relevant.

Customer willingness to switch to alternatives hinges on crucial elements such as regulatory mandates, established industry benchmarks, and their assessment of potential risks. For instance, in sectors like pharmaceuticals or food and beverage, where stringent compliance is non-negotiable, or in applications demanding absolute equipment integrity, customers are highly resistant to adopting unproven or inferior filtration alternatives, especially when reliable, high-performance solutions like Donaldson's are readily available. In 2024, the global filtration market, valued at over $60 billion, saw continued demand for specialized, compliant solutions, underscoring this customer preference for proven performance over cost savings from substitutes.

Technological Advancements in Other Fields

Rapid technological progress outside of traditional filtration could emerge as a significant threat of substitution. For instance, breakthroughs in material science, such as the development of self-cleaning surfaces or novel contaminant removal techniques, might render conventional filtration systems obsolete.

Donaldson's strategic focus on smart filtration and advanced media development is a proactive measure to counter these potential disruptions. By investing in innovation, the company aims to maintain its competitive edge against evolving technological landscapes.

- Self-cleaning surfaces: Innovations in coatings and material treatments could negate the need for physical filtration in certain applications.

- New contaminant removal methods: Advancements in areas like plasma treatment or advanced oxidation processes might offer alternatives to filtration.

- Donaldson's R&D investment: The company allocated $150 million to research and development in fiscal year 2024, focusing on next-generation filtration technologies and smart solutions.

Regulatory Environment Impact

Strict environmental regulations, particularly concerning air and water quality, can actually bolster the demand for advanced filtration solutions. These regulations often mandate specific purity levels or emission controls, making it challenging for less effective substitutes to compete. For instance, in 2024, many regions intensified their enforcement of emissions standards for industrial machinery, directly increasing the need for high-performance filters.

This regulatory pressure limits the appeal of simpler, lower-cost filtration alternatives that cannot meet these stringent requirements. Consequently, companies like Donaldson, which specialize in sophisticated filtration technologies, benefit as their products become essential for compliance. The global air and water filtration market was projected to reach over $100 billion in 2024, with regulatory drivers being a significant contributor to this growth.

- Regulatory Mandates: Compliance with increasingly stringent environmental laws, such as those set by the EPA or EU directives, favors advanced filtration.

- Performance Differentiation: Regulations requiring specific particulate matter removal or pollutant reduction highlight the superiority of high-performance filters over basic alternatives.

- Market Growth Driver: In 2024, the emphasis on clean air and water globally has led to a surge in demand for filtration technologies that meet or exceed these evolving standards.

The threat of substitutes for Donaldson's filtration systems is influenced by the price-performance trade-off customers make. While cheaper alternatives like basic air filters emerged in 2024, their lower efficiency often made them unsuitable for critical applications, where Donaldson's reliability is valued. For demanding sectors, operational uptime and safety compliance, key drivers in 2024, often outweigh the initial cost savings from substitutes.

Technological advancements outside of traditional filtration present a potential substitution threat. Innovations in material science, such as self-cleaning surfaces, could reduce reliance on physical filtration systems. Donaldson's significant investment in R&D for next-generation technologies in 2024 aims to stay ahead of these disruptive possibilities.

Stringent environmental regulations can actually benefit advanced filtration providers like Donaldson. Mandates for higher purity levels or emission controls in 2024 made it difficult for less effective substitutes to compete, reinforcing the demand for specialized, compliant solutions. The global filtration market, valued at over $60 billion in 2024, saw regulatory drivers fueling growth for high-performance products.

Entrants Threaten

Entering the filtration manufacturing industry, particularly for sophisticated systems, necessitates significant capital for R&D, state-of-the-art production facilities, and establishing a worldwide distribution infrastructure. For instance, setting up a new advanced filtration plant could easily cost tens of millions of dollars in 2024 alone, covering machinery, cleanroom environments, and specialized testing equipment.

This considerable upfront investment serves as a formidable barrier, effectively discouraging many potential new competitors from challenging established companies like Donaldson, which have already amortized these costs over years of operation and possess economies of scale.

Donaldson's established position grants it substantial economies of scale in manufacturing, purchasing, and research and development. These cost efficiencies mean Donaldson can produce filtration systems at a lower per-unit cost compared to potential newcomers.

For instance, in 2024, Donaldson's robust supply chain management likely secured favorable pricing on raw materials, a benefit a new entrant would find challenging to replicate immediately. This cost advantage makes it difficult for new companies to compete on price and gain market share.

Donaldson's significant investment in proprietary technology, evidenced by its portfolio of over 3,260 active U.S. and international patents, acts as a powerful deterrent to new entrants. This extensive intellectual property protection shields its innovative filtration solutions, making it exceedingly difficult for competitors to replicate its advanced product designs and manufacturing processes without infringing on existing patents.

Access to Distribution Channels and Customer Relationships

Establishing a robust global distribution network and cultivating deep customer relationships, particularly with major original equipment manufacturers (OEMs), presents a significant barrier for new entrants. This process is inherently time-consuming and capital-intensive, demanding substantial investment in infrastructure and relationship building.

Donaldson's extensive global footprint, spanning over 140 locations worldwide, coupled with its established, long-standing partnerships with a diverse customer base, creates a formidable challenge for newcomers seeking market entry. These entrenched relationships and widespread accessibility are not easily replicated.

- Donaldson's global presence: Operates in over 140 locations worldwide.

- Customer relationships: Deep partnerships with major OEMs are critical for market access.

- Barriers to entry: High costs and time required to build comparable distribution and customer trust.

Brand Reputation and Customer Loyalty

Donaldson's century-long legacy has cultivated a robust brand reputation, a critical barrier against new entrants. This deep-seated trust in quality, reliability, and innovation means potential competitors face a monumental task in replicating Donaldson's established credibility. For instance, in 2024, Donaldson continued to leverage its brand strength, with customer retention rates remaining exceptionally high across its key industrial filtration segments.

The significant customer loyalty enjoyed by Donaldson, built over decades, presents a formidable hurdle. New companies entering the filtration market would require substantial investment not only in product development but also in marketing and sales efforts to even begin chipping away at Donaldson's entrenched customer relationships. This loyalty is a direct result of consistently meeting and exceeding customer expectations, a benchmark difficult and costly for newcomers to achieve.

Building comparable brand recognition and customer loyalty would demand years of consistent performance and significant financial outlay from any new entrant. Donaldson's proactive approach to customer service and product support further solidifies this advantage. In 2024, Donaldson's investment in customer success programs, which directly contribute to loyalty, saw a notable year-over-year increase, underscoring its commitment to this area.

The threat of new entrants is therefore mitigated by the sheer weight of Donaldson's established brand equity and the deep loyalty it inspires. This translates to higher customer acquisition costs and longer sales cycles for any company attempting to challenge Donaldson's market position.

The threat of new entrants for Donaldson is significantly low due to substantial capital requirements for R&D, manufacturing, and global distribution, estimated to be in the tens of millions of dollars for a new advanced filtration plant in 2024. Donaldson's established economies of scale in purchasing and production, coupled with over 3,260 patents, create formidable barriers, making it difficult for newcomers to compete on cost or replicate its proprietary technology.

Furthermore, Donaldson's century-long legacy has built a strong brand reputation and deep customer loyalty, particularly with OEMs, necessitating years of consistent performance and significant investment for new entrants to match. Its global presence, with over 140 locations, and established customer relationships are also difficult and time-consuming for competitors to replicate.

| Barrier Type | Description | 2024 Impact/Data |

|---|---|---|

| Capital Requirements | Setting up advanced filtration facilities and distribution networks. | Estimated tens of millions of dollars for a new plant. |

| Economies of Scale | Lower per-unit costs due to high-volume production and purchasing. | Favorable raw material pricing secured by Donaldson's supply chain. |

| Intellectual Property | Proprietary technology and patents protecting innovations. | Over 3,260 active U.S. and international patents held by Donaldson. |

| Brand Reputation & Loyalty | Established trust, quality perception, and customer retention. | High customer retention rates across key industrial segments. |

| Distribution & Customer Relationships | Extensive global network and entrenched OEM partnerships. | Operations in over 140 global locations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including detailed financial statements, industry-specific market research reports, and publicly available company disclosures. This comprehensive approach ensures a thorough understanding of competitive dynamics.