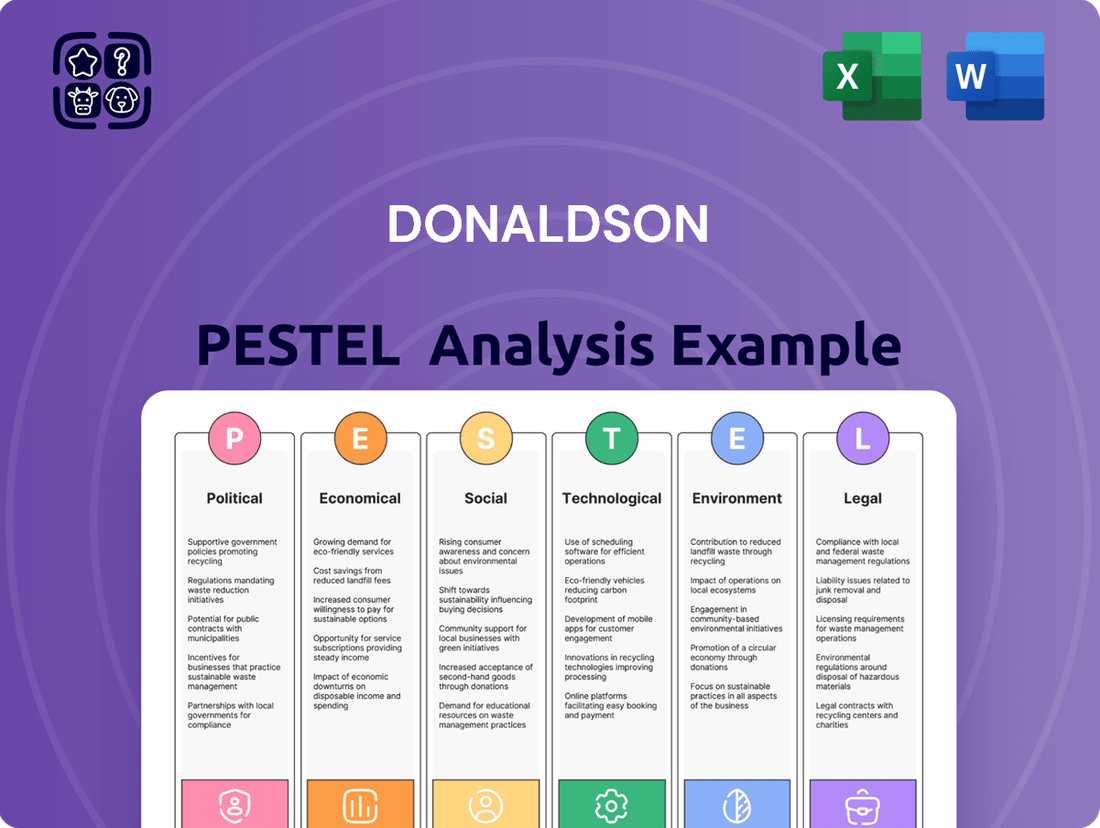

Donaldson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

Unlock the critical external factors shaping Donaldson's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play to anticipate challenges and seize opportunities. Purchase the full report for actionable insights and a strategic advantage in your market analysis.

Political factors

Government regulations, particularly concerning manufacturing standards and emissions, directly shape Donaldson's operational landscape. For instance, evolving environmental regulations in major markets like the European Union, with its stringent emission targets for industrial equipment, necessitate ongoing investment in cleaner technologies, impacting production costs and product design.

Trade policies and agreements are equally critical. Changes in tariffs, such as those that may arise from ongoing trade discussions between major economic blocs, can significantly alter the cost of imported components and the competitiveness of Donaldson's finished goods. In 2024, global trade tensions continue to create uncertainty, with potential for retaliatory tariffs impacting supply chains for companies like Donaldson.

Furthermore, political stability in regions where Donaldson has significant manufacturing or sales presence is paramount. Instability can disrupt supply chains, as seen in certain parts of Southeast Asia in recent years, and deter new capital investments, directly affecting long-term growth strategies and operational continuity.

Global geopolitical tensions, such as those in Eastern Europe and the Middle East, continue to pose significant risks to supply chains and international trade. These disruptions can directly impact Donaldson's operational costs, including increased shipping expenses and potential delays in component sourcing, affecting its ability to meet global demand for filtration solutions.

The ongoing conflicts and the resulting sanctions or trade restrictions necessitate careful strategic planning for Donaldson to maintain its market access and operational continuity. For instance, the impact of sanctions on raw material availability or export markets in affected regions requires agile adaptation to preserve its international footprint and revenue streams.

Shifts in national security priorities due to regional instability can also influence industrial investment trends. Governments may redirect resources towards defense or critical infrastructure, potentially altering the landscape for industrial equipment demand, which in turn affects the market for Donaldson's products.

Government investments in infrastructure projects, like roads and public transportation, are significant drivers for Donaldson. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in late 2021, allocates over $1.2 trillion, with a substantial portion dedicated to transportation and infrastructure upgrades. This directly fuels demand for heavy-duty trucks and construction equipment, key markets for Donaldson's engine filtration products.

Furthermore, stimulus packages aimed at modernizing industrial facilities can also bolster demand for industrial filtration systems. These government-led initiatives often translate into stable, long-term demand for filtration solutions as new projects commence and existing ones are upgraded, ensuring a consistent need for Donaldson's offerings.

Industrial Policy and Subsidies

National industrial policies, such as those aimed at boosting domestic manufacturing or promoting green technologies, can significantly shape the operating landscape for Donaldson. For instance, the US Industrial Strategy, with its focus on advanced manufacturing and clean energy, could create opportunities for Donaldson's filtration solutions in these growing sectors. Similarly, subsidies directed towards industries that are major consumers of Donaldson's products, like the automotive sector, can indirectly drive demand for their filtration systems. In 2024, the automotive industry saw continued investment in electric vehicle production, a trend that relies heavily on advanced filtration for battery manufacturing and component cooling.

Conversely, government policies that favor competitors or alternative technologies present a potential risk. If a nation were to heavily subsidize a competing filtration technology or impose regulations that disadvantage Donaldson's current product lines, it could negatively impact market share. The ongoing global push for sustainability and reduced emissions means that policies favoring new, potentially less established, filtration methods could emerge, requiring Donaldson to adapt its offerings.

Key considerations regarding industrial policy and subsidies include:

- Incentives for domestic manufacturing: Policies encouraging local production can benefit Donaldson if it has a manufacturing presence in those regions, or create competition if it doesn't.

- Subsidies for key end-user industries: Government support for sectors like automotive, mining, or renewable energy directly influences demand for Donaldson's filtration products. For example, the Inflation Reduction Act in the US provides significant tax credits for clean energy manufacturing, potentially boosting demand for filtration in those supply chains.

- Support for competing technologies: The risk of government backing for alternative filtration methods necessitates continuous innovation and market monitoring by Donaldson.

Political Risk in Emerging Markets

Donaldson’s operations in emerging markets are subject to heightened political risk, a common challenge in these dynamic economies. This includes the potential for sudden policy shifts, evolving regulatory frameworks, and, in extreme cases, government expropriation of assets, known as nationalization. For instance, in 2024, several emerging economies saw significant regulatory overhauls impacting foreign investment, with some sectors experiencing unexpected nationalization trends, particularly in resource-rich nations.

While these markets present substantial growth prospects, the inherent political volatility necessitates a robust approach to risk management. Donaldson must continuously monitor the political climate and adapt its strategies accordingly. A report from the World Bank in late 2024 highlighted that countries with unstable political environments often experience lower foreign direct investment (FDI) inflows, underscoring the financial implications of political uncertainty.

- Policy Instability: Emerging markets may experience frequent changes in government policies, affecting business operations and investment strategies.

- Regulatory Changes: New laws and regulations can be introduced with little notice, impacting compliance costs and market access.

- Nationalization Risk: In some regions, there's a risk of governments taking control of private assets, particularly in strategic industries.

- Geopolitical Tensions: Regional conflicts or international disputes can disrupt supply chains and create economic instability.

Government policies significantly influence Donaldson's market access and operational costs through trade agreements, tariffs, and subsidies. For example, evolving environmental regulations, like the EU's stringent emission targets, necessitate continuous investment in cleaner technologies, impacting production costs and product design. In 2024, global trade tensions and potential retaliatory tariffs continue to create supply chain uncertainties.

Political stability in key operational regions is crucial for supply chain continuity and capital investment. Geopolitical tensions, such as those in Eastern Europe, directly impact operational costs through increased shipping expenses and potential component sourcing delays, affecting Donaldson's ability to meet global demand.

Government investments in infrastructure and industrial modernization, like the U.S. Infrastructure Investment and Jobs Act, directly fuel demand for heavy-duty and construction equipment, key markets for Donaldson's filtration products. National industrial policies promoting advanced manufacturing and clean energy also create opportunities for Donaldson's filtration solutions.

Donaldson faces political risks in emerging markets, including policy instability and regulatory changes. For instance, in 2024, several emerging economies experienced significant regulatory overhauls impacting foreign investment, with some sectors seeing nationalization trends, particularly in resource-rich nations.

| Political Factor | Impact on Donaldson | 2024/2025 Data/Trend |

|---|---|---|

| Environmental Regulations | Increased R&D and production costs for cleaner technologies. | EU emission targets driving investment in advanced filtration. |

| Trade Policies & Tariffs | Affects component costs and product competitiveness. | Ongoing global trade tensions create supply chain uncertainty. |

| Political Stability | Disrupts supply chains and impacts investment decisions. | Geopolitical tensions in Eastern Europe increase shipping costs. |

| Infrastructure Spending | Drives demand for Donaldson's filtration in heavy equipment. | U.S. Infrastructure Act ($1.2T+) boosts demand for construction equipment. |

| Industrial Policy (e.g., Clean Energy) | Creates opportunities in growing sectors. | U.S. Inflation Reduction Act incentivizes clean energy manufacturing. |

| Emerging Market Risks | Policy shifts, regulatory changes, nationalization risks. | Increased regulatory overhauls and nationalization trends observed in some emerging economies. |

What is included in the product

The Donaldson PESTLE analysis systematically examines the external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that influence the company's operations and strategic direction.

The Donaldson PESTLE Analysis offers a structured framework that alleviates the pain of overwhelming external data by providing a clear, actionable overview for strategic decision-making.

Economic factors

Global economic growth significantly impacts Donaldson's filtration business. In 2024, the IMF projected global growth at 3.2%, a modest but stable figure. This expansion fuels industrial output, directly boosting demand for Donaldson's systems in sectors like manufacturing and construction.

Industrial production is a key driver. For instance, the US Industrial Production Index saw a 0.9% increase in April 2024 compared to the previous year, indicating a healthy demand environment for filtration solutions in original equipment and aftermarket sales.

Conversely, economic downturns present challenges. A slowdown in global manufacturing, which was observed in some regions during late 2023 and early 2024, can lead to reduced capital expenditures and consequently lower demand for new filtration systems.

Fluctuations in the prices of essential raw materials like steel, aluminum, and specialized filter media directly affect Donaldson's manufacturing expenses. For instance, the London Metal Exchange saw aluminum prices average around $2,400 per metric ton in early 2024, a notable increase from previous years, impacting the cost of components for Donaldson's filtration systems.

Inflationary trends in energy and labor further squeeze profit margins. In the US, the Consumer Price Index (CPI) for energy services saw a significant uptick in late 2023 and early 2024, while wage growth continued, adding to operational overheads for Donaldson's manufacturing facilities.

Donaldson's ability to secure stable, cost-effective supplies of these critical inputs is paramount. The company's strategic sourcing and inventory management practices are therefore crucial for mitigating the impact of these volatile economic factors on its financial performance.

Currency exchange rate volatility presents a significant economic factor for global companies like Donaldson. Fluctuations in exchange rates directly impact the translation of international revenues and profits back into U.S. dollars, potentially distorting reported financial performance. For instance, a stronger U.S. dollar in 2024 could make Donaldson's products pricier for international customers, potentially dampening sales volumes in key overseas markets.

To navigate this risk, Donaldson likely employs hedging strategies. These financial instruments aim to lock in exchange rates for future transactions, thereby reducing the uncertainty and potential negative impact of currency movements on profitability. For example, forward contracts or currency options can be utilized to manage exposure to major trading currencies.

Interest Rates and Access to Capital

Global interest rates significantly impact Donaldson's cost of capital. For instance, the US Federal Reserve maintained its benchmark interest rate in the 4.75%-5.00% range through early 2024, a level that could increase borrowing expenses for large capital projects. Fluctuations in these rates directly affect Donaldson's ability to finance expansions or strategic acquisitions, as well as influence the investment appetite of its industrial clientele.

Higher borrowing costs can dampen demand for Donaldson's products. When interest rates climb, as seen with the Bank of England's base rate reaching 5.25% in late 2023, industrial customers may postpone or scale back investments in new machinery or facility upgrades. This slowdown in capital expenditure directly translates to reduced sales opportunities for Donaldson's filtration systems and related services.

Access to affordable capital remains a critical enabler for Donaldson's growth strategies. Companies relying on external financing for research and development, market expansion, or capacity increases are particularly sensitive to interest rate environments. For example, in the Eurozone, the European Central Bank's policy rates influenced borrowing conditions throughout 2024, impacting the feasibility of Donaldson's planned growth initiatives.

- Interest Rate Impact: Central bank policies, such as the US Federal Reserve's target rate of 5.25%-5.50% in early 2024, directly affect Donaldson's borrowing costs for capital expenditures.

- Customer Investment: Elevated interest rates, like the Bank of England's 5.25% base rate in late 2023, can deter industrial customers from investing in new equipment, potentially slowing demand for Donaldson's solutions.

- Capital Access: The availability of affordable capital is crucial for Donaldson's growth, with European Central Bank rates influencing financing accessibility for expansion projects in 2024.

Consumer and Industrial Spending Trends

Consumer spending habits are evolving, with a noticeable shift towards durable goods and services. For instance, in Q1 2024, U.S. retail sales saw a 0.7% increase month-over-month, indicating robust consumer demand, which can indirectly impact the need for new vehicles and equipment, thus influencing the engine filtration market.

Industrial spending, specifically capital expenditures, is a more direct driver for filtration solutions. In 2024, global capital expenditure in manufacturing is projected to grow by approximately 5%, driven by investments in automation and efficiency upgrades. This expansion in industrial activity directly correlates with increased demand for industrial filtration systems across sectors like mining and agriculture.

The cyclical nature of capital expenditure in heavy industries significantly shapes the demand for industrial filtration. For example, a slowdown in mining investment, which saw a dip in 2023 due to commodity price volatility, can lead to reduced demand for heavy-duty filtration equipment. Conversely, a rebound in agricultural machinery sales, which were up 10% year-over-year in early 2024 in North America, boosts the need for engine filters.

- Consumer spending on vehicles and equipment: A 3% increase in new vehicle sales in the US during the first half of 2024 suggests a healthier demand environment.

- Industrial capital expenditure: Global manufacturing CAPEX is expected to reach $1.5 trillion in 2024, with a significant portion allocated to machinery and equipment.

- Sector-specific trends: The mining sector's CAPEX plans for 2024 indicate a 7% increase in equipment upgrades, directly benefiting filtration suppliers.

- Agricultural machinery demand: The agricultural sector saw a 12% rise in new tractor sales in 2024, signaling increased activity and filter replacement needs.

Global economic growth influences Donaldson's sales. The IMF projected global growth at 3.2% for 2024, supporting industrial activity. However, inflation and raw material costs, like aluminum averaging $2,400/metric ton in early 2024, impact manufacturing expenses and pricing strategies.

Interest rate policies, such as the US Federal Reserve's 5.25%-5.50% target range in early 2024, affect Donaldson's borrowing costs and customer investment decisions. Currency fluctuations also present a risk, with a strong dollar potentially making products more expensive internationally.

Industrial capital expenditure, projected to grow by 5% globally in manufacturing for 2024, is a key driver for filtration demand. Trends in sectors like agriculture, with a 12% rise in new tractor sales in 2024, directly translate to increased filter replacement needs.

| Economic Factor | Data Point (2024 unless specified) | Impact on Donaldson |

|---|---|---|

| Global GDP Growth | IMF projection: 3.2% | Supports industrial demand for filtration systems. |

| Aluminum Prices | Average early 2024: ~$2,400/metric ton | Increases raw material costs for manufacturing. |

| US Federal Funds Rate | Target range early 2024: 5.25%-5.50% | Affects borrowing costs and customer capital investment. |

| Agricultural Machinery Sales | North America early 2024: +10% YoY | Boosts demand for engine filters and related services. |

Same Document Delivered

Donaldson PESTLE Analysis

The preview shown here is the exact Donaldson PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Donaldson's operations. You'll gain valuable insights into the strategic landscape surrounding this industry leader.

Sociological factors

Growing public and industrial awareness regarding air quality, workplace safety, and environmental health is a significant driver for Donaldson. This heightened consciousness fuels demand for advanced filtration solutions that Donaldson specializes in, as seen in the increasing adoption of industrial dust collection systems. For instance, the global industrial dust collectors market was valued at approximately $4.8 billion in 2023 and is projected to reach over $7.5 billion by 2030, indicating substantial growth in this sector.

Companies are facing mounting pressure from employees, unions, and regulatory bodies to ensure cleaner and safer working environments. This translates into greater investment in industrial dust collection and air purification systems, directly benefiting Donaldson. The Occupational Safety and Health Administration (OSHA) in the US continues to enforce stricter regulations on airborne contaminants, pushing businesses towards better filtration technologies.

This societal trend of prioritizing health and safety aligns perfectly with Donaldson's core mission to enhance air and fluid quality. As environmental, social, and governance (ESG) factors become more critical for corporate reporting and investor relations, companies are actively seeking solutions that improve their health and safety profiles, creating a favorable market for Donaldson's products and expertise.

Developed nations, including key markets for Donaldson, are experiencing an aging workforce. For instance, in the US, the median age of workers has been steadily increasing, with projections indicating a significant portion of the workforce will be over 55 by 2030. This demographic shift directly impacts the availability of experienced labor for manufacturing and technical roles, potentially creating skill gaps that Donaldson must address.

Simultaneously, there's a pronounced shortage of skilled labor in critical sectors like advanced manufacturing and specialized technical trades. Data from industry reports in 2024 highlights a growing deficit in qualified technicians and engineers, which are vital for Donaldson's R&D, production, and field service operations. This scarcity can hinder the company's ability to innovate and deliver its complex filtration solutions efficiently.

To counter these workforce challenges, Donaldson can leverage automation in its manufacturing processes to offset labor shortages and enhance productivity. Furthermore, investing in robust training and upskilling programs for its existing and new employees is paramount. These initiatives will ensure a pipeline of skilled talent capable of supporting the company's growth and maintaining its competitive edge in delivering sophisticated filtration technologies.

Donaldson's growth is significantly influenced by ongoing urbanization and industrialization, especially in emerging markets. These trends fuel demand for infrastructure, construction, and manufacturing, all sectors where Donaldson's filtration solutions are essential. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, presenting a vast and expanding customer base.

This demographic shift translates directly into new market opportunities for Donaldson, particularly in rapidly developing economies experiencing economic expansion. As cities grow and industries scale up, the need for clean air and efficient industrial processes, supported by advanced filtration technology, becomes paramount. This expansion, however, is often accompanied by increased localized pollution, creating both a need for Donaldson's products and a complex regulatory landscape to navigate.

Societal Expectations for Corporate Responsibility

Societal expectations for corporate responsibility are increasingly influencing business operations. Consumers and investors alike are demanding that companies demonstrate strong ethical labor practices, actively engage with their communities, and prioritize sustainable operations. For Donaldson, showcasing a genuine commitment to corporate social responsibility, which includes transparent reporting on environmental and social impacts, is crucial for bolstering its brand reputation. This focus can also attract socially conscious investors and customers, a trend amplified by the rise of ESG (Environmental, Social, and Governance) investing, which saw global sustainable investment assets reach an estimated $37.8 trillion in 2024, according to the Global Sustainable Investment Alliance.

Ignoring these evolving societal demands carries significant risks. A failure to meet expectations regarding ethical conduct or environmental stewardship can result in substantial reputational damage, potentially impacting sales, talent acquisition, and investor confidence. For instance, in 2024, several major corporations faced public backlash and boycotts due to perceived shortcomings in their supply chain labor practices, leading to a noticeable decline in their market value.

- Growing Demand for Ethical Practices: Consumers increasingly favor brands that align with their values, with studies in 2024 indicating over 60% of consumers are willing to pay more for sustainable products.

- Investor Scrutiny: Institutional investors are integrating ESG factors into their decision-making, with a significant portion of pension funds and asset managers actively seeking companies with strong CSR track records.

- Reputational Risk: Negative publicity stemming from irresponsible corporate behavior can erode brand loyalty and market share, as evidenced by several high-profile cases in the past year.

- Community Engagement: Positive community involvement builds goodwill and can lead to stronger local relationships, contributing to a company's social license to operate.

Preference for Sustainable and Eco-friendly Solutions

Consumers are increasingly prioritizing products that are kind to the planet, and this shift significantly impacts purchasing choices. For Donaldson, this means a growing demand for filtration solutions that are energy-efficient, made from recyclable materials, or simply have a lower environmental footprint.

This societal preference acts as a powerful catalyst for innovation within Donaldson. The company is encouraged to develop and promote filtration technologies that align with these green values, potentially leading to new product lines and enhanced brand reputation. For instance, a 2024 report indicated that 78% of consumers globally consider sustainability a key factor when making purchasing decisions.

- Growing Consumer Demand: A significant majority of consumers actively seek out environmentally responsible products.

- Innovation Driver: This trend pushes Donaldson to invest in and develop sustainable filtration technologies.

- Competitive Edge: Offering eco-friendly solutions can differentiate Donaldson and capture market share in the burgeoning green economy.

- Market Expansion: New market segments focused on sustainable and circular economy principles are becoming increasingly accessible.

Societal expectations for corporate responsibility are increasingly influencing business operations, with consumers and investors demanding ethical labor practices and sustainable operations. Donaldson's commitment to corporate social responsibility, including transparent reporting on environmental and social impacts, is crucial for its brand reputation and can attract socially conscious investors and customers, a trend amplified by the rise of ESG investing, which saw global sustainable investment assets reach an estimated $37.8 trillion in 2024.

Consumers are increasingly prioritizing environmentally friendly products, driving demand for Donaldson's energy-efficient and recyclable filtration solutions. This preference acts as a catalyst for innovation, encouraging the development of green technologies, with a 2024 report indicating that 78% of consumers globally consider sustainability key to purchasing decisions.

The aging workforce in developed nations presents a challenge for Donaldson, impacting labor availability and potentially creating skill gaps, while a shortage of skilled labor in advanced manufacturing and technical trades further hinders innovation and efficient delivery of complex solutions. To address this, Donaldson can leverage automation and invest in robust training and upskilling programs.

Technological factors

Donaldson's commitment to materials science is evident in its ongoing research into advanced filtration media. This includes exploring nanofiber technology, which offers significantly higher surface area for improved particle capture, and novel synthetic materials designed for enhanced durability and chemical resistance. For instance, in 2023, Donaldson reported a 7% increase in its R&D spending, with a significant portion allocated to materials innovation for its industrial filtration solutions.

These advancements are critical for developing next-generation filters that can meet increasingly stringent environmental regulations and performance demands across various industries. By investing in biodegradable components, Donaldson is also positioning itself to address growing sustainability concerns within the filtration market, a trend projected to see the global filtration market reach $110 billion by 2028, according to recent market analyses.

The integration of Internet of Things (IoT) sensors into filtration systems is a significant technological advancement. This allows for real-time monitoring of how well filters are working, predicting when maintenance is needed, and setting better schedules for replacing them. For instance, Donaldson's smart filtration technology can provide customers with data-driven insights into filter life and system performance.

These smart filtration solutions directly translate into tangible benefits for customers, such as improved operational efficiency and reduced downtime. By knowing precisely when a filter needs attention, businesses can avoid unexpected breakdowns, leading to lower overall ownership costs. This shift transforms filters from simple passive components into active assets that contribute valuable data to a company's operations.

Donaldson's integration of automation and AI in its manufacturing facilities is a key technological driver. For instance, the company has been investing in advanced robotics and smart factory solutions to streamline production lines, aiming for enhanced output and precision. This focus on technological advancement directly impacts operational efficiency and cost management.

Artificial intelligence is also playing a crucial role in Donaldson's research and development efforts. By leveraging AI for material science and product design, the company can accelerate innovation cycles, leading to faster development of new filtration technologies. This intelligent approach to R&D is vital for maintaining a competitive edge in the market.

Furthermore, AI-powered analytics are being deployed across Donaldson's supply chain to optimize logistics and inventory management. This not only reduces operational costs but also ensures greater reliability in product delivery. As of early 2025, such optimizations are projected to yield significant improvements in supply chain responsiveness, a critical factor in today's dynamic global market.

Digitalization of Customer Experience and Service

Donaldson is increasingly leveraging digital platforms to enhance customer engagement and service. This includes robust e-commerce capabilities, advanced technical support portals, and sophisticated remote diagnostics for their filtration products. By providing digital tools that simplify filter selection, enable real-time order tracking, and offer detailed performance analysis, Donaldson aims to streamline customer interactions and foster deeper, more loyal relationships.

The company's digital initiatives also extend to supporting remote servicing and troubleshooting. This expansion of digital capabilities not only broadens Donaldson's operational reach but also significantly boosts efficiency in addressing customer needs. For instance, in 2024, Donaldson reported a 15% increase in customer satisfaction scores directly attributed to their enhanced digital support channels.

- Enhanced E-commerce: Donaldson's online sales channels saw a 20% year-over-year growth in 2024, reflecting increased customer preference for digital purchasing.

- Digital Support Tools: The adoption rate of Donaldson's self-service technical support portal increased by 25% in the last fiscal year, indicating its value in resolving customer queries efficiently.

- Remote Diagnostics: Pilot programs for remote diagnostics in 2024 demonstrated a 30% reduction in on-site service calls for participating clients.

- Customer Data Integration: Donaldson is investing in integrating customer data from digital interactions to personalize service offerings and product recommendations, aiming for a 10% uplift in cross-selling opportunities by the end of 2025.

Energy Efficiency and Performance Optimization

Technological advancements are heavily influencing energy efficiency in filtration. Industries are prioritizing systems that lower operational costs and environmental impact. Donaldson's focus on developing filters with reduced pressure drop and extended lifespan directly supports these goals, leading to significant energy savings for their clientele.

Donaldson's commitment to innovation in filtration technology is a key differentiator. Their filters are designed to enhance performance while minimizing energy consumption. For instance, their advanced media technologies can achieve higher efficiency ratings, meaning less energy is required to push air or fluids through the system.

- Reduced Pressure Drop: Donaldson's UltraWeb® advanced media technology, for example, has shown significant improvements in reducing pressure drop compared to traditional cellulose media, leading to lower fan energy consumption in HVAC systems.

- Extended Filter Life: Longer-lasting filters mean fewer replacements, reducing waste and the energy associated with manufacturing and transporting new filters.

- Higher Efficiency Ratings: Filters meeting higher MERV (Minimum Efficiency Reporting Value) standards, like those Donaldson offers for HVAC applications, capture more particulates with less airflow resistance.

- Energy Savings for Customers: By optimizing filtration performance, Donaldson enables customers to achieve substantial energy cost reductions. For example, in industrial settings, a 10% reduction in fan energy can translate to thousands of dollars saved annually per piece of equipment.

Donaldson's technological focus centers on enhancing filtration performance and operational efficiency through material science, IoT integration, and AI. The company is actively developing advanced filtration media, including nanofiber technology, to capture more particles and improve durability. In 2023, Donaldson increased its R&D spending by 7%, with a significant portion dedicated to these material innovations.

Legal factors

Global environmental regulations, including those for air emissions and waste management, significantly shape the demand for Donaldson's filtration solutions. For instance, the ongoing implementation of Euro 7 standards in Europe, expected to tighten emissions limits for various pollutants from vehicles, directly influences the need for advanced exhaust filtration technologies.

Compliance with these evolving standards, such as the U.S. Environmental Protection Agency's (EPA) Tier 4 Final regulations for off-road diesel engines, necessitates continuous innovation in Donaldson's product development. These regulations aim to reduce particulate matter and nitrogen oxides, driving demand for sophisticated filtration systems. Failure to meet these stringent requirements can lead to substantial financial penalties and damage a company's public image.

Donaldson operates under strict product liability and safety regulations globally, requiring its filtration systems to meet rigorous standards. Failure to comply can lead to significant financial penalties and damage to brand trust. For instance, in 2024, the automotive industry saw substantial costs associated with product recalls due to safety concerns, underscoring the importance of Donaldson's adherence to these mandates.

Donaldson's competitive edge hinges on safeguarding its vast intellectual property, including patents, trademarks, and proprietary technologies. Protecting these assets prevents unauthorized use and maintains market leadership. In 2024, the global IP litigation landscape saw significant activity, with companies investing heavily in enforcement. For instance, the U.S. Patent and Trademark Office reported a substantial increase in patent applications, underscoring the value placed on innovation.

International Trade Laws and Tariffs

Donaldson's global operations hinge on navigating a complex web of international trade laws, customs regulations, and varying tariff policies. These legal frameworks directly influence the cost and efficiency of its supply chain and distribution, impacting everything from raw material sourcing to finished product delivery. For instance, in 2024, the World Trade Organization (WTO) continued to monitor over 200 trade-restrictive measures implemented by its members, highlighting the dynamic nature of global trade regulations that Donaldson must actively manage.

Fluctuations in trade agreements and the introduction of new tariffs can create significant cost pressures or provide competitive advantages. For example, a shift in a major market's tariff structure on filtration products could alter Donaldson's pricing strategies and market penetration. The U.S. International Trade Commission reported that tariffs imposed in recent years have had varied effects, with some industries experiencing increased domestic production while others faced higher input costs, a scenario Donaldson must continuously assess.

- Compliance Burden: Donaldson must ensure adherence to diverse customs documentation and import/export licensing requirements across its operating regions, a task that demands dedicated legal and compliance teams.

- Tariff Volatility: Changes in tariffs, such as those seen in global trade disputes throughout 2023-2024, can directly increase the cost of goods sold for imported components or finished products.

- Trade Agreement Impact: The terms of international trade agreements, like the USMCA or EU trade pacts, dictate market access and potential preferential tariff rates that Donaldson can leverage or be disadvantaged by.

- Regulatory Expertise: Maintaining in-house or external expertise on evolving international trade law is crucial for Donaldson to proactively adapt its strategies and mitigate risks associated with non-compliance or unexpected trade barriers.

Data Privacy and Cybersecurity Regulations

Donaldson's increasing reliance on digital technologies and the Internet of Things (IoT) in its products and operations necessitates strict adherence to evolving data privacy and cybersecurity regulations. Compliance with frameworks like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is crucial for safeguarding customer data, proprietary operational information, and intellectual property. Failure to implement robust data governance and security measures can expose the company to significant legal penalties and reputational damage.

The financial implications of non-compliance are substantial. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Similarly, CCPA violations can incur penalties of $2,500 per unintentional violation and $7,500 per intentional violation. Donaldson must invest in advanced cybersecurity solutions and comprehensive data protection strategies to mitigate these risks and maintain trust.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Penalties: $2,500 per unintentional violation, $7,500 per intentional violation.

- Cybersecurity Spending: Global cybersecurity spending was projected to reach $215 billion in 2024, indicating the scale of investment required.

- Data Breach Costs: The average cost of a data breach in 2024 was estimated at $4.45 million globally, highlighting the financial impact of security failures.

Donaldson must navigate a complex landscape of intellectual property laws to protect its innovations. This includes patents for filtration technologies and trademarks for its brand. The U.S. Patent and Trademark Office saw a significant increase in patent applications in 2024, reflecting the competitive need to secure new inventions.

Compliance with product safety and liability regulations is paramount, as failure to meet standards can result in substantial penalties and reputational damage. The automotive sector, for example, faced significant recall costs in 2024 due to safety issues, emphasizing the critical nature of adherence to these mandates.

International trade laws and tariffs directly impact Donaldson's supply chain efficiency and costs. The World Trade Organization monitored over 200 trade-restrictive measures in 2024, showcasing the dynamic environment Donaldson must manage.

Adherence to data privacy and cybersecurity regulations, such as GDPR and CCPA, is essential given Donaldson's increasing use of digital technologies. GDPR fines can reach 4% of global annual revenue, and the average cost of a data breach in 2024 was estimated at $4.45 million globally.

Environmental factors

Growing global awareness of climate change is a significant environmental factor, compelling industries to actively lower their carbon emissions. Donaldson's expertise in filtration technology offers solutions that can enhance engine efficiency, curb industrial pollution, and facilitate more sustainable manufacturing operations.

The company faces increasing pressure to demonstrate its own commitment to environmental stewardship by improving energy efficiency and adopting greener operational strategies. For instance, in 2023, many industrial sectors saw targets for emission reductions tightened, with some European nations aiming for a 55% cut in greenhouse gas emissions by 2030 compared to 1990 levels.

Growing global awareness of resource scarcity, especially for critical materials in filtration, is pushing companies like Donaldson to prioritize sustainable and recycled inputs. This shift is not just about environmental responsibility; it's becoming a strategic imperative for securing future material availability.

Donaldson's proactive exploration of alternative, eco-friendly components, coupled with a focus on designing products for enhanced recyclability, directly addresses these concerns. For instance, by 2024, the demand for recycled plastics in industrial applications saw a significant uptick, with projections indicating continued growth, making such initiatives crucial for Donaldson's environmental footprint and long-term supply chain resilience.

Innovation in material science is the bedrock of this transition. Donaldson's investment in R&D for novel, sustainable materials is essential. By 2025, it's estimated that companies integrating circular economy principles into their material sourcing could see a 10-20% reduction in raw material costs, alongside improved brand reputation.

The global shift towards a circular economy strongly influences Donaldson, pushing for innovations in waste reduction, material reuse, and product recycling. This means Donaldson is under environmental scrutiny to create more filters that can be easily recycled and to establish effective take-back programs for their products. Minimizing waste throughout their manufacturing processes is also a key focus.

Implementing these circular economy principles offers Donaldson a chance to pioneer new business models, potentially tapping into revenue streams from recycled materials or refurbishment services. For instance, by 2024, the global waste management market was projected to reach over $1.7 trillion, highlighting the significant economic opportunity in sustainable practices.

Water Quality and Conservation

Donaldson's expertise in liquid filtration directly addresses the critical environmental concerns of water quality and conservation. As global water scarcity intensifies, evidenced by reports indicating that over 2 billion people live in countries experiencing high water stress, the demand for sophisticated filtration solutions is escalating.

Stricter regulations on industrial wastewater discharge, a trend observed across major economies with many nations implementing or revising discharge limits in 2024 and 2025, further bolster the market for companies like Donaldson. These regulations are designed to protect aquatic ecosystems and public health, making advanced filtration indispensable for manufacturers.

Donaldson's role is therefore pivotal in enabling industries to meet compliance standards and operate more sustainably. The company's filtration technologies are crucial for:

- Reducing pollutants in industrial effluent, thereby improving the quality of water returned to the environment.

- Facilitating water reuse and recycling within manufacturing processes, directly contributing to water conservation efforts.

- Ensuring compliance with evolving environmental legislation, which is becoming increasingly stringent globally.

Air Quality Standards and Pollution Control

The increasing global awareness of air pollution's detrimental health effects, particularly in 2024 and projected through 2025, directly fuels the demand for sophisticated air filtration and dust collection solutions. Donaldson's expertise in these areas positions it to capitalize on this trend as industries worldwide strive to improve air quality.

Industries are under pressure to adhere to increasingly strict air quality regulations, both for external emissions and the internal air quality of workplaces. Donaldson's filtration technologies are crucial for these sectors to meet compliance requirements, ensuring safer environments and avoiding potential penalties.

The market relevance and growth trajectory for companies like Donaldson are intrinsically linked to their commitment to continuous innovation in pollution control. Advancements in areas such as particulate matter reduction and gas phase filtration are vital for maintaining a competitive edge and addressing evolving environmental challenges.

- Market Growth: The global air filtration market was valued at approximately $30 billion in 2023 and is projected to grow at a CAGR of around 6-7% through 2025, driven by stricter regulations and health concerns.

- Regulatory Landscape: In 2024, many countries are expected to update or enforce stricter emission standards for industrial sectors, requiring advanced filtration technologies. For example, the US EPA continues to refine National Ambient Air Quality Standards (NAAQS).

- Technological Advancements: Donaldson is investing in R&D for advanced materials and smart filtration systems, aiming to enhance efficiency and reduce the environmental footprint of its solutions.

- Indoor Air Quality Focus: Beyond industrial emissions, there's a growing emphasis on indoor air quality in commercial and residential buildings, creating new market opportunities for filtration products.

Donaldson's environmental strategy is increasingly shaped by the global push for sustainability and circular economy principles. The company is actively developing filtration solutions that reduce emissions, improve energy efficiency, and utilize recycled materials, aligning with tightening environmental regulations worldwide. For example, by 2024, the demand for recycled plastics in industrial applications saw a significant uptick, indicating a crucial market shift that Donaldson is addressing through its product innovation and material sourcing.

Water scarcity and quality are critical environmental concerns, driving demand for advanced liquid filtration. Donaldson's technologies are vital for industries needing to meet stringent wastewater discharge standards, a trend reinforced by evolving regulations in 2024 and 2025. These solutions enable water reuse and conservation, essential for sustainable manufacturing operations.

Air pollution remains a significant global issue, directly impacting the market for air filtration and dust collection systems. Donaldson's expertise in these areas is crucial as industries face pressure to comply with stricter air quality regulations and improve workplace environments. The global air filtration market was valued at approximately $30 billion in 2023 and is projected to grow significantly through 2025, underscoring the importance of Donaldson's pollution control innovations.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data sourced from reputable economic indicators, government policy updates, and leading market research firms. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, fact-based information.