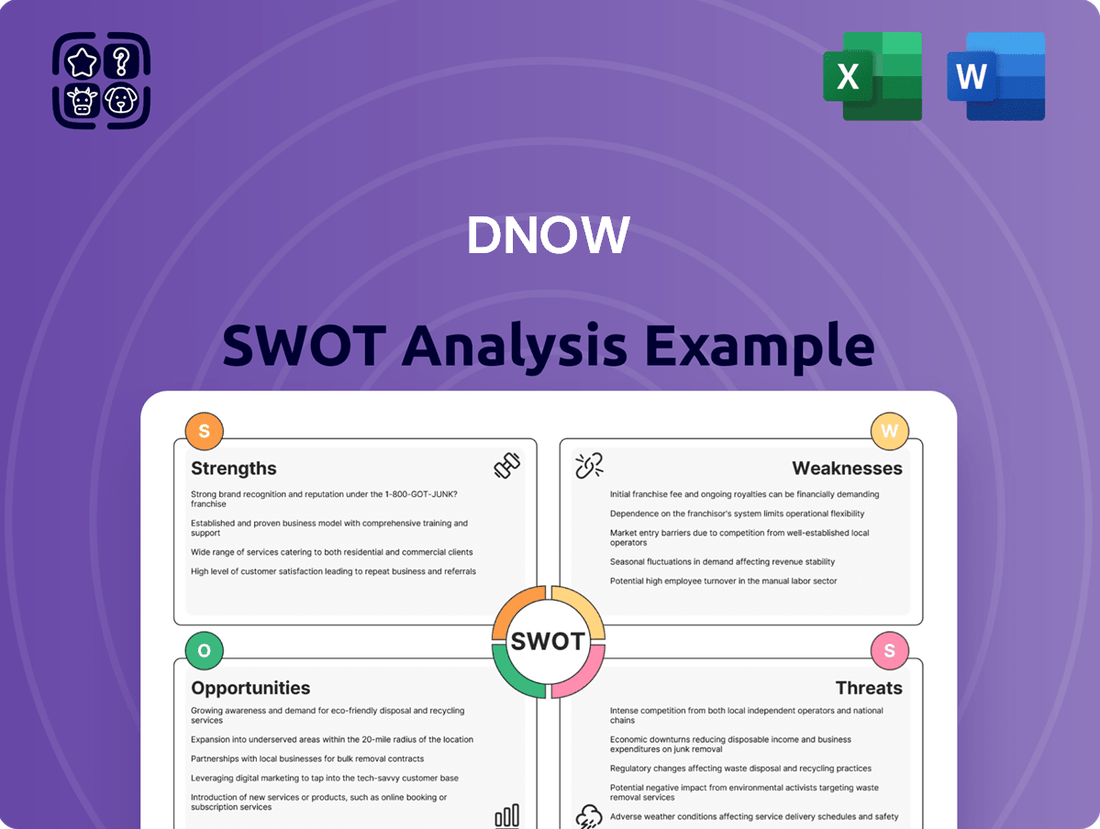

DNOW SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNOW Bundle

DNOW's strengths lie in its established distribution network and diverse product offerings, but its reliance on the oil and gas sector presents a significant threat. Understanding these internal capabilities and external market forces is crucial for strategic planning.

Want the full story behind DNOW's competitive advantages, potential weaknesses, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

DistributionNOW (DNOW) boasts an impressive global network of distribution centers and branches, a significant asset that translates into broad market reach and highly efficient supply chain management. This expansive physical presence is a key differentiator, allowing for swift and reliable product delivery across various geographies.

With a legacy stretching back over 160 years, DNOW has cultivated deep industry expertise and fostered enduring customer relationships. This long-standing history is not just a testament to longevity but also signifies a proven track record and a profound understanding of market dynamics, which are invaluable in building trust and loyalty.

The company's ability to effectively leverage this extensive network is crucial for ensuring consistent product availability and optimizing delivery processes for its wide-ranging customer base. For instance, DNOW's commitment to maintaining a robust inventory across its locations, particularly in key energy hubs, directly supports its clients' operational continuity, especially during periods of high demand or supply chain disruptions.

DistributionNOW (DNOW) boasts a remarkably broad selection of products, encompassing essential items like pipes, valves, and fittings. This extensive catalog is further enhanced by valuable services such as sophisticated supply chain management and crucial project management support.

This all-encompassing approach positions DNOW as a convenient one-stop-shop for clients operating within the upstream, midstream, and downstream segments of the energy and industrial sectors. By meeting diverse customer requirements under one roof, the company fosters stronger client relationships and cultivates a more reliable stream of recurring revenue.

DNOW boasts a strong financial position, underscored by a substantial cash reserve and a debt-free balance sheet. This financial resilience is further evidenced by its significant free cash flow generation in 2024, which reached $333 million, and a robust share repurchase program authorized up to $500 million.

This financial strength not only allows DNOW to pursue strategic growth opportunities but also provides a crucial buffer against economic uncertainties, reinforcing its commitment to enhancing shareholder value.

Strategic Diversification and Market Adaptability

DNOW's strategic diversification is a key strength, moving beyond traditional upstream energy to embrace midstream, industrial, and emerging energy transition markets. This broadens their revenue streams and reduces reliance on any single segment of the energy industry.

Their adaptability is clearly demonstrated by their investment in growth areas such as renewable natural gas, bio and sustainable fuels, hydrogen production, and water/wastewater management. For instance, in 2024, DNOW has actively pursued partnerships and acquisitions in the sustainable fuels sector, aiming to capture a larger share of this rapidly expanding market.

- Market Mix Expansion: DNOW is strategically broadening its reach across midstream, industrial, and energy transition sectors.

- Energy Transition Focus: Significant efforts are being made to grow in renewable natural gas, bio/sustainable fuels, and hydrogen.

- Risk Mitigation: Diversification across various energy sub-sectors helps to cushion the impact of volatility in any one area.

- Growth Opportunities: Investment in water/wastewater solutions taps into essential infrastructure needs.

Innovation and Digital Solutions

DNOW's commitment to innovation is a significant strength, particularly evident in its DigitalNOW platform. This suite provides advanced digital commerce, data analytics, and information management capabilities, directly addressing the need for streamlined operations and enhanced customer interaction in the energy sector.

These digital solutions are designed to boost operational efficiency and customer engagement. For instance, in 2023, DNOW reported that its digital channels contributed to a significant portion of its total revenue, demonstrating the tangible impact of these technological investments. This focus allows DNOW to offer leading-edge technology, adapting swiftly to changing market dynamics and customer expectations.

- DigitalNOW Suite: Offers integrated digital commerce, data, and information management.

- Operational Efficiency: Enhances processes through technological advancements.

- Customer Engagement: Improves interaction and service delivery.

- Market Adaptability: Facilitates quick responses to evolving market demands.

DNOW's extensive global distribution network is a core strength, enabling efficient supply chain management and broad market reach. This physical infrastructure, coupled with over 160 years of industry experience, fosters deep customer relationships and a proven understanding of market needs.

The company's robust financial health, characterized by a debt-free balance sheet and significant free cash flow generation, provides a strong foundation for growth and shareholder returns. In 2024, DNOW generated $333 million in free cash flow, supporting strategic initiatives like its $500 million share repurchase program.

DNOW's strategic diversification into midstream, industrial, and energy transition markets mitigates risk and opens new revenue avenues. Investments in areas like sustainable fuels and hydrogen production in 2024 highlight their commitment to adapting to evolving energy landscapes.

The company's investment in its DigitalNOW platform enhances operational efficiency and customer engagement through advanced digital commerce and data analytics. In 2023, digital channels significantly contributed to DNOW's revenue, underscoring the effectiveness of these technological advancements.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Network & Experience | Global Distribution Network | Extensive network of centers and branches |

| Industry Expertise | Over 160 years of operation | |

| Financial Strength | Debt-Free Balance Sheet | Strong financial resilience |

| Free Cash Flow (2024) | $333 million | |

| Share Repurchase Program | Authorized up to $500 million | |

| Strategic Diversification | Market Mix Expansion | Midstream, industrial, energy transition |

| Energy Transition Focus | Investments in sustainable fuels, hydrogen | |

| Innovation & Digitalization | DigitalNOW Platform | Digital commerce, data analytics |

| Digital Channel Revenue Impact (2023) | Significant contribution to total revenue |

What is included in the product

Delivers a strategic overview of DNOW’s internal strengths and weaknesses alongside external market opportunities and threats.

DNOW's SWOT analysis simplifies complex strategic thinking, offering a clear framework to identify and address critical business challenges.

Weaknesses

Despite efforts to broaden its services, DistributionNOW (DNOW) remains heavily concentrated in the energy sector. This focus exposes the company to the inherent volatility of energy prices and market sentiment, which can significantly impact demand for its products and services. For instance, a downturn in oil and gas prices, as experienced periodically, could directly lead to reduced capital expenditure by exploration and production companies, thereby affecting DNOW's sales volumes and profitability.

DistributionNOW (DNOW) faces significant competitive market pressures, operating alongside major players such as MRC Global, WESCO International, and Fastenal Company. This crowded field intensifies pricing competition, potentially squeezing profit margins for DNOW.

The intense competition can also make it more challenging for DNOW to secure new projects, impacting its ability to grow market share and revenue. For instance, in Q1 2024, DNOW reported a revenue of $445 million, a slight decrease from the previous year, highlighting the impact of a challenging market environment.

While DNOW has made strides in diversifying its sourcing, the company still relies heavily on global supply chains. This makes it vulnerable to disruptions, such as shipping delays or manufacturing issues in key regions. For instance, in early 2024, ongoing geopolitical tensions continued to impact shipping routes, leading to increased lead times for certain components.

Furthermore, DNOW is exposed to the effects of tariffs imposed on industrial supplies. These tariffs can directly increase the cost of goods, potentially squeezing profit margins or forcing price adjustments that could dampen customer demand. In 2024, the potential for new or adjusted tariffs on goods from China and other major manufacturing hubs remained a significant consideration for the company's cost management.

Potential for Declining International Revenue in Some Regions

DNOW's international revenue could face headwinds. For instance, Canadian revenue saw a sequential decrease, and the company anticipates a decline in international revenue for Q2 2025. This is largely attributed to the non-repeating nature of certain projects, highlighting potential volatility in specific global markets.

This trend suggests that DNOW's performance in certain international regions might be susceptible to project cycles and could experience fluctuations.

- Project-Specific Dependencies: International revenue streams can be heavily reliant on the completion and renewal of specific, often large-scale, projects.

- Regional Economic Factors: Broader economic conditions or geopolitical events in key international markets could also impact project pipelines and revenue generation.

- Competitive Landscape: Increased competition in international territories might also put pressure on pricing and project acquisition, affecting revenue growth.

Challenges in Sustaining Long-Term Revenue Growth

While DistributionNOW (DNOW) has demonstrated recent positive revenue trends, its historical performance indicates a susceptibility to revenue declines in prior periods. For instance, in fiscal year 2020, DNOW experienced a significant revenue drop. Sustaining consistent, long-term revenue growth presents a notable challenge, necessitating ongoing strategic adjustments and a keen understanding of market dynamics.

Key factors contributing to this weakness include:

- Cyclical Industry Dependence: DNOW's revenue is closely tied to the oil and gas industry's capital expenditure cycles, which can lead to volatility and make consistent growth difficult to achieve.

- Intense Competition: The industrial distribution market is highly fragmented and competitive, putting pressure on DNOW to constantly innovate and offer competitive pricing to maintain market share and drive sales.

- Economic Sensitivity: Broader economic downturns can significantly impact customer spending on industrial products, directly affecting DNOW's sales volume and revenue generation.

DistributionNOW's significant reliance on the energy sector, particularly oil and gas, exposes it to substantial revenue volatility tied to commodity prices and industry capital expenditure cycles. This concentration means that downturns in the energy market, such as those seen in 2020, can directly and severely impact DNOW's sales and profitability, making consistent revenue growth a persistent challenge.

The company operates in a highly competitive landscape with major players like MRC Global and WESCO International, leading to intense pricing pressure that can erode profit margins. For instance, DNOW's Q1 2024 revenue of $445 million showed a slight year-over-year decrease, reflecting the market's challenging conditions and competitive intensity.

Global supply chain dependencies create vulnerability to disruptions, including shipping delays and manufacturing issues, which can impact product availability and costs. Additionally, DNOW faces risks from tariffs on industrial supplies, which can increase costs and potentially reduce customer demand, as seen with ongoing trade considerations in 2024.

International revenue streams for DNOW can be unpredictable, influenced by project-specific dependencies and regional economic factors. For example, Canadian revenue saw a sequential decrease, and the company anticipates a decline in international revenue for Q2 2025, underscoring the potential for fluctuations in global markets.

Preview the Actual Deliverable

DNOW SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global industrial distribution market is anticipated to see robust expansion, fueled by rising demand in developing economies and the ongoing digital shift. This growth trajectory, estimated to reach over $1.5 trillion by 2025, provides DNOW with a fertile ground for increasing its market share and reaching new clients.

The global shift towards sustainability presents a prime opportunity for DNOW to expand into renewable energy and decarbonization markets. This evolving energy landscape, driven by climate concerns and policy changes, is seeing increased investment in green technologies.

DNOW is strategically positioning itself by exploring ventures in renewable natural gas, bio and sustainable fuels, and hydrogen production. These initiatives directly address the growing demand for cleaner energy sources and align with broader global decarbonization trends, offering significant growth potential.

For instance, the renewable natural gas market alone is projected to grow substantially, with some estimates suggesting a compound annual growth rate exceeding 15% in the coming years. DNOW's involvement in these emerging sectors allows it to capitalize on this expanding market, diversifying its revenue streams beyond traditional oil and gas services.

DNOW's strategic acquisition of a Singapore-based company in early 2024 significantly broadened its reach in the Asia-Pacific market, a region projected for robust industrial growth through 2025. This move, alongside the proposed combination with MRC Global, is designed to create a more comprehensive global footprint and enhance its ability to serve diverse customer needs.

These inorganic growth strategies are crucial for DNOW to quickly gain market share and expand its specialized product and service offerings, particularly in areas like advanced materials and digital solutions. The integration of acquired capabilities is expected to bolster supply chain resilience and efficiency, a key competitive advantage in the current economic climate.

Leveraging Digital Transformation and AI in Supply Chain

The ongoing digital transformation within supply chain management, particularly the integration of Artificial Intelligence (AI) and cloud computing, offers significant opportunities for DNOW. By embracing these advanced technologies, DNOW can achieve greater operational efficiency and enhanced visibility across its entire supply network. For instance, AI-powered demand forecasting can lead to more accurate inventory management, reducing carrying costs and preventing stockouts. This strategic adoption is crucial for staying competitive in a rapidly evolving market.

Investing in digital tools allows for the optimization of logistics and distribution. Advanced analytics can identify bottlenecks and streamline processes, leading to faster delivery times and reduced operational expenses. DNOW can leverage these capabilities to improve customer satisfaction by ensuring product availability and efficient order fulfillment. The company's commitment to innovation in this area will be a key differentiator.

Specific opportunities include:

- Enhanced Demand Forecasting: Implementing AI algorithms to predict customer demand with greater accuracy, potentially reducing excess inventory by up to 15-20% based on industry benchmarks.

- Improved Inventory Management: Utilizing cloud-based systems for real-time inventory tracking, minimizing stockouts and overstock situations.

- Optimized Logistics: Employing advanced analytics to optimize shipping routes and delivery schedules, potentially lowering transportation costs by 5-10%.

- Increased Supply Chain Visibility: Gaining end-to-end visibility into the supply chain, allowing for quicker responses to disruptions and better risk management.

Increasing Demand from Midstream and Process Solutions

DistributionNOW (DNOW) has seen a significant uplift in its U.S. midstream and Process Solutions segments. This growth is driven by robust project activity and a corresponding increase in quarterly revenue from these divisions. For instance, in the first quarter of 2024, DNOW reported that its Process Solutions segment saw a notable increase in demand, contributing positively to overall financial performance.

The ongoing expansion of energy infrastructure, particularly in the midstream sector, coupled with substantial investments in processing facilities, creates a consistent and expanding market for DNOW's offerings. This trend is expected to continue through 2024 and into 2025, providing a stable demand base.

- Midstream Momentum: Increased project pipelines in U.S. midstream infrastructure.

- Process Solutions Growth: Higher demand for components and services in processing plants.

- Revenue Contribution: These segments are increasingly important to DNOW's overall financial results, with Q1 2024 showing strong performance.

The global industrial distribution market's projected growth to over $1.5 trillion by 2025 offers DNOW significant opportunities to expand its reach and client base. Furthermore, the increasing focus on sustainability and decarbonization presents a chance for DNOW to tap into the expanding renewable energy sector, including renewable natural gas and hydrogen, which is seeing compound annual growth rates potentially exceeding 15%.

DNOW's strategic acquisitions and proposed combinations, like the one with MRC Global, are enhancing its global footprint, especially in high-growth regions like the Asia-Pacific. Embracing digital transformation through AI and cloud computing can lead to improved operational efficiency, better inventory management, and optimized logistics, potentially reducing transportation costs by 5-10%.

The company is also benefiting from strong momentum in its U.S. midstream and Process Solutions segments, driven by robust project activity. These segments are increasingly contributing to DNOW's financial performance, as evidenced by strong Q1 2024 results, indicating a stable and expanding market for its offerings through 2025.

Threats

Fluctuations in oil and natural gas prices directly impact the operating budgets and activity levels of DNOW's primary customers in the energy sector. For instance, during periods of lower commodity prices, such as the average West Texas Intermediate (WTI) crude oil price of approximately $77.50 per barrel in 2023, customers may scale back their capital expenditures and drilling activities, leading to reduced demand for DNOW's products and services.

Significant reductions in these prices can adversely affect DNOW's revenue and operating performance, as the market remains volatile. A sustained downturn in energy prices, like the sharp decline seen in late 2020, can compress margins and decrease sales volumes, posing a direct threat to the company's profitability and market position.

Broader macroeconomic uncertainties, including persistent inflation and rising interest rates, pose a significant threat to DNOW. For instance, the Federal Reserve's continued tightening cycle, with rates potentially remaining elevated through 2024, could dampen industrial production and overall demand for DNOW's offerings, leading to reduced customer spending and investment.

Intensifying geopolitical rivalries and evolving trade policies, including the potential for new tariffs, present a significant threat by disrupting global supply chains and increasing sourcing costs for DNOW. For instance, the ongoing trade friction between major economic blocs could directly impact the cost of imported components or finished goods, affecting DNOW's operational efficiency and pricing strategies. This market uncertainty can also dampen demand for energy services, as businesses postpone capital expenditures amid global instability.

Supply Chain Disruptions and Cybersecurity Risks

Despite ongoing efforts to build more robust supply chains, global networks continue to face significant vulnerabilities. These disruptions, whether from geopolitical events or natural disasters, can impact the availability and cost of essential components for DNOW. For instance, the ongoing semiconductor shortage, which began in 2020 and extended well into 2023, significantly affected various industries, including energy services.

Furthermore, DNOW's increasing integration of digital technologies, while boosting efficiency, also exposes the company to elevated cybersecurity threats. A successful cyberattack could compromise sensitive operational data, disrupt service delivery, and erode customer confidence. In 2023, the energy sector experienced a notable rise in ransomware attacks, highlighting the critical need for advanced cybersecurity measures.

- Supply Chain Vulnerability: Global supply chains remain susceptible to disruptions, impacting component availability and pricing for DNOW.

- Cybersecurity Risks: Increased reliance on digital solutions creates potential vulnerabilities to cyberattacks, threatening data integrity and operations.

- Industry Trends: The energy sector has seen a rise in cyber threats, underscoring the importance of robust security protocols for companies like DNOW.

Environmental Regulations and Energy Transition Pace

While DNOW is expanding into renewable energy sectors, the speed and nature of environmental policy changes present a significant threat. A faster-than-anticipated shift away from fossil fuels, driven by stricter regulations or accelerated climate initiatives, could reduce demand for DNOW's traditional product lines, impacting a substantial part of its current revenue streams. For instance, if regulatory bodies implement aggressive carbon pricing or phase-out mandates for oil and gas equipment sooner than expected, DNOW's legacy business could face headwinds.

The pace of the global energy transition itself is a key concern. If the adoption of renewable energy sources outstrips DNOW's diversification efforts, or if the transition creates unforeseen market disruptions for established energy infrastructure, it could challenge the company's strategic adjustments. For example, a sudden surge in demand for green hydrogen infrastructure components, coupled with a concurrent decline in demand for traditional pipeline materials, could strain DNOW's ability to adapt its supply chain and product mix effectively. In 2024, global investment in renewable energy is projected to reach new highs, underscoring the accelerating nature of this transition.

- Regulatory Uncertainty: Unpredictable changes in environmental laws could negatively impact demand for DNOW's fossil fuel-related products.

- Pace of Transition: A rapid global shift to renewables might outpace DNOW's diversification strategy, creating market imbalances.

- Impact on Existing Business: A significant portion of DNOW's revenue is still tied to traditional energy sectors, making it vulnerable to these changes.

- Adaptation Challenges: The speed of the energy transition may test DNOW's agility in adapting its product offerings and supply chain.

DNOW faces significant threats from volatile energy prices, as demonstrated by the average WTI crude oil price of approximately $77.50 per barrel in 2023, which can lead to reduced customer spending. Macroeconomic uncertainties, including inflation and interest rates potentially remaining elevated through 2024, further dampen industrial demand. Global supply chain vulnerabilities and increasing cybersecurity risks, highlighted by a rise in energy sector ransomware attacks in 2023, also pose considerable challenges.

| Threat Category | Specific Threat | Impact on DNOW | Supporting Data/Example |

| Market Volatility | Fluctuations in Oil & Gas Prices | Reduced customer capital expenditures and demand for products/services. | WTI Crude Oil Average Price 2023: ~$77.50/barrel. |

| Macroeconomic Factors | Inflation & Rising Interest Rates | Dampened industrial production and overall demand, reduced customer spending. | Interest rates potentially remaining elevated through 2024. |

| Supply Chain & Operations | Supply Chain Disruptions | Impacted availability and cost of essential components. | Semiconductor shortage (2020-2023) affected various industries. |

| Cybersecurity | Cyberattacks (e.g., Ransomware) | Compromised data, disrupted services, eroded customer confidence. | Notable rise in energy sector ransomware attacks in 2023. |

SWOT Analysis Data Sources

This DNOW SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide the critical data needed for an accurate and insightful assessment of DNOW's current standing and future potential.