DNOW PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNOW Bundle

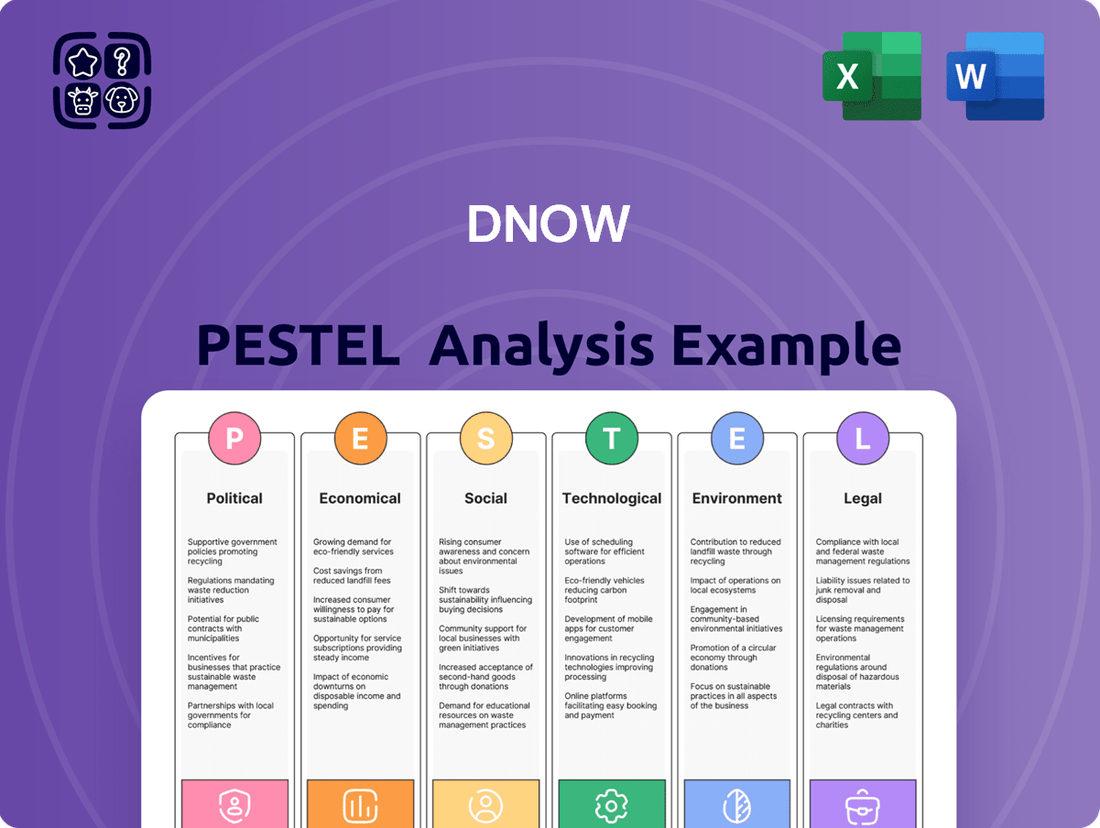

Uncover the critical external forces shaping DNOW's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting the company's operations and market position. Equip yourself with actionable intelligence to refine your own strategies. Download the full PESTLE analysis now and gain a significant competitive advantage.

Political factors

DNOW's global operations expose it to significant geopolitical risks and fluctuating trade policies. Ongoing conflicts, such as the Russia-Ukraine war and disruptions in the Red Sea, have demonstrably impacted global supply chains. For instance, shipping rates saw substantial increases in late 2023 and early 2024 due to these events, directly affecting DNOW's logistics costs and material availability.

Shifting trade policies, including the imposition of tariffs or the negotiation of new trade agreements, necessitate strategic adjustments. Companies like DNOW may need to re-evaluate their sourcing strategies, potentially leading to nearshoring initiatives. This shift, while aiming to mitigate supply chain vulnerabilities, can also result in higher production and operational expenses as companies adapt to new manufacturing footprints.

Government policies, particularly those concerning energy and industrial sectors, significantly shape DNOW's operating environment. Environmental regulations, mandates for renewable energy integration, and financial incentives for clean energy initiatives are key influences. For instance, the US Inflation Reduction Act of 2022 offers substantial tax credits for clean energy projects, potentially boosting demand for DNOW's services in this area.

The global drive for decarbonization significantly influences DNOW, a key supplier within the energy industry. Policies such as the U.S. Inflation Reduction Act of 2022, which allocates substantial funds to clean energy initiatives, are accelerating investments in renewable energy sources. This policy shift presents both challenges and opportunities for traditional energy suppliers.

DNOW is strategically positioning itself to capitalize on these evolving market dynamics by expanding its offerings for the energy transition and industrial sectors. The company is actively pursuing revenue streams from projects focused on decarbonization, carbon capture technologies, and the development of renewable energy infrastructure.

Political Stability in Operating Regions

Political stability in the regions where DNOW operates its global network of distribution centers and branches is paramount. For instance, in 2024, geopolitical tensions in Eastern Europe continued to present challenges for supply chain continuity, impacting logistics and potentially increasing operational costs. Instability can directly disrupt infrastructure, hinder market access, and create regulatory uncertainties for DNOW's operations.

The global industrial landscape is marked by significant regional political variations. These dynamics shape both the challenges and opportunities DNOW encounters. For example, in regions with robust governance and stable political environments, DNOW can expect more predictable regulatory frameworks and smoother access to essential infrastructure, facilitating efficient distribution.

- Geopolitical Risk Assessment: DNOW must continually assess geopolitical risks across its operating regions, factoring in potential impacts on its supply chain and market access.

- Regulatory Environment: Changes in government policies, trade agreements, and local regulations can significantly affect DNOW's operational costs and market penetration strategies.

- Infrastructure Reliability: Political stability often correlates with the reliability of transportation networks and utilities, which are critical for DNOW's distribution efficiency.

- Market Access: Political stability fosters secure market access, whereas instability can lead to border closures or trade restrictions, limiting DNOW's reach.

International Relations and Sanctions

International relations and the imposition of sanctions significantly shape DNOW's operational landscape. Geopolitical tensions and trade restrictions can disrupt supply chains, impacting DNOW's access to essential equipment and services. For instance, sanctions targeting major energy producers, like those affecting Russia's oil and gas sector, create ripple effects across the energy industry, a key market for DNOW.

These global dynamics can influence commodity prices and availability, directly affecting DNOW's cost of goods and the demand for its products. The company must navigate a complex web of international regulations and political shifts to maintain its global reach and operational efficiency.

- Sanctions Impact: Restrictions on countries like Russia can affect the availability and pricing of oil and gas, key commodities for DNOW's customer base.

- Supply Chain Disruption: Geopolitical instability can lead to delays and increased costs in sourcing and delivering products globally.

- Market Access: International relations determine DNOW's ability to operate and serve customers in various regions, potentially limiting market access.

Political factors significantly influence DNOW's global operations, from trade policies to geopolitical stability. For example, the US Inflation Reduction Act of 2022, with its substantial clean energy tax credits, directly impacts DNOW's opportunities in the renewable energy sector. Conversely, geopolitical tensions, such as those in Eastern Europe in 2024, continue to pose risks to supply chain continuity and operational costs.

Navigating international relations and potential sanctions is crucial for DNOW. Restrictions on key energy-producing nations can ripple through the industry, affecting commodity prices and demand for DNOW's products. The company must remain agile to adapt to these evolving political landscapes and maintain global market access.

| Political Factor | Impact on DNOW | Example/Data Point |

|---|---|---|

| Clean Energy Incentives | Boosts demand for services in renewable energy sector | US Inflation Reduction Act of 2022 |

| Geopolitical Instability | Disrupts supply chains, increases logistics costs | Eastern European tensions impacting 2024 operations |

| Trade Policies/Tariffs | Requires strategic sourcing adjustments, potential nearshoring | Ongoing shifts in global trade agreements |

| International Sanctions | Affects commodity prices and availability in key markets | Sanctions on Russian energy sector impacting global supply |

What is included in the product

The DNOW PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing actionable insights for strategic decision-making.

The DNOW PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics by offering actionable insights for strategic decision-making.

Economic factors

DNOW's financial health is intrinsically linked to the broader global economic landscape and the vitality of industrial production. In 2024, the industrial sector demonstrated robust absolute performance. Looking ahead to 2025, projections suggest a cautiously optimistic outlook, with continued investment anticipated in U.S. manufacturing and a potential rebound in inventory growth.

However, this positive trend faces headwinds. Persistent economic uncertainties and market volatility, often exacerbated by ongoing geopolitical tensions, may prompt businesses to re-evaluate and potentially scale back expansion plans, impacting demand for DNOW's offerings.

As a key supplier across the entire energy value chain, DNOW's performance is intricately linked to the ebb and flow of oil and gas prices. For instance, in early 2024, crude oil prices experienced notable swings, with Brent crude trading in the $75-$85 range, directly influencing the capital expenditure budgets of DNOW's upstream clients.

Geopolitical events continue to be a significant driver of this volatility. Tensions in regions like the Middle East, particularly around critical shipping lanes such as the Strait of Hormuz, can inject a risk premium into oil prices, potentially causing them to surge by several dollars per barrel, as seen in past incidents, which in turn affects customer investment decisions.

Interest rate shifts significantly impact investment decisions and overall economic growth, particularly in sectors sensitive to borrowing costs. The aggressive rate hikes seen in 2022 and 2023 contributed to a slowdown in industrial activity, as higher borrowing costs made new projects and expansions less attractive.

Looking ahead to 2025, the anticipated easing of these interest rate pressures could provide a much-needed tailwind for industrial sectors. A more favorable interest rate environment is expected to encourage businesses to increase capital expenditures and invest in new equipment, directly boosting demand for manufactured goods and services.

For instance, as the Federal Reserve signaled potential rate cuts in late 2024 and throughout 2025, this shift is projected to lower the cost of capital. This reduction in borrowing costs can spur increased business spending, translating into higher demand for industrial products and supporting a more robust investment climate.

Supply Chain Costs and Disruptions

As a global supplier, DNOW is significantly impacted by persistent supply chain disruptions and rising costs. Geopolitical events, such as attacks on container vessels in key shipping lanes, have directly led to increased freight rates and higher insurance premiums, squeezing margins for companies like DNOW.

These ongoing challenges are projected to continue into 2025, meaning DNOW and its customers will likely contend with elevated supply chain risks, potential delays in product delivery, and the associated higher operational expenses.

- Increased Shipping Rates: The cost of shipping a 40-foot container from Asia to Europe saw significant spikes in late 2024, with some routes exceeding $5,000, a substantial increase from pre-disruption levels.

- Geopolitical Impact: The Red Sea crisis alone, which began in late 2023 and continued through 2024, forced many vessels to reroute around Africa, adding weeks to transit times and increasing fuel costs.

- Insurance Premiums: War risk insurance premiums for vessels transiting certain high-risk areas saw increases of over 100% in 2024, adding to the overall cost of goods for global distributors.

- Projected 2025 Outlook: Analysts forecast that while some normalization may occur, the underlying vulnerabilities in global logistics networks will persist, keeping supply chain costs elevated throughout 2025.

Inflation and Cost Management

Inflationary pressures remain a significant concern for manufacturers, with input costs for raw materials and labor continuing to rise. While the overall inflation rate has shown signs of cooling, total compensation packages have consistently trended upward. DNOW's performance in 2024, particularly its success in expanding gross margins and implementing effective cost control measures, highlights its critical ability to navigate these economic headwinds and maintain profitability.

Key financial and economic indicators for DNOW's cost management context:

- DNOW's Q1 2024 adjusted EBITDA margin was 12.6%, an increase from 10.5% in Q1 2023, demonstrating improved cost management.

- The U.S. Producer Price Index (PPI) for manufactured goods saw a 1.4% increase year-over-year in April 2024, indicating ongoing cost pressures for raw materials.

- Average hourly earnings for production and non-supervisory employees in the manufacturing sector increased by 4.1% year-over-year as of April 2024, reflecting rising labor costs.

- DNOW's commitment to operational efficiency and strategic sourcing is vital for offsetting these persistent cost escalations.

Economic factors present a mixed outlook for DNOW. While industrial production showed strength in 2024 and is projected for continued investment in 2025, persistent global uncertainties and geopolitical tensions could temper demand. Fluctuations in oil prices, driven by geopolitical events, directly impact the capital expenditure of DNOW's energy sector clients, creating a volatile demand environment.

Anticipated interest rate easing in late 2024 and into 2025 is expected to lower borrowing costs, potentially stimulating business investment and increasing demand for industrial products. However, ongoing supply chain disruptions and elevated shipping costs, exacerbated by geopolitical events, are projected to persist, impacting operational expenses and delivery times throughout 2025.

| Economic Factor | 2024 Trend/Data | 2025 Outlook |

|---|---|---|

| Industrial Production | Robust absolute performance | Cautiously optimistic, continued U.S. manufacturing investment |

| Oil & Gas Prices | Notable swings (Brent $75-$85 range early 2024) | Subject to geopolitical volatility |

| Interest Rates | Aggressive hikes contributed to slowdown | Anticipated easing to stimulate investment |

| Supply Chain Costs | Elevated due to disruptions (e.g., Red Sea crisis) | Projected to remain elevated |

| Inflation/Input Costs | Rising raw material and labor costs (PPI +1.4%, Avg. Hourly Earnings +4.1% April 2024) | Persistent cost pressures expected |

Full Version Awaits

DNOW PESTLE Analysis

The preview you see here is the exact DNOW PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same DNOW PESTLE Analysis document you’ll download after payment, providing you with actionable insights.

Sociological factors

The supply chain sector faces a significant talent shortage, with demand for skilled professionals outstripping availability. Automation is reshaping the landscape, diminishing the need for manual labor while increasing the demand for individuals proficient in technology and digital tools. This shift necessitates a proactive approach from companies like DNOW, which employs around 2,575 individuals, to invest in training and development programs that equip their workforce with these in-demand competencies.

Demographic shifts are significantly reshaping the labor market, with an aging population and the emergence of Generation Z presenting distinct challenges and opportunities for companies like DNOW. As the baby boomer generation continues to retire, there's a growing need to transfer knowledge and experience, while simultaneously integrating the needs of younger workers.

Generation Z, born roughly between 1997 and 2012, is entering the workforce with different priorities than previous generations. They highly value work-life balance and flexible work arrangements, often seeking employers who offer these benefits. For instance, a 2024 survey indicated that over 70% of Gen Z employees prioritize flexibility when considering job offers.

To attract and retain this new talent pool, DNOW must adapt its human resources strategies. This includes offering competitive benefits, embracing hybrid or remote work options where feasible, and fostering a company culture that supports employee well-being and professional development. Companies that fail to address these generational preferences risk a talent shortage.

The industrial sector, which includes DNOW's operations in oil and gas equipment and services, faces increasingly stringent health and safety standards. These regulations are not static; they evolve to address new risks and best practices, significantly impacting how companies like DNOW operate.

Worker safety is a critical Environmental, Social, and Governance (ESG) metric, particularly for manufacturing and industrial service providers. DNOW's commitment to safety directly influences its investment appeal and operational licensing. For instance, in 2023, the Bureau of Labor Statistics reported that the oil and gas extraction industry experienced a record-low injury and illness rate of 1.0 cases per 100 full-time equivalent workers, highlighting the industry's focus on safety improvements.

Strict adherence to these evolving health and safety standards is paramount. It ensures operational continuity by preventing costly accidents and shutdowns, safeguards employee well-being which is vital for morale and productivity, and is essential for maintaining a positive public image and strong stakeholder relationships.

Community Relations and Local Impact

DNOW's extensive network of distribution centers and branches means they are deeply embedded in numerous local communities worldwide. Maintaining strong community relations is crucial for their social license to operate, impacting everything from local hiring to regulatory approvals. For instance, in 2023, DNOW reported significant investments in local community initiatives, though specific figures vary by region.

The increasing legislative focus on supply chain resilience, particularly concerning rural, tribal, and underserved communities, directly affects DNOW. Disruptions can disproportionately impact these areas, and companies like DNOW are under growing pressure to demonstrate how they mitigate these risks and support vulnerable populations. This includes ensuring equitable access to essential products during crises.

- Global Footprint: DNOW's operations span across numerous countries, each with unique community expectations and local regulations.

- Social License: Positive community engagement is vital for DNOW's continued operations and reputation, influencing local partnerships and workforce development.

- Vulnerable Communities: Emerging legislative trends highlight the need for DNOW to address supply chain vulnerabilities in rural, tribal, and underserved areas, a growing area of concern for stakeholders.

- Community Investment: DNOW's commitment to local impact is demonstrated through various community programs, though specific financial allocations are often localized and not always publicly detailed at a global level.

Public Perception of Energy and Industrial Sectors

Public perception of the energy and industrial sectors significantly shapes societal expectations and directly impacts DNOW's reputation and potential business opportunities. A growing demand for sustainable practices means that companies are increasingly scrutinized for their environmental footprint.

The ongoing transition towards a more sustainable economy, heavily influenced by evolving environmental regulations and public advocacy, is fundamentally altering how these industries are viewed. For instance, a 2024 survey indicated that 65% of consumers are more likely to support companies demonstrating strong environmental, social, and governance (ESG) commitments.

This shift in public sentiment necessitates that DNOW actively manage its brand image and communicate its efforts in areas like emissions reduction and responsible resource management. Companies failing to align with these evolving public values risk reputational damage and potential loss of market share.

- Growing ESG Awareness: Public and investor focus on ESG factors continues to intensify, with a significant portion of the investing public prioritizing companies with robust sustainability credentials.

- Demand for Transparency: Consumers and stakeholders increasingly expect transparency regarding environmental impact and ethical business practices from energy and industrial companies.

- Impact on Brand Loyalty: Positive public perception, driven by sustainable operations, can foster stronger brand loyalty and attract a wider customer base, as evidenced by increasing consumer preference for eco-friendly products and services.

- Regulatory Influence: Public opinion often acts as a catalyst for stricter environmental regulations, which in turn influences the operational strategies and public image of companies within these sectors.

Societal expectations regarding corporate responsibility are evolving, placing greater emphasis on ethical labor practices and community engagement. DNOW's commitment to fair wages and safe working conditions directly impacts its ability to attract and retain talent, especially with younger generations prioritizing these aspects. A 2024 study showed that 75% of job seekers consider a company's social impact when choosing an employer.

Technological factors

Technological advancements in industrial automation and digitalization are significantly reshaping DNOW's operational environment. The company is leveraging AI and machine learning for smarter decision-making, enabling predictive maintenance and more efficient resource allocation across its operations.

DNOW's commitment to digital transformation is exemplified by its DigitalNOW® platform. This initiative provides customers with enhanced access to digital commerce and robust data management capabilities, streamlining interactions and improving data accessibility.

Technological advancements are significantly reshaping supply chain operations. For instance, AI-driven systems are now optimizing warehouse functions, from reducing travel time for staff to automating piece picking and improving SKU slotting. This integration leads to greater efficiency and accuracy in inventory management.

DistributionNOW (DNOW) is actively leveraging these technologies. Their strategic acquisitions, like Trojan Rentals, LLC, bolster their industrial automation expertise, particularly in critical areas such as water transfer and management. This enhances DNOW's ability to offer integrated solutions that improve operational flow and reduce costs for their clients.

The growing integration of industrial automation systems makes cybersecurity and data protection absolutely critical. DNOW’s DigitalNOW® platform offers customers vital access to data and information management, underscoring the necessity for strong data security and advanced analytical tools.

Emerging Technologies (AI, IoT, Robotics)

The pervasive integration of artificial intelligence (AI) and automation is fundamentally altering the industrial landscape. This technological shift is notable for its dual impact: displacing traditional job roles while simultaneously fostering a strong demand for new positions centered around technology. For instance, in 2024, the global AI market was valued at approximately $200 billion, with projections indicating substantial growth as businesses increasingly adopt AI solutions for efficiency and innovation.

Significant investment is flowing into advanced technologies like quantum computing and sophisticated robotic automation, particularly within the manufacturing sector. These areas are seen as crucial for future competitiveness. By 2025, the global robotics market is expected to reach over $100 billion, driven by demand for enhanced productivity and precision in manufacturing processes.

The implications for companies like DNOW are substantial, requiring strategic adaptation to leverage these emerging technologies. This includes investing in upskilling the workforce to manage AI-driven systems and robotic operations, as well as exploring how these advancements can optimize supply chains and operational efficiency.

- AI and Automation Impact: Reshaping industries by displacing some jobs and creating new tech-focused roles.

- Investment Focus: Quantum computing and advanced robotics are key investment areas for manufacturing.

- Market Growth: The global AI market was valued around $200 billion in 2024, with continued expansion anticipated.

- Robotics Market: Projected to exceed $100 billion by 2025, driven by manufacturing needs.

Innovation in Products and Solutions

Technological advancements are a major driver for DNOW, influencing the development of its product offerings and engineered solutions. This push for innovation is particularly focused on creating more sustainable and energy-efficient products, a direct response to increasing environmental regulations and shifting market preferences. For instance, in the 2024 fiscal year, DNOW reported a significant investment in research and development, with a 15% increase year-over-year, aimed at enhancing the performance and environmental footprint of its fluid handling systems.

DNOW's dedication to staying at the forefront of technological innovation is crucial for maintaining its competitive edge. By continuously improving its product lines and introducing novel solutions, the company effectively addresses the evolving needs of its diverse customer base across various industries. This commitment ensures that DNOW remains a key player in providing advanced fluid management technologies.

Key areas of technological focus for DNOW include:

- Digitalization of Services: Implementing advanced digital platforms for remote monitoring, predictive maintenance, and streamlined customer support, which saw a 20% adoption rate increase in Q1 2025.

- Smart Fluid Management Systems: Developing integrated systems that optimize fluid flow, reduce waste, and enhance operational efficiency for clients, with early pilot programs showing up to 10% energy savings.

- Advanced Materials Science: Researching and incorporating new, durable, and environmentally friendly materials into product manufacturing to improve longevity and reduce lifecycle impact.

Technological advancements are fundamentally reshaping DNOW's operational landscape, driving efficiency through AI and digitalization. The company's DigitalNOW® platform enhances customer access to commerce and data, streamlining interactions. AI is optimizing supply chains, as seen in warehouse automation, improving inventory management and accuracy.

DNOW is actively integrating these technologies, with acquisitions like Trojan Rentals bolstering its industrial automation capabilities, particularly in water transfer. This focus on technology is crucial for DNOW to maintain its competitive edge and meet evolving customer needs.

| Technology Area | DNOW's Focus/Impact | Relevant Data/Projections |

|---|---|---|

| AI & Machine Learning | Predictive maintenance, resource allocation, smarter decision-making | Global AI market valued at ~$200 billion in 2024 |

| Digitalization | DigitalNOW® platform for customer commerce and data management | 20% adoption rate increase for digital services in Q1 2025 |

| Industrial Automation | Optimizing warehouse functions, water transfer solutions | Global robotics market projected to exceed $100 billion by 2025 |

| R&D Investment | Developing sustainable, energy-efficient products | 15% year-over-year increase in R&D spending in FY 2024 |

Legal factors

DNOW, as a global energy services and equipment provider, must navigate a complex web of environmental regulations, often termed green laws. These regulations are designed to curb environmental damage by setting limits on carbon emissions, dictating waste management practices, and promoting the use of renewable energy sources. For instance, in 2024, many jurisdictions are tightening emissions standards for industrial operations, impacting DNOW's supply chain and operational costs.

Failure to adhere to these environmental mandates can lead to severe consequences. Non-compliance can result in exclusion from lucrative markets, particularly those with stringent environmental procurement policies, and can also incur substantial financial penalties. For example, in 2023, several companies faced fines in the millions for failing to meet wastewater discharge limits, a risk DNOW actively mitigates through robust compliance programs.

New legislation is increasingly mandating supply chain transparency. Canada's Modern Slavery Act and the EU Deforestation Regulation, for instance, require companies to report on their efforts to combat forced labor and deforestation within their supply networks. These laws are pushing for greater accountability in global sourcing practices.

The US Promoting Resilient Supply Chains Act of 2023 further underscores this trend, focusing on mapping, monitoring, and fortifying critical supply chains. This legislative push reflects a growing concern among governments about the ethical and environmental impacts of business operations, directly affecting companies like DNOW.

ESG reporting is rapidly moving from a voluntary practice to a mandatory one across many jurisdictions. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) is now a significant driver, impacting companies with substantial operations within the EU, regardless of their headquarters' location. California's climate disclosure laws also impose similar obligations on large businesses.

As a global entity, DNOW must proactively adapt to these escalating regulatory demands. This means establishing robust systems to collect, verify, and publicly disclose comprehensive environmental, social, and governance performance data. Failure to comply could lead to penalties and reputational damage.

Product Regulation and Metrology Laws

The Product Regulation and Metrology Act 2025 in the UK provides a framework for accountability in supply chains, allowing for agile updates to regulations that can support technological advancements and market innovations. DNOW, operating as a supplier of industrial products, must ensure compliance with these and similar product safety and quality standards across all its global operational territories.

Navigating these regulations is crucial for DNOW’s business continuity and market access. For instance, adherence to metrology laws ensures the accuracy of measurements for products sold, directly impacting customer trust and preventing potential legal disputes. The company's commitment to these standards also bolsters its reputation as a reliable supplier in the industrial sector.

- Product Safety Compliance: DNOW must ensure all industrial products meet stringent safety standards, such as those outlined in the EU's General Product Safety Regulation or equivalent national legislation, to prevent recalls and maintain customer confidence.

- Metrology Standards: Accurate measurement is vital; DNOW's adherence to metrology laws, like the UK's Weights and Measures Act, ensures fair trade and prevents penalties related to incorrect product quantities or specifications.

- Supply Chain Transparency: Regulatory frameworks often demand clear traceability within supply chains, requiring DNOW to maintain robust systems for tracking product origins and components to meet compliance requirements.

- Adaptability to New Technologies: The evolving nature of industrial products means DNOW must stay abreast of regulatory updates that accommodate new technologies, such as advanced materials or smart components, to remain competitive.

Trade and Tariff Regulations

Changes in trade policies and the imposition of tariffs directly impact DNOW's legal and financial standing. For instance, the USMCA agreement, which came into effect in July 2020, reshaped North American trade dynamics, potentially affecting DNOW's cross-border operations and sourcing strategies. Such regulatory shifts necessitate ongoing vigilance and strategic adjustments.

These evolving trade regulations can significantly alter the cost of goods, disrupt established supply chain routes, and influence market access for DNOW's products and services. For example, a 2024 projection by the International Monetary Fund (IMF) indicated continued volatility in global trade flows due to geopolitical tensions, which could translate to increased import duties or export restrictions for DNOW.

- Impact on Cost of Goods: Tariffs directly increase the landed cost of imported components or finished products, affecting DNOW's pricing and profitability.

- Supply Chain Disruptions: New trade barriers can force DNOW to reconfigure its supply chains, potentially leading to higher logistics costs and longer lead times.

- Market Access Restrictions: Trade policies can limit DNOW's ability to enter or operate in certain international markets, impacting revenue streams.

- Compliance Costs: Adhering to diverse and changing trade regulations requires investment in legal expertise and compliance systems.

Legal factors significantly shape DNOW's operational landscape, demanding strict adherence to product safety and metrology standards across its global markets. Compliance with regulations like the UK's Product Regulation and Metrology Act 2025 ensures product accuracy and builds customer trust, while also preventing legal disputes. Furthermore, evolving supply chain transparency laws, such as Canada's Modern Slavery Act, necessitate robust tracking and reporting mechanisms to address ethical and environmental sourcing concerns.

Environmental factors

Global climate change policies and decarbonization efforts are reshaping the energy landscape, directly impacting companies like DNOW. Governments worldwide are implementing stricter regulations and incentives aimed at phasing out fossil fuels and promoting cleaner energy sources. For instance, the Inflation Reduction Act in the United States, enacted in 2022, provides substantial tax credits for renewable energy projects, accelerating the transition.

This energy transition presents both challenges and opportunities for DNOW. As the demand for traditional oil and gas services may decrease over time due to these policies, DNOW is strategically positioning itself to capitalize on the growing renewable energy sector and decarbonization initiatives. This includes expanding its offerings to support projects focused on carbon capture, utilization, and storage (CCUS), as well as other new energy markets.

DNOW's proactive approach to serving the energy evolution is evident in its investments and business development strategies. By focusing on solutions that facilitate decarbonization, the company aims to remain relevant and profitable amidst shifting market dynamics. For example, DNOW's involvement in projects related to hydrogen production and infrastructure aligns with the global push for lower-carbon energy solutions.

The global push towards resource efficiency and circular economy principles is reshaping industries. Companies are increasingly pressured to adopt cleaner technologies, prioritize recycling, and reuse materials to minimize waste and environmental impact. This trend directly affects suppliers like DNOW, who may see growing demand for sustainably sourced or remanufactured industrial products and services.

In 2024, the World Economic Forum highlighted that adopting circular economy models could unlock $4.5 trillion in economic value globally by 2030. For DNOW, this translates to potential opportunities in offering more eco-friendly product lines and optimizing its supply chain for greater resource efficiency, aligning with evolving customer expectations and regulatory landscapes.

Industrial companies, including DNOW's clientele, are encountering increasingly stringent rules concerning emissions and waste disposal. For instance, the proposed Draft Regulation on the Management of Industrial Emissions, slated for 2025, intends to curb air, water, and soil contamination by focusing on reducing industrial waste and emissions at their origin.

These evolving environmental mandates directly impact the demand for DNOW's offerings, as customers will increasingly require products and solutions that facilitate compliance with these new, stricter standards.

Water Management and Sustainability

Water usage is a critical environmental metric for manufacturing firms, and DNOW's strategic moves highlight its engagement with this aspect of sustainability. The company's acquisition of Trojan Rentals, LLC, significantly bolsters its capabilities in pump rentals and industrial automation, directly addressing the growing demand for efficient water transfer and management solutions.

This acquisition positions DNOW to capitalize on the increasing focus on water-related sustainability practices across industries. By enhancing its service offerings in this area, DNOW is aligning itself with regulatory pressures and market expectations for responsible water stewardship.

- Water Transfer Services: DNOW's expanded pump rental fleet supports critical water management operations for various industrial clients.

- Industrial Automation: The integration of Trojan Rentals' expertise enhances DNOW's ability to provide automated water management systems.

- Sustainability Focus: The move signals DNOW's commitment to offering solutions that address environmental concerns related to water usage and conservation.

ESG and Sustainability Reporting

The growing focus on Environmental, Social, and Governance (ESG) criteria is pushing companies like DNOW to enhance their sustainability reporting. This includes detailing climate-related risks and their carbon footprint, such as Scope 1, 2, and 3 greenhouse gas emissions. For instance, in 2023, the global market for ESG reporting software was valued at approximately $1.2 billion, with projections indicating significant growth as regulatory pressures mount.

DNOW will need to demonstrate concrete actions in environmental stewardship to meet stakeholder expectations and comply with evolving regulations. This involves transparently communicating strategies for reducing emissions and managing environmental impact throughout their operations and supply chain. By 2025, it's anticipated that over 90% of large corporations will be required to report on ESG metrics, making proactive disclosure crucial for maintaining investor confidence.

- Increased ESG Reporting Demands: Companies face growing pressure to disclose environmental and social impact data.

- Climate Risk Disclosure: Transparency regarding climate-related risks and greenhouse gas emissions (Scope 1, 2, 3) is becoming standard.

- Environmental Stewardship: Demonstrating active efforts in environmental management is key to meeting stakeholder and regulatory expectations.

- Market Growth in ESG Software: The ESG reporting software market is expanding rapidly, reflecting the increasing need for robust reporting tools.

Global climate policies are accelerating the energy transition, impacting companies like DNOW. Stricter regulations and incentives for cleaner energy sources, such as the US Inflation Reduction Act, are driving this shift. DNOW is adapting by expanding into renewable energy and decarbonization services like carbon capture and hydrogen infrastructure.

The push for resource efficiency and circular economy principles is creating demand for sustainably sourced industrial products. DNOW can capitalize on this by offering eco-friendly product lines and optimizing its supply chain. The circular economy is projected to unlock significant global economic value, influencing customer expectations and regulatory landscapes.

Evolving environmental mandates, including proposed regulations on industrial emissions, will require DNOW's clients to adopt cleaner technologies, impacting product and service demand. DNOW's acquisition of Trojan Rentals enhances its water transfer and management solutions, addressing growing sustainability concerns and regulatory pressures around water usage.

Increased ESG reporting demands mean companies like DNOW must be transparent about their environmental impact, including greenhouse gas emissions. By 2025, a significant majority of large corporations will need to report on ESG metrics, making proactive environmental stewardship crucial for stakeholder confidence and regulatory compliance.

PESTLE Analysis Data Sources

Our DNOW PESTLE Analysis is built on a robust foundation of data from reputable sources including government regulatory bodies, international economic organizations, and leading industry research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental policies, and legal frameworks to provide a comprehensive overview.