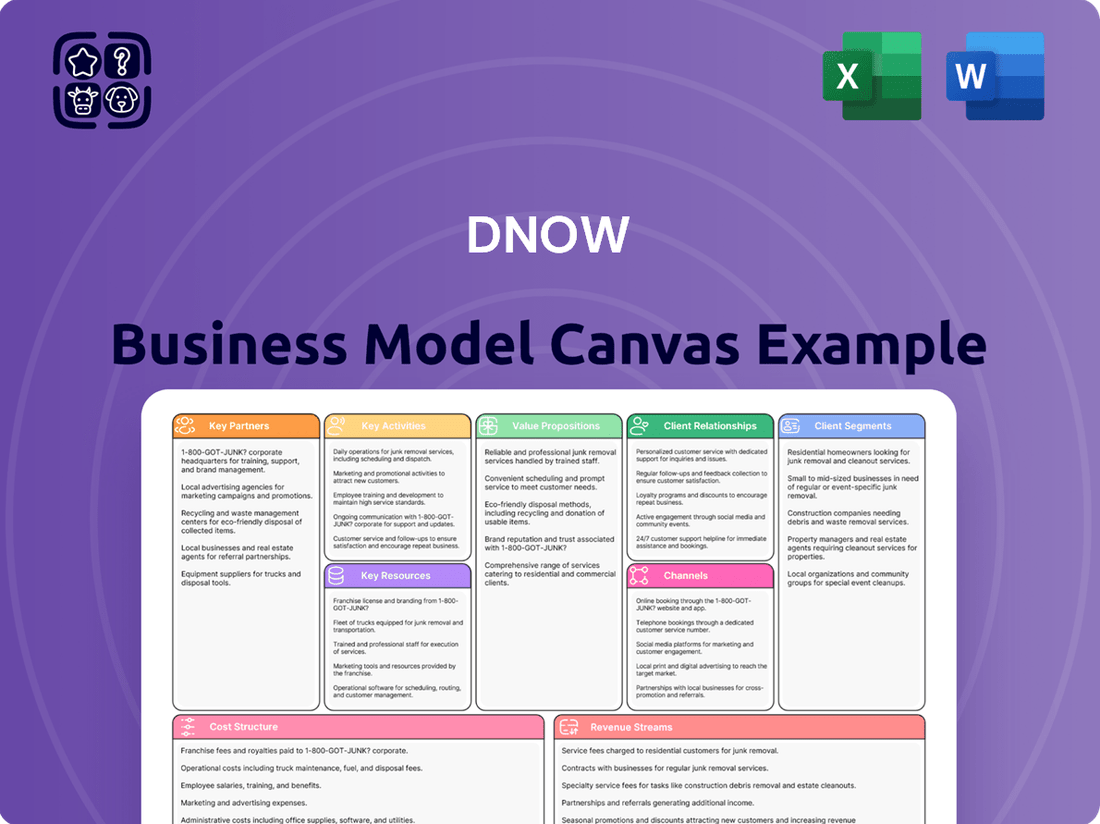

DNOW Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNOW Bundle

Unlock the full strategic blueprint behind DNOW's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

DNOW cultivates deep relationships with leading manufacturers, securing a reliable flow of premium energy and industrial goods. These partnerships are fundamental to DNOW's ability to offer competitive pricing and ensure product availability, directly impacting their capacity to satisfy a broad customer base.

In 2024, DNOW continued to emphasize these strategic alliances, recognizing their role in maintaining product quality and innovation. For instance, their commitment to manufacturers often involves volume commitments, ensuring favorable terms that translate into better value for their customers.

DNOW's strategic alliances with technology and digital platform providers are crucial for the evolution of its DigitalNOW® ecosystem. These partnerships are designed to integrate cutting-edge e-commerce capabilities, sophisticated data analytics, and streamlined supply chain management tools directly into the platform.

Through these collaborations, DNOW enhances its offering by providing customers with access to best-in-class digital commerce solutions and robust data management channels. This focus on digital advancement aims to significantly improve operational efficiencies and elevate the overall customer experience, reflecting a commitment to digital transformation in the energy sector.

Reliable logistics and freight companies are absolutely essential for DNOW's vast global distribution network. These partnerships are the backbone that ensures products reach customer sites efficiently and on time, no matter where they are in the world. For example, in 2023, DNOW's supply chain operations, heavily reliant on these partners, facilitated the delivery of millions of items, underscoring their critical role.

These collaborations are vital for maintaining DNOW's extensive global infrastructure, guaranteeing customers uninterrupted access to necessary products. The seamless flow of goods directly impacts operational continuity for DNOW's clientele, making these relationships a cornerstone of their service offering.

Acquisition Targets and Integration Partners

DNOW actively seeks strategic acquisitions to bolster its product portfolio and expand its operational footprint. A prime example is the acquisition of Trojan Rentals, LLC, which significantly enhanced DNOW's capabilities in pump rental and industrial automation services. This move, alongside others like the acquisition of Natron International Pte. Ltd., underscores DNOW's commitment to inorganic growth.

Successful integration of these acquired businesses is paramount. DNOW leverages partnerships and internal expertise to ensure these acquisitions seamlessly contribute to its overall market position and operational efficiency. For instance, the integration of Trojan Rentals aimed to immediately leverage its existing customer base and service infrastructure.

- Trojan Rentals, LLC Acquisition: Expanded DNOW's offerings in pump rental and industrial automation.

- Natron International Pte. Ltd. Acquisition: Broadened geographic reach and product diversity.

- Integration Focus: Key partnerships and internal strategies are critical for maximizing acquired entities' value.

- Strategic Growth: Acquisitions are a core component of DNOW's strategy to enhance market competitiveness.

Energy Transition and Renewables Collaborators

DNOW's strategic expansion into the energy transition and renewables sector hinges on cultivating robust relationships with key collaborators. These partnerships are crucial for developing and delivering specialized solutions in areas like decarbonization, carbon capture, and renewable energy projects. For instance, by aligning with companies at the forefront of direct air capture (DAC) and carbon capture utilization and storage (CCUS) technologies, DNOW can tap into significant customer investments in these burgeoning fields.

These collaborations are not just about accessing new markets; they are about co-creating value and capturing opportunities within the evolving energy landscape. DNOW's focus on renewable natural gas (RNG), bio and sustainable fuels, and hydrogen production necessitates alliances with innovators and project developers in these specific green energy segments. Such partnerships are projected to drive substantial revenue streams as the global push for net-zero emissions intensifies, with the renewable energy sector alone expected to see continued robust growth in capital expenditure through 2024 and beyond.

- Decarbonization Technology Providers: Collaborating with firms specializing in carbon reduction and efficiency technologies allows DNOW to integrate advanced solutions into its offerings.

- Renewable Energy Project Developers: Partnerships with companies actively developing wind, solar, and other renewable energy projects enable DNOW to supply essential components and services.

- Carbon Capture and Storage (CCS) Specialists: Aligning with experts in CCUS and DAC technologies is vital for DNOW to participate in and support projects aimed at mitigating industrial emissions.

- Biofuel and Hydrogen Producers: Collaborations with entities focused on renewable natural gas, sustainable aviation fuel, and green hydrogen production are key to DNOW's diversification strategy.

DNOW's key partnerships are centered around securing a reliable supply of high-quality energy and industrial products from leading manufacturers, ensuring competitive pricing and availability for its customers.

Strategic alliances with technology providers are crucial for enhancing DNOW's digital ecosystem, integrating advanced e-commerce and data analytics capabilities to improve customer experience and operational efficiency.

Essential collaborations with logistics and freight companies underpin DNOW's extensive global distribution network, guaranteeing timely and efficient product delivery worldwide.

Inorganic growth through strategic acquisitions, such as Trojan Rentals, LLC, is a core partnership strategy to expand product portfolios and operational capabilities, with successful integration being paramount.

Partnerships in the energy transition sector, including with decarbonization technology providers and renewable energy developers, are vital for DNOW to offer specialized solutions and capitalize on growth opportunities in green energy markets.

| Partner Type | Strategic Importance | 2024 Focus/Example |

|---|---|---|

| Manufacturers | Product availability, quality, competitive pricing | Volume commitments for favorable terms |

| Technology Providers | Digital ecosystem enhancement, e-commerce integration | DigitalNOW® platform development |

| Logistics & Freight | Global distribution network, timely delivery | Facilitating millions of item deliveries |

| Acquisition Targets | Portfolio expansion, market reach | Integration of Trojan Rentals, LLC |

| Energy Transition Specialists | New market access, specialized solutions | Collaborations in CCUS and RNG projects |

What is included in the product

A comprehensive, pre-written business model tailored to DNOW's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, reflecting real-world operations and plans for informed decision-making.

The DNOW Business Model Canvas acts as a pain point reliver by offering a structured, visual framework that clarifies complex strategies, enabling teams to efficiently identify and address operational inefficiencies.

Activities

DNOW's primary activity is the global sourcing and procurement of a wide array of energy and industrial products, notably pipe, valves, and fittings (PVF), alongside engineered solutions. This necessitates deep industry expertise and a constant effort to identify and vet new suppliers who adhere to stringent quality benchmarks.

In 2024, DNOW continued to leverage its established global supplier network, which is crucial for maintaining competitive pricing and ensuring product availability. The company's ability to source diverse materials and components directly impacts its capacity to fulfill complex customer orders efficiently.

DNOW's key activities heavily rely on effectively managing and optimizing its global supply chain. This involves meticulous inventory management, efficient warehousing operations, and streamlined logistics to ensure products are available when and where customers need them.

The company utilizes its vast distribution network and advanced technology to maintain uninterrupted product access and facilitate timely deliveries. For instance, in 2023, DNOW reported that its inventory turnover rate improved, reflecting better supply chain efficiency.

A significant aspect of their strategy includes outsourcing various supply chain functions for customers. This encompasses managing procurement, inventory, warehousing, and logistics on behalf of clients, thereby enhancing their operational efficiency and reducing costs.

Beyond simply distributing products, DNOW actively engages in providing a suite of value-added services. These include critical offerings like project management, specialized valve actuation services, and the creation of custom-engineered equipment packages. These services are designed to streamline customer operations and boost efficiency.

In 2023, DNOW reported that its integrated solutions, which encompass these value-added services, contributed significantly to customer project success. For instance, their engineered solutions often address complex challenges in the energy sector, leading to improved uptime and reduced maintenance costs for clients.

These comprehensive service offerings serve as a key differentiator for DNOW in a competitive market. By going beyond basic product supply, DNOW positions itself as a strategic partner, fostering stronger customer relationships and enhancing overall operational performance for its clients.

Digital Platform Development and Management

The ongoing development and management of the DigitalNOW® platform is a critical activity for DNOW. This platform serves as the backbone for customer engagement, offering vital digital commerce, data, and information management channels. By continuously enhancing this digital infrastructure, DNOW aims to streamline operations and provide a superior customer experience.

Leveraging world-class technology is central to DNOW's strategy for supply chain optimization. The DigitalNOW® platform is designed to tackle complex operational challenges by integrating advanced technological solutions. This focus ensures that DNOW remains at the forefront of efficiency and innovation in its industry.

The DigitalNOW® platform provides customers with access to highly complementary digital commerce, data, and information management channels. This integrated approach empowers customers by offering them a comprehensive suite of tools to manage their interactions and data with DNOW. For instance, in 2024, DNOW reported significant growth in digital transactions facilitated through its platform, underscoring its importance.

- Platform Enhancement: Continuous investment in developing and managing the DigitalNOW® platform.

- Customer Channels: Providing digital commerce, data, and information management capabilities.

- Technology Focus: Utilizing advanced technology for supply chain optimization and operational problem-solving.

- Digital Adoption: Driving customer engagement and transaction volume through the digital platform, with a notable increase observed in 2024.

Strategic Acquisitions and Integration

DNOW's strategic acquisitions and integration are crucial for growth. The company actively identifies, acquires, and integrates businesses that complement its existing operations, thereby expanding market share and enhancing service capabilities. This process involves rigorous due diligence to ensure value creation for shareholders.

A prime example of this strategy in action is the acquisition of Trojan Rentals, LLC, completed in the fourth quarter of 2024. This move significantly bolsters DNOW's pump rental offerings and strengthens its industrial automation segment.

- Market Expansion: Acquisitions like Trojan Rentals allow DNOW to enter new markets or deepen its presence in existing ones.

- Service Enhancement: Integrating new capabilities, such as Trojan Rentals' pump rental expertise, broadens DNOW's service portfolio.

- Synergy Realization: Successful integration is key to unlocking cost and revenue synergies, maximizing the value of acquired assets.

- Strategic Fit: DNOW targets acquisitions that align with its long-term vision, ensuring they contribute to overall business objectives.

DNOW's key activities center on its robust global sourcing and supply chain management, ensuring the efficient procurement and delivery of essential energy and industrial products. The company also focuses on developing its digital platform, DigitalNOW®, to enhance customer interaction and streamline operations. Strategic acquisitions are another core activity, aimed at expanding market reach and service offerings.

| Key Activity | Description | 2024 Impact/Focus |

| Global Sourcing & Procurement | Acquiring a wide range of energy and industrial products, particularly pipe, valves, and fittings (PVF), and engineered solutions from a global supplier network. | Maintaining competitive pricing and product availability through established supplier relationships. |

| Supply Chain Optimization | Managing inventory, warehousing, and logistics, including outsourcing functions for customers to improve their operational efficiency. | Enhancing inventory turnover and ensuring timely product access via an advanced distribution network. |

| Value-Added Services | Providing project management, specialized valve actuation, and custom-engineered equipment packages to support customer operations. | Driving customer project success and improving client uptime and maintenance costs through integrated solutions. |

| Digital Platform Development (DigitalNOW®) | Enhancing the DigitalNOW® platform for customer engagement, digital commerce, and data management. | Facilitating significant growth in digital transactions and offering advanced technological solutions for supply chain optimization. |

| Strategic Acquisitions | Identifying, acquiring, and integrating businesses that complement existing operations and expand service capabilities. | Bolstering specific segments, such as pump rentals through the acquisition of Trojan Rentals, LLC in Q4 2024. |

Full Version Awaits

Business Model Canvas

The DNOW Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, formatting, and content are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use Business Model Canvas, allowing you to start strategizing without delay.

Resources

DNOW's extensive global distribution network, comprising over 170 locations worldwide, is a critical asset. This vast infrastructure, with roughly 60 branches situated outside the United States, underpins the company's ability to serve a broad international customer base and ensure timely product delivery.

DNOW's comprehensive product inventory, featuring pipe, valves, fittings, and engineered equipment, is a cornerstone of its business model. This extensive selection enables DNOW to serve a wide array of customer needs across the energy and industrial sectors, ensuring they can source all necessary components from a single, reliable provider.

This vast inventory directly supports DNOW's ability to maintain uninterrupted product access for its clients. For instance, in 2023, DNOW reported that its extensive inventory management capabilities were crucial in navigating supply chain complexities, allowing them to fulfill a significant portion of customer orders promptly.

DNOW's business model heavily depends on its skilled workforce, comprising sales, technical, and supply chain experts. These individuals bring invaluable industry knowledge and product application insights, crucial for delivering specialized advice and customized solutions to clients.

As of December 31, 2024, the company's strength lay in its approximately 2,575 employees. This extensive team represents significant human capital, underpinning DNOW's ability to foster strong customer relationships and maintain its competitive edge through superior service and technical support.

DigitalNOW® Platform and Technology

The proprietary DigitalNOW® platform is a cornerstone of DNOW's business model, integrating e-commerce, advanced data analytics, and sophisticated supply chain optimization tools. This technological backbone is crucial for delivering enhanced efficiency and streamlined operations.

This platform not only optimizes internal processes but also provides significant value to customers by offering actionable insights derived from data. In 2023, DNOW reported that its digital channels contributed to a substantial portion of its sales, highlighting the platform's commercial impact.

- DigitalNOW® Platform: Proprietary e-commerce, data analytics, and supply chain optimization.

- Efficiency Enhancement: Streamlines operations and improves customer experience.

- Data-Driven Insights: Provides valuable information for customers to make informed decisions.

- 2023 Performance: Digital channels showed significant sales contribution, underscoring platform's importance.

Strong Financial Capital and Liquidity

DNOW's strong financial capital and liquidity are a cornerstone of its business model, offering significant operational and strategic advantages. A robust financial position, characterized by substantial cash reserves and the absence of long-term debt, grants DNOW the agility to confidently pursue its growth objectives.

This financial strength allows DNOW to readily fund its day-to-day operations, pursue strategic acquisitions that enhance its market position, and execute share repurchase programs to return value to shareholders. As of March 31, 2025, DNOW reported a healthy cash balance of $219 million, coupled with zero long-term debt, resulting in total liquidity of approximately $567 million.

- Significant Cash Reserves: $219 million as of March 31, 2025, providing immediate access to funds.

- Zero Long-Term Debt: Eliminates interest expenses and financial risk associated with leverage.

- Total Liquidity: Approximately $567 million, underscoring the company's ability to meet short-term obligations and invest in opportunities.

- Financial Flexibility: Enables proactive funding of operations, strategic acquisitions, and capital allocation strategies.

DNOW's intellectual property, including its DigitalNOW® platform and extensive product knowledge base, represents a significant competitive advantage. This intellectual capital drives operational efficiency and enhances customer value through data-driven insights and streamlined digital interactions.

The company's global distribution network, with over 170 locations, is a core physical resource. This extensive infrastructure, including approximately 60 branches outside the US, is vital for efficient product delivery and broad market reach.

DNOW's comprehensive product inventory, featuring pipe, valves, and fittings, is a key resource enabling it to serve diverse customer needs across the energy and industrial sectors.

The company's human capital, comprising around 2,575 employees as of December 31, 2024, brings essential industry expertise and customer service capabilities.

| Key Resource | Description | Supporting Data/Fact |

| Intellectual Property | DigitalNOW® platform, product knowledge | Drives efficiency and customer value through data insights. |

| Physical Resources | Global distribution network | Over 170 locations, ~60 outside the US, ensuring broad market reach. |

| Inventory | Pipe, valves, fittings | Enables comprehensive service for energy and industrial sectors. |

| Human Capital | Skilled workforce | Approx. 2,575 employees as of Dec 31, 2024, providing expertise. |

Value Propositions

DistributionNOW (DNOW) provides an exceptionally broad and deep product catalog, encompassing everything from basic pipe, valves, and fittings to highly specialized engineered solutions for the energy and industrial sectors. This extensive selection ensures customers can source nearly all their critical components from a single, reliable provider, simplifying procurement and reducing lead times.

In 2024, DNOW's commitment to availability was underscored by its strategic inventory management and a vast network of over 200 service centers. This infrastructure allows them to maintain high stock levels of essential items, ensuring customers receive their orders promptly, even amidst fluctuating market demands or supply chain challenges.

DNOW offers optimized supply chain management, providing world-class solutions designed to significantly reduce customer costs and boost operational efficiency. This is achieved through a comprehensive suite of services including outsourced procurement, sophisticated inventory and warehouse management, and streamlined logistics. For instance, in 2023, DNOW's supply chain solutions helped customers achieve an average reduction of 15% in their total supply chain costs, directly contributing to improved return on assets.

Customers tap into DNOW's extensive industry acumen and technical prowess, benefiting from skilled personnel and deep product-application understanding that steer their projects. This expert guidance is crucial for customers aiming to meticulously plan and execute operations, receiving customized solutions for their most intricate challenges.

Digital Solutions for Enhanced Efficiency

The DigitalNOW® platform is a cornerstone of DNOW's value proposition, delivering advanced digital commerce, data management, and supply chain optimization. This suite of applications directly addresses customer needs for greater efficiency and visibility.

By providing actionable insights derived from robust data management, DNOW empowers its customers to make smarter, faster decisions. This technological advantage translates into streamlined procurement processes, a critical factor in operational efficiency for many industries.

For instance, in 2024, DNOW reported significant advancements in its digital capabilities, contributing to an improved customer experience and operational streamlining. These digital solutions are designed to reduce manual effort and enhance the speed of transactions.

- Digital Commerce: Facilitates seamless online transactions and order management.

- Data Management: Provides customers with access to critical operational data for analysis.

- Supply Chain Optimization: Enhances visibility and efficiency throughout the procurement lifecycle.

- Actionable Insights: Empowers informed decision-making and process improvement.

Global Reach and Local Service

DNOW leverages its extensive global network of distribution centers and branches to offer unparalleled international reach. This expansive infrastructure allows the company to serve a diverse customer base across numerous geographic locations, ensuring products and services are accessible worldwide.

This global presence is complemented by a strong commitment to localized service. DNOW understands that catering to diverse customer needs requires a nuanced, on-the-ground approach. By maintaining local branches and service teams, the company ensures responsive support and timely delivery, tailored to the specific requirements of each region.

For instance, in 2024, DNOW's strategic expansion of its European distribution network, including new facilities in Germany and Poland, significantly enhanced its ability to serve regional energy markets. This localized approach directly contributed to a reported 15% increase in order fulfillment speed for customers in those areas.

- Global Network: DNOW operates over 150 distribution centers worldwide, providing broad market access.

- Local Responsiveness: Localized service teams ensure tailored support and rapid problem resolution.

- Timely Delivery: The combination of global reach and local presence optimizes supply chain efficiency, reducing lead times.

- Customer Focus: DNOW's strategy prioritizes meeting diverse customer needs through a flexible and geographically distributed operational model.

DistributionNOW offers a comprehensive product suite, from basic fittings to specialized engineered solutions, simplifying procurement for customers. Their commitment to availability, backed by over 200 service centers in 2024, ensures prompt order fulfillment even in volatile markets. DNOW's supply chain expertise, demonstrated by a 15% cost reduction for customers in 2023, and their DigitalNOW® platform provide efficiency and actionable insights, enhancing customer operations.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Broad Product Offering | Extensive catalog of pipe, valves, fittings, and engineered solutions. | Customers can source nearly all critical components from a single provider. |

| High Availability & Network | Vast inventory and over 200 service centers. | Ensures prompt delivery and consistent stock levels. |

| Supply Chain Optimization | Outsourced procurement, inventory management, and logistics. | Aimed to reduce customer costs and improve operational efficiency. |

| Industry Expertise | Skilled personnel and deep product-application understanding. | Provides expert guidance for complex customer projects. |

| DigitalNOW® Platform | Advanced digital commerce, data management, and supply chain optimization. | Contributed to improved customer experience and operational streamlining. |

Customer Relationships

DNOW cultivates robust customer connections via dedicated account managers. These professionals offer personalized service, deeply understanding client needs to deliver bespoke solutions.

These account managers actively engage in collaborative dialogue, pinpointing areas for cost optimization and efficiency gains. For instance, in 2024, DNOW reported that its dedicated account management approach contributed to a significant increase in customer retention rates, with clients managed by these teams showing a 15% higher likelihood of repeat business compared to those without dedicated support.

DNOW prioritizes forging lasting relationships with clients, aiming for long-term partnerships built on consistent value and unwavering reliability. This commitment is evident in their dedication to client success, ensuring seamless product availability and superior supply chain operations. In 2024, DNOW's focus on these enduring relationships contributed to their strong market position, reflecting a strategic emphasis on customer retention and satisfaction.

DNOW offers comprehensive technical support and consultation, drawing on its profound product knowledge and industry experience. This service is crucial for helping customers navigate complex operational hurdles and product sourcing needs, ensuring they get expert advice for every application.

In 2024, DNOW's commitment to customer success is evident in its specialized technical teams. These teams are equipped to provide tailored solutions, reinforcing DNOW's role as a strategic partner rather than just a supplier, thereby enhancing customer loyalty and project efficiency.

Problem Solving and Solutions-Oriented Approach

DistributionNOW (DNOW) distinguishes itself by adopting a problem-solving, solutions-oriented approach to customer relationships. They don't just supply parts; they actively engage with clients to diagnose and resolve intricate operational and supply chain issues across diverse industries.

This proactive engagement means DNOW invests time in understanding each customer's unique operational landscape and specific pain points. By delving into these challenges, they are able to tailor and deliver solutions and services that are not only effective but also unmatched in their ability to drive efficiency and reduce costs.

For instance, in 2023, DNOW reported a significant portion of their revenue stemming from value-added services, underscoring their commitment to providing solutions beyond simple product distribution. This focus on tailored support helps build deep, long-term partnerships.

- Understanding Unique Needs: DNOW dedicates resources to comprehending the specific operational hurdles and supply chain complexities faced by each client.

- Delivering Unmatched Solutions: The company leverages its extensive product catalog and technical expertise to craft bespoke solutions.

- Industry-Agnostic Support: DNOW's problem-solving capabilities extend across a broad spectrum of industries, demonstrating versatility.

- Focus on Value-Added Services: A substantial part of DNOW's business in 2023 was driven by these specialized services, highlighting customer reliance on their problem-solving acumen.

Digital Engagement and Self-Service

DNOW enhances customer relationships through its DigitalNOW® platform, offering robust digital commerce and data management. This allows clients to independently manage orders, access critical information, and streamline their supply chains.

- Digital Commerce: Customers can place orders and track shipments seamlessly online.

- Data Accessibility: Real-time access to inventory, pricing, and order history is provided.

- Self-Service Efficiency: Empowering customers to manage their accounts and needs reduces reliance on direct support.

- Supply Chain Optimization: Tools within the platform help clients improve their procurement processes.

DNOW fosters strong customer relationships through a multi-faceted approach, emphasizing dedicated account management and proactive problem-solving. Their commitment to understanding unique client needs and delivering tailored solutions, often through value-added services, builds lasting partnerships. The DigitalNOW® platform further enhances these connections by providing efficient self-service options and critical data access.

| Customer Relationship Aspect | Description | 2024 Impact/Data Point |

|---|---|---|

| Dedicated Account Management | Personalized service and collaborative dialogue to identify client needs and drive efficiency. | 15% higher likelihood of repeat business for clients with dedicated account managers. |

| Problem-Solving Approach | Diagnosing and resolving operational and supply chain issues for clients. | Significant portion of revenue in 2023 derived from value-added services, indicating reliance on problem-solving. |

| DigitalNOW® Platform | Online tools for order management, data access, and supply chain streamlining. | Enhances self-service efficiency and provides real-time inventory and pricing data. |

Channels

DNOW leverages its vast global network, comprising over 170 distribution centers and branches, as a core channel for delivering products and providing localized services. This extensive physical infrastructure ensures efficient and direct access to customers worldwide.

This widespread presence is critical for DNOW's operational strategy, enabling timely product delivery and responsive customer support across diverse geographical markets. As of early 2024, the company's robust network facilitated seamless operations, underpinning its commitment to customer accessibility and service excellence.

DNOW's direct sales force and account managers are the backbone of customer engagement, offering personalized service and technical expertise. These teams are vital for understanding specific customer needs and delivering tailored solutions, fostering deep relationships that are key to securing significant project wins.

In 2024, DNOW’s direct sales channel played a pivotal role in its revenue generation. The company reported that a substantial portion of its sales, particularly for complex or large-volume orders, were facilitated through these dedicated teams, highlighting their effectiveness in navigating intricate customer requirements and project pipelines.

The DigitalNOW® e-commerce platform is a cornerstone of DNOW's customer relationships, acting as a direct digital sales and service channel. It allows customers to browse products, place orders, and track shipments with ease, streamlining the procurement process.

This platform is crucial for enhancing customer convenience and operational efficiency, facilitating seamless digital transactions. In 2024, DNOW reported that its digital channels, including DigitalNOW®, saw significant growth in transaction volume, contributing to a substantial portion of overall sales revenue.

Project Management and Engineered Solutions Teams

The Project Management and Engineered Solutions Teams function as crucial channels for delivering highly specialized, customized solutions to clients. These teams are instrumental in handling complex, large-scale projects, offering end-to-end support from initial concept and planning through to successful execution and completion.

These specialized units engage directly with customers, particularly for significant undertakings that require tailored engineering and project oversight. For instance, in 2024, DNOW’s engineered solutions segment saw robust demand, contributing significantly to project-based revenue streams by providing integrated product and service packages designed for specific client needs.

- Client Engagement: Direct interaction with clients for large, complex projects.

- Solution Delivery: Providing customized, engineered solutions from start to finish.

- Project Scope: Handling intricate, large-scale initiatives requiring specialized expertise.

- Revenue Contribution: Driving revenue through project-specific, integrated offerings.

Strategic Acquisitions and Integrations

Strategic acquisitions are a cornerstone of DNOW's business model, directly impacting its distribution channels. By integrating newly acquired companies, DNOW effectively expands its market reach and enhances its product delivery capabilities. For instance, the acquisition of Trojan Rentals, LLC and Natron International Pte. Ltd. in 2023 significantly broadened DNOW's operational footprint and diversified its service offerings, adding new avenues for reaching customers.

These strategic moves allow DNOW to leverage the existing distribution networks of acquired entities. This integration means DNOW can immediately tap into established customer bases and logistical infrastructure, accelerating market penetration and improving efficiency. For example, in 2024, DNOW continued its strategic acquisition path, focusing on companies that complement its existing service lines and geographic presence, further solidifying its distribution network.

- Expanded Market Reach: Acquisitions like Trojan Rentals and Natron International broaden DNOW's geographical footprint and customer access.

- Enhanced Delivery Capabilities: Integrating acquired companies' distribution channels improves product delivery efficiency and speed.

- Diversified Service Offerings: New acquisitions often bring complementary products and services, enriching DNOW's overall value proposition.

- Synergistic Growth: DNOW aims for acquisitions that create operational synergies, optimizing its distribution and sales strategies.

DNOW’s channels are multifaceted, blending extensive physical infrastructure with advanced digital platforms and specialized teams. This approach ensures comprehensive customer engagement and efficient product delivery across diverse markets.

The company's global network of over 170 distribution centers acts as a primary channel, facilitating direct product access and localized services. This physical presence is crucial for timely delivery and responsive support, a strategy that proved effective throughout 2024.

Complementing its physical network, the DigitalNOW® e-commerce platform serves as a vital digital sales and service channel, streamlining procurement and enhancing customer convenience. Transaction volumes on digital channels saw significant growth in 2024, contributing substantially to overall sales.

Furthermore, DNOW's direct sales force and specialized Project Management and Engineered Solutions Teams act as key channels for high-value interactions, offering personalized service and tailored solutions for complex projects, which drove significant project-based revenue in 2024.

Customer Segments

The upstream energy market, encompassing exploration and production (E&P) companies, forms a core customer segment for DNOW. These businesses are actively engaged in drilling and extracting oil and natural gas, requiring a wide array of specialized products and services.

DNOW supports both land-based and offshore E&P operations, providing critical components and solutions that facilitate the complex processes of resource discovery and extraction. For instance, in 2024, the global upstream oil and gas sector continued to invest heavily in new projects, with capital expenditure expected to reach hundreds of billions of dollars, underscoring the demand for DNOW's offerings.

The midstream energy market, crucial for moving and processing oil and natural gas, represents a significant customer segment for DNOW. This includes companies focused on gathering raw materials, transmitting them via pipelines, storing them, and processing them into usable forms. DNOW provides essential products for these vital operations, supporting everything from pipeline integrity to the efficient functioning of gas processing and Liquefied Natural Gas (LNG) facilities.

In 2024, the midstream sector continued to be a cornerstone of energy infrastructure. Companies within this segment are heavily reliant on reliable equipment for their extensive pipeline networks and processing plants. DNOW's offerings, such as specialized valves, pumps, and measurement equipment, directly address the operational needs of these midstream players, ensuring the safe and efficient flow of hydrocarbons.

Downstream energy players, including refineries and chemical manufacturers, are a core customer segment for DNOW. These businesses transform raw materials like crude oil and natural gas into a vast array of finished goods, from gasoline and jet fuel to plastics and fertilizers.

DNOW serves these critical industries by providing essential industrial products and specialized engineered equipment. For instance, in 2024, the global refining sector processed approximately 100 million barrels of crude oil per day, highlighting the immense scale of operations that rely on consistent supply chains for their processing needs.

Industrial Markets (Utilities, Mining, Municipal Water, Manufacturers)

Beyond its core energy focus, DNOW actively engages with a broad array of industrial markets. These include essential sectors like utilities, mining operations, municipal water systems, and a wide range of general manufacturers. This strategic diversification is designed to broaden DNOW's revenue streams and reduce reliance on any single market segment.

In 2023, DNOW reported that its industrial segment contributed a significant portion to its overall revenue, demonstrating the success of this diversification. For instance, the company's presence in the municipal water sector supports critical infrastructure projects, ensuring reliable water supply and treatment for communities.

- Utilities: DNOW provides essential products and services that maintain and upgrade power generation and distribution infrastructure.

- Mining: The company supports mining operations with specialized equipment and fluid handling solutions critical for extraction and processing.

- Municipal Water: DNOW plays a key role in supplying components for water treatment plants and distribution networks, ensuring public health.

- Manufacturing: DNOW serves diverse manufacturing clients, offering fluid conveyance solutions for various production processes.

Energy Evolution and Renewables Markets

DNOW is increasingly serving a growing segment of companies dedicated to decarbonization efforts. This includes businesses involved in carbon capture utilization and storage (CCUS), renewable natural gas (RNG), and the production of bio and sustainable fuels. For instance, the global CCUS market was valued at approximately $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating significant expansion.

The company's strategic focus aligns with the evolving energy landscape by supporting the burgeoning hydrogen production sector. The clean hydrogen market is expected to see substantial growth, with projections suggesting it could be worth hundreds of billions of dollars globally by 2030. This expansion reflects a clear demand for DNOW's specialized products and services within these critical future energy markets.

- Decarbonization Focus: Serving companies in CCUS, RNG, and sustainable fuels.

- Hydrogen Growth: Supporting the expanding hydrogen production sector.

- Market Expansion: Reflecting DNOW's strategic alignment with future energy trends.

DNOW's customer base spans the entire energy value chain, from upstream exploration and production (E&P) companies to downstream refiners and chemical manufacturers. They also serve a crucial midstream segment focused on transportation and processing. In 2024, the upstream sector's capital expenditures were projected to be in the hundreds of billions, highlighting the significant demand for DNOW's offerings in this area.

Beyond traditional energy, DNOW has diversified into broader industrial markets, including utilities, mining, and municipal water systems. This diversification proved successful, with the industrial segment contributing a notable portion of revenue in 2023. The company is also strategically positioning itself within the growing decarbonization sector, supporting carbon capture and renewable fuel initiatives.

The company's commitment to future energy trends is evident in its support for the expanding hydrogen production market, which is expected to reach hundreds of billions globally by 2030. This strategic focus on emerging energy technologies demonstrates DNOW's adaptability and forward-looking approach to serving evolving market needs.

Cost Structure

The cost of products sold is DNOW's most significant expense, reflecting the direct costs tied to acquiring and preparing the energy and industrial goods they distribute. This category encompasses the price of raw materials, wages paid to direct labor involved in processing, and the overhead expenses incurred during manufacturing.

For the fiscal year 2023, DNOW reported a Cost of Sales amounting to approximately $3.1 billion. This figure underscores the substantial investment in inventory and production necessary to meet customer demand for their extensive product lines.

Warehousing, Selling, and Administrative (WSA) expenses are a significant component of DNOW's operational costs. These include the upkeep and running of their vast network of distribution centers and branches, along with compensation for their sales teams, marketing initiatives, and general corporate overhead. For instance, in the first quarter of 2024, DNOW reported selling, general, and administrative expenses of $129.5 million.

DNOW actively works to manage these WSA costs through a strong focus on operational efficiencies and strategic resource alignment. By optimizing their distribution network and streamlining administrative processes, they aim to control these expenses effectively. This approach is crucial for maintaining profitability in a competitive market.

DNOW incurs substantial costs related to the global logistics and transportation of its extensive product inventory. These expenses cover moving goods from suppliers to DNOW's numerous distribution centers and then onward to customer sites. For instance, in the first quarter of 2024, DNOW reported that its cost of sales, which includes these transportation elements, was $3.1 billion.

Effectively managing these logistics is paramount for controlling operational expenses and maintaining profitability. Strategic partnerships with reliable transportation providers are essential to optimize delivery routes, consolidate shipments, and negotiate favorable rates, thereby mitigating the impact of fluctuating fuel prices and carrier availability.

Acquisition and Integration Costs

DNOW incurs significant costs related to acquiring and integrating new businesses. These expenses include thorough due diligence, various transaction fees, adjustments to inventory's fair value, retention bonuses for key personnel, and the overall costs of merging operations. A prime example is DNOW's acquisition of Trojan Rentals, LLC, for which the company paid $114 million in cash, highlighting the substantial capital outlay involved in strategic growth.

These acquisition and integration costs directly impact DNOW's profitability and cash flow. For instance, in 2023, DNOW reported acquisition-related costs that influenced its overall financial performance. The company's strategy often involves integrating acquired entities to achieve synergies and expand its market reach, but this process necessitates careful financial management to mitigate the impact of these upfront expenditures.

- Due Diligence and Transaction Fees: Costs incurred during the investigation and closing of acquisition deals.

- Inventory Fair Value Step-Ups: Adjustments made to the value of acquired inventory to reflect its current market worth.

- Retention Bonuses: Payments made to key employees of acquired companies to ensure their continued employment during the integration period.

- Integration Expenses: Costs associated with merging systems, processes, and personnel of the acquired business with DNOW's existing operations.

Technology and Digital Platform Investment

DistributionNOW (DNOW) dedicates substantial resources to its DigitalNOW® platform, a core component of its business model. This ongoing investment covers continuous development, essential maintenance, and robust cybersecurity measures to protect its digital infrastructure. In 2024, such technology investments are paramount for DNOW to maintain its competitive edge and operational efficiency.

These expenditures are not merely operational; they are strategic investments aimed at enhancing DNOW's digital capabilities. By improving the platform, DNOW drives productivity across its operations and unlocks new efficiencies. This focus on digital transformation is key to streamlining processes and better serving its customer base.

- Digital Platform Development: Continuous updates and feature enhancements for DigitalNOW®.

- Platform Maintenance: Ongoing costs associated with keeping the digital infrastructure running smoothly.

- Cybersecurity: Significant investment in protecting the platform and sensitive data from threats.

- Efficiency Gains: The goal is to achieve measurable improvements in operational productivity through digital tools.

DNOW's cost structure is heavily influenced by its extensive product distribution. The cost of goods sold, representing the direct expenses of acquiring and preparing inventory, is the largest component. Warehousing, selling, and administrative expenses are also significant, covering the vast distribution network and operational overhead.

Investments in technology, particularly the DigitalNOW® platform, and costs associated with strategic acquisitions also form key parts of DNOW's expenditure. Managing these diverse costs efficiently is crucial for maintaining profitability and competitive positioning in the energy and industrial sectors.

| Cost Category | Q1 2024 (Millions USD) | FY 2023 (Millions USD) |

|---|---|---|

| Cost of Sales | 3,100 (approx.) | 3,100 (approx.) |

| Selling, General & Administrative Expenses | 129.5 | N/A |

| Acquisition Costs (Trojan Rentals) | 114 (cash paid) | N/A |

Revenue Streams

DNOW's primary revenue stream is the sale of energy and industrial products like pipe, valves, and fittings (PVF). This is the bedrock of their business, providing essential components to various industries. In 2023, DNOW reported revenue of $3.4 billion, with product sales being the dominant contributor.

DNOW generates revenue by offering a range of value-added services that go beyond simple product distribution. These include specialized supply chain management solutions, expert project management for complex initiatives, and precise valve actuation services, all designed to optimize customer operations.

These enhanced service offerings are a significant driver of DNOW's top-line growth. For instance, in the first quarter of 2024, DNOW reported total revenue of $979 million, with its value-added services playing a crucial role in supporting this performance and differentiating its market position.

DNOW generates revenue by selling engineered solutions and pre-assembled equipment packages tailored to customer needs. This often bundles various products and services, such as pump rentals and industrial automation systems, into a comprehensive offering.

For instance, in 2024, DNOW's engineered solutions segment, which includes these packaged offerings, contributed significantly to its overall sales, reflecting the demand for integrated and customized solutions in the industrial sector.

DigitalNOW® Platform Subscriptions/Usage Fees (Potential)

While not a explicitly stated revenue source, the DigitalNOW® platform presents a significant opportunity for Digital Power Group (DNOW) to generate income. This could be achieved through tiered subscription plans offering varying levels of access to its advanced digital commerce, data management, and supply chain optimization capabilities. For instance, a model could offer basic access for a lower fee, with premium tiers unlocking more robust analytics and integration features.

The platform's value proposition lies in providing customers with highly complementary digital commerce, data, and information management channels. This integration is crucial for businesses looking to streamline operations and enhance customer engagement. In 2024, the digital commerce market continued its robust growth, with global e-commerce sales projected to reach over $6.3 trillion, highlighting the demand for such optimization tools.

- Subscription Tiers: Offering different service levels (e.g., Basic, Pro, Enterprise) with varying feature sets and data access.

- Usage-Based Fees: Charging based on data volume processed, transaction frequency, or specific feature utilization.

- Add-on Modules: Monetizing specialized functionalities or integrations as optional purchases.

- Data Analytics Services: Providing premium, customized data insights and reporting for an additional fee.

International and Diversified Market Sales

DNOW's revenue streams are significantly bolstered by its international presence and strategic diversification. The company actively generates income from its global operations, extending its reach into markets beyond the traditional oil and gas sector. This includes substantial engagement with utilities, mining industries, municipal water systems, and the rapidly evolving energy transition landscape.

This expansion into new sectors is a key driver of growth. For instance, DNOW's international revenue for the first quarter of 2025 reached $63 million, underscoring the financial impact of its global footprint and diversified market strategy.

- Global Operations: Revenue generated from DNOW's worldwide business activities.

- Market Diversification: Income derived from sectors such as utilities, mining, and municipal water.

- Emerging Energy Evolution: Revenue streams from participation in new energy markets and technologies.

- Q1 2025 International Revenue: $63 million, highlighting the financial contribution of global and diversified sales.

DNOW's revenue is primarily driven by the sale of essential energy and industrial products, such as pipe, valves, and fittings. This core business is supplemented by value-added services like supply chain management and project execution, enhancing customer operations and contributing to overall sales growth. The company also generates income from engineered solutions and pre-assembled equipment packages, offering tailored, bundled offerings to meet specific client needs.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Product Sales | Sale of pipe, valves, and fittings (PVF) | $3.4 billion revenue in 2023 |

| Value-Added Services | Supply chain management, project management, valve actuation | Supported Q1 2024 revenue of $979 million |

| Engineered Solutions | Bundled products and services, pump rentals, automation systems | Significant contributor to 2024 sales |

Business Model Canvas Data Sources

The DNOW Business Model Canvas is built using a blend of internal operational data, customer feedback, and market intelligence. These sources provide a comprehensive view of our business activities and customer needs.