DNOW Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DNOW Bundle

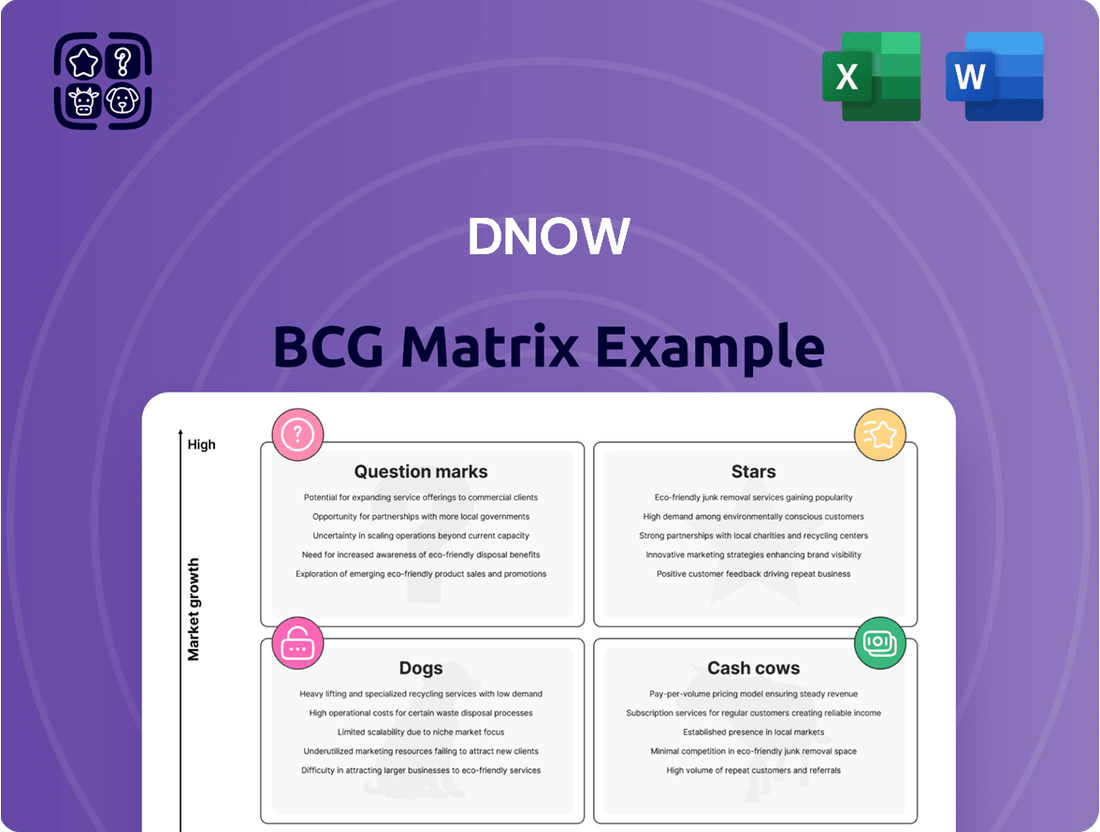

Are you ready to unlock the secrets of a company's product portfolio? The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a powerful framework for strategic decision-making. This glimpse provides a foundational understanding, but imagine the clarity of knowing precisely where each product fits and the actionable insights you can glean.

Purchase the full BCG Matrix report to gain a comprehensive breakdown of each product's position, complete with data-backed recommendations and a clear roadmap for optimizing your investments and product strategy. Don't just understand the theory; leverage it for tangible business impact.

Stars

DNOW's U.S. Process Solutions segment marked a significant milestone in Q1 2025, achieving its peak revenue contribution. This growth is fueled by the increasing demand for engineered solutions and industrial automation as businesses prioritize operational efficiency.

The segment's robust performance is further amplified by strategic moves, such as the late 2024 acquisition of Trojan Rentals. This acquisition significantly strengthened DNOW's capabilities in water transfer and management, directly supporting the burgeoning trend of industrial automation.

The midstream energy sector, especially natural gas pipelines, is looking strong. This is thanks to worldwide energy needs, more liquefied natural gas exports, and the increasing power demands from AI and data centers. In 2024, the U.S. Energy Information Administration (EIA) projected continued growth in natural gas consumption, underscoring the importance of this infrastructure.

DNOW (DistributionNOW) has a solid footing in U.S. midstream infrastructure, holding a significant market share. This positions them well to benefit from the ongoing investments in this vital energy area, as companies continue to build out the necessary networks.

The DigitalNOW platform is a cornerstone of DNOW's strategy, already accounting for 53% of its total SAP revenue. This highlights DNOW's substantial presence in the digital transformation wave sweeping through industrial distribution.

The industrial distribution sector is rapidly embracing e-commerce and digital solutions, presenting a fertile ground for DNOW's digital products to capture high growth. This trend underscores the strategic importance of DNOW's digital investments.

By consistently investing in its digital capabilities, DNOW is not only boosting its operational efficiency but also elevating the customer experience. This focus on digital innovation reinforces its position as a leader in the evolving market.

Decarbonization and Energy Evolution Offerings

DNOW is strategically positioning itself to capitalize on the growing demand for decarbonization and energy evolution solutions. This focus aligns with a market experiencing significant expansion due to increasing environmental awareness and sustainability mandates.

While precise market share figures for these emerging product lines are not yet widely published, DNOW's dedicated investment in this sector suggests a strong potential to secure substantial market presence as these energy transition markets mature.

The company is actively adapting its product and service portfolio to address the evolving needs of its clientele, who are increasingly seeking cleaner energy alternatives and sustainable operational practices.

- Focus on Decarbonization: DNOW is investing in products and solutions that facilitate the shift towards lower-carbon energy sources.

- Energy Evolution Alignment: The company is adapting its offerings to support the broader transition in the energy sector, including renewable energy and energy efficiency technologies.

- Market Growth Potential: This strategic direction targets a high-growth market driven by global sustainability goals and regulatory pressures.

- Customer Demand Responsiveness: DNOW is responding to customer needs for cleaner and more sustainable energy solutions.

High-Value Engineered Solutions

DNOW's high-value engineered solutions, such as packaged process and production equipment, are critical to the energy sector's evolving needs. These complex, integrated offerings, including specialized services like valve actuation, cater to demanding industrial applications. The company's ability to deliver customized and efficient solutions positions it strongly in markets requiring deep technical expertise.

In 2024, DNOW's focus on these specialized areas contributed significantly to its revenue streams, reflecting a growing demand for sophisticated equipment and services. For instance, their engineered solutions segment saw robust activity, driven by projects requiring advanced automation and control systems.

- Engineered Solutions Growth: DNOW's engineered solutions segment experienced a notable uptick in demand throughout 2024, particularly in areas supporting energy transition projects and enhanced oil recovery.

- Market Share in Complex Projects: The company maintains a strong market position in providing integrated equipment packages, often commanding significant market share due to the specialized nature and high entry barriers of these offerings.

- Customer Value Proposition: DNOW's approach emphasizes delivering tailored, efficient solutions that directly address critical operational challenges for its clients, enhancing productivity and reducing downtime.

DNOW's U.S. Process Solutions, particularly engineered solutions, are performing as Stars in the BCG matrix. These segments are characterized by high growth and high market share, demanding significant investment to maintain their leading positions and capitalize on future opportunities.

The strong performance in engineered solutions, driven by demand for automation and decarbonization technologies, positions these areas for continued expansion. DNOW's strategic acquisitions, like Trojan Rentals in late 2024, further bolster these high-growth segments.

The company's substantial presence in digital transformation, with its DigitalNOW platform capturing 53% of SAP revenue, also aligns with Star characteristics, benefiting from the rapid e-commerce adoption in industrial distribution.

The midstream energy sector, supported by global energy needs and AI-driven power demands, represents another Star, with DNOW holding a significant market share in infrastructure development.

| Segment | Growth Rate | Market Share | BCG Classification |

| U.S. Process Solutions (Engineered) | High | High | Star |

| DigitalNOW Platform | High | High | Star |

| Midstream Energy Infrastructure | High | High | Star |

What is included in the product

The DNOW BCG Matrix analyzes business units by market share and growth, guiding investment decisions.

A clear BCG Matrix visualization quickly identifies underperforming units, relieving the pain of resource misallocation.

Cash Cows

DNOW's traditional U.S. energy centers are indeed its cash cows, generating a substantial 69% of its total U.S. revenue. This highlights their significant role in a mature but steady segment of the energy distribution landscape.

These established operations consistently deliver robust cash flow, a critical advantage even with the moderate growth observed in traditional upstream and downstream energy sectors. This financial stability is a testament to their enduring market position.

The resilience of this segment is a core strength for DNOW, providing the necessary capital to fuel investments and expansion into other, potentially higher-growth areas of the business.

DNOW's Industrial PVF Distribution business is a strong Cash Cow. As the fourth-largest distributor in North America, they command a substantial presence in a market critical for energy and industrial infrastructure. This segment consistently generates significant cash flow due to stable demand and DNOW's optimized supply chain and deep customer ties.

MRO Industrial Distribution, represented by DNOW, operates within a mature, low-growth sector, positioning it as a potential Cash Cow. Its standing among the top 20 distributors underscores a significant market share in this essential, non-discretionary segment.

The consistent demand for MRO supplies ensures a reliable revenue stream, a hallmark of Cash Cow businesses. This stability allows for efficient operations and substantial cash generation with minimal need for aggressive marketing or expansion investments.

Core Supply Chain Management Services

DNOW's core supply chain management services are a cornerstone of its operations, acting as a reliable cash cow. These offerings are designed to boost customer efficiency through DNOW's extensive network and deep industry expertise.

While operating in a mature market, DNOW's established infrastructure and long-standing relationships allow it to maintain a strong market share. This consistent performance translates into significant contributions to the company's profitability and fosters robust customer loyalty.

- Foundational Business Aspect: DNOW's supply chain services are integral to its business model, delivering value-added solutions.

- Mature Market Dominance: Despite market maturity, DNOW leverages its network and experience to secure a high market share.

- Profitability Driver: These reliable services are a key contributor to overall company earnings and customer retention.

- 2023 Performance Indicator: DNOW reported revenues of $3.5 billion in 2023, with supply chain services representing a substantial portion of this figure, demonstrating their cash cow status.

Established Product Distribution in Mature Industrial Markets

Distribution beyond the energy sector places DNOW firmly within mature industrial and construction markets. These sectors, characterized by stable, predictable demand, allow DNOW to leverage its extensive product catalog and deep market penetration.

DNOW's established relationships and broad product portfolio in these general industrial segments translate into a significant market share. This strong position allows the company to generate reliable cash flows from these operations.

These mature segments act as cash cows, providing consistent income that DNOW can reinvest in higher-growth areas or utilize for other strategic purposes. For instance, in 2024, DNOW reported that its industrial segment continued to be a significant contributor to overall revenue, demonstrating the stability of these cash-generating assets.

- Stable Demand: Mature industrial and construction markets offer predictable revenue streams.

- High Market Share: DNOW's extensive product range and long-standing presence secure a dominant position.

- Consistent Cash Flow: These segments generate reliable income, supporting other business initiatives.

- Strategic Funding: Cash generated passively funds growth opportunities in other DNOW business areas.

DNOW's traditional U.S. energy centers, generating 69% of its U.S. revenue, are prime examples of cash cows. These mature but steady operations consistently deliver robust cash flow, a critical advantage in the energy distribution landscape. This financial stability fuels investments in higher-growth areas.

The company's Industrial PVF Distribution business, as the fourth-largest distributor in North America, also functions as a cash cow. Stable demand and DNOW's optimized supply chain and deep customer ties ensure significant cash generation. Similarly, MRO Industrial Distribution, a mature, low-growth sector where DNOW holds a significant market share, acts as a reliable revenue stream, a hallmark of cash cow businesses.

DNOW's core supply chain management services are a foundational cash cow, boosting customer efficiency through its extensive network and industry expertise. Despite market maturity, DNOW maintains strong market share in these segments, contributing significantly to profitability and fostering customer loyalty. In 2023, DNOW reported revenues of $3.5 billion, with supply chain services representing a substantial portion.

Distribution beyond the energy sector, into mature industrial and construction markets, further solidifies DNOW's cash cow portfolio. These sectors offer predictable revenue streams, allowing DNOW to leverage its broad product catalog and deep market penetration. In 2024, DNOW reported that its industrial segment continued to be a significant contributor to overall revenue, underscoring the stability of these income-generating assets.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) | Growth Outlook |

|---|---|---|---|---|

| Traditional U.S. Energy Centers | Cash Cow | Mature, steady cash flow, 69% of U.S. revenue | Substantial | Moderate |

| Industrial PVF Distribution | Cash Cow | Large market share, stable demand, optimized operations | Significant | Low to Moderate |

| MRO Industrial Distribution | Cash Cow | Essential segment, reliable revenue, significant market share | Consistent | Low |

| Supply Chain Management Services | Cash Cow | Value-added, strong customer loyalty, deep expertise | High | Low |

| General Industrial & Construction Distribution | Cash Cow | Predictable demand, broad product catalog, deep penetration | Strong | Low |

Preview = Final Product

DNOW BCG Matrix

The preview you see of the DNOW BCG Matrix is the definitive version you will receive upon purchase, ensuring no hidden surprises or alterations. This comprehensive analysis, detailing Stars, Cash Cows, Question Marks, and Dogs, is fully formatted and ready for immediate integration into your strategic planning. You can confidently use this preview as a direct representation of the polished, professional report that will be delivered to you, enabling swift decision-making and effective communication of your business portfolio's status. Expect the same high-quality, actionable insights that are crucial for optimizing resource allocation and driving future growth.

Dogs

DNOW's international segments, such as Canada, are currently underperforming. This weakness is evident in a sequential revenue decrease in Canada and projections of further declines in other international markets, largely due to the winding down of non-recurring projects.

These segments likely hold a smaller market share within their respective geographies and are operating in markets that are either experiencing slower growth or facing significant challenges. This combination of factors contributes to their current struggles.

If this underperformance persists, these international operations could become a drain on resources, consuming more capital and attention than they generate in returns, which is a key concern for the DNOW BCG Matrix analysis.

Within DNOW's extensive product offerings, some older product lines, perhaps representing outdated equipment, are experiencing reduced demand. This is often due to new technologies emerging or changes in what industries prefer. These items typically hold a small portion of the market and aren't expected to grow much, meaning they could be using up valuable capital without generating much profit.

For instance, if DNOW still offers certain types of legacy pipe fittings that have been largely replaced by more advanced composite materials, these would fit the description of low demand. While specific 2024 figures for individual legacy product lines are proprietary, the broader trend in industrial supply suggests that companies like DNOW are actively managing their portfolios to shed products with diminishing relevance. This strategic pruning is crucial for optimizing resource allocation.

Certain DNOW distribution centers situated in intensely competitive or fragmented markets, where the company hasn't secured a leading market share, can be classified as question marks. These locations often face challenges in achieving robust profitability and sustained growth due to fierce local rivalries and a lack of significant strategic advantage. For instance, in 2024, DNOW's market share in certain highly contested regional oilfield service markets hovered around 5-8%, indicating a struggle against established local players.

These question mark branches may require careful evaluation regarding their long-term viability and operational efficiency. Without a clear path to increased market penetration or a unique value proposition, they risk becoming drains on resources. The company must analyze if further investment is justified or if divesting or consolidating these operations would be a more prudent strategic move to reallocate capital to more promising areas.

Highly Commoditized Products with Minimal Differentiation

Products in DNOW's portfolio that are highly commoditized, meaning they offer little to no unique features compared to competitors, typically face intense price competition. This often results in thin profit margins. For instance, basic industrial pipes or standard fittings might fall into this category. In 2023, the industrial distribution sector, which DNOW operates in, saw average gross profit margins hover around 18-22%, with commoditized goods often at the lower end of this range.

These low-differentiation products can become cash traps within the BCG matrix. Growth in these segments is often only achievable through aggressive price cuts, which further erodes profitability and doesn't necessarily build sustainable market share. DNOW might find itself investing in inventory and sales efforts for these items, only to see minimal returns or even losses if prices fall too sharply.

Consequently, these commoditized offerings require minimal strategic investment but also generate minimal returns. DNOW's strategy for these products would likely focus on efficient inventory management and cost control rather than innovation or market expansion. For example, if a specific type of valve has numerous identical alternatives from other suppliers, DNOW's focus would be on selling it at a competitive price without expecting high-value growth.

- Low Profitability: Highly commoditized products often operate with gross margins below the industry average, potentially impacting overall company profitability.

- Price Sensitivity: Market share gains are heavily reliant on price, making these products vulnerable to competitor pricing strategies.

- Cash Trap Potential: Investments in sales and inventory for these items may not yield sufficient returns, tying up capital without significant growth.

- Minimal Differentiation: Lack of unique selling propositions makes it challenging to command premium pricing or build customer loyalty.

Segments Heavily Reliant on Volatile Upstream Rig Counts

Despite DNOW's Q1 2025 performance demonstrating resilience even with reduced operating rigs, the upstream oil and gas sector remains inherently sensitive to fluctuations in rig counts and subsequent customer spending. This volatility directly impacts segments of DNOW's business that are exclusively linked to upstream drilling and completion operations.

These upstream-dependent segments, especially those lacking product and service diversification, are positioned for potentially sluggish growth and exhibit a susceptibility to market share swings. For instance, a significant drop in active drilling rigs, a common occurrence when oil prices dip, can directly curtail demand for specific DNOW offerings.

Consider the impact on a business unit solely supplying specialized drilling fluids. If the national rig count falls by, say, 15% from a previous period due to economic uncertainty or commodity price drops, that unit's revenue could contract proportionally, assuming no offsetting factors.

- Upstream Rig Count Sensitivity: Segments tied directly to drilling and completion activities are vulnerable to changes in rig count, impacting demand for DNOW's products and services.

- Customer Spending Impact: Lower customer spending, often a consequence of volatile commodity prices or economic downturns, disproportionately affects these specialized upstream-focused business areas.

- Diversification as a Mitigator: Businesses within DNOW that offer a broader range of products or services across different energy sectors, or those with a strong presence in midstream or downstream, are less exposed to this specific upstream volatility.

- Growth and Market Share Volatility: Without diversification, these segments face the dual challenge of limited growth potential and unpredictable shifts in their market share based on upstream activity levels.

Dogs in DNOW's portfolio represent products or segments with low market share and low growth potential. These are often legacy products or operations in mature, highly competitive markets. For instance, certain older types of industrial hoses or fittings that have been largely superseded by newer materials might fall into this category. In 2024, DNOW's focus has been on optimizing inventory and reducing costs for such offerings, rather than investing in their expansion.

These segments typically require minimal investment but also generate minimal returns, acting as cash traps. DNOW's strategy for these dogs would likely involve efficient management, cost control, and potentially divestment if they become a significant drain. For example, a small regional distribution center with declining local industrial activity and a low market share would exemplify a dog within the company's structure.

The challenge with dogs is that they can consume resources without contributing meaningfully to overall growth or profitability. DNOW's approach is to identify these areas and manage them to minimize their negative impact, ensuring capital is not tied up in unproductive assets. This strategic pruning is essential for maintaining a healthy and growth-oriented business portfolio.

Dogs are characterized by low market share and low growth prospects, often representing mature or declining product lines. These segments typically require minimal investment but also yield low returns. For example, DNOW might have certain legacy product lines in its industrial consumables category that have seen demand dwindle due to technological advancements or shifts in customer preferences. In 2024, the company's strategy for these items is primarily focused on efficient inventory management and cost containment, rather than growth initiatives.

Question Marks

DNOW's strategic acquisition of Natron International in April 2025 significantly bolsters its electrical supply presence in the Asia Pacific. This move positions DNOW within a high-growth region, crucial for energy and industrial expansion.

The Asia Pacific electrical supply market presents a substantial opportunity, with forecasts indicating continued robust growth through 2030. However, DNOW's market share in this nascent segment is still developing, reflecting its status as a new entrant.

This new international market entry can be characterized as a question mark in the DNOW BCG Matrix. It operates in a high-growth industry with an unproven, albeit promising, market share for the company.

Developing renewable energy infrastructure solutions fits within DNOW's strategic shift towards 'energy evolution opportunities' and 'decarbonization.' While this sector is booming, with the global renewable energy market valued at approximately $1.2 trillion in 2023 and projected to reach $2.1 trillion by 2030, DNOW's current penetration is likely minimal.

This positions renewable energy infrastructure as a potential Question Mark in the BCG matrix for DNOW. The market's rapid expansion, driven by climate initiatives and technological advancements, presents a high-growth environment. However, DNOW's relatively small market share means significant investment will be necessary to capture substantial growth and transform these opportunities into Stars.

The industrial distribution market is experiencing a significant surge in demand for advanced automation technologies, with Artificial Intelligence (AI) and the Internet of Things (IoT) at the forefront. These technologies are revolutionizing how businesses operate, leading to greater efficiency and productivity.

DNOW's strategic investment in industrial automation, exemplified by its acquisition of Trojan Rentals, places the company squarely within this high-growth technological sector. This move signifies a commitment to leveraging innovation for competitive advantage.

While the overall trend favors automation, the market share for highly specialized, cutting-edge automation solutions is still in its formative stages. This presents both an opportunity for early movers and a challenge in capturing nascent market segments.

Expansion of Electrical Cable Distribution Manufacturing Relationships

DNOW's strategic focus on expanding electrical cable distribution manufacturing relationships, particularly targeting Singapore, positions this segment as a potential 'Question Mark' within the BCG matrix. This expansion signifies an investment in a high-growth area where DNOW's market share as a primary distributor or manufacturer is still developing.

This initiative requires significant capital to establish a strong foothold and build manufacturing partnerships in new geographic markets like Singapore. The objective is to increase market share and eventually transition this segment into a 'Star' performer.

- Targeted Expansion: DNOW is actively seeking to broaden its electrical cable distribution manufacturing relationships, with a specific emphasis on Singapore.

- Nascent Market Position: In these new regions, DNOW's market share as a manufacturer or primary distributor for electrical cables is currently low, characteristic of a Question Mark.

- Strategic Investment Required: Significant investment is necessary to build brand recognition, establish robust supply chains, and secure manufacturing partnerships to gain traction.

- Growth Potential: The electrical cable market, especially in developing industrial hubs like Singapore, presents substantial growth opportunities that DNOW aims to capitalize on.

Integration of MRC Global Acquisition Synergies

The integration of MRC Global into DNOW's operations, announced as an all-stock deal, is a significant strategic maneuver designed to bolster scale and diversify DNOW's market footprint. This integration phase is critical for transforming potential synergies into tangible market gains.

The success of this acquisition hinges on DNOW's ability to effectively manage the combined assets, aiming to elevate them into Stars or Cash Cows within the BCG matrix. This requires focused investment and strategic planning to unlock operational efficiencies and expand market share.

For instance, in 2024, DNOW's reported revenue was approximately $1.9 billion, and the acquisition of MRC Global, which had revenues around $3.2 billion in 2023, will create a significantly larger entity. The realization of cost synergies, estimated to be around $50 million annually within three years post-closing, will be a key driver in moving acquired segments towards Star or Cash Cow status.

- Increased Scale: The combined entity will possess a more substantial market presence, enabling greater negotiation power and broader service offerings.

- Synergy Realization: Achieving projected cost savings and revenue enhancements is paramount for repositioning acquired assets within the BCG matrix.

- Operational Efficiencies: Streamlining processes and leveraging combined infrastructure are crucial for improving profitability and market competitiveness.

- Market Share Growth: Successful integration is expected to capture new market segments and solidify DNOW's position as a leading distributor.

Question Marks represent business units or markets where DNOW has a low market share but operates within a high-growth industry. These are areas requiring significant investment to gain traction and potentially become future Stars.

The key challenge with Question Marks is determining which ones warrant further investment and which should be divested if they fail to gain market share. Success here means transforming potential into market leadership.

DNOW's strategic ventures into new international markets like the Asia Pacific electrical supply sector, and its investments in emerging areas like renewable energy infrastructure and advanced industrial automation, all exemplify Question Marks.

These segments are characterized by high growth potential but also by DNOW's current limited market penetration, necessitating careful resource allocation and strategic execution to achieve desired growth trajectories.

| Segment | Industry Growth | DNOW Market Share | BCG Classification | Strategic Focus |

| Asia Pacific Electrical Supply | High | Low (New Entrant) | Question Mark | Market Penetration & Brand Building |

| Renewable Energy Infrastructure | Very High | Low | Question Mark | Investment for Market Share Growth |

| Industrial Automation (AI/IoT) | High | Developing | Question Mark | Technology Integration & Market Capture |

| Singapore Electrical Cable Distribution | High | Low | Question Mark | Manufacturing Partnerships & Supply Chain Development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and competitive landscape analysis, to accurately position each business unit.