DMG Mori SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMG Mori Bundle

DMG Mori, a titan in machine tool manufacturing, boasts significant strengths in its technological innovation and global service network, yet faces challenges from intense market competition and evolving customer demands. Understanding these dynamics is crucial for anyone looking to navigate this complex industry.

Want the full story behind DMG Mori's market position, including its key opportunities and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

DMG MORI stands as a preeminent global force in high-precision machine tool manufacturing. Its extensive portfolio encompasses a wide array of products, from sophisticated CNC turning and milling machines to cutting-edge ultrasonic and laser texturing technologies. This comprehensive offering, bolstered by integrated automation and software solutions, solidifies DMG MORI's position as a full-service provider within the manufacturing sector.

DMG Mori's Machining Transformation (MX) strategy, a comprehensive approach combining process integration, automation, digital transformation (DX), and green transformation (GX), is resonating strongly with its customer base. This strategy is designed to boost both productivity and resource efficiency for its clients.

By focusing on sustainable manufacturing solutions, DMG Mori's MX strategy directly addresses growing customer demand for environmentally conscious production methods. This forward-thinking approach positions the company favorably in a market increasingly prioritizing ecological impact.

DMG MORI places a significant emphasis on innovation and research and development, consistently bringing new products and technological advancements to market. This focus is clearly demonstrated through their offerings in areas like 5-axis machining, advanced multitasking machines, and the growing field of additive manufacturing.

The company's dedication to R&D is quantifiable; in 2024 alone, DMG MORI presented 34 new innovations, with a remarkable 20 of those being world premieres. This aggressive pace of introducing cutting-edge technology underscores their commitment to staying at the forefront of the machine tool industry and providing customers with the latest solutions.

Commitment to Sustainability and Green Transformation (GX)

DMG MORI places a strong emphasis on sustainability, integrating its 'Green Transformation (GX)' initiative throughout its entire operational framework. This commitment is not just aspirational; it's backed by concrete goals for emissions reduction.

The company is actively working to lower its greenhouse gas emissions across Scope 1, 2, and 3 categories, aiming for significant reductions by 2030. This dedication to environmental responsibility has been recognized with an 'A' rating from the Carbon Disclosure Project (CDP) for its 2023 performance, highlighting its leadership in climate action.

- Commitment to GX: Sustainability is central to DMG MORI's corporate strategy.

- Ambitious Targets: Aims to reduce Scope 1, 2, and 3 greenhouse gas emissions by 2030.

- CDP Recognition: Achieved an 'A' rating from the Carbon Disclosure Project (CDP) in 2023.

Robust Global Sales and Service Network

DMG MORI boasts an impressive global footprint with 124 sales and service locations and 17 production plants strategically situated across 44 countries. This vast network is a significant strength, allowing for localized support and rapid response to customer needs worldwide. Their commitment to customer-centric service extends across the entire machine lifecycle, encompassing essential after-sales support like maintenance, training, and spare parts availability.

This extensive infrastructure directly translates into enhanced customer satisfaction and loyalty. For instance, in 2023, DMG MORI reported a substantial order intake, underscoring the effectiveness of their global reach in capturing market demand. The ability to offer integrated solutions and reliable service globally is a key differentiator in the competitive machine tool industry.

- Global Reach: 124 sales and service locations in 44 countries.

- Production Footprint: 17 production plants supporting global operations.

- Comprehensive Lifecycle Support: Services include maintenance, training, and spare parts.

- Market Responsiveness: Facilitates quick adaptation to regional market demands and customer requirements.

DMG MORI's strengths lie in its robust innovation pipeline and commitment to sustainability. The company consistently introduces new technologies, evidenced by 34 new innovations, including 20 world premieres, presented in 2024. Its Machining Transformation (MX) strategy, focusing on process integration, automation, digital, and green transformation, directly addresses market demands for efficiency and eco-friendly solutions. This forward-thinking approach, coupled with a strong emphasis on R&D, positions DMG MORI as a leader in technological advancement within the machine tool industry.

What is included in the product

Analyzes DMG Mori’s competitive position by examining its technological leadership and brand reputation against market challenges and the threat of new entrants.

Offers a clear, actionable framework for identifying and addressing DMG Mori's strategic challenges and opportunities.

Weaknesses

DMG MORI experienced a notable downturn in profitability during 2024. While sales revenue saw a modest uptick, operating profit and net income took a substantial hit. This financial setback was primarily due to a significant one-time loss stemming from the seizure of its manufacturing subsidiary located in Russia, which directly impacted the company's overall financial health.

DMG Mori experienced a notable decrease in consolidated order intake during 2024. This downturn, amounting to a 9% drop to €2.3 billion compared to the previous year, highlights a subdued demand for capital goods amidst a challenging global economic landscape.

The primary drivers behind this reduced order intake include persistent geopolitical uncertainties and widespread economic restraint. These factors collectively dampened investment appetite, directly impacting DMG Mori's ability to secure new business and casting a shadow over future revenue streams.

DMG MORI faces significant headwinds from ongoing geopolitical tensions and economic slowdowns in crucial markets. These external pressures directly impact demand for their capital goods, as businesses become more cautious with large investments. For instance, the ongoing conflict in Eastern Europe and broader global economic restraint, evidenced by a projected 2.8% global GDP growth in 2024 according to the IMF, can dampen customer spending.

Furthermore, these volatile conditions can create logistical hurdles. Delays in obtaining export licenses, a common occurrence during periods of international instability, can slow down machine deliveries. This not only affects DMG MORI's revenue recognition but also impacts customer satisfaction and project timelines, creating a ripple effect across their operations.

Dependency on Highly Skilled Labor

DMG Mori's reliance on highly skilled labor presents a significant weakness. The company's advanced manufacturing solutions, including complex CNC machines and automated systems, require specialized expertise for operation and maintenance.

This dependency is amplified by a global scarcity of qualified manufacturing talent. For instance, reports from 2023 and early 2024 consistently highlight a widening skills gap in advanced manufacturing, with many countries facing shortages of machinists, programmers, and automation specialists. This can lead to increased recruitment costs and potential delays in project execution.

- Skills Gap Impact: A 2024 Deloitte report indicated that the manufacturing skills gap could result in 2.1 million unfilled jobs in the US alone by 2030, a trend likely mirrored globally.

- Training Investment: DMG Mori must continually invest in robust training and development programs to upskill its existing workforce and attract new talent, adding to operational expenses.

- Operational Risks: A lack of readily available skilled personnel can hinder the adoption of new technologies and potentially impact the quality and efficiency of production for its clients.

Potential for Supply Chain Disruptions

The global manufacturing sector, including players like DMG MORI, faces inherent vulnerabilities in its supply chains. Events like the COVID-19 pandemic in 2020-2021 demonstrated how quickly these networks can be disrupted, leading to material shortages and delivery delays.

While specific data for DMG MORI's supply chain resilience isn't publicly detailed, its reliance on a global network of suppliers means it's exposed to geopolitical instability, natural disasters, and transportation issues. For instance, the semiconductor chip shortage impacted various manufacturing sectors significantly in 2021-2022, affecting production timelines across the automotive and electronics industries, which are also key markets for machine tool manufacturers.

These disruptions can directly impact DMG MORI's ability to meet customer demand and maintain production schedules.

- Vulnerability to Global Events: Exposure to geopolitical tensions, trade disputes, and unforeseen crises can interrupt the flow of components and raw materials.

- Logistical Challenges: Increased shipping costs and port congestion, issues that persisted into 2023 for many industries, can delay inbound parts and outbound finished goods.

- Supplier Dependence: Reliance on a concentrated supplier base for critical components increases risk if a key supplier experiences operational issues.

DMG MORI's profitability was significantly impacted in 2024 due to a substantial one-time loss from the seizure of its Russian subsidiary. This event directly reduced operating profit and net income, despite a modest increase in sales revenue. The company also saw a 9% drop in consolidated order intake to €2.3 billion in 2024, reflecting weaker demand for capital goods amid global economic uncertainty.

The reliance on highly specialized labor is a key weakness, exacerbated by a global shortage of skilled manufacturing talent. This skills gap, projected to leave millions of manufacturing jobs unfilled globally by 2030, necessitates ongoing investment in training, increasing operational costs and posing risks to project execution and technology adoption.

Supply chain vulnerabilities remain a concern, with global disruptions like geopolitical instability and logistical challenges impacting material flow and delivery times. The lingering effects of port congestion and increased shipping costs from 2023 continue to pose risks to inbound parts and outbound finished goods, potentially affecting DMG MORI's ability to meet customer demand.

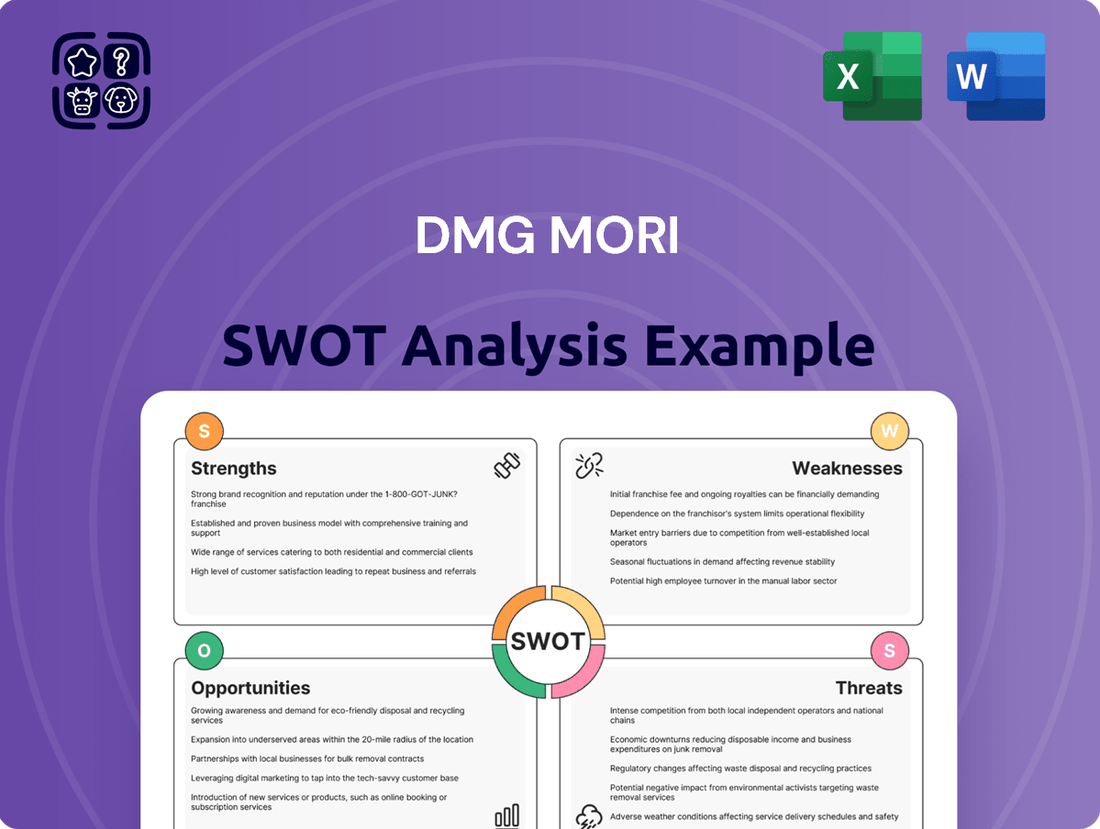

Preview the Actual Deliverable

DMG Mori SWOT Analysis

This is the actual DMG Mori SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full DMG Mori SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive overview.

This is a real excerpt from the complete DMG Mori SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The global industrial automation market is a significant growth area, with projections indicating it could reach USD 420.49 billion by 2033. This expansion is fueled by a strong push for better productivity and favorable government policies worldwide. For DMG MORI, this translates into a prime opportunity to broaden its offerings in automation solutions.

DMG MORI is capitalizing on the expanding metal additive manufacturing market, a sector projected to reach $22.7 billion by 2028, according to recent market analyses. Their presence at events like RAPID + TCT 2024 highlights their commitment to showcasing advancements in this area.

The company's integrated process chains, which seamlessly blend laser deposition welding with traditional metal-cutting, provide a significant competitive edge. This holistic approach allows for efficient production of complex metal parts, a key driver for growth in the additive manufacturing industry.

The manufacturing sector's push towards digital transformation, including IoT and AI, presents a significant opportunity. DMG MORI's CELOS X platform, designed to integrate digital solutions and data-driven insights, is strategically aligned to meet this growing demand for enhanced efficiency and smarter operations.

Shift Towards Sustainable Manufacturing Practices (Green Transformation - GX)

The global push for sustainability presents a prime opportunity for DMG MORI. As industries worldwide increasingly prioritize environmentally responsible operations, the demand for greener manufacturing solutions is on the rise. This trend is particularly evident in key markets, with reports from the International Energy Agency (IEA) indicating a significant global investment in energy efficiency technologies, projected to reach over $1 trillion annually by 2025.

DMG MORI's commitment to its Green Transformation (GX) strategy directly addresses this growing market need. By developing and promoting machine tools that are more resource-efficient and contribute to lower CO2 emissions throughout their lifecycle, the company is well-positioned to capture market share. For instance, their DMG MORI Neo technology aims to reduce energy consumption by up to 20% compared to previous generations, a compelling proposition for cost-conscious and eco-aware manufacturers.

- Growing Market Demand: Increased global focus on environmental, social, and governance (ESG) criteria drives demand for sustainable manufacturing.

- GX Strategy Alignment: DMG MORI's Green Transformation initiative directly addresses this demand by offering resource-efficient and low-emission solutions.

- Customer Attraction: Environmentally conscious customers are more likely to choose partners with demonstrable sustainability commitments, enhancing brand loyalty and market appeal.

- Competitive Advantage: Leading in green manufacturing practices can differentiate DMG MORI from competitors, potentially leading to higher sales and market penetration in forward-thinking sectors.

Leveraging Global Manufacturing Industry Upgrades

The global manufacturing sector is experiencing a significant technological uplift, with automotive and aerospace industries leading the charge in adopting high-precision machining and advanced materials. This ongoing modernization, coupled with the natural equipment replacement cycles, creates a persistent demand for advanced machinery like that offered by DMG MORI. For instance, the automotive industry alone is projected to invest heavily in Industry 4.0 technologies, with smart factory implementations expected to grow substantially in the coming years.

This presents a substantial opportunity for DMG MORI to capitalize on the need for sophisticated, high-performance machine tools. The increasing complexity of components and the drive for greater efficiency in production lines directly translate into a market ripe for DMG MORI's cutting-edge solutions.

- Automotive Industry Investment: Global automotive manufacturers are expected to increase their capital expenditures on advanced manufacturing technologies, with a focus on automation and digitalization, creating a strong market for DMG MORI's offerings.

- Aerospace Demand: The aerospace sector's continuous need for lightweight, high-strength components manufactured with extreme precision fuels demand for DMG MORI's specialized machining capabilities.

- Equipment Renewal Cycles: As older machinery reaches the end of its lifecycle, manufacturers are increasingly looking towards modern, efficient, and automated solutions, benefiting companies like DMG MORI.

- Industry 4.0 Adoption: The widespread adoption of Industry 4.0 principles, including the Industrial Internet of Things (IIoT) and artificial intelligence in manufacturing, creates a demand for integrated and smart machining solutions that DMG MORI provides.

The expansion of additive manufacturing, particularly in metal, presents a significant growth avenue for DMG MORI. With the market projected to reach substantial figures by the mid-2020s, their expertise in integrated process chains offers a distinct advantage.

DMG MORI's strategic focus on digital transformation through platforms like CELOS X aligns perfectly with the industry's move towards IoT and AI-driven manufacturing, promising enhanced operational efficiency.

The company's commitment to sustainability, evident in its GX strategy and technologies like DMG MORI Neo, positions it favorably to meet increasing global demand for eco-friendly manufacturing solutions.

The ongoing modernization of industries, especially automotive and aerospace, creates a consistent demand for high-precision and advanced machinery, a core strength of DMG MORI's product portfolio.

| Opportunity Area | Market Projection (approx.) | DMG MORI Relevance |

|---|---|---|

| Industrial Automation | USD 420.49 billion by 2033 | Broaden automation solutions offerings |

| Metal Additive Manufacturing | USD 22.7 billion by 2028 | Showcase advancements, leverage integrated processes |

| Digital Transformation (IoT/AI) | Growing adoption across manufacturing | Utilize CELOS X for integrated digital solutions |

| Sustainability (GX Strategy) | Global investment in energy efficiency > USD 1 trillion annually by 2025 | Promote resource-efficient, low-emission machines |

| Industry Modernization (Auto/Aerospace) | Significant capital expenditure on advanced tech | Meet demand for high-precision, advanced machine tools |

Threats

Ongoing geopolitical uncertainties and intensified international trade conflicts present a significant threat by potentially dampening demand for capital goods. DMG Mori's financial results were directly impacted in 2024 by the one-time loss stemming from the seizure of its Russian subsidiary, highlighting the tangible consequences of such instability.

These global disruptions also pose a risk to DMG Mori's operations through the potential for disrupted global supply chains. Such disruptions can lead to increased costs and delays in production and delivery, ultimately affecting profitability and customer satisfaction.

Volatile raw material and energy costs present a significant challenge for DMG MORI. These fluctuations directly impact manufacturing expenses, potentially squeezing profit margins for the company.

As a global player, DMG MORI's exposure to these price swings is substantial. For instance, the price of steel, a key component in machine tools, saw significant increases throughout 2021 and 2022, with some benchmarks reporting rises of over 30% year-on-year. Similarly, energy prices, particularly natural gas and electricity, have experienced unprecedented volatility, especially in Europe, adding further pressure to operational costs.

The machine tool sector is intensely competitive, featuring global giants and niche innovators, placing significant pressure on DMG MORI to defend its market share. In 2023, the global machine tool market was valued at approximately $90 billion, with significant growth projected. Maintaining a competitive edge requires continuous investment in R&D and strategic pricing to counter both established rivals and emerging specialized players.

Technological Challenges and Rapid Advancements

The relentless march of technological progress, especially in AI and automation, necessitates substantial and ongoing investment in research and development for DMG Mori to maintain its competitive edge. Failure to adapt to these swift innovations risks diminishing market relevance and customer adoption.

For instance, the global industrial automation market was projected to reach $316.4 billion in 2024 and is expected to grow significantly. Staying ahead in this dynamic landscape demands agility and foresight.

- AI Integration: Developing and implementing AI-driven solutions for machine diagnostics and predictive maintenance is crucial.

- Automation Adoption: Keeping pace with the increasing demand for highly automated manufacturing processes is essential.

- Digitalization: Investing in digital platforms for customer interaction, service, and data analytics is a key challenge.

Shortage of Skilled Labor

DMG MORI faces a significant threat from the ongoing global shortage of skilled labor. This scarcity particularly impacts the operation and programming of sophisticated machine tools, a core area for the company. The lack of qualified personnel can directly hinder DMG MORI's ability to scale production and could lead to increased labor expenses as companies compete for talent. For instance, reports from early 2024 indicated that manufacturing sectors worldwide were struggling with an average skill gap of 15-20% for specialized technical roles.

To address this, DMG MORI is actively involved in programs aimed at developing and nurturing skilled workers. This proactive stance is crucial for mitigating the impact of labor shortages on their growth trajectory and operational efficiency. The company recognizes that investing in training and education is key to securing a future workforce capable of handling their advanced technological offerings.

- Global manufacturing skill gap estimated at 15-20% for specialized roles in early 2024.

- Shortage directly affects operation and programming of advanced machine tools.

- DMG MORI actively supports initiatives to develop skilled labor to counter this threat.

Intensified global competition and rapid technological advancements pose significant threats to DMG Mori. The need for continuous R&D investment to keep pace with AI and automation demands substantial capital. The machine tool market, valued at approximately $90 billion in 2023, is fiercely contested by established players and innovative niche companies, requiring strategic pricing and product development to maintain market share.

Supply chain disruptions and volatile raw material costs, such as the over 30% year-on-year increase in steel prices seen in 2021-2022, directly impact manufacturing expenses and profitability. Furthermore, a global shortage of skilled labor, with a 15-20% skill gap for specialized roles in early 2024, hinders production scaling and increases labor costs, necessitating company investment in workforce development.

SWOT Analysis Data Sources

This DMG Mori SWOT analysis is informed by a comprehensive review of the company's financial statements, detailed market research reports, and expert opinions from industry analysts to provide a robust and actionable strategic overview.