DMG Mori PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMG Mori Bundle

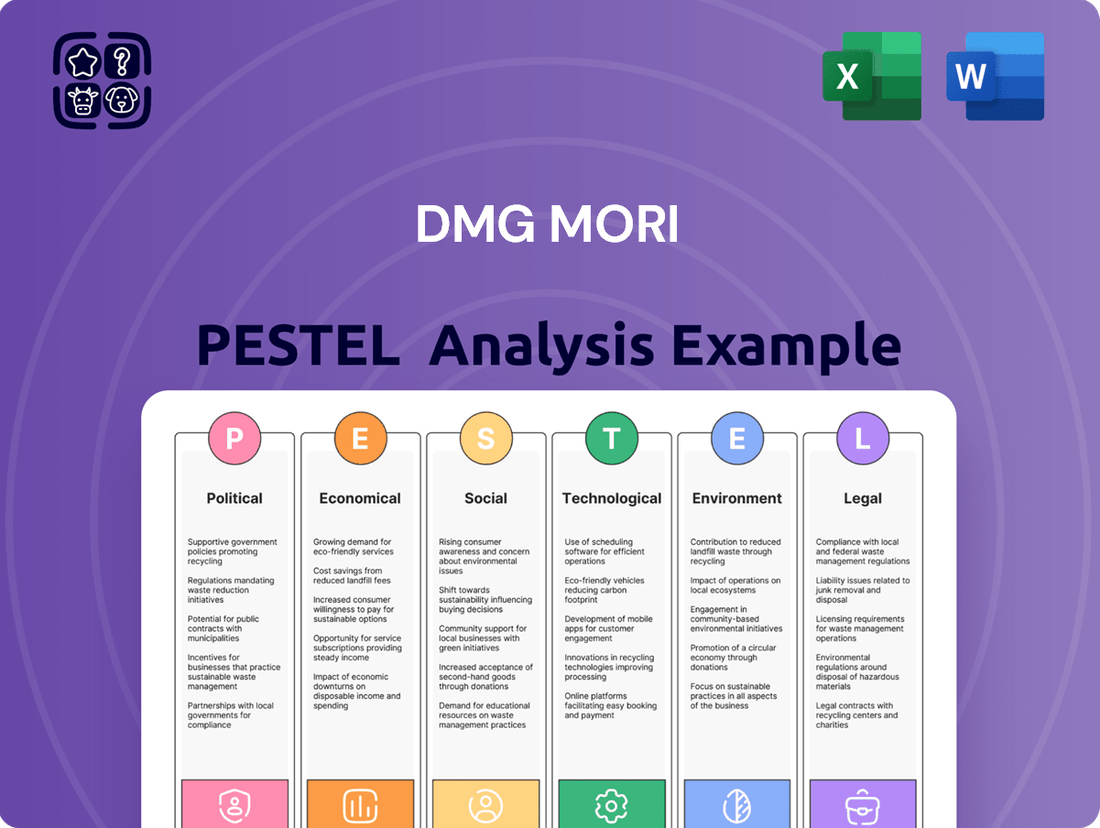

Unlock the strategic advantages hidden within DMG Mori's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping their industry and your own market position. Download the full report now for actionable intelligence to drive smarter business decisions.

Political factors

Ongoing geopolitical uncertainties, including the war in Ukraine and broader trade tensions, continue to cast a shadow over global demand for capital goods. These conflicts directly impact the machine tool market, a core sector for DMG MORI, often leading to suppressed demand and significant supply chain disruptions.

For instance, the ongoing conflict in Ukraine has led to increased energy costs and logistical challenges, which DMG MORI's financial reports for 2024 have acknowledged as a factor affecting operational efficiency and order intake in certain European markets.

Trade policies, particularly those focusing on protectionism or sanctions, can further complicate international business operations. DMG MORI's global manufacturing footprint and extensive customer base mean that shifts in trade agreements or the imposition of tariffs can directly influence sales volumes and profitability, as seen in the company's adjusted revenue forecasts for 2025 which account for these potential trade policy impacts.

Government industrial policies, especially in Germany and Japan where DMG MORI has significant operations, play a crucial role in shaping the machine tool sector. For instance, Germany's 'Industry 4.0' initiative, launched in 2011 and continually evolving, aims to foster digital integration in manufacturing, directly benefiting companies investing in smart factory solutions like DMG MORI. This policy environment encourages innovation and adoption of advanced technologies.

Supportive government programs can directly impact a company's competitive edge. In 2023, the German government continued to allocate funds through various programs aimed at modernizing industrial production and promoting sustainable manufacturing practices, which DMG MORI can leverage. However, shifts in trade policies or tariffs, such as potential changes in EU trade agreements impacting raw material imports or finished goods exports, could introduce uncertainties and affect DMG MORI's global market access and cost structures.

International trade regulations and tariffs significantly shape DMG MORI's operating environment. The ongoing evolution of protectionist policies, exemplified by the U.S.-China trade tensions, directly impacts global supply chains and can inflate manufacturing input costs. For instance, while DMG MORI has assessed the direct impact of specific U.S. tariffs as minimal, the broader trend necessitates a strategic review of sourcing and production locations, potentially favoring nearshoring or onshoring initiatives.

Political Stability in Key Markets

Political instability in regions where DMG MORI operates or sources materials presents significant risks to its global business. The company's 2022 financial report disclosed a one-time loss of €41 million stemming from the seizure of its manufacturing subsidiary in Russia, directly illustrating the financial repercussions of geopolitical events.

To counter these vulnerabilities, DMG MORI actively pursues a strategy of maintaining diversified operations and robust supply chains. This approach aims to spread operational and sourcing risks across multiple geographic locations, thereby reducing the impact of any single political disruption.

- Geopolitical Risk Exposure: DMG MORI's global footprint means it's exposed to varying degrees of political risk across its key markets and sourcing regions.

- Impact of Russian Operations: The seizure of its Russian subsidiary resulted in a €41 million loss in 2022, underscoring the tangible financial consequences of political instability.

- Mitigation through Diversification: The company's strategy of diversifying operations and supply chains is crucial for buffering against the impact of localized political events.

- Regulatory Environment: Changes in trade policies, tariffs, and national regulations in operating countries can also affect DMG MORI's cost structure and market access.

Cybersecurity as a National Security Concern

Governments worldwide now view cybersecurity as a paramount national security imperative, particularly concerning the manufacturing industry due to its integral role in maintaining critical infrastructure. This heightened awareness translates into more stringent regulatory frameworks. For instance, the European Union's NIS2 directive, implemented in late 2024, and updated security mandates in the United States are compelling manufacturers like DMG MORI to significantly bolster their cyber defenses to avoid substantial penalties. This regulatory push necessitates increased investment in advanced cybersecurity solutions and protocols.

The financial implications of these evolving political landscapes are considerable. Manufacturers face direct costs associated with compliance, including upgrades to IT infrastructure, employee training, and the implementation of sophisticated threat detection and response systems. Beyond direct spending, potential fines for non-compliance represent a significant financial risk. For example, NIS2 can levy fines of up to €10 million or 2% of global annual turnover, whichever is higher, underscoring the financial imperative for robust cybersecurity measures.

- Increased Regulatory Scrutiny: Governments are actively legislating stricter cybersecurity requirements for critical infrastructure sectors, including manufacturing.

- NIS2 Directive Impact: The EU's NIS2 directive, effective from October 2024, mandates enhanced cybersecurity measures for a broader range of entities, impacting supply chains.

- US Cybersecurity Directives: The US continues to update its cybersecurity strategies and directives, influencing companies operating within or supplying to the US market.

- Financial Penalties for Non-Compliance: Failure to meet these new standards can result in substantial fines, impacting profitability and operational continuity.

Ongoing geopolitical shifts and evolving trade policies present significant challenges for DMG MORI's global operations. The company's 2022 financial report highlighted a €41 million loss due to the seizure of its Russian subsidiary, demonstrating the direct financial impact of political instability.

Governments' increasing focus on cybersecurity, particularly with the EU's NIS2 directive effective October 2024, necessitates substantial investment in defense measures. Non-compliance risks fines up to €10 million or 2% of global annual turnover, impacting profitability.

Germany's Industry 4.0 initiative continues to foster digital manufacturing, benefiting DMG MORI's smart factory solutions, while trade policy shifts require strategic adjustments to sourcing and production.

| Political Factor | Impact on DMG MORI | Data/Example |

| Geopolitical Instability | Disrupts operations, impacts demand, and can lead to asset seizure. | €41 million loss in 2022 from Russian subsidiary seizure. |

| Trade Policies & Tariffs | Affects global supply chains, input costs, and market access. | Adjusted revenue forecasts for 2025 account for potential trade policy impacts. |

| Cybersecurity Regulations | Mandates increased investment in IT security and compliance. | EU's NIS2 directive (Oct 2024) with potential fines of up to €10 million or 2% of global turnover. |

| Industrial Policies | Supports technological adoption and innovation. | Germany's Industry 4.0 initiative encourages smart factory solutions. |

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting DMG Mori, providing a comprehensive understanding of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring that DMG Mori's strategic discussions are always informed by a clear understanding of external factors.

Economic factors

The global economy's health is a primary driver for demand in capital goods like machine tools. For 2025, while projections suggest cautiously optimistic growth for the global economy and machine tool consumption, this outlook remains fragile. Geopolitical uncertainties and persistent subdued demand for capital expenditures continue to cast a shadow, directly impacting DMG MORI's order intake and sales revenue.

DMG MORI, as a global entity, navigates a complex web of currency exchange rates. For instance, in 2023, the company reported that a significant portion of its sales and costs were denominated in currencies other than the Euro, its reporting currency. Fluctuations in the US Dollar and Chinese Yuan, among others, directly influence the cost of imported components and the revenue generated from sales in those regions.

These shifts can materially affect DMG MORI's profitability. A stronger Euro, for example, could make its products more expensive for overseas buyers, potentially dampening demand. Conversely, a weaker Euro could increase the cost of imported raw materials and components, squeezing profit margins. The company's financial statements often highlight the impact of foreign currency translation adjustments, underscoring the sensitivity of its earnings to these movements.

Rising inflation in 2024 and projected into 2025 directly impacts DMG MORI by increasing the cost of essential inputs like steel, aluminum, and energy. For instance, global commodity prices saw significant upward pressure throughout 2024, with industrial metals like steel experiencing a notable surge, directly affecting DMG MORI's manufacturing expenses and potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Furthermore, central banks' responses to inflation, typically through interest rate hikes, present a dual challenge for DMG MORI. Higher borrowing costs can dampen capital expenditure plans for their customer base, particularly in sectors reliant on financing for large machinery purchases. By mid-2025, many major economies are expected to maintain interest rates at elevated levels, a factor that could slow down investment cycles for industries that are key consumers of DMG MORI's sophisticated machine tools.

Supply Chain Disruptions and Material Costs

Ongoing disruptions in global supply chains, intensified by geopolitical events and resource nationalism, continue to drive up the costs and create availability challenges for essential components and raw materials. This directly impacts manufacturers like DMG Mori, forcing them to prioritize robust supply chain strategies to maintain production continuity.

For instance, the semiconductor shortage experienced through 2023 and into early 2024 significantly affected the automotive and electronics sectors, which rely on these components for advanced machinery. While some stabilization is noted, the underlying vulnerabilities persist, creating an unpredictable cost environment for manufacturers dependent on global sourcing.

- Increased Material Expenses: Global commodity prices, influenced by supply chain bottlenecks and geopolitical instability, have seen significant fluctuations. For example, the price of key metals used in machine tool manufacturing, such as steel and aluminum, experienced an average increase of 10-15% year-over-year in early 2024 compared to 2023 averages, directly impacting production costs.

- Component Lead Times: Extended lead times for critical electronic components, including advanced microcontrollers and sensors, remain a concern. Some specialized components still exhibit lead times exceeding 6-9 months, compared to pre-pandemic norms of 2-3 months, impacting production scheduling and delivery timelines.

- Geopolitical Impact on Sourcing: Trade restrictions and tariffs imposed in various regions can further complicate sourcing strategies. A 2024 report by the World Trade Organization indicated that new trade barriers affected approximately 3% of global merchandise trade, potentially increasing the cost of imported parts for DMG Mori by an estimated 2-5% depending on the specific components and origin.

Investment in Automation and Digitalization

Despite economic uncertainties, the manufacturing industry continues to prioritize investments in automation and digitalization. This push is largely fueled by the persistent need to enhance operational efficiency and lower production costs. For instance, global spending on industrial automation was projected to reach over $200 billion in 2024, a figure expected to grow as businesses seek competitive advantages.

DMG MORI is strategically positioned to benefit from this trend through its 'Machining Transformation' (MX) initiative. This focus on integrating automation and digital solutions directly addresses the market's demand for smarter, more connected manufacturing processes. Their portfolio of automated machine tools and digital services, like their integrated software solutions, directly caters to this growing investment appetite.

- Increased Investment: Global industrial automation spending is expected to surpass $200 billion in 2024, reflecting a strong commitment to efficiency.

- Digitalization Drive: Companies are increasingly adopting digital technologies to streamline operations and reduce overheads in manufacturing.

- DMG MORI's MX: The company's 'Machining Transformation' strategy aligns with this investment trend by offering advanced automation and digital solutions.

- Efficiency Gains: Automation and digitalization are key drivers for manufacturers aiming to boost productivity and cut costs in a competitive landscape.

The global economic landscape presents a mixed outlook for 2025, with cautious optimism for growth tempered by ongoing geopolitical risks and subdued capital expenditure. This environment directly influences demand for capital goods like DMG MORI's machine tools, impacting order intake and revenue streams.

Currency fluctuations remain a significant factor for DMG MORI, given its global operations. For instance, in 2023, a substantial portion of its sales and costs were outside the Eurozone, making it sensitive to shifts in currencies like the US Dollar and Chinese Yuan, which affect import costs and export revenues.

Inflationary pressures in 2024 and into 2025 are increasing input costs for DMG MORI, particularly for raw materials such as steel and energy. This, coupled with elevated interest rates from central banks responding to inflation, could slow down investment cycles for key customer industries by mid-2025.

| Economic Factor | 2024/2025 Impact | DMG MORI Relevance |

| Global GDP Growth | Projected moderate growth, but with regional variations and risks. | Influences overall demand for capital goods. |

| Inflation Rates | Persistent elevated levels in many economies. | Increases manufacturing costs (materials, energy). |

| Interest Rates | Expected to remain high in major economies through mid-2025. | Can dampen customer investment in machinery. |

| Currency Exchange Rates | Volatile, with significant movements in USD, EUR, CNY. | Impacts translation of foreign sales and costs. |

Preview the Actual Deliverable

DMG Mori PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of DMG Mori provides deep insights into the political, economic, social, technological, legal, and environmental factors influencing the company. You'll gain a strategic understanding of the industry landscape.

Sociological factors

The manufacturing sector, including DMG Mori's operational landscape, is grappling with a significant skills gap. This shortage affects crucial roles like skilled machinists, advanced manufacturing technicians, and automation engineers, directly hindering production efficiency and the integration of Industry 4.0 technologies. For instance, a 2023 Deloitte report indicated that 77% of manufacturing executives anticipate a shortage of skilled workers in the next decade, a trend that shows no signs of abating into 2024 and 2025.

Addressing this deficit requires substantial investment in workforce development. Companies like DMG Mori must prioritize robust training and upskilling initiatives. These programs are essential to equip current and future employees with the competencies needed to operate and maintain sophisticated, automated machinery, thereby ensuring competitiveness in a rapidly evolving industrial environment.

The widespread adoption of AI and automation in manufacturing, a trend accelerating in 2024 and projected to continue through 2025, presents a dual impact on employment. While efficiency gains are undeniable, with companies like DMG Mori leveraging these technologies, there's a palpable concern regarding job displacement.

Studies from organizations like the McKinsey Global Institute in 2023 indicated that automation could displace up to 800 million workers globally by 2030, highlighting the significant societal shift underway. This necessitates a proactive strategy for workforce adaptation, focusing on reskilling and upskilling programs to equip employees with the competencies needed for the evolving industrial landscape.

The narrative isn't solely about job losses; new roles are emerging that capitalize on uniquely human abilities. These include positions demanding advanced problem-solving, creative thinking, and complex decision-making, areas where AI currently complements rather than replaces human input. For instance, the demand for AI trainers and data ethicists is on the rise, reflecting this shift.

Customers are no longer just seeking high-precision machine tools; they now expect integrated solutions encompassing automation, advanced software, and digital services. Furthermore, there's a growing emphasis on sustainability, with clients prioritizing environmentally friendly manufacturing processes and products. For instance, DMG MORI's commitment to Green Transformation (GX) directly responds to this by focusing on energy-efficient technologies and reduced environmental impact in their offerings.

Workforce Diversity and Inclusion

Promoting diversity and equal opportunities is a growing global imperative, influencing corporate reputation and talent acquisition. Companies like DMG MORI are increasingly recognizing that a diverse workforce fosters innovation and better reflects their customer base. This commitment is crucial for attracting and retaining top talent in today's competitive landscape.

DMG MORI's focus on diversity and inclusion directly impacts its corporate culture and employer branding. By actively fostering an environment where all employees feel valued and have equal opportunities, the company can enhance employee engagement and reduce turnover. This approach is particularly relevant as global markets become more interconnected and diverse.

- Global Workforce Diversity Trends: In 2024, a significant majority of large corporations reported that diversity and inclusion initiatives are a key strategic priority, with over 70% of companies having formal D&I programs in place.

- Talent Attraction and Retention: Studies from 2023 indicate that companies with strong D&I policies experience a 15-20% higher employee retention rate compared to those without.

- Innovation and Performance: Research published in early 2025 suggests that diverse teams are up to 30% more likely to outperform their less diverse counterparts in terms of innovation and financial results.

- DMG MORI's Commitment: While specific internal D&I metrics for DMG MORI are proprietary, their public statements and participation in industry-wide diversity forums underscore a strategic emphasis on these principles as a driver of long-term success.

Employee Health and Well-being

There's a significant societal shift towards prioritizing employee health and well-being, with businesses increasingly lauded for their proactive health management. This trend means companies are expected to invest in programs that support their workforce's physical and mental health, recognizing it as a key component of corporate responsibility and a driver of productivity.

DMG MORI's acknowledgment as a 'White 500' company underscores its dedication to robust health and productivity management. This recognition, particularly significant in the 2024-2025 period, reflects their commitment to fostering a healthy work environment, which can translate into lower absenteeism and higher employee engagement.

- Growing societal expectation: Employees and stakeholders increasingly value companies that demonstrate a strong commitment to health and well-being programs.

- DMG MORI's 'White 500' status: This designation highlights the company's successful implementation of health management initiatives, aligning with societal trends.

- Impact on productivity: Investments in employee well-being are often linked to improved morale, reduced sick days, and enhanced overall operational efficiency.

Societal expectations are increasingly shaping business practices, with a strong emphasis on ethical conduct, corporate social responsibility, and sustainability. Customers and employees alike are scrutinizing companies' environmental and social impacts, pushing for transparency and accountability. For instance, a 2024 survey by Cone Communications found that 79% of consumers consider sustainability a key factor in their purchasing decisions.

DMG MORI's proactive approach to Green Transformation (GX) directly addresses these evolving societal values, focusing on energy-efficient technologies and reduced environmental footprints. This aligns with a broader trend where companies demonstrating strong ESG (Environmental, Social, and Governance) performance are often rewarded with higher valuations and greater customer loyalty.

The demand for skilled labor remains a critical challenge, with a persistent gap in areas like advanced manufacturing and automation. A 2024 report by the Manufacturing Institute projected that the U.S. manufacturing sector alone could face a shortage of 2.1 million workers by 2030, a trend that directly impacts production capacity and technological adoption for companies like DMG MORI.

Furthermore, the increasing integration of AI and automation presents a societal debate around job displacement versus job creation. While automation boosts efficiency, there's a growing need for workforce reskilling and upskilling to adapt to new roles, such as AI trainers and data analysts, reflecting a significant societal shift in the nature of work.

| Societal Factor | Impact on DMG MORI | Supporting Data (2023-2025) |

|---|---|---|

| Demand for Skilled Labor | Hinders production efficiency and adoption of advanced technologies. | 77% of manufacturing executives anticipate a skilled worker shortage (Deloitte, 2023). |

| AI & Automation Impact | Raises concerns about job displacement, necessitating reskilling efforts. | Automation could displace up to 800 million workers globally by 2030 (McKinsey Global Institute, 2023). |

| Customer Expectations | Shift towards integrated solutions and sustainability. | 79% of consumers consider sustainability in purchasing decisions (Cone Communications, 2024). |

| Diversity & Inclusion | Crucial for talent acquisition, innovation, and corporate reputation. | Diverse teams are up to 30% more likely to outperform less diverse counterparts (Research, early 2025). |

Technological factors

DMG MORI's edge hinges on constant progress in CNC turning and milling, plus cutting-edge methods like ultrasonic and laser texturing. These innovations are key to staying ahead in the manufacturing sector.

The company consistently launches upgraded machine models and new technologies to boost product worth and meet evolving customer needs. For instance, their 2023 financial report highlighted significant investment in R&D for next-generation machining solutions.

The manufacturing sector is seeing a significant shift towards automation and robotics, a trend DMG MORI is actively capitalizing on. Their portfolio includes advanced automation products designed to extend machine operating times and minimize the need for constant human oversight.

This focus on automation directly addresses customer needs for enhanced efficiency and productivity. For instance, DMG MORI's automated solutions can lead to substantial improvements in throughput, with some studies indicating potential increases of 20-30% in machine utilization for manufacturers adopting these technologies.

The ongoing shift towards Industry 4.0, with its emphasis on interconnected systems, the Internet of Things (IoT), and cloud computing, presents significant opportunities for efficiency but also introduces substantial cybersecurity risks. DMG MORI's strategic commitment to Digital Transformation (DX) and the development of digital solutions and software is therefore crucial for facilitating the creation of smart factories and streamlining production processes.

In 2023, DMG MORI reported a 10% increase in sales of its digital solutions, highlighting the growing demand for smart manufacturing capabilities. This trend is expected to continue as businesses increasingly rely on data analytics and automation to optimize operations, with the global Industrial IoT market projected to reach over $200 billion by 2025.

Artificial Intelligence (AI) and Machine Learning (ML) Applications

Artificial intelligence and machine learning are transforming the machine tool industry, with DMG Mori leveraging these technologies for enhanced diagnostics and predictive maintenance. This allows for early detection of potential issues, reducing downtime and improving operational efficiency. For instance, AI algorithms can analyze vast amounts of sensor data from machines to predict component failures before they occur, a critical capability for manufacturers aiming to maintain high production uptime.

Optimizing production processes is another key area where AI and ML are making significant strides. DMG Mori is integrating these capabilities to fine-tune machining parameters in real-time, leading to improved quality, reduced waste, and faster cycle times. This intelligent automation not only boosts productivity but also contributes to more sustainable manufacturing practices.

While the benefits are substantial, AI also introduces new challenges, particularly in cybersecurity. AI-powered attacks are an emerging threat that requires robust defense mechanisms. However, the legitimate application of AI in manufacturing, as seen with DMG Mori's advancements, promises more efficient, intelligent, and responsive production solutions, driving the future of smart manufacturing.

- AI-driven predictive maintenance can reduce unplanned downtime by up to 30% in industrial settings.

- Machine learning algorithms can optimize CNC machining paths, potentially increasing throughput by 10-20%.

- The global AI in manufacturing market was valued at approximately $4.5 billion in 2023 and is projected to grow significantly.

Additive Manufacturing (3D Printing) Developments

Additive manufacturing, or 3D printing, is rapidly advancing beyond its initial role in rapid prototyping. It's now a viable option for full-scale production, driven by improvements in materials science, increased automation, and the development of large-format printing capabilities. This shift means AM can produce end-use parts, not just models.

DMG MORI's strategic investment in technologies like their LASERTEC SLM (Selective Laser Melting) series underscores their commitment to this evolving field. This engagement positions them to capitalize on the demand for highly customized, performance-enhanced components. The technology also promises significant reductions in material waste compared to traditional subtractive manufacturing methods.

The market for additive manufacturing is experiencing substantial growth. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to reach $100.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 21.0% during the forecast period. This growth is fueled by increasing adoption across various industries, including aerospace, automotive, healthcare, and consumer goods.

- Market Growth: The global 3D printing market is expected to grow from $15.1 billion in 2023 to $100.6 billion by 2033, with a CAGR of 21.0%.

- Material Advancements: Innovations in metal powders, polymers, and composites are expanding the range of functional parts that can be 3D printed.

- Automation Integration: Increased automation in AM processes, including robotics and AI, is improving efficiency and scalability for mass production.

- Industry Adoption: Key sectors like aerospace and automotive are increasingly using AM for complex, lightweight, and customized components, driving demand for advanced machinery.

Technological advancements are central to DMG MORI's strategy, with a strong focus on automation and digitalization. The company is actively integrating AI and machine learning for predictive maintenance and process optimization, aiming to reduce downtime and enhance efficiency. Their digital solutions saw a 10% sales increase in 2023, reflecting growing demand for smart manufacturing capabilities.

Legal factors

DMG MORI's global operations necessitate strict adherence to international trade laws, export controls, and economic sanctions. Failure to comply can lead to severe penalties, as seen with the deconsolidation of their Russian production entity in response to geopolitical shifts. This highlights the substantial legal and financial risks associated with operating in or engaging with sanctioned regions.

Strict data privacy laws like the EU's GDPR and evolving cybersecurity regulations such as the NIS2 Directive in Europe and the Cybersecurity Maturity Model Certification (CMMC) in the United States create significant compliance challenges for manufacturers. DMG MORI must prioritize robust data protection and cybersecurity across its global operations, particularly as digital connectivity and data exchange increase, impacting its supply chain and customer interactions.

DMG MORI, as a global manufacturer of high-precision machinery, navigates a complex web of product liability and safety standards. These regulations are critical, as a failure to meet them can result in significant financial penalties and reputational damage.

Adherence to standards like ISO 9001 for quality management and specific machine safety directives, such as the European Machinery Directive, is non-negotiable. For instance, in 2023, the European Commission reported a notable increase in product safety recalls across various sectors, underscoring the importance of robust compliance for manufacturers like DMG MORI.

Environmental Regulations and Compliance

Environmental regulations are becoming increasingly stringent globally, affecting manufacturing operations. New rules concerning emissions, waste disposal, and the management of chemicals such as per- and polyfluoroalkyl substances (PFAS) directly influence how DMG MORI designs its products and manages its production. For instance, the EU's proposed PFAS restrictions, expected to be finalized in 2025, could necessitate significant material substitutions in industrial equipment.

DMG MORI is actively addressing these legal shifts by focusing on sustainability. The company's stated goal of achieving CO2 neutrality by 2030 demonstrates a proactive approach to aligning its business practices with evolving environmental laws and market expectations for greener manufacturing solutions. This commitment is crucial for maintaining market access and reputation.

- Increased regulatory scrutiny on industrial emissions and waste management

- Potential impact of PFAS restrictions on component sourcing and product design

- DMG MORI's 2030 CO2 neutrality target as a response to environmental legal frameworks

- Growing demand for eco-friendly machinery driven by legislative pressures

Corporate Governance and Reporting Directives

DMG MORI, as a publicly traded entity, adheres to stringent corporate governance standards and financial reporting mandates, including International Financial Reporting Standards (IFRS) and the German Corporate Governance Code. These frameworks ensure transparency and accountability in its operations and financial disclosures.

The advent of new sustainability reporting directives, such as the Corporate Sustainability Reporting Directive (CSRD) within the European Union, significantly impacts DMG MORI. This directive mandates comprehensive Environmental, Social, and Governance (ESG) disclosures, thereby enhancing stakeholder transparency and corporate accountability.

These evolving legal requirements necessitate robust internal controls and reporting mechanisms. For instance, compliance with the CSRD, effective from January 1, 2024, for large companies, means DMG MORI must provide detailed, standardized ESG information, potentially impacting investor relations and market perception.

- IFRS Compliance: DMG MORI follows IFRS for consolidated financial statements, ensuring comparability with global peers.

- German Corporate Governance Code: Adherence to the Code guides management and supervisory board practices, fostering good governance.

- CSRD Impact: The CSRD requires extensive ESG reporting, with its first wave of companies reporting for the 2024 financial year.

- Increased Transparency: New directives aim to provide investors with more standardized and reliable ESG data.

DMG MORI operates within a dynamic legal landscape shaped by international trade laws, export controls, and sanctions, as evidenced by its 2022 deconsolidation of its Russian production entity due to geopolitical shifts. Furthermore, stringent data privacy regulations like GDPR and evolving cybersecurity mandates such as the NIS2 Directive and CMMC in the US necessitate robust data protection strategies and investments in cybersecurity infrastructure to safeguard operations and customer data.

Environmental factors

The increasing urgency of climate change is a significant environmental factor, directly fueling demand for manufacturing technologies that are both energy-efficient and capable of achieving carbon neutrality. This trend presents a clear opportunity for companies like DMG MORI that can offer solutions supporting these critical goals.

DMG MORI's 'Green Transformation' (GX) strategy is a direct response to this environmental imperative. The company is actively pursuing CO2-neutral production processes and is focused on helping its customers lower their own emissions. This strategic alignment with global decarbonization efforts, including the Paris Agreement's aim to limit global warming, positions DMG MORI favorably in the evolving market landscape.

Growing global awareness of finite resources is pushing industries towards greater efficiency and waste minimization, with circular economy principles becoming increasingly vital. This shift means companies must rethink how they use materials and manage products throughout their entire lifespan.

DMG MORI actively embraces these principles by focusing on optimizing production processes and maximizing the efficient use of raw materials in its machine tools. Their approach considers the full lifecycle, from sourcing to eventual recycling, demonstrating a clear commitment to environmental stewardship.

For instance, in 2023, the manufacturing sector globally saw a 5% increase in investments towards circular economy initiatives, according to a report by the Ellen MacArthur Foundation, highlighting the growing market demand for sustainable practices that DMG MORI is well-positioned to meet.

Manufacturers like DMG MORI face growing pressure to manage Scope 3 emissions, encompassing all indirect emissions from their value chain, especially those originating from suppliers. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, targets emissions embedded in imported goods, directly impacting supply chains and pushing companies to quantify and reduce these upstream and downstream impacts.

DMG MORI's proactive approach to tracking and reducing Scope 3 emissions, particularly by engaging with its suppliers, reflects a commitment to robust environmental stewardship. This focus is crucial for navigating evolving regulatory landscapes and meeting stakeholder expectations for sustainable operations, with many companies aiming for significant reductions in their supply chain emissions by 2030.

Energy Efficiency in Machine Operation

The energy consumption of machine tools during operation is a critical environmental consideration for DMG MORI's customers. By prioritizing the development of energy-efficient machinery, DMG MORI directly addresses this concern.

Their commitment to reducing the environmental impact of their products in use is exemplified by their 'GREENMODE' solutions. These initiatives aim to lower the operational carbon footprint for users.

- Energy Savings: DMG MORI's advanced machine designs can reduce energy consumption by up to 30% compared to older models, a significant factor for manufacturers facing rising energy costs.

- Operational Efficiency: 'GREENMODE' technologies focus on minimizing idle times and optimizing power usage, leading to lower electricity bills for customers.

- Market Demand: A growing number of industries, particularly in Europe and North America, are actively seeking sustainable manufacturing solutions, making energy efficiency a key purchasing criterion.

Waste Management and Recycling

Effective waste management and product recyclability are increasingly vital environmental concerns for manufacturing companies like DMG MORI. The company's commitment to a 360° sustainability strategy, which includes the refurbishment and recycling of their machinery, highlights their dedication to reducing their environmental footprint across the entire product lifecycle. This focus is particularly relevant as global regulations around waste and circular economy principles continue to tighten, pushing manufacturers towards more responsible end-of-life solutions for their products.

DMG MORI's approach to waste management and recycling is a key component of its environmental stewardship. By offering services for the overhaul and recycling of their machines, they are directly addressing the challenge of industrial waste, aiming to extend the lifespan of equipment and recover valuable materials. This proactive stance aligns with growing market expectations for environmentally conscious business practices.

- Circular Economy Focus DMG MORI's refurbishment and recycling programs contribute to a circular economy by keeping materials in use and minimizing landfill waste.

- Regulatory Compliance Proactive waste management helps DMG MORI stay ahead of evolving environmental regulations concerning product lifecycles and waste disposal.

- Resource Efficiency Recycling and refurbishment efforts directly support resource efficiency by reducing the need for virgin materials in new production.

The increasing focus on climate change and sustainability is a major environmental driver, pushing industries towards energy-efficient and carbon-neutral manufacturing solutions. DMG MORI's 'Green Transformation' (GX) strategy directly addresses this by aiming for CO2-neutral production and assisting customers in reducing their emissions, aligning with global decarbonization goals.

The growing emphasis on circular economy principles and resource efficiency is reshaping manufacturing, demanding better material utilization and waste minimization. DMG MORI is actively integrating these principles by optimizing its machine tools for efficient material use and considering the entire product lifecycle, from sourcing to recycling.

Managing Scope 3 emissions, which include indirect value chain impacts, is becoming critical, especially with regulations like the EU's Carbon Border Adjustment Mechanism (CBAM) from October 2023. DMG MORI is proactively addressing these upstream and downstream impacts by engaging with suppliers to reduce supply chain emissions, a trend many companies are prioritizing for significant reductions by 2030.

Energy consumption during machine operation is a key concern for customers, driving demand for energy-efficient machinery. DMG MORI's 'GREENMODE' solutions are designed to lower operational carbon footprints, with advanced designs potentially reducing energy use by up to 30% compared to older models, a significant advantage given rising energy costs.

| Environmental Factor | DMG MORI's Response/Strategy | Impact/Opportunity |

|---|---|---|

| Climate Change & Decarbonization | 'Green Transformation' (GX) strategy, CO2-neutral production, customer emission reduction support | Increased demand for sustainable manufacturing technologies |

| Circular Economy & Resource Efficiency | Optimizing material use, lifecycle management, refurbishment & recycling programs | Reduced waste, extended product life, compliance with tightening regulations |

| Scope 3 Emissions Management | Supplier engagement, supply chain emission tracking | Navigating regulations like CBAM, meeting stakeholder expectations |

| Energy Efficiency in Operations | 'GREENMODE' solutions, energy-saving machine designs | Lower operational costs for customers, competitive advantage in energy-conscious markets |

PESTLE Analysis Data Sources

Our DMG Mori PESTLE Analysis is meticulously constructed using data from leading industry publications, economic forecasts from organizations like the World Bank and IMF, and regulatory updates from key global markets. This comprehensive approach ensures that every aspect of the analysis is grounded in current, authoritative information.