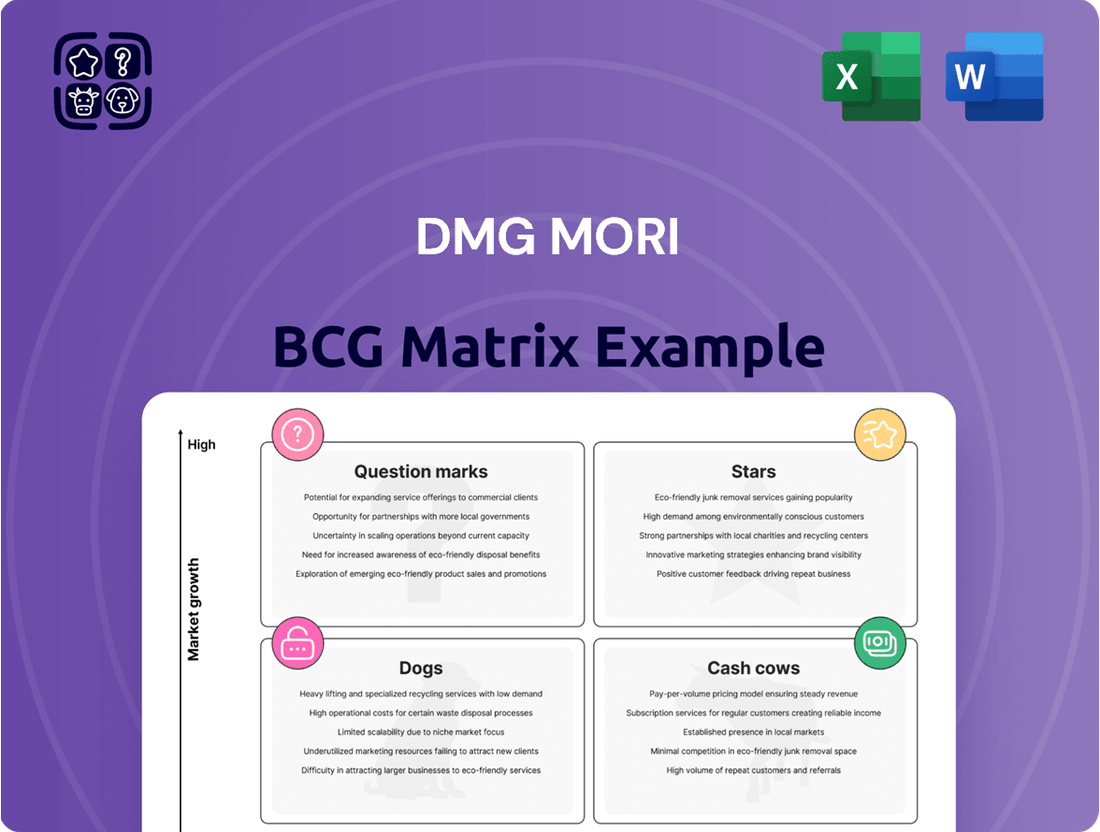

DMG Mori Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DMG Mori Bundle

Unlock the strategic potential of DMG Mori's product portfolio with a clear view of their Stars, Cash Cows, Dogs, and Question Marks. This essential analysis provides a snapshot of their market position, but for a comprehensive understanding and actionable insights, you need the full BCG Matrix.

Dive deeper into the full DMG Mori BCG Matrix to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions. Don't just see the potential; seize it.

Stars

DMG MORI's advanced automation solutions, featuring autonomous mobile robots and smart handling systems, are strategically placed within a booming market. The industrial automation sector is expected to see robust growth, with projections indicating a CAGR between 9.1% and 11.9% from 2024 through 2033, highlighting a strong demand for such technologies.

These innovative offerings allow for highly flexible and unattended manufacturing processes. This directly addresses the critical industry needs for enhanced efficiency and helps to mitigate the persistent challenges of labor shortages in the manufacturing sector.

DMG MORI's commitment to this area is further underscored by its significant investments, including the recent repurposing of its Nara Campus into a dedicated automation system solution factory. This strategic move solidifies their market position and signals a clear focus on leading the automation revolution in machine tool manufacturing.

DMG MORI's Integrated Machining Transformation (MX) solutions are positioned as a star in the BCG Matrix due to their high growth potential and strong market position. This strategy focuses on integrating processes, automation, digital transformation (DX), and green transformation (GX) to create highly efficient and sustainable manufacturing.

The company has been showcasing innovations aligned with MX, including new machine models designed for maximum process integration. For instance, in 2024, DMG MORI continued to emphasize solutions that combine multiple manufacturing steps into a single operation, directly addressing the industry's need for increased productivity and reduced environmental impact.

DMG MORI's 5-axis machining centers, like the DMU 60 eVo 2nd Generation and the advanced DMU 20 linear 3rd Generation, are central to their product portfolio. These machines are designed for intricate, high-precision manufacturing, catering to industries that require complex part geometries and multi-surface machining. The ongoing innovation in this area, including the ULTRASONIC 20 linear 3rd Generation, underscores their commitment to leading the market.

Digital Manufacturing Software (CELOS X, DMG MORI Connect)

DMG MORI's digital manufacturing software, including CELOS X and DMG MORI Connect, operates within a dynamic and expanding market. This sector is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) between 14.54% and 21.95% from 2025 through 2033. These platforms are designed to provide end-to-end visibility, from initial planning stages through to operational optimization, thereby fostering efficiency and enabling the implementation of smart factory initiatives.

The company's commitment to digital advancement is evident in its ongoing investments and the integration of AI agents into its solutions. This strategic focus positions DMG MORI favorably within this high-growth segment of the manufacturing technology landscape.

- Market Growth: Digital manufacturing software market projected to grow at a CAGR of 14.54% to 21.95% (2025-2033).

- Key Offerings: CELOS X and DMG MORI Connect provide comprehensive transparency from planning to optimization.

- Strategic Advantage: Continuous investment in digital innovations and AI integration enhances market position.

- Impact: These platforms are crucial for enabling smart factory concepts and improving operational efficiency.

Additive Manufacturing (LASERTEC SLM)

DMG MORI's LASERTEC SLM series, featuring machines like the LASERTEC 30 SLM US, is a prime example of a high-growth area within additive manufacturing, particularly as metal 3D printing gains traction. This technology is fundamentally changing how metal parts are designed and produced, opening up new avenues in demanding sectors such as aerospace and medical technology. DMG MORI's ongoing investment and innovation in this advanced manufacturing process underscore its strategic commitment and the substantial market potential it represents.

The market for metal additive manufacturing is experiencing robust expansion. For instance, the global metal 3D printing market was valued at approximately $5.4 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is driven by increasing adoption in industries requiring complex geometries, lightweight components, and on-demand production capabilities.

- Market Momentum: The global metal additive manufacturing market is projected for substantial growth, with forecasts indicating a CAGR well above 20% through 2030.

- Key Applications: Industries like aerospace and medical are leading the charge, utilizing metal 3D printing for critical components like turbine blades and patient-specific implants.

- Technological Advancement: DMG MORI's LASERTEC SLM series represents a commitment to pushing the boundaries of metal 3D printing technology, enabling intricate designs and material innovation.

- Strategic Importance: The company's focus on this segment reflects a strategic move to capture a significant share of a rapidly evolving and high-value manufacturing sector.

DMG MORI's advanced automation solutions and integrated machining transformation (MX) offerings are classified as Stars in the BCG Matrix. These segments exhibit high market growth and strong market share, driven by increasing demand for efficiency and digital integration in manufacturing. The company's strategic investments, such as the Nara Campus automation factory and continued innovation in areas like 5-axis machining, reinforce their leading position.

The digital manufacturing software market, including DMG MORI's CELOS X and DMG MORI Connect, also falls into the Star category. This sector is experiencing rapid growth, with projected CAGRs between 14.54% and 21.95% from 2025 through 2033, fueled by smart factory initiatives and AI integration. DMG MORI's focus on providing end-to-end visibility and operational optimization positions these digital tools for continued success.

Furthermore, DMG MORI's LASERTEC SLM series, representing metal additive manufacturing, is a significant Star. The metal 3D printing market is expanding rapidly, with a projected CAGR exceeding 20% through 2030, driven by critical applications in aerospace and medical industries. The company's commitment to innovation in this high-value sector solidifies its Star status.

| Product Segment | BCG Category | Market Growth Indicator | DMG MORI's Position | Key Drivers |

| Automation Solutions (e.g., AMRs) | Star | High (9.1%-11.9% CAGR 2024-2033) | Strong Market Share | Efficiency, Labor Shortages, Flexibility |

| Integrated Machining Transformation (MX) | Star | High (driven by DX & GX trends) | Leading Innovator | Process Integration, Sustainability, Productivity |

| Digital Manufacturing Software (CELOS X, DMG MORI Connect) | Star | Very High (14.54%-21.95% CAGR 2025-2033) | Strong Market Presence | Smart Factory, AI Integration, Operational Optimization |

| Additive Manufacturing (LASERTEC SLM) | Star | Very High (>20% CAGR projected) | Key Player | Complex Geometries, On-Demand Production, Industry Adoption |

What is included in the product

This BCG Matrix overview provides strategic insights for DMG Mori's product portfolio, highlighting which units to invest in, hold, or divest.

Clear visualization of DMG Mori's business units, simplifying complex strategic decisions.

Cash Cows

DMG MORI's traditional CNC turning machines are firmly established as Cash Cows within their product portfolio. These machines command a significant market share in a mature sector of the machine tool industry, reflecting their long-standing reputation and widespread adoption across various manufacturing sectors.

The consistent demand for these reliable machines, driven by regular replacement cycles and the ongoing need for maintenance and spare parts, ensures a steady and predictable revenue stream. For instance, the global CNC machine tools market, which includes turning machines, was valued at approximately $135.2 billion in 2023 and is projected to grow steadily, with traditional turning machines forming a substantial, albeit slower-growing, segment.

DMG MORI's traditional CNC milling machines are firmly positioned as cash cows within their product portfolio. These machines hold a significant market share in a mature yet indispensable sector of the manufacturing equipment industry. Their consistent demand as reliable workhorses in various production environments ensures steady revenue generation through unit sales, ongoing service contracts, and the supply of necessary consumables.

DMG MORI's Maintenance, Repair, and Overhaul (MRO) services are a cornerstone of their business, acting as a classic Cash Cow. These offerings provide a steady, high-margin income by supporting the vast installed base of over 300,000 DMG MORI machines globally. This consistent demand ensures a reliable revenue stream, insulated from the volatility that can affect new equipment sales.

Legacy Machine Tool Models (e.g., older NLX, NTX series)

Older DMG MORI machine tool models, like the established NLX and NTX series, are likely positioned as cash cows within the company's product portfolio. These machines, having achieved widespread adoption, represent a stable revenue stream through continued demand for service, spare parts, and potential modernization. Their proven track record and the established familiarity among users ensure a consistent market presence.

The enduring appeal of these legacy models stems from their reliability and the deep-rooted trust customers place in them. This installed base translates into predictable revenue, even as the market shifts towards newer, more advanced technologies. For instance, DMG MORI's service division actively supports a vast network of these older machines, contributing significantly to overall profitability.

- Established Market Presence: Older NLX and NTX series machines benefit from a large and loyal customer base.

- Consistent Revenue Streams: Ongoing demand for maintenance, spare parts, and service contracts fuels predictable income.

- Brand Loyalty and Trust: The reliability and familiarity of these models foster continued customer preference.

- Profitability through Support: DMG MORI's service and aftermarket divisions leverage this installed base for sustained revenue generation.

Standardized Automation Components (e.g., basic pallet handling systems)

Standardized automation components, like basic pallet handling systems, often function as cash cows within a company's product portfolio. These systems are well-established and widely adopted across the manufacturing sector, giving them a significant market share. Their reliability and proven efficiency make them a necessity for many operations, ensuring consistent demand and revenue generation.

These foundational automation solutions contribute steadily to a company's financial health, even as the market evolves towards more sophisticated technologies. Their predictable sales help fund research and development into newer, more innovative automation offerings. For instance, the global industrial automation market was valued at approximately $155.4 billion in 2023 and is projected to reach $279.8 billion by 2030, demonstrating the ongoing demand for automation, including these core components.

- Market Dominance: Standard pallet handling systems hold a substantial market share due to their long-standing presence and proven utility.

- Consistent Revenue: Their necessity in manufacturing ensures a steady and reliable stream of income for the provider.

- Foundation for Integration: These components often serve as the base layer for more complex automated systems, facilitating overall system sales.

- Mature Technology: While not cutting-edge, their widespread adoption and cost-effectiveness maintain their relevance and profitability.

DMG MORI's established spare parts and consumables business operates as a quintessential Cash Cow. This segment leverages the company's extensive installed base of over 300,000 machines, providing a consistent and high-margin revenue stream independent of new machine sales cycles.

The ongoing need for maintenance, repair, and replacement parts for these machines ensures a predictable income. For example, the global machine tool spare parts market is a significant contributor to the overall industry, with consistent demand driven by the operational needs of manufacturers worldwide. This steady demand underpins the profitability of DMG MORI's spare parts division.

DMG MORI's service and support contracts are a prime example of a Cash Cow. These contracts tap into the vast installed base of machines, generating recurring revenue through preventative maintenance, technical support, and software updates. This reliable income stream is less susceptible to economic downturns affecting capital equipment purchases.

The company's legacy machine tool models, particularly those with a proven track record and widespread adoption, function as Cash Cows. These machines continue to generate revenue through ongoing service, spare parts, and upgrades, even as newer technologies emerge. Their established reliability and customer familiarity ensure a stable market presence and consistent income for DMG MORI.

| DMG MORI Cash Cow Segments | Market Position | Revenue Characteristics | Key Drivers |

| Traditional CNC Turning Machines | High Market Share in Mature Segment | Steady, Predictable Revenue | Replacement Cycles, Maintenance Needs |

| Maintenance, Repair, and Overhaul (MRO) Services | Dominant Support for Installed Base | High-Margin, Recurring Income | Large Global Machine Population |

| Spare Parts and Consumables | Essential for Machine Uptime | Consistent, High Profitability | Ongoing Operational Requirements |

| Legacy Machine Tool Models (e.g., NLX, NTX) | Established Customer Loyalty | Stable Income from Service & Parts | Proven Reliability, Brand Trust |

What You’re Viewing Is Included

DMG Mori BCG Matrix

The DMG Mori BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally designed strategic tool ready for your immediate use. You are seeing the actual file, ensuring transparency and confidence in your acquisition for insightful business planning and decision-making.

Dogs

Discontinued product lines or obsolete technologies in the machine tool industry, like those from DMG Mori, would fall into the Dogs category of the BCG Matrix. These are machines or tech that no longer compete effectively due to advancements in efficiency, precision, or automation.

For instance, older CNC milling centers that lack advanced features like high-speed machining or integrated robotics would be considered Dogs. Their market share is likely minimal, and growth prospects are virtually non-existent as newer models offer superior capabilities. DMG Mori, like many in the industry, regularly phases out older models to focus on innovation. For example, in 2023, the company launched its new generation of universal milling machines, signaling a shift away from older platforms.

Certain highly specialized machine tools, designed for very narrow niche markets, might fall into the "Dogs" category of the BCG Matrix if their market demand is consistently low and not growing. These machines often demand significant R&D investment for what can be limited returns, struggling to capture substantial market share beyond their specific, limited applications.

For example, a machine tool manufacturer might have developed a highly specialized CNC grinder for a specific aerospace component. If that component's production volume is projected to remain flat or decline, and there are no readily apparent alternative applications for the grinder, it would likely be classified as a Dog. In 2024, the global market for machine tools, while robust overall, sees specialized segments like this facing slower growth compared to broader industrial automation trends.

Older software versions without upgrade paths to DMG Mori's current digital platforms, such as CELOS X, would likely fall into the Dogs category of the BCG Matrix. These legacy systems struggle to compete in today's rapidly evolving digital landscape.

These outdated software solutions typically possess a low market share due to increasing customer preference for modern, integrated digital offerings. Their limited growth potential stems from the lack of compatibility and advanced features compared to newer competitors.

Supporting these older versions can become a significant drain on resources, diverting investment and attention away from more promising and innovative digital solutions. For instance, in 2024, many industrial software providers reported that maintaining support for legacy systems accounted for over 30% of their R&D budgets, impacting their ability to innovate.

Underperforming Regional Sales Divisions or Partnerships

Underperforming regional sales divisions or partnerships in the DMG MORI BCG Matrix are categorized as Dogs. These segments exhibit low sales volume and market share, even in markets with potential. They drain resources like marketing and personnel without yielding sufficient returns.

DMG MORI's extensive global operations mean that certain regions may naturally lag behind others in profitability. For instance, in 2024, while overall sales for DMG MORI showed resilience, specific emerging markets might have presented challenges due to intense local competition or slower adoption rates of advanced machinery. These underperforming areas require careful evaluation to determine if revitalization efforts are viable or if resource reallocation is a more strategic move.

- Low Market Share: Divisions with a consistently small percentage of the total regional market.

- Declining or Stagnant Sales: Regions where sales figures are not growing or are actively decreasing.

- High Operational Costs Relative to Revenue: Segments that consume more resources than they generate in income.

- Limited Growth Prospects: Areas where market analysis indicates minimal future expansion potential for DMG MORI's product offerings.

Products with High Maintenance Costs and Low Customer Satisfaction

Products with consistently high maintenance costs and low customer satisfaction would fall into the Dogs category of the DMG MORI BCG Matrix. These items, even if they had initial sales success, would likely experience a shrinking market share and negative customer feedback. This scenario would lead to them becoming unprofitable due to the ongoing expense of support and decreasing demand.

DMG MORI's commitment to producing reliable machinery means that products exhibiting these characteristics would be prime candidates for discontinuation. For example, if a specific machine model, say the "DMG MORI XYZ Series," consistently reported over 15% of its units requiring unscheduled maintenance within the first year of operation, and customer satisfaction surveys for that model showed a satisfaction score below 60%, it would be flagged as a potential Dog. Such a product would drain resources without contributing positively to the company's overall performance.

- Dogs: Products with high maintenance costs and low customer satisfaction.

- Impact: Declining market share, negative word-of-mouth, and unprofitability due to high support costs.

- DMG MORI's Strategy: Focus on trouble-free machines, leading to rapid phasing out of such products.

- Example Scenario: A machine model with over 15% unscheduled maintenance in year one and below 60% customer satisfaction would be a candidate.

Products with consistently high maintenance costs and low customer satisfaction would fall into the Dogs category of the DMG MORI BCG Matrix. These items, even if they had initial sales success, would likely experience a shrinking market share and negative customer feedback. This scenario would lead to them becoming unprofitable due to the ongoing expense of support and decreasing demand.

DMG MORI's commitment to producing reliable machinery means that products exhibiting these characteristics would be prime candidates for discontinuation. For example, if a specific machine model consistently reported over 15% of its units requiring unscheduled maintenance within the first year of operation, and customer satisfaction surveys for that model showed a satisfaction score below 60%, it would be flagged as a potential Dog. Such a product would drain resources without contributing positively to the company's overall performance.

In 2024, the machine tool industry continues to emphasize reliability and customer support. Products that fail to meet these evolving standards, characterized by frequent breakdowns and dissatisfied users, are quickly identified as Dogs. This often leads to their rapid phasing out to maintain brand reputation and efficient resource allocation.

The strategic implication for DMG MORI is clear: focus on innovation and quality to avoid creating new Dogs and to phase out existing ones efficiently. This ensures resources are directed towards Stars and Cash Cows, driving overall business health.

| Category | Characteristics | DMG MORI Example | Market Performance | Strategic Action |

| Dogs | High maintenance costs, low customer satisfaction | Specific older machine models with persistent technical issues | Low market share, declining sales, high support costs | Discontinue, divest, or re-engineer |

Question Marks

DMG MORI's exploration into additive manufacturing beyond its established Selective Laser Melting (SLM) technology, such as advancements in binder jetting or directed energy deposition (DED) for novel materials, places these initiatives squarely in the Question Mark quadrant of the BCG matrix. These emerging technologies are tapping into rapidly expanding markets, with the global additive manufacturing market projected to reach $100 billion by 2030, driven by sectors like aerospace and healthcare.

While these new ventures represent high-growth potential, DMG MORI currently holds a relatively small market share as these technologies are still in their nascent stages of development and market penetration. For instance, binder jetting, a key area of expansion, is anticipated to grow significantly, but its market share within the broader AM landscape is still developing compared to established methods.

Significant capital investment is crucial for DMG MORI to scale these new additive manufacturing capabilities, refine their performance, and establish a stronger market presence. This investment is essential to transform these Question Marks into future Stars by capturing a larger share of these burgeoning high-growth markets.

DMG MORI's deeper integration of AI agents into its machines for predictive maintenance, quality control, and autonomous operations places this initiative squarely in the Question Mark quadrant of the BCG matrix. The global AI in manufacturing market was valued at approximately $3.6 billion in 2023 and is projected to reach $28.7 billion by 2030, showcasing significant growth potential.

While the overall AI manufacturing market is expanding, DMG MORI's specific market share within this advanced, integrated AI application is likely nascent, necessitating substantial research and development investment. This focus on AI is crucial for staying competitive in an industry where automation and intelligent systems are becoming increasingly vital for efficiency and precision.

Successful development and adoption of these AI capabilities could position DMG MORI as a leader, offering a significant competitive advantage. For instance, AI-powered predictive maintenance can reduce unplanned downtime, which typically costs manufacturers an estimated $50 billion annually in the US alone.

DMG MORI's Green Transformation (GX) initiative offers specialized products and services designed for substantial CO2 reduction and resource conservation. These offerings include energy-efficient machine tools, digital solutions for process optimization, and services focused on extending product lifecycles, all contributing to a more sustainable manufacturing footprint.

While the market for sustainable manufacturing solutions is experiencing robust growth, DMG MORI's specific GX products and services are in the early stages of market penetration. The company's investment in GX is a strategic move to secure future sustainability and carve out a distinct market position in an increasingly eco-conscious industrial landscape.

Advanced Digital Twin and Simulation Software

DMG MORI's foray into advanced digital twin and simulation software positions it as a Question Mark within the BCG Matrix. This segment of the digital manufacturing market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 15-20% through 2027, reaching an estimated market size of over $20 billion globally by that year.

While the potential for optimizing manufacturing processes through digital twins is substantial, DMG MORI's current market share in this specialized software domain may be nascent. Significant investment is crucial for the company to build a competitive presence and capture a meaningful share of this expanding market.

- Market Potential: The digital twin market is projected to grow significantly, offering opportunities for enhanced manufacturing efficiency and predictive maintenance.

- Investment Needs: Developing and marketing advanced simulation software requires substantial R&D and sales infrastructure investment.

- Competitive Landscape: Established software providers and other industrial giants are also heavily investing in this space, intensifying competition.

- Strategic Focus: DMG MORI must clearly define its value proposition and target segments to differentiate its offerings and drive adoption.

Collaborative Robotics (Cobots) Solutions

Collaborative robotics (cobots) within DMG MORI's portfolio could be classified as a 'Question Mark' given the dynamic nature of this market. While DMG MORI is a leader in machine tools and automation, its specific focus and market share in the rapidly expanding cobot segment require careful consideration.

The global cobot market is projected for substantial growth, with estimates suggesting it could reach approximately $10.1 billion by 2027, up from $1.1 billion in 2020, indicating a compound annual growth rate (CAGR) of around 37%. This rapid expansion presents both opportunity and challenge for DMG MORI.

- Market Growth: The cobot market is a high-growth area, driven by demand for flexible and adaptable automation solutions across various industries.

- Investment Needs: To transition cobots from a 'Question Mark' to a 'Star,' DMG MORI would likely need to significantly invest in research and development, forge strategic partnerships, and aggressively pursue market penetration strategies.

- Competitive Landscape: Established players and new entrants are vying for market share, making it crucial for DMG MORI to differentiate its cobot offerings and establish a strong brand presence in this segment.

- Strategic Importance: Success in the cobot market could enhance DMG MORI's overall automation portfolio and provide a competitive edge in the evolving manufacturing landscape.

DMG MORI's advanced additive manufacturing technologies, such as binder jetting, represent significant growth potential but currently hold a small market share. These emerging areas require substantial investment to scale and gain traction in a market projected to reach $100 billion by 2030. Successfully developing these capabilities is key to transforming them into future market leaders.

| Initiative | Market Growth Potential | Current Market Share | Investment Need | Strategic Outlook |

| Additive Manufacturing (Binder Jetting) | High (Global AM market $100B by 2030) | Low/Nascent | High (R&D, scaling) | Potential Star if successful |

| AI in Manufacturing | High (Market $3.6B in 2023, $28.7B by 2030) | Low/Nascent | High (R&D, integration) | Potential Star if successful |

| Green Transformation (GX) | Growing (Focus on sustainability) | Early Stage | Moderate (Product development) | Future market differentiator |

| Digital Twin & Simulation | High (CAGR 15-20% through 2027) | Nascent | High (Software development) | Potential Star if successful |

| Collaborative Robotics (Cobots) | Very High (CAGR ~37%) | Developing | High (R&D, market penetration) | Potential Star if successful |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, customer feedback, and competitive analysis to deliver actionable strategic insights.