Diana Shipping Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diana Shipping Bundle

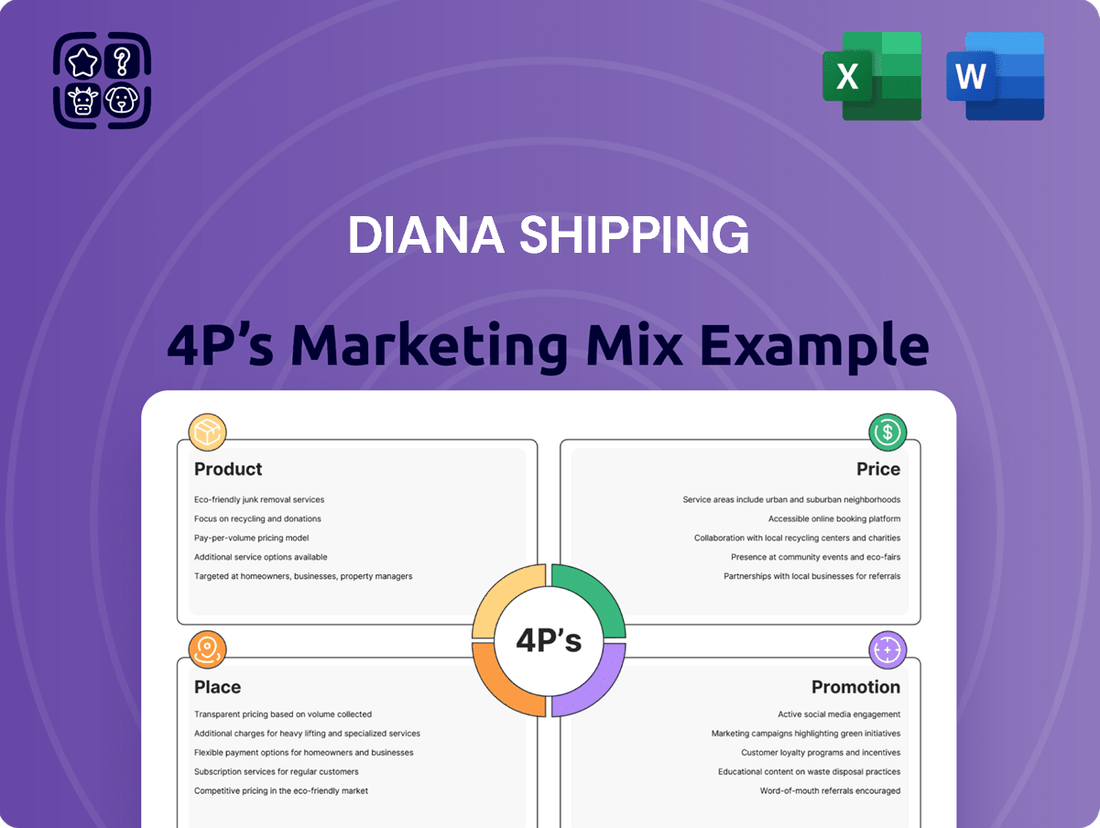

Diana Shipping's marketing mix is a fascinating study in how a global maritime leader navigates a complex industry. Our analysis delves into their product (fleet capabilities), pricing (freight rates), place (global routes), and promotion (investor relations and market presence). Discover the strategic levers they pull to maintain their competitive edge.

Ready to unlock a comprehensive understanding of Diana Shipping's marketing strategy? Go beyond this snapshot and gain access to an in-depth, ready-made Marketing Mix Analysis covering all 4Ps. Ideal for business professionals, students, and consultants seeking actionable insights.

Product

Diana Shipping Inc.'s core product is its fleet of dry bulk vessels, which are the essential assets for its business. The company focuses on owning and operating these specialized ships, designed for the global transport of key dry bulk commodities. This specialization directly addresses the market's need for efficient and reliable cargo movement.

As of July 28, 2025, Diana Shipping operates a substantial fleet of 37 dry bulk vessels. This diverse fleet includes various vessel types such as Newcastlemax, Capesize, Post-Panamax, Kamsarmax, Panamax, and Ultramax. The variety in vessel size and capacity allows Diana Shipping to cater to a broad spectrum of cargo requirements and trade routes, offering flexibility to its customers.

Diana Shipping's diverse cargo transportation capability is a cornerstone of its market offering. The company's fleet is adept at moving a wide spectrum of dry bulk commodities, including vital materials like iron ore, coal, and grain. This flexibility ensures they can serve a broad range of global industrial and agricultural sectors.

For instance, in the first quarter of 2024, Diana Shipping reported a net charter rate of $13,869 per day for its capesize vessels, highlighting their operational capacity. Their fleet's ability to handle various dry bulk cargoes directly supports global supply chains for essential resources.

Diana Shipping's core product offering revolves around its fleet of dry bulk vessels, primarily utilized for time charter services. This means clients secure the use of a ship for an extended period, say a year or more, paying a daily rate. This strategy provides Diana Shipping with a predictable income stream, a crucial element in the often-volatile shipping market.

For instance, as of the first quarter of 2024, Diana Shipping reported that 100% of its operating days were covered by time charters, highlighting the company's reliance on this service. This consistent utilization underscores the stability inherent in their product strategy, offering a clear value proposition to their charterers seeking reliable maritime transport.

Spot Market Voyages

Diana Shipping actively participates in spot market voyages, which are short-term charter agreements. This strategy allows them to quickly respond to immediate market demand and secure potentially higher freight rates. It’s a key component of their flexible revenue generation.

In 2024, the dry bulk shipping market experienced periods of volatility, with spot rates fluctuating based on global trade flows and vessel supply. For instance, the Baltic Dry Index, a benchmark for dry bulk shipping costs, saw significant movements throughout the year, reflecting these market dynamics. This environment provides opportunities for companies like Diana Shipping to leverage spot voyages.

The advantage of spot market voyages lies in their ability to capture favorable rate movements. When demand surges or supply tightens, spot rates can significantly outperform longer-term charter rates. This offers a dynamic revenue stream, complementing their time charter business.

- Flexibility: Spot voyages enable rapid deployment of vessels to capitalize on prevailing market conditions.

- Rate Potential: These shorter agreements can offer higher per-day rates during periods of strong demand.

- Market Responsiveness: Spot trading allows Diana Shipping to adapt quickly to shifts in the global dry bulk market.

- Revenue Diversification: It adds another layer to their income streams beyond fixed-term charters.

Fleet Modernization and Future-Proofing

Diana Shipping is strategically upgrading its fleet to meet future demands. This includes ordering two new Kamsarmax dry bulk vessels capable of running on methanol, with deliveries anticipated by early 2028. This proactive approach ensures their product offering remains competitive and environmentally sound.

These new vessels represent a significant investment in efficiency and sustainability, directly addressing growing client preferences for greener shipping solutions. By adopting dual-fuel technology, Diana Shipping is positioning itself ahead of stricter environmental regulations and enhancing its appeal in the global market.

- Fleet Expansion: Two new Kamsarmax dry bulk vessels ordered.

- Fuel Technology: Vessels will be methanol dual-fuel capable.

- Delivery Timeline: Expected deliveries in early 2028.

- Market Alignment: Focus on efficiency and environmental compliance.

Diana Shipping's product is its fleet of dry bulk vessels, offering global transportation for commodities like iron ore and grain. The company's strategy centers on time charters, ensuring predictable revenue, with 100% of operating days covered by such agreements in Q1 2024. They also engage in spot market voyages to capitalize on rate fluctuations, demonstrating adaptability in a dynamic market.

| Fleet Size (as of July 28, 2025) | Vessel Types | Key Commodities Transported | Q1 2024 Capesize Net Charter Rate | Fleet Utilization Strategy |

|---|---|---|---|---|

| 37 dry bulk vessels | Newcastlemax, Capesize, Post-Panamax, Kamsarmax, Panamax, Ultramax | Iron ore, coal, grain | $13,869 per day | 100% time charter coverage (Q1 2024) |

What is included in the product

This analysis offers a comprehensive examination of Diana Shipping's marketing mix, detailing their product offerings (fleet type and size), pricing strategies (time charter rates), distribution channels (brokerage networks), and promotional activities (investor relations and industry presence).

Simplifies Diana Shipping's marketing strategy by clearly outlining the 4Ps, making it easy to identify and address potential market challenges.

Provides a clear, actionable framework for understanding and optimizing Diana Shipping's product, price, place, and promotion efforts.

Place

Diana Shipping's global maritime reach is a cornerstone of its marketing strategy, enabling it to serve a diverse international clientele. The company's fleet navigates major trade routes, facilitating the movement of dry bulk commodities across continents.

This extensive operational footprint allows Diana Shipping to connect key production centers with consumption hubs, a critical factor in the global supply chain. For instance, in 2024, the company's vessels were instrumental in transporting goods across the Atlantic, Pacific, and Indian Oceans, supporting global trade flows.

Diana Shipping solidifies its market presence by forging strategic alliances with key global players like Cargill Ocean Transportation and Bunge SA. These are not just casual connections; they are often cemented through long-term time charter agreements.

These time charter contracts are crucial, acting as a bedrock for consistent demand and ensuring high utilization rates for Diana Shipping's fleet. For instance, in the first quarter of 2024, the company reported an average fleet utilization of 95.4%, a testament to the strength of these partnerships.

Such collaborations provide a predictable revenue stream, shielding the company from the volatility of the spot market. This strategic placement in the market, anchored by these major client relationships, is a cornerstone of Diana Shipping's operational stability and financial planning.

Diana Shipping's direct sales and chartering teams are instrumental in securing business. These internal teams directly negotiate time charter contracts and spot market voyages, fostering strong client relationships and allowing for customized agreements. This direct engagement is crucial for optimizing fleet utilization and revenue generation in the dynamic shipping market.

Operating from Athens, Greece

Diana Shipping Inc. strategically anchors its global operations from Athens, Greece. This location serves as a vital nerve center for managing its extensive fleet and coordinating international activities. Being situated in a major maritime hub like Athens provides significant advantages in terms of industry access and operational efficiency.

The company's Greek base facilitates seamless communication and oversight across its diverse fleet, which primarily consists of dry bulk vessels. As of early 2024, Diana Shipping managed a fleet of 38 vessels, with an average age of approximately 10.5 years. This strategic positioning in Athens allows for effective navigation of the complexities inherent in global shipping logistics and market dynamics.

- Fleet Size: 38 dry bulk vessels as of early 2024.

- Average Vessel Age: Approximately 10.5 years.

- Operational Hub: Athens, Greece, facilitating global fleet management.

- Strategic Advantage: Proximity to a major shipping center enhances operational oversight.

Vessel Deployment and Route Optimization

Diana Shipping's 'place' strategy hinges on smart vessel deployment and route optimization for its dry bulk fleet. This means making sure the right ships are in the right places at the right times to pick up and deliver cargo efficiently. For instance, in the first quarter of 2024, the company had an average of 36.6 vessels in operation, demonstrating their commitment to maintaining a robust and active fleet.

Effective route planning minimizes transit times and fuel consumption, directly impacting profitability. By leveraging advanced logistics and market intelligence, Diana Shipping aims to optimize fleet utilization. This focus on operational efficiency is crucial in the volatile dry bulk market, where timely deliveries are paramount for customer satisfaction and securing future contracts.

- Fleet Size: Diana Shipping operated an average of 36.6 vessels during Q1 2024.

- Operational Efficiency: Focus on minimizing transit times and fuel costs through optimized routes.

- Market Responsiveness: Strategic deployment to capitalize on cargo opportunities and market demand.

- Fleet Utilization: Maximizing the use of each vessel to enhance revenue generation.

Diana Shipping's strategic placement is defined by its global operational network and its central management hub in Athens, Greece. This Greek base is critical for overseeing its fleet and engaging with international markets. The company's fleet, numbering 38 dry bulk vessels as of early 2024, is strategically deployed across major global trade routes to serve its diverse clientele effectively.

| Metric | Value (as of early 2024/Q1 2024) | Significance |

| Operational Hub | Athens, Greece | Centralized management and market access |

| Fleet Size | 38 dry bulk vessels | Global reach and cargo capacity |

| Average Vessels in Operation (Q1 2024) | 36.6 | High fleet utilization and operational readiness |

| Key Partnerships | Cargill Ocean Transportation, Bunge SA | Secures consistent demand and revenue stability |

Same Document Delivered

Diana Shipping 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Diana Shipping's 4P's Marketing Mix is fully prepared for your immediate use. You can be confident that the content you see is the complete and final version you'll download.

Promotion

Diana Shipping Inc. prioritizes clear investor relations through consistent financial reporting, including their 2024 Annual Report on Form 20-F, earnings call transcripts, and investor presentations. This approach ensures stakeholders are kept up-to-date on the company's financial standing and strategic plans.

For instance, their Q1 2024 results reported net income of $11.9 million, demonstrating operational progress. This transparency builds trust and facilitates informed decision-making for investors.

Diana Shipping leverages its official website as a central hub for promotion, offering detailed insights into its fleet, services, and financial health, including key performance indicators that stakeholders can easily access.

The company ensures broad accessibility by featuring press releases, corporate presentations, and webcast replays on its website, facilitating informed decision-making for investors and analysts alike.

For instance, the company's commitment to transparency is evident in its readily available financial reports, such as the Q4 2024 results, which highlight fleet utilization and revenue figures, providing crucial data for market analysis.

Diana Shipping actively uses press releases to communicate crucial business updates, including securing new time charter contracts and reporting financial performance. For instance, in early 2024, the company announced securing new charters for several of its vessels, contributing to its revenue streams.

These announcements are strategically disseminated through major financial news channels and directly via the company's investor relations website. This multi-channel approach ensures broad market visibility and keeps stakeholders, such as investors and analysts, well-informed about the company's operational progress and strategic moves.

For example, the company's first quarter 2024 earnings report, released in May 2024, detailed a net income of $15.2 million, showcasing the impact of their chartering activities and providing transparency to the market.

Industry Conferences and Investor Days

Diana Shipping actively participates in key industry conferences and hosts dedicated investor days, such as their recent Investor Day in New York. These forums are crucial for direct engagement with financial professionals, analysts, and potential investors. For instance, during their 2024 Investor Day, the company highlighted its fleet modernization strategy and its outlook for the dry bulk market, aiming to foster transparency and confidence.

These events serve as a platform to articulate Diana Shipping's strategic direction, address market concerns, and cultivate vital relationships within the financial ecosystem. By providing detailed operational updates and financial projections, the company seeks to enhance its visibility and attract investment. As of mid-2024, the dry bulk shipping market has shown signs of recovery, with freight rates for capesize vessels, a key segment for Diana Shipping, experiencing fluctuations but generally trending upwards compared to the previous year.

The company's engagement strategy includes:

- Presenting financial performance and strategic initiatives to a targeted audience of financial stakeholders.

- Facilitating Q&A sessions to address investor queries and provide clarity on business operations and market outlook.

- Building and strengthening relationships with key members of the investment community, including analysts and portfolio managers.

- Showcasing fleet capabilities and growth plans to demonstrate the company's competitive positioning in the global dry bulk market.

ESG Reporting and Sustainability Initiatives

Diana Shipping actively communicates its dedication to Environmental, Social, and Governance (ESG) principles through its comprehensive ESG reports and ongoing sustainability programs. This proactive approach aims to resonate with investors and clients who prioritize responsible corporate citizenship and sustainable practices within the maritime industry.

The company's strategy includes showcasing fleet upgrades, such as the introduction of methanol dual-fuel vessels, which directly addresses environmental concerns and demonstrates a commitment to reducing its carbon footprint. For instance, as of early 2024, Diana Shipping has continued its fleet modernization efforts, with investments in greener technologies reflecting a tangible step towards sustainability goals.

- Fleet Modernization: Investments in eco-friendly vessel technologies, including dual-fuel capabilities, to reduce emissions.

- ESG Reporting: Regular publication of detailed ESG reports outlining environmental performance, social impact, and governance structures.

- Investor Appeal: Targeting investors who prioritize sustainability and responsible investment criteria.

- Client Engagement: Attracting clients who value environmental stewardship and seek partners committed to sustainable shipping solutions.

Diana Shipping enhances its promotional efforts through consistent financial reporting and investor communications, including earnings calls and presentations. For example, their Q1 2024 results showed a net income of $15.2 million, demonstrating operational clarity.

The company utilizes its website as a primary promotional tool, offering detailed fleet information and financial health indicators, with press releases announcing new charters, such as those secured in early 2024, reinforcing revenue streams.

Participation in industry conferences and investor days, like the 2024 Investor Day, allows for direct engagement with financial professionals, fostering transparency on fleet modernization and market outlook.

Furthermore, Diana Shipping highlights its commitment to ESG principles through detailed reports and investments in eco-friendly technologies, such as dual-fuel vessels, attracting sustainability-focused investors and clients.

Price

Diana Shipping's pricing strategy revolves around time charter rates, essentially daily fees for leasing their dry bulk vessels for specific durations. These rates fluctuate based on factors like vessel size, prevailing market demand, the length of the charter agreement, and the cargo being transported.

For instance, in the first quarter of 2024, Diana Shipping reported average time charter rates for its Newcastlemax vessels at approximately $17,852 per day, a significant increase from $10,993 per day in the same period of 2023, reflecting a stronger dry bulk market.

Diana Shipping strategically focuses on medium to long-term time charters. This approach is key to providing predictable revenue streams and buffering against the inherent ups and downs of the shipping market. It’s a way to build a more stable financial foundation.

As of July 22, 2025, the company had already secured substantial contracted revenues. Specifically, $66.1 million was locked in for 69% of their remaining ownership days in 2025. This demonstrates a strong commitment to forward planning and revenue certainty.

Further bolstering this strategy, Diana Shipping had also secured $50 million for 20% of their ownership days in 2026. These forward contracts are crucial for managing financial risk and ensuring operational continuity, even when market conditions fluctuate.

Diana Shipping strategically employs the spot market to capitalize on immediate freight rate opportunities, even while prioritizing long-term charter agreements. This approach allows them to benefit from market upturns, supplementing the predictable revenue from their longer contracts.

For instance, in the first quarter of 2024, the Baltic Dry Index, a key benchmark for dry bulk shipping rates, saw fluctuations. While specific spot rates vary by vessel class and route, periods of high demand, such as those driven by increased commodity shipments, can lead to significantly higher per-day earnings compared to contracted rates.

This spot market activity provides flexibility, enabling Diana Shipping to optimize its fleet deployment and capture transient market strength. For example, a Capesize vessel might secure a spot rate of $20,000 per day during a peak demand period in late 2024, a substantial increase from a hypothetical long-term contract rate of $15,000 per day.

Competitive Market Positioning

Diana Shipping's pricing strategy is deeply intertwined with the volatile dry bulk shipping market, where competitor rates and global economic health are paramount. The company actively monitors these external factors to ensure its charter rates remain competitive. For instance, in the first quarter of 2024, the Baltic Dry Index (BDI) experienced fluctuations, averaging around 1,300 points, a figure that influences the pricing power of all carriers, including Diana Shipping.

The company's objective is to strike a balance between offering attractive rates to clients and safeguarding its profitability. This involves optimizing fleet utilization, a key metric in the shipping industry. High utilization rates, often exceeding 85% for well-managed fleets, directly contribute to revenue generation and the ability to absorb operational costs.

Diana Shipping's approach to pricing is designed to achieve several key goals:

- Market Competitiveness: Setting charter rates that align with or are slightly below prevailing market averages for similar vessel classes.

- Profitability Assurance: Ensuring that all contracted rates cover operational expenses, vessel depreciation, and provide a margin for reinvestment and shareholder returns.

- Fleet Utilization Maximization: Securing employment for its vessels as consistently as possible to minimize idle time and maximize revenue-generating days.

- Adaptability to Market Conditions: Adjusting pricing strategies in response to shifts in demand, supply of vessels, and macroeconomic trends impacting global trade.

Cost Management and Operational Efficiency

Effective cost management is a cornerstone of Diana Shipping's strategy, directly impacting its pricing power and profitability. By diligently controlling operational expenditures, the company enhances its ability to offer competitive charter rates in the dynamic shipping market. This focus on efficiency translates into improved financial performance and a stronger bottom line.

Diana Shipping's commitment to operational efficiency is demonstrated through concrete cost reductions. For instance, a projected 6% decrease in daily operating expenses in Q2 2025 compared to Q2 2024 highlights their proactive approach. This financial discipline allows them to maintain healthy profit margins even when adjusting prices to meet market demands.

- Cost Reduction: A targeted 6% reduction in daily operating expenses is planned for Q2 2025 versus Q2 2024.

- Pricing Flexibility: Lower operating costs provide greater latitude in setting competitive charter rates.

- Profitability Enhancement: Improved efficiency directly boosts net income and overall financial health.

Diana Shipping's pricing strategy is fundamentally tied to daily time charter rates, reflecting the rental cost of their dry bulk vessels. These rates are dynamic, influenced by vessel size, market demand, charter duration, and cargo type.

The company aims for a balance between market competitiveness and profitability, ensuring rates cover costs and generate margins. This is supported by a strong focus on fleet utilization, with a goal to keep vessels consistently employed to maximize revenue-generating days.

For example, in Q1 2024, Newcastlemax vessels averaged daily rates of $17,852, up from $10,993 in Q1 2023, showcasing market responsiveness. Furthermore, as of July 22, 2025, $66.1 million in contracted revenue was secured for 69% of remaining 2025 ownership days, highlighting a commitment to revenue certainty.

Diana Shipping also strategically utilizes the spot market to capture higher earnings during periods of peak demand, supplementing their long-term charter agreements. This dual approach allows for both predictable income and opportunistic gains.

| Vessel Type | Q1 2024 Avg. Daily Rate | Q1 2023 Avg. Daily Rate | Contracted Revenue (as of July 22, 2025) | Fleet Utilization Goal |

|---|---|---|---|---|

| Newcastlemax | $17,852 | $10,993 | N/A | >85% |

| Other Dry Bulk | Varies | Varies | $66.1M (for 69% of 2025 days) | N/A |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Diana Shipping is grounded in official filings with the SEC, including annual reports and current reports, which detail fleet operations, charter rates, and financial performance. We also incorporate industry publications and maritime news sources to understand market dynamics and competitive positioning.