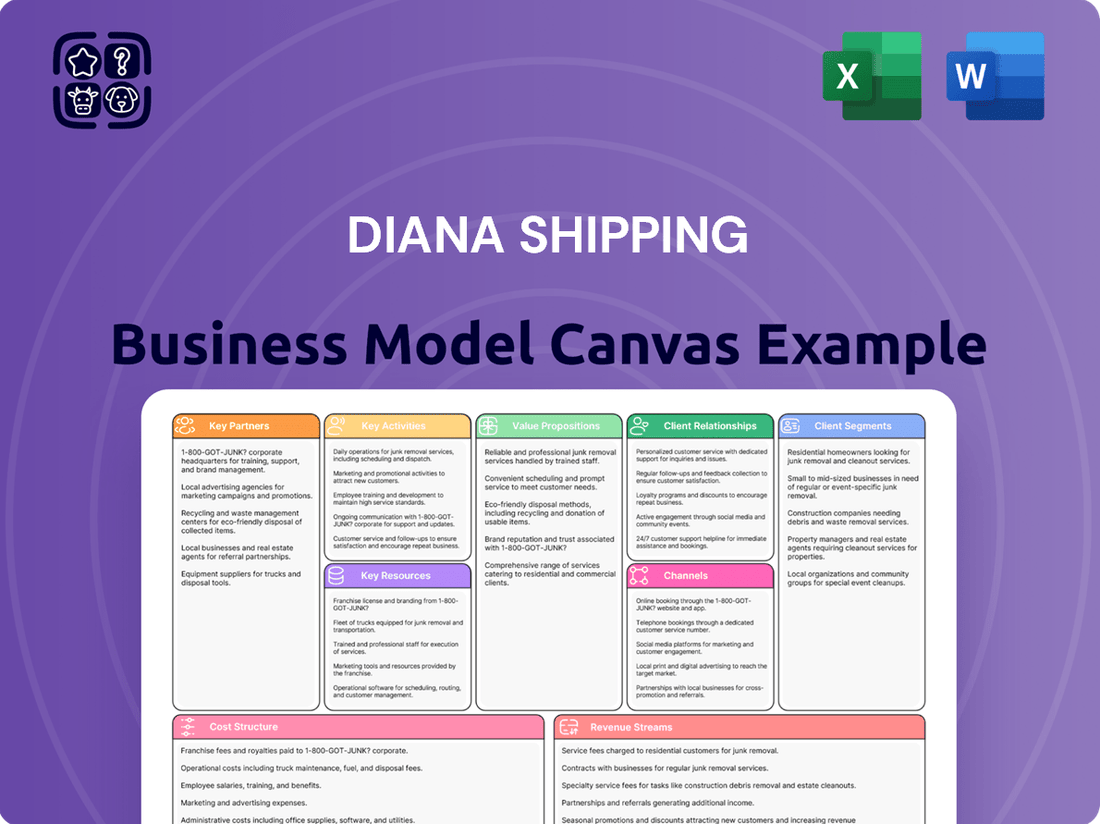

Diana Shipping Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diana Shipping Bundle

Unlock the full strategic blueprint behind Diana Shipping's business model. This in-depth Business Model Canvas reveals how the company drives value through its dry bulk carrier fleet, captures market share by focusing on key shipping routes, and stays ahead in a competitive landscape by optimizing operational efficiency and managing charter agreements. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into the maritime industry.

Partnerships

Diana Shipping's key partnerships with shipyards and shipbuilders are fundamental to its operational strategy. These collaborations are vital for both the acquisition of new vessels and the execution of significant structural repairs or upgrades. For instance, in 2024, Diana Shipping continued to manage its fleet, which includes a range of dry bulk vessels, relying on these partnerships to maintain its fleet's condition and expand its capacity.

Engaging with reputable shipyards ensures that the fleet's quality, safety standards, and delivery timelines are met, directly impacting operational efficiency and the ability to satisfy market demand. These strategic alliances often necessitate long-term commitments and substantial capital investments, reflecting the significant nature of vessel acquisition and maintenance in the maritime industry.

Diana Shipping collaborates with leading classification societies such as Lloyd's Register, DNV, and ABS. These partnerships are essential for verifying that their fleet meets stringent international safety and environmental regulations, a requirement for all maritime operations.

These societies perform critical surveys and issue certifications, which are non-negotiable for a vessel's operational status and insurability. For instance, in 2024, maintaining these certifications is paramount as the International Maritime Organization (IMO) continues to enforce stricter environmental targets, impacting vessel design and operation.

Strong relationships with these classification bodies facilitate smoother operations and ensure Diana Shipping's vessels remain compliant with evolving global maritime laws. This adherence is fundamental to the company's ability to secure insurance and engage in international trade, directly impacting its revenue streams and operational efficiency.

Diana Shipping depends on a robust network of marine equipment and service suppliers for essential vessel components, spare parts, and vital maintenance services. These partnerships are crucial for maintaining operational efficiency and ensuring vessels are always ready for charter.

Reliable supplier relationships are key to minimizing downtime and optimizing performance, directly impacting revenue generation. For instance, in 2024, the dry bulk shipping market saw fluctuating fuel prices, making strategic bunker sourcing particularly important for cost management.

Financial Institutions and Lenders

Diana Shipping's reliance on financial institutions and lenders is critical due to the inherently capital-intensive nature of owning and operating a fleet of dry bulk vessels. These partnerships are essential for securing the substantial funding required for new vessel acquisitions, refinancing existing debt, and ensuring adequate working capital to manage day-to-day operations. For instance, in 2023, Diana Shipping reported total debt of $283.5 million, highlighting the significant role of lenders in its capital structure.

These relationships provide the necessary financial flexibility to adapt to the cyclical shipping market, allowing for fleet modernization and expansion when opportunities arise. Access to competitive financing terms from these institutions directly impacts the company's profitability and its ability to maintain a healthy balance sheet. The company actively manages its debt facilities, often securing credit lines from various international banks to support its strategic objectives.

- Financing Vessel Acquisitions: Partnerships with banks are crucial for funding the purchase of new or secondhand vessels, which represent the largest capital expenditures for the company.

- Debt Management and Refinancing: Lenders provide facilities for managing existing debt and refinancing it on more favorable terms, optimizing the company's cost of capital.

- Working Capital: Credit lines from financial institutions ensure liquidity for operational expenses, dry-docking, and other immediate needs, particularly during periods of market volatility.

- Fleet Modernization: Access to capital allows Diana Shipping to invest in newer, more fuel-efficient vessels, enhancing operational performance and environmental compliance.

Port Authorities and Terminal Operators

Diana Shipping's operational efficiency hinges on robust relationships with port authorities and terminal operators globally. These entities are crucial for streamlining cargo handling, which directly impacts vessel turnaround times. For instance, in 2024, efficient port calls are paramount for bulk carriers like those in Diana Shipping's fleet, minimizing idle time at sea and at berth.

Effective coordination ensures optimized vessel routing and adherence to diverse local port regulations, preventing costly delays. Smooth interactions at these critical nodes are fundamental for the timely delivery of commodities, a core aspect of Diana Shipping's service offering.

These partnerships are vital for:

- Facilitating efficient cargo loading and unloading processes.

- Optimizing vessel turnaround times and reducing port congestion.

- Ensuring compliance with international and local port regulations.

Diana Shipping's key partnerships extend to charterers, who are the direct customers for its fleet of dry bulk vessels. These relationships are essential for securing employment for the company's ships and generating revenue. In 2024, the company continued to engage with a diverse range of charterers across various industries, from grain traders to industrial commodity producers, ensuring consistent utilization of its fleet.

These chartering agreements, whether for time charters or voyage charters, are the lifeblood of Diana Shipping's business model, directly translating fleet capacity into income. The ability to secure favorable charter rates is heavily influenced by market conditions and the strength of these customer relationships.

Diana Shipping's strategic alliances with charterers are crucial for:

- Securing vessel employment and revenue streams.

- Gaining market intelligence on demand for dry bulk shipping services.

- Building long-term relationships for stable business.

What is included in the product

Diana Shipping's business model focuses on providing dry bulk shipping services, leveraging a fleet of vessels to transport commodities globally.

This model emphasizes efficient vessel operations, strategic chartering, and cost management to generate revenue from freight rates and time charters.

Diana Shipping's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex shipping logistics and charter agreements.

This visual tool effectively addresses the pain point of understanding a global shipping company's intricate revenue streams and cost structures.

Activities

Diana Shipping's key activity of vessel acquisition and management is central to its operations. This involves a rigorous process of identifying, purchasing, and integrating both new and second-hand dry bulk vessels into its expansive fleet. For instance, in 2024, the company continued to manage its fleet strategically, focusing on optimizing the performance and value of its existing assets.

Beyond just acquiring vessels, the strategic management of the existing fleet is paramount. This includes making crucial decisions regarding necessary upgrades to maintain compliance and efficiency, as well as strategically disposing of older or less profitable vessels. Effective fleet management ensures optimal utilization, a critical factor in maintaining Diana Shipping's competitive edge in the volatile dry bulk market.

Diana Shipping's core activity involves securing time charters and spot market voyages for its dry bulk fleet. This means actively engaging with clients to transport commodities like iron ore, coal, and grain.

The company focuses on negotiating favorable charter rates and terms, ensuring the commercial deployment of its vessels maximizes revenue. For instance, in the first quarter of 2024, Diana Shipping reported an average time charter rate of $15,298 per day for its fleet, a significant increase from the previous year, reflecting strong market demand.

Efficient chartering is crucial for maintaining high fleet utilization. In Q1 2024, the company achieved an average fleet utilization rate of 99.3%, demonstrating their effectiveness in keeping their ships consistently employed.

Diana Shipping's key activity of vessel maintenance and repairs is vital for operational efficiency and asset longevity. This involves regular, preventative upkeep like scheduled dry-dockings and routine inspections, alongside addressing unforeseen technical issues. For instance, in 2023, the company completed dry-docking for several vessels, ensuring compliance with regulations and maintaining peak performance.

Proactive maintenance directly translates to minimized downtime, which is critical in the shipping industry. By investing in timely repairs and upkeep, Diana Shipping safeguards its fleet against major breakdowns, thereby extending the useful life of its substantial assets and ensuring consistent revenue generation.

Crew Management and Training

Diana Shipping's commitment to crew management and training is central to its operational success. This involves the rigorous recruitment, ongoing training, and effective management of qualified maritime professionals. Ensuring that all personnel are certified and adhere to international maritime regulations is paramount for the safe and efficient operation of their fleet.

The company focuses on fostering a positive crew welfare environment and investing in continuous professional development. This dedication to its seafarers directly translates into higher service quality and operational reliability. For instance, in 2024, Diana Shipping continued its focus on maintaining a high standard of crew competency, a critical factor in avoiding operational disruptions and ensuring timely cargo delivery.

- Recruitment and Retention: Attracting and keeping skilled seafarers is a core activity, supported by competitive compensation and a commitment to professional growth.

- Training and Development: Providing regular training on safety protocols, vessel operations, and new technologies ensures the crew remains at the forefront of industry standards.

- Regulatory Compliance: Strict adherence to international maritime labor conventions and safety management systems is managed through diligent crew administration.

- Crew Welfare: Initiatives aimed at improving living conditions and well-being onboard contribute to crew morale and operational efficiency.

Regulatory Compliance and Safety Management

Diana Shipping's key activities include rigorous adherence to international maritime regulations, safety standards, and environmental protocols. This is a non-negotiable aspect of their operations, ensuring they meet the requirements set by bodies like the International Maritime Organization (IMO).

To achieve this, the company implements comprehensive safety management systems, conducts frequent internal and external audits, and actively monitors changes in global maritime legislation. For instance, in 2024, the industry continues to focus on decarbonization efforts, requiring ongoing adaptation of operational procedures and vessel technologies to meet evolving environmental standards.

- Regulatory Adherence: Maintaining compliance with IMO, MARPOL, and SOLAS conventions is paramount.

- Safety Systems: Implementing and regularly reviewing the Safety Management System (SMS) as per the ISM Code.

- Environmental Protocols: Ensuring all vessels meet stringent environmental protection standards, including those related to emissions and waste management.

- Audit and Training: Conducting regular safety audits and providing continuous training for crew to uphold high operational standards.

Diana Shipping's key activities are centered around managing a fleet of dry bulk vessels. This includes acquiring new and second-hand ships, as well as strategically selling older ones to optimize fleet composition. The company also focuses on the crucial tasks of vessel maintenance and repair to ensure operational efficiency and longevity.

Securing profitable employment for its vessels through time charters and spot market voyages is another core activity. This involves actively negotiating charter rates and terms to maximize revenue. For example, in the first quarter of 2024, Diana Shipping reported an average time charter rate of $15,298 per day, reflecting strong market demand.

Effective crew management and training are also vital. This encompasses recruiting qualified seafarers, providing ongoing training in safety and operations, and ensuring crew welfare. High crew competency, a continued focus in 2024, is essential for operational reliability and avoiding disruptions.

Furthermore, Diana Shipping prioritizes strict adherence to international maritime regulations, safety standards, and environmental protocols. This involves implementing robust safety management systems and adapting to evolving environmental standards, such as decarbonization efforts in the industry.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Fleet Acquisition & Management | Identifying, purchasing, integrating, and managing dry bulk vessels. | Strategic management of existing assets; optimizing performance and value. |

| Vessel Employment | Securing time charters and spot market voyages for the fleet. | Negotiating favorable charter rates and terms; Q1 2024 average time charter rate: $15,298/day. |

| Fleet Utilization | Ensuring high operational uptime for vessels. | Q1 2024 fleet utilization rate: 99.3%. |

| Vessel Maintenance & Repairs | Regular upkeep, preventative maintenance, and addressing technical issues. | Focus on scheduled dry-dockings and maintaining peak performance (e.g., completed in 2023). |

| Crew Management & Training | Recruitment, training, and welfare of maritime professionals. | Maintaining high crew competency for operational reliability. |

| Regulatory & Safety Compliance | Adhering to international maritime regulations and safety standards. | Ongoing adaptation to environmental standards (e.g., decarbonization efforts). |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing for Diana Shipping is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the complete, ready-to-use analysis. Upon completing your order, you will gain full access to this identical file, allowing you to immediately leverage its insights for your strategic planning.

Resources

Diana Shipping's most crucial key resource is its substantial and varied fleet of dry bulk vessels. This fleet comprises Capesize, Panamax, and Kamsarmax types, representing the company's core operational capability for global commodity transport.

As of the first quarter of 2024, Diana Shipping operated a fleet of 39 vessels, a significant physical asset base. The age profile of these vessels, with an average age of around 10.3 years, directly influences their efficiency, fuel consumption, and ultimately, the company's cost structure and market competitiveness.

The diversity in vessel types allows Diana Shipping to cater to a broad range of cargo sizes and shipping routes, optimizing its service offering. This fleet is the primary engine generating revenue through time charters and spot market voyages, making its size, condition, and deployment strategy paramount to the business model.

Diana Shipping's maritime expertise and personnel are a cornerstone of its business model. This includes the deep collective knowledge and experience of its teams in vessel operations, chartering, technical management, and navigating complex maritime law. This human capital, comprising highly qualified seafarers, skilled onshore technical staff, and experienced commercial professionals, is critical for ensuring the company's operations are efficient, safe, and fully compliant with all regulations.

The company's commitment to its personnel directly translates into service reliability for its customers. For instance, in 2023, Diana Shipping maintained a strong operational record, with its fleet of 39 vessels, underscoring the effectiveness of its experienced crews and management in keeping vessels active and generating revenue. This skilled workforce is essential for minimizing downtime and maximizing the utilization of its dry bulk carrier fleet.

Diana Shipping relies on substantial financial capital, encompassing equity, debt, and cash reserves, to acquire vessels, manage daily operations, and service its debt. For instance, in the first quarter of 2024, the company reported total cash and cash equivalents of $108.8 million, demonstrating a solid liquidity position.

Access to capital markets and robust relationships with financial institutions are paramount for Diana Shipping's growth strategy, enabling fleet expansion and modernization. In 2023, the company secured a new credit facility of $175 million, highlighting its ability to leverage external financing for strategic initiatives.

This financial bedrock is crucial for maintaining stability and pursuing opportunities in the capital-intensive shipping industry, directly supporting all other operational and strategic activities.

Global Network and Relationships

Diana Shipping's global network and relationships are a cornerstone of its operations, acting as a crucial intangible asset. These established connections with commodity traders, industrial producers, and brokers worldwide streamline chartering processes and enhance market intelligence. For instance, in 2024, the company's ability to leverage these relationships was evident in securing favorable terms for its fleet, contributing to operational efficiencies.

These vital networks are not just about day-to-day transactions; they foster trust and a strong reputation within the shipping industry. This credibility is essential for negotiating and securing long-term charter agreements, which provide predictable revenue streams. Repeat business, a direct result of these trusted relationships, further solidifies Diana Shipping's market position.

The value of these connections is amplified by the flow of critical market information. This intelligence helps Diana Shipping make more informed decisions regarding fleet deployment and optimal routes, directly impacting profitability.

- Established relationships with key industry players facilitate access to chartering opportunities.

- These networks provide valuable market intelligence, improving operational decision-making.

- A strong reputation built on trust encourages repeat business and long-term contracts.

- Global reach through these relationships ensures operational flexibility and efficiency.

Information Systems and Technology

Diana Shipping leverages a robust IT infrastructure, including enterprise resource planning (ERP) systems, to streamline its operations. This technology is crucial for efficient fleet management and data analysis. In 2023, the company continued to invest in these systems to enhance operational decision-making.

Vessel performance monitoring software plays a key role in optimizing fleet efficiency. These systems help monitor fuel consumption, a significant cost factor in shipping. Effective communication systems ensure seamless connectivity between vessels and shore-based operations, vital for timely responses and coordination.

- ERP Systems: Facilitate integrated management of core business processes.

- Vessel Performance Monitoring: Aids in optimizing fuel efficiency and maintenance schedules.

- Communication Systems: Ensure reliable connectivity for operational coordination.

- Data Analysis: Supports informed decision-making across fleet operations.

Diana Shipping's key resources extend beyond its physical fleet to include its skilled workforce and established global network. The company's maritime expertise, encompassing vessel operations, chartering, and technical management, is critical for efficient and compliant operations. This human capital is directly reflected in the company's operational record, with its fleet of 39 vessels consistently generating revenue. Furthermore, its global relationships with traders and producers streamline chartering and provide essential market intelligence, fostering trust and securing long-term contracts.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Fleet of Dry Bulk Vessels | 39 vessels (Capesize, Panamax, Kamsarmax) with an average age of 10.3 years as of Q1 2024. | Core revenue-generating asset, enabling global commodity transport. |

| Maritime Expertise & Personnel | Experienced seafarers, technical staff, and commercial professionals. | Ensures efficient, safe, and compliant operations, minimizing downtime. |

| Financial Capital | Equity, debt, and cash reserves; $108.8 million in cash and cash equivalents as of Q1 2024. | Supports vessel acquisition, operations, and strategic growth initiatives. |

| Global Network & Relationships | Connections with commodity traders, industrial producers, and brokers. | Facilitates chartering, provides market intelligence, and builds reputation. |

| IT Infrastructure | ERP systems, vessel performance monitoring, and communication systems. | Enhances fleet management, operational efficiency, and decision-making. |

Value Propositions

Diana Shipping provides dependable and secure transport for dry bulk goods, significantly reducing the chances of delays or damage to cargo. Their adherence to stringent safety protocols and the upkeep of their fleet ensure clients can trust their valuable shipments are handled with care.

This unwavering reliability is crucial for global supply chains, guaranteeing that industrial operations receive their necessary materials on schedule. For instance, in 2024, Diana Shipping maintained a strong operational record, contributing to the smooth flow of essential commodities like iron ore and coal, which are vital for manufacturing and energy sectors worldwide.

Diana Shipping's global reach, facilitated by its diversified fleet of dry bulk vessels, enables seamless operations across international waters and key trade routes. This expansive network provides clients with the crucial flexibility to transport commodities to virtually any destination worldwide, aligning with their dynamic supply chain requirements.

For instance, in the first quarter of 2024, Diana Shipping reported an average fleet utilization rate of 99.5%, underscoring its operational efficiency and consistent global service delivery. This high utilization rate directly translates into reliable shipping solutions for customers, regardless of their cargo's origin or destination.

The company's adaptability to evolving market demands and route shifts is a core value proposition. This agility allows clients to optimize their logistics and respond effectively to global economic fluctuations, ensuring their goods reach their intended markets efficiently.

Diana Shipping provides a cost-effective solution for transporting large volumes of dry bulk commodities, a crucial service for global trade. By leveraging their fleet's economies of scale, they significantly reduce per-unit shipping costs for clients. This makes them an attractive partner for major commodity traders and industrial consumers who rely on efficient, large-scale logistics.

Experienced Fleet Management

Diana Shipping leverages its deep experience in fleet management to provide clients with exceptional service. This translates into professional technical oversight and the deployment of skilled crews, all operating under rigorous standards. For cargo owners, this means a higher level of confidence in vessel performance and a reduction in potential operational disruptions.

Clients benefit directly from Diana Shipping's seasoned approach to managing its contemporary dry bulk fleet. This includes meticulous technical management, ensuring vessels are maintained to the highest standards, and employing well-trained seafarers. The company's commitment to strict operational protocols is a cornerstone of its value proposition, aiming for peak efficiency and safety.

- Optimized Vessel Performance: Experienced management ensures vessels operate at peak efficiency, reducing transit times and fuel consumption.

- Minimized Operational Risks: Strict adherence to safety and maintenance standards significantly lowers the likelihood of costly delays or incidents.

- Expert Crewing: Highly trained and professional crews are essential for safe and efficient vessel operation.

- Modern Fleet: Managing a modern fleet equipped with up-to-date technology contributes to reliability and performance.

Long-Term Chartering Options

Diana Shipping offers long-term time charter agreements, providing clients with a stable and predictable way to manage their shipping requirements and expenses. This strategy allows customers to lock in vessel capacity for extended durations, shielding them from the unpredictable fluctuations of the spot market.

These long-term contracts are instrumental in cultivating robust client relationships and ensuring a consistent revenue stream for Diana Shipping. For instance, in 2024, the company continued to secure multi-year charters for its fleet, demonstrating the ongoing demand for this service.

- Stability for Clients: Secures vessel capacity, mitigating exposure to volatile spot market rates.

- Predictable Costs: Offers clients a clear understanding of their shipping expenses over extended periods.

- Revenue Stability: Provides Diana Shipping with a reliable and predictable income stream.

- Client Relationships: Fosters stronger partnerships through long-term commitments.

Diana Shipping's value proposition centers on providing reliable, safe, and cost-effective transportation of dry bulk commodities globally. Their modern fleet, coupled with expert management and a commitment to operational excellence, ensures clients receive their goods efficiently and without disruption. This reliability is critical for maintaining stable supply chains, as demonstrated by their consistently high fleet utilization rates.

The company offers flexible and predictable shipping solutions through long-term time charter agreements, allowing clients to manage costs and secure capacity. This approach fosters strong client relationships and provides a stable revenue stream for Diana Shipping, reinforcing its position as a trusted partner in the global dry bulk market.

| Value Proposition | Description | Key Benefit for Client | Supporting Data (2024) |

|---|---|---|---|

| Reliable and Safe Transport | Dependable delivery of dry bulk goods with stringent safety protocols. | Reduced risk of delays and cargo damage, ensuring supply chain continuity. | Average fleet utilization rate of 99.5% in Q1 2024. |

| Global Reach and Flexibility | Extensive network of vessels for transport across international waters. | Ability to ship commodities to virtually any destination worldwide. | Operates a diversified fleet of dry bulk vessels. |

| Cost-Effectiveness | Economies of scale in transporting large volumes of commodities. | Lower per-unit shipping costs for clients. | Focus on efficient fleet management to optimize operating expenses. |

| Experienced Fleet Management | Professional technical oversight and skilled crews. | Higher confidence in vessel performance and reduced operational disruptions. | Commitment to rigorous maintenance and operational standards. |

| Long-Term Charter Agreements | Stable and predictable shipping solutions for extended periods. | Mitigates exposure to volatile spot market rates and provides predictable costs. | Continued securing of multi-year charters throughout 2024. |

Customer Relationships

Diana Shipping prioritizes building robust connections with its major clients by assigning dedicated account managers. These professionals act as the main liaison, deeply understanding each client's unique requirements to guarantee smooth service and communication.

This personalized strategy is designed to cultivate trust and enduring client loyalty. For instance, in 2024, Diana Shipping reported that its top 10 clients accounted for approximately 65% of its total voyage revenues, highlighting the critical importance of these dedicated relationships.

Diana Shipping prioritizes continuous operational support and transparent communication. This includes providing clients with real-time updates on vessel movements, schedules, and any potential operational challenges. For instance, in the first quarter of 2024, the company reported a fleet of 39 vessels, ensuring consistent tracking and information flow for all charterers.

Regular updates on cargo status and vessel performance are key to keeping clients well-informed. This proactive approach, which was evident throughout 2023 and into 2024, helps to build trust and manage expectations effectively. Such transparency minimizes uncertainties, leading to a more positive and reliable customer experience.

Diana Shipping's business model is built on long-term contractual relationships, primarily through time charters. These agreements, often spanning several years, foster deep, enduring connections with their shipping clients.

Securing these long-term charters requires continuous dialogue and collaboration, involving performance tracking and joint problem-solving. This sustained interaction solidifies client loyalty and provides a predictable revenue stream.

For instance, in the first quarter of 2024, Diana Shipping reported an average fleet-wide charter rate of $15,400 per day, reflecting the stability and value derived from these extended contracts.

Problem Resolution and Responsiveness

Diana Shipping prioritizes rapid and effective problem resolution to foster strong customer relationships. Being highly responsive to client inquiries, concerns, and operational challenges is vital. For instance, in 2024, the company's commitment to addressing charter party disputes swiftly contributed to maintaining long-term agreements with key clients.

The ability to quickly and effectively resolve any issues, whether logistical or technical, demonstrates a deep commitment to client satisfaction. This proactive approach ensures smooth operations and minimizes disruptions for charterers, reinforcing Diana Shipping's reputation.

This responsiveness reinforces reliability and trust, crucial elements in the shipping industry where timely delivery and operational certainty are paramount. By consistently meeting and exceeding client expectations in problem-solving, Diana Shipping builds enduring partnerships.

- Responsiveness to client inquiries and operational challenges.

- Quick and effective resolution of logistical and technical issues.

- Demonstrated commitment to client satisfaction through problem-solving.

- Reinforcement of reliability and trust in customer relationships.

Industry Networking and Trust Building

Diana Shipping actively engages in industry networking events and conferences to cultivate relationships with current and prospective clients. For instance, participation in events like the Posidonia International Shipping Exhibition, a major global maritime trade fair, provides direct access to key stakeholders. In 2024, such events continue to be vital for fostering these connections.

Building trust is paramount in the maritime sector. Diana Shipping prioritizes demonstrating its expertise, reliability, and adherence to ethical business practices. This consistent commitment to professionalism within the global maritime community is a cornerstone of its customer relationships.

- Industry Engagement: Active participation in maritime conferences and trade shows in 2024.

- Network Cultivation: Building and maintaining strong relationships with clients and partners.

- Trust and Reputation: Emphasizing reliability, expertise, and ethical conduct.

- Client Retention: Leveraging a strong reputation to attract and retain high-value clients.

Diana Shipping focuses on long-term contractual relationships, primarily through time charters, fostering deep client connections. In 2024, the company reported an average fleet-wide charter rate of $15,400 per day, reflecting the stability derived from these extended contracts.

Dedicated account managers ensure smooth service and communication, understanding unique client needs. In 2024, the top 10 clients accounted for approximately 65% of total voyage revenues, underscoring the importance of these relationships.

Proactive communication, including real-time updates on vessel movements and cargo status, builds trust. The company's fleet of 39 vessels in Q1 2024 facilitated consistent information flow to charterers.

Rapid problem resolution is key to client satisfaction and retention. In 2024, swift handling of charter party disputes contributed to maintaining long-term agreements.

| Key Relationship Aspect | 2024 Data/Focus | Impact |

|---|---|---|

| Contractual Basis | Time Charters (Long-term) | Deep client connections, predictable revenue |

| Client Concentration | Top 10 clients = ~65% of voyage revenue | High importance of key client relationships |

| Operational Communication | Real-time updates on 39-vessel fleet | Transparency, trust, expectation management |

| Problem Resolution | Swift handling of disputes | Client retention, reliability reinforcement |

| Average Charter Rate | $15,400 per day | Value derived from stable, long-term contracts |

Channels

Diana Shipping leverages its in-house commercial team and a network of trusted shipbrokers to directly engage with customers. This approach is crucial for negotiating time charters and spot voyages, ensuring personalized service and customized solutions for charterers.

In 2024, the effectiveness of these direct channels is paramount. For instance, a significant portion of Diana Shipping's revenue is generated through these relationships, highlighting their importance in securing profitable contracts in the competitive dry bulk market.

Diana Shipping actively participates in key industry conferences like Posidonia and Capital Link's Maritime Forum. These events are crucial for networking, allowing direct engagement with potential clients, industry peers, and investors. In 2024, such conferences remain vital for showcasing services and staying informed about evolving market trends, directly impacting business development and relationship building.

Diana Shipping's official website is a crucial digital touchpoint, offering detailed fleet information, operational updates, and investor relations resources. It functions as a central repository for public reports and company news, fostering transparency among stakeholders.

While not a direct revenue generator, the website significantly bolsters the company's credibility and accessibility for potential investors and partners. As of early 2024, the company reported a fleet of 34 vessels, a key detail readily available on their online platform.

Reputation and Word-of-Mouth

Diana Shipping's reputation for reliable service, safety, and operational efficiency in the dry bulk sector acts as a crucial, though intangible, channel. This strong standing within the industry fosters trust and encourages repeat business, directly impacting customer acquisition. The company's consistent performance over time is the bedrock of this valuable asset.

Positive word-of-mouth referrals from satisfied charterers are invaluable for attracting new business, serving as a highly credible and cost-effective marketing channel. This organic growth mechanism is directly linked to the quality of service provided on each voyage. For instance, strong client relationships often translate into preferential booking and contract renewals.

The company's commitment to operational excellence, evidenced by its fleet modernization and adherence to stringent safety standards, underpins its reputation. In 2024, Diana Shipping continued to focus on maintaining a high standard of fleet management, which is critical for client satisfaction and positive industry perception. This focus on quality directly fuels positive word-of-mouth.

- Reputation as a Key Intangible Asset: Diana Shipping's strong industry standing is built on years of consistent, reliable service and operational efficiency.

- Word-of-Mouth as a Growth Driver: Positive referrals from satisfied clients are a powerful, organic channel for attracting new business.

- Impact of Safety and Efficiency: Adherence to stringent safety standards and efficient operations bolster the company's reputation, directly influencing client trust and loyalty.

Shipping Exchanges and Digital Platforms

Shipping exchanges and digital platforms offer Diana Shipping a channel for market outreach, particularly for spot market opportunities. While not the primary focus for their long-term chartering strategy, these digital avenues provide valuable visibility. For instance, in 2024, the dry bulk shipping market saw increased activity on digital platforms, with companies leveraging them to secure timely cargo. This channel can facilitate quicker transactions for shorter voyages.

These digital marketplaces connect Diana Shipping with a wider pool of potential clients, enhancing their ability to find suitable charters. They also serve as a source of real-time industry insights and pricing trends, crucial for navigating the volatile shipping market. For example, platforms like the Baltic Exchange provide crucial data that can inform chartering decisions.

- Spot Market Access: Digital platforms provide visibility for short-term voyage opportunities, complementing long-term chartering.

- Broader Client Reach: These channels connect Diana Shipping with a wider network of potential charterers.

- Industry Insights: Digital exchanges offer real-time data on market trends and pricing, aiding strategic decisions.

- Transaction Efficiency: Facilitates faster and more streamlined transactions for spot market engagements.

Diana Shipping's channels are multifaceted, encompassing direct client engagement via its commercial team and shipbrokers for time charters and spot voyages. Industry conferences are vital for networking and showcasing services, while the company website serves as a key digital touchpoint for information and transparency. In 2024, these direct and digital channels are critical for securing profitable contracts and maintaining strong stakeholder relationships.

The company's reputation for reliability and operational efficiency acts as a powerful, albeit intangible, channel, fostering trust and repeat business. Positive word-of-mouth referrals, directly linked to service quality and fleet modernization efforts in 2024, further drive organic growth. These intangible assets are crucial for client acquisition and retention in the competitive dry bulk market.

Digital platforms and shipping exchanges offer access to the spot market, enhancing visibility and facilitating quicker transactions for shorter voyages. These platforms also provide invaluable real-time market insights and pricing data, essential for strategic decision-making in the volatile shipping environment. As of early 2024, Diana Shipping operated a fleet of 34 vessels, a fact readily accessible through these channels.

| Channel Type | Description | Key Activities | 2024 Relevance |

|---|---|---|---|

| Direct Engagement | In-house commercial team & shipbrokers | Negotiating time charters & spot voyages | Securing profitable contracts, personalized service |

| Industry Events | Conferences like Posidonia, Capital Link | Networking, showcasing services, client engagement | Business development, market trend awareness |

| Digital Presence | Official website | Fleet info, operational updates, investor relations | Transparency, credibility, accessibility |

| Intangible Assets | Reputation, word-of-mouth | Reliable service, safety, efficiency | Client trust, repeat business, organic growth |

| Digital Marketplaces | Shipping exchanges, online platforms | Spot market outreach, market insights | Transaction efficiency, wider client reach |

Customer Segments

Major commodity traders, the global giants orchestrating the movement of millions of tons of iron ore, coal, and grain, represent a critical customer segment for Diana Shipping. These entities, including firms like Glencore and Cargill, rely heavily on dependable and cost-efficient dry bulk shipping services to connect resource-rich regions with industrial demand centers across the globe.

Their operational success hinges on the timely and economical transport of commodities. For instance, in 2024, global seaborne trade in dry bulk commodities is projected to reach significant volumes, underscoring the sheer scale of operations these traders manage and their dependence on shipping partners like Diana Shipping for their supply chain efficiency.

Industrial producers, like steel manufacturers and power plants, form a core customer segment for shipping companies. These businesses rely heavily on the consistent and timely delivery of bulk raw materials such as iron ore, coal, and cement. For instance, in 2024, global steel production was projected to reach over 1.9 billion metric tons, underscoring the immense demand for iron ore, a key commodity shipped by companies like Diana Shipping.

These industrial clients prioritize secure and reliable shipping services to maintain their production schedules and avoid costly downtime. Their needs often translate into long-term charter agreements, providing a stable revenue stream for shipping providers. The stability of this segment is crucial, as disruptions in raw material supply can have significant ripple effects on manufacturing output.

Large agricultural corporations and major grain merchants represent a core customer base for Diana Shipping. These companies depend on efficient and reliable transport for bulk commodities like wheat, corn, and soybeans, moving them from key agricultural hubs to global demand centers.

Their shipping requirements are often characterized by significant volumes, though demand can fluctuate seasonally. For instance, the 2024 harvest season will likely see increased demand for dry bulk carriers. In 2023, global grain trade reached approximately 470 million metric tons, highlighting the scale of these operations.

For these agricultural clients, maintaining the integrity of their supply chains is paramount. This translates into a critical need for dependable shipping services that adhere strictly to delivery schedules, minimizing disruptions and ensuring timely arrival of essential food and feed ingredients.

Mining Companies

Mining companies are a cornerstone customer segment for shipping firms like Diana Shipping. These entities are primarily involved in extracting and exporting bulk minerals, including vital commodities like iron ore, bauxite, and phosphates. Their core need is the efficient and cost-effective transportation of these raw materials from their extraction points to processing facilities or directly to end consumers worldwide. The volume of their shipping needs is intricately linked to global commodity prices and the overall health of industrial production.

For instance, in 2024, the demand for dry bulk shipping, a key service for mining companies, saw fluctuations influenced by global economic activity. Iron ore shipments, a major component of dry bulk cargo, remained a significant driver. Diana Shipping, with its fleet of dry bulk vessels, directly serves this critical industry need. The company's ability to provide reliable shipping solutions is paramount for these resource-based businesses to maintain their supply chains and meet international market demands.

- Key Clients: Companies extracting and exporting bulk minerals like iron ore, bauxite, and phosphates.

- Core Need: Transporting raw materials across continents from mines to processing plants or end-users.

- Demand Drivers: Global commodity prices and levels of industrial production directly influence their shipping requirements.

- Market Context: In 2024, dry bulk shipping demand, crucial for mining exports, remained a significant factor in the maritime industry.

Energy Companies

Energy companies, especially those heavily reliant on coal for power generation, represent a core customer segment. These entities require dependable, high-volume shipping solutions to transport coal from mines to power plants across the globe. Their demand is intrinsically linked to global energy consumption patterns and the stability of supply chains.

In 2024, the global seaborne coal trade remained significant, with approximately 1.3 billion tonnes expected to be shipped. For instance, major coal-producing regions like Australia and Indonesia continue to be key suppliers to import-heavy nations such as China and India. Companies in this segment prioritize cost-effectiveness and reliable delivery schedules to ensure uninterrupted power supply.

- Coal-fired power generation remains a substantial part of the global energy mix, driving demand for seaborne coal.

- In 2024, the seaborne coal trade volume is projected to be around 1.3 billion tonnes, highlighting the scale of operations for these clients.

- Supply chain efficiency and timely delivery are paramount for energy companies to meet power generation needs.

Diana Shipping's customer base is primarily comprised of major commodity traders and industrial producers who require consistent and cost-effective dry bulk shipping services. These clients, including global giants in iron ore, coal, and grain trading, and large-scale manufacturers like steel mills and power plants, depend on reliable transport to maintain their operations. For example, in 2024, global steel production was anticipated to exceed 1.9 billion metric tons, directly fueling demand for iron ore shipments, a core service for Diana Shipping.

Agricultural corporations and grain merchants also form a significant segment, needing efficient movement of crops like wheat and corn. In 2023, global grain trade reached approximately 470 million metric tons, indicating the substantial volumes handled by these clients. Mining companies, focused on exporting minerals such as iron ore and bauxite, rely on shipping for their supply chains, with dry bulk demand in 2024 showing continued importance.

Energy companies, particularly those utilizing coal for power generation, are another key customer group. The seaborne coal trade in 2024 was projected to be around 1.3 billion tonnes, underscoring the critical role of shipping in meeting global energy demands. These clients prioritize cost-effectiveness and timely deliveries to ensure uninterrupted power supply, making reliable shipping partners essential.

| Customer Segment | Primary Need | Key Commodities | 2024 Market Context |

|---|---|---|---|

| Commodity Traders | Reliable, cost-effective transport | Iron ore, coal, grain | Significant global trade volumes |

| Industrial Producers | Consistent, timely raw material delivery | Iron ore, coal, cement | Steel production > 1.9 billion tons |

| Agricultural Corporations | Efficient, dependable crop movement | Wheat, corn, soybeans | Global grain trade ~470 million tons (2023) |

| Mining Companies | Cost-effective mineral export transport | Iron ore, bauxite, phosphates | Continued importance of dry bulk demand |

| Energy Companies | High-volume, reliable coal shipping | Coal | Seaborne coal trade ~1.3 billion tons projected |

Cost Structure

Vessel Operating Expenses (OPEX) are the ongoing costs of keeping Diana Shipping's fleet operational. These include crew salaries, food, engine lubricants, routine maintenance, and insurance. For 2023, Diana Shipping reported total vessel operating expenses of $110.2 million, highlighting the substantial and recurring nature of these costs.

Efficiently managing OPEX is vital for profitability, as these expenses are largely fixed per vessel, meaning they don't change significantly with the amount of cargo carried. The company's ability to control these day-to-day expenditures directly impacts its bottom line and competitiveness in the dry bulk shipping market.

Vessel Capital Expenditures (CAPEX) represent a core cost for Diana Shipping, primarily encompassing the acquisition of new vessels and significant upgrades to the existing fleet. These are not everyday expenses but rather substantial, periodic investments essential for maintaining a competitive and modern fleet. For instance, in 2023, Diana Shipping reported capital expenditures of $21.6 million, reflecting ongoing investments in its fleet.

Dry-docking expenses, a critical component of vessel maintenance and regulatory compliance, also fall under CAPEX. These are large, recurring costs necessary to ensure vessels meet safety standards and operational efficiency. Such expenditures directly impact the company's balance sheet and necessitate meticulous financial planning to manage cash flow effectively.

These capital investments are vital for Diana Shipping's strategy of fleet modernization and expansion. By investing in new vessels and maintaining the current ones through dry-docking, the company aims to enhance its operational capabilities and secure long-term revenue streams in the dry bulk shipping market.

Fuel costs, often referred to as bunkers, represent a significant and variable expense for Diana Shipping. These costs are especially impactful for ships trading on the spot market or when moving between voyages. For instance, in 2024, the volatility of global fuel prices directly influenced the profitability of individual voyages, making precise cost forecasting a challenge.

The fluctuating nature of fuel prices means that effective management is paramount. Strategies like slow steaming, which reduces a vessel's speed to conserve fuel, and financial hedging instruments are actively employed by Diana Shipping to mitigate the impact of price swings and maintain better control over this major cost component.

Financing and Interest Costs

Financing and interest costs are a substantial component of Diana Shipping's expenses due to the significant capital investment required for owning a fleet of vessels. These costs are directly influenced by the company's debt levels and the prevailing interest rates it secures for its loans.

For instance, in 2024, Diana Shipping's financial statements would detail interest expenses incurred on various credit facilities used to finance its dry bulk carriers. Managing this debt effectively is crucial for maintaining profitability and ensuring the company's financial stability.

- Debt Financing: The company relies on loans to acquire and maintain its fleet, making interest payments a consistent operating expense.

- Interest Rate Sensitivity: Fluctuations in global interest rates directly impact the cost of servicing this debt.

- Capital Structure Impact: The proportion of debt versus equity in the company's capital structure significantly shapes its financing costs.

Regulatory Compliance and Safety Costs

Diana Shipping incurs significant costs to maintain compliance with stringent international maritime regulations and environmental standards. These expenses are ongoing and essential for safe and legal operation. For instance, fees for classification societies, which ensure vessels meet technical and safety requirements, are a consistent outlay. In 2024, the company continued to invest in upgrades and certifications to meet evolving global environmental mandates, such as those related to emissions and ballast water management.

These regulatory compliance and safety costs encompass a range of expenditures. They include regular surveys and audits conducted by maritime authorities and classification bodies, the purchase and maintenance of advanced safety equipment, and the implementation of new environmental technologies. These are not optional expenses but are fundamental to the company's ability to operate its fleet and access global shipping routes, directly impacting its overall operational expenditure.

- Classification Society Fees: Ongoing payments to organizations like DNV, Lloyd's Register, and American Bureau of Shipping for vessel surveys and certifications.

- Safety Equipment and Training: Costs associated with maintaining life-saving appliances, fire-fighting equipment, and crew training on safety protocols.

- Environmental Compliance: Investments in technologies and processes to meet regulations like IMO 2020 (sulfur cap) and upcoming emissions standards, including surveys and reporting.

- Audits and Inspections: Expenses related to mandatory inspections by flag states, port states, and charterers to verify compliance.

Diana Shipping's cost structure is dominated by vessel operating expenses (OPEX) and capital expenditures (CAPEX). OPEX, including crew, maintenance, and insurance, totaled $110.2 million in 2023. CAPEX, primarily for fleet acquisition and upgrades, was $21.6 million in 2023. Fuel costs are also a significant and volatile expense, managed through strategies like slow steaming. Financing and interest costs, driven by debt for fleet ownership, and regulatory compliance expenses are also key components impacting profitability.

| Cost Category | 2023 ($ Million) | Key Components |

|---|---|---|

| Vessel Operating Expenses (OPEX) | 110.2 | Crew, lubricants, maintenance, insurance |

| Capital Expenditures (CAPEX) | 21.6 | Vessel acquisition, dry-docking, upgrades |

| Fuel Costs | Variable | Bunkers for propulsion, managed by slow steaming |

| Financing & Interest Costs | Variable | Interest on debt facilities |

| Regulatory Compliance & Safety | Ongoing | Classification society fees, safety equipment, environmental upgrades |

Revenue Streams

Time charter revenue is Diana Shipping's main income source. This comes from clients renting their ships for a set daily fee over a period, irrespective of cargo. For 2024, Diana Shipping reported that time charter revenues represented a significant portion of their total income, demonstrating the stability this model provides.

Diana Shipping also earns revenue from the spot market, which involves chartering vessels for specific, shorter-term voyages based on current market prices. This offers flexibility and the chance to profit from favorable market conditions. For example, in the first quarter of 2024, the company reported total revenues of $71.1 million, with a significant portion likely stemming from these dynamic spot market activities alongside their time charters.

Diana Shipping may opportunistically sell older or less efficient vessels from its fleet. These sales, driven by market conditions or fleet renewal plans, can generate significant, non-recurring revenue. For instance, in 2023, the company completed the sale of two dry bulk vessels, the m/v Santa Barbara and the m/v Amaryllis, contributing to its financial performance.

Demurrage and Detention Fees

Demurrage and detention fees represent a significant, albeit variable, revenue stream for Diana Shipping. These charges are levied when a vessel's turnaround time at port exceeds the contractually agreed laytime for loading or unloading cargo. For 2024, these fees are directly tied to the efficiency of port operations and the charterer's ability to manage cargo movements. While specific figures for 2024 are still being finalized as the year progresses, historical data indicates these fees can significantly bolster overall revenue, particularly during periods of port congestion.

Demurrage is essentially compensation paid by the charterer to the shipowner for delays that are the charterer's responsibility. Detention fees are applied if the vessel is held up even longer, beyond the initial demurrage period. These mechanisms are crucial for mitigating the financial impact of unforeseen delays, which can otherwise lead to substantial lost earning opportunities for Diana Shipping's fleet.

- Demurrage: Fees paid by the charterer for exceeding agreed laytime for loading/unloading.

- Detention: Additional fees if the vessel is delayed beyond the demurrage period.

- Purpose: Compensates Diana Shipping for lost time and potential revenue due to port delays.

- Impact: Revenue varies based on port efficiency and charterer performance, with 2024 figures reflecting current global shipping dynamics.

Other Operating Income

Other Operating Income for Diana Shipping encompasses miscellaneous earnings beyond core charter hire. This can include income from sub-chartering vessels to other shipping companies or providing minor ancillary services related to their fleet operations. While not the primary revenue driver, these streams add to the company's total operational income.

For the fiscal year 2023, Diana Shipping reported other operating income of $1.3 million. This figure, while modest compared to their charter revenues, demonstrates the contribution of these supplementary income sources to their overall financial performance.

- Sub-chartering Activities: Income generated by chartering out vessels to third parties for specific periods or routes.

- Ancillary Services: Earnings from minor services provided to customers or partners, directly related to vessel operations.

- 2023 Contribution: Other Operating Income for Diana Shipping in 2023 amounted to $1.3 million.

Diana Shipping's revenue is primarily generated through time charters, where vessels are leased for a fixed daily rate over an extended period. This provides a predictable income stream, as seen in their 2024 financial reports highlighting time charter revenues as a substantial portion of their total earnings.

The company also participates in the spot market, chartering vessels for shorter, voyage-specific contracts based on prevailing rates. This allows them to capitalize on favorable market conditions, contributing to their overall revenue alongside stable time charter income. For instance, their Q1 2024 total revenues reached $71.1 million.

Opportunistic vessel sales represent another revenue source, occurring when older or less efficient ships are sold. These transactions, driven by fleet management strategies, can provide significant one-off income, as demonstrated by the 2023 sale of two dry bulk vessels.

Additionally, demurrage and detention fees are earned when charterers exceed agreed-upon port turnaround times, compensating Diana Shipping for delays. While variable, these fees can notably boost revenue, reflecting the efficiency of port operations and charterer performance in 2024.

| Revenue Stream | Description | 2023/2024 Data Point |

| Time Charter Revenue | Fixed daily rate for extended vessel leases | Significant portion of total income in 2024 |

| Spot Market Revenue | Voyage-specific charters at current market rates | Contributed to $71.1 million total revenue in Q1 2024 |

| Vessel Sales | Proceeds from selling fleet assets | Sale of two vessels in 2023 |

| Demurrage/Detention Fees | Compensation for port delays | Variable income tied to 2024 port efficiency |

| Other Operating Income | Sub-chartering and ancillary services | $1.3 million in 2023 |

Business Model Canvas Data Sources

The Diana Shipping Business Model Canvas is built upon a foundation of financial statements, industry analysis reports, and fleet operational data. These sources provide a comprehensive view of the company's performance, market position, and strategic direction.