Diana Shipping Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diana Shipping Bundle

Diana Shipping navigates a competitive landscape shaped by the bargaining power of buyers and the threat of new entrants, which could impact its profitability. Understanding these forces is crucial for any stakeholder looking to gauge the company's strategic positioning.

The complete report reveals the real forces shaping Diana Shipping’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The dry bulk shipping sector often depends on a concentrated group of shipyards for new vessel construction and a limited number of engine manufacturers. This concentration can grant these suppliers considerable bargaining power, allowing them to influence pricing and terms. For instance, a few major shipbuilders in East Asia often dominate the market for constructing large dry bulk carriers.

However, the power of suppliers for other essential inputs, such as fuel, is considerably less. The global fuel market is highly dispersed, with numerous suppliers worldwide, which prevents any single entity from exerting significant leverage over shipping companies like Diana Shipping. This diversification in fuel sourcing limits supplier power in that segment.

Furthermore, the global availability of multiple shipyards, even with some concentration, can act as a counterbalance to the power of any individual shipbuilding supplier. While certain yards might specialize or have higher demand, the existence of alternatives worldwide provides shipping companies with options, thereby somewhat mitigating the overall bargaining power of shipbuilding suppliers.

Switching costs for major inputs like vessel types or engine designs are extremely high once a vessel is built, as these are long-term assets with significant capital investment. This inherent inflexibility in the core assets of Diana Shipping limits their ability to easily switch to different suppliers for these fundamental components.

For operational supplies such as bunker fuel, switching costs between suppliers are relatively low. Fuel is a commodity, and numerous global providers exist, meaning Diana Shipping can readily shift between suppliers without incurring substantial penalties or setup fees, thus diminishing individual supplier power in this area.

However, long-term maintenance contracts with specific equipment providers for critical onboard systems can introduce some switching costs. If a vessel has a substantial portion of its operational life remaining under such a contract, changing to a different maintenance provider would likely involve termination fees or unamortized costs, thereby granting some leverage to those specific suppliers.

While vessels are intricate, core components like steel, engines, and navigation systems are typically sourced from specialized yet diverse industries. This means that while some specialized equipment, like cutting-edge propulsion, could give certain manufacturers leverage, many standard dry bulk vessel designs utilize readily available parts, thus reducing the uniqueness of many inputs.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Diana Shipping is minimal. Major suppliers, such as shipyards and engine manufacturers, typically lack the capital, expertise, and distinct business models required to enter the complex world of vessel ownership and operation. Their core strengths are in manufacturing, not in managing a global shipping fleet.

This lack of a credible threat from suppliers attempting to move into the shipping business itself significantly curtails their bargaining power. They are unlikely to leverage their position by threatening to become direct competitors to shipping companies like Diana Shipping.

For instance, the shipbuilding industry, while critical, is characterized by long lead times and high capital investment for new yards. In 2023, the global shipbuilding market was valued at approximately $150 billion, with a significant portion dedicated to commercial vessels. The operational complexities of managing a fleet, including chartering, crewing, maintenance, and regulatory compliance, are vastly different from manufacturing.

- Limited Supplier Forward Integration: Shipyards and engine makers are unlikely to enter vessel ownership due to high capital needs and different operational expertise.

- Core Competency Mismatch: Suppliers' strengths are in manufacturing, not in the intricate management of global shipping operations.

- Reduced Supplier Bargaining Power: The absence of this threat weakens suppliers' ability to dictate terms to shipping firms like Diana Shipping.

- Industry Capital Demands: The global shipbuilding market, valued around $150 billion in 2023, highlights the substantial investment required to even enter manufacturing, let alone fleet operation.

Impact of Input Costs on Operations

The cost of bunker fuel is a significant operational expense for Diana Shipping, and its volatility directly impacts profitability. For instance, in 2023, bunker fuel costs represented a substantial portion of operating expenses for dry bulk carriers, with prices fluctuating throughout the year due to global oil market dynamics.

While individual fuel suppliers may not wield high bargaining power in isolation due to the commodity nature of fuel, the global oil market's price-setting mechanisms exert considerable collective supplier power. This means that broader geopolitical events and supply/demand imbalances in crude oil directly influence the cost of bunker fuel for shipping companies.

Beyond fuel, other critical input costs such as crew wages, vessel maintenance, and insurance premiums also shape operational expenses. The markets for these services, characterized by varying levels of competition and specialization, determine the leverage that their respective suppliers hold over Diana Shipping.

- Bunker Fuel Volatility: In 2023, the average price of Very Low Sulphur Fuel Oil (VLSFO), a common bunker fuel, saw significant fluctuations, impacting operating costs for companies like Diana Shipping.

- Global Oil Market Influence: Geopolitical events and OPEC+ production decisions in 2023 directly influenced global crude oil prices, subsequently affecting bunker fuel costs.

- Other Input Costs: Crewing costs, dry-docking expenses for maintenance, and P&I (Protection and Indemnity) insurance premiums are other key supplier-driven costs that impact Diana Shipping's bottom line.

The bargaining power of suppliers for Diana Shipping is mixed, with significant leverage held by specialized shipyards and engine manufacturers due to high switching costs and industry concentration. However, the broad availability of fuel suppliers and the limited threat of forward integration by most suppliers temper their overall power.

While a few East Asian shipyards dominate large vessel construction, the global nature of the industry provides some alternatives, somewhat diluting supplier dominance. For crucial components, the high cost of changing designs once a vessel is built means suppliers of these core elements retain influence.

Conversely, the fuel market is highly fragmented, offering shipping companies numerous sourcing options and thus limiting individual fuel supplier power. The lack of forward integration by manufacturers, who are unlikely to enter the capital-intensive shipping operations, further reduces supplier leverage.

The cost of bunker fuel, a major expense, is heavily influenced by global oil market dynamics rather than individual suppliers. For example, in 2023, bunker fuel prices saw considerable volatility driven by geopolitical factors and OPEC+ decisions, impacting companies like Diana Shipping. Other input costs, such as crewing and insurance, are also subject to market forces and competition among providers.

| Input Category | Supplier Concentration | Switching Costs | Supplier Bargaining Power | Key Considerations (2023/2024) |

| New Vessel Construction | Moderate to High (few dominant shipyards) | Very High | High | Long lead times for new builds; significant capital investment required. |

| Engines & Critical Systems | Moderate (specialized manufacturers) | Very High | High | Proprietary technology can create lock-in effects. |

| Bunker Fuel | Low (highly dispersed market) | Low | Low (individually); High (collectively via global oil market) | Price volatility driven by global oil prices and geopolitical events. |

| Crewing & Management | Moderate (diverse pool of agencies) | Moderate | Moderate | Availability of skilled seafarers can fluctuate. |

| Maintenance & Repair | Moderate (specialized service providers) | Moderate to High (depending on contracts) | Moderate | Dry-docking costs are a significant expense. |

What is included in the product

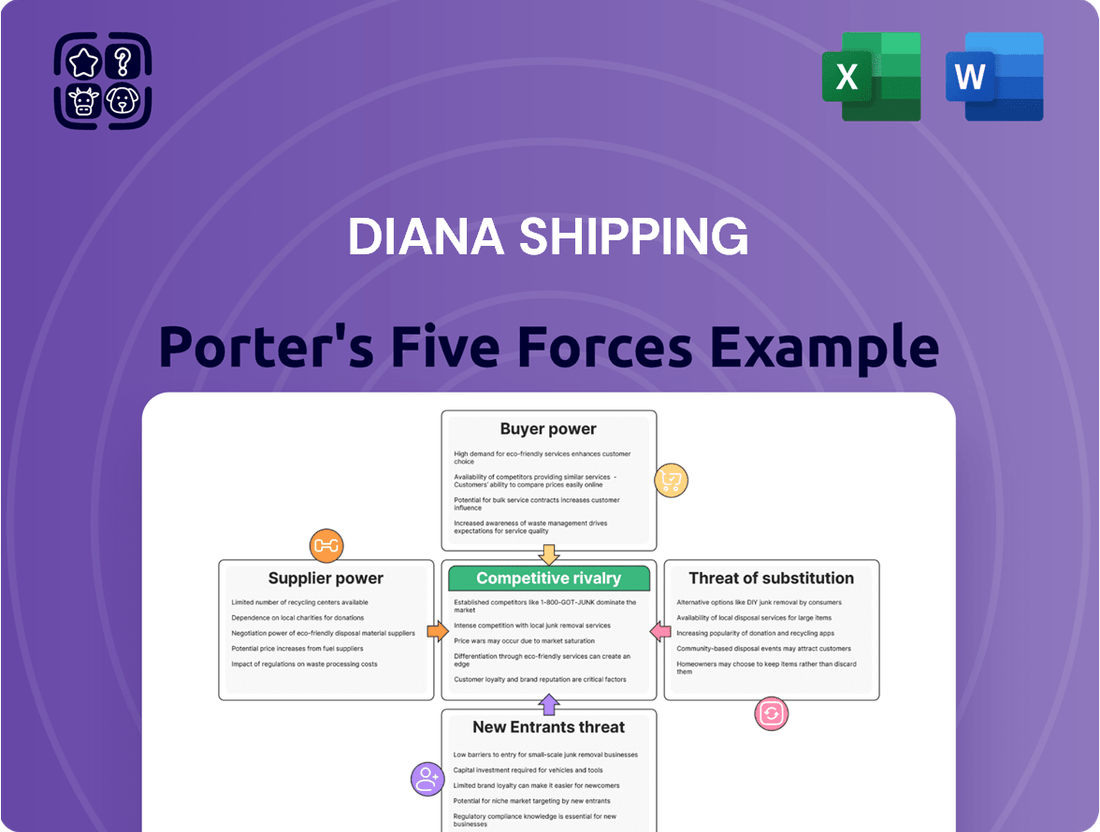

Analyzes the competitive intensity and profitability of the dry bulk shipping market for Diana Shipping, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Instantly visualize competitive intensity with a clear, actionable breakdown of each Porter's Five Forces element, enabling rapid strategic adjustments for Diana Shipping.

Customers Bargaining Power

Diana Shipping's customer base is concentrated, with large commodity traders and industrial producers chartering significant volumes of dry bulk. For instance, in 2023, Diana Shipping's top customers represented a substantial portion of its revenue, highlighting the leverage these entities hold. This concentration means that losing even one major client could have a material impact on the company's financial performance.

The dry bulk shipping sector is highly competitive, with many companies offering similar services. This abundance of choices gives customers significant leverage. For instance, in 2024, the global dry bulk fleet comprised over 12,000 vessels, illustrating the vast number of shipping providers available to charterers.

Customers can readily compare rates and service quality across numerous operators, making it simple to switch if they find better terms elsewhere. This ease of switching directly amplifies their bargaining power, as providers must remain competitive to retain business.

Customer switching costs in the dry bulk shipping sector are generally quite low, particularly for those engaging in the spot market. This means that charterers, who are the customers in this industry, can readily move from one shipping company to another for individual voyages without incurring significant expenses or operational disruptions.

Even with longer-term time charter agreements, the actual process of switching carriers is typically straightforward. The core service offered by dry bulk shipping companies is largely commoditized, meaning the operational complexity of changing providers is minimal. For instance, in 2024, the ease of securing available vessels in a competitive market further reduces the perceived risk and cost associated with switching.

This low barrier to switching directly translates into increased bargaining power for customers. They can leverage the availability of multiple providers to negotiate more favorable rates and terms, as the cost and effort to switch are not deterrents to seeking better deals. This dynamic is a key factor influencing the profitability of companies like Diana Shipping.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Diana Shipping. Dry bulk commodities, the core business, are often traded on very thin margins. This means that the cost of shipping is a critical element for their customers, who are constantly looking to minimize expenses. In 2024, the dry bulk shipping market continued to be characterized by this intense price competition.

The services offered in dry bulk shipping are largely undifferentiated. Customers, therefore, tend to base their decisions primarily on cost, seeking the most economical option available. This behavior directly translates into downward pressure on freight rates, giving customers considerable bargaining power.

- High Price Sensitivity: Customers in the dry bulk sector prioritize cost-effectiveness due to thin commodity margins.

- Undifferentiated Services: The lack of service differentiation means price is the primary decision-making factor for buyers.

- Downward Pressure on Rates: Intense price competition empowers customers, leading to lower freight rates for shipping companies.

- Impact on Profitability: This customer behavior directly affects Diana Shipping's revenue and profitability in a competitive market.

Threat of Backward Integration by Customers

The threat of customers backward integrating into owning and operating their own dry bulk fleet, like Diana Shipping, is generally low. While a few major commodity traders or large industrial groups might possess a small fleet for their own cargo needs, establishing and managing a substantial dry bulk operation is a complex undertaking.

The significant capital investment required, coupled with the need for specialized operational knowledge and navigating intricate regulations, makes full backward integration an unappealing prospect for most customers. This limited ability or willingness for customers to bring shipping operations in-house consequently moderates their bargaining power.

- Low Capital Efficiency: The dry bulk shipping industry is highly capital-intensive, with the cost of a single Panamax vessel, for example, often exceeding $20 million in 2024. This high barrier to entry deters most customers from undertaking such investments.

- Operational Complexity: Managing a fleet involves intricate logistics, vessel maintenance, crewing, and compliance with international maritime laws, requiring specialized expertise that most customers in commodity trading or industrial sectors lack.

- Regulatory Hurdles: The shipping industry faces a complex web of international and national regulations concerning safety, environmental protection, and crewing, adding further complexity and cost to operating a fleet.

Diana Shipping faces significant bargaining power from its customers due to a concentrated client base and the commoditized nature of dry bulk shipping. The ease with which customers can switch providers, coupled with their high price sensitivity, forces shipping companies like Diana to compete fiercely on rates. While backward integration by customers is a limited threat, the overall market dynamics empower buyers.

| Factor | Impact on Diana Shipping | Supporting Data (2023-2024) |

|---|---|---|

| Customer Concentration | High leverage for major clients | Top customers represented a substantial portion of 2023 revenue. |

| Ease of Switching | Downward pressure on rates | Low switching costs for spot market charters; straightforward for time charters. |

| Price Sensitivity | Demand for lower freight rates | Dry bulk commodities traded on thin margins, making shipping costs critical. |

| Service Differentiation | Price as primary decision factor | Undifferentiated services lead to cost-based purchasing decisions. |

| Backward Integration Threat | Low | High capital investment and operational complexity deter most customers. |

Full Version Awaits

Diana Shipping Porter's Five Forces Analysis

This preview shows the exact Diana Shipping Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the dry bulk shipping industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This detailed document is ready for your immediate use, providing a strategic overview without any placeholders.

Rivalry Among Competitors

The global dry bulk shipping market is quite fragmented, meaning there are many companies involved, and most of them have fairly small fleets. This creates a highly competitive landscape where no single company holds a dominant position.

This fragmentation directly impacts Diana Shipping, as it faces a multitude of competitors all vying for the same shipping contracts and cargo opportunities. For instance, as of early 2024, the dry bulk sector includes hundreds of shipowners and operators globally, with many managing fleets of fewer than 10 vessels, highlighting the dispersed nature of market participants.

The dry bulk shipping sector is inherently cyclical, closely tied to global economic performance and commodity demand. When demand falters or too many ships are available, competition heats up dramatically, leading to price wars for cargo and lower freight rates. This market volatility directly fuels intense rivalry among shipping companies.

In the dry bulk shipping sector, product differentiation is minimal, as the core service involves moving commodities between locations. While aspects like vessel age, maintenance standards, and operational efficiency can provide minor competitive edges, they rarely translate into substantial price premiums.

This inherent lack of strong differentiation means that competition often centers on pricing. For instance, in 2024, the Baltic Dry Index, a key benchmark for dry bulk shipping rates, experienced significant volatility, reflecting the intense price competition among operators. The average spot rate for a Capesize vessel, a common dry bulk carrier, fluctuated, with periods seeing rates below operational costs, underscoring the pressure to offer competitive pricing.

High Fixed Costs and Exit Barriers

Diana Shipping, like other dry bulk operators, faces intense competition partly due to substantial fixed costs. These costs, encompassing vessel acquisition, maintenance, insurance, and crew salaries, must be paid whether ships are sailing or idle. For instance, a Panamax vessel, a common type in the dry bulk sector, can cost upwards of $20 million to purchase, with annual operating expenses potentially reaching millions of dollars. This financial burden forces companies to seek charters even at marginal rates to avoid accumulating losses, intensifying price competition among existing players.

Furthermore, the dry bulk shipping industry presents significant exit barriers, primarily stemming from the high capital investment required for fleet ownership. Selling vessels during market downturns can result in substantial capital losses, making it difficult for companies to divest assets and exit the market gracefully. This lack of easy exit means that even struggling companies remain in the market, contributing to sustained rivalry and pressure on freight rates. In 2023, the average age of the global dry bulk fleet was around 10-12 years, indicating a substantial asset base that owners are reluctant to abandon without significant recovery.

- High Capital Outlay: The acquisition of large vessels represents a significant upfront investment, creating a substantial barrier to entry and exit.

- Operating Expenses: Fixed operational costs, including crewing, maintenance, and insurance, continue to accrue regardless of chartering activity, pressuring companies to maintain utilization.

- Asset Depreciation and Resale Value: The resale value of vessels can fluctuate significantly with market conditions, making it costly to exit the industry during periods of low freight rates.

- Industry Structure: The presence of many established players with substantial invested capital ensures a highly competitive environment where price is often a key differentiator.

Strategic Objectives of Competitors

Competitors in the dry bulk shipping sector exhibit a wide array of strategic aims. These can include optimizing their fleet's operational efficiency, defending or expanding their market share, or specializing in particular vessel classes like capesize or supramax, or focusing on specific geographical trade lanes. This strategic heterogeneity means that competitive actions are not always uniform, leading to a dynamic and often intense rivalry.

The competitive landscape is further complicated by the varying financial structures and ownership of these companies. Some dry bulk operators are state-owned enterprises, which may operate with different profit motives or be subject to national strategic priorities, potentially allowing them to weather market downturns differently than publicly traded, commercially driven entities. This disparity in financial backing and strategic imperatives can result in unpredictable competitive behaviors.

For instance, during 2024, the dry bulk market saw fluctuations driven by global trade patterns and geopolitical events. Companies focused on maximizing fleet utilization might aggressively pursue contracts even at lower rates to keep vessels employed, while those prioritizing market share might invest in new builds or acquisitions. This divergence in objectives directly fuels competitive pressure.

Key strategic objectives observed among major dry bulk players in 2024 included:

- Fleet Modernization: Investing in newer, more fuel-efficient vessels to reduce operating costs and meet environmental regulations.

- Geographic Expansion: Targeting growth in emerging markets or specific trade routes with projected demand increases.

- Cost Leadership: Implementing operational efficiencies and economies of scale to offer competitive freight rates.

- Market Share Defense: Maintaining or increasing tonnage to ensure visibility and bargaining power in contract negotiations.

Competitive rivalry in the dry bulk shipping sector is intense due to market fragmentation and a lack of product differentiation, forcing companies like Diana Shipping to compete primarily on price. The high fixed costs associated with vessel ownership and operation, coupled with significant exit barriers, compel companies to maintain fleet utilization, further intensifying price competition.

The global dry bulk market is characterized by numerous small operators, with hundreds of companies managing fleets of fewer than ten vessels as of early 2024. This dispersed structure means no single entity dominates, leading to constant competition for cargo. For example, the Baltic Dry Index's volatility in 2024 reflected intense price wars, with some Capesize vessel spot rates dipping below operational costs.

Diana Shipping faces this fierce competition, partly because the dry bulk service offers little differentiation beyond vessel condition and efficiency. Consequently, pricing becomes the primary battleground. The substantial capital investment required for vessels, with Panamax ships costing over $20 million, and high ongoing expenses, such as millions annually for operating costs, pressure companies to secure charters even at low rates, perpetuating rivalry.

The industry's structure, with many players heavily invested in fleets that are difficult to divest during downturns, ensures sustained competition. The average global dry bulk fleet age of 10-12 years in 2023 highlights the significant assets owners are committed to, contributing to ongoing rivalry and downward pressure on freight rates.

| Key Competitive Factors | Description | Impact on Diana Shipping |

| Market Fragmentation | Hundreds of small operators globally, with many managing fewer than 10 vessels (early 2024). | No dominant player; requires constant effort to secure contracts and maintain market presence. |

| Lack of Differentiation | Core service is commodity transport; minor differences in vessel efficiency or maintenance. | Competition centers on price; freight rates are a primary differentiator. |

| High Fixed Costs | Vessel acquisition (e.g., Panamax >$20M), maintenance, crewing, insurance. | Pressure to maintain fleet utilization, even at lower rates, to cover costs. |

| Exit Barriers | Significant capital loss on vessel sales during market downturns. | Companies remain in the market, contributing to sustained rivalry and price pressure. |

SSubstitutes Threaten

For the specific bulk commodities Diana Shipping transports, such as iron ore, coal, and grain, direct substitutes for ocean shipping on international, intercontinental routes are extremely limited. While rail and pipelines are effective for land-locked or regional transport, they simply cannot compete for long-distance, overseas dry bulk movements. This scarcity of viable alternatives significantly dampens the threat of substitutes for Diana Shipping.

Ocean shipping remains the undisputed champion for moving massive quantities of dry bulk goods globally, offering unparalleled cost-effectiveness. For instance, in 2024, the cost per ton-mile for bulk ocean freight is estimated to be significantly lower than any other mode, often in the range of cents, making it the most economical choice for international trade.

Land-based alternatives like rail and road transport simply cannot compete when it comes to the sheer volume and distance involved in dry bulk commodity movements. The logistical complexities and drastically higher per-unit costs associated with moving millions of tons of cargo via rail or truck across continents render them impractical substitutes for Diana Shipping's core business.

Air freight is entirely out of the question for bulk commodities due to astronomical costs and severe capacity limitations, making it a non-viable substitute. The economics simply do not align; the cost to ship even a small fraction of the cargo Diana Shipping handles by air would be prohibitive, further solidifying ocean transport's dominance.

No other transportation method can replicate the sheer volume and cost-effectiveness of dry bulk shipping for moving vast quantities of raw materials across continents. For instance, in 2024, the global seaborne trade of dry bulk commodities like iron ore and coal, crucial for industries from steelmaking to power generation, continued to rely heavily on this mode due to its unparalleled capacity.

Developing land-based infrastructure, such as extensive transcontinental rail networks capable of handling comparable bulk volumes, is prohibitively expensive and often impractical, especially in regions with challenging geography. The existing infrastructure for land transport simply cannot absorb the immense tonnages that ocean-going vessels routinely manage, reinforcing the strategic advantage of maritime transport for these essential global trade flows.

Customer Switching Costs to Substitutes

Shifting from maritime transport to land-based alternatives for international dry bulk trade presents formidable obstacles. Developing the necessary infrastructure, such as new rail lines and intermodal facilities, alongside reconfiguring intricate supply chains, would incur substantial capital outlays. For instance, a hypothetical large-scale shift could necessitate billions in infrastructure investment, far exceeding the cost of maintaining existing maritime operations.

The global commodity trade's established logistics network is fundamentally structured around ocean shipping. This deep integration means that a transition to substitutes would not only be complex but also likely lead to increased per-unit transportation costs for many goods. For example, the cost per ton-mile for rail transport of bulk commodities can be higher than for ocean freight, especially over long international distances.

These significant economic and operational hurdles effectively create very high switching costs for customers currently reliant on maritime transport.

- Infrastructure Investment: Billions required for new rail, road, and port facilities to handle international dry bulk.

- Supply Chain Reconfiguration: Extensive redesign and investment needed to adapt global logistics to land-based routes.

- Operational Costs: Potential for higher per-unit transportation expenses compared to established ocean freight.

- Market Inertia: The established global trade system is heavily optimized for maritime shipping, making radical shifts impractical.

Evolution of New Transport Technologies

While research into new transport technologies is ongoing, there are currently no emerging technologies that pose a credible threat as a substitute for large-scale international dry bulk shipping in the foreseeable future. Innovations tend to focus on improving vessel efficiency or propulsion rather than replacing the fundamental mode of transport.

The capital intensity and scale of current dry bulk operations make disruption by new technologies a very long-term prospect. For instance, the global fleet of dry bulk carriers, a significant portion of which is involved in international trade, represents a massive investment in existing infrastructure.

- Limited Substitute Impact: No currently viable substitute technologies threaten large-scale international dry bulk shipping.

- Focus on Efficiency: Innovations primarily target improving existing vessel performance, not replacing the core transport method.

- Long-Term Disruption Horizon: The high capital costs and established scale of dry bulk shipping suggest any technological disruption will occur over an extended period.

The threat of substitutes for Diana Shipping's services is remarkably low. For the global transport of bulk commodities like iron ore, coal, and grain, ocean shipping remains the most cost-effective and practical method. Land-based alternatives like rail and pipelines are simply not feasible for intercontinental movements, and air freight is prohibitively expensive and lacks the capacity for such cargo.

In 2024, the cost per ton-mile for bulk ocean freight continued to be significantly lower than any other mode, often in the range of cents. This economic advantage, coupled with the sheer volume capacity of vessels, makes it difficult for any substitute to compete for long-haul international dry bulk movements.

The established global logistics network is deeply integrated with maritime transport, and any shift to land-based alternatives would require billions in infrastructure investment and extensive supply chain reconfiguration, creating substantial switching costs for customers.

| Transport Mode | Estimated Cost per Ton-Mile (USD Cents) | Capacity for Bulk Commodities |

|---|---|---|

| Ocean Shipping | 1-3 | Very High (Millions of Tons) |

| Rail Transport | 5-15 | High (Thousands of Tons per train) |

| Pipeline | 2-8 | Very High (Continuous Flow) |

| Air Freight | 50-150+ | Very Low (Limited by volume/weight) |

Entrants Threaten

The dry bulk shipping sector presents a formidable barrier to entry due to its exceptionally high capital requirements. Acquiring or constructing even a single modern dry bulk vessel can easily run into tens of millions of dollars, with prices for a Capesize vessel, for instance, often exceeding $70 million in 2024. Building a competitive fleet necessitates multiple such substantial investments, creating an immense financial hurdle.

This significant upfront investment acts as a powerful deterrent for prospective new companies. Very few organizations possess the sheer volume of capital needed or the established creditworthiness to secure the necessary financing. Consequently, the threat of new entrants is considerably weakened by the sheer scale of financial commitment required to even begin operations in this industry.

New companies looking to enter the dry bulk shipping industry, like Diana Shipping, must contend with a formidable array of international maritime regulations, stringent environmental standards, and comprehensive safety protocols. These rules, enforced by bodies like the International Maritime Organization (IMO), require significant investment in compliance, from vessel design and equipment to operational procedures and crew certification.

The financial and administrative burden of meeting these requirements is substantial. For instance, the IMO's Ballast Water Management Convention, fully enforced since September 2017, necessitates costly ballast water treatment systems on vessels, with installation costs often ranging from $50,000 to $500,000 per ship. Furthermore, ongoing compliance, including regular inspections and audits, adds to operational expenses, making it difficult for new, undercapitalized entrants to compete effectively.

Established dry bulk shipping companies, including Diana Shipping, leverage significant economies of scale. This allows them to achieve lower per-unit costs in fleet management, bulk purchasing of fuel and spare parts, and securing favorable insurance rates. For instance, in 2024, major shipping lines continued to consolidate fleets, enhancing their purchasing power and operational efficiency. New entrants face a substantial hurdle in replicating these cost advantages from day one.

Furthermore, the experience curve plays a crucial role. Companies like Diana Shipping have honed their expertise over years in optimizing shipping routes, managing complex logistics, and cultivating strong relationships with charterers and port authorities. This accumulated operational knowledge translates into greater efficiency and reliability, which is difficult for newcomers to quickly acquire. This expertise can lead to significant cost savings and better service delivery, creating a barrier for potential competitors.

Access to Distribution Channels and Customer Relationships

Newcomers face a significant hurdle in accessing established distribution channels within the dry bulk shipping sector. Building relationships with freight brokers and securing direct contracts with major commodity traders, who are the lifeblood of cargo volume, takes considerable time and proven reliability.

Existing companies, like Diana Shipping, have cultivated strong, trust-based ties with key clients over many years. This deep-seated loyalty makes it difficult for new entrants to quickly penetrate the market and secure the consistent cargo flows necessary for profitability. For instance, in 2024, the dry bulk market saw continued consolidation, with established players leveraging their existing networks to win long-term charters.

- Established Charter Networks: Existing operators have long-standing agreements with charterers, making it hard for new firms to break in.

- Freight Broker Relationships: Key brokers often favor known entities, limiting access for new entrants.

- Direct Client Connections: Major commodity traders prefer working with reliable, experienced shipping companies, a status new entrants must earn.

- Market Penetration Difficulty: The time and effort required to build these essential relationships present a substantial barrier to entry.

Industry Overcapacity and Cyclicality

The threat of new entrants in the dry bulk shipping sector, particularly for companies like Diana Shipping, is significantly mitigated by the industry's inherent overcapacity and cyclicality. Periods where the supply of ships outstrips the demand for cargo are common, driving down freight rates and making profitability a challenge even for established players. For instance, in early 2024, the Baltic Dry Index, a key benchmark for dry bulk shipping costs, experienced fluctuations, reflecting this ongoing supply-demand imbalance.

New companies venturing into this market would immediately confront the risk of entering an environment where earnings are already suppressed by existing oversupply. This inherent instability, characterized by volatile cycles of boom and bust, serves as a substantial deterrent to new capital investment. The substantial upfront costs associated with acquiring or building vessels, coupled with the unpredictable revenue streams, make the barrier to entry quite high.

- The dry bulk shipping industry is prone to cycles of overcapacity, impacting freight rates.

- New entrants face the challenge of entering a market with already strained profitability due to oversupply.

- The cyclical nature and high capital requirements act as significant deterrents to new investment in the sector.

- In 2023, while freight rates saw some recovery, the underlying issue of vessel oversupply persisted, influencing market dynamics.

The dry bulk shipping sector presents a formidable barrier to entry due to its exceptionally high capital requirements, with Capesize vessels costing upwards of $70 million in 2024. Coupled with stringent international regulations and the need for substantial investment in compliance, new entrants face significant financial and administrative hurdles. Established players like Diana Shipping benefit from economies of scale and accumulated operational expertise, making it difficult for newcomers to compete on cost and efficiency.

Furthermore, securing established charter networks and relationships with freight brokers and major commodity traders is a lengthy process, with existing companies leveraging trust and proven reliability. The industry's inherent overcapacity and cyclicality, evidenced by fluctuations in the Baltic Dry Index in early 2024, also deter new investment by creating an environment of suppressed profitability and unpredictable revenue streams.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | Cost of acquiring vessels | Capesize vessel price: >$70 million |

| Regulatory Compliance | Investment in environmental and safety standards | Ballast Water Treatment System cost: $50,000 - $500,000 per ship |

| Economies of Scale | Cost advantages for larger fleets | Consolidation of fleets by major lines for purchasing power |

| Customer Relationships | Securing cargo through established networks | Long-term charters favored by major commodity traders |

| Industry Cycles | Impact of oversupply on profitability | Baltic Dry Index fluctuations indicating supply-demand imbalance |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Diana Shipping leverages data from the company's SEC filings, annual reports, and investor presentations. We supplement this with industry-specific reports from maritime research firms and global trade statistics to capture a comprehensive view of the dry bulk shipping market.