Diana Shipping Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diana Shipping Bundle

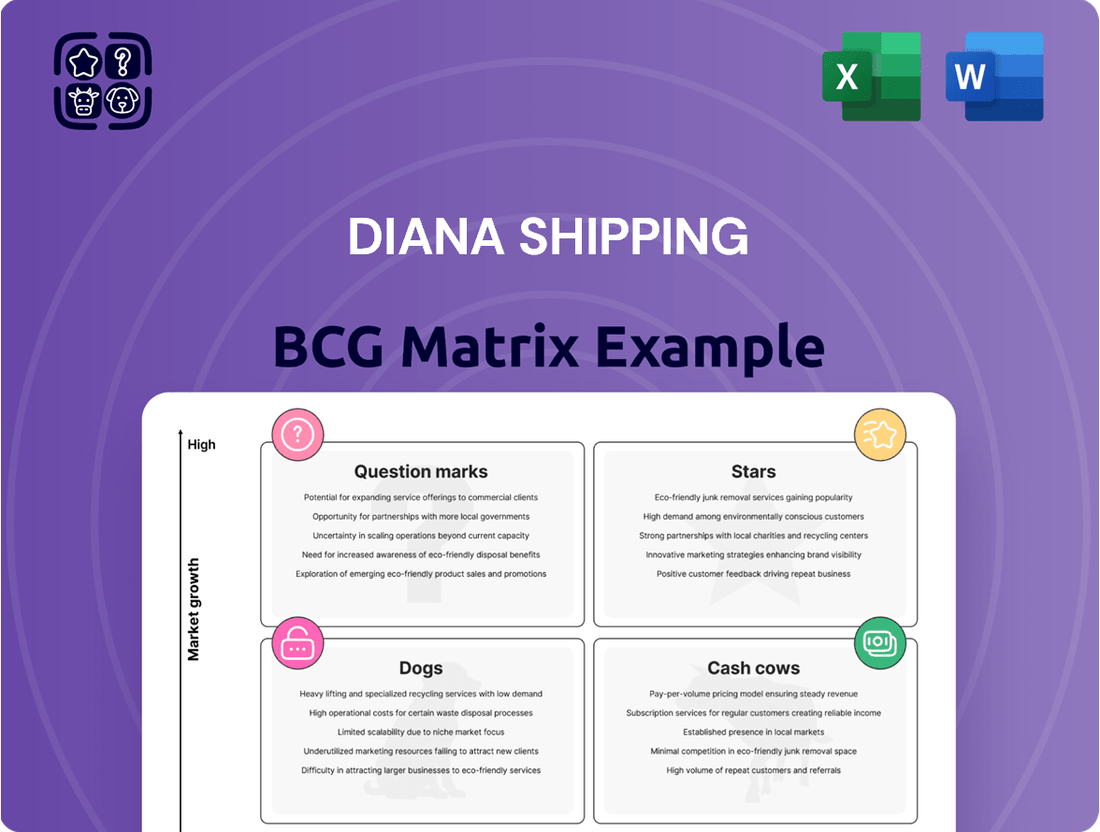

Curious about Diana Shipping's strategic positioning? Our BCG Matrix preview offers a glimpse into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for a detailed breakdown and actionable insights to navigate the shipping industry.

Unlock the full potential of Diana Shipping's market standing with our comprehensive BCG Matrix. This report provides a clear, quadrant-by-quadrant analysis, revealing where their assets truly shine and where strategic adjustments are needed. Invest in clarity and purchase the full BCG Matrix to make informed decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Diana Shipping.

Stars

Diana Shipping's fleet utilization hit an impressive 99.5% in the second quarter of 2025, a figure that mirrors strong performance in prior periods. This exceptionally high rate directly reflects robust demand for their dry bulk vessels.

This sustained high utilization in the currently expanding dry bulk market is a key driver for the company, enabling them to generate maximum revenue from their existing fleet. It clearly shows that their ships are consistently at work, capitalizing on every available market opportunity.

The dry bulk shipping market is experiencing robust growth, with projections indicating an increase from $11.36 billion in 2024 to $12.16 billion in 2025. This represents a healthy compound annual growth rate of 7.0%.

This expanding market presents a favorable backdrop for Diana Shipping's operations, particularly for its efficiently utilized fleet. The positive market trajectory supports the classification of its core dry bulk shipping services as a 'Star' within the BCG matrix.

Diana Shipping saw its Time Charter Equivalent (TCE) rate climb to $15,492 in the second quarter of 2025. This marks a notable increase from the $15,106 TCE rate reported in the same period of 2024. This upward trend highlights the company's success in negotiating more favorable charter agreements.

Profitability Turnaround

The company's return to profitability is a key indicator of its strategic positioning. In Q2 2025, Diana Shipping reported a net income of $4.5 million, a substantial leap from a net loss of $2.8 million in Q2 2024. This turnaround demonstrates a strong ability to navigate market fluctuations and optimize operations.

This positive financial shift suggests Diana Shipping is effectively capitalizing on current market conditions. The move from a loss to a profit in a growing market points to successful strategies in securing business and managing expenses efficiently.

- Profitability Resurgence: Net income of $4.5 million in Q2 2025 compared to a net loss of $2.8 million in Q2 2024.

- Market Responsiveness: Successful adaptation to market dynamics leading to improved financial performance.

- Operational Efficiency: Effective cost control measures contributing to the return to profitability.

- Growth Capture: Ability to gain market share and leverage a growing market environment.

Strategic Positioning in Key Segments

Diana Shipping's strategic positioning in key segments is evident in its focus on Capesize and Newcastlemax vessels. These larger ship types are crucial for transporting commodities like iron ore and bauxite, which have seen increased global demand. This specialization allows Diana to benefit from the inherent strengths of these segments within the dry bulk market.

The company's fleet composition directly addresses segments experiencing robust trade activity. For instance, Capesize vessels are vital for long-haul routes, often carrying iron ore from Australia to China. Newcastlemax vessels, specifically designed for the Port of Newcastle, Australia, also handle significant volumes of coal and iron ore. This strategic alignment positions Diana to capture earnings growth in these high-demand trade lanes.

In 2024, the dry bulk market, particularly for Capesize and Newcastlemax segments, demonstrated resilience. Average daily rates for Capesize vessels, for example, have shown a notable upward trend compared to previous years, reflecting strong charter demand. This performance underscores Diana Shipping's advantageous market placement.

- Fleet Focus: Diana Shipping primarily operates Capesize and Newcastlemax vessels.

- Trade Route Advantage: These vessel types are essential for transporting key commodities like iron ore and bauxite.

- Market Resilience: The Capesize and Newcastlemax segments have shown strong earnings potential in 2024, benefiting from increased shipment volumes.

- Strategic Alignment: Diana's fleet is strategically positioned to capitalize on high-demand trade routes, enhancing its competitive edge.

Diana Shipping's strong fleet utilization, reaching 99.5% in Q2 2025, coupled with a growing dry bulk market projected to reach $12.16 billion in 2025, firmly places its core operations in the Star category of the BCG matrix. The company's return to profitability, with a Q2 2025 net income of $4.5 million compared to a $2.8 million loss in Q2 2024, further solidifies this classification. This success is driven by operational efficiency and the strategic focus on Capesize and Newcastlemax vessels, which benefit from high demand for iron ore and coal transport.

| Metric | Q2 2024 | Q2 2025 | Change |

|---|---|---|---|

| Fleet Utilization | ~99.0% | 99.5% | Positive |

| Time Charter Equivalent (TCE) Rate | $15,106 | $15,492 | +3.2% |

| Net Income | -$2.8 million | $4.5 million | Profitability Resurgence |

| Dry Bulk Market Size (2024 est.) | $11.36 billion | $12.16 billion (2025 est.) | +7.0% CAGR |

What is included in the product

Diana Shipping's BCG Matrix offers a strategic overview of its fleet, categorizing vessels as Stars, Cash Cows, Question Marks, or Dogs.

It highlights which vessel segments to invest in, hold, or divest based on market share and growth potential.

Provides a clear, visual roadmap of Diana Shipping's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Diana Shipping's business model is anchored by its time charter agreements, which form a strong foundation for its Cash Cow status. The company has secured $66.1 million in contracted revenues for 69% of its remaining ownership days in 2025. This predictability is a hallmark of a mature, stable business segment.

Further solidifying this position, Diana Shipping has $50 million in contracted revenues for 20% of its ownership days in 2026. These long-term commitments create a reliable stream of cash flow, essential for supporting other business units and generating consistent returns.

Diana Shipping's existing fleet operates at an impressive 99.5% utilization rate, meaning its vessels are almost constantly at work generating revenue. This high uptime is a hallmark of a cash cow, as it maximizes the income from these mature, established assets.

The company's focus on operational efficiency, evidenced by decreasing vessel operating expenses, further bolsters the cash cow status. Lower costs directly translate to higher profit margins on each voyage, ensuring that these mature assets contribute significantly to Diana Shipping's overall cash flow.

Diana Shipping's core fleet operates within the traditional dry bulk shipping sector, a market characterized by its maturity. While the broader dry bulk market is experiencing growth, this specific segment is anticipated to see softer earnings in 2025, following a stronger 2024. This mature market presence, coupled with their established market share, firmly positions these assets as cash cows for the company.

Consistent Cash Generation for Debt Service and Dividends

Diana Shipping's core operations are a reliable source of funds, demonstrating consistent cash generation. In the first half of 2025, the company reported positive operating cash flows totaling $25.8 million. This robust cash flow is strategically allocated to manage its debt obligations effectively and to provide dividends to its shareholders.

This financial stability, underpinned by consistent cash generation, allows Diana Shipping to meet its financial commitments and reward its investors. The ability to consistently service debt and pay dividends highlights the maturity and stability of its business model within the shipping industry.

- Consistent Operating Cash Flow: $25.8 million generated in the first half of 2025.

- Debt Service Capability: Funds are utilized to meet existing debt obligations.

- Shareholder Returns: Cash generation supports the payment of dividends.

- Financial Stability: Demonstrates the company's ability to maintain a healthy financial position.

Disciplined Chartering Strategy

Diana Shipping's disciplined chartering strategy, characterized by its non-speculative nature, is a key factor reinforcing its Cash Cow status. This approach prioritizes securing favorable employment for its fleet, even when market conditions are less than ideal. This focus on predictable revenue streams helps to insulate the company from the sharp swings often seen in the dry bulk shipping market.

This deliberate strategy translates into more stable and reliable cash flows, a hallmark of a Cash Cow. For instance, in the first quarter of 2024, Diana Shipping reported total revenues of $53.6 million, demonstrating consistent operational performance. The company's ability to maintain such revenue levels through its disciplined chartering underscores its position as a strong Cash Cow.

- Predictable Revenue Streams: The non-speculative chartering strategy aims to lock in revenue, reducing reliance on volatile spot market rates.

- Market Volatility Mitigation: By focusing on securing employment, Diana Shipping lessens its exposure to adverse market downturns.

- Consistent Operational Performance: The company's ability to generate stable revenues, such as the $53.6 million in Q1 2024, highlights the effectiveness of this approach.

- Reinforced Cash Cow Status: This disciplined methodology solidifies the dry bulk shipping segment as a reliable generator of cash within Diana Shipping's portfolio.

Diana Shipping's core dry bulk operations function as reliable cash cows, consistently generating funds. The company secured $66.1 million in contracted revenues for 69% of its 2025 ownership days, with an additional $50 million for 20% of its 2026 days. This predictability, coupled with a 99.5% vessel utilization rate, highlights the mature and stable nature of these assets.

| Metric | Value (H1 2025) | Significance |

| Operating Cash Flow | $25.8 million | Supports debt service and dividends. |

| Vessel Utilization | 99.5% | Maximizes revenue from mature assets. |

| Contracted Revenue (2025) | $66.1 million | Provides revenue visibility. |

What You’re Viewing Is Included

Diana Shipping BCG Matrix

The Diana Shipping BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis will equip you with a clear strategic overview of Diana Shipping's fleet, enabling informed decision-making regarding resource allocation and future investments. No watermarks or demo content will be present; you'll gain immediate access to a professional-grade report ready for immediate application in your business planning.

Dogs

Diana Shipping has been strategically divesting older, less competitive vessels, a move aligning with the 'Dog' category in the BCG Matrix. For instance, the company sold the m/v Selina for $11.8 million and the m/v Atalandi, which was handed over to new owners in July 2025.

These transactions highlight a clear focus on shedding assets that may not perform optimally in today's evolving maritime market, potentially due to efficiency or competitive disadvantages. This proactive approach to fleet modernization is crucial for maintaining a strong market position.

Diana Shipping's fleet size reduction in the first half of 2025, averaging 37.4 vessels, down from 39.4 vessels in the same period of 2024, indicates a strategic move. This downsizing, primarily due to vessel sales, suggests a focus on optimizing the fleet by divesting assets that may be underperforming or no longer align with the company's core strategic objectives.

While Diana Shipping's overall daily operating expenses saw a reduction across its fleet, certain older vessels might still present challenges. These ships could be burdened by disproportionately higher maintenance and crew expenses, impacting their overall profitability.

If these older vessels struggle to secure charter rates that adequately cover their elevated operating costs, they would fall into the 'dog' category within a BCG matrix. This classification signifies low profitability and a weak competitive position, potentially hindering the company's overall performance.

For instance, in the first quarter of 2024, Diana Shipping reported a decrease in total operating expenses, but the specific cost breakdown per vessel is crucial. Older vessels with higher maintenance needs could easily tip into negative cash flow if charter rates don't compensate for these increased expenditures, a key indicator for identifying 'dogs'.

Exposure to Weakening Segments

Diana Shipping's fleet includes vessels in segments like Panamax, which are anticipated to experience challenges in 2025. This is largely due to an expected increase in the number of ships available and a decline in coal cargo volumes. For instance, the Panamax segment saw a significant order book growth in prior years, potentially leading to oversupply.

Vessels heavily reliant on these weakening market conditions, without a clear strategy for repositioning or securing alternative employment, could be categorized as Question Marks or even Dogs in a BCG matrix analysis. This exposure highlights the importance of fleet flexibility and market foresight.

- Panamax Vessel Exposure: Projected headwinds in 2025 due to high fleet growth.

- Coal Shipment Weakening: A key cargo type for some segments facing reduced demand.

- Strategic Redeployment: Crucial for mitigating risks in vulnerable market conditions.

- Potential for Underperformance: Vessels without adaptation may become less profitable.

Potential for Low Return on Investment

Diana Shipping's potential for low return on investment within the BCG matrix framework highlights vessels that have historically struggled to generate substantial profits. These assets, while potentially breaking even, tie up valuable capital that could be better utilized elsewhere, hindering overall cash flow generation. For instance, if older, less fuel-efficient vessels are consistently underperforming in the charter market, they might fall into this category.

The company's strategic approach involves divesting these underperforming assets to enhance the efficiency and profitability of its entire fleet. By shedding vessels that consistently yield low returns, Diana Shipping can redirect capital towards newer, more competitive ships or other growth opportunities. This proactive management of the fleet is crucial for optimizing the company's financial performance and ensuring a stronger competitive position.

- Fleet Optimization: Divesting low-return vessels frees up capital for investment in more profitable segments.

- Cash Flow Enhancement: Removing underperforming assets can improve overall cash generation for the company.

- Strategic Realignment: Focusing on high-performing assets strengthens the company's market position.

Diana Shipping's "Dogs" represent vessels that are likely to have low market share and low growth prospects, thus generating minimal profit. The sale of the m/v Selina for $11.8 million and the m/v Atalandi in July 2025 exemplifies the divestment of such assets. These actions are consistent with a strategy to shed underperforming ships that may face challenges like high operating costs or reliance on declining cargo segments.

The company's fleet reduction, averaging 37.4 vessels in H1 2025 compared to 39.4 in H1 2024, directly reflects the removal of these "Dogs." This optimization aims to improve overall fleet efficiency and profitability by concentrating resources on more competitive assets.

Vessels in segments like Panamax, facing oversupply and reduced demand for key cargoes like coal in 2025, are particularly susceptible to becoming "Dogs." Without strategic repositioning, these ships could struggle to achieve charter rates covering their operational expenses, a hallmark of underperforming assets.

| Vessel Type | Market Outlook (2025) | Potential BCG Classification | Rationale |

| Panamax | Challenging (oversupply, declining coal) | Dog | High operating costs, weak charter rates, low profitability. |

| Older Vessels | Varies (depends on efficiency) | Dog | Higher maintenance/crew costs, struggle to cover expenses. |

Question Marks

Diana Shipping's investment in two methanol dual-fuel Kamsarmax dry bulk vessels, slated for delivery in late 2027 and early 2028, positions them within a burgeoning, environmentally conscious sector of the shipping industry. This strategic move targets a high-growth area where the company currently holds a modest market presence but sees considerable future expansion opportunities.

Diana Shipping's investment in Ecogas Holding AS for new LPG vessels marks a strategic diversification into the LPG shipping sector. This move positions the company to tap into a high-growth market, though its current market share within this segment is minimal.

As of the first quarter of 2024, Diana Shipping reported a fleet of 39 vessels, primarily dry bulk carriers. The addition of LPG vessels through Ecogas Holding AS represents a significant departure from its core business, aiming to capture emerging opportunities in a sector with strong demand drivers, such as increasing global energy needs.

Diana Shipping's investment in Windward Offshore signifies a strategic move into the high-growth offshore wind support sector. This venture positions Diana to capitalize on the expanding renewable energy market, which is projected to see significant expansion in the coming years.

While the offshore wind sector is experiencing robust growth, Diana Shipping's market share within this specific niche is currently minimal. This suggests Windward Offshore, as a new entrant or relatively small player, would likely be categorized as a question mark in the BCG matrix, requiring substantial investment to gain market share and potentially become a star.

For instance, the global offshore wind market was valued at approximately $50 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of over 10% through 2030. Diana's commitment, though not specified in exact figures for Windward Offshore in publicly available data as of early 2024, represents a capital allocation into a sector with immense future potential but also considerable competitive intensity and development costs.

Strategic Investment in Genco Shipping & Trading

Diana Shipping's acquisition of a 7.72% stake in Genco Shipping and Trading Limited in 2024 positions Genco as a 'Question Mark' within Diana's strategic portfolio, particularly if Genco's operational strategies or market segment focus in dry bulk represent a new frontier for Diana. This investment might signal Diana's intent to explore novel growth avenues within the shipping industry, leveraging Genco's specific expertise.

Genco Shipping and Trading, as of early 2024, operates a fleet of 44 vessels, focusing on the Capesize, Ultramax, and Supramax segments. This diversified approach within dry bulk could offer Diana valuable insights into different market dynamics and operational efficiencies that differ from its own core business, thereby qualifying it as a 'Question Mark' requiring further strategic evaluation and potential development.

- Market Exposure: Genco's presence in various dry bulk segments provides Diana with a broader market perspective.

- Strategic Alignment: The investment allows Diana to assess potential synergies or competitive advantages from Genco's distinct operational model.

- Growth Potential: This stake could be a stepping stone for Diana to enter or expand its presence in specific, high-potential dry bulk niches.

- Investment Risk: As a 'Question Mark,' the investment carries uncertainty regarding its future contribution to Diana's overall portfolio performance.

Exploration of Future Decarbonization Technologies

Future decarbonization technologies, such as ammonia or methanol-powered vessels, represent potential stars for Diana Shipping. While currently holding a low market share, these innovations are poised for significant growth as the industry pushes for greener operations. Diana's investment in these areas would be crucial for establishing a leadership position in a rapidly evolving market.

Investing in advanced carbon capture systems for ships also falls into this high-growth, high-investment category. These technologies, while nascent, offer a pathway to reducing emissions from existing fleets. For Diana, early adoption and development could unlock substantial future revenue streams, even if initial market penetration is modest.

- Ammonia-fueled ships are gaining traction, with several major shipping lines announcing orders for ammonia-ready or ammonia-powered vessels in 2024.

- The global market for maritime carbon capture technology is projected to grow significantly, with estimates suggesting it could reach several billion dollars by the end of the decade.

- The International Maritime Organization (IMO) has set ambitious emission reduction targets, driving the need for these innovative solutions.

Diana Shipping's investments in areas like offshore wind support and potentially Genco Shipping, where market share is currently limited but growth prospects are high, exemplify 'Question Marks'. These ventures require significant capital and strategic focus to develop into market leaders, carrying inherent risks but also offering substantial future rewards.

The company's foray into LPG vessels via Ecogas Holding AS also fits the 'Question Mark' profile. While the LPG market shows strong demand, Diana's current position is nascent, necessitating investment to build scale and competitive advantage.

Similarly, new decarbonization technologies like ammonia or methanol-powered vessels, and advanced carbon capture systems, are classic 'Question Marks'. Diana's early engagement in these areas, despite a small current market share, positions it to capture future growth driven by global emission reduction mandates.

Diana Shipping's strategic investments in nascent, high-growth sectors such as offshore wind support through Windward Offshore, and its stake in Genco Shipping and Trading, highlight its 'Question Mark' portfolio elements. These ventures, while requiring substantial investment to gain traction, offer significant upside potential in evolving markets.

| Investment Area | Current Market Share (Diana) | Market Growth Potential | Strategic Rationale | BCG Category |

|---|---|---|---|---|

| Offshore Wind Support (Windward Offshore) | Minimal | High (Global market ~$50B in 2023, >10% CAGR) | Capitalize on renewable energy expansion | Question Mark |

| LPG Shipping (Ecogas Holding AS) | Minimal | High (Driven by global energy needs) | Diversification into a high-growth sector | Question Mark |

| Genco Shipping & Trading Stake | Indirect (via stake) | Moderate to High (within specific dry bulk segments) | Explore new growth avenues, gain insights | Question Mark |

| Decarbonization Tech (Ammonia/Methanol, Carbon Capture) | Low | Very High (Driven by IMO targets) | Establish leadership in future shipping | Question Mark |

BCG Matrix Data Sources

Our Diana Shipping BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.