DFIN PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

Understand how political, economic, and technological forces impact DFIN's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

DFIN's business is inherently tied to the financial services sector, a domain heavily influenced by political decisions and regulatory frameworks. Political stability is paramount, as shifts in government can directly impact the legislative agenda concerning financial markets. For instance, a change in administration in the United States could lead to a review of Dodd-Frank Act provisions or new regulations impacting financial reporting, areas where DFIN provides essential software and services.

The direction of regulatory policy is a key factor. For example, during 2024, discussions around capital requirements for financial institutions and evolving data privacy laws, like potential updates to GDPR or similar frameworks in other jurisdictions, could necessitate significant adjustments to DFIN's compliance solutions. Rapid adaptation to these changes is crucial for maintaining market relevance and avoiding penalties.

Conversely, a predictable and stable regulatory environment fosters greater certainty for DFIN's strategic planning. This stability allows the company to invest with confidence in developing long-term technological solutions and expanding its service offerings without the immediate threat of disruptive policy changes. The upcoming period from late 2024 into 2025 is expected to see continued focus on cybersecurity regulations and digital asset oversight, presenting both challenges and opportunities for DFIN.

Global geopolitical tensions, like the ongoing conflict in Ukraine and evolving trade relations between major economies, significantly influence financial markets. These shifts can create demand for more sophisticated compliance and risk management solutions, areas where DFIN offers expertise. For instance, the imposition of sanctions or export restrictions often requires businesses to navigate complex regulatory landscapes, presenting opportunities for DFIN to provide necessary services.

However, sustained geopolitical instability can dampen overall economic activity. Reduced cross-border investment and slower capital market transactions, potentially seen in 2024 as global growth forecasts remain cautious, could lead to decreased demand for certain financial services. This volatility underscores the importance of DFIN's diversified service offerings to mitigate revenue impacts.

Governments worldwide are significantly increasing spending on digital infrastructure. For instance, the United States' Bipartisan Infrastructure Law allocated $65 billion in 2021 for broadband expansion, which indirectly supports secure data exchange. This trend creates a fertile ground for companies like DFIN, which specialize in financial data management and reporting.

These government initiatives, focused on modernizing digital networks and ensuring secure data flows, directly benefit DFIN. As nations invest in national digital frameworks and implement stricter cybersecurity mandates, the demand for DFIN's sophisticated compliance and reporting solutions is expected to surge. This is particularly true for tools that facilitate transparent and secure data handling.

Furthermore, regulatory pushes for enhanced transparency and disclosure across various industries, driven by government policy, are a key opportunity. For example, the ongoing evolution of environmental, social, and governance (ESG) reporting requirements necessitates robust data management and accurate disclosure, areas where DFIN excels. The increasing scrutiny on data integrity and privacy compliance, often spurred by government action, positions DFIN favorably.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) Focus

Political efforts to combat financial crime, including updated Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations, directly influence DFIN's product development and service offerings. As governments worldwide bolster their defenses against illicit financial flows, there's a growing demand for advanced RegTech solutions. These tools are crucial for automating the complex monitoring and reporting processes required by regulators.

The intensification of global efforts against financial crime, including the FATF's ongoing evaluations and national regulatory updates, is a significant driver for DFIN. For instance, the UK's Serious Fraud Office (SFO) reported a 20% increase in the value of investigations opened in 2023 compared to the previous year, highlighting the heightened enforcement environment. This trend is projected to continue, with increased scrutiny and stricter enforcement measures expected in 2024 and 2025, creating a sustained market for DFIN's compliance solutions.

- Increased Regulatory Scrutiny: Governments globally are enhancing AML/CFT regulations, necessitating more robust compliance solutions.

- Demand for RegTech: The growing complexity of financial crime fuels demand for automated monitoring and reporting technologies.

- Enforcement Trends: Stricter enforcement and higher penalties for non-compliance encourage businesses to invest in advanced compliance tools.

- Global Cooperation: International collaboration in combating financial crime creates a unified market for compliance solutions.

Data Sovereignty and Cross-Border Data Flows

The growing emphasis on data sovereignty and the rules surrounding international data transfers pose significant challenges for companies like DFIN that operate globally. Political decisions dictate where data can be stored and how it's accessed across different countries, directly affecting DFIN's cloud services and its worldwide clientele. This necessitates adaptable and compliant data management strategies.

Countries are enacting stricter data localization laws, compelling businesses to store data within their borders. For instance, by the end of 2024, many nations will have updated or introduced new data privacy laws, impacting cross-border data movement. This trend requires DFIN to maintain robust data governance frameworks to navigate these varying legal landscapes effectively.

- Global Data Localization Trends: Over 100 countries had some form of data localization requirements by early 2025, up from a smaller number in previous years, impacting how DFIN manages client data.

- Cross-Border Data Flow Regulations: The EU's General Data Protection Regulation (GDPR) continues to influence global data transfer mechanisms, with ongoing discussions and potential updates in 2024-2025 regarding adequacy decisions.

- Cloud Infrastructure Compliance: DFIN must ensure its cloud partners comply with diverse national data residency mandates, a complex undertaking given the evolving regulatory environment.

- Impact on Service Delivery: Restrictions on data flows can slow down or complicate the delivery of DFIN's financial data and analytics services to international clients, necessitating decentralized data processing capabilities.

Political stability and government policies directly shape the financial services landscape where DFIN operates. Shifts in regulatory environments, particularly concerning financial reporting, data privacy, and cybersecurity, are critical. For example, ongoing discussions in 2024 and 2025 about potential updates to data protection laws globally, similar to GDPR, could necessitate significant adjustments to DFIN's compliance solutions.

Government investments in digital infrastructure, such as the significant allocations for broadband expansion, indirectly support secure data exchange, benefiting companies like DFIN. Furthermore, a strong political will to combat financial crime, leading to stricter Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations, drives demand for DFIN's RegTech solutions. The UK's Serious Fraud Office's reported 20% increase in investigation openings in 2023 highlights this intensified enforcement environment, a trend expected to continue through 2024-2025.

Global geopolitical tensions can influence financial markets, potentially increasing demand for risk management solutions. However, sustained instability can dampen economic activity and capital market transactions, impacting DFIN's revenue. Data sovereignty laws are also a growing concern, with over 100 countries expected to have data localization requirements by early 2025, requiring DFIN to adapt its global data management strategies.

What is included in the product

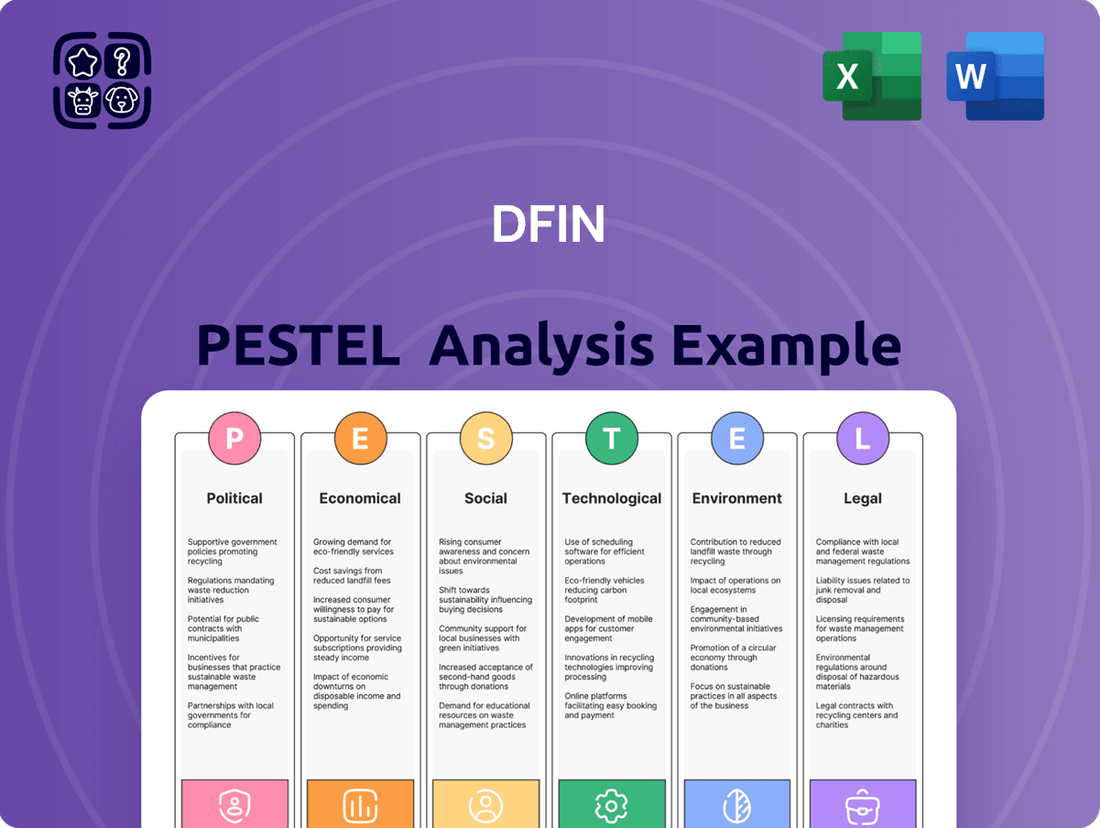

This DFIN PESTLE analysis comprehensively examines the external macro-environmental factors influencing the company's operations and strategic direction across political, economic, social, technological, environmental, and legal dimensions.

The DFIN PESTLE analysis provides a structured framework to proactively identify and address external threats and opportunities, thereby alleviating the pain point of uncertainty in strategic planning.

Economic factors

DFIN's performance is intrinsically linked to global economic health and capital markets activity. For instance, during periods of robust economic expansion, such as seen in early 2024 with many developed economies showing resilience, DFIN typically benefits from a surge in mergers, acquisitions, and initial public offerings. These transactions directly drive demand for DFIN's compliance and communication solutions.

Conversely, increased global economic uncertainty and heightened market volatility, a trend observed in various geopolitical hotspots and inflationary pressures throughout 2024, can significantly dampen transactional volumes. This slowdown directly impacts DFIN's revenue streams as fewer companies engage in capital markets activities, leading to reduced demand for their specialized services.

Looking ahead to 2025, projections from institutions like the IMF suggest a moderate but potentially uneven global growth trajectory. This environment could present a mixed bag for DFIN, with opportunities arising from any stabilization in market sentiment, but risks remaining if volatility persists or economic headwinds strengthen.

The prevailing interest rate environment significantly shapes investment and financing strategies for DFIN's clientele. Rising rates can temper capital market activity, impacting deal volumes, while declining rates often spur such transactions.

DFIN's performance in Q1 2024 demonstrated resilience, with notable growth in its software solutions segment and capital markets transactional sales, suggesting an ability to navigate varying rate landscapes by offering essential services.

For instance, the Federal Reserve maintained its benchmark interest rate within the 5.25%-5.50% range through early 2024, a factor that influences corporate borrowing costs and the attractiveness of different investment vehicles for DFIN's customers.

This sustained rate level likely contributed to a cautious but active capital markets environment, supporting DFIN's transactional revenue streams as companies continued to engage in financing and advisory activities.

Inflationary pressures significantly affect DFIN's operational expenses, particularly in areas like talent acquisition, essential technology infrastructure, and the cost of various business inputs. For instance, rising wage demands and increased cloud computing costs directly influence DFIN's bottom line.

Maintaining profitability hinges on DFIN's ability to effectively manage these escalating costs. The company's focus on cost control was evident in its Q1 2024 results, where it achieved an improved adjusted EBITDA margin, signaling successful operational efficiencies.

The core challenge for DFIN lies in balancing prudent cost management with necessary investments in innovation and future growth initiatives, ensuring neither aspect is compromised.

Client Investment in Compliance Technology

The increasing readiness of financial institutions to allocate capital towards cutting-edge compliance technology is a key economic driver. This trend is directly influenced by the escalating complexity of regulatory frameworks and the substantial financial penalties associated with non-adherence.

Consequently, clients are exhibiting a greater propensity to adopt DFIN's software solutions. This heightened demand translated into a tangible financial outcome for the company, with DFIN's software solutions net sales experiencing a robust increase of 10.7% in the fourth quarter of 2024.

- Increased Regulatory Burden: As regulations become more stringent, the necessity for effective compliance technology grows.

- Cost of Non-Compliance: The financial repercussions of failing to meet regulatory standards incentivize investment in preventative solutions.

- Client Investment: Financial institutions are demonstrating a clear economic willingness to invest in technologies that mitigate risk and ensure adherence.

- DFIN's Sales Growth: The company's software solutions saw a 10.7% rise in net sales in Q4 2024, directly reflecting this client investment trend.

Currency Exchange Rate Fluctuations

As a company with global operations, DFIN faces the reality of currency exchange rate fluctuations. These shifts directly influence how its international earnings and costs are reported in its home currency, impacting overall financial performance. For instance, if the US dollar strengthens significantly against other major currencies, DFIN's foreign revenues will translate into fewer dollars, potentially lowering reported profits. Conversely, a weaker dollar could boost reported international earnings. This volatility also affects DFIN's ability to price its services competitively in various global markets.

The impact of these fluctuations can be substantial. For example, a 10% appreciation of the US dollar against the Euro in 2024 could reduce the dollar value of DFIN's Euro-denominated revenue by a similar margin, assuming no price adjustments. Similarly, a weakening of the dollar could make DFIN's services more attractive in dollar terms to international clients. These movements are a constant consideration in DFIN's financial planning and risk management strategies.

- Impact on Reported Earnings: Currency shifts can alter the reported value of international sales and expenses, affecting DFIN's net income.

- Competitive Pricing: Exchange rate changes influence the cost of DFIN's services for clients in different countries, impacting market competitiveness.

- Translation Risk: The process of converting foreign currency financial statements into DFIN's reporting currency introduces variability in financial results.

- Hedging Strategies: DFIN may employ financial instruments to mitigate the adverse effects of currency volatility, though these also carry costs and risks.

Global economic growth directly fuels DFIN's business by increasing demand for capital markets transactions like M&A and IPOs. Periods of economic expansion, such as the observed resilience in developed economies in early 2024, typically correlate with higher deal volumes, benefiting DFIN's service offerings. Conversely, economic downturns or heightened uncertainty, as seen with persistent inflationary pressures in 2024, tend to suppress these activities, impacting DFIN's revenue. Projections for 2025 suggest moderate but potentially uneven global growth, indicating a mixed outlook for DFIN.

Interest rates significantly influence DFIN's clients' investment and financing decisions, thereby affecting deal activity. For example, the Federal Reserve's sustained rate of 5.25%-5.50% through early 2024 created a cautious but active capital markets environment, supporting DFIN's transactional revenue. Inflation, however, increases DFIN's operating costs, like talent and technology, though the company demonstrated successful cost management with improved adjusted EBITDA margins in Q1 2024.

The increasing complexity of regulations and the high cost of non-compliance are driving financial institutions to invest more in compliance technology, a key economic factor for DFIN. This trend is reflected in DFIN's software solutions net sales, which grew by 10.7% in Q4 2024. Furthermore, currency exchange rate fluctuations impact DFIN's international earnings and competitive pricing, requiring careful financial planning and risk management.

| Economic Factor | Impact on DFIN | 2024 Data/Trend | 2025 Outlook |

|---|---|---|---|

| Global GDP Growth | Drives capital markets activity (M&A, IPOs) | Resilient growth in developed economies early 2024; moderate global growth projected | Moderate but potentially uneven growth |

| Interest Rates | Influences client investment and financing decisions | Fed rates held at 5.25%-5.50% through early 2024, supporting cautious activity | Continued influence on borrowing costs and deal making |

| Inflation | Affects operating costs (wages, tech) | Persistent inflationary pressures in 2024; DFIN improved EBITDA margins via cost control | Ongoing cost management challenge |

| Regulatory Investment | Drives demand for compliance technology | 10.7% net sales growth in software solutions (Q4 2024) | Continued client investment in risk mitigation |

| Currency Exchange Rates | Impacts reported international earnings and pricing competitiveness | USD strength could reduce reported foreign revenue; hedging strategies employed | Ongoing consideration for global operations |

Preview the Actual Deliverable

DFIN PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This DFIN PESTLE analysis provides a comprehensive overview of the external factors impacting the company, covering Political, Economic, Social, Technological, Legal, and Environmental aspects. It is designed to offer actionable insights for strategic decision-making. You'll get the complete, detailed analysis as displayed.

Sociological factors

The financial industry's continued embrace of digital transformation and remote work significantly fuels the demand for DFIN's cloud-based and Software-as-a-Service (SaaS) offerings. Clients are increasingly seeking digital avenues for critical functions like regulatory reporting and compliance, a trend that directly supports DFIN's strategic push to grow its SaaS revenue streams.

This shift isn't just a passing fad; evolving work arrangements and heightened client expectations are actively accelerating the adoption of these digital solutions. For instance, by the end of 2024, many financial institutions reported over 70% of their workforce operating in hybrid or fully remote models, underscoring the necessity for robust digital platforms.

The availability of skilled talent, particularly in specialized fields like Regulatory Technology (RegTech), cybersecurity, and advanced data analytics, directly fuels DFIN's capacity for innovation and the effective delivery of its services. A recent report indicated that demand for cybersecurity professionals in the financial sector alone saw a 40% increase in job postings between 2023 and early 2024.

Sociological shifts, including evolving educational pathways and changing career aspirations among younger generations, significantly shape the available talent pool. For instance, surveys in 2024 show a growing preference for roles offering continuous learning and technological engagement, directly impacting recruitment in areas critical to DFIN.

DFIN's strategic imperative involves a strong focus on workforce transformation. This means proactively attracting and retaining professionals who possess deep expertise not only in traditional finance but also in the rapidly evolving regulatory frameworks and cutting-edge technological landscapes essential for future growth.

Client trust is a cornerstone for any financial services provider like DFIN, especially with growing societal concerns around data privacy. In 2024, a significant percentage of consumers are wary of sharing personal financial information online, with reports indicating over 60% express anxiety about data breaches. This makes DFIN's commitment to robust cybersecurity and transparent data handling absolutely critical for attracting and retaining clients in the compliance sector.

The integrity of financial data is paramount, and societal awareness of potential vulnerabilities directly impacts client choices. By 2025, we anticipate further increases in regulatory scrutiny and public demand for providers who demonstrate superior data protection. DFIN's ability to maintain a strong reputation for security, evidenced by a low incident rate of data compromise, will be a key differentiator in a competitive market.

Evolving Expectations for Transparency and ESG

Societal demands for greater corporate accountability are intensifying, pushing financial institutions to be more transparent. This includes a strong push for robust Environmental, Social, and Governance (ESG) reporting. For instance, in 2024, the global sustainable investment market reached over $37 trillion, a significant increase reflecting these evolving expectations. This trend directly impacts DFIN as clients increasingly need sophisticated tools to meet these rising transparency standards and accurately report their ESG performance.

These evolving expectations create a clear market opportunity for DFIN. Clients are actively seeking solutions that can streamline and enhance the accuracy of their ESG disclosures. A 2025 survey indicated that 75% of investors consider ESG factors material to their investment decisions, underscoring the demand for reliable ESG data. This demand translates into a direct need for DFIN's expertise in data management and reporting, positioning the company to offer valuable services in this burgeoning area.

- Growing Investor Demand: Over 75% of investors consider ESG factors in 2025, driving demand for transparent reporting.

- Market Size: The global sustainable investment market surpassed $37 trillion in 2024, highlighting the scale of ESG integration.

- Client Needs: Financial institutions require advanced solutions for accurate and comprehensive ESG data management and disclosure.

- DFIN's Opportunity: This societal shift presents a significant new market for DFIN's reporting and data management services.

Cultural Adoption of New Technologies

The speed at which DFIN's client base and their workforce embrace new technologies, particularly those powered by artificial intelligence, directly impacts the adoption rate of DFIN's more sophisticated solutions. For instance, a recent survey indicated that 65% of financial services firms in North America are prioritizing AI integration in their operational strategies for 2024-2025.

A proactive culture that welcomes automation and AI within financial workflows is crucial for DFIN's expansion, especially in domains such as automated regulatory reporting and sophisticated risk management. This willingness to adopt innovation is a significant driver for clients seeking efficiency gains.

Consider these points regarding cultural adoption:

- AI Readiness: A study by Deloitte in late 2024 found that over 70% of financial institutions are actively exploring or piloting AI for enhanced data analysis and client services.

- Automation Appetite: Companies that have already integrated Robotic Process Automation (RPA) often show a higher propensity to adopt more advanced AI tools, indicating a foundational comfort with technological change.

- Employee Training Investment: Organizations investing heavily in upskilling their employees in data science and AI tools are more likely to see successful integration of new technological platforms offered by DFIN.

- Perception of AI: Positive sentiment towards AI, viewing it as an augmentation tool rather than a replacement, fosters quicker adoption of AI-driven financial solutions.

Societal expectations for transparency and ethical conduct are increasingly influencing the financial sector, directly impacting demand for DFIN's services. Clients are demanding more robust reporting on Environmental, Social, and Governance (ESG) factors, a trend that grew significantly between 2023 and 2025.

The global sustainable investment market surpassed $37 trillion in 2024, illustrating this societal shift. Consequently, financial institutions require advanced solutions to manage and disclose ESG data accurately, creating a substantial market opportunity for DFIN.

Furthermore, evolving career aspirations, particularly among younger generations, favor roles with continuous learning and technological engagement. This shapes the talent pool, emphasizing the need for DFIN to attract professionals skilled in both finance and emerging technologies.

| Sociological Factor | Impact on DFIN | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Transparency & ESG Reporting | Increases need for DFIN's data management and reporting solutions. | Global sustainable investment market reached over $37 trillion in 2024; 75% of investors consider ESG factors material by 2025. |

| Talent Pool Evolution | Shapes recruitment focus towards tech-savvy financial professionals. | Surveys in 2024 show a growing preference for roles offering continuous learning and technological engagement. |

| Client Trust & Data Privacy Concerns | Highlights the critical importance of DFIN's cybersecurity and data handling. | Over 60% of consumers express anxiety about data breaches in 2024. |

Technological factors

Artificial intelligence and machine learning are transforming regulatory compliance, automating complex tasks, analyzing data instantly, and bolstering fraud detection. These advancements allow DFIN to develop more efficient, precise, and forward-looking compliance tools, minimizing human mistakes and speeding up reporting for their customers.

For instance, in 2024, financial institutions are increasingly adopting AI for Anti-Money Laundering (AML) processes, with some reporting up to a 40% reduction in false positives. This efficiency gain directly translates to cost savings and improved operational focus, areas where DFIN's enhanced solutions can provide significant value.

By integrating AI and ML, DFIN can offer predictive analytics for risk management, helping clients anticipate regulatory changes and proactively adapt their strategies. This proactive approach is crucial in a rapidly evolving financial landscape, where staying ahead of compliance demands is paramount for sustained success.

The growing embrace of cloud computing and Software-as-a-Service (SaaS) is a significant technological factor for DFIN. These technologies offer adaptable and secure foundations for DFIN's services, enabling more efficient delivery and lower infrastructure expenses for clients. This shift also aids in maintaining consistent regulatory adherence across various regions.

DFIN's strategic emphasis on boosting its SaaS revenue streams directly benefits from this trend. For instance, by mid-2024, the global SaaS market was projected to reach over $300 billion, showcasing the substantial growth potential DFIN can tap into by leveraging these cloud-based models.

The cybersecurity landscape for financial institutions like DFIN is constantly shifting. Sophisticated threats such as advanced ransomware and insidious supply chain attacks are becoming more prevalent. For instance, in 2024, the average cost of a data breach reached $4.73 million globally, underscoring the financial impact of these vulnerabilities.

This escalating risk environment creates a significant opportunity for DFIN. As financial firms grapple with heightened cyber risks, there's a surging demand for compliance and reporting tools that offer integrated, top-tier cybersecurity features. DFIN's ability to provide secure data management solutions is therefore paramount to meeting this critical market need.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and distributed ledger technology (DLT) are poised to significantly reshape financial operations by bolstering transparency, security, and the immutability of records. These advancements are particularly relevant for compliance and auditing, offering a robust framework for data integrity.

While widespread regulatory adoption is still evolving, DFIN can strategically leverage blockchain and DLT to create unalterable audit trails. This can streamline critical processes like Know Your Customer (KYC) and Anti-Money Laundering (AML) by providing a secure and verifiable digital identity and transaction history.

The market for blockchain in financial services is experiencing substantial growth. For instance, the global blockchain in financial services market was valued at approximately $2.8 billion in 2023 and is projected to reach over $16.5 billion by 2028, with a compound annual growth rate (CAGR) of roughly 42.5% during this period. This rapid expansion highlights the increasing industry confidence and investment in these transformative technologies.

Integrating these technologies offers several key benefits for DFIN:

- Enhanced Data Security: Cryptographic hashing and distributed consensus mechanisms make data extremely difficult to alter or compromise.

- Improved Transparency: Shared ledgers allow authorized participants to view transaction histories, fostering trust and accountability.

- Streamlined Compliance: Automating KYC/AML checks and maintaining immutable records can significantly reduce manual effort and regulatory risk.

- Operational Efficiency: Faster settlement times and reduced intermediaries can lead to cost savings and quicker processing.

Data Analytics and Big Data Processing

The capacity to process and extract valuable information from enormous datasets is paramount for robust compliance and effective risk mitigation in the financial sector. DFIN's offerings are significantly enhanced by sophisticated data analytics, enabling the detection of irregularities, forecasting potential risks, and delivering actionable intelligence to clients navigating intricate regulatory landscapes and reporting mandates.

Advanced data analytics empowers DFIN to assist clients in meeting these challenges. For instance, in 2024, the global big data analytics market was projected to reach over $300 billion, highlighting the increasing reliance on such technologies. DFIN leverages this trend by providing tools that scrutinize financial data, ensuring accuracy and adherence to evolving compliance standards.

- Enhanced Risk Identification: DFIN's analytics can identify subtle patterns indicating potential financial fraud or operational risks, which might otherwise go unnoticed.

- Regulatory Compliance Automation: By processing large volumes of regulatory data, DFIN helps automate compliance checks, reducing manual effort and potential errors.

- Predictive Insights: Advanced analytics allow DFIN to offer predictive models, helping clients anticipate market shifts or compliance breaches before they occur.

- Improved Reporting Accuracy: The ability to analyze vast datasets ensures that client reports are not only compliant but also highly accurate and insightful.

Technological advancements, particularly in AI and cloud computing, are reshaping DFIN's operational landscape and client offerings. The integration of AI and machine learning is automating compliance, improving fraud detection, and enabling predictive analytics for risk management, with financial institutions seeing significant reductions in false positives in AML processes by up to 40% in 2024.

DFIN's strategic focus on SaaS revenue benefits from the robust growth of the cloud computing sector, with the global SaaS market projected to exceed $300 billion by mid-2024, allowing for more efficient service delivery and reduced infrastructure costs for clients.

The increasing sophistication of cyber threats, with the average cost of a data breach reaching $4.73 million globally in 2024, creates a demand for DFIN's secure data management and compliance solutions.

Blockchain and DLT offer opportunities for enhanced transparency and security in financial operations, with the blockchain in financial services market expected to grow from $2.8 billion in 2023 to over $16.5 billion by 2028, enabling DFIN to create immutable audit trails for improved KYC and AML processes.

Legal factors

DFIN operates within a constantly shifting global financial regulatory environment. Key frameworks like Basel III, with its latest iterations CRR III and CRD VI, alongside directives such as PSD3, are undergoing continuous updates. These changes introduce new capital requirements and operational mandates that financial institutions must adhere to.

The complexity and pace of these legal evolution are notable, with expectations for intensified regulatory scrutiny and new obligations to emerge throughout 2025. DFIN's business model is intrinsically linked to assisting clients in successfully navigating these intricate and evolving legal landscapes.

For instance, the implementation of CRR III, which fully applies from January 1, 2025, for many institutions, introduces significant adjustments to risk-weighted asset calculations and capital buffers. Similarly, PSD3 aims to foster further competition and innovation in payments, potentially impacting how financial services firms manage data and customer interactions.

Global data privacy laws are getting stricter. Think about regulations like GDPR in Europe, CCPA in California, and the new Digital Operational Resilience Act (DORA) in the EU. These laws mean financial companies, including DFIN, have to be very careful about how they handle customer information – how it's collected, used, and kept safe.

DFIN needs to make sure its systems and services completely follow these rules. This is especially true for DORA, which financial institutions in the EU had to comply with starting in January 2025. Failing to comply can lead to hefty fines and damage to reputation.

The evolving landscape of AI regulation, exemplified by the EU AI Act’s upcoming implementation in mid-2024, directly influences DFIN’s strategic approach to developing and deploying its AI-driven compliance solutions. This legislation introduces stringent requirements for AI systems, particularly those deemed high-risk, which will likely encompass many of DFIN’s offerings.

DFIN must meticulously navigate legal mandates concerning AI transparency, ensuring users understand how its tools operate, and accountability, establishing clear lines of responsibility for AI-driven outcomes. Meeting these demands is crucial for DFIN to maintain legal compliance and foster trust in its AI-powered products.

Furthermore, DFIN faces legal obligations to actively mitigate bias within its AI algorithms to prevent discriminatory results and to uphold robust data governance practices. Failure to adhere to these principles could result in significant penalties and reputational damage, impacting DFIN’s market position.

Cybersecurity Compliance Mandates

Legal mandates surrounding cybersecurity are tightening significantly. These requirements often include strict protocols for reporting data breaches and ensuring operational resilience in the face of cyber threats.

DFIN, as a vital technology partner for financial institutions, faces heightened scrutiny. It must rigorously adhere to these evolving cybersecurity compliance standards to safeguard sensitive client data and guarantee uninterrupted service delivery.

For instance, the European Union's Digital Operational Resilience Act (DORA), fully applicable from January 2025, imposes comprehensive requirements on financial entities and their critical third-party providers, like DFIN, concerning ICT risk management, incident reporting, and resilience testing. This regulation reflects a global trend towards more robust cybersecurity oversight.

- Increased Regulatory Scrutiny: Financial regulators worldwide are intensifying oversight of third-party technology providers like DFIN.

- Mandatory Incident Reporting: Laws now require timely and detailed reporting of cybersecurity incidents, impacting DFIN's response protocols.

- Operational Resilience Requirements: DFIN must demonstrate its ability to maintain critical operations even when facing cyberattacks or system failures.

- Data Protection Laws: Compliance with regulations like GDPR and CCPA necessitates stringent data handling and security measures for DFIN.

ESG Reporting and Disclosure Requirements

New and expanding legal mandates for Environmental, Social, and Governance (ESG) reporting, such as the EU's Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy Regulation, present substantial legal compliance hurdles for DFIN’s clientele. These regulations are increasingly requiring detailed and standardized disclosures, impacting how companies report their sustainability performance. For instance, the CSRD, which began applying to large listed companies in fiscal year 2024, significantly broadens the scope of mandatory ESG reporting.

DFIN must proactively adapt and enhance its technological solutions to facilitate accurate, transparent, and legally compliant ESG disclosures for its clients. This involves ensuring its platforms can capture, manage, and report the vast array of data points now mandated by these evolving legal frameworks. Meeting these requirements is critical for maintaining client trust and ensuring market access, especially as regulatory bodies worldwide tighten oversight on sustainability information.

The legal landscape for ESG is rapidly evolving, with new legislation and amendments expected to continue shaping reporting obligations. For example, the SEC’s Climate Disclosure Rule, though facing legal challenges, illustrates the global trend towards mandated climate-related financial disclosures. DFIN needs to stay abreast of these dynamic legal changes to provide relevant and effective solutions.

- CSRD Application: The Corporate Sustainability Reporting Directive (CSRD) began applying to approximately 11,700 companies in the EU from January 1, 2024, for their 2023 financial year reports, with further expansions planned for 2025 and 2026.

- EU Taxonomy Alignment: The EU Taxonomy Regulation requires companies to disclose the environmental performance of their investments, with specific reporting obligations for financial undertakings starting in 2024.

- Global Regulatory Trends: Over 1,000 ESG-related regulations were introduced globally between 2020 and 2023, highlighting the accelerating pace of legal requirements for corporate sustainability.

DFIN must navigate an increasingly complex web of global financial regulations, with ongoing updates to frameworks like Basel III, PSD3, and DORA impacting capital requirements and operational mandates. The EU AI Act, set for implementation in mid-2024, will impose stringent rules on AI transparency, accountability, and bias mitigation, directly influencing DFIN's AI-driven solutions.

Stringent data privacy laws such as GDPR and CCPA, alongside DORA's emphasis on operational resilience, necessitate robust data handling and security for DFIN. Cybersecurity compliance is also paramount, with DORA's broad ICT risk management requirements for critical third-party providers like DFIN highlighting a global trend toward enhanced oversight.

The evolving ESG reporting landscape, driven by directives like the CSRD and the EU Taxonomy, requires DFIN to facilitate accurate and transparent sustainability disclosures for its clients, with the CSRD impacting thousands of companies from fiscal year 2024.

| Regulation | Key Impact on DFIN | Effective Date/Period |

|---|---|---|

| CRR III / CRD VI | Adjustments to risk-weighted asset calculations and capital buffers | Fully applicable from January 1, 2025 |

| PSD3 | Potential impact on data management and customer interactions in payments | Ongoing evolution |

| DORA | Comprehensive ICT risk management, incident reporting, and resilience testing for third-party providers | Fully applicable from January 2025 |

| EU AI Act | Strict requirements for AI transparency, accountability, bias mitigation | Implementation mid-2024 |

| CSRD | Mandatory detailed ESG disclosures for clients | Applied to large listed companies from fiscal year 2024 |

Environmental factors

Regulators globally are intensifying their focus on environmental, social, and governance (ESG) factors, leading to a surge in mandatory reporting requirements for financial institutions. This trend is directly impacting DFIN's client base, who are increasingly seeking robust solutions for environmental data management. For instance, the Corporate Sustainability Reporting Directive (CSRD) in the European Union mandates comprehensive ESG disclosures, with initial reports expected from early filers in 2024 covering the 2023 financial year.

Investors are also playing a pivotal role, with a growing number of institutional investors demanding greater transparency on environmental performance before committing capital. This shift is pushing companies like DFIN to develop and refine their services to help clients accurately capture, aggregate, and report environmental data, ensuring compliance with evolving frameworks such as the EU Taxonomy for sustainable activities. A 2024 report indicated that over 70% of investors consider ESG factors material to their investment decisions.

Regulators worldwide are stepping up requirements for financial institutions to disclose climate-related financial risks. This includes both physical risks, like damage from extreme weather, and transitional risks, such as policy changes impacting carbon-intensive industries. For instance, by early 2025, many jurisdictions expect robust reporting on these exposures.

DFIN is well-positioned to assist clients by offering sophisticated tools designed to pinpoint, measure, and report on these evolving climate risks. These solutions can seamlessly embed climate considerations into existing risk management processes and compliance structures, ensuring adherence to new regulatory mandates.

The financial sector is seeing a significant shift, with major banks and asset managers actively enhancing their climate risk assessment capabilities. For example, a 2024 survey indicated that over 60% of large financial firms were implementing new frameworks for climate risk disclosure, driven by regulatory pressure and investor demand.

DFIN, while a software and services firm, faces scrutiny regarding its operational carbon footprint. Companies like DFIN are increasingly expected to demonstrate a commitment to sustainability, impacting their brand image and ability to attract both clients and employees who prioritize environmental responsibility.

In 2023, many technology companies reported progress in reducing their Scope 1 and Scope 2 emissions. For instance, a significant portion of the tech sector aims for carbon neutrality by 2030, a trend DFIN will likely align with to maintain competitiveness.

Adopting sustainable business practices, such as optimizing data center energy efficiency and reducing business travel, is becoming a standard expectation. Transparent reporting on these environmental metrics, as seen with many publicly traded companies in the 2024-2025 period, bolsters credibility and market appeal.

Supply Chain Environmental Standards

DFIN, like many companies, is increasingly expected to showcase the environmental responsibility of its entire supply chain. This means scrutinizing not only its own operations but also those of its partners, particularly in areas like data centers and technology providers. As of 2024, a significant portion of corporate buyers are integrating environmental, social, and governance (ESG) criteria into their procurement processes, with over 70% of large companies reporting such practices.

This trend puts pressure on DFIN to ensure its technology infrastructure and data handling partners adhere to sustainability benchmarks. For instance, a growing number of data center operators are investing in renewable energy sources; in 2023, the global data center industry saw a notable increase in renewable energy procurement, with some major players aiming for 100% renewable energy by 2030.

Failure to demonstrate robust environmental standards within its supply chain could impact DFIN’s reputation and its ability to secure business with clients who prioritize sustainability. This includes ensuring that partners are actively working to reduce carbon emissions and manage waste responsibly.

- Growing Client Scrutiny: Over 70% of large corporations now incorporate ESG factors into their procurement decisions, impacting DFIN's supply chain demands.

- Data Center Sustainability: The data center industry is actively pursuing renewable energy, with many aiming for 100% renewable power by 2030.

- Reputational Risk: Non-compliance with environmental standards in the supply chain can damage DFIN's brand and client relationships.

Resource Scarcity and Energy Costs for Data Centers

The relentless growth in digital services, from cloud computing to AI, directly translates into escalating energy demands for data centers like those operated by DFIN. This heightened consumption places DFIN squarely in the path of fluctuating energy markets.

As global resource scarcity tightens and governments implement carbon pricing mechanisms, the cost of energy is a significant concern. For instance, in 2024, the average price of electricity for industrial users in many developed nations saw an uptick of 5-10% compared to the previous year, a trend expected to continue. These rising operational expenses could notably affect DFIN's profitability.

To navigate this challenge, DFIN must prioritize strategic investments in energy-efficient infrastructure and renewable energy sources. This proactive approach is not just about sustainability; it's a crucial element of long-term cost management and operational resilience. Companies that embraced renewable energy procurement in 2024 reported an average reduction in energy costs by 7-12% over a five-year period.

- Increasing Digital Demand: Global data center energy consumption is projected to rise by 20-30% by 2027, driven by AI and big data analytics.

- Rising Energy Costs: In 2024, industrial electricity prices in regions like Europe increased by an average of 8%, influenced by natural gas prices and renewable energy transition costs.

- Strategic Investments: Companies investing in energy efficiency measures and renewable power purchase agreements saw an average operational cost saving of 5% in 2024.

- Carbon Pricing Impact: The expansion of carbon taxes or cap-and-trade systems in key markets adds a direct cost layer to energy consumption for data center operators.

The increasing focus on environmental regulations and climate risk disclosure by governments and investors directly impacts DFIN's business. Companies are being compelled to report on their environmental performance, creating a demand for services that manage and analyze this data. For example, the EU’s CSRD, which began reporting for early filers in 2024, mandates extensive ESG disclosures, and over 70% of investors now consider ESG factors in their decisions.

DFIN's operational footprint, particularly its reliance on energy-intensive data centers, is also under scrutiny. As digital services grow, so does energy consumption, leading to rising operational costs influenced by fluctuating energy markets and carbon pricing mechanisms. By 2024, industrial electricity prices in regions like Europe rose by an average of 8%. To mitigate these risks and costs, DFIN must invest in energy efficiency and renewable energy sources, a strategy that can yield operational cost savings of up to 5% annually.

| Environmental Factor | Impact on DFIN | Supporting Data (2023-2025) |

| Regulatory Pressure (ESG Reporting) | Increased demand for data management and reporting solutions. | CSRD reporting began in 2024 for early filers; 70%+ of investors consider ESG material. |

| Climate Risk Disclosure | Need for tools to help clients assess and report climate-related financial risks. | Many jurisdictions expect robust climate risk reporting by early 2025. |

| Operational Energy Consumption | Rising energy costs and potential for increased operational expenses. | Industrial electricity prices in Europe up 8% in 2024; data center energy use projected to rise 20-30% by 2027. |

| Supply Chain Sustainability | Pressure to ensure partners meet environmental standards, impacting procurement. | 70%+ of large companies integrate ESG into procurement; many data centers aim for 100% renewable energy by 2030. |

PESTLE Analysis Data Sources

Our DFIN PESTLE analysis is meticulously constructed using data from reputable sources including the International Monetary Fund (IMF), World Bank, and leading market research firms. This ensures comprehensive coverage of political stability, economic indicators, and technological advancements.