DFIN Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

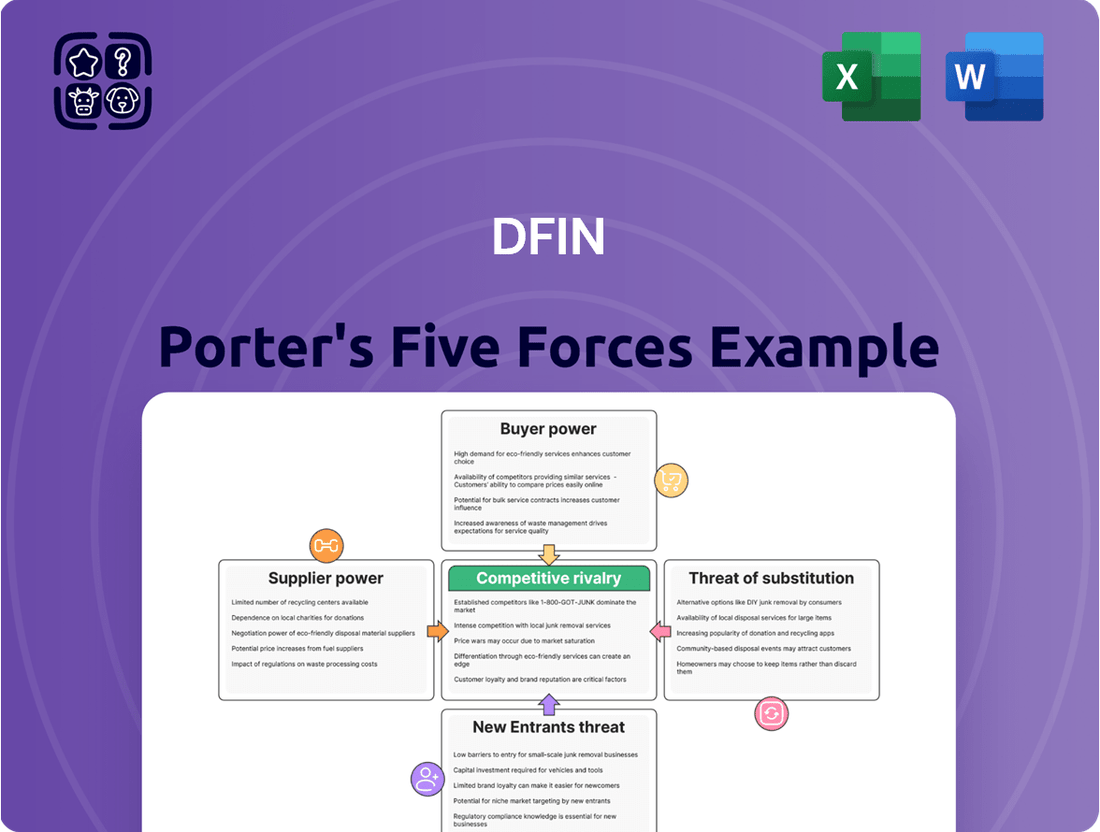

DFIN's competitive landscape is a complex interplay of five key forces. Understanding the bargaining power of both buyers and suppliers, the intensity of rivalry among existing competitors, the threat of new entrants, and the potential impact of substitute products is crucial for any strategic decision. This brief snapshot only scratches the surface of these dynamics. Unlock the full Porter's Five Forces Analysis to explore DFIN’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

DFIN's reliance on specialized software and cloud infrastructure means suppliers in this domain hold considerable sway. If these providers offer truly unique or essential components that are hard to replace, they can command higher prices or dictate terms, impacting DFIN's profitability.

The difficulty in switching from a deeply integrated software or cloud provider can further amplify their bargaining power. This means DFIN might face increased costs or operational constraints if these key suppliers decide to adjust their pricing or service agreements unfavorably.

DFIN's own financial disclosures, such as its 2025 investor presentation detailing capital expenditures for software development and supporting technologies, underscore this dependence. These investments highlight the critical nature of these specialized suppliers to DFIN's RegTech operations.

DFIN's reliance on highly skilled professionals, especially in areas like regulatory compliance, financial technology, and cybersecurity, means these individuals hold significant bargaining power. A shortage of such specialized talent, a trend observed across the broader RegTech sector, can force DFIN to offer higher compensation and benefits to attract and retain these crucial employees, directly impacting operational costs.

Data providers hold significant bargaining power over DFIN. DFIN's core business relies heavily on accessing extensive financial and regulatory data, making it dependent on these suppliers. Companies with unique or exceptionally high-quality datasets can command higher licensing fees, directly impacting DFIN's operational costs.

The increasing emphasis on data integrity and compliance in financial reporting, especially in 2024, further amplifies the leverage of reliable data sources. For instance, the demand for real-time, audited financial data for regulatory filings means DFIN must secure these from providers who can guarantee accuracy and timeliness, often at a premium.

Hardware and Network Equipment Vendors

While DFIN's core business is software, it relies on hardware and network equipment for its operations, whether in its own data centers or through cloud providers. Suppliers of specialized, high-performance, or secure IT infrastructure components can wield significant bargaining power, especially when DFIN has unique or demanding technical specifications. For instance, the global data center infrastructure market was valued at approximately $206.5 billion in 2023 and is projected to grow, indicating a substantial ecosystem of suppliers.

DFIN's ongoing investment in technology platforms, including cloud migration and data analytics capabilities, means it continually needs to procure hardware and network services. This creates a consistent demand, but the power of these suppliers hinges on factors like:

- Market Concentration: If only a few vendors can supply the required specialized hardware (e.g., high-end servers, advanced networking gear), their bargaining power increases.

- Switching Costs: The effort and expense involved in changing hardware or network vendors can influence DFIN's ability to negotiate favorable terms. High switching costs give suppliers more leverage.

- DFIN's Scale: As a large enterprise, DFIN's purchasing volume can provide some leverage against suppliers, but this is counterbalanced by the specialized nature of some technology needs.

The reliance on specific hardware for critical functions, such as secure data processing or high-speed transaction capabilities, can amplify supplier influence. For example, in 2024, the demand for advanced semiconductor chips for AI and high-performance computing remained strong, giving chip manufacturers considerable pricing power.

Legal and Consulting Services

DFIN, deeply involved in regulatory compliance, often relies on external legal and consulting firms for expert guidance on shifting regulations and intricate client matters. These specialized service providers, possessing unique expertise and established reputations, can command significant leverage in negotiating fees and service agreements, especially given the constant evolution and complexity of the regulatory landscape.

For instance, the global legal services market was valued at approximately $730 billion in 2023 and is projected to grow steadily, reflecting the ongoing demand for specialized legal counsel across various industries. Similarly, the management consulting market, estimated at over $300 billion in 2023, highlights the significant reliance businesses place on external expertise for strategic and operational advice, including navigating regulatory environments.

- High Switching Costs: DFIN might incur substantial costs and disruptions if it were to switch legal or consulting partners, particularly for ongoing regulatory matters.

- Concentration of Expertise: Specialized firms often hold a near-monopoly on niche regulatory knowledge, making it difficult for DFIN to find readily available alternatives.

- Reputation and Brand Value: The reputation of a legal or consulting firm is critical in sensitive regulatory contexts, giving well-regarded providers pricing power.

- Essential Services: The critical nature of compliance and regulatory advice means DFIN cannot easily forgo these services, strengthening supplier bargaining power.

DFIN's reliance on specialized software, cloud infrastructure, and critical data providers grants these suppliers significant bargaining power. Their ability to dictate terms is amplified by high switching costs and the unique nature of the services or data they offer. For instance, DFIN's significant investments in technology platforms, as noted in its 2025 financial outlook, highlight its dependence on these key external resources, impacting cost structures.

The market for specialized regulatory data and advanced IT infrastructure, including semiconductors crucial for high-performance computing, saw continued demand and price strength through 2024. This environment benefits suppliers who offer unique, high-quality datasets or essential technological components, allowing them to command premium pricing and favorable contract terms.

Furthermore, DFIN's need for expert legal and consulting services in the complex and evolving regulatory landscape empowers these niche providers. Their specialized knowledge, established reputations, and the high switching costs associated with changing advisors mean they can negotiate higher fees, directly influencing DFIN's operational expenses.

| Supplier Category | Impact on DFIN | Example Data/Trend (2024-2025) | Supplier Bargaining Power Factors |

|---|---|---|---|

| Software & Cloud Providers | Increased costs, potential operational constraints | Continued demand for cloud services, driving provider pricing power. | High switching costs, proprietary technology |

| Data Providers | Higher licensing fees, reliance on data integrity | Growing demand for real-time, audited financial data. | Uniqueness of data, data quality assurance |

| IT Infrastructure Suppliers | Potential for increased hardware costs | Strong demand for advanced semiconductors and data center equipment. | Market concentration, specialized technical requirements |

| Legal & Consulting Firms | Higher fees for specialized expertise | Ongoing complexity in regulatory environments, increasing reliance on expert advice. | Concentration of niche expertise, reputation |

What is included in the product

DFIN's Porter's Five Forces Analysis offers a comprehensive examination of the competitive forces impacting the company, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Quickly identify and prioritize competitive threats with a visual, actionable framework, eliminating guesswork in strategic planning.

Customers Bargaining Power

DFIN's substantial customer base, particularly its large financial institutions, significantly influences its bargaining power of customers. These sophisticated clients, often representing substantial transaction volumes, possess considerable leverage to negotiate favorable terms and pricing. DFIN's investor presentations consistently showcase a robust portfolio of Fortune 500 companies and leading global fund complexes, underscoring the concentrated purchasing power these entities wield.

While customers do possess bargaining power, the significant switching costs associated with DFIN's regulatory reporting and compliance systems can effectively diminish their leverage. These costs encompass the substantial investments required for integration of new systems, complex data migration, and the essential retraining of personnel, all of which contribute to making DFIN's offerings quite sticky for their client base.

DFIN's compliance services are vital for financial institutions, especially as regulatory landscapes become more intricate. For example, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust compliance measures across the financial sector.

This mission-critical nature means customers are often hesitant to push too hard on price. The potential costs of non-compliance, including hefty fines and significant reputational damage, far outweigh any short-term savings from aggressive negotiation. This dependency grants DFIN a degree of leverage.

Customer Concentration in Specific Segments

DFIN's customer base exhibits a degree of concentration within specific financial services segments, particularly capital markets and investment companies. This concentration means that a few large clients or dominant market segments can wield significant bargaining power. If a substantial portion of DFIN's revenue stems from a limited number of these key customers, they could demand more favorable pricing, enhanced service offerings, or influence product roadmaps, knowing their business is crucial to DFIN's performance. For instance, a slowdown in IPO activity or a shift in investment strategies among major asset managers could disproportionately affect DFIN's revenue streams.

The bargaining power of customers is amplified when they represent a significant portion of a company's revenue. For DFIN, this dynamic is particularly relevant given its specialization. The departure of even a few major clients in its core segments could lead to a noticeable impact on financial results.

- Customer Concentration Impact: If DFIN derives a large percentage of its income from a small number of clients, those clients gain leverage to negotiate better terms.

- Segment Focus: DFIN's emphasis on capital markets and investment sectors means that shifts within these areas can directly affect its customer relationships and pricing power.

- Potential for Demands: Concentrated customers can push for lower prices, higher service quality, or specific product features, threatening DFIN's profitability and strategic direction.

Potential for In-house Solutions or Hybrid Models

Sophisticated financial institutions, especially larger ones, might explore developing some compliance tools internally or adopting hybrid approaches. This is particularly true if they possess strong IT departments. For instance, a major bank with a dedicated fintech division could potentially build a custom anti-money laundering (AML) screening tool, reducing reliance on external vendors like DFIN.

This capability to develop in-house solutions acts as a significant bargaining lever when negotiating with DFIN. While the upfront investment and ongoing maintenance can be substantial, the threat of self-provisioning can lead to more favorable pricing or service agreements. Consider that in 2024, the average cost for developing custom enterprise software can range from $150,000 to over $1 million, depending on complexity.

- Potential for In-house Development: Financial institutions with robust IT infrastructure can explore building certain compliance tools internally.

- Hybrid Model Adoption: Combining in-house capabilities with external vendor solutions offers flexibility and can strengthen negotiation positions.

- Bargaining Chip: The option to develop solutions independently provides customers leverage when discussing terms with DFIN.

- Cost-Benefit Analysis: Despite the potential for in-house development, the high costs and complexity often make external solutions more economically viable in the long run.

The bargaining power of DFIN's customers is a key consideration, particularly for its large financial institution clients who represent significant transaction volumes. These sophisticated buyers possess considerable leverage to negotiate favorable terms, as evidenced by DFIN's consistent reporting of a robust client base including Fortune 500 companies and leading global fund complexes.

While switching costs for DFIN's critical compliance systems are high, potentially mitigating customer leverage, the concentration of DFIN's revenue within specific segments like capital markets means key clients can still exert substantial influence. For instance, a major asset manager could leverage its substantial business to demand price concessions or influence product development. In 2024, the financial sector continued to navigate complex regulatory environments, making DFIN's services indispensable, yet the threat of in-house development by well-resourced clients remains a bargaining chip.

| Factor | Impact on DFIN | Mitigating Factors for DFIN |

|---|---|---|

| Customer Concentration | High leverage for major clients in capital markets and investment sectors. | High switching costs for regulatory reporting systems. |

| In-house Development Potential | Threat of self-provisioning can lead to negotiation leverage. | High upfront costs and complexity of developing custom compliance tools. |

| Mission-Critical Nature of Services | Reduces price sensitivity due to compliance risks. | Sophisticated clients may still seek cost efficiencies through negotiation. |

Preview the Actual Deliverable

DFIN Porter's Five Forces Analysis

This preview showcases the complete DFIN Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive instantly upon purchase. It meticulously details the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You're looking at the actual document that will be yours to use immediately, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The RegTech market, while still somewhat fragmented with many specialized firms, is actively consolidating. This means DFIN encounters competition not only from these niche providers but also from larger, established technology companies that are acquiring smaller, innovative RegTech startups. For instance, in 2024, several significant acquisitions occurred as larger financial technology providers sought to bolster their compliance offerings.

DFIN's competitive landscape includes both these specialized RegTech companies and broader enterprise software vendors expanding into regulatory compliance solutions. This dual threat means DFIN must contend with deep expertise in specific regulatory areas from smaller players and the extensive reach and resources of larger technology giants entering the space.

The RegTech sector is experiencing robust growth, with market research projecting continued expansion through 2025 and beyond. This attractive growth trajectory fuels both the entry of new competitors and the strategic acquisitions by existing players, intensifying the competitive pressure on DFIN.

Competitive rivalry within the financial disclosure sector is fierce, driven by the critical importance of regulatory expertise and advanced technology. Companies like DFIN compete not just on price, but on their ability to navigate complex and ever-changing compliance requirements. This necessitates a constant investment in both human capital with deep regulatory knowledge and cutting-edge technological solutions.

DFIN's strategy hinges on continuous innovation, particularly in its Software-as-a-Service (SaaS) offerings such as ActiveDisclosure and Arc Suite. These platforms are designed to streamline the often-arduous process of financial reporting and regulatory filings. By enhancing the sophistication and user-friendliness of these tools, DFIN aims to create a significant differentiation from competitors who may lag in technological adoption or specialized expertise.

The ability to adapt to evolving regulatory landscapes is paramount. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine its disclosure rules, impacting how companies prepare and submit their financial information. DFIN’s success is directly tied to its capacity to quickly integrate these changes into its technology and service models, offering clients seamless compliance solutions.

In 2023, the global RegTech market, which encompasses many of the technologies DFIN employs, was valued at approximately $11.7 billion and is projected to grow substantially. This growth underscores the increasing demand for sophisticated technological solutions in financial compliance, a trend that intensifies the competitive landscape and rewards firms like DFIN that can effectively meet these demands.

In financial compliance, competitive rivalry is intensified by the critical importance of customer relationships and trust. Competitors battle for market share by showcasing unwavering reliability, robust data security, and a nuanced grasp of unique client regulatory hurdles. This focus makes winning new clients an uphill battle.

DFIN's strategy leverages its client-centric approach, fostering deep trust and leading to high client retention. For instance, in 2023, DFIN reported a significant portion of its revenue stemmed from long-term client relationships, underscoring the value placed on enduring partnerships within the industry.

Pricing Pressure and Value Proposition

The competitive landscape for DFIN is characterized by significant pricing pressure. This is driven by the need to constantly prove the robust value proposition of its solutions, which offer clients substantial risk reduction, notable efficiency improvements, and tangible cost savings. For instance, in 2024, many companies in the financial services sector were actively seeking technology partners that could demonstrate a clear return on investment, making price a critical factor in purchasing decisions.

Competition extends beyond just price, with firms vying on key features, the scalability of their offerings, and seamless integration capabilities. This is particularly relevant as artificial intelligence (AI) becomes increasingly integrated into Regulatory Technology (RegTech) solutions. Companies are looking for platforms that can adapt to evolving regulatory requirements and leverage AI for enhanced compliance and data analysis.

- Intensified Pricing Pressure: DFIN faces constant pressure to justify its pricing by highlighting the direct benefits of its services, such as reduced compliance costs and mitigated regulatory risks.

- Value-Based Competition: Success hinges on demonstrating clear value, including efficiency gains and cost savings, which is crucial in the current economic climate.

- Feature and Scalability Wars: Competitors are differentiating on the depth of features, the ability to scale with client growth, and interoperability, especially with AI advancements in RegTech.

- AI Integration as a Differentiator: The strategic adoption and effective deployment of AI in its solutions are becoming critical for DFIN to maintain a competitive edge and meet evolving client demands for sophisticated RegTech capabilities.

Global Reach and Localized Compliance

DFIN's competitive landscape is defined by a tension between global reach and the necessity of localized compliance. Companies like DFIN must navigate a complex web of regulations that vary significantly by country and even within regions. This creates a battleground where firms with extensive international operations compete against those deeply entrenched in specific regional markets and their unique compliance demands. North America, for instance, represents a substantial market for regulatory reporting solutions, highlighting the importance of mastering its specific requirements.

The ability to offer a comprehensive suite of services that address diverse global and local compliance needs is a critical differentiator. For example, as of early 2024, the increasing complexity of ESG (Environmental, Social, and Governance) reporting mandates across jurisdictions like the EU and the US necessitates specialized expertise. Companies that can provide seamless, compliant solutions across these varied regulatory environments gain a significant competitive advantage.

- Global Firms vs. Regional Specialists: DFIN faces competition from both large, multinational players with broad service offerings and smaller, specialized firms excelling in specific regional compliance.

- Regulatory Complexity as a Battleground: The core competition revolves around how effectively companies can adapt to and manage the ever-changing and diverse regulatory landscapes worldwide.

- North America as a Key Market: The significant demand for regulatory reporting solutions in North America underscores its importance in the competitive strategy for global players like DFIN.

- ESG Reporting Demands: The growing emphasis on ESG compliance is a significant factor, with companies needing to demonstrate robust capabilities in meeting these new, varied international standards.

Competitive rivalry in the financial disclosure sector is intense, driven by the need for regulatory expertise and advanced technology. DFIN competes on its ability to navigate complex compliance, requiring continuous investment in knowledgeable staff and cutting-edge solutions.

The market sees competition from specialized RegTech firms and larger enterprise software vendors. DFIN differentiates through its SaaS offerings like ActiveDisclosure and Arc Suite, focusing on user-friendliness and sophisticated features to stay ahead.

The global RegTech market's substantial growth, valued at approximately $11.7 billion in 2023, fuels competition and rewards firms that can meet increasing demands for sophisticated compliance technology.

DFIN faces pricing pressure, emphasizing value through risk reduction, efficiency, and cost savings, a critical factor for financial services clients in 2024 seeking clear ROI.

| Competitor Type | Key Differentiators | Example Focus Areas |

| Specialized RegTech Firms | Deep regulatory expertise, niche solutions | Specific compliance modules, localized knowledge |

| Large Enterprise Software Vendors | Extensive resources, broad market reach | Acquisitions of RegTech startups, integrated platforms |

| DFIN | SaaS innovation, client-centric approach | ActiveDisclosure, Arc Suite, AI integration, ESG reporting |

SSubstitutes Threaten

Manual processes and traditional consulting represent a significant threat of substitutes for DFIN's automated solutions. While less efficient, financial institutions might opt to revert to extensive spreadsheet use and engage traditional legal or accounting firms for regulatory reporting and compliance needs. This approach, particularly for less complex or smaller-scale requirements, offers an alternative, albeit one carrying higher risks of error and potential non-compliance.

For basic document creation and communication, readily available generic office productivity tools can act as substitutes. For instance, users might leverage standard word processors and spreadsheet software for simple data entry or report generation, bypassing DFIN's more sophisticated features. However, these alternatives typically lack the specialized regulatory compliance capabilities and automated workflows that are DFIN's core value proposition.

Large financial institutions, particularly those with substantial IT budgets, increasingly opt for in-house developed regulatory reporting and compliance solutions. This internal development acts as a potent substitute, especially when commercial offerings are seen as inadequately addressing highly specialized or unique operational needs. For instance, major banks in 2024 are investing billions in custom technology, with some allocating over 15% of their operating budget to IT infrastructure and development, aiming for greater control and tailored compliance frameworks.

Alternative Compliance Software Vendors with Different Approaches

Beyond direct competitors, alternative compliance software vendors present a threat by offering specialized solutions that can partially substitute DFIN's broader services. These vendors might focus on niche areas like data governance or specific regulatory frameworks, attracting businesses that prioritize these aspects over a comprehensive suite. The evolving market landscape sees new entrants integrating advanced technologies such as AI to streamline compliance processes, potentially offering more agile and cost-effective solutions for certain business needs.

For instance, while DFIN offers a wide range of regulatory and compliance solutions, a company needing only robust data privacy management might opt for a specialized vendor. This segmentation of the market means DFIN faces indirect competition from these focused players. The rise of AI in compliance is a significant trend, with reports indicating a growing adoption rate across industries. By 2024, the global AI in Fintech market was projected to reach substantial figures, highlighting the potential for AI-driven compliance tools to disrupt traditional offerings.

- Specialized Vendors: Companies offering solutions focused on data governance, cybersecurity compliance, or specific industry regulations (e.g., HIPAA for healthcare) act as partial substitutes.

- AI Integration: New software vendors are incorporating artificial intelligence to automate tasks like risk assessment, transaction monitoring, and regulatory reporting, offering potentially more efficient alternatives.

- Market Disruption: The emergence of these specialized and AI-powered solutions can fragment the market, drawing away customers seeking targeted capabilities rather than a full-service platform.

- Cost-Effectiveness: In some cases, niche solutions might offer a more cost-effective alternative for businesses with specific, limited compliance needs compared to DFIN's broader, potentially more expensive, integrated platforms.

Outsourcing to Business Process Outsourcers (BPOs)

The threat of substitutes for DFIN's software arises significantly from Business Process Outsourcers (BPOs). Financial firms may choose to offload their entire regulatory reporting and compliance obligations to these specialized BPO providers. This effectively bypasses the need for DFIN's direct software licensing, as the BPO manages the entire process, often with their proprietary tools.

This outsourcing trend allows clients to shift the operational burden and complexity of compliance management away from their internal resources. By engaging a BPO, firms gain access to specialized expertise and infrastructure without direct software investment. For instance, the global business process outsourcing market was valued at approximately $262 billion in 2023 and is projected to grow, indicating a substantial and expanding alternative for managing financial processes.

- BPO providers offer end-to-end solutions for regulatory reporting and compliance.

- Clients can outsource management and operational complexities to BPOs.

- BPOs may utilize their own proprietary software, substituting DFIN's offerings.

- The growing BPO market, valued at over $260 billion in 2023, highlights its significance as a substitute.

The threat of substitutes for DFIN's offerings is multifaceted, ranging from manual processes to sophisticated in-house solutions. While less efficient, manual processes and traditional consulting firms remain viable substitutes for less complex needs, albeit with higher error potential. Generic office productivity tools can also serve as basic substitutes for simple data entry, though they lack DFIN's specialized regulatory capabilities.

Large financial institutions are increasingly developing in-house solutions, a significant substitute driven by the need for greater control and tailored compliance. For instance, in 2024, major banks continued to invest heavily in custom IT, with a notable portion of their budgets allocated to internal development to meet unique operational requirements.

Specialized software vendors focusing on niche areas like data governance or specific regulations also present a threat by offering targeted, potentially more cost-effective alternatives. The integration of AI into compliance solutions by new entrants further intensifies this threat, offering more agile and automated processes.

Business Process Outsourcers (BPOs) represent another substantial substitute, as they manage entire regulatory reporting and compliance functions for clients. This trend is supported by the robust growth of the BPO market, which was valued at approximately $262 billion in 2023, demonstrating a significant outsourcing alternative.

| Substitute Category | Description | Key Characteristics | Impact on DFIN | Example Data (2023/2024) |

|---|---|---|---|---|

| Manual Processes & Traditional Consulting | Using spreadsheets or engaging external accounting/legal firms. | Lower efficiency, higher error risk, suitable for simple tasks. | Draws clients with basic needs; less of a threat for complex compliance. | N/A specific to DFIN; general market trend. |

| In-House Development | Financial institutions building their own regulatory software. | Greater control, tailored solutions, significant IT investment required. | Major threat for large institutions with substantial IT budgets. | Banks allocating over 15% of operating budget to IT in 2024 for custom solutions. |

| Specialized Software Vendors | Companies offering solutions for niche compliance areas (e.g., data privacy, specific regulations). | Focused expertise, potentially lower cost for specific needs. | Fragments market, attracts customers seeking targeted capabilities. | AI in Fintech market projected for substantial growth by 2024. |

| Business Process Outsourcers (BPOs) | Third-party providers managing end-to-end compliance functions. | Outsourced operational burden, access to specialized expertise. | Bypasses DFIN's software licensing by managing the entire process. | Global BPO market valued at ~$262 billion in 2023. |

Entrants Threaten

New entrants into the financial services sector, particularly those looking to offer RegTech solutions, encounter a formidable barrier due to the intricate and ever-changing landscape of financial regulations. Acquiring the specialized knowledge required to navigate and comply with these rules across different markets demands significant time and resources, often posing a challenge for less experienced firms.

This deep regulatory understanding is not merely an advantage but a prerequisite for developing effective and compliant technologies. For instance, the European Union's MiFID II (Markets in Financial Instruments Directive II) implementation in 2018 alone introduced thousands of pages of new rules, highlighting the sheer volume of expertise needed. Generalist technology companies often find it prohibitively expensive to build this internal domain knowledge from scratch, thus limiting their ability to compete with established players who possess this critical expertise.

The cost associated with hiring and retaining regulatory experts, coupled with continuous training to keep pace with legislative updates, acts as a substantial deterrent. In 2024, the global RegTech market is projected to reach $22.16 billion, yet the barrier to entry remains high for many potential innovators, ensuring that incumbents retain a significant competitive edge.

Developing robust, scalable, and secure RegTech platforms demands significant capital investment. This includes substantial outlays for technology infrastructure, ongoing research and development, and stringent cybersecurity measures to protect sensitive financial data. For instance, in 2024, the global RegTech market was projected to reach over $10 billion, highlighting the scale of investment required.

New entrants face the daunting task of building sophisticated software from the ground up or acquiring existing technologies, both of which represent high entry costs. DFIN, a prominent player, continues to demonstrate its commitment by investing heavily in its software platforms, underscoring the capital-intensive nature of this competitive landscape.

DFIN, along with other incumbents, has cultivated enduring relationships and deep trust with financial institutions. This is paramount because compliance data is highly sensitive, making credibility a non-negotiable factor for clients.

Newcomers face significant hurdles in winning market acceptance without a demonstrated history of reliability and robust client endorsements. DFIN's consistent leadership as a top SEC filer underscores the trust it has earned over time.

Data Security and Compliance Requirements

The financial services sector faces substantial hurdles for new entrants due to rigorous data security and compliance mandates. Meeting these demands requires significant investment in technology and expertise, acting as a strong deterrent.

New players must prove robust security measures and adherence to regulations like the Digital Operational Resilience Act (DORA) and the General Data Protection Regulation (GDPR), a complex and expensive undertaking. Cybersecurity remains a paramount concern for established financial institutions, meaning any newcomer must offer a demonstrably superior or equivalent level of protection.

- High Barrier to Entry: Implementing and maintaining advanced data security infrastructure and compliance frameworks is a significant financial commitment.

- Regulatory Complexity: Navigating and adhering to a patchwork of global and regional data protection laws adds considerable operational overhead and risk.

- Cybersecurity Investment: Significant resources are needed to protect against sophisticated cyber threats, a cost that can disproportionately impact smaller, new entrants.

- Reputational Risk: A single data breach can severely damage a new entrant's reputation, making trust a critical but difficult asset to build quickly.

Economies of Scale and Network Effects

DFIN, a major player in the financial services industry, enjoys significant advantages from economies of scale. These scale benefits in areas like technology development, customer acquisition, and operational efficiency enable DFIN to maintain competitive pricing structures and allocate substantial resources towards research and development. This robust R&D investment is crucial for staying ahead in a dynamic market.

While not as dominant as in some other sectors, network effects do play a role in creating barriers for new entrants targeting DFIN's market. These effects can manifest through shared regulatory knowledge, the establishment of industry-wide standards, and the inherent value derived from a large, interconnected client base. Building such a network from scratch presents a considerable challenge for newcomers.

- Economies of Scale: DFIN's substantial operational size allows for lower per-unit costs in development, sales, and support, making it difficult for smaller, newer firms to match pricing.

- R&D Investment: In 2023, companies in the financial technology sector, a space DFIN operates within, saw significant investment in R&D, with some leading firms dedicating over 15% of their revenue to innovation, a level challenging for startups.

- Network Effects: A large existing client base for DFIN provides a network advantage, fostering trust and offering established channels for industry insights and best practices that new entrants must replicate.

- Industry Standards: DFIN's participation in setting or adhering to key industry standards can create a hurdle for new entrants who may lack the credibility or resources to meet these established benchmarks.

The threat of new entrants into the financial services sector, particularly for technology-driven solutions like those offered by DFIN, is significantly constrained by high capital requirements and deeply entrenched regulatory expertise.

Building compliant and robust platforms necessitates substantial upfront investment in technology, cybersecurity, and specialized talent, creating a formidable financial barrier. For instance, the global RegTech market, a key area for innovation, was projected to exceed $10 billion in 2024, illustrating the scale of investment needed.

Furthermore, the established trust and long-standing relationships that incumbents like DFIN have cultivated with financial institutions are critical, as clients prioritize reliability and proven track records when handling sensitive compliance data.

The significant regulatory knowledge required to operate effectively in financial services acts as a potent deterrent, with companies needing to master complex and evolving rules to avoid substantial penalties.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Capital Investment | High barrier due to technology, R&D, and compliance costs. | Global RegTech market projected to exceed $10 billion in 2024. |

| Regulatory Expertise | Requires deep, specialized knowledge of complex and evolving rules. | MiFID II implementation in 2018 introduced thousands of new rules. |

| Trust and Reputation | Challenging to build without a proven history of reliability. | DFIN's consistent leadership as a top SEC filer demonstrates earned trust. |

| Economies of Scale | Incumbents benefit from lower per-unit costs, impacting pricing. | Leading FinTech R&D spending can exceed 15% of revenue. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of industry-specific data, including financial statements, market research reports from leading firms, and competitor disclosures. We also leverage government databases and regulatory filings to ensure a comprehensive understanding of the competitive landscape.