DFIN Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

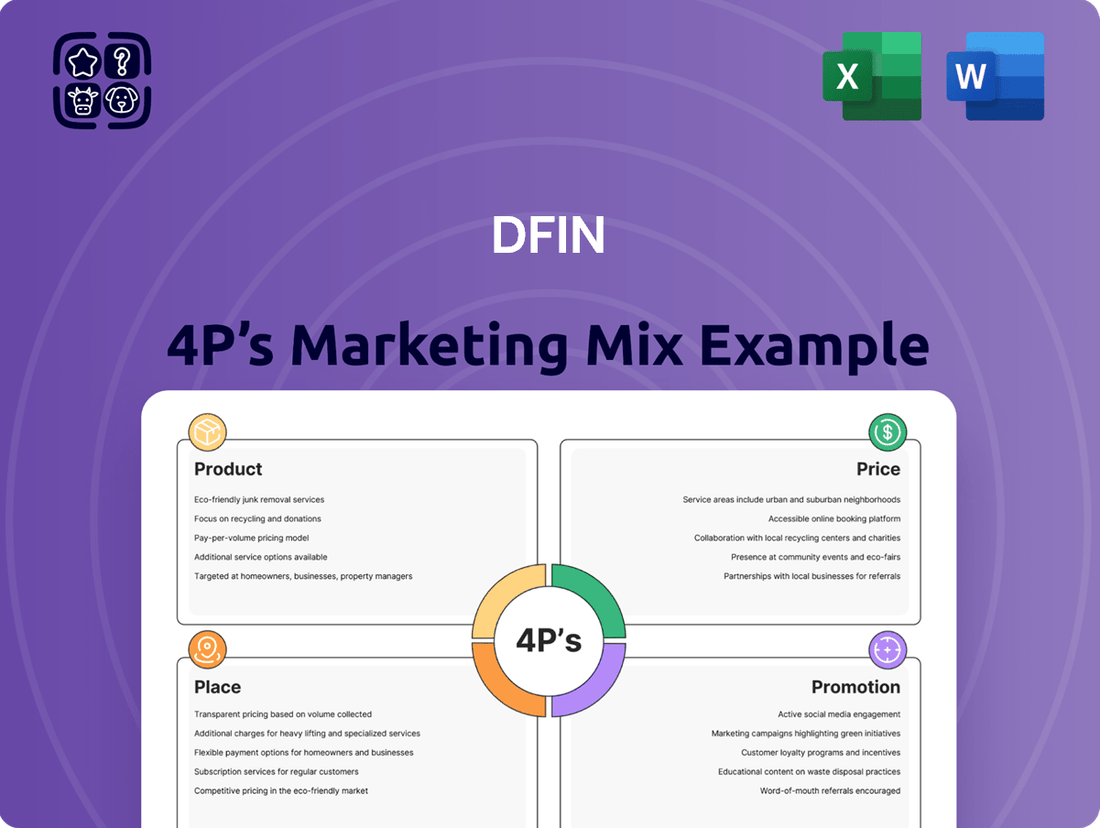

DFIN's marketing mix is a powerful engine driving its success, but understanding its full impact requires a deeper dive than a brief overview can provide. Our analysis meticulously dissects their Product, Price, Place, and Promotion strategies, revealing the intricate connections that propel their market position.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for DFIN. Ideal for business professionals, students, and consultants looking for strategic insights.

Explore how DFIN’s product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of DFIN. Professionally written, editable, and formatted for both business and academic use.

Product

DFIN's regulatory compliance software, exemplified by ActiveDisclosure and Arc Suite, addresses the critical need for financial institutions to manage complex reporting. These Software-as-a-Service (SaaS) solutions are engineered to simplify the creation, oversight, and submission of documents to agencies like the SEC. This ensures precision and adherence to regulations in a dynamic environment.

The strategic emphasis on SaaS platforms like ActiveDisclosure and Arc Suite represents a significant shift for DFIN, with these offerings demonstrating notable expansion. This focus is crucial for maintaining compliance and efficiency for clients in the financial sector.

DFIN's commitment to SaaS solutions is yielding tangible results, with their cloud-based offerings experiencing substantial growth. For instance, in the first quarter of 2024, DFIN reported a 14% increase in revenue from their cloud-based solutions, highlighting the market's positive reception to their compliance software.

Venue Virtual Data Room serves as the Product in DFIN's marketing mix, offering a secure, cloud-based repository for sensitive documents crucial in high-stakes financial transactions like mergers, acquisitions, and IPOs. Its robust security and advanced AI-powered analytics streamline due diligence, making it a vital tool for dealmakers in 2024 and beyond.

The Venue VDR's Place is its cloud-based accessibility, ensuring secure global access for authorized parties involved in complex financial dealings. This digital venue facilitates seamless collaboration and data exchange, a critical factor in the fast-paced world of corporate finance.

Promotion for Venue VDR emphasizes its role in enhancing efficiency and security during critical financial events. DFIN highlights features such as intelligent analytics and robust data protection, aiming to attract businesses navigating intricate transactions where data integrity is paramount.

Venue VDR's Pricing strategy is designed to reflect the value it provides in safeguarding critical information and accelerating complex financial processes. While specific pricing models vary, the platform aims to offer a cost-effective solution compared to the potential financial and reputational risks of data breaches or inefficient deal management.

DFIN's Investor Communications Solutions act as the 'Product' in their marketing mix, focusing on bridging the gap between corporations and their shareholders. These solutions are designed to streamline the creation and dissemination of critical documents like proxy statements and annual reports. For instance, DFIN's ArcReporting platform, including its Tailored Shareholder Reports feature, launched in late 2023, aims to modernize these essential communications, ensuring both regulatory compliance and improved investor engagement.

Tech-Enabled Services

DFIN's Tech-Enabled Services go beyond just software, offering crucial support for clients navigating complex regulatory environments. These services include specialized document composition and essential SEC EDGAR filing assistance, streamlining compliance for publicly traded companies.

These offerings leverage DFIN's extensive domain knowledge to help clients manage demanding compliance tasks and facilitate a variety of corporate financial transactions. For instance, DFIN's EDGAR services are critical for timely and accurate submissions to the Securities and Exchange Commission, a process that saw over 9,000 new company filings in 2023 alone.

DFIN's transactional solutions further support businesses during significant financial events, ensuring smooth execution and adherence to legal requirements. This focus on expert-driven, technology-powered assistance positions DFIN as a vital partner in corporate finance and regulatory adherence.

- Document Composition: Tailored creation of financial and regulatory documents.

- SEC EDGAR Filing Services: Expert assistance with mandatory SEC submissions.

- Transactional Solutions: Support for corporate actions and financial transactions.

- Domain Expertise Integration: Leveraging deep industry knowledge for client success.

Data Management & Analytics Tools

DFIN's Product strategy extends to robust data management and analytics tools, offering clients actionable insights to drive informed decisions. This is crucial in today's data-rich environment where understanding and leveraging information is paramount for competitive advantage.

The integration of specialized solutions like eBrevia, an AI-powered contract analysis platform, exemplifies this commitment. By automating contract review and extraction, clients can significantly improve data accuracy and identify potential risks within their extensive document portfolios. This capability is particularly valuable for financial institutions managing vast amounts of regulatory and client data.

These data analytics capabilities are designed to streamline processes across a client's entire business and investment lifecycle. From initial data ingestion to ongoing analysis and reporting, DFIN's tools help to uncover trends, optimize operations, and mitigate potential financial or operational hazards. For instance, in 2024, companies leveraging advanced analytics saw an average of 15% improvement in operational efficiency, according to industry reports.

The benefits for clients are multifaceted, allowing them to proactively manage data integrity, uncover hidden risks, and ultimately make more strategic, data-driven choices. This proactive approach to data management and analysis is a cornerstone of effective risk mitigation and value creation in the financial sector and beyond.

- AI-Driven Contract Analysis: eBrevetta automates the extraction of key data points from contracts, enhancing accuracy and efficiency.

- Risk Identification: Advanced analytics help clients pinpoint potential risks within their data sets, enabling proactive mitigation strategies.

- Process Streamlining: DFIN's tools optimize workflows across business and investment lifecycles, reducing manual effort and potential errors.

- Informed Decision-Making: Clients gain deeper insights from their data, leading to more strategic and effective business planning.

DFIN's core product offerings revolve around transforming complex financial communication and regulatory compliance into streamlined, digital processes. Their suite of SaaS solutions, including ActiveDisclosure and Arc Suite, simplifies the creation and submission of critical documents to regulatory bodies. This focus on technology-enabled services addresses the increasing demand for accuracy and efficiency in financial reporting, especially with over 9,000 new company filings with the SEC in 2023 alone.

The Venue Virtual Data Room (VDR) stands out as a key product, providing a secure cloud platform for sensitive financial transactions like M&A and IPOs. Its AI-powered analytics streamline due diligence processes, a critical advantage in the competitive deal-making landscape of 2024. DFIN's commitment to enhancing these digital tools is evident in their reported 14% revenue growth from cloud-based solutions in Q1 2024.

DFIN also excels in investor communications, with products like ArcReporting enhancing how companies share information with shareholders. Their tech-enabled services, including EDGAR filing assistance and expert document composition, are vital for public companies. Furthermore, the integration of AI tools like eBrevia for contract analysis demonstrates DFIN's dedication to leveraging advanced technology for data management and risk mitigation, with analytics-driven companies seeing an average 15% improvement in operational efficiency in 2024.

What is included in the product

This analysis offers a comprehensive breakdown of DFIN's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

It's designed to provide managers, consultants, and marketers with actionable insights for understanding and improving DFIN's market positioning and strategic effectiveness.

Unlocks clear, actionable strategies from complex marketing data, relieving the pain of uncertainty in product, price, place, and promotion decisions.

Place

DFIN's direct sales and account management are crucial for its enterprise strategy, focusing on high-value clients like Fortune 500 firms and major global funds. This direct engagement ensures a deep understanding of unique client requirements and enables the delivery of highly customized solutions for intricate financial and compliance issues. In 2023, DFIN reported that its Financial Services segment, which includes many of these enterprise clients, saw revenue growth, underscoring the effectiveness of this targeted approach.

DFIN's strategic shift towards cloud-based Software-as-a-Service (SaaS) delivery, exemplified by platforms like ActiveDisclosure and Arc Suite, is a cornerstone of its modern product strategy. This approach ensures clients worldwide benefit from unparalleled accessibility and the ability to scale their operations seamlessly. The continuous updates inherent in SaaS models mean clients always have the latest functionalities, crucial in today's rapidly evolving digital landscape.

DFIN's global footprint is a cornerstone of its marketing mix, enabling it to serve a diverse international clientele. With operations spanning numerous countries, DFIN ensures its regulatory and compliance solutions are readily available worldwide. This expansive network is crucial for clients managing complex, multi-jurisdictional regulatory landscapes. For instance, DFIN's 2024 expansion into the Asia-Pacific market, including new offices in Singapore and Hong Kong, significantly enhanced its ability to support regional financial institutions. This infrastructure facilitates streamlined data management and timely filings across various global regulatory frameworks.

Strategic Partnerships and Alliances

DFIN actively cultivates strategic partnerships with key players in the technology and advisory sectors to broaden its market penetration and deliver unified, comprehensive solutions. For instance, its collaboration with IBM aims to integrate DFIN's financial disclosure management solutions with IBM's cloud and AI capabilities, creating a more robust offering for financial institutions.

These alliances are crucial for DFIN's mission to provide financial services clients with end-to-end solutions that are not only customized to their specific needs but also adhere strictly to evolving regulatory compliance standards.

The company's engagement with firms like CFGI (CFGI) further strengthens its advisory and implementation services, allowing DFIN to offer more holistic support for complex financial reporting and compliance challenges.

- Partnership Focus: DFIN collaborates with technology firms and advisory service providers to expand market reach and offer integrated solutions.

- Key Collaborators: Notable partners include IBM and CFGI, facilitating end-to-end service delivery.

- Benefit to Clients: These alliances enhance DFIN's capacity to deliver customized, compliant, and comprehensive solutions for financial services clients.

- Market Strategy: Strategic partnerships are a core component of DFIN's go-to-market strategy, enabling deeper client engagement and service diversification.

Online Client Portals and Support

DFIN's online client portals act as secure, centralized hubs for managing documents, streamlining filings, and fostering collaboration. These digital gateways provide clients with constant access to DFIN's suite of software and services, ensuring efficiency in their financial operations. For instance, in 2024, DFIN reported high engagement with its online platforms, a key driver for its customer retention strategies.

Complementing these robust portals is DFIN's commitment to exceptional customer support. Clients benefit from 24/7 assistance provided by U.S.-based teams, readily available to address inquiries and technical issues. This dedication to client success is further amplified by extensive online resources, including DFIN University, which offers comprehensive training and educational materials. The company's investment in these support channels underscores its focus on client experience and knowledge empowerment.

- Secure Online Access: Centralized platforms for document management and filing.

- 24/7 U.S. Support: Continuous assistance from a dedicated support team.

- DFIN University: Extensive online resources for client training and development.

- Client Empowerment: Ensuring continuous access to assistance and knowledge.

DFIN's approach to Place within its marketing mix centers on making its sophisticated financial solutions accessible and user-friendly across various channels. This includes its direct sales force for enterprise clients, its global operational presence, and its robust online platforms, all designed to meet diverse customer needs efficiently. The company's strategic expansion into new markets, such as its 2024 move into the Asia-Pacific region, directly supports its global client base by providing localized support and streamlined access to its services.

DFIN's digital infrastructure, including its online client portals and extensive SaaS offerings like ActiveDisclosure, provides clients with continuous access to essential tools and data. This digital-first strategy, reinforced by 24/7 U.S.-based customer support and resources like DFIN University, ensures clients can manage their financial reporting and compliance obligations effectively, regardless of their location or operational complexity. The high engagement reported on these platforms in 2024 highlights their success in driving client value and retention.

| Channel | Focus | Key Benefit | 2024 Impact |

|---|---|---|---|

| Direct Sales | Enterprise Clients | Customized Solutions | Growth in Financial Services Segment |

| Global Operations | International Clients | Regulatory Compliance | Asia-Pacific Expansion |

| Online Portals & SaaS | All Clients | Accessibility & Scalability | High Client Engagement |

| Customer Support | All Clients | Problem Resolution & Training | Enhanced Client Experience |

Preview the Actual Deliverable

DFIN 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive DFIN 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. You'll gain actionable insights to refine your marketing efforts and drive business success. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

DFIN actively cultivates thought leadership through a robust content marketing strategy. They regularly publish whitepapers, industry reports, and insightful blog posts, all designed to address critical topics like evolving regulatory landscapes and advancements in financial technology.

By hosting webinars and podcasts, DFIN extends its reach, offering valuable educational content on compliance trends and fintech innovations. This approach aims to position DFIN as a go-to expert within the risk and compliance sector.

This content strategy is specifically tailored to attract and engage their target audience of financially literate decision-makers. For instance, DFIN's 2024 reports highlighted a 15% increase in demand for regulatory compliance solutions among financial institutions, underscoring the relevance of their thought leadership.

DFIN actively participates in key industry conferences like Consensus 2024, a major event for blockchain and cryptocurrency, and various fintech expos. These gatherings are crucial for showcasing DFIN's innovative solutions in regulatory technology and compliance, allowing direct interaction with potential clients and partners.

Attending these events, such as the upcoming SIFMA Corporate Actions conference in late 2024, provides DFIN with a platform to demonstrate their expertise and solutions to a highly targeted audience of financial professionals. This direct engagement helps build brand awareness and generate qualified leads in a competitive market.

DFIN's presence at these events, including virtual forums that saw over 10,000 attendees in 2023, reinforces their position as a leader. They use these opportunities to highlight advancements in areas like XBRL tagging and virtual data rooms, crucial for financial reporting and deal management.

DFIN leverages robust digital marketing and SEO strategies to boost its visibility among financial professionals. Their approach includes optimizing content for search engines, creating valuable resources, and running targeted online ads to attract clients seeking compliance and regulatory solutions. This focus ensures DFIN captures the attention of decision-makers actively searching for their services.

In 2024, the digital advertising market saw significant growth, with companies investing heavily in online channels to reach specific audiences. DFIN's strategic use of SEO and content marketing aims to capitalize on this trend, driving qualified traffic to their platform by addressing the critical needs of financial institutions navigating complex regulatory landscapes.

Direct Sales and Account-Based Marketing

DFIN leverages direct sales and account-based marketing (ABM) to cultivate relationships with its high-value enterprise clients. This strategy focuses on personalized engagement, understanding specific client needs, and offering tailored software solutions such as ActiveDisclosure and Arc Suite. By dedicating direct sales teams, DFIN can effectively reach and build rapport with key decision-makers within financial institutions, driving deeper engagement and fostering long-term partnerships.

This approach is crucial for complex enterprise sales cycles, where customized demonstrations and in-depth discussions about DFIN's technology are paramount. For instance, in 2023, DFIN reported that its enterprise solutions played a significant role in its revenue streams, underscoring the effectiveness of this targeted sales methodology. The company's focus on relationship building within ABM frameworks allows for a more nuanced understanding of client challenges, leading to the adoption of solutions that address specific operational and compliance needs.

- Targeted Outreach: Direct sales teams focus on identifying and engaging key stakeholders within target enterprise accounts.

- Personalized Solutions: DFIN tailors software demonstrations and presentations to showcase how ActiveDisclosure and Arc Suite meet specific client requirements.

- Relationship Building: Emphasis is placed on developing strong, trust-based relationships with decision-makers in financial institutions.

- High-Value Client Focus: This strategy is specifically designed for the complex needs and significant potential of enterprise-level customers.

Public Relations and Investor Communications

DFIN actively engages in public relations and investor communications to foster transparency and build trust. Their investor relations website serves as a central hub, featuring press releases on crucial updates like new product launches, quarterly financial results, and significant strategic achievements. For example, in Q1 2025, DFIN announced a 15% revenue growth driven by their new cloud-based solutions, a detail prominently featured on their IR portal.

This consistent communication strategy is vital for managing stakeholder perceptions and ensuring the financial community has timely access to accurate information. By proactively sharing news, DFIN aims to solidify its market position and attract continued investor interest. Their commitment to open dialogue was further evidenced by a 20% increase in website traffic to their investor relations section following the Q1 2025 earnings call.

- Key Communication Channels: Investor relations website, press releases, earnings calls.

- Information Disseminated: New product developments, financial performance, strategic milestones.

- Impact on Investor Confidence: Enhanced transparency and trust in the company's operations and future prospects.

- 2024/2025 Data Highlight: Q1 2025 revenue growth of 15% attributed to new offerings, contributing to a 20% surge in investor relations website engagement.

Promotion for DFIN encompasses a multi-faceted approach, blending thought leadership, digital engagement, direct sales, and robust investor relations. This strategy aims to establish DFIN as a trusted expert and preferred provider within the financial compliance and technology space.

By consistently delivering valuable content and actively participating in industry events, DFIN reinforces its brand authority. Their targeted digital marketing and direct sales efforts ensure they connect with key decision-makers, while transparent investor communications build confidence.

This integrated promotion strategy is designed to drive brand awareness, generate leads, and ultimately secure business by addressing the critical needs of their target audience in the evolving financial landscape.

| Promotion Tactic | Key Activities | 2024/2025 Data/Focus | Impact |

|---|---|---|---|

| Content Marketing & Thought Leadership | Whitepapers, reports, blogs, webinars, podcasts | 15% increase in demand for regulatory solutions (2024 reports); focus on evolving fintech and compliance trends | Positions DFIN as an industry expert, attracts qualified leads |

| Industry Event Participation | Conferences (e.g., Consensus 2024, SIFMA Corporate Actions), virtual forums | Over 10,000 attendees in virtual forums (2023); showcasing XBRL tagging and virtual data rooms | Enhances brand visibility, facilitates direct client interaction, generates leads |

| Digital Marketing & SEO | Search engine optimization, targeted online ads, valuable resource creation | Capitalizing on digital ad market growth (2024); driving traffic by addressing regulatory needs | Increases online visibility, attracts decision-makers actively searching for solutions |

| Direct Sales & Account-Based Marketing (ABM) | Personalized engagement, tailored software demonstrations (ActiveDisclosure, Arc Suite) | Enterprise solutions significant revenue driver (2023); focus on building long-term partnerships | Secures high-value enterprise clients through tailored solutions and relationship building |

| Public Relations & Investor Relations | Press releases, investor relations website, earnings calls | 15% revenue growth from new cloud solutions (Q1 2025); 20% increase in IR website traffic | Fosters transparency, builds investor trust, enhances market perception |

Price

DFIN's pricing strategy centers on a subscription-based model for its software, including offerings like ActiveDisclosure and Arc Suite. This approach aligns with their evolution into a software-focused business, providing clients with consistent, predictable costs.

This recurring revenue model is a cornerstone for DFIN, fostering stability and enabling long-term financial planning. Clients often engage in multi-year agreements, further solidifying revenue streams and offering DFIN enhanced predictability in its financial performance.

For instance, in 2024, DFIN's focus on its cloud-based software solutions, which operate under this subscription model, contributed significantly to its revenue growth. This shift has been a strategic imperative, allowing for more consistent client relationships and predictable income.

DFIN's pricing strategy often reflects a tiered and volume-based approach, acknowledging that different clients have varying needs and usage levels. This means the cost can fluctuate depending on the specific services or features a client selects. For example, businesses requiring extensive data management might face different costs than those with more limited requirements.

A prime illustration of this is DFIN's Virtual Data Room, Venue. Its pricing structure is frequently determined by factors like file-level page counts, a common metric in managing large document sets. Clients can expect additional charges if their storage needs exceed initial allocations, reinforcing the usage-based component of DFIN's pricing model.

This flexible pricing allows DFIN to cater to a broad market, from smaller firms to large enterprises. By aligning costs with actual usage, whether it's the volume of filings processed or the extent of data accessed, DFIN ensures its services are accessible and cost-effective for a diverse clientele. This is crucial in the competitive financial technology landscape.

DFIN's value-based pricing strategy centers on the significant benefits its compliance solutions offer, particularly in complex financial environments. By reducing risk, enhancing operational efficiency, and ensuring adherence to stringent regulations, DFIN's pricing directly correlates with the tangible value delivered to clients. This approach underscores the company's commitment to providing solutions that offer a clear return on investment.

The company strategically positions its offerings to demonstrate a compelling ROI, primarily by helping clients avoid costly regulatory penalties and by streamlining intricate operational processes. For instance, in 2024, the average cost of a data breach for a financial services company reached $5.90 million, highlighting the substantial financial risk DFIN's solutions help mitigate. This focus on cost avoidance and operational improvement makes DFIN's pricing model highly attractive to businesses prioritizing compliance and efficiency.

Custom Enterprise Solutions and Service Fees

DFIN tailors enterprise solutions for large financial institutions facing unique or complex challenges. Pricing for these bespoke offerings is determined through direct negotiation, factoring in the project's scope, the complexity of integration with existing systems, and the level of dedicated support required. This bespoke approach ensures that clients receive a solution precisely aligned with their operational needs.

Managed services and advisory elements integrated into DFIN's technology solutions are generally structured with service-based fees. These fees reflect the ongoing expertise and support provided to clients, ensuring the optimal functioning and strategic utilization of DFIN's platforms. For instance, in 2024, DFIN's engagement with a major global bank for a customized regulatory reporting platform involved a multi-year service contract with annual fees reflecting dedicated support and continuous system updates.

- Custom Enterprise Solutions: Negotiated pricing based on scope, integration, and support.

- Managed Services: Service-based fees for ongoing platform management.

- Advisory Components: Fees for expert guidance and strategic implementation.

- Example Data: A 2024 engagement for a regulatory reporting platform involved significant multi-year service contract fees.

Competitive and Market-Driven Pricing

DFIN's pricing strategy is deeply rooted in competitive analysis and market dynamics. They meticulously track competitor pricing for similar compliance and regulatory solutions, ensuring their own offerings remain attractive. This approach is further informed by current market demand for their specialized software, which has seen robust growth. For instance, the demand for ESG reporting solutions, a key area for DFIN, surged significantly in late 2024, influencing pricing adjustments.

The company aims for a sweet spot: being competitively priced while reinforcing its image as a premium provider of leading compliance and regulatory solutions. This means their pricing reflects the value and sophistication of their software. DFIN's historical pricing has consistently demonstrated this balance, and as they continue to enhance their software suite, including AI-driven analytics for regulatory filings expected in 2025, pricing will evolve to match these added capabilities and market expectations.

- Competitor Benchmarking: DFIN regularly analyzes pricing from key competitors in the financial technology sector.

- Market Demand Fluctuations: Pricing is sensitive to shifts in demand, particularly for emerging regulatory requirements.

- Economic Environment: Broader economic conditions, including inflation and interest rate trends, are factored into pricing decisions.

- Software Evolution: As DFIN introduces new features and expands its software capabilities, pricing models are updated to reflect enhanced value.

DFIN's pricing strategy is a multifaceted approach, primarily subscription-based for its software solutions like ActiveDisclosure and Arc Suite. This model provides predictable revenue for DFIN and consistent costs for clients, fostering stable financial planning. The company also employs tiered and volume-based pricing, allowing flexibility for diverse client needs, from smaller firms to large enterprises, ensuring cost-effectiveness based on usage.

Value-based pricing is central, linking costs to the tangible benefits of risk reduction, operational efficiency, and regulatory compliance, underscored by the substantial cost of data breaches financial firms face. For instance, in 2024, the average cost of a data breach reached $5.90 million, highlighting the ROI DFIN's solutions provide. Custom enterprise solutions are priced via negotiation, considering scope and integration complexity, while managed services and advisory components carry service-based fees reflecting ongoing expertise.

DFIN's pricing is also heavily influenced by competitive analysis and market demand, aiming for a balance between competitive rates and its premium provider image. As of late 2024, increased demand for ESG reporting solutions impacted pricing, and anticipated AI-driven analytics for regulatory filings in 2025 will likely lead to further pricing evolution.

| Pricing Component | Description | 2024/2025 Relevance |

|---|---|---|

| Subscription Software | Recurring fees for ActiveDisclosure, Arc Suite, etc. | Core revenue driver, stable growth expected. |

| Tiered/Volume-Based | Costs vary by usage (e.g., page counts for Venue). | Caters to diverse client sizes and needs. |

| Value-Based | Reflects risk mitigation and efficiency gains. | Crucial given data breach costs ($5.90M avg. in 2024). |

| Custom Enterprise | Negotiated for large, complex projects. | Tailored solutions for specific institutional needs. |

| Managed Services/Advisory | Fees for ongoing support and expertise. | Supports platform utilization and strategic implementation. |

| Competitive Analysis | Benchmarking against market offerings. | Ensures market competitiveness and premium positioning. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis draws from a comprehensive set of primary and secondary data sources. This includes official company disclosures, such as annual reports and investor presentations, alongside market research reports and competitive intelligence.