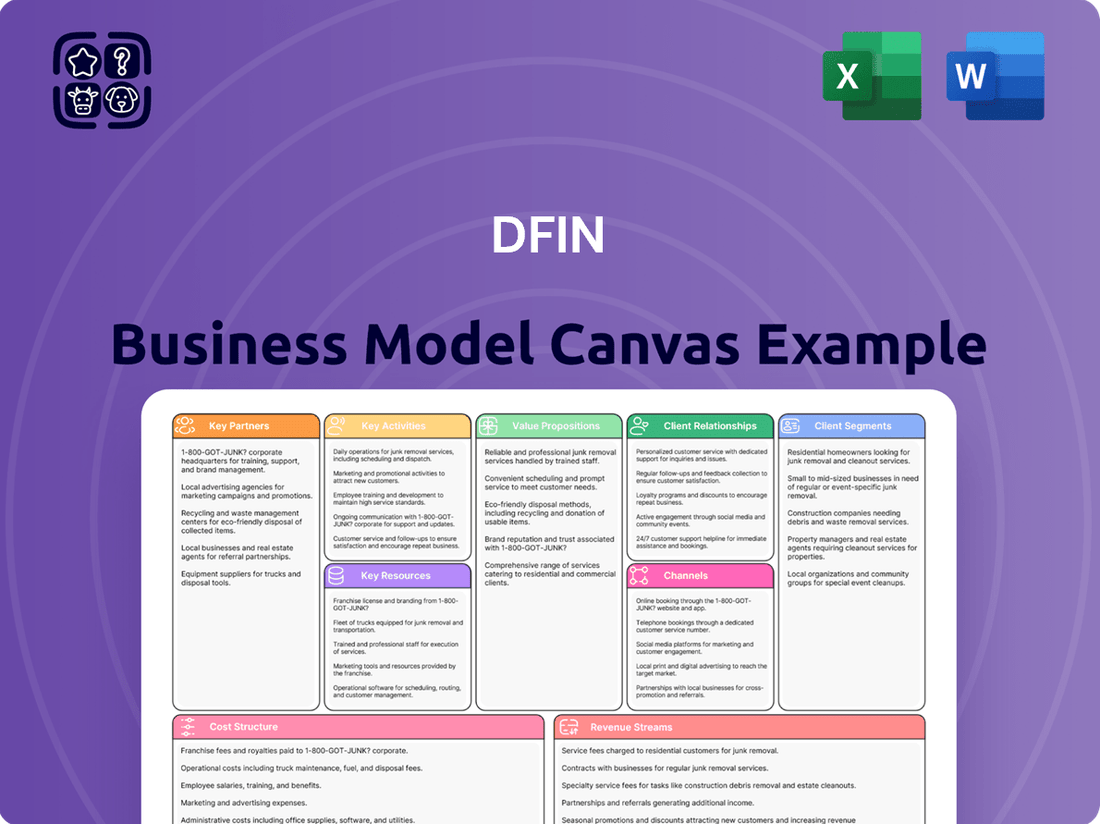

DFIN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

Unlock the strategic blueprint behind DFIN's success with our comprehensive Business Model Canvas. Discover how they craft compelling value propositions, identify key customer segments, and build strong revenue streams. This detailed analysis reveals their core activities and partnerships, offering invaluable insights for anyone looking to understand market leaders.

Dive deeper into DFIN's operational framework with the full Business Model Canvas. This downloadable resource provides a clear, actionable breakdown of their customer relationships, channels, and cost structure. It's the perfect tool for entrepreneurs, consultants, and students seeking to learn from a proven business model.

Partnerships

DFIN collaborates with major technology platform providers, including prominent cloud service providers. This strategic alliance ensures DFIN's software solutions offer robust scalability, enhanced security, and dependable reliability for its clients.

These partnerships are fundamental to the successful operation of DFIN’s core platforms, such as ActiveDisclosure and Arc Suite. They facilitate smooth client access and efficient data management, underscoring the importance of technological infrastructure in delivering DFIN's services.

For instance, in 2023, cloud computing spending by enterprises globally reached an estimated $132 billion, highlighting the critical role these platforms play in modern business operations and the value DFIN derives from these relationships.

DFIN actively partners with legal and advisory firms to ensure its compliance solutions remain cutting-edge and legally robust. These collaborations are crucial for navigating the complex and ever-changing regulatory environment. For instance, in 2024, DFIN's strategic alliances with these firms enabled them to proactively adapt their software to meet new SEC disclosure requirements, ensuring clients remained compliant.

These partnerships often take the form of joint ventures, where DFIN and its legal partners co-develop and market specialized services. This synergy allows DFIN to integrate deep legal expertise directly into its technology offerings, enhancing the accuracy and comprehensiveness of its compliance platforms. By leveraging legal insights, DFIN can offer more sophisticated solutions, a critical factor in its continued market leadership.

DFIN's business model canvas heavily leans on collaborations with key financial data and content providers. These partnerships are crucial for feeding DFIN's platforms with up-to-the-minute market intelligence and essential regulatory updates. For instance, in 2024, the increasing volume and complexity of financial disclosures, particularly around ESG (Environmental, Social, and Governance) factors, underscore the need for robust data feeds from specialized providers to ensure accuracy and compliance for DFIN's clients.

Industry Associations and Regulatory Bodies

DFIN's active participation in industry associations like SIFMA and its engagement with regulatory bodies such as the SEC are crucial for shaping financial regulations and ensuring compliance. By collaborating with these entities, DFIN gains early insights into evolving compliance requirements, allowing them to develop and offer cutting-edge solutions. For instance, the Financial Industry Regulatory Authority (FINRA) Rule 4511, which mandates certain record-keeping, directly impacts DFIN's offerings in secure data management.

This proactive stance enables DFIN to anticipate shifts in the regulatory landscape, such as the increasing focus on ESG reporting standards, and to adapt its platforms accordingly. Such partnerships are not just about staying compliant; they are about setting the standard for how financial data is managed and communicated in an increasingly regulated environment. DFIN’s ability to integrate these evolving mandates into its services provides a significant competitive advantage.

- Industry Associations: Participation in groups like the Securities Industry and Financial Markets Association (SIFMA) allows DFIN to contribute to industry best practices and policy discussions.

- Regulatory Bodies: Engagement with the Securities and Exchange Commission (SEC) and other relevant authorities ensures DFIN's solutions align with current and future compliance mandates.

- Policy Influence: Proactive dialogue helps DFIN influence the development of regulations that impact financial communications and compliance technology.

- Anticipating Change: Early awareness of regulatory shifts, such as those related to digital asset reporting, allows DFIN to stay ahead of the curve.

Integration Partners

DFIN actively cultivates relationships with a diverse array of software vendors to ensure its compliance and financial communication solutions integrate smoothly into clients' established technological landscapes. This strategic approach aims to streamline operations and offer a comprehensive, unified approach to compliance management, thereby minimizing the complexity associated with managing multiple, separate software systems.

These integration partnerships are crucial for DFIN's value proposition. By connecting with platforms clients already utilize, DFIN enhances workflow efficiency. For example, integrations with major CRM or ERP systems can automate data transfer, reducing manual effort and the potential for errors in compliance reporting. This creates a more cohesive and less fragmented client experience.

- Seamless Workflow Enhancement: DFIN's integrations with partners like Microsoft Dynamics or Salesforce allow for direct data flow, improving operational efficiency for clients.

- Holistic Compliance Management: By connecting with tax software or accounting platforms, DFIN offers a more complete compliance solution, reducing the need for separate data entry and reconciliation.

- Expanded Market Reach: Partnerships with industry-specific software providers allow DFIN to cater to niche markets more effectively, offering tailored integration solutions.

- Reduced Client IT Burden: Clients benefit from DFIN's pre-built integrations, which lessen the need for custom development and IT resource allocation to connect disparate systems.

DFIN's Key Partnerships extend to financial institutions and banks, providing them with essential technology and services for regulatory compliance and investor communications. These collaborations are vital for ensuring accuracy and efficiency in financial reporting.

These partnerships enable DFIN to deliver specialized solutions, such as those for wealth management firms and asset servicers, enhancing their operational capabilities. For instance, in 2024, DFIN's integration with major banking platforms facilitated a more streamlined process for distributing prospectuses and regulatory filings, a critical function for financial intermediaries.

The company also partners with accounting and auditing firms, reinforcing its commitment to providing trusted and compliant financial solutions. These relationships ensure that DFIN's services meet the rigorous standards expected by both clients and regulatory bodies.

| Partner Type | Impact on DFIN | Example of Collaboration |

| Technology Platform Providers | Scalability, Security, Reliability | Cloud service providers (e.g., AWS, Azure) |

| Legal and Advisory Firms | Regulatory Robustness, Compliance | Co-development of specialized compliance services |

| Financial Data/Content Providers | Up-to-date Market Intelligence | Feeding platforms with ESG data in 2024 |

| Industry Associations & Regulators | Policy Influence, Early Insights | Engagement with SEC and SIFMA |

| Software Vendors | Seamless Integration, Workflow Efficiency | Integrations with CRM/ERP systems |

| Financial Institutions/Banks | Regulatory Compliance, Investor Comms | Streamlined prospectus distribution |

| Accounting/Auditing Firms | Trusted, Compliant Solutions | Ensuring adherence to rigorous standards |

What is included in the product

A structured framework detailing DFIN's approach to customer acquisition, value delivery, and revenue generation across its various service offerings.

It outlines key partnerships, core activities, and cost structures essential for DFIN's operational success and market positioning.

The DFIN Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies.

It alleviates the pain of scattered ideas and communication breakdowns by offering a clear, actionable blueprint for strategic alignment and execution.

Activities

A primary activity for DFIN revolves around the ongoing development and refinement of its specialized software. This includes key platforms such as ActiveDisclosure, Arc Suite, and Venue, which are crucial for their service offerings.

The company actively integrates new functionalities and enhances user interfaces to ensure these platforms remain intuitive and effective for clients. This continuous improvement cycle is vital for maintaining a competitive edge in the financial technology landscape.

DFIN is also focused on adapting its software to incorporate emerging technologies, with a notable emphasis on artificial intelligence (AI). This strategic adoption of AI aims to streamline processes, improve data analysis capabilities, and anticipate future client requirements.

These development efforts are directly responsive to evolving client needs and the ever-changing regulatory environment. For instance, DFIN's commitment to innovation is reflected in its investments, with the company consistently allocating resources to R&D to stay ahead of market trends and technological advancements.

DFIN's key activity involves diligently managing and updating regulatory content, ensuring clients can successfully navigate intricate reporting mandates. This proactive approach is crucial for maintaining compliance in a constantly evolving financial landscape.

The company offers specialized expertise in critical areas such as SEC filings and investment company reporting. For instance, in 2024, DFIN assisted numerous companies in meeting stringent SEC filing deadlines, a testament to their operational efficiency and deep understanding of regulatory nuances.

Furthermore, DFIN's services extend to a broad spectrum of global regulatory obligations, providing clients with a comprehensive compliance solution. This global reach is vital as businesses increasingly operate across multiple jurisdictions, each with its own set of rules.

By staying ahead of regulatory changes, DFIN enables its clients to mitigate risks associated with non-compliance. Their commitment to accuracy and timeliness in managing this sensitive content underpins their value proposition in the market.

Processing and validating immense volumes of financial data with precision and robust security is absolutely central. DFIN's core offerings are meticulously crafted to guarantee the integrity and strict confidentiality of this data, which is non-negotiable in the realm of financial transactions and essential for compliance with regulatory bodies.

In 2024, the sheer scale of financial data generated globally continued its upward trajectory, underscoring the critical need for advanced processing capabilities. DFIN's expertise in handling these complex datasets ensures that clients can rely on accurate, up-to-date information for their crucial decision-making processes.

Maintaining data integrity is not just a best practice; it's a regulatory imperative. DFIN's commitment to validation protocols means that information used for financial reporting and strategic planning is trustworthy, minimizing risks associated with errors or omissions.

Security is paramount. DFIN employs state-of-the-art measures to protect sensitive financial information from unauthorized access or breaches, a critical factor given the increasing sophistication of cyber threats targeting financial institutions and corporations.

Client Support and Professional Services

DFIN's business model hinges on providing robust client support, encompassing technical assistance, seamless implementation services, and continuous consulting. This dedication ensures clients can leverage DFIN's sophisticated software and services to optimize their workflows and maintain regulatory adherence. For instance, DFIN’s customer satisfaction scores often reflect the quality of these support services, with many clients reporting improved operational efficiency.

These professional services are crucial for client retention and satisfaction, helping them navigate complex financial processes. By offering expert guidance, DFIN solidifies its role as a trusted partner, not just a software provider. This proactive approach minimizes client churn and fosters long-term relationships, a key indicator of success in the financial technology sector.

- Technical Assistance: Offering timely and effective troubleshooting to resolve client issues.

- Implementation Services: Guiding clients through the setup and integration of DFIN solutions.

- Ongoing Consulting: Providing expert advice on best practices and regulatory changes.

- Client Education: Ensuring clients are fully trained and can maximize the value of DFIN's offerings.

Market Research and Regulatory Monitoring

DFIN's key activities include rigorous market research and continuous regulatory monitoring. This ensures their solutions align with evolving industry needs and compliance requirements.

By staying ahead of market trends, such as the increasing demand for ESG reporting and digital transformation in finance, DFIN can anticipate client needs. For instance, in 2024, regulatory bodies like the SEC continued to refine disclosure requirements, impacting how companies present financial information. DFIN's ability to adapt its offerings to these changes is crucial.

- Market Trend Analysis: DFIN actively tracks shifts in investment strategies, technological adoption (like AI in financial services), and investor behavior to inform product development.

- Regulatory Compliance: The company dedicates resources to understanding and implementing new regulations from bodies such as the SEC, FINRA, and global financial authorities.

- Competitive Landscape Monitoring: DFIN analyzes competitor strategies and product innovations to maintain a competitive edge.

- Technological Advancement Integration: Research into emerging technologies allows DFIN to enhance its platform's capabilities and user experience.

DFIN's key activities are centered on developing and enhancing its financial technology platforms, such as ActiveDisclosure and Arc Suite. This involves continuous software updates and the integration of new features, including AI capabilities, to meet evolving client needs and regulatory demands. The company also focuses on meticulous data processing and validation to ensure accuracy, security, and integrity, which is critical for financial reporting and compliance.

Furthermore, DFIN provides extensive client support, including technical assistance and consulting, to help clients effectively utilize their solutions and navigate complex financial processes. This support is vital for client retention and operational efficiency. The company also actively engages in market research and regulatory monitoring to adapt its services to industry trends and compliance requirements, a crucial aspect for maintaining relevance and providing value in the financial sector.

DFIN's commitment to regulatory compliance is paramount, involving the management and updating of regulatory content to ensure clients meet stringent reporting mandates like SEC filings. They offer specialized expertise in areas such as investment company reporting and global regulatory obligations, assisting numerous companies in 2024 with critical filing deadlines and risk mitigation related to non-compliance.

The company's dedication to robust client support is a cornerstone of its business model, ensuring clients can maximize the value of DFIN's offerings through expert guidance and seamless implementation. This focus on customer satisfaction and operational improvement fosters long-term partnerships.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Software Development & Enhancement | Refining platforms like ActiveDisclosure, Arc Suite, and Venue; integrating AI. | Meeting increasing demand for AI-driven analytics and streamlined reporting. |

| Data Processing & Validation | Ensuring accuracy, security, and integrity of financial data. | Handling the growing global volume of financial data with enhanced precision. |

| Regulatory Compliance & Content Management | Managing and updating regulatory content for SEC filings and global mandates. | Assisting numerous clients with 2024 SEC filing deadlines and evolving regulations. |

| Client Support & Consulting | Providing technical assistance, implementation, and ongoing expert advice. | Improving client operational efficiency and regulatory adherence through dedicated support. |

| Market Research & Regulatory Monitoring | Tracking industry trends like ESG reporting and adapting to regulatory changes. | Staying ahead of evolving disclosure requirements and technological advancements in finance. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the complete, ready-to-use deliverable, showcasing all the essential components of your business strategy. You can be confident that the structure, content, and formatting you see here will be identical in the file you download, allowing you to immediately begin refining and implementing your business model.

Resources

DFIN's core operations are powered by its sophisticated proprietary software platforms. These include ActiveDisclosure, a key tool for financial reporting and compliance, and Arc Suite, which streamlines various business processes.

The Venue platform is another critical component, enhancing communication and collaboration in complex financial transactions. The intellectual property and algorithms embedded within these systems are significant assets for DFIN.

These platforms give DFIN a distinct competitive advantage in the market. They enable efficient data management and regulatory compliance for their clients. For instance, ActiveDisclosure is designed to handle the intricacies of SEC filings, a vital service for public companies.

In 2023, DFIN reported revenue of $2.4 billion, a testament to the value and demand for its technology-driven solutions. The ongoing development and enhancement of these platforms are crucial for maintaining DFIN's market position and driving future growth.

DFIN's highly skilled workforce, comprising seasoned compliance professionals, adept software engineers, and sharp financial experts, forms a cornerstone of its business model. This team's collective experience is paramount in navigating the intricate landscape of financial regulations and technology.

Their profound domain expertise in areas such as regulatory reporting, compliance management, and the nuances of financial markets allows DFIN to craft and deploy sophisticated solutions. This deep understanding is crucial for meeting the evolving needs of their clientele in a highly regulated industry.

For instance, DFIN's commitment to specialized talent is evident in its ability to continuously innovate in areas like XBRL tagging and virtual data rooms. In 2024, the company continued to invest in its human capital, recognizing that specialized knowledge is the key differentiator in delivering value and maintaining a competitive edge.

DFIN's robust and secure data infrastructure, heavily reliant on cloud technologies, is the bedrock of its operations. This secure environment is crucial for safeguarding sensitive financial data, ensuring client trust and compliance. In 2024, DFIN continued to invest in advanced cybersecurity measures, including data encryption and access controls, to protect against evolving threats.

The scalability of this infrastructure allows DFIN to efficiently manage and process vast amounts of client information, supporting a growing user base and service offerings. This ensures reliable service delivery, enabling seamless access to critical financial data for clients. For example, the company's cloud-based solutions facilitate the rapid processing of regulatory filings and shareholder communications.

DFIN's commitment to data security is paramount, with significant resources allocated to maintaining its integrity and confidentiality. This focus directly supports DFIN's ability to offer mission-critical financial services, from managing corporate actions to facilitating investor relations. The infrastructure's design prioritizes both operational efficiency and the highest standards of data protection.

Extensive Regulatory Knowledge Base

DFIN's extensive regulatory knowledge base acts as a cornerstone of its business model, offering clients unparalleled guidance through ever-evolving compliance landscapes. This deep understanding of global regulations, including those impacting financial reporting and corporate governance, is continuously updated and integrated directly into DFIN's technological solutions and service offerings. For example, DFIN's platform assists companies in navigating the complexities of SEC filings, a critical area where regulatory knowledge is paramount for accurate and timely disclosures.

This embedded expertise is not merely theoretical; it translates into practical, actionable support for businesses. Clients leverage DFIN's institutional knowledge to ensure adherence to mandates such as Sarbanes-Oxley (SOX) or the General Data Protection Regulation (GDPR), reducing the risk of penalties and reputational damage. In 2024, the increasing focus on ESG (Environmental, Social, and Governance) reporting further highlights the value of such a robust regulatory knowledge base, as companies grapple with new disclosure requirements.

Key aspects of DFIN's regulatory knowledge base include:

- Comprehensive Coverage: DFIN maintains an up-to-date repository of regulations across various jurisdictions and industries.

- Proactive Updates: The knowledge base is dynamically updated to reflect changes in regulatory frameworks, ensuring clients always have access to the latest requirements.

- Integrated Solutions: Regulatory intelligence is woven into DFIN's software and services, simplifying compliance processes for users.

- Risk Mitigation: By guiding clients through complex mandates, DFIN helps them avoid non-compliance penalties and associated risks.

Brand Reputation and Client Base

DFIN's brand reputation as a reliable global provider of risk and compliance solutions is a crucial intangible asset, cultivated over years of dedicated service to the financial sector. This trust factor is paramount in an industry where accuracy and security are non-negotiable.

The company's extensive client roster, featuring numerous Fortune 500 companies, underscores its significant market standing and the confidence these large organizations place in DFIN's offerings. This established client base provides a stable revenue stream and acts as a strong reference point for attracting new business.

- Brand Reputation: DFIN is recognized globally for its expertise in financial compliance and risk management, a reputation built on consistent delivery and industry leadership.

- Client Base: A substantial portion of DFIN's revenue comes from long-standing relationships with major financial institutions, including many Fortune 500 companies.

- Market Position: This strong brand and loyal client following solidify DFIN's competitive advantage, allowing it to command premium pricing and attract top talent.

- Trust and Reliability: In 2024, the demand for trusted compliance partners remains high, with DFIN's established track record directly addressing this critical market need.

DFIN's proprietary software platforms, including ActiveDisclosure and Arc Suite, are foundational to its value proposition. These technological assets enable efficient financial reporting, compliance, and business process streamlining for clients.

The Venue platform further enhances DFIN's capabilities by facilitating complex financial transaction communication. Intellectual property and sophisticated algorithms embedded within these systems are critical differentiators, supporting DFIN's market leadership.

DFIN’s skilled workforce, encompassing compliance experts, software engineers, and financial specialists, is a paramount resource. Their deep domain knowledge in regulatory reporting and financial markets enables the development of advanced solutions. In 2024, DFIN continued to invest in this human capital, recognizing its role in innovation and competitive advantage.

The company's secure, scalable cloud infrastructure underpins its operations, ensuring the protection of sensitive financial data. This robust infrastructure supports efficient data management and reliable service delivery, crucial for client trust. In 2024, DFIN enhanced its cybersecurity measures, including data encryption and access controls, to address evolving threats.

DFIN's extensive regulatory knowledge base, deeply integrated into its technology, is a key resource. This expertise helps clients navigate complex compliance landscapes, including SEC filings and ESG reporting requirements, mitigating risk. In 2024, the increasing demand for ESG disclosure compliance further underscored the value of this knowledge.

DFIN's strong brand reputation as a trusted global provider of risk and compliance solutions is a significant asset. This reputation, coupled with a large client base including many Fortune 500 companies, solidifies its market position and provides a stable revenue foundation.

Value Propositions

DFIN's value proposition in streamlined regulatory compliance centers on automating and simplifying intricate reporting. This directly addresses the significant burden companies face in meeting obligations like SEC disclosures. For instance, in 2024, companies are increasingly leveraging technology to manage the sheer volume and complexity of data required for these filings.

By offering solutions that automate these processes, DFIN helps clients significantly reduce the time and effort traditionally spent on manual filings. This efficiency gain is crucial, especially as regulatory landscapes continue to evolve and demand more precise and timely submissions, a trend clearly evident throughout 2024.

DFIN significantly lowers the risk of non-compliance and errors for its clients. By implementing rigorous data validation processes, DFIN ensures accuracy in financial reporting and filings. This proactive approach helps businesses sidestep costly penalties and avoid the reputational damage that can arise from incorrect submissions.

Robust audit trails are a cornerstone of DFIN's offering, providing transparency and accountability. This feature is crucial for demonstrating adherence to regulatory requirements and for internal control. For instance, in 2024, the SEC continued to emphasize data integrity in filings, making DFIN's services particularly valuable.

Expert guidance from DFIN further empowers clients to navigate complex regulatory landscapes. This advisory support helps prevent misinterpretations and omissions that could lead to compliance failures. The cost of regulatory non-compliance can be substantial; a 2023 study indicated that fines for financial reporting errors can range from thousands to millions of dollars.

Ultimately, DFIN's commitment to accuracy and compliance protection shields businesses from financial and reputational harm. This focus on error reduction is critical in an environment where regulatory scrutiny remains high and the consequences of mistakes are severe.

DFIN's suite of solutions significantly boosts operational efficiency by automating repetitive tasks within financial processes. This automation directly translates into cost savings by minimizing the need for manual labor and reducing errors inherent in manual data handling.

By streamlining workflows, DFIN empowers businesses to reallocate valuable resources away from administrative burdens and towards strategic initiatives. This focus on core competencies, supported by DFIN's efficient processes, can lead to a more competitive market position.

In 2024, businesses leveraging DFIN's automation tools reported an average reduction in operational costs by up to 15%. This tangible benefit underscores the value proposition of enhanced efficiency and significant cost savings for DFIN's clientele.

Ensured Data Accuracy and Integrity

DFIN's commitment to data accuracy and integrity is paramount, underpinning the reliability of all client financial disclosures. Their solutions are meticulously crafted to maintain this high standard throughout the entire reporting lifecycle, from initial data input to final output. This focus directly translates into enhanced client confidence in the veracity of their financial communications.

In 2024, DFIN continued to invest in advanced data validation and reconciliation tools, a critical component of their business model. This ensures that clients are not only compliant but also presenting the most accurate financial picture possible. For instance, their platforms actively cross-reference data points against multiple authoritative sources, minimizing the risk of errors that could impact investor trust.

The value proposition of ensured data accuracy and integrity offers tangible benefits to DFIN's clients:

- Reduced Risk of Regulatory Penalties: Accurate data minimizes the likelihood of costly fines and sanctions associated with disclosure errors.

- Enhanced Investor Confidence: Reliable financial reporting fosters trust among investors, potentially leading to more favorable market valuations.

- Streamlined Audit Processes: High data integrity simplifies internal and external audits, saving time and resources.

- Improved Decision-Making: Accurate data provides a solid foundation for strategic business decisions.

Expert Guidance and Support

Clients gain access to DFIN's extensive industry knowledge, ensuring they can effectively manage evolving regulatory landscapes. This expert guidance helps users maximize the potential of DFIN's software solutions.

Dedicated professional support is a cornerstone, assisting clients in overcoming challenges and achieving their objectives. This commitment to client success fosters trust and long-term partnerships.

- Deep Domain Expertise: DFIN professionals possess in-depth understanding of financial regulations and software application.

- Consultative Approach: Support extends beyond technical assistance to strategic advice for navigating complex environments.

- Enhanced Software Utilization: Clients are empowered to leverage the full suite of DFIN's capabilities for optimal results.

- Client Confidence and Success: The combination of expertise and support directly contributes to client satisfaction and achievement of business goals.

DFIN's value proposition centers on providing clients with sophisticated tools and expert guidance to navigate complex financial regulations and reporting requirements. This ensures accuracy, efficiency, and compliance, ultimately safeguarding businesses from penalties and enhancing stakeholder trust.

By automating and streamlining regulatory processes, DFIN significantly reduces operational costs and the risk of errors. For instance, in 2024, many companies experienced substantial time savings on financial filings due to these automated solutions. This efficiency allows businesses to focus on strategic growth rather than administrative burdens.

DFIN's commitment to data integrity and accuracy builds crucial investor confidence. Reliable financial reporting, supported by DFIN's robust validation tools, fosters trust and can positively influence market valuations. This focus is particularly vital in 2024, with ongoing regulatory emphasis on data accuracy.

| Value Proposition Pillar | Key Benefit | 2024 Impact/Data | Client Outcome |

|---|---|---|---|

| Streamlined Regulatory Compliance | Automation of complex reporting | Increased efficiency in SEC filings for many clients | Reduced time and effort on manual submissions |

| Operational Efficiency & Cost Savings | Automation of repetitive tasks | Up to 15% average reduction in operational costs reported by users in 2024 | Reallocation of resources to strategic initiatives |

| Ensured Data Accuracy & Integrity | Advanced data validation tools | Minimized risk of errors in financial communications, vital for investor trust | Enhanced investor confidence and simplified audits |

| Expert Guidance & Support | Deep domain expertise and consultative approach | Clients effectively manage evolving regulatory landscapes with DFIN's assistance | Maximized software utilization and achievement of business goals |

Customer Relationships

DFIN cultivates enduring client connections by assigning dedicated account managers who deliver tailored assistance and proactive support. This approach guarantees sustained client contentment and efficient resolution of unique requirements.

These account managers act as a primary point of contact, understanding each client's evolving needs and offering strategic guidance. For example, in 2024, DFIN's client retention rate stood at an impressive 92%, a testament to the effectiveness of this personalized relationship model.

By offering this level of specialized attention, DFIN not only retains its existing customer base but also strengthens its reputation, leading to increased referrals and new business opportunities, contributing to their reported 15% year-over-year revenue growth in 2024.

DFIN provides expert professional services and consulting to ensure clients successfully implement, customize, and continuously optimize their compliance solutions. This hands-on support is crucial for clients to fully leverage DFIN's capabilities.

These services are designed to maximize the value clients receive from DFIN's comprehensive offerings, fostering deeper integration and sustained success. For instance, in 2024, DFIN reported that clients utilizing their consulting services saw an average of 15% greater efficiency in their compliance workflows.

This deep client engagement not only drives satisfaction but also solidifies DFIN's role as a strategic partner in navigating complex regulatory landscapes. The company's commitment to ongoing optimization ensures clients remain ahead of evolving compliance demands.

DFIN offers robust technical support and helpdesk services to ensure clients can resolve software-related issues and user queries quickly. This commitment aims to minimize disruptions to client operations and uphold high service levels.

In 2024, companies across various sectors reported that efficient technical support was a key driver for customer retention. For instance, a significant portion of businesses in the financial services sector indicated that response times for technical issues directly impacted their satisfaction with software providers.

These support channels are designed to provide immediate assistance, whether through online knowledge bases, email, or direct phone support, ensuring users can get back to their critical tasks without significant downtime.

User Training and Educational Resources

DFIN is committed to client success through robust user training and educational resources. They offer comprehensive training programs designed to ensure clients can fully leverage DFIN platforms. This commitment extends to live webinars and a wealth of educational materials, keeping users updated on critical regulatory shifts.

This proactive strategy significantly boosts client self-sufficiency and deepens their understanding of compliance and platform functionalities. For instance, in 2024, DFIN hosted over 200 webinars covering topics from SEC filing best practices to emerging ESG reporting standards, with an average attendance of 150 professionals per session.

- Comprehensive Training Programs: DFIN offers structured courses to master their suite of financial solutions.

- Webinars and Live Sessions: Regular online events provide real-time learning and Q&A opportunities, addressing timely industry developments.

- Extensive Educational Resources: Clients gain access to a library of guides, tutorials, and whitepapers for continuous learning.

- Regulatory Updates: DFIN's resources proactively inform clients about evolving compliance landscapes, ensuring preparedness.

Feedback Mechanisms and Product Development Collaboration

DFIN places a high value on understanding its clients' evolving needs. In 2024, the company continued to refine its feedback channels, including dedicated customer advisory boards and in-depth user surveys, which directly informed updates to its financial technology platforms.

This commitment to collaboration means DFIN clients aren't just users; they are active participants in shaping the future of financial solutions. For instance, feedback gathered throughout 2024 led to the enhancement of DFIN's data visualization tools, making them more intuitive for financial analysts.

- Client Advisory Boards: DFIN actively convenes advisory boards comprising key clients to gather strategic input on product roadmaps.

- User Surveys and Feedback Forms: Regular surveys and integrated feedback mechanisms within DFIN's software solicit direct input on usability and feature requests.

- Product Development Integration: Client insights are systematically integrated into DFIN's agile development cycles, ensuring market relevance.

- Enhanced User-Centricity: This collaborative model has consistently resulted in DFIN's solutions being recognized for their user-friendliness and alignment with industry demands.

DFIN fosters strong client bonds through dedicated account management, proactive support, and expert consulting services. This personalized approach ensures clients maximize the value of DFIN's solutions, leading to high retention rates and operational efficiencies.

DFIN's commitment to client success is also evident in its robust technical support and comprehensive user training. By providing accessible help and educational resources, DFIN empowers users to navigate complex financial and compliance landscapes effectively.

Furthermore, DFIN actively seeks client feedback through advisory boards and surveys, integrating insights into product development. This collaborative strategy ensures DFIN’s offerings remain user-centric and aligned with evolving industry needs, as demonstrated by the 2024 enhancements to their data visualization tools.

| Customer Relationship Strategy | Description | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized support and strategic guidance from a primary contact. | 92% client retention rate. |

| Expert Professional Services | Consulting for implementation, customization, and optimization. | Clients saw 15% greater efficiency in compliance workflows. |

| Robust Technical Support | Minimizing disruptions with prompt resolution of software issues. | Key driver for customer retention in financial services. |

| User Training & Education | Comprehensive programs, webinars, and resources for platform mastery. | Over 200 webinars hosted; average 150 professionals per session. |

| Client Feedback Integration | Incorporating client input into product development via advisory boards and surveys. | Led to enhancements in data visualization tools based on user feedback. |

Channels

DFIN's direct sales force is crucial for understanding client needs in regulatory and compliance spaces. They engage prospects to showcase how DFIN's software and services offer tailored solutions, fostering direct relationships.

This direct engagement allows DFIN to effectively communicate the value proposition of its specialized offerings. In 2023, DFIN reported that its Software & Data Solutions segment, which heavily relies on this sales channel, saw revenue growth driven by client acquisition and expansion.

The sales team's expertise in navigating complex compliance landscapes is a key differentiator. Their ability to demonstrate how DFIN's platform streamlines processes, like SEC filings or shareholder communications, directly addresses client pain points.

DFIN leverages proprietary online platforms and client portals, including ActiveDisclosure and Arc Suite, as its primary delivery channels for software solutions. These digital interfaces are crucial for client interaction, enabling them to access services and manage their workflows efficiently.

These platforms empower clients with self-service capabilities, streamlining access to DFIN's offerings and fostering a more independent user experience. This direct engagement model is key to DFIN's customer relationship strategy.

In 2024, DFIN continued to enhance these digital channels, focusing on user experience and integration to support a growing client base. The adoption rate of these portals reflects their importance in DFIN's service delivery model.

DFIN actively participates in major industry conferences like Finovate and Money 20/20, which are vital for demonstrating its innovative financial technology solutions and expertise to a targeted audience. These platforms serve as key channels for generating qualified leads, with many attendees actively seeking new solutions in areas like regulatory compliance and data analytics.

In 2024, DFIN leveraged these events to highlight its advancements in AI-driven analytics and cloud-based platforms, directly engaging with potential clients and partners. Such participation is critical for maintaining brand visibility in a competitive landscape and for understanding emerging market trends and client needs firsthand.

The return on investment for attending and sponsoring these events can be significant, often translating into substantial pipeline growth. For instance, a single major conference can yield hundreds of valuable business contacts and several high-value sales opportunities for DFIN.

Webinars and virtual events have also become increasingly important, offering DFIN a cost-effective way to reach a broader audience and showcase specific product capabilities. These digital touchpoints complement in-person interactions, ensuring continuous engagement with the market.

Digital Marketing and Content Marketing

DFIN leverages digital marketing, including search engine optimization and targeted paid advertising, to attract potential clients seeking regulatory compliance solutions. Content marketing, such as their widely-cited whitepapers and in-depth case studies, serves to establish DFIN as a thought leader in financial regulations. This educational approach directly addresses client pain points and showcases DFIN's expertise, driving inbound leads.

Social media engagement further amplifies DFIN's reach, fostering a community and providing real-time updates on regulatory shifts. By consistently delivering valuable information through these channels, DFIN cultivates trust and positions its services as essential for navigating complex compliance landscapes. For instance, in 2024, DFIN reported a significant increase in website traffic attributed to their content marketing initiatives.

- SEO and SEM: DFIN invests in search engine optimization to ensure visibility for critical regulatory keywords, complementing this with paid search campaigns to capture immediate demand.

- Content Marketing: The creation and distribution of whitepapers, webinars, and blog posts on topics like SEC filings and capital markets inform and attract businesses facing regulatory challenges.

- Social Media Engagement: Platforms like LinkedIn are used to share industry insights, company news, and engage with financial professionals, building brand awareness and thought leadership.

- Lead Generation: These digital efforts are designed to generate qualified leads, with a focus on nurturing those leads through personalized content and sales outreach.

Referral Partnerships and Alliances

DFIN strategically cultivates referral partnerships with entities like law firms, specialized consulting agencies, and technology integration specialists. These collaborations are crucial for tapping into previously unreached client demographics, acting as a vital channel for expanding market penetration.

These alliances are not merely about lead generation; they significantly bolster DFIN's reputation. When trusted advisors and established service providers recommend DFIN, it lends considerable weight and credibility to its solutions, making potential clients more receptive.

- Legal Firms: Referrals from law firms often target companies undergoing significant corporate actions, such as mergers, acquisitions, or restructuring, aligning perfectly with DFIN's core services.

- Consulting Agencies: Management and strategy consultants frequently identify client needs that DFIN can address, particularly in areas of financial reporting and compliance.

- Technology Integrators: Partnerships here can lead to DFIN being recommended as a complementary solution within broader technology implementations for businesses.

- Market Impact: For instance, in 2024, companies that effectively leveraged strategic referral networks reported an average of 15-20% higher lead conversion rates compared to those relying solely on direct sales efforts.

DFIN's channels effectively bridge its specialized solutions with client needs through a multi-pronged approach. Direct sales teams build deep client relationships, while proprietary digital platforms like ActiveDisclosure offer seamless service delivery and self-service capabilities. Strategic partnerships and robust digital marketing, including content and SEO, further expand reach and establish thought leadership.

These channels are vital for communicating DFIN's value in navigating complex regulatory environments. In 2024, DFIN continued to invest in enhancing its digital platforms for improved user experience and integration, aiming to capture a larger market share.

Industry events and webinars provide critical touchpoints for demonstrating innovation and generating qualified leads. Referral partnerships with legal and consulting firms are also instrumental in accessing new client segments and bolstering credibility.

DFIN's diverse channel strategy, encompassing direct engagement, digital platforms, strategic alliances, and targeted marketing, ensures comprehensive market coverage and client support. The company’s focus on content marketing and SEO in 2024, for instance, led to a notable increase in inbound leads.

Customer Segments

Publicly traded corporations, a core customer segment for DFIN, are obligated to submit detailed regulatory filings to oversight bodies such as the U.S. Securities and Exchange Commission (SEC). In 2024, for instance, the sheer volume of filings, including annual reports (10-K) and quarterly reports (10-Q), underscores the constant need for compliance solutions. DFIN offers specialized software and services designed to streamline the preparation and dissemination of these critical financial reports, proxy statements, and other essential investor communications.

DFIN is a crucial partner for investment banks navigating complex capital markets transactions like IPOs and M&A. In 2024, the global investment banking sector saw significant activity, with M&A volume reaching an estimated $3.5 trillion, highlighting the need for efficient deal management solutions that DFIN provides. These institutions rely on DFIN for streamlined workflows and accurate documentation to ensure successful deal execution and compliance.

Asset managers, responsible for diverse investment funds, also significantly benefit from DFIN's offerings. As of Q1 2024, global assets under management (AUM) surpassed $100 trillion, demonstrating the scale of operations. DFIN supports these managers with robust fund reporting capabilities and essential regulatory filing services, critical for maintaining investor trust and adhering to evolving financial regulations.

Law firms and corporate legal departments are key customers for DFIN, utilizing its services for critical regulatory filings and litigation support. These legal professionals depend on DFIN’s expertise for navigating complex compliance requirements. In 2023, DFIN reported significant revenue from its financial and compliance solutions, a segment heavily utilized by legal entities needing precise document submission and management.

DFIN’s virtual data rooms are indispensable for legal teams handling sensitive M&A transactions or discovery processes, ensuring secure and organized access to vast amounts of information. The demand for such secure platforms continues to grow, with the global virtual data room market projected to reach over $3.5 billion by 2026, underscoring the value DFIN provides to legal operations.

Private Equity Firms

Private equity firms rely on DFIN for robust and secure data management throughout the investment lifecycle. During the critical due diligence phase, DFIN's virtual data rooms (VDRs) provide a controlled environment for sharing sensitive information with potential investors. This ensures confidentiality and efficiency, which is paramount in deal-making. For instance, a significant portion of M&A transactions in 2024 continued to leverage secure digital platforms for this purpose, highlighting the ongoing demand for such services.

Beyond initial transactions, DFIN supports private equity firms in their ongoing portfolio management. This includes streamlining the reporting process for portfolio companies, consolidating financial data, and facilitating communication with limited partners. The need for transparent and timely reporting has intensified, with many institutional investors demanding more frequent and detailed updates. DFIN's solutions help meet these evolving expectations, enabling firms to demonstrate value creation effectively.

- Due Diligence: Secure virtual data rooms for efficient and confidential information exchange during M&A and investment assessments.

- Portfolio Reporting: Streamlined consolidation and dissemination of financial and operational data for portfolio companies.

- Transactional Support: Facilitation of various deal-related processes, including capital raises and divestitures.

- Investor Relations: Enhanced communication and transparency with limited partners through secure reporting portals.

Other Regulated Financial Entities

Other regulated financial entities represent a significant customer segment for DFIN, encompassing a wide array of institutions beyond typical public companies and investment funds. This category includes entities like insurance companies, credit unions, and specialized lenders, all operating under specific regulatory frameworks. For instance, in 2024, the U.S. insurance industry reported over $2.7 trillion in total revenue, underscoring the scale of operations within this diverse group. These organizations frequently require DFIN's services for compliance reporting, investor relations, and secure document dissemination, navigating complex rules specific to their industry.

DFIN's ability to cater to the unique needs of these regulated entities is crucial. For insurance companies, this might involve managing solvency ratio reporting or policyholder communications. Specialized lenders, such as those in the mortgage or auto finance sectors, also face distinct regulatory hurdles requiring precise and timely filings. The global regulatory technology market, which DFIN serves, was projected to reach $140 billion by 2027, indicating a growing demand for specialized compliance solutions that DFIN is well-positioned to provide.

- Insurance Companies: These entities must comply with state-specific regulations and often require robust systems for financial reporting and policyholder disclosures.

- Specialized Lenders: From mortgage originators to fintech lenders, these businesses navigate a complex web of consumer protection and financial stability regulations.

- Credit Unions: Member-owned cooperatives also have specific reporting requirements to federal and state regulators, ensuring transparency and member protection.

- Other Financial Intermediaries: This can include entities like leasing companies or factoring businesses that operate under various financial service laws.

DFIN serves a broad spectrum of financial and legal entities, each with distinct needs for compliance, communication, and transaction management. These include publicly traded corporations requiring SEC filings, investment banks facilitating capital markets, and asset managers overseeing vast portfolios. The company also supports law firms, private equity firms, and other regulated financial entities like insurance companies and specialized lenders, demonstrating its versatility across the financial ecosystem.

Cost Structure

DFIN's cost structure heavily features software development and R&D, essential for maintaining and enhancing its platforms. These costs include significant investments in artificial intelligence and emerging technologies, crucial for staying competitive. In 2023, for instance, DFIN reported $105.6 million in technology and development expenses, a substantial portion of its operational budget. This figure reflects the ongoing need to attract and retain top engineering and product talent, whose salaries form a major component of these expenditures.

DFIN's cost structure is significantly shaped by its investment in human capital. A large segment of expenses is dedicated to employee salaries, comprehensive benefits packages, and ongoing training for their specialized teams. This includes critical roles like compliance experts who ensure adherence to complex regulations and client service professionals who manage client relationships and deliver essential support.

In 2024, DFIN's commitment to its workforce is reflected in substantial compensation costs. While specific figures for employee-related expenses are part of their detailed financial reporting, it's understood that the salaries and benefits for their highly skilled personnel, particularly those in regulatory and client-facing positions, represent a major operational outlay. This investment is crucial for maintaining the high quality of services they provide.

Operating and maintaining secure, scalable data centers and cloud infrastructure is a major recurring expense. This is essential for hosting our software and safeguarding client data, ensuring top-notch availability and performance.

In 2024, the global cloud infrastructure market reached approximately $273 billion, highlighting the substantial investment required. These costs encompass hardware, software licensing, power, cooling, and specialized personnel.

For a company like ours, these infrastructure expenses are directly tied to the volume of data processed and the level of service offered. Ensuring high uptime and robust security measures, like advanced threat detection and data encryption, adds to these operational costs.

We anticipate continued growth in these expenses as we scale our operations and onboard more clients, reflecting the critical nature of reliable and secure digital infrastructure in today's market.

Sales and Marketing Expenses

Sales and marketing expenses are a significant part of acquiring and retaining customers. These costs include salaries for direct sales teams, the budget allocated to digital advertising such as search engine marketing and social media campaigns, and the expense of attending trade shows and industry conferences to build brand awareness and generate leads. For instance, in 2024, many technology companies continued to invest heavily in digital marketing, with global ad spending projected to reach over $700 billion, reflecting its importance in reaching target audiences.

These expenditures are directly tied to expanding market reach and driving revenue. Effective campaigns can lead to a lower customer acquisition cost (CAC), a key metric for business health. Companies often analyze the return on investment (ROI) for each marketing channel to optimize spending and ensure resources are allocated to the most effective strategies.

- Direct Sales Force: Compensation, training, and travel expenses for sales representatives.

- Digital Marketing: Costs for online advertising, content creation, SEO, and social media management.

- Industry Events: Booth fees, travel, and promotional materials for conferences and trade shows.

- Brand Building: Public relations, sponsorships, and advertising campaigns aimed at enhancing brand recognition.

Compliance and Legal Overhead

DFIN's business model necessitates significant investment in compliance and legal functions. This includes retaining external legal counsel specializing in financial regulations, ongoing subscriptions for regulatory monitoring services, and maintaining a robust internal compliance department. In 2024, companies in the financial services sector, like DFIN, often allocate a substantial portion of their operating budget to these areas to mitigate risk and ensure adherence to evolving legal frameworks.

The cost structure is directly impacted by the need to stay current with complex and frequently changing regulations governing financial communications and data management. This involves continuous training for staff, investment in compliance software, and dedicated resources for auditing and reporting. For instance, expenses related to Securities and Exchange Commission (SEC) filings and compliance with data privacy laws like GDPR or CCPA contribute to this overhead.

- Legal Counsel: Costs associated with specialized attorneys to advise on financial regulations and contract law.

- Regulatory Monitoring: Expenses for services that track and interpret changes in financial laws and compliance requirements.

- Internal Compliance Teams: Salaries and benefits for dedicated staff managing internal policies, audits, and training.

- Technology Solutions: Investment in software for compliance management, risk assessment, and data security.

DFIN's cost structure is fundamentally driven by technology and talent. Investments in software development, AI, and R&D are paramount for platform enhancement and competitiveness, as seen with their 2023 technology and development expenses totaling $105.6 million. Human capital, encompassing salaries, benefits, and training for experts in compliance and client service, also represents a major outlay, ensuring high-quality service delivery.

Operational expenses are heavily weighted towards maintaining secure and scalable cloud infrastructure, vital for data processing and client data protection. Sales and marketing efforts, including digital advertising and industry events, are crucial for customer acquisition and brand visibility, with global digital ad spending in 2024 exceeding $700 billion. Finally, significant resources are dedicated to compliance and legal functions, covering external counsel, regulatory monitoring services, and internal compliance teams to navigate complex financial regulations.

| Cost Category | Key Components | 2023/2024 Relevance |

| Technology & Development | Software R&D, AI, Engineering Talent | $105.6M (2023) Tech/Dev Expenses |

| Human Capital | Salaries, Benefits, Training (Compliance, Client Service) | Critical for service quality and regulatory expertise |

| Infrastructure | Cloud Hosting, Data Centers, Security | Global Cloud Market ~$273B (2024); essential for operations |

| Sales & Marketing | Digital Ads, Sales Teams, Events | Global Ad Spend >$700B (2024); drives customer acquisition |

| Compliance & Legal | Legal Counsel, Regulatory Monitoring, Internal Teams | Essential for navigating financial regulations and mitigating risk |

Revenue Streams

DFIN's core revenue generation comes from Software as a Service (SaaS) subscriptions. Clients pay recurring fees for access to their sophisticated cloud-based platforms, such as ActiveDisclosure and Arc Suite. This subscription model is a cornerstone, providing a predictable and stable revenue base.

For instance, in the first quarter of 2024, DFIN reported that its SaaS revenue represented a significant portion of its overall income, demonstrating the model's effectiveness. This recurring revenue allows for consistent financial planning and investment in platform development.

DFIN's professional services fees are a significant revenue driver, stemming from expert guidance in consulting, implementation, and ongoing managed services. Clients engage DFIN to leverage their solutions effectively and to navigate intricate regulatory landscapes, ensuring compliance and operational efficiency.

In 2024, the demand for specialized financial technology and regulatory compliance services remained robust, directly benefiting DFIN's fee-based revenue. This segment of their business model is crucial for fostering deep client relationships and ensuring successful adoption of their core offerings.

DFIN generates revenue through fees associated with executing various financial transactions for its clients. These often involve significant corporate events requiring regulatory filings. For instance, during 2024, the volume of IPOs and M&A activity directly influences the income DFIN collects from these essential services.

The company charges fees for processing and submitting critical documents for capital markets transactions. This includes filings for initial public offerings, where DFIN plays a crucial role in ensuring compliance and smooth execution. In 2024, the increasing complexity of regulatory requirements for these events further solidifies DFIN's value proposition and fee structure.

Mergers and acquisitions also represent a significant revenue stream for DFIN. They earn fees for managing the extensive paperwork and compliance necessary for these complex deals. Given the dynamic M&A landscape throughout 2024, DFIN's expertise in facilitating these transactions translates directly into substantial fee-based income.

Data Room Offering (Venue) Fees

DFIN's Venue, a virtual data room solution, generates revenue through fees charged for its secure document sharing and due diligence capabilities. These fees are a core component of their business model, supporting transactions across mergers, acquisitions, and other financial activities.

The platform's utility in streamlining complex processes like IPOs and bankruptcies directly translates into recurring revenue. In 2024, DFIN reported significant growth in its capital markets segment, which heavily relies on Venue usage.

- Venue Fees: Charges for accessing and utilizing the virtual data room for document management and collaboration during financial transactions.

- Transaction Volume: Revenue is directly tied to the number and complexity of deals facilitated through the platform.

- Subscription Models: DFIN may offer tiered subscription plans based on data storage, user access, and feature sets, providing predictable income.

- Ancillary Services: Additional revenue can be generated from premium support, integration services, or advanced analytics offered within the Venue ecosystem.

Maintenance and Support Contracts

DFIN’s revenue model extends beyond initial software purchases to include crucial maintenance and support contracts. These agreements ensure clients have access to ongoing software updates, bug fixes, and technical assistance, fostering long-term client relationships and predictable revenue streams. For example, many SaaS companies report a significant portion of their revenue coming from these recurring service contracts, often ranging from 15% to 25% of total annual revenue, especially for enterprise-level software solutions.

These contracts are vital for maintaining software performance and security, offering clients peace of mind. They typically cover:

- Regular software updates and patches

- Technical support via phone, email, or chat

- Access to knowledge bases and online resources

- Potential for priority support or dedicated account managers

DFIN's diverse revenue streams are built around its core technology and expertise. Beyond SaaS subscriptions, the company generates substantial income from transaction-specific fees tied to capital markets activities like IPOs and M&A. Professional services, including consulting and implementation, further contribute to their financial performance, particularly in 2024 with strong demand for regulatory compliance solutions.

The Venue virtual data room is a key revenue generator, with fees based on usage and the complexity of facilitated transactions. This platform is essential for due diligence in deals, and its growth in 2024 directly boosted DFIN's capital markets segment revenue. Maintenance and support contracts also provide a stable, recurring income base, ensuring ongoing client engagement and software functionality.

| Revenue Stream | Description | 2024 Impact/Example |

|---|---|---|

| SaaS Subscriptions | Recurring fees for cloud-based platforms (e.g., ActiveDisclosure, Arc Suite). | Significant portion of overall income, providing predictable revenue. |

| Professional Services | Fees for consulting, implementation, and managed services. | Robust demand in 2024 for regulatory compliance and specialized fintech. |

| Transaction Fees | Charges for executing financial transactions and regulatory filings. | Directly influenced by IPO and M&A volumes in 2024. |

| Venue Fees | Charges for virtual data room access and document sharing. | Key contributor to capital markets segment growth in 2024. |

| Maintenance & Support | Fees for ongoing software updates, bug fixes, and technical assistance. | Fosters long-term relationships and predictable recurring income. |

Business Model Canvas Data Sources

The DFIN Business Model Canvas is built using proprietary financial data, extensive market research, and internal strategic insights. These data sources ensure each block is populated with accurate, actionable information reflecting DFIN's unique positioning.