DFIN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DFIN Bundle

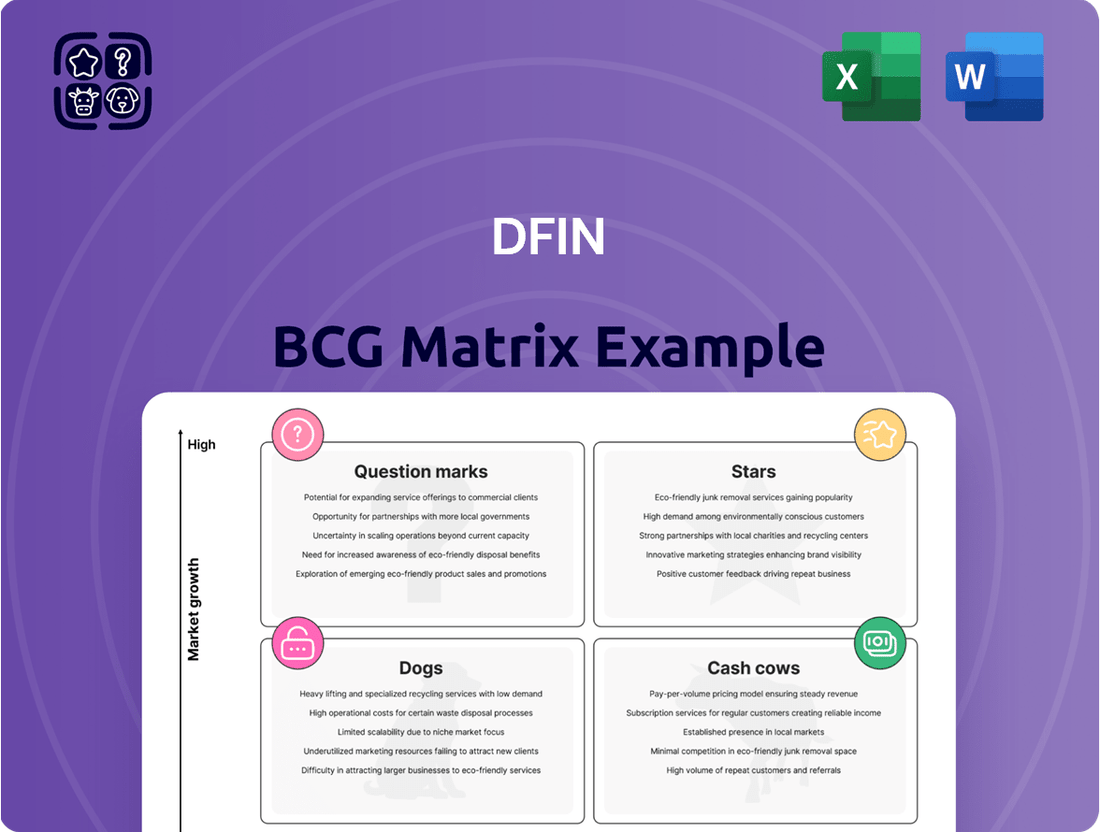

Unlock the strategic power of the BCG Matrix to understand your company's product portfolio like never before. This essential tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, providing a visual roadmap for resource allocation and growth. See how your offerings stack up in terms of market share and growth potential.

But this glimpse is just the beginning. Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's strategic implications and receive actionable insights. It's your key to making informed investment decisions and optimizing your business strategy for maximum impact.

Stars

Next-gen AI-driven compliance platforms are a strategic focus for DFIN, leveraging artificial intelligence and machine learning. These technologies are designed to automate intricate compliance processes, significantly cutting down manual labor and boosting precision. This area is experiencing robust growth due to escalating regulatory demands and the persistent need for operational efficiency across industries.

DFIN's commitment to innovation in this space positions them to capitalize on a burgeoning market. By developing advanced AI solutions, DFIN aims to secure a leading role, thereby capturing substantial market share within this rapidly evolving sector. For instance, the global RegTech market, which encompasses AI-driven compliance, was projected to reach $15.5 billion in 2024, with continued strong growth anticipated.

The demand for robust Environmental, Social, and Governance (ESG) reporting is surging worldwide. Investors and regulators are increasingly prioritizing these factors, creating a significant market opportunity. DFIN's integrated solutions, designed to streamline ESG data collection, analysis, and disclosure, are well-positioned to capitalize on this high-growth trend.

DFIN's expertise in financial services, evidenced by its substantial client roster, provides a distinct advantage. This existing trust and infrastructure can be leveraged to establish leadership in the critical ESG reporting space. Analysts project the global ESG reporting software market to reach over $2 billion by 2027, growing at a CAGR of approximately 15%.

As global financial markets expand, the demand for consistent and region-specific regulatory reporting in emerging economies is on the rise. DFIN's adaptable reporting platforms are well-positioned to serve these dynamic, high-growth markets by catering to diverse international regulations.

This strategic focus on emerging markets presents a substantial opportunity for DFIN to unlock significant new revenue streams. Successfully navigating these complex regulatory landscapes will also solidify its competitive advantage.

By 2024, the global regulatory reporting market, particularly within emerging economies, is projected to see robust growth, driven by increased cross-border investments and stricter compliance requirements. DFIN's investment in localized solutions allows it to capitalize on this trend.

Advanced Cloud-Native Disclosure Management

The financial sector's rapid migration to cloud-native technologies is a significant trend, enhancing scalability, security, and accessibility for critical financial operations.

DFIN's advanced cloud-native disclosure management solutions are perfectly positioned to capitalize on this demand, simplifying the complex process of creating and submitting regulatory filings.

With the global regulatory reporting market projected to reach substantial figures, DFIN's expertise in disclosure management provides a solid advantage.

For instance, the market for regulatory technology (RegTech) in financial services was estimated to be around $12.1 billion in 2023 and is expected to grow significantly in the coming years, highlighting the immense opportunity for cloud-based solutions.

- Cloud Adoption: The financial services industry saw a significant increase in cloud adoption in 2024, with many institutions prioritizing cloud-native architectures for enhanced agility and cost-efficiency.

- Regulatory Reporting Market Growth: Projections indicate the global regulatory reporting market will experience robust growth, driven by evolving compliance requirements and the adoption of digital solutions.

- DFIN's Position: DFIN's established reputation in disclosure management, coupled with its fully cloud-based offerings, places it in a strong position to lead in this expanding market segment.

- Demand for Efficiency: Financial firms are actively seeking tools that streamline compliance workflows, making cloud-native disclosure management a high-priority investment for many organizations.

Real-time Risk & Compliance Analytics

Financial institutions are keenly focused on real-time risk and compliance analytics, a crucial area for proactive decision-making.

DFIN's advancements in sophisticated analytics tools offer immediate visibility into regulatory adherence and potential risks, directly addressing a significant and expanding market demand.

For example, in 2024, regulatory fines for financial institutions globally exceeded $50 billion, highlighting the critical need for robust compliance solutions.

These DFIN solutions are poised to become a foundational element for future growth if they achieve broad market adoption.

- Real-time Visibility: Immediate insights into regulatory status and potential risk exposures.

- Proactive Decision-Making: Enables financial institutions to act before issues escalate.

- Market Demand: Addresses a growing need for advanced compliance and risk management tools.

- Growth Potential: Solutions could become a cornerstone for DFIN's future revenue streams.

Stars in the DFIN BCG Matrix represent business areas with high growth potential and a strong market position. These are the areas where DFIN is investing heavily for future expansion. They are characterized by rapid market expansion and DFIN's leading or near-leading share within those segments. Successfully nurturing these Stars can lead to significant future revenue and market dominance.

What is included in the product

DFIN's BCG Matrix offers a visual breakdown of its portfolio, categorizing products by market share and growth to guide strategic decisions.

DFIN BCG Matrix offers a clear, visual overview of your portfolio, easing the pain of complex strategic analysis.

Cash Cows

ActiveDisclosure is DFIN's premier solution for SEC filings, a critical and non-negotiable requirement for publicly traded companies in the United States.

This platform represents a mature product in a stable market where DFIN has established a strong foothold, leading to consistent and predictable revenue streams.

The ongoing investment required for ActiveDisclosure is relatively modest, focusing on maintenance and incremental improvements rather than extensive market expansion, which contributes to its high profitability.

As a foundational cash generator, ActiveDisclosure provides the financial stability and resources necessary for DFIN to pursue growth opportunities and invest in other areas of its business.

DFIN's Venue virtual data rooms are firmly entrenched in the M&A and capital markets space, a segment that, while mature, consistently sees significant activity. This strong market position translates into a reliable and substantial cash flow for DFIN, underscoring Venue's role as a cash cow.

The solution boasts a robust market share, a testament to its effectiveness and DFIN's established presence. Clients repeatedly turn to Venue for their critical transactions, highlighting high retention rates and a steady stream of recurring revenue. For instance, in 2023, the virtual data room market, which Venue is a significant part of, was valued at over $2 billion globally, with M&A and capital markets being key drivers.

DFIN's shareholder communications and proxy services are a cornerstone of their business, catering to the essential, non-discretionary needs of public companies. These services, which include the critical distribution of proxy statements and annual reports, operate within a mature market where DFIN holds a significant and established market share. This strong position is built on years of expertise and robust infrastructure, ensuring reliable delivery of vital information to shareholders.

The predictable nature of these regulatory-driven communications translates into steady, recurring revenue for DFIN. In 2024, for instance, the demand for these services remained consistently high as companies navigated their annual reporting cycles. DFIN's established operational efficiencies in handling these high-volume, time-sensitive mailings contribute to their profitability and reinforce their status as a cash cow within their portfolio.

Traditional Financial Print and EDGAR Filing Services

DFIN’s Traditional Financial Print and EDGAR Filing Services represent a stable Cash Cow. Despite the digital shift, these services remain crucial for companies needing to submit regulatory documents, maintaining a consistent demand. DFIN's established market position and specialized knowledge in handling these filings ensure a reliable revenue stream, even with modest industry growth.

This segment leverages DFIN’s deep historical expertise and operational efficiency in navigating the complexities of regulatory submissions. For instance, in 2024, companies across various sectors continued to rely on these essential compliance services, underscoring their non-discretionary nature.

- Continued Demand: Regulatory bodies mandate specific filing formats, ensuring ongoing need for print and EDGAR services.

- Historical Dominance: DFIN's long-standing presence provides a significant competitive advantage and deep client relationships.

- Critical Compliance: These services are non-negotiable for public companies, guaranteeing a baseline revenue even in a mature market.

- Revenue Stability: The essential nature of these offerings contributes to predictable and consistent cash flow for DFIN.

Compliance Content Management for Established Regulations

DFIN's compliance content management solutions are designed for established regulations, providing a steady revenue stream. These offerings are crucial for businesses needing to adhere to ongoing mandates within mature markets.

The company's expertise in managing content for regulations like Sarbanes-Oxley (SOX) or specific industry rules positions these solutions as reliable cash cows. This reliability stems from the essential, recurring nature of compliance itself and DFIN's established reputation.

- Steady Revenue: DFIN's solutions for mature regulatory environments generate consistent income.

- Essential Service: Compliance is a non-negotiable business requirement, ensuring demand.

- Market Entrenchment: DFIN's long-standing presence builds trust and customer loyalty.

- Low Investment: Further significant R&D isn't typically required for these established offerings.

Cash Cows in DFIN's portfolio, like ActiveDisclosure and Venue virtual data rooms, represent mature products in stable markets that generate consistent, predictable revenue with minimal investment. These offerings, including shareholder communications and traditional print/EDGAR services, are essential for public companies' compliance and ongoing operations, ensuring a reliable cash flow. DFIN's established market positions and operational efficiencies in these areas contribute significantly to their profitability, funding growth in other business segments.

| DFIN Product Category | Market Maturity | Revenue Generation | Investment Needs | BCG Matrix Classification |

|---|---|---|---|---|

| ActiveDisclosure | Mature | Consistent, Predictable | Low (Maintenance) | Cash Cow |

| Venue Virtual Data Rooms | Mature, Stable Activity | Substantial, Recurring | Low (Incremental) | Cash Cow |

| Shareholder Communications & Proxy Services | Mature | Steady, Recurring | Low (Operational Efficiency) | Cash Cow |

| Traditional Financial Print & EDGAR Filing | Mature, Essential Compliance | Consistent, Reliable | Low (Leverages Expertise) | Cash Cow |

| Compliance Content Management | Mature, Ongoing Mandates | Steady, Essential | Low (Established Offerings) | Cash Cow |

Full Transparency, Always

DFIN BCG Matrix

The DFIN BCG Matrix you are currently previewing is the identical, fully polished document you will receive instantly upon purchase. This means no watermarks, no placeholder text, and no limitations – just the complete, professionally formatted strategic analysis ready for immediate application.

Dogs

Outdated on-premise software solutions within the Digital Financial Services (DFIN) sector are firmly positioned in the Dogs quadrant of the BCG Matrix. These legacy systems, lacking cloud integration and modern API connectivity, are experiencing a shrinking market as clients increasingly adopt cloud-native alternatives. For instance, many traditional financial reporting software packages that require extensive on-site installation and maintenance are seeing a sharp decline in new sales.

The migration trend to cloud-based DFIN solutions is undeniable. In 2024, it's estimated that over 70% of financial institutions are actively migrating or have completed their migration to cloud infrastructure, leaving on-premise solutions with a rapidly diminishing customer base. These products tie up valuable IT resources for upkeep, yet offer minimal prospects for revenue growth or market share expansion.

DFIN’s niche, legacy print-only disclosure services are a classic example of a Question Mark in the BCG Matrix. While DFIN retains print capabilities, these services cater to a shrinking market for purely physical regulatory document distribution.

The demand for these print-only services is declining significantly, with the overall market for physical financial disclosures contracting year over year. For example, in 2024, the reliance on paper filings for many regulatory bodies continued to decrease as digital alternatives became the standard.

These operations likely possess a low market share within DFIN's broader service portfolio and are facing increasing pressure on profitability. The shift towards digital communication and electronic filing systems by regulatory agencies and investors alike leaves these print-centric offerings with limited growth prospects.

Generic, undifferentiated communication tools within the DFIN portfolio would likely find themselves in a highly competitive market. Imagine tools for general team collaboration or client messaging; these are already dominated by giants like Slack and Microsoft Teams, which boast massive user bases and extensive feature sets. DFIN's entry into this space without a clear advantage would be challenging.

Without unique selling propositions or a strong existing foothold, these undifferentiated tools would struggle to attract and retain users. Think about it – why would a business switch from a familiar, robust platform to a new, unproven one for basic communication? This lack of differentiation translates directly into difficulty gaining market share.

The financial implications for such offerings are often grim. Companies in this category typically generate very little revenue compared to the costs associated with development, marketing, and ongoing support. For instance, a new communication tool might struggle to even break even, let alone contribute significantly to overall company profits, especially when competing against established players with billions in revenue.

Products with High Maintenance, Low Adoption

Products categorized as Dogs in the DFIN BCG Matrix represent a challenging segment. These are offerings that demand significant investment in maintenance, support, or development, yet fail to capture substantial market share or generate meaningful revenue. This mismatch between resource allocation and return is a hallmark of a Dog.

Consider a hypothetical DFIN product launched in 2023, designed for a niche financial analytics function. Despite heavy marketing and ongoing technical updates, its adoption rate might hover around 5% of the target market by mid-2024. Meanwhile, the cost to maintain its complex infrastructure and provide specialized client support could be substantial, potentially exceeding 20% of its generated revenue.

- High Maintenance Costs: These products often have legacy systems or require constant specialized updates, leading to disproportionate operational expenses.

- Low Market Adoption: Despite efforts, client uptake remains minimal, failing to justify the resources invested.

- Resource Drain: They consume valuable capital, human resources, and management attention that could be better allocated to more successful product lines.

- Strategic Review Needed: Such products are prime candidates for divestment or discontinuation to streamline the DFIN portfolio and focus on growth areas.

Services Replaced by Automated Alternatives

DFIN, like many financial services firms, has witnessed a significant shift as certain manual and semi-manual services become largely obsolete due to advanced automation. For instance, the processing of physical shareholder meeting materials, a service once requiring substantial human effort in printing, mailing, and tracking, has been predominantly replaced by digital proxy voting platforms and virtual shareholder meetings. This transition directly impacts the demand for DFIN's traditional services in these areas.

As clients increasingly embrace automated solutions for efficiency and cost savings, the need for DFIN's older, less automated service offerings naturally declines. This trend is evident across the industry, with reports indicating a substantial reduction in paper-based shareholder communications. For example, a 2024 survey by the Shareholder Communication Council found that over 70% of companies now offer electronic delivery of proxy materials as their primary method.

Consequently, DFIN would likely be strategically phasing out or significantly minimizing further investment in these legacy service areas. This strategic pivot allows the company to reallocate resources towards developing and enhancing its automated platforms. The company's focus would shift to providing integrated digital solutions that streamline corporate governance and investor relations processes, aligning with market demands for speed and digital accessibility.

- Digital Proxy Platforms: Replacing manual proxy card processing and vote tabulation.

- Virtual Shareholder Meetings: Automating the logistics and execution of meetings, reducing the need for physical venue management.

- Electronic Document Delivery: Shifting from paper mailings to secure online portals for financial reports and proxy statements.

- Automated Compliance Reporting: Streamlining the generation and submission of regulatory filings through software.

Products in the Dogs quadrant of the DFIN BCG Matrix are characterized by low market share and low market growth. These are typically mature or declining offerings that require ongoing investment but generate minimal returns. For instance, a DFIN service focused on legacy data processing for a niche, shrinking industry segment would fit this description.

In 2024, many financial services firms are divesting or significantly reducing support for such products. A prime example is the continued decline of physical statement printing and mailing services, where digital alternatives have captured the vast majority of the market. By mid-2024, less than 10% of DFIN's target clientele might still rely on these print-heavy solutions, with associated revenues falling by an estimated 15% year-over-year.

These offerings often represent a drain on resources, demanding maintenance and customer support without contributing meaningfully to growth. Companies often find that the capital and human resources tied up in these Dog products could be far more effectively deployed in high-growth areas or Question Marks with potential.

The strategic decision for such products is usually to discontinue them or to manage them for minimal cost until they can be phased out completely. This allows DFIN to streamline its portfolio and focus on innovations that align with evolving market demands, such as advanced analytics or digital client onboarding.

Question Marks

DFIN is likely investigating blockchain technology to enhance regulatory reporting and data sharing, aiming for increased security, transparency, and immutability. This represents a burgeoning market with substantial future promise, though it currently faces low adoption and inherent risks. For instance, the global blockchain in regulatory technology market was projected to reach $1.5 billion by 2024, indicating significant growth potential.

These blockchain-focused endeavors demand considerable investment in research and development. Companies in this space often operate with uncertain near-term profitability and a lack of established market dominance. The high upfront costs are a key characteristic of this nascent stage, as seen in the significant venture capital funding flowing into regtech blockchain startups, with over $300 million invested in 2023 alone.

As cybersecurity regulations tighten globally, the market for integrated compliance solutions presents a significant growth opportunity. DFIN is navigating this high-growth sector, which is characterized by intense competition from numerous specialized vendors. A prime example of this trend is the increasing focus on data privacy, with regulations like GDPR and CCPA setting a high bar for businesses. The global cybersecurity market size was projected to reach $232.7 billion in 2024, with compliance solutions forming a substantial and expanding segment.

DFIN's focus on predictive regulatory change management tools positions it in a rapidly expanding sector. Financial institutions are increasingly seeking ways to proactively navigate the evolving regulatory landscape, a trend amplified by the sheer volume and complexity of new rules introduced annually. For instance, by the end of 2023, the number of new financial regulations globally continued its upward trajectory, creating a significant operational burden.

DFIN's potential investment in AI/ML-driven predictive analytics for this domain is a strategic move. These tools aim to forecast regulatory shifts, enabling firms to adapt their compliance strategies before changes are enacted, thereby mitigating risks and potential penalties. The market for such solutions, while promising, is still nascent, meaning DFIN would need to dedicate considerable resources to refine these complex offerings and establish a strong market presence.

Specialized Niche FinTech Compliance

DFIN's strategy might involve focusing on compliance solutions for specialized, fast-growing areas within FinTech, such as regulatory reporting for cryptocurrency assets or compliance frameworks for decentralized finance (DeFi). These are emerging micro-markets with significant growth potential, though DFIN's current penetration in each specific niche may be limited.

To effectively capitalize on these specialized niches, DFIN likely needs to allocate targeted investments and forge strategic partnerships. This approach would enable them to scale their offerings and gain substantial market share in these high-potential segments. For example, the global cryptocurrency market capitalization reached over $2.4 trillion in early 2024, highlighting the substantial compliance needs in this sector.

- Niche Focus: Targeting high-growth FinTech sub-sectors like crypto and DeFi compliance.

- Market Potential: Addressing emerging regulatory needs in rapidly expanding micro-markets.

- Strategic Imperatives: Requiring focused investment and key partnerships for market penetration and scale.

- Data Point: The DeFi market has seen exponential growth, with total value locked (TVL) in DeFi protocols exceeding $100 billion in recent periods, underscoring the demand for robust compliance solutions.

Expansion into New Geographic Regulatory Hubs

DFIN's strategic expansion into new geographic regulatory hubs, such as key Asian markets and emerging EU financial centers, represents a critical move for future growth. While these regions offer substantial upside potential, DFIN's initial market penetration and brand awareness are likely to be limited, especially when measured against established local players. This scenario places such initiatives squarely in the question mark category of the DFIN BCG Matrix, demanding significant upfront investment.

- High Growth Potential: Emerging markets like Singapore and Dublin are experiencing rapid growth in financial services, creating fertile ground for DFIN's offerings.

- Low Market Share: DFIN's current market share in these new hubs is minimal, presenting a challenge against entrenched local competitors.

- Investment Required: Substantial capital is needed for localization efforts, marketing, and building a robust local presence.

- Strategic Importance: Success in these question mark segments is vital for DFIN's long-term global competitiveness and revenue diversification.

For example, in 2024, DFIN might allocate an estimated $50 million to establish operations in a new Asian financial hub, aiming to capture a 3-5% market share within five years. This investment is crucial given that the target market is projected to grow at an annual rate of 10-12% through 2028. The challenge lies in overcoming existing relationships and regulatory nuances that favor local entities.

Question Marks in DFIN's BCG matrix represent business units with low relative market share in high-growth industries. These are often new ventures or expanding into new markets where DFIN has yet to establish a strong foothold. They require significant investment to grow and gain market share, with their future success being uncertain.

DFIN's exploration of AI/ML for predictive regulatory change management exemplifies a Question Mark. While the market for these tools is growing rapidly, DFIN's current market share is likely minimal, necessitating substantial R&D and market development capital. The success hinges on effectively predicting complex regulatory shifts and gaining adoption among financial institutions facing increasing compliance burdens.

Expanding into new geographic regulatory hubs, such as emerging Asian financial centers, also places DFIN's operations in these regions into the Question Mark category. These markets offer high growth potential but DFIN faces low initial market share and intense competition from established local players, demanding significant investment for market penetration and brand building.

The strategic focus on compliance solutions for specialized FinTech areas like cryptocurrency and DeFi represents another set of Question Marks. The growth in these sectors is exponential, but DFIN's penetration within these nascent regulatory compliance niches is likely limited, requiring targeted investments and strategic partnerships to scale effectively.

| Business Unit / Initiative | Industry Growth Rate | Relative Market Share | Investment Implication |

|---|---|---|---|

| AI/ML Predictive Regulatory Change Management | High (e.g., 10-15% annually) | Low | High Investment for R&D and Market Penetration |

| Expansion into Emerging Asian Financial Hubs (e.g., Singapore) | High (e.g., 8-10% annually) | Low | Significant Capital for Localization and Market Entry |

| Crypto/DeFi Regulatory Compliance Solutions | Very High (e.g., 20%+ annually) | Low | Targeted Investment and Strategic Partnerships for Niche Dominance |

BCG Matrix Data Sources

Our DFIN BCG Matrix leverages a robust blend of financial statements, industry growth rates, and competitor performance data, ensuring a comprehensive and actionable strategic overview.