Denso PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denso Bundle

Discover how political stability, economic shifts, and technological advancements are shaping Denso's global operations. Our PESTLE analysis dives deep into the external forces impacting this automotive giant, offering you a strategic advantage. Download the full version to unlock actionable intelligence and refine your own market approach.

Political factors

Governments worldwide are tightening emissions regulations, pushing for cleaner transportation. For instance, the European Union's upcoming Euro 7 standards, expected to be finalized in 2025, will impose more stringent limits on pollutants from internal combustion engines. This regulatory push directly impacts Denso, necessitating increased investment in electrification technologies and advanced exhaust aftertreatment systems to ensure compliance and maintain market access.

Shifting international trade policies, particularly tariffs and trade agreements, directly influence Denso's global supply chain and overall profitability. For instance, the impact of U.S. tariffs in early 2024 led to a noticeable effect on Denso's first-quarter earnings, prompting strategic considerations for production localization to buffer these financial pressures.

Navigating these intricate geopolitical trade environments is crucial for Denso to sustain efficient operations and maintain cost competitiveness in the global automotive parts market.

Ongoing geopolitical tensions, like the protracted conflict in Ukraine and escalating tensions in the Middle East, cast a long shadow over global economic stability and critical supply chains. These conflicts directly impact raw material availability and can significantly inflate logistics expenses, as seen with the increased shipping costs in 2024 due to maritime route disruptions.

For a company like Denso, these disruptions translate into potential raw material shortages and increased manufacturing costs, necessitating robust risk assessment and mitigation strategies to maintain operational continuity and global business stability throughout 2025.

Government Incentives for Automotive Technologies

Governments worldwide are actively encouraging the advancement and uptake of cutting-edge automotive technologies, such as autonomous driving systems and electric vehicle (EV) powertrains. These initiatives, often manifesting as direct subsidies, preferential tax treatments, and research and development grants, are pivotal in shaping Denso's strategic investment decisions and accelerating its innovation pipeline in these critical sectors.

For instance, the United States' Inflation Reduction Act of 2022 offers substantial tax credits for EV purchases and domestic battery manufacturing, directly impacting the demand for components Denso produces. Similarly, the European Union's Green Deal aims to phase out internal combustion engine vehicles, pushing manufacturers and suppliers like Denso to prioritize electrification. Denso's strategy involves closely monitoring and aligning its research and development efforts with these governmental priorities to effectively leverage emerging growth opportunities and secure a competitive edge.

- Government support for EV adoption: Many countries are offering purchase incentives and infrastructure development grants to boost EV sales, creating a larger market for Denso's electrification components.

- R&D funding for autonomous technology: Significant public investment in autonomous driving research, including grants for sensor development and AI, directly benefits Denso's innovation in this area.

- Regulatory alignment: Denso actively tracks evolving emissions standards and safety regulations, ensuring its product development aligns with government mandates and incentives.

- Global incentive landscape: In 2024, countries like China continued to offer substantial subsidies for new energy vehicles, while Japan and South Korea also provided tax breaks and grants for green automotive technologies.

Local Content Requirements and Investment Policies

Many nations are enacting regulations that push for or require a certain percentage of locally sourced components in manufactured products. This directly impacts how Denso approaches its production and where it sources its materials, potentially increasing costs or requiring new operational setups.

These local content mandates often compel companies like Denso to build or grow their manufacturing presence and develop local supply chains within specific countries. For instance, in 2024, several emerging markets continued to strengthen their local content policies, particularly in the automotive sector, aiming to foster domestic industrial capabilities.

Denso's strategic response involves a decentralized approach to global management. They are focusing on empowering regional operations to manage independently, taking into account unique local market conditions and regulatory environments, which includes adapting to these local content requirements.

- Local Content Mandates: Countries increasingly use these policies to boost domestic economies and job creation in manufacturing sectors.

- Supply Chain Adaptation: Denso must assess and potentially reconfigure its global supply chains to meet varying local content percentages.

- Regional Autonomy: Denso's strategy of regional independent management allows for more agile responses to diverse political and economic landscapes, including local content rules.

Governments worldwide are increasingly prioritizing sustainability and emissions reduction, directly influencing the automotive sector. For example, the European Union's ongoing efforts towards stricter emissions standards, with proposals for Euro 7 regulations impacting 2025, necessitate significant investment by companies like Denso in cleaner technologies and advanced emission control systems to maintain market access and compliance.

Shifting trade policies and geopolitical tensions, such as those impacting global shipping costs in 2024, create volatility for Denso's supply chain and manufacturing operations. Consequently, Denso must adapt its sourcing strategies and potentially localize production to mitigate risks associated with tariffs and international disputes, ensuring operational resilience through 2025.

Government incentives for electric vehicle (EV) adoption and autonomous driving technologies are accelerating innovation in the automotive industry. Many nations, including the U.S. with its Inflation Reduction Act, offer substantial financial support, directly encouraging Denso to align its research and development with these growth areas and capitalize on emerging market demands.

What is included in the product

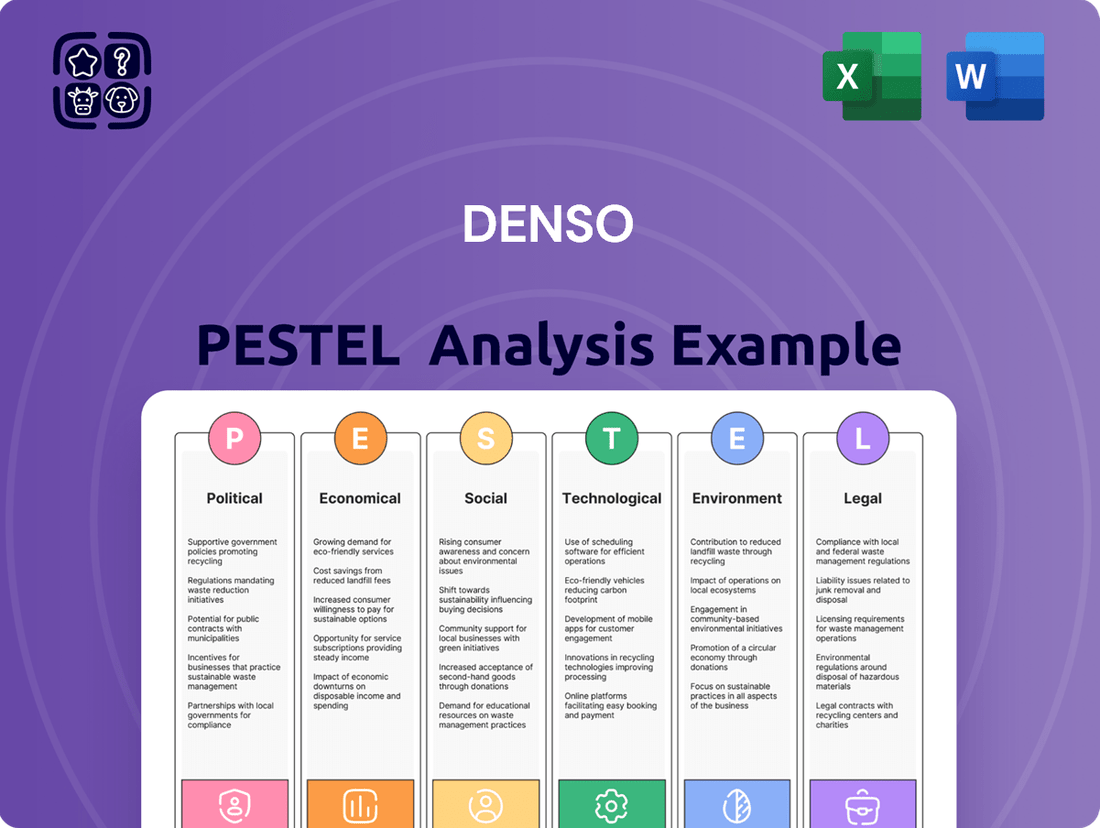

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Denso, offering a comprehensive view of the external landscape.

A clear, actionable summary of Denso's PESTLE factors, transforming complex external forces into manageable insights for strategic decision-making.

Economic factors

The automotive industry is rapidly shifting, with electric vehicle sales projected to reach 14 million units globally in 2024, a substantial increase from previous years. This transition, alongside advancements in connected and autonomous technologies, presents both challenges and opportunities for established suppliers like Denso. The market's reliance on vehicle production volumes means that disruptions, such as the lingering effects of the 2023 semiconductor shortage which saw production cuts across major automakers, directly influence Denso's revenue streams.

Denso's financial health is intrinsically linked to the ebb and flow of global vehicle sales, which in 2024 are expected to see moderate growth, though regional disparities persist. For instance, while the North American market shows resilience, certain European markets are experiencing slower recovery. Denso's strategic positioning and future profitability will depend on its agility in navigating these market shifts and its investment in areas like advanced driver-assistance systems (ADAS) and electrification components.

Persistent global inflation, coupled with rising wage pressures, significantly impacts Denso's operational expenses. For instance, in the fiscal year ending March 2024, Denso reported increased costs for parts and materials, a direct consequence of these inflationary trends.

Fluctuations in raw material prices, such as semiconductors and metals, directly affect Denso's production costs and overall profitability. The company has actively worked to mitigate these effects by implementing robust cost management strategies and strategically passing on a portion of these increased expenses through pricing adjustments.

Effectively managing these inflationary pressures is paramount for Denso to sustain healthy profit margins. By focusing on cost efficiencies and adaptive pricing, Denso aims to navigate the challenges posed by the current economic climate.

Exchange rate fluctuations, especially involving the Japanese yen against major currencies like the US dollar and Euro, significantly influence Denso's financial performance. A weaker yen, for instance, generally translates to higher reported revenues and profits when converting foreign earnings back into yen.

Conversely, a stronger yen can reduce the value of overseas earnings when translated, negatively impacting reported figures. For example, Denso's financial forecasts for fiscal year 2025, announced in May 2024, assumed an average exchange rate of 150 JPY/USD and 160 JPY/EUR, highlighting the crucial role these assumptions play in their outlook.

Denso actively manages its exposure to these currency movements, employing strategies to mitigate potential adverse impacts on its profitability and revenue streams. This proactive approach is vital for maintaining financial stability in a globalized market.

Consumer Spending and Demand for New Technologies

Consumer spending habits are a critical driver for Denso, especially concerning new automotive technologies. As consumers increasingly show interest in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), their willingness to purchase these technologies directly impacts Denso's sales figures for related components.

While the demand for EVs is on the rise, several factors can temper this growth. Concerns about the initial cost of EVs and the availability of reliable charging infrastructure remain significant hurdles for many consumers. For instance, in early 2024, consumer surveys indicated that price remained a primary deterrent for EV adoption in several key markets, despite growing environmental awareness.

Denso's success hinges on its ability to anticipate and adapt to these evolving consumer preferences. Understanding which technological features resonate most with buyers, and addressing any perceived barriers to adoption, is essential for stimulating demand for Denso's innovative product offerings.

- EV Adoption Rate: Projections for 2025 suggest a continued, albeit varied, increase in EV market share globally, with some regions seeing adoption rates exceeding 20% of new vehicle sales.

- ADAS Feature Demand: Consumer surveys in late 2024 highlighted ADAS features like adaptive cruise control and automatic emergency braking as highly desired, even in non-EV segments.

- Consumer Affordability: Average EV prices in major markets in mid-2024 still presented a significant premium over comparable internal combustion engine vehicles, impacting broader consumer uptake.

Supply Chain Disruptions and Resilience

The automotive sector, including suppliers like Denso, has navigated significant supply chain challenges, most notably the semiconductor shortage that impacted production volumes globally. While the most acute phase of this shortage has passed, the imperative for robust and adaptable supply chains remains a top priority for Denso.

Denso is actively investing in strengthening its manufacturing footprint and fostering deeper collaborations with its suppliers. This strategic focus aims to mitigate future disruptions and ensure the consistent availability of critical automotive components. For instance, Denso announced in late 2023 plans to expand its semiconductor manufacturing capabilities in Japan, a move designed to bolster its control over a key input.

- Semiconductor Shortage Impact: The global automotive industry experienced production losses estimated in the millions of units due to semiconductor scarcity in 2021-2022.

- Denso's Mitigation Strategy: Denso is enhancing vertical integration and diversifying its supplier base to reduce reliance on single sources.

- Resilience Investment: The company is prioritizing investments in advanced manufacturing technologies and digital supply chain management tools to improve visibility and responsiveness.

- Supplier Partnerships: Strengthening long-term relationships with key suppliers is crucial for securing component supply and fostering innovation.

Global economic conditions significantly shape Denso's operational landscape. Persistent inflation, evident in rising material and labor costs, directly impacts Denso's profitability, as seen in their fiscal year ending March 2024 results which noted increased input expenses. Exchange rate volatility, particularly the yen's movement against major currencies, also plays a crucial role, influencing the reported value of Denso's international earnings.

Consumer demand for automotive products, especially newer technologies like EVs and ADAS, is a key economic driver for Denso. While EV adoption is growing, consumer concerns about upfront costs and charging infrastructure availability, highlighted in early 2024 surveys, continue to influence purchase decisions. Denso's ability to align its product offerings with consumer affordability and technological preferences is vital for sustained sales growth.

The automotive industry's ongoing recovery from supply chain disruptions, such as the 2021-2022 semiconductor shortage which cost millions of production units globally, underscores the importance of supply chain resilience. Denso's strategic investments, including expanding its semiconductor manufacturing capabilities in Japan by late 2023, aim to mitigate future component availability risks and ensure production continuity.

Preview the Actual Deliverable

Denso PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Denso PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights. You'll gain a deep understanding of the external forces shaping Denso's operations and future trajectory.

Sociological factors

Consumers are increasingly prioritizing eco-friendly, secure, and hassle-free transportation. This is evident in the rising demand for electric vehicles (EVs), advanced driver-assistance systems (ADAS), and integrated in-car digital services.

For instance, global EV sales are projected to reach over 16 million units in 2024, a significant jump from previous years, showcasing this preference. Denso's ability to adapt its offerings to these evolving expectations is crucial for maintaining its competitive edge.

Aging populations in key markets, especially Japan, are a significant factor affecting labor availability and posing challenges for manufacturing sectors like automotive components. For instance, Japan's population is projected to continue aging, with the proportion of those aged 65 and over expected to reach 35.3% by 2050, according to UN data. This demographic trend directly impacts Denso's ability to secure a sufficient workforce for its operations.

To address these workforce dynamics, Denso is actively exploring strategies such as increased automation to compensate for labor shortages and a concerted effort to attract a more diverse talent pool, including older workers and individuals from different backgrounds. The company's commitment to employee development and well-being is also crucial in retaining existing talent and making the company an attractive employer amidst these demographic shifts.

Societal acceptance is a major hurdle for autonomous vehicles (AVs). While many consumers are intrigued by advanced driver-assistance systems, like those Denso supplies, fully entrusting a vehicle to drive itself remains a challenge. A 2024 survey indicated that only about 40% of US adults felt comfortable riding in a fully autonomous vehicle, highlighting a significant gap in public trust.

Concerns often stem from safety worries and a general lack of understanding regarding how AVs make critical decisions, particularly in unpredictable situations. Denso's ongoing investments in AV technology must therefore prioritize not only technical innovation but also transparent communication and demonstrable safety records to foster greater public confidence and pave the way for broader adoption.

Ethical Considerations in AI and Data Privacy

As Denso integrates more sophisticated AI into its automotive offerings, ethical considerations surrounding data privacy are paramount. Consumer apprehension regarding the collection and utilization of data within connected vehicles is a significant sociological factor. For instance, a 2024 survey indicated that over 70% of vehicle owners express concerns about the privacy of their driving data.

Denso's commitment to robust data security and transparent privacy protocols is crucial for fostering consumer trust. Ethical AI development, ensuring fairness and accountability in algorithmic decision-making, is equally vital. Failure to address these concerns could lead to reputational damage and hinder market adoption of advanced automotive technologies. By Q2 2025, evolving data privacy regulations globally, such as stricter enforcement of GDPR-like principles, will further necessitate Denso's proactive approach.

- Data Security Investment: Denso's projected investment in cybersecurity for connected vehicle systems is expected to reach $500 million by the end of 2024, aiming to safeguard sensitive user information.

- Consumer Trust Surveys: Ongoing consumer surveys in 2024-2025 reveal a growing demand for explicit consent mechanisms and clear data usage policies from automotive manufacturers.

- Ethical AI Frameworks: The company is actively developing internal ethical AI guidelines, drawing inspiration from industry best practices and anticipating regulatory shifts by mid-2025.

- Regulatory Compliance: Denso is monitoring and preparing for stricter data privacy legislation anticipated in key markets, including the EU and North America, throughout 2025.

Corporate Social Responsibility and Brand Image

Societal expectations for corporate social responsibility (CSR) and sustainable business practices are increasingly influencing consumer and investor decisions. For instance, a 2024 survey indicated that over 70% of consumers consider a company's environmental and social impact when making purchasing choices. This growing awareness directly impacts how companies like Denso are perceived and valued.

Denso's commitment to environmental sustainability, ethical procurement, and fair labor practices is a cornerstone of its brand image and fosters crucial stakeholder trust. In its 2024 Sustainability Report, Denso highlighted a 15% reduction in CO2 emissions across its operations compared to 2020, demonstrating tangible progress in its environmental goals.

The company actively communicates its CSR initiatives, reinforcing its dedication to responsible business. This includes readily available sustainability reports and detailed supplier guidelines, which are vital for building confidence among investors and customers alike.

- Growing Consumer Demand: Over 70% of consumers in a 2024 study prioritized a company's social and environmental impact.

- Environmental Progress: Denso reported a 15% reduction in CO2 emissions by 2024, showcasing its sustainability efforts.

- Stakeholder Trust: Ethical practices and transparent communication of CSR initiatives are key to building and maintaining trust.

- Brand Reputation: Strong CSR performance directly correlates with a positive brand image and enhanced stakeholder loyalty.

Societal shifts toward eco-consciousness and safety are reshaping automotive preferences, driving demand for EVs and advanced driver assistance systems (ADAS). For instance, global EV sales are projected to exceed 16 million units in 2024, underscoring this trend. Denso's ability to align its product development with these evolving consumer values is critical for its market position.

Demographic changes, particularly aging populations in key markets like Japan, present workforce challenges. Japan's projected 35.3% elderly population by 2050 highlights potential labor shortages. Denso is addressing this through automation and diverse talent acquisition strategies.

Public trust in autonomous vehicles (AVs) remains a significant hurdle, with only about 40% of US adults comfortable in a fully autonomous vehicle in a 2024 survey. Denso's focus on safety and transparent communication is vital to overcome this hesitancy.

Concerns over data privacy are growing, with over 70% of vehicle owners expressing worries about their driving data in a 2024 survey. Denso's commitment to robust data security and transparent privacy protocols is essential for building consumer confidence amidst evolving regulations by mid-2025.

| Sociological Factor | Impact on Denso | Denso's Response/Data |

|---|---|---|

| Consumer Preference for Sustainability & Safety | Increased demand for EVs, ADAS | Global EV sales projected >16M units (2024); Focus on ADAS innovation |

| Aging Demographics | Labor shortages | Automation investment; Diverse talent acquisition |

| Public Trust in AVs | Slow adoption of autonomous technology | Emphasis on safety demonstration; Transparent communication |

| Data Privacy Concerns | Hesitancy towards connected car features | >70% vehicle owners concerned (2024); Investment in cybersecurity ($500M by end-2024) |

Technological factors

The automotive sector's accelerating move towards electrification, encompassing hybrid (HEVs), battery electric (BEVs), and fuel cell electric vehicles (FCEVs), represents a significant technological force impacting Denso. The company is strategically channeling substantial resources into research and development, focusing on enhancing its offerings in critical components such as inverters, motor generators, and advanced battery management systems.

Denso's commitment to carbon neutrality is intrinsically linked to its product development, aiming to facilitate the broader adoption of electric mobility solutions. By 2023, Denso had already announced investments of over ¥1 trillion (approximately $7 billion USD at current exchange rates) in areas like electrification and software development, underscoring the scale of its technological pivot.

Denso is heavily invested in autonomous driving and Advanced Driver-Assistance Systems (ADAS) as a core technological driver. This focus translates into substantial capital allocation for crucial components like semiconductors, sophisticated sensors, and artificial intelligence, all aimed at creating unified systems for enhanced vehicle safety and user experience.

The company is actively pursuing strategic partnerships to expedite the development of cutting-edge AI and high-performance automotive semiconductors. For instance, Denso announced a significant investment in Renesas Electronics in 2020, aiming to strengthen their collaboration in the semiconductor domain, a move that continues to bear fruit in their ADAS and autonomous driving solutions.

The automotive industry's rapid shift towards connected cars means Denso must prioritize advanced software and integrated system development. This encompasses critical areas such as vehicle-to-everything (V2X) communication, robust cybersecurity measures, and efficient data management strategies. For instance, the global connected car market was valued at an estimated $227.9 billion in 2023 and is projected to reach $817.7 billion by 2030, highlighting the immense growth potential and necessity for Denso's software focus.

Denso is actively strengthening its software value proposition by focusing on integrated Electronic Control Unit (ECU) development. This approach serves as a fundamental building block for enhancing vehicle intelligence and enabling sophisticated functionalities. By consolidating software and hardware, Denso aims to streamline development and improve the overall performance and capabilities of the connected vehicle ecosystem, positioning itself to capitalize on the growing demand for smarter automotive solutions.

Semiconductor Development and Supply

Semiconductors are the brains of modern vehicles, powering everything from infotainment systems to advanced driver-assistance features. The automotive industry faced significant disruptions due to semiconductor shortages, with production losses estimated in the millions of vehicles globally in 2021 and 2022. Denso, a major automotive supplier, is actively addressing this by bolstering its in-house semiconductor development and manufacturing capabilities. This strategic move aims to secure a more consistent supply chain and foster innovation in automotive electronics.

Denso's commitment extends to collaborative efforts, participating in joint development projects to advance semiconductor technology. A key focus is the development of Neural Processing Units (NPUs), specialized chips designed to accelerate artificial intelligence processing within vehicles. These NPUs are crucial for enabling sophisticated AI applications like autonomous driving and predictive maintenance, positioning Denso at the forefront of automotive technological advancement.

- Semiconductor Impact: Global automotive production losses due to chip shortages were substantial, impacting revenue for many automakers and suppliers.

- Denso's Strategy: Consolidating in-house semiconductor expertise and investing in joint development projects to ensure supply stability and technological leadership.

- AI Integration: Development of NPUs for AI processing signifies a move towards more intelligent and autonomous vehicle systems.

Factory Automation and Advanced Manufacturing

Denso is a leader in factory automation and advanced manufacturing, applying its extensive experience to sectors beyond automotive, including agriculture. This focus on digital infrastructure and automation within its own plants allows for highly adaptable production lines and significant efficiency gains.

These technological advancements are crucial for Denso to stay competitive and effectively manage labor challenges. For instance, Denso's investment in smart factories aims to boost productivity, with a goal to increase the automation rate in its production processes. By integrating AI and robotics, Denso is enhancing precision and speed in its manufacturing operations.

- Denso's commitment to Industry 4.0 principles drives its automation strategy.

- The company is actively developing and deploying advanced robotics and IoT solutions in its factories.

- Flexible production systems are a key outcome, enabling quicker response to market demands and product customization.

- Efficiency improvements are projected to reach double-digit percentages in automated lines by 2025.

Denso's technological strategy is deeply intertwined with the automotive industry's shift towards electrification and autonomous driving. The company is investing heavily in components like inverters and sensors, aiming to lead in these evolving segments.

Semiconductor development is a critical focus, with Denso enhancing its capabilities and collaborating on advanced chips like Neural Processing Units (NPUs) to power AI in vehicles.

The company is also prioritizing software development for connected cars, including V2X communication and cybersecurity, recognizing the immense growth in this market, projected to reach $817.7 billion by 2030.

Denso's commitment to Industry 4.0 principles is evident in its factory automation efforts, leveraging robotics and AI to boost efficiency and flexibility in production, with targets for significant automation rate increases.

| Technological Factor | Denso's Focus/Action | Market Context/Data |

|---|---|---|

| Electrification | R&D in inverters, motor generators, battery management systems | Global EV market growth continues, with significant investments in charging infrastructure and battery technology. |

| Autonomous Driving & ADAS | Investment in semiconductors, sensors, AI development | ADAS adoption is increasing, driven by safety regulations and consumer demand for advanced features. |

| Connected Cars | Software development for V2X, cybersecurity, data management | Connected car market projected to reach $817.7 billion by 2030. |

| Semiconductors | In-house development, joint projects for NPUs | Automotive chip shortages impacted production significantly in 2021-2022. |

| Factory Automation | Robotics, AI integration, IoT solutions | Efficiency improvements in automated lines projected to reach double-digit percentages by 2025. |

Legal factors

Strict global regulations on automotive product safety and liability are a critical factor for Denso. These rules mandate the highest quality and reliability for all components and systems. Failure to comply can lead to costly recalls and legal battles. For instance, in 2023, the automotive industry faced significant recall costs, highlighting the financial impact of safety lapses.

Denso navigates a landscape of tightening environmental protection laws and emissions standards worldwide. These regulations, which govern pollutants from manufacturing and vehicle exhaust, are a significant driver for Denso's investment in sustainable production and the creation of eco-friendly technologies. For instance, in 2024, the European Union's proposed Euro 7 standards aim to further reduce vehicle emissions, impacting component manufacturers like Denso.

Denso faces increasing scrutiny under data privacy and cybersecurity laws like the GDPR and CCPA, especially with its growing involvement in connected and autonomous vehicle technology. These regulations mandate robust protection for sensitive vehicle and user data, with significant penalties for non-compliance. For instance, a data breach could lead to substantial fines, impacting Denso's financial performance and reputation.

To address these challenges, Denso is actively developing advanced security measures. This includes creating systems for dynamically updating firewall rules within vehicle networks, a critical step in preventing unauthorized access. Furthermore, securing software package composition information is a key focus, ensuring transparency and integrity throughout the software lifecycle.

Intellectual Property Rights and Patent Protection

Protecting its vast intellectual property (IP) portfolio, which includes patents, trademarks, and copyrights, is absolutely crucial for Denso's ongoing competitiveness in the automotive technology sector. The company is diligent in managing this IP and actively pursues measures against third-party infringement to secure its groundbreaking technological advancements.

Denso strategically leverages its IP assets to not only fuel business expansion but also to contribute solutions to pressing societal challenges. For instance, in fiscal year 2023, Denso reported significant investment in research and development, a key driver for IP generation.

- Patent Portfolio Growth: Denso consistently files new patents globally, with a notable increase in filings related to electrification and advanced driver-assistance systems (ADAS) in 2023.

- IP Enforcement Actions: The company actively monitors the market for potential IP violations and has engaged in legal actions to protect its innovations.

- Strategic IP Licensing: Denso explores licensing opportunities for its patented technologies, creating new revenue streams and fostering wider adoption of its solutions.

Anti-Bribery and Anti-Corruption Laws

Denso, as a global automotive supplier, navigates a complex web of anti-bribery and anti-corruption regulations across its numerous operating regions. These laws, such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, are critical to maintaining ethical operations and avoiding severe legal and financial penalties. For instance, in 2023, companies globally faced significant fines for bribery violations, underscoring the importance of robust compliance programs.

To address these legal mandates, Denso has implemented a comprehensive Global Anti-Bribery Policy. This policy serves as the cornerstone of its commitment to fair and ethical business conduct. The company actively engages in awareness campaigns and provides regular training to its employees and suppliers, fostering a culture of integrity and compliance throughout its value chain.

Denso's commitment to anti-bribery and anti-corruption is further reinforced by dedicated compliance committees. These committees play a vital role in overseeing the effectiveness of the company's policies and procedures, ensuring adherence to legal requirements and promoting a strong ethical framework. This proactive approach is essential for mitigating risks in the highly regulated automotive industry.

- Global Reach, Local Laws: Denso must comply with diverse anti-bribery and anti-corruption laws in every country it operates.

- Policy and Training: A Global Anti-Bribery Policy guides operations, supported by awareness activities and education for employees and suppliers.

- Oversight: Compliance committees are in place to monitor and ensure adherence to these critical legal standards.

- Industry Context: In 2023, numerous companies faced substantial fines for bribery, highlighting the severe consequences of non-compliance.

Denso operates under stringent product safety and liability regulations, demanding high quality and reliability for all automotive components. Non-compliance can lead to significant recall expenses and legal issues, as seen with widespread automotive recalls in 2023 costing billions globally. The company must also adhere to evolving environmental laws, such as the upcoming Euro 7 standards in the EU from 2024, which will further impact emissions control technologies and manufacturing processes. Furthermore, data privacy laws like GDPR and CCPA necessitate robust cybersecurity measures for connected vehicle technologies, with substantial penalties for breaches.

| Legal Factor | Impact on Denso | 2023/2024 Data/Trend |

| Product Safety & Liability | Mandates high quality, risk of recalls and legal costs | Automotive industry recall costs in 2023 were substantial, affecting component suppliers. |

| Environmental Regulations | Drives investment in sustainable production and eco-friendly tech | EU's proposed Euro 7 standards (effective from 2024) tighten emission limits for vehicles. |

| Data Privacy & Cybersecurity | Requires robust protection for vehicle/user data, risk of fines | Increased focus on GDPR/CCPA compliance for connected vehicle data in 2023/2024. |

| Intellectual Property (IP) Protection | Crucial for competitiveness, requires active enforcement | Denso's R&D investment in FY2023 fuels IP generation, with increased patent filings in ADAS and electrification. |

| Anti-Bribery & Anti-Corruption | Requires ethical operations, risk of severe penalties | Global companies faced significant bribery violation fines in 2023; Denso maintains a Global Anti-Bribery Policy. |

Environmental factors

DENSO is actively pursuing ambitious goals for carbon neutrality and reducing greenhouse gas emissions. The company has set a target to achieve carbon neutrality at its own facilities by fiscal year 2035, excluding the use of carbon credits. This commitment extends to its entire supply chain, with a goal of reaching carbon neutrality by fiscal year 2050.

To support these targets, DENSO is focusing on significant energy savings initiatives and increasing its adoption of renewable energy sources. A key part of their strategy involves collaborating closely with suppliers to help them reduce their own carbon footprints, thereby tackling Scope 3 emissions. Specifically, DENSO aims for a 25% reduction in Scope 3 emissions by FY 2030, measured against a FY 2020 baseline.

Denso is deeply committed to resource efficiency and waste management, aiming to minimize its environmental footprint. The company actively works to reduce waste generated during manufacturing and champions a circular economy approach. For instance, in fiscal year 2023, Denso reported a 3.5% reduction in waste generated per unit of production compared to the previous year.

A key focus for Denso is the reduction of environmentally hazardous substances and water consumption across its global facilities. These efforts are integral to their sustainability targets, with a goal to decrease water usage by 10% by 2025 from a 2019 baseline. This aligns with broader industry trends driven by increasing environmental regulations and consumer demand for eco-friendly products.

Denso is also a proponent of expanding automotive recycling processes, notably through car-to-car recycling initiatives. This strategy aims to maximize the reuse of automotive components and materials, thereby reducing the demand for virgin resources and diverting waste from landfills. Such initiatives are crucial for the automotive sector as it navigates the transition to more sustainable lifecycle management of vehicles.

Denso places a strong emphasis on responsible procurement, particularly for raw materials like cobalt and tin, often sourced from regions with potential conflict mineral concerns. In 2023, Denso reported that 99.9% of its suppliers had completed sustainability surveys, a testament to its commitment to ethical sourcing and labor practices throughout its extensive global supply chain.

The company's supplier sustainability guidelines, updated regularly, aim to ensure compliance with environmental and social standards, thereby proactively mitigating reputational and operational risks associated with unsustainable practices. This rigorous approach to sustainable sourcing is crucial for maintaining Denso's brand integrity and ensuring long-term supply chain resilience.

Product Lifecycle Environmental Impact

Denso is actively working to minimize the environmental footprint of its products throughout their entire journey, from initial design and production to their operational phase and eventual recycling. This commitment is evident in their focus on developing technologies that enhance fuel efficiency and slash vehicle emissions. For instance, Denso's advanced engine management systems and lightweight materials contribute to better fuel economy, a critical factor in reducing the environmental impact of internal combustion engines.

The company's strategic direction strongly supports the transition to electric mobility. Denso is investing heavily in the research and development of components essential for electric vehicles, such as advanced battery management systems and electric powertrains. This aligns with global trends, where EV adoption is accelerating. For example, by the end of 2024, projections indicate a significant increase in global EV sales, driving demand for Denso's innovative solutions.

Furthermore, Denso is exploring innovative avenues like biofuels and agricultural support technologies. This forward-thinking approach aims to create more sustainable solutions for transportation and related industries. Their research into biofuels could offer alternatives to traditional fossil fuels, potentially reducing carbon emissions in sectors where electrification is more challenging.

- Fuel Efficiency Technologies: Denso's innovations in engine control units and fuel injection systems have demonstrably improved fuel efficiency in traditional vehicles, contributing to lower CO2 emissions.

- Electric Vehicle Components: The company is a key supplier of critical EV components, including power electronics and battery cooling systems, supporting the global shift towards zero-emission transportation.

- Biofuel and Agricultural Research: Denso's investment in these areas signifies a commitment to exploring diverse sustainable energy sources and supporting environmentally conscious agricultural practices.

Climate Change Adaptation and Resilience

Denso is actively addressing climate change beyond just reducing emissions, focusing on adapting its operations to mitigate risks from extreme weather events. These events could disrupt manufacturing facilities or supply chain logistics, impacting production and delivery schedules. For instance, the increasing frequency of typhoons in Japan, a key operational region for Denso, necessitates robust contingency planning for its plants and distribution networks.

The company's commitment to developing technologies that enhance energy efficiency and promote renewable energy sources is a core component of its resilience strategy. By investing in solutions like advanced battery management systems and thermal management technologies for electric vehicles, Denso not only contributes to a lower-carbon economy but also positions itself to better withstand energy market volatility and potential disruptions in fossil fuel supplies. This forward-thinking approach is crucial in navigating the uncertainties of a changing climate.

Denso's proactive stance on climate change and water security has garnered external recognition. For example, in 2023, the company was included in the CDP Water Security A List, highlighting its effective management of water-related risks and opportunities. This acknowledgment underscores Denso's commitment to sustainable practices that extend to critical environmental resources, further bolstering its operational resilience.

Key initiatives and recognitions include:

- Focus on adaptation: Implementing measures to manage physical risks from extreme weather events impacting manufacturing and supply chains.

- Technology development: Investing in energy efficiency and renewable energy technologies to enhance operational resilience.

- Water security: Recognized on the CDP Water Security A List in 2023 for robust water management practices.

- Supply chain resilience: Diversifying sourcing and enhancing logistics to counter potential climate-related disruptions.

DENSO's environmental strategy centers on achieving carbon neutrality by 2035 for its own facilities and by 2050 across its supply chain, driven by significant investments in energy savings and renewable energy adoption. The company is actively reducing its environmental footprint through waste management, aiming for a 3.5% reduction in waste per production unit in FY2023, and targets a 10% decrease in water usage by 2025 from a 2019 baseline.

The company is a major player in developing components for electric vehicles and exploring sustainable energy sources like biofuels, aligning with global trends and driving demand for its innovative solutions. DENSO also focuses on adapting its operations to mitigate climate change risks, such as extreme weather events, and was recognized on the CDP Water Security A List in 2023 for its water management practices.

| Environmental Target | Current Status/Progress | Year |

|---|---|---|

| Carbon Neutrality (Own Facilities) | Target set | FY2035 |

| Carbon Neutrality (Supply Chain) | Target set | FY2050 |

| Scope 3 Emissions Reduction | Target: 25% reduction vs FY2020 | FY2030 |

| Water Usage Reduction | Target: 10% reduction vs FY2019 | 2025 |

| Waste Reduction (per unit production) | 3.5% reduction | FY2023 |

PESTLE Analysis Data Sources

Our Denso PESTLE analysis is built on a robust foundation of data from official government publications, international organizations, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to provide a comprehensive overview.