Denso Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denso Bundle

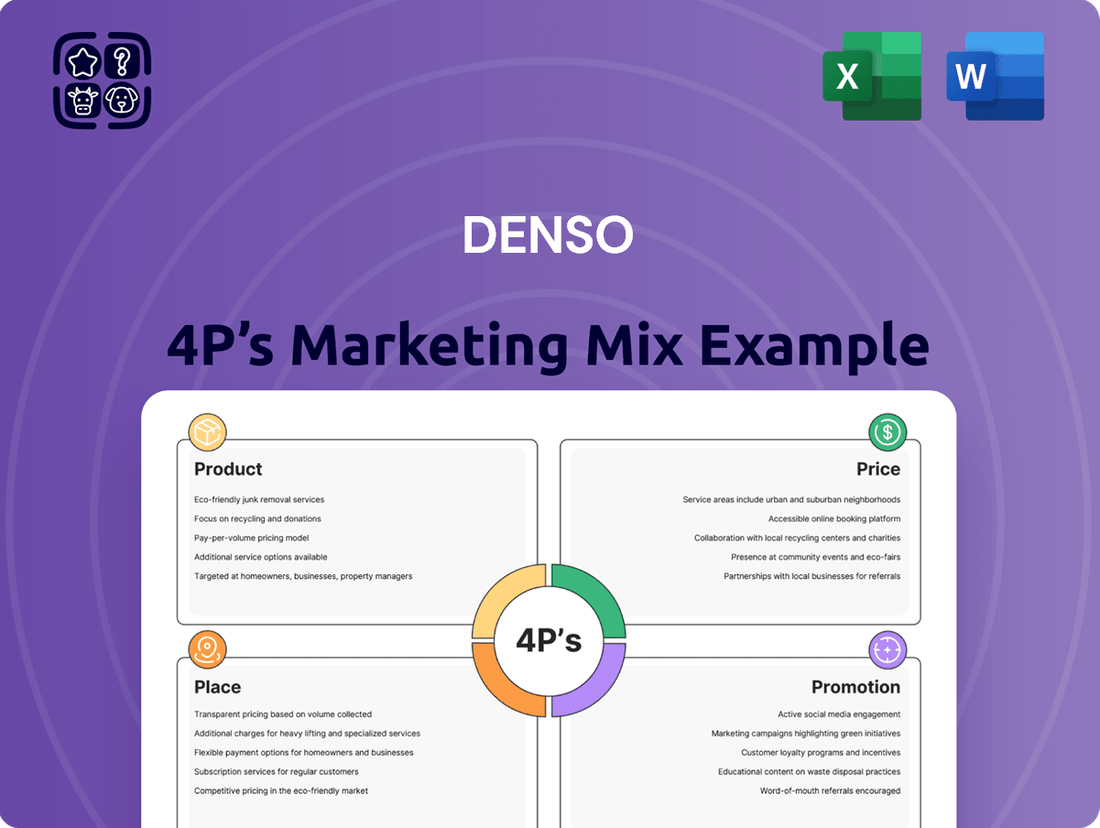

Discover how Denso leverages its Product innovation, strategic Pricing, expansive Place in the market, and impactful Promotion to maintain its leadership in the automotive industry. This analysis reveals the interconnectedness of these elements, offering a glimpse into their winning formula.

Go beyond this overview and unlock the complete Denso 4Ps Marketing Mix Analysis, packed with actionable insights and ready for your strategic planning. Elevate your understanding and gain a competitive edge.

Product

Denso's product strategy for automotive core systems is broad and deep, covering thermal systems like climate control and battery thermal management, crucial for electric vehicle efficiency. They also provide robust powertrain systems, essential for both traditional and electrified vehicles, alongside advanced mobility systems that enhance safety and connectivity.

In 2024, Denso's commitment to these core systems is evident in their continued R&D investment, aiming to address the industry's shift towards electrification and autonomous driving. For instance, their thermal management solutions are critical as battery performance and longevity in EVs are directly tied to temperature control.

Denso's electrification solutions are central to their product strategy, supplying essential components like inverters, motor generators, and battery ECUs for EVs, HEVs, and FCVs. This focus directly addresses the growing demand for electric mobility and contributes to a carbon-neutral future. For instance, Denso announced in 2024 a significant investment in expanding its electrification component production capabilities to meet anticipated market growth.

Denso's Advanced Mobility & Safety product line focuses on sophisticated electronics that significantly boost vehicle safety and driver convenience. Their investment in areas like advanced driver-assistance systems (ADAS) is a cornerstone of this strategy.

Key components like Human Machine Interface (HMI) ECUs and the Global Safety Package 3 (GSP3) are designed to actively reduce accidents and create a more comfortable driving environment. For instance, ADAS technologies are projected to prevent millions of crashes annually as adoption grows.

Further innovation is seen in solutions such as keyless access systems, particularly beneficial for fleet management, offering enhanced security and operational efficiency. The market for ADAS is experiencing robust growth, with projections indicating a significant expansion in the coming years, driven by consumer demand and regulatory pushes for safer vehicles.

Non-Automotive Innovations

Denso leverages its advanced manufacturing and technological prowess beyond the automotive realm, showcasing a commitment to broader societal and industrial advancement. This diversification is a key element of its product strategy, extending its reach into critical non-automotive sectors.

In factory automation, Denso offers sophisticated solutions designed to boost industrial productivity and efficiency. For instance, their expertise in robotics and control systems is applied to create smarter, more automated manufacturing environments, a trend that saw global industrial automation market valued at approximately $170 billion in 2023 and projected to grow steadily.

Denso is also actively developing agricultural technology, aiming to enhance food value chains. This includes precision farming tools and sensor technologies that can optimize crop yields and resource management. The global agri-tech market is experiencing significant growth, expected to reach over $30 billion by 2027, with innovations like those from Denso playing a crucial role.

Furthermore, the company is exploring new energy frontiers, particularly in hydrogen production and utilization. This strategic focus aligns with global decarbonization efforts and positions Denso to contribute to sustainable energy solutions. The hydrogen economy is gaining momentum, with significant investments anticipated in production infrastructure and fuel cell technology throughout the 2020s and beyond.

- Factory Automation: Denso's solutions enhance industrial productivity through advanced robotics and control systems.

- Agricultural Technology: Development of precision farming tools and sensors to optimize food production.

- New Energy Solutions: Focus on hydrogen production and utilization to support sustainable energy initiatives.

Next-Generation Technologies

Denso is heavily investing in next-generation technologies to stay ahead, particularly focusing on semiconductors and software-defined vehicles. This strategic push aims to create more adaptable and upgradable automotive systems by merging sophisticated software with robust hardware. For example, Denso announced a significant investment of ¥200 billion (approximately $1.3 billion USD) in its semiconductor business through fiscal year 2025, signaling a strong commitment to this area.

Their research and development pipeline is geared towards innovations that will define future mobility. This includes advancements in areas like advanced driver-assistance systems (ADAS) and electrification, where software plays an increasingly critical role. By fiscal year 2023, Denso had already allocated approximately ¥130 billion (around $870 million USD) towards software development and related fields, highlighting the growing importance of this segment in their strategy.

- Semiconductor Investment: ¥200 billion planned through FY2025 for semiconductor advancement.

- Software Focus: Significant allocation of resources to software development and integration.

- Future Mobility: Technologies for ADAS and electrification are key R&D priorities.

Denso's product portfolio is a cornerstone of its marketing strategy, emphasizing innovation and breadth across automotive and non-automotive sectors. Their offerings range from critical EV components like battery thermal management systems to advanced driver-assistance systems (ADAS) that enhance safety. This diverse product range is designed to meet evolving market demands and technological shifts.

Denso's commitment to electrification is a key product differentiator, with significant investments in components like inverters and motor generators. Their expansion into factory automation and agricultural technology showcases a strategy to leverage core competencies into new growth areas. The company's focus on semiconductors and software-defined vehicles underscores its forward-looking product development.

The company's product development is strongly driven by R&D, with a notable ¥200 billion investment planned through FY2025 for semiconductor advancements. This investment supports their strategy to create next-generation automotive systems. Denso also allocated approximately ¥130 billion by FY2023 towards software development, highlighting its importance.

| Product Area | Key Offerings | Strategic Focus | Recent Investment/Data |

| Automotive Core Systems | Thermal Management, Powertrain, Electrification Components (Inverters, Motor Generators) | Supporting EV transition, improving efficiency | Continued R&D investment in 2024 for electrification |

| Advanced Mobility & Safety | ADAS, HMI ECUs, Global Safety Package | Enhancing vehicle safety and driver convenience | ADAS market projected for significant expansion |

| Non-Automotive Solutions | Factory Automation (Robotics), Agricultural Technology (Precision Farming), New Energy (Hydrogen) | Diversification, industrial productivity, sustainable solutions | Global industrial automation market ~$170 billion (2023); Agri-tech market >$30 billion by 2027 |

| Next-Generation Technologies | Semiconductors, Software-Defined Vehicles | Enabling future mobility, adaptability, upgradability | ¥200 billion planned investment in semiconductors through FY2025; ~¥130 billion allocated to software by FY2023 |

What is included in the product

This analysis provides a comprehensive deep dive into Denso's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking a grounded understanding of Denso's marketing practices, ideal for strategic planning, benchmarking, and reporting.

Simplifies complex marketing strategies into actionable insights, relieving the pain of information overload for busy executives.

Provides a clear, structured overview of Denso's 4Ps, easing the burden of understanding their market positioning and competitive advantages.

Place

Denso leverages a vast global manufacturing network, encompassing around 180 facilities worldwide, to produce advanced automotive components and systems. This extensive reach ensures proximity to major customers, facilitating efficient supply chains and rapid adaptation to regional market needs.

Direct sales to Original Equipment Manufacturers (OEMs) represent a cornerstone of Denso's distribution strategy, facilitating deep integration of their components into new vehicles worldwide. This business-to-business approach allows Denso to forge robust partnerships with leading automotive brands, ensuring their advanced technologies are a fundamental part of global vehicle production.

In 2023, Denso's automotive segment, which heavily relies on OEM sales, generated ¥4,487.9 billion (approximately $30 billion USD based on average 2023 exchange rates), highlighting the sheer volume and value of these direct relationships. This channel is critical for Denso's market penetration, as it places their innovative products directly into the supply chains of major car manufacturers, reaching millions of consumers annually.

Denso's aftermarket distribution network is crucial for reaching the independent service and repair sector, offering OE-quality replacement parts. This includes a comprehensive selection of thermal management components and wiper blades, vital for vehicle maintenance. In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the significant market Denso serves.

Strategic Supply Chain Management

Denso prioritizes a sustainable supply chain, actively engaging suppliers in carbon emission reduction efforts. This focus on environmental responsibility is crucial for building a resilient and ethical flow of goods, aligning with global sustainability goals. For instance, in 2023, Denso reported a 12.5% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2015 baseline, demonstrating tangible progress in their environmental stewardship.

Their strategic supply chain management involves close collaboration with partners to implement eco-friendly practices. This includes encouraging suppliers to adopt renewable energy sources and optimize logistics for reduced environmental impact. Denso's commitment extends to fostering transparency and accountability across its entire value chain, ensuring that sustainability is not just an aspiration but a core operational principle.

- Supplier Engagement: Denso actively partners with its suppliers to promote sustainability initiatives.

- Carbon Emission Reduction: A key focus is encouraging suppliers to measure, manage, and decrease their carbon footprints.

- Resilience and Responsibility: This strategic approach aims to create a supply chain that is both robust and environmentally conscious.

- 2023 Performance: Denso achieved a 12.5% reduction in Scope 1 and 2 GHG emissions against its 2015 baseline, showcasing its commitment to environmental targets.

Regional Market Expansion

Denso is strategically expanding its global presence, with a keen eye on emerging markets for significant growth. This expansion is exemplified by investments in new production facilities, such as the motor generator plant established in India. These regional capacity additions are designed to cater to localized demand and bolster Denso's position in crucial automotive growth areas.

These strategic regional investments are crucial for Denso's long-term growth trajectory. For instance, Denso's investment in India, a key emerging market, is part of a broader strategy to enhance its manufacturing capabilities closer to its customer base. This approach allows for greater responsiveness to regional market needs and a more efficient supply chain.

- Global Footprint Expansion: Denso is actively increasing its international operations, with a strong emphasis on emerging economies.

- Production Capacity in India: The establishment of a motor generator plant in India highlights a concrete step in this expansion strategy.

- Meeting Localized Demand: These investments are directly aimed at fulfilling the growing automotive needs within specific regions.

- Strengthening Key Markets: Denso's regional focus seeks to solidify its competitive advantage in vital automotive growth corridors.

Denso's place strategy centers on a robust global manufacturing and distribution network, ensuring proximity to its key Original Equipment Manufacturer (OEM) clients and aftermarket customers. This extensive physical presence, with approximately 180 facilities worldwide, underpins its ability to serve diverse regional markets efficiently. Their direct sales to OEMs are critical, as evidenced by the automotive segment's ¥4,487.9 billion revenue in 2023, demonstrating the scale of their integration into new vehicle production.

The aftermarket distribution network further solidifies Denso's reach, catering to the independent service sector with essential replacement parts. Expansion into emerging markets, such as the new motor generator plant in India, highlights their commitment to localized production and meeting growing regional demand. This strategic placement of facilities enhances supply chain resilience and responsiveness to evolving automotive landscapes.

| Key Distribution Channels | Description | 2023/2024 Relevance |

| Direct OEM Sales | Supplying components directly to car manufacturers for new vehicle assembly. | Automotive segment revenue of ¥4,487.9 billion in 2023. |

| Aftermarket Distribution | Providing OE-quality replacement parts to independent repair shops and service centers. | Access to the global automotive aftermarket, projected over $500 billion in 2024. |

| Global Manufacturing Network | Approximately 180 facilities worldwide, ensuring regional proximity to customers. | Facilitates efficient supply chains and adaptation to local market needs. |

| Emerging Market Expansion | Strategic investments in new production facilities in growth regions. | Example: Motor generator plant in India to meet localized demand. |

Preview the Actual Deliverable

Denso 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Denso 4P's Marketing Mix Analysis covers all essential elements, providing a complete and ready-to-use resource for your strategic planning.

Promotion

Denso leverages public relations and news releases to share its corporate activities, financial performance, and technological breakthroughs. For instance, in fiscal year 2024, Denso reported net sales of ¥6,407.4 billion, underscoring its significant market presence and operational scale. These communications are vital for maintaining stakeholder trust and providing insights into the company's strategic trajectory.

Denso actively participates in significant industry events and expos as a core part of its promotional efforts. This strategy allows them to directly showcase their cutting-edge technologies and innovative solutions to a targeted audience of industry professionals and potential clients.

For instance, Denso's presence at events like the NAFA Institute & Expo and the Tennessee Smart Mobility Expo in 2024 and 2025 serves as a crucial touchpoint. These expos offer invaluable opportunities to demonstrate the practical applications and benefits of their products, fostering direct engagement with key stakeholders in the automotive and mobility sectors.

These platforms are instrumental in highlighting Denso's commitment to advancing future mobility. By exhibiting their latest advancements, Denso not only reinforces its brand image but also gathers critical market feedback, which is vital for ongoing product development and strategic planning in the rapidly evolving automotive landscape.

Denso’s commitment to transparency is evident in its annual Integrated and Sustainability Reports. These publications are crucial for investors and stakeholders, detailing Denso's approach to creating long-term value and outlining its strategic direction.

The reports offer a deep dive into Denso's growth strategies, alongside its Environmental, Social, and Governance (ESG) performance. For instance, their 2023 Sustainability Report highlighted a 14% reduction in CO2 emissions from manufacturing sites compared to 2019 levels, demonstrating tangible progress in their environmental goals.

This detailed disclosure fosters trust and a clearer understanding of Denso's dedication to sustainable corporate value enhancement, aligning financial performance with responsible business practices.

B2B Partner Engagement

Denso actively cultivates strong B2B partner relationships through structured engagement programs. A prime example is the annual North America Business Partner Awards, which acknowledge suppliers for outstanding contributions. These accolades highlight excellence in quality, service, technology, value, and sustainability, fostering a culture of mutual growth and shared objectives within Denso's extensive supply chain.

These awards serve as a critical component of Denso's partner engagement strategy, reinforcing the importance of collaboration and performance. By recognizing and rewarding top-tier suppliers, Denso incentivizes continuous improvement and innovation across its network. This focus on strong partnerships is essential for maintaining Denso's competitive edge and ensuring the reliability of its operations.

- Supplier Recognition: Denso's Business Partner Awards celebrate suppliers for exceptional performance.

- Key Performance Areas: Awards focus on quality, service, technology, value, and sustainability.

- Relationship Strengthening: These initiatives are designed to foster deeper ties within the supply chain.

- Collaborative Goals: The program promotes working together towards common business objectives.

Strategic Communication of Value Proposition

Denso's promotional messaging strongly centers on its core value propositions of 'green' and 'peace of mind,' aligning with evolving consumer and regulatory demands. This strategy effectively communicates their dedication to environmental sustainability, showcasing products designed to reduce emissions and support carbon neutrality goals. For instance, their advancements in electrification and thermal management systems directly address the automotive industry's push towards greener transportation solutions.

Simultaneously, Denso leverages its communication channels to highlight innovations that bolster vehicle safety and enhance the overall quality of life for users. This includes their sophisticated sensor technologies and advanced driver-assistance systems (ADAS), which contribute to accident prevention and a more comfortable driving experience. In 2024, the automotive industry saw continued investment in ADAS, with market research indicating significant growth driven by safety regulations and consumer preference for advanced features.

- Green Value Proposition: Denso's focus on emission reduction technologies and carbon neutrality initiatives resonates with global environmental targets.

- Peace of Mind: Emphasis on safety innovations, such as advanced driver-assistance systems, addresses consumer demand for secure and reliable vehicles.

- Market Alignment: Promotional efforts reflect the growing market preference for sustainable and safe automotive solutions, a trend projected to continue through 2025.

Denso's promotional strategy heavily emphasizes its commitment to sustainability and safety, aligning with global trends and consumer preferences. Their communication highlights advancements in electrification and thermal management, directly supporting the automotive sector's shift towards greener mobility. This focus on environmental responsibility is a key pillar of their brand messaging.

Furthermore, Denso actively promotes its innovations in advanced driver-assistance systems (ADAS) and sensor technologies, underscoring their dedication to vehicle safety and user well-being. The company's financial performance, such as the ¥6,407.4 billion in net sales reported for fiscal year 2024, provides a solid foundation for these forward-looking promotional efforts.

Denso's participation in key industry events, like the NAFA Institute & Expo and the Tennessee Smart Mobility Expo in 2024-2025, serves as a crucial platform to demonstrate these technological advancements directly to industry professionals and potential clients.

| Promotional Focus | Key Initiatives/Data | Impact |

|---|---|---|

| Sustainability & Green Tech | Electrification, thermal management, 14% CO2 reduction (vs. 2019) from manufacturing sites (2023 report) | Aligns with market demand for eco-friendly solutions, supports carbon neutrality goals. |

| Safety & Peace of Mind | ADAS, sensor technologies | Enhances vehicle safety, improves user experience, meets growing consumer demand for advanced safety features. |

| Industry Engagement | Participation in NAFA Institute & Expo, Tennessee Smart Mobility Expo (2024-2025) | Showcases cutting-edge technology, fosters direct engagement with stakeholders, gathers market feedback. |

| Financial Strength | Net sales of ¥6,407.4 billion (FY2024) | Underpins investment in R&D and promotional activities, signals market stability and scale. |

Price

Denso's value-based pricing for advanced technologies, particularly in electrification and ADAS, aligns component costs with the significant value they deliver to Original Equipment Manufacturers (OEMs). This strategy recognizes that innovations in these critical areas directly enhance vehicle performance, safety, and future marketability. For instance, Denso's advanced power control units for electric vehicles, crucial for battery management and efficiency, are priced to reflect their contribution to range and charging capabilities, a key selling point for EVs in 2024 and beyond.

Denso navigates a fiercely competitive global automotive components landscape, directly impacting its pricing strategies. The company must constantly benchmark against rivals and gauge overall market demand to ensure its offerings remain appealing and within reach for its intended customer base.

For instance, in fiscal year 2024, Denso reported net sales of ¥6,407.1 billion, reflecting the sheer volume and value of its operations amidst this competitive pressure. This necessitates a pricing approach that is agile and highly responsive to fluctuating market conditions to maintain market share and profitability.

Denso's commitment to cost management is a cornerstone of its strategy, allowing it to navigate rising input costs, like the 3.5% increase in raw material prices reported for the fiscal year ending March 2024, without immediately passing them onto customers. This efficiency focus is crucial for maintaining competitive pricing in the automotive sector.

By optimizing production processes and supply chains, Denso aims to absorb a significant portion of potential cost increases, such as those stemming from currency fluctuations, which saw the Japanese Yen weaken against the dollar in early 2024. This proactive approach helps protect profit margins and ensures stable pricing for their diverse product range.

Impact of External Economic Factors

External economic conditions, such as shifts in foreign exchange rates and global vehicle production trends, directly impact Denso's financial performance. For instance, a stronger yen can reduce the value of overseas earnings when translated back into Japanese currency, potentially affecting reported revenues and profitability. Denso's financial planning actively incorporates these macroeconomic variables to anticipate potential impacts.

Denso's revenue is particularly sensitive to the overall health of the automotive industry. A slowdown in global vehicle production, as seen in periods of economic uncertainty, can lead to decreased demand for Denso's components. Conversely, robust vehicle sales generally translate to higher sales volumes for the company.

- Foreign Exchange Impact: Denso's fiscal year 2024 results showed that a 1 JPY appreciation against the USD would have reduced operating income by approximately 15 billion JPY, highlighting the sensitivity to currency fluctuations.

- Vehicle Production Volumes: Global light vehicle production is projected to increase by approximately 2% in 2024 compared to 2023, a positive indicator for Denso's component sales.

- Economic Growth & Consumer Spending: Broader economic growth influences consumer purchasing power, directly affecting new vehicle sales and, consequently, demand for automotive parts.

- Inflationary Pressures: Rising inflation can increase Denso's raw material and manufacturing costs, potentially squeezing profit margins if not passed on through pricing adjustments.

Strategic Investment for Future Value

Denso's pricing strategy is deeply connected to its substantial investments in future growth, particularly in research and development and expanding its manufacturing capabilities. The company consistently earmarks considerable funds for pioneering new technologies, aiming to build long-term value that will underpin competitive pricing structures.

This strategic allocation of capital is designed to secure sustained profitability and maintain market leadership. For instance, Denso's commitment to electrification and advanced driver-assistance systems (ADAS) represents a significant portion of its R&D budget for fiscal year 2024-2025, projected to be around ¥350 billion (approximately $2.3 billion USD based on a ¥150/USD exchange rate). These investments are expected to yield higher-margin products in the coming years.

- R&D Investment: Denso's fiscal year 2024-2025 R&D spending targets approximately ¥350 billion, focusing on next-generation automotive technologies.

- Capacity Expansion: Investments are being made in new and existing facilities to support the anticipated demand for these advanced technologies.

- Value Justification: The company anticipates that its technological innovations will justify premium and competitive pricing in the market.

- Profitability Focus: This forward-looking pricing approach is key to Denso's strategy for achieving sustained profitability and market dominance.

Denso's pricing strategy is a delicate balance, reflecting the value of its advanced automotive components, especially in crucial areas like electrification and ADAS. The company links the cost of these innovative parts to the significant benefits they offer to car manufacturers, recognizing how these technologies enhance vehicle performance and appeal. For example, Denso's power control units for EVs, vital for battery management and efficiency, are priced to highlight their contribution to driving range and charging speed, key selling points for electric vehicles in the 2024-2025 market.

The competitive automotive component market forces Denso to constantly assess its pricing against rivals and market demand, ensuring its products remain attractive and accessible. This dynamic pricing approach is essential for maintaining market share and profitability amidst global economic shifts and fluctuating raw material costs. For fiscal year 2024, Denso's net sales reached ¥6,407.1 billion, underscoring the scale of its operations and the need for agile pricing strategies.

Denso's commitment to cost management is key to its competitive pricing, especially when facing rising input costs, like the 3.5% increase in raw material prices for the fiscal year ending March 2024. By optimizing production and supply chains, the company absorbs much of these cost increases, including those from currency fluctuations, ensuring stable pricing for its wide range of products.

Denso's significant investments in R&D and manufacturing capabilities, particularly for electrification and ADAS technologies, underpin its pricing strategy. The company allocated approximately ¥350 billion for R&D in fiscal year 2024-2025, aiming to develop higher-margin products that justify premium pricing and secure long-term profitability and market leadership.

| Key Pricing Factors | Denso's Approach | Impact/Data (FY2024-2025) |

|---|---|---|

| Value-Based Pricing | Aligning component costs with OEM value (e.g., electrification, ADAS) | Enhances vehicle performance, safety, and marketability. |

| Competitive Landscape | Benchmarking against rivals, responding to market demand | Ensures product appeal and accessibility. |

| Cost Management & Inflation | Absorbing input cost increases (e.g., raw materials) | Raw material prices rose 3.5% in FY ending March 2024; Denso aims to mitigate immediate customer impact. |

| R&D Investment | Funding next-gen technologies (electrification, ADAS) | Approx. ¥350 billion R&D budget; aims for higher-margin products. |

| Foreign Exchange Sensitivity | Impact of currency fluctuations on earnings | A 1 JPY appreciation vs. USD could reduce operating income by ~15 billion JPY. |

4P's Marketing Mix Analysis Data Sources

Our Denso 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations, alongside detailed industry research and competitive intelligence. We also incorporate data from Denso's official website, product catalogs, and publicly available information on their distribution networks and promotional activities.