Denso Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denso Bundle

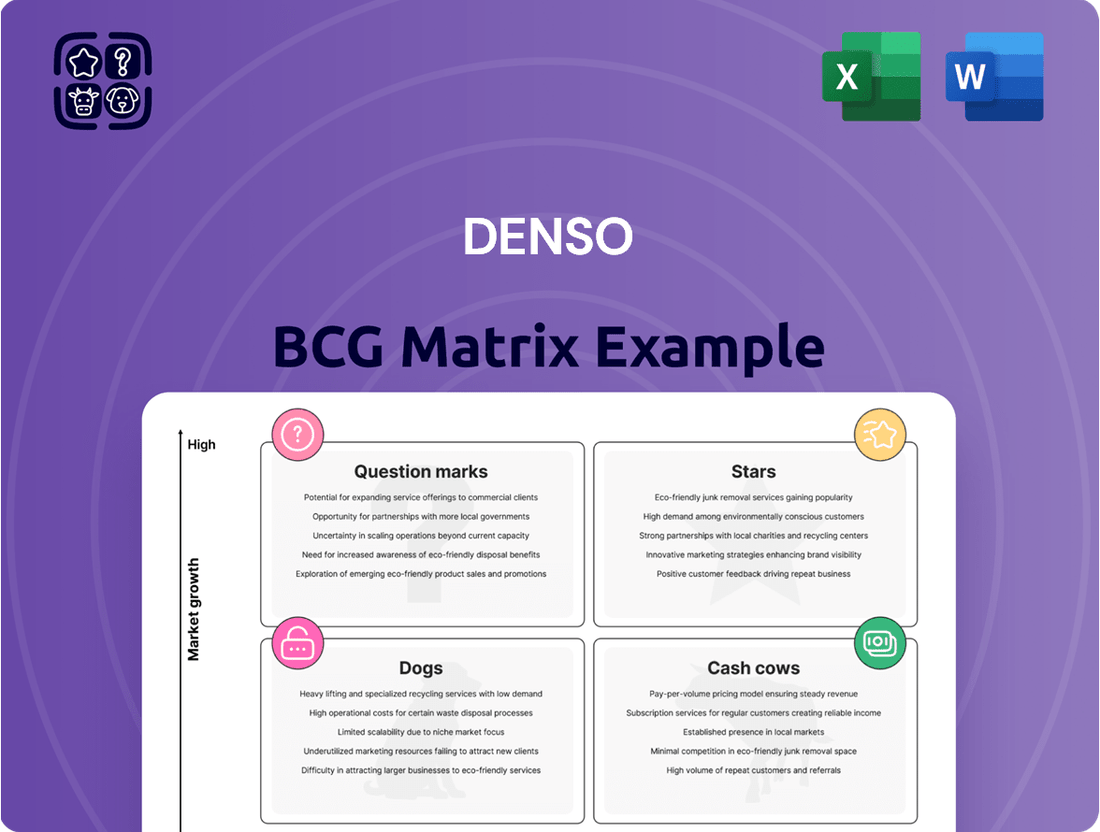

Curious about Denso's strategic product positioning? This glimpse into their BCG Matrix reveals how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their competitive landscape and make informed decisions, you need the full picture.

Unlock the complete Denso BCG Matrix to gain a comprehensive understanding of each product's market share and growth potential. This detailed analysis will equip you with the insights needed to optimize your investment strategy and drive future success.

Don't just guess where Denso's products stand; know it with the full BCG Matrix. Purchase now for actionable intelligence and a clear roadmap to capitalize on opportunities and mitigate risks.

Stars

Denso's electrification systems, encompassing vital components like inverters and motor generators, are a powerhouse for the company's growth. They've set an ambitious revenue target of 1.2 trillion yen (approximately $7.97 billion) for fiscal year 2025, with a further sights set on 1.7 trillion yen by 2030.

The company's strategic investments in new production lines specifically for Battery Electric Vehicle (BEV) inverters underscore their commitment and confidence in capturing a significant market share within this rapidly expanding automotive sector.

This robust expansion is directly propelled by the global automotive industry's decisive pivot towards electric and hybrid vehicles, a trend where Denso has firmly established itself as a frontrunner in supplying essential components.

Advanced Driver-Assistance Systems (ADAS) represent a significant growth area for Denso, with a stated revenue target of 520 billion yen by the 2025 business year. This ambitious goal is fueled by a market that's rapidly expanding due to a strong consumer push for enhanced vehicle safety and increasingly strict governmental mandates.

Denso's strategic positioning in the ADAS sector is bolstered by its innovative product offerings. Solutions like the Global Safety Package 3 (GSP3) and its Human-Machine Interface (HMI) Electronic Control Units (ECUs) are key revenue drivers, demonstrating Denso's commitment to developing and supplying critical components for the evolving automotive landscape.

Denso's thermal systems are a cornerstone of the burgeoning electrified vehicle market. As the automotive sector rapidly electrifies, the need for sophisticated thermal management solutions to ensure optimal battery performance and passenger comfort is paramount. The market for these systems is substantial, with projections indicating it will reach approximately USD 105.84 billion by 2025, underscoring Denso's strategic positioning.

Denso's commitment to this space is evident in innovations like its LD9 electric zero emissions thermal management unit, specifically designed for buses and coaches. This technology plays a vital role in maintaining ideal operating temperatures for batteries and cabins in electric and hybrid vehicles, a critical factor for range and longevity. Denso's established dominance in the automotive thermal management sector provides a strong foundation for continued growth and market leadership in this evolving landscape.

Hydrogen Technology

Denso's investment in hydrogen technology, particularly Solid Oxide Electrolysis Cells (SOECs) for generation and Solid Oxide Fuel Cells (SOFCs) for usage, positions it as a rising star in the clean energy sector. The company is actively pursuing carbon neutrality by 2035, with hydrogen playing a pivotal role in this strategy.

This strategic focus is underscored by Denso's manufacturing license for SOEC stacks and ongoing joint demonstration testing. These initiatives are designed to capture a significant share of the projected high-growth hydrogen market.

- Market Growth Projection: The global green hydrogen market is anticipated to reach USD 150.5 billion by 2030, growing at a CAGR of 51.1%.

- Denso's Investment: Denso has committed substantial resources to R&D in advanced electrolysis and fuel cell technologies.

- Technological Advancement: SOEC technology offers higher efficiency in hydrogen production compared to other electrolysis methods.

- Strategic Partnerships: Collaborations and licensing agreements are crucial for Denso to scale its hydrogen solutions rapidly.

Factory Automation and Robotics

Denso's Factory Automation and Robotics segment capitalizes on the burgeoning demand for automated manufacturing. This sector is expected to see a compound annual growth rate of 9.6% between 2025 and 2033, underscoring its considerable expansion potential.

The company is a significant player in the industrial robotics market, a field driven by the persistent need for automation and the ongoing challenge of skilled labor shortages. Denso's offerings are designed to streamline complex manufacturing operations.

Denso's automation solutions are particularly impactful for the automotive industry, enabling automakers to better manage intricate supply chains and achieve greater efficiency throughout their production lines. This focus positions Denso to benefit from the ongoing technological advancements in manufacturing.

- Market Growth: The factory automation market is projected for robust expansion, with a 9.6% CAGR anticipated from 2025 to 2033.

- Key Vendor Status: Denso is recognized as a leading vendor in the industrial robotics sector.

- Demand Drivers: Growth is fueled by automation trends and the scarcity of skilled manufacturing labor.

- Automotive Impact: Denso's solutions enhance efficiency for automakers, particularly in managing long supply chains.

Denso's electrification systems, particularly its BEV inverters, and its hydrogen technologies (SOEC and SOFC) are positioned as Stars within the BCG Matrix. These segments exhibit high market growth and strong competitive positions for Denso. The company's substantial investments and ambitious revenue targets for these areas, such as 1.2 trillion yen for electrification by FY2025, highlight their high potential.

The global green hydrogen market's projected growth to USD 150.5 billion by 2030, with a 51.1% CAGR, further solidifies hydrogen technology's Star status for Denso. These areas represent significant opportunities for market share capture and future revenue generation.

Denso's ADAS and Thermal Systems also demonstrate strong growth potential, aligning with the broader automotive industry's shift towards safety and electrification. While not explicitly labeled Stars, their high market growth and Denso's strategic focus suggest they are key contributors to the company's overall growth trajectory.

| Denso Business Segment | BCG Category | Key Growth Drivers | Market Data Point |

|---|---|---|---|

| Electrification Systems (BEV Inverters) | Star | Global pivot to EVs, Denso's production line investments | Targeting 1.2 trillion yen revenue by FY2025 |

| Hydrogen Technologies (SOEC, SOFC) | Star | Carbon neutrality goals, high-growth hydrogen market | Green hydrogen market to reach USD 150.5 billion by 2030 (51.1% CAGR) |

| Advanced Driver-Assistance Systems (ADAS) | Potential Star/Question Mark | Consumer demand for safety, government mandates | Targeting 520 billion yen revenue by FY2025 |

| Thermal Systems | Potential Star/Question Mark | Electrification of vehicles, need for battery thermal management | Global thermal management market projected at USD 105.84 billion by 2025 |

| Factory Automation & Robotics | Cash Cow/Question Mark | Automation demand, skilled labor shortages | Factory automation market CAGR of 9.6% (2025-2033) |

What is included in the product

The Denso BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

Simplified visualization of Denso's business portfolio, acting as a pain point reliever by clarifying strategic focus.

Cash Cows

Denso's conventional powertrain components, like engine control units and fuel injection systems, remain significant revenue drivers despite the company's shift to electrification. These established products command a strong market share in the ongoing internal combustion engine vehicle sector. In 2024, Denso reported that its Powertrain and Engine Business Unit continued to be a major contributor, with sales reflecting the enduring demand for these core technologies in key global markets.

Denso's broad portfolio of automotive aftermarket parts, covering a vast array of vehicle makes and models, is a significant contributor to its stable and predictable revenue. This segment thrives on the ongoing need for vehicle maintenance and repair, insulating it from fluctuations in new car sales.

The automotive aftermarket, while generally experiencing slower growth compared to other sectors, typically boasts robust profit margins. This is driven by consistent demand for essential replacement parts and the cultivation of strong brand loyalty among consumers and repair shops alike. For instance, in 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the sheer scale and resilience of this market.

Denso's traditional thermal systems for internal combustion engine (ICE) vehicles remain a robust cash cow, even as the automotive industry shifts towards electrification. These systems, crucial for heating, ventilation, and air conditioning (HVAC) in conventional cars, benefit from Denso's established market position and technological expertise.

The sheer volume of ICE vehicles still in operation globally underpins the strong cash flow generated by these components. For instance, in 2024, the global automotive market saw millions of new ICE vehicles produced, adding to the vast installed base that requires ongoing maintenance and replacement parts for thermal systems.

Car Air Conditioning Systems

Denso's car air conditioning systems are a prime example of a Cash Cow within their portfolio. These systems are a ubiquitous component in vehicles worldwide, ensuring a steady and substantial revenue stream. In 2023, the global automotive HVAC market, which includes air conditioning, was valued at approximately $30 billion, with Denso holding a significant share due to its long-standing presence and technological expertise.

The mature nature of the car air conditioning market means that while innovation continues, the pace of radical investment is slower compared to emerging technologies. This allows Denso to reap significant profits with relatively stable, lower levels of reinvestment. For instance, Denso's automotive components segment, which heavily features AC systems, consistently contributes a large portion to their overall operating profit, often exceeding 30% in recent fiscal years.

- Strong Global Market Position: Denso is a leading supplier of car air conditioning systems, equipping millions of vehicles annually.

- Consistent Demand and High Volume: AC systems are standard features, driving high sales volumes year after year.

- High Cash Generation: The maturity of the market allows for substantial cash flow with optimized operational costs.

- Stable Profitability: These systems provide a reliable and significant contribution to Denso's overall financial performance.

Ignition and Exhaust Systems

Denso's ignition and exhaust systems are classic cash cows, representing mature product lines that have been a cornerstone of their business since the early days. These components, essential for the functioning of traditional internal combustion engine vehicles, have consistently provided a stable and predictable revenue stream for the company.

The sheer size of the existing market for these established technologies ensures a steady demand, allowing Denso to generate substantial and reliable cash flow. For instance, in fiscal year 2024, Denso reported strong performance in its thermal systems segment, which includes exhaust-related products, indicating the continued profitability of these mature offerings.

- Established Market: Ignition and exhaust systems serve a vast global market of conventional vehicles.

- Stable Revenue: These products contribute significantly to Denso's consistent cash flow.

- Mature Product Lines: Denso has decades of experience and market penetration in this sector.

Denso's traditional powertrain components, particularly those for internal combustion engine (ICE) vehicles, continue to be significant revenue generators. These products, like engine control units and fuel injection systems, benefit from a strong market share in the ongoing ICE vehicle sector. In 2024, Denso's Powertrain and Engine Business Unit demonstrated robust sales, reflecting sustained demand for these core technologies across key global markets.

The automotive aftermarket parts segment offers Denso a stable and predictable revenue stream. This sector thrives on the consistent need for vehicle maintenance and repair, providing a buffer against new car sales volatility. Despite slower growth compared to emerging segments, the aftermarket typically boasts healthy profit margins due to consistent demand for essential replacement parts and established brand loyalty. The global automotive aftermarket was projected to exceed $500 billion in 2024, underscoring its immense scale and resilience.

Denso's established thermal systems for ICE vehicles remain strong cash cows, even as the industry pivots towards electrification. These systems, vital for vehicle climate control, leverage Denso's market leadership and technical prowess. The vast number of ICE vehicles globally ensures consistent demand for these components, generating substantial cash flow. For instance, millions of new ICE vehicles were produced in 2024, adding to the installed base requiring ongoing thermal system maintenance.

Car air conditioning systems are a prime example of Denso's cash cows, providing a steady revenue stream due to their ubiquity. The global automotive HVAC market, including AC systems, was valued at approximately $30 billion in 2023, with Denso holding a significant position. The maturity of this market allows for substantial profits with optimized reinvestment, as Denso's automotive components segment, heavily featuring AC systems, consistently contributes over 30% to their operating profit in recent fiscal years.

| Product Category | Market Maturity | Denso's Position | Cash Flow Generation |

| Powertrain Components (ICE) | Mature | Strong Market Share | High & Stable |

| Automotive Aftermarket Parts | Mature | Leading Supplier | Consistent & Predictable |

| Thermal Systems (ICE) | Mature | Established Leader | Substantial & Reliable |

| Car Air Conditioning Systems | Mature | Dominant Player | Significant & Profitable |

Delivered as Shown

Denso BCG Matrix

The preview you see is the complete and final Denso BCG Matrix report, identical to what you will receive immediately after your purchase. This means no watermarks or placeholder content, ensuring you get a fully formatted, analysis-ready document for immediate strategic application.

Dogs

Components specifically for older internal combustion engine technologies, particularly those Denso is phasing out, would fall into the Dogs category of the BCG Matrix. The market for these parts is shrinking as the automotive sector accelerates its transition to electric vehicles and faces increasingly stringent environmental standards.

Denso's strategic divestment of businesses focused on internal combustion engine products underscores a future of low growth and diminishing market share for these particular offerings. For instance, in 2023, Denso announced plans to sell its stake in Denso Thermal Systems, a move that signals a broader strategy to exit or reduce exposure to ICE-related businesses.

Legacy Powertrain Systems (Non-Electrified) are likely to be categorized as Dogs in the Denso BCG Matrix. This is because the global market for purely conventional internal combustion engine (ICE) powertrains is shrinking as the automotive industry pivots towards electrification. While these systems may still contribute to Denso's revenue, their market share is expected to decline, with limited future growth potential.

For instance, in 2024, the demand for new ICE vehicles is projected to continue its downward trend in many developed markets, while the sales of electric vehicles (EVs) are accelerating. Denso's investment in these legacy systems might not yield significant returns going forward, and they could become a drain on resources if not managed strategically. The company may need to consider restructuring or even divesting these non-electrified powertrain components to optimize its portfolio and focus on future growth areas.

Certain older sensor technologies, especially those with declining sales due to reduced vehicle production or being replaced by newer ADAS sensors, would likely be classified as Dogs in Denso's BCG Matrix. These sensors, if not finding new applications in high-growth sectors like advanced driver-assistance systems or vehicle electrification, face limited market share and growth prospects. Denso's strategic emphasis on cutting-edge safety features indicates a strategic shift away from these less advanced sensor applications.

Specific Geographic Markets with Declining Vehicle Production

While Denso has experienced revenue growth in regions like Japan and North America, it's also faced revenue and operating profit declines in Europe and Asia during certain periods. This suggests that specific geographic markets are experiencing a slowdown in vehicle production.

Products heavily reliant on these declining or stagnant regional markets, without strategic adaptation or the introduction of new offerings, could be categorized as Dogs within the BCG Matrix. These are products facing low growth prospects in their current form.

- European Automotive Market Challenges: In 2023, the European automotive market saw mixed performance, with some countries experiencing production dips due to ongoing supply chain issues and the transition to electric vehicles. For instance, Germany's vehicle production experienced a slight decline in early 2024 compared to the previous year.

- Asian Market Stagnation: Certain Asian markets, particularly those heavily dependent on traditional internal combustion engine vehicles, are showing signs of stagnation as the global shift towards EVs accelerates. This can lead to reduced demand for components primarily designed for these older technologies.

- Impact on Denso's Portfolio: Denso products predominantly sold in these specific European and Asian markets, which are witnessing declining vehicle production, might be considered Dogs if they haven't been diversified or adapted for emerging automotive trends like electrification or advanced driver-assistance systems.

Niche or Obsolete Automotive Component Lines

Niche or obsolete automotive component lines would fall into the Dogs quadrant of the BCG Matrix. These are typically specialized parts that haven't kept pace with technological shifts, leading to a shrinking market and low growth. For instance, components solely for older internal combustion engine vehicles might be considered here as the industry rapidly transitions to electric powertrains.

Denso, a major automotive supplier, has been strategically re-evaluating its business portfolio. This often involves divesting or reducing focus on areas that are no longer profitable or strategically aligned. In 2024, companies like Denso are increasingly prioritizing investments in areas like electrification, advanced driver-assistance systems (ADAS), and software-defined vehicles, which naturally de-emphasizes legacy product lines.

- Declining Market Share: Components designed for vehicles with diminishing sales volumes or those replaced by newer technologies.

- Low Growth Potential: Limited opportunities for expansion due to obsolescence or lack of demand.

- Resource Drain: These product lines can tie up capital and R&D resources that could be better allocated to growth areas.

- Strategic Divestment: Companies often look to sell or phase out these components to streamline operations and focus on future mobility solutions.

Products in Denso's "Dogs" category represent areas with low market share and low growth potential, often tied to declining automotive technologies like older internal combustion engine (ICE) components. These segments may require significant resources for maintenance but offer limited future returns.

Denso's strategic moves, such as divesting from ICE-related businesses, highlight a conscious effort to shed these low-performing assets. For instance, the ongoing global shift towards EVs means that components exclusively for traditional powertrains are increasingly becoming obsolete.

The company's focus in 2024 is heavily on electrification and advanced systems, indicating a deliberate de-prioritization of legacy products that fall into the Dogs quadrant. This strategic repositioning aims to optimize Denso's portfolio for future profitability and innovation.

Products facing shrinking demand due to technological obsolescence or market shifts, such as components for older ICE vehicles, are classified as Dogs. These items contribute minimally to growth and may even drain resources. For example, in 2024, the demand for new ICE vehicles continues to decline in key markets, impacting the sales of related components.

Question Marks

Denso's hydrogen production and utilization systems, including Solid Oxide Electrolysis Cells (SOECs) and Solid Oxide Fuel Cells (SOFCs), represent significant future growth opportunities. These technologies are currently in their nascent stages, operating within an emerging market that demands substantial investment for scaling and market penetration.

The success of these early-stage ventures is intrinsically linked to the broader adoption of hydrogen as a primary clean energy carrier, a transition that is still unfolding globally. For instance, the global green hydrogen market was valued at approximately USD 3.1 billion in 2023 and is projected to reach USD 37.2 billion by 2030, indicating substantial growth potential for Denso's SOEC and SOFC technologies as they mature.

Denso's strategic move into Agricultural Technology (AgriTech), marked by acquisitions like Axia Vegetable Seeds and the development of smart horticulture, positions it in a high-growth market where its current market share is minimal. This expansion leverages Denso's expertise in automotive AI and automation, applying it to seed research and development as well as automated harvesting.

These innovative AgriTech solutions are relatively new, and the market is still in the process of understanding and adopting their full potential benefits. Denso's investment in this nascent industry is substantial, crucial for building brand recognition and achieving scalability.

Denso's exploration into new mobility solutions, including MaaS technologies and quantum computing for mobility, places these ventures in the Question Marks category of the BCG Matrix. These are high-potential, but currently low-market-share areas, demanding substantial R&D investment. For instance, the global MaaS market was valued at approximately $100 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for Denso to capture market share through innovation.

Advanced Semiconductor Technologies for Future Applications

Denso's strategic investments in semiconductors, particularly for advanced driver assistance systems (ADAS) and neural processing units (NPUs), position it to capitalize on high-growth future applications. These ventures, often pursued through partnerships, signal a clear direction towards innovation.

While Denso's internal semiconductor manufacturing is significant, its market share in these specialized, forward-looking segments may currently be nascent compared to established leaders. For instance, the global automotive semiconductor market, a key area for Denso's focus, was projected to reach over $65 billion in 2024, with ADAS and autonomous driving components representing a substantial and rapidly expanding portion of this.

- Investment in ADAS and NPUs: Denso's collaboration with companies like Qualcomm for advanced automotive chipsets underscores its commitment to next-generation vehicle technologies.

- Market Position: Denso's market share in the highly competitive advanced semiconductor space, while growing, is still developing relative to dominant players.

- Growth Potential: These investments are critical for Denso's long-term growth, requiring substantial capital to build a strong competitive presence in these evolving markets.

- Industry Trends: The demand for specialized automotive semiconductors is expected to surge, with projections indicating continued double-digit growth for ADAS-related chips through 2030.

Next-Generation Battery Electric Vehicle (BEV) Specific Components

Next-generation battery electric vehicle (BEV) specific components, while part of the burgeoning electrification trend, might currently occupy a Question Mark position for Denso. These highly specialized parts, crucial for advanced BEVs, are entering mass production or wider adoption, placing them in a rapidly expanding market. However, Denso's immediate market share for these nascent components could still be in its formative stages, reflecting the early-stage nature of their commercial rollout.

Consider Denso's investment in its new motor generator plant for EVs in India. This strategic move targets a high-growth segment of the automotive industry, aligning with the global shift towards electrification. Despite the promising market outlook, the plant's immediate contribution to Denso's overall market share for these specific, cutting-edge BEV components may be relatively low as production scales and market penetration increases.

- Early Market Penetration: Denso’s share in the niche market for advanced BEV components is likely still developing, despite the overall market's rapid expansion.

- Investment in Growth Areas: Investments like the Indian motor generator plant signal strategic focus on high-potential EV segments, even if immediate market share is modest.

- Technological Advancement: These components represent the forefront of BEV technology, meaning market leadership is still being established by various players.

- Future Potential: As BEV technology matures and adoption accelerates, these components are poised to become Stars, but currently require significant investment and market development.

Denso's ventures in areas like advanced hydrogen systems, AgriTech, new mobility solutions, specialized semiconductors, and next-generation BEV components largely fall into the Question Marks category of the BCG Matrix. These represent high-growth potential markets where Denso is either a new entrant or has a currently minimal market share.

Significant investment in research and development, market penetration, and scaling operations is crucial for these segments to transition into Stars or Cash Cows. The success of these initiatives is closely tied to broader industry trends and technological adoption rates.

For example, the global hydrogen market's projected growth from USD 3.1 billion in 2023 to USD 37.2 billion by 2030 highlights the potential for Denso's hydrogen technologies. Similarly, the MaaS market, valued at approximately $100 billion in 2023, offers substantial room for Denso's new mobility solutions.

The automotive semiconductor market, expected to exceed $65 billion in 2024, presents a key opportunity for Denso's investments in ADAS and NPUs, despite current market share being in its early stages.

| Denso's Question Mark Ventures | Market Growth Potential | Current Market Share (Estimated) | Strategic Focus |

|---|---|---|---|

| Hydrogen Production & Utilization (SOEC, SOFC) | High (Global green hydrogen market projected to reach USD 37.2 billion by 2030 from USD 3.1 billion in 2023) | Nascent | Scaling production, market adoption |

| Agricultural Technology (AgriTech) | High | Minimal | Leveraging AI/automation, market penetration |

| New Mobility Solutions (MaaS, Quantum Computing) | High (MaaS market ~USD 100 billion in 2023) | Low | R&D investment, innovation |

| Specialized Semiconductors (ADAS, NPUs) | High (Automotive semiconductor market >USD 65 billion in 2024) | Developing | Partnerships, technological advancement |

| Next-Generation BEV Components | High (Electrification trend) | Formative | Capacity expansion, market entry |

BCG Matrix Data Sources

Our Denso BCG Matrix is built on robust data, integrating financial disclosures, market growth trends, and internal performance metrics for a comprehensive strategic view.