Denso Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denso Bundle

Denso's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its formidable buyers to the constant threat of new entrants disrupting the automotive supply chain. Understanding these dynamics is crucial for any stakeholder seeking to navigate this industry.

The complete report reveals the real forces shaping Denso’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Denso sources a wide array of automotive parts, from basic materials to sophisticated electronics. The concentration of suppliers for highly specialized components, such as advanced semiconductors crucial for electric vehicles and autonomous driving systems, can significantly amplify their bargaining power. For instance, the global automotive semiconductor market was valued at approximately $43.5 billion in 2023 and is projected to grow substantially, with a limited number of key players dominating advanced chip production.

Switching costs for Denso can be substantial, particularly when dealing with suppliers who provide integrated systems or proprietary technologies. This dependence on specialized expertise or existing contractual agreements can grant suppliers significant leverage in negotiations. For instance, if a supplier has developed a unique electronic control unit tailored to Denso's specific vehicle platforms, switching to another supplier would involve significant re-engineering and validation costs.

Denso's strategic initiatives to mitigate these high switching costs include a strong focus on standardizing components across its product lines and maximizing its global procurement power. By consolidating demand for common parts, Denso can negotiate more favorable terms and reduce the impact of any single supplier's specialized offerings. This approach aims to foster a more competitive supplier landscape, thereby diminishing individual supplier bargaining power.

The threat of suppliers integrating forward into automotive component manufacturing, while not a frequent occurrence, could potentially shift power dynamics. This would mean suppliers moving into areas currently occupied by companies like Denso.

However, the significant capital investment required and the highly specialized knowledge needed to produce automotive components present substantial hurdles for most suppliers looking to make such a move. For instance, developing the advanced manufacturing capabilities for electric vehicle powertrains alone demands billions in investment.

Denso's own robust investment in research and development, consistently placing it among the top automotive suppliers for R&D spending, creates a strong competitive advantage that further strengthens its position against potential supplier encroachment.

Importance of Denso to Suppliers

Denso's substantial global footprint as a leading automotive component manufacturer positions it as a critical customer for many of its suppliers. This significant customer base means Denso often accounts for a considerable percentage of a supplier's overall revenue, thereby diminishing the supplier's leverage. For instance, in 2023, Denso reported total sales of approximately ¥5.7 trillion (roughly $38 billion USD based on average 2023 exchange rates), illustrating the scale of its purchasing power.

Denso actively cultivates collaborative relationships with its suppliers, acknowledging their vital role in its supply chain. This partnership approach, while beneficial for innovation and quality, also reinforces Denso's position as a key client. The company’s commitment to supplier development and long-term partnerships can further centralize business with Denso for many, thereby moderating individual supplier bargaining power.

- Denso's 2023 sales: ¥5.7 trillion (approx. $38 billion USD).

- Significant customer revenue share for suppliers.

- Collaborative approach acknowledges supplier importance.

- Centralized business can reduce individual supplier leverage.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for a company like Denso. When Denso can easily find alternative suppliers for its components, the existing suppliers have less leverage. This is particularly true for standardized parts where multiple manufacturers can produce them. For instance, if Denso requires basic electronic components, and many companies can supply them to similar specifications, suppliers of these standard items face limited power.

However, the situation changes for highly specialized or proprietary technologies. If Denso relies on a unique sensor technology or a patented engine control unit, the supplier of that specific item holds considerable power. This is because Denso has fewer, if any, alternative sources for that critical input. In 2024, the automotive industry continued to see high demand for advanced semiconductors and specialized electronic components, where a limited number of suppliers often dominate the market, thereby increasing their bargaining power.

Denso's strategic approach involves actively mitigating this supplier power. Through continuous research and development, Denso aims to diversify its component requirements and explore new technologies. This diversification strategy reduces the company's dependence on any single supplier or a narrow set of specialized inputs. By investing in internal R&D and fostering relationships with a broader range of technology providers, Denso can negotiate more favorable terms and ensure a more resilient supply chain.

- Standardized Components: High availability of substitutes limits supplier power.

- Specialized Technologies: Scarcity of substitutes grants suppliers greater leverage.

- 2024 Automotive Trends: Increased demand for specialized electronics, like semiconductors, strengthened supplier power in those segments.

- Denso's Strategy: R&D and diversification aim to reduce reliance on single-source suppliers.

The bargaining power of suppliers for Denso is influenced by several factors, including supplier concentration, switching costs, and the availability of substitute inputs. For highly specialized components, such as advanced semiconductors critical for EVs and autonomous driving, a limited number of suppliers can significantly increase their leverage. The global automotive semiconductor market, valued around $43.5 billion in 2023, is dominated by a few key players in advanced chip production, giving them substantial power.

High switching costs for Denso, especially with suppliers providing integrated systems or proprietary technologies, can also amplify supplier power. If a supplier's unique technology requires significant re-engineering to replace, they gain leverage. Denso counters this by standardizing components and leveraging its global procurement scale to negotiate better terms and reduce dependence on any single supplier.

Denso's substantial global presence and its status as a critical customer for many suppliers help to moderate supplier bargaining power. With 2023 sales reaching approximately ¥5.7 trillion (about $38 billion USD), Denso represents a significant portion of many suppliers' revenue. Furthermore, Denso’s collaborative approach and focus on long-term partnerships can centralize business, thereby reducing individual supplier leverage.

| Factor | Impact on Supplier Bargaining Power | Denso's Mitigation Strategy |

| Supplier Concentration (Specialized Components) | High | Component standardization, global procurement |

| Switching Costs (Integrated Systems) | High | R&D for diversification, exploring new technologies |

| Denso's Customer Scale | Low | N/A (inherently reduces supplier power) |

| Availability of Substitutes (Standard Components) | Low | N/A (inherently reduces supplier power) |

| Availability of Substitutes (Proprietary Tech) | High | R&D for diversification, exploring new technologies |

What is included in the product

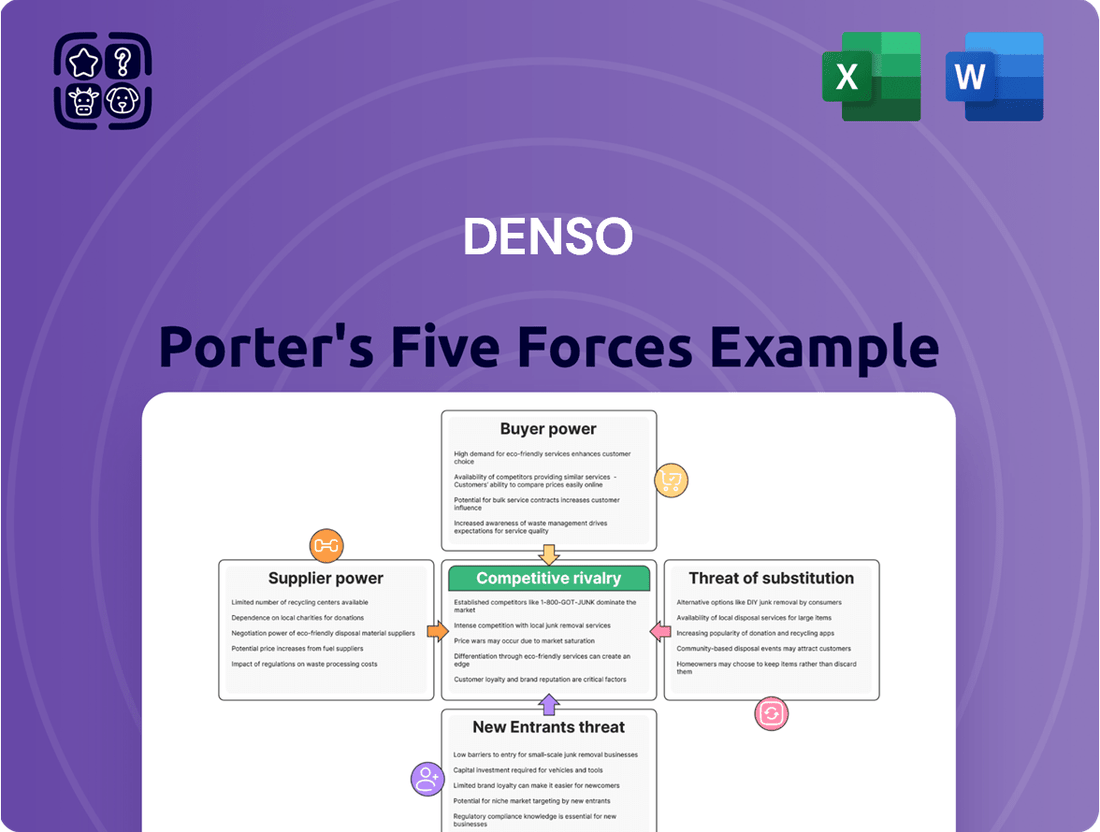

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Denso's automotive supplier landscape.

Visualize competitive intensity with a dynamic, interactive dashboard that highlights key threats and opportunities for Denso.

Customers Bargaining Power

Denso's customer base is heavily concentrated among major automotive Original Equipment Manufacturers (OEMs). Toyota, a key customer, also holds a significant stake in Denso, further solidifying its influence.

This concentration means large OEMs represent a substantial portion of Denso's sales volume, granting them considerable bargaining power. For instance, Toyota's purchasing decisions alone can significantly impact Denso's revenue streams.

The automotive sector's ongoing emphasis on cost reduction and supply chain optimization amplifies this customer leverage. OEMs can demand lower prices or more favorable terms, directly impacting Denso's profitability.

Switching costs for automotive Original Equipment Manufacturers (OEMs) to change component suppliers like Denso can be substantial. These costs stem from the intricate integration of parts into vehicle systems, requiring extensive re-testing and validation. For instance, a shift in a critical electronic component could necessitate months of rigorous testing to ensure compatibility and safety, impacting production timelines and incurring significant expenses. This "stickiness" once Denso secures a design win gives it a degree of pricing power.

However, the automotive landscape is dynamic. The advent of electric vehicles (EVs) and new vehicle platform development presents OEMs with opportunities to reassess their supplier relationships. In 2024, the automotive industry saw continued investment in EV technology, with major manufacturers announcing new EV models and platform strategies. This technological shift can lower the barriers to entry for new suppliers and encourage OEMs to explore alternative component providers, thereby potentially increasing customer bargaining power in these emerging segments.

Customer price sensitivity is a major factor for Denso, especially given the intense competition in the automotive sector. Original Equipment Manufacturers (OEMs) are constantly pressured to keep vehicle prices attractive to consumers, which directly impacts their purchasing decisions for components like those Denso supplies.

This pressure forces Denso to be highly efficient and cost-conscious. For instance, in 2024, the automotive industry continued to grapple with fluctuating raw material costs and global supply chain challenges, amplifying the need for Denso to find ways to reduce its own production expenses to remain competitive for its OEM clients.

Threat of Backward Integration by Customers

Automotive Original Equipment Manufacturers (OEMs) possess the capability to integrate backward, bringing component production in-house. This is particularly true for critical or high-volume parts, offering them significant leverage in negotiations with suppliers like Denso. For instance, in 2024, several major OEMs were reportedly exploring increased in-house production of certain electronic control units (ECUs) to gain greater control over supply chains and costs.

While this backward integration is capital-intensive, it acts as a powerful bargaining chip for customers. The potential for OEMs to develop their own manufacturing capabilities puts pressure on component suppliers to offer competitive pricing and superior value. This dynamic is a constant consideration in supplier-customer relationships within the automotive sector.

Denso counters this threat through its unwavering commitment to continuous innovation and specialized expertise. By consistently developing advanced technologies and offering unique solutions, Denso aims to make in-house production by OEMs less appealing or economically unviable. For example, Denso's recent advancements in next-generation thermal management systems for electric vehicles, announced in early 2025, showcase their ability to deliver highly specialized components that are difficult for OEMs to replicate efficiently.

- Threat of Backward Integration: Automotive OEMs can produce components internally, especially for critical or high-volume parts.

- Customer Leverage: This potential for in-house production grants customers significant bargaining power in negotiations.

- Denso's Counter-Strategy: Denso mitigates this threat through ongoing innovation and deep technical expertise in specialized automotive components.

- Market Dynamics: The automotive industry's focus on supply chain resilience and cost efficiency in 2024 and beyond intensifies this pressure on suppliers.

Availability of Substitute Products for Customers

The availability of substitute products significantly empowers customers, particularly Original Equipment Manufacturers (OEMs) in the automotive sector. Denso faces competition from major players such as Bosch, Continental, Valeo, and Aptiv, all offering a wide array of automotive components. This robust competitive landscape allows OEMs to readily switch suppliers if Denso's offerings do not meet their specific requirements regarding technology, quality, cost, or reliability.

- Competitive Landscape: Denso operates in an automotive component market with established global competitors like Bosch, Continental, Valeo, and Aptiv.

- OEM Sourcing Flexibility: Automotive manufacturers have multiple viable options for sourcing critical components, reducing reliance on any single supplier.

- Key Differentiators: Customers evaluate suppliers based on technological innovation, product quality, pricing structures, and dependable supply chain performance.

- Impact on Bargaining Power: The presence of strong alternatives grants OEMs considerable leverage to negotiate favorable terms with Denso.

Denso's bargaining power with customers is shaped by the concentration of its client base among major automotive OEMs and the inherent switching costs for these large buyers. While Denso benefits from the integration of its components into complex vehicle systems, the automotive industry's drive for cost reduction and the evolving landscape of electric vehicles present ongoing challenges.

The automotive sector's intense focus on cost efficiency, exacerbated by fluctuating raw material prices and supply chain disruptions observed in 2024, places significant pressure on Denso to maintain competitive pricing. Furthermore, the potential for OEMs to bring component manufacturing in-house, a strategy explored by several major manufacturers in 2024 for specific electronic units, acts as a potent bargaining tool.

Denso actively counters these pressures by investing in innovation, such as its advanced thermal management systems for EVs, aiming to offer specialized solutions that are difficult for OEMs to replicate internally. The competitive market, featuring players like Bosch and Continental, also means OEMs have considerable flexibility in sourcing, further empowering their negotiating position.

| Factor | Impact on Denso's Customer Bargaining Power | 2024 Context/Data |

|---|---|---|

| Customer Concentration | High (Major OEMs represent significant sales) | Toyota remains a key, influential customer. |

| Switching Costs | Moderate (High for integrated systems, but evolving) | Integration of electronic components requires extensive re-testing. |

| Price Sensitivity | High (OEMs seek cost-effective vehicle production) | Fluctuating raw material costs in 2024 intensified cost pressures. |

| Threat of Backward Integration | Moderate to High (OEMs can internalize production) | Some OEMs explored in-house ECU production in 2024. |

| Availability of Substitutes | High (Strong competition from Bosch, Continental, etc.) | OEMs can readily switch suppliers based on cost, quality, and technology. |

What You See Is What You Get

Denso Porter's Five Forces Analysis

You're previewing the final version of the Denso Porter's Five Forces Analysis. This comprehensive document meticulously examines the competitive landscape for Denso, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive components industry. What you see here is precisely the same document that will be available to you instantly after purchase, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The automotive components industry is a crowded arena with numerous global contenders. Major players such as Bosch, Continental, Valeo, Tenneco, Aptiv, Magna International, and BorgWarner are all vying for market share. These companies often produce similar product lines, intensifying the competitive landscape.

While the global automotive market is projected to grow, with the electric vehicle (EV) segment showing particularly strong expansion, some traditional automotive component sectors are experiencing slower growth or even saturation. For instance, the global automotive market was valued at approximately $3.2 trillion in 2023 and is expected to reach over $4.5 trillion by 2030, demonstrating robust overall expansion.

This uneven growth dynamic intensifies competition, as companies vie for a larger share of the expanding EV market and defend their positions in more mature segments. The rapid advancement and adoption of EV technology are introducing new players and shifting the competitive landscape significantly, creating both opportunities and challenges for established suppliers.

Denso stands out by focusing on advanced technology, exceptional quality, and a wide array of products. Their offerings span crucial automotive sectors like thermal management, powertrain, mobility solutions, and electrification systems, catering to diverse market needs.

The company's commitment to continuous innovation, particularly in high-growth areas such as semiconductors for electric vehicles and autonomous driving technologies, is a key strategy. For instance, Denso's investment in advanced driver-assistance systems (ADAS) components directly addresses the evolving demands of the automotive industry, helping them maintain a strong competitive position.

Exit Barriers

High fixed costs in automotive component manufacturing, such as those for specialized machinery and R&D, can make it incredibly difficult for companies to exit the market. For instance, the automotive supply chain often involves substantial capital investment in tooling and testing equipment, with some estimates suggesting that setting up a new automotive component plant can cost hundreds of millions of dollars. This financial commitment means companies are often reluctant to abandon their investments, even when facing challenging market conditions.

Specialized assets, designed for specific vehicle models or platforms, also contribute to high exit barriers. If a company has invested heavily in manufacturing components for a particular car model that is nearing the end of its production run, those assets may have little to no resale value or alternative use. Denso, a major player in this sector, operates with a vast array of highly specialized production lines for everything from engine control units to thermal systems, making a swift exit impractical.

Long-term contracts with major automakers further lock companies into the industry. These agreements, often spanning several years, provide a degree of revenue stability but also obligate suppliers to continue production and investment. Failure to meet contract obligations can result in severe penalties. In 2024, many automotive component suppliers found themselves navigating extended supply agreements, highlighting the ongoing commitment required.

- High Fixed Costs: Significant capital outlays for specialized machinery and facilities in automotive component manufacturing.

- Specialized Assets: Investments in equipment tailored to specific vehicle models or technologies with limited alternative uses.

- Long-Term Contracts: Binding agreements with automakers that necessitate continued operation and investment, often for multiple years.

- Sustained Rivalry: These barriers encourage companies to remain competitive even during economic downturns, intensifying rivalry.

Strategic Stakes and Industry Importance

The automotive sector is a cornerstone of many global economies, making market share a crucial battleground for companies like Denso. This intense focus on maintaining and growing their slice of the pie directly translates into fierce rivalry across all fronts.

This high strategic importance drives aggressive competition, pushing companies to invest heavily in research and development, engage in price wars, and relentlessly pursue market penetration. For instance, in 2024, the global automotive market experienced significant shifts, with companies vying for dominance in areas like electric vehicle (EV) technology and autonomous driving systems.

- R&D Investment: Major automotive suppliers, including Denso, are channeling billions into next-generation technologies. In 2023, global R&D spending in the automotive sector exceeded $200 billion, a figure projected to climb further in 2024, particularly in areas like battery technology and advanced driver-assistance systems (ADAS).

- Market Share Battles: Denso, as a leading automotive components manufacturer, faces intense competition from rivals such as Bosch, Continental, and Magna International. These companies are constantly innovating and optimizing their supply chains to capture a larger share of the OEM market.

- Pricing Pressures: The need to secure contracts with major automakers often leads to significant pricing pressures. Suppliers must balance cost-efficiency with the high quality and technological sophistication demanded by the industry.

The automotive components industry is characterized by intense competition among a large number of global players. Companies like Bosch, Continental, and Magna International are constantly innovating and vying for market share, often offering similar product lines. This rivalry is further fueled by the high strategic importance of the automotive sector, pushing companies to invest heavily in R&D and engage in aggressive pricing strategies to secure contracts.

The drive for dominance, particularly in emerging areas like electric vehicles (EVs) and autonomous driving, intensifies this competition. For instance, in 2024, the race to supply advanced semiconductors for EVs saw significant investment and strategic maneuvering among top suppliers. This dynamic ensures that companies like Denso must maintain a sharp focus on technological advancement and cost-efficiency to remain competitive.

| Key Competitors | Focus Areas | 2023 Estimated Revenue (USD Billions) |

| Bosch | Powertrain, Chassis, Infotainment, EV components | ~90 |

| Continental | Tires, Automotive Systems, ContiTech | ~45 |

| Magna International | Body, Chassis, Powertrain, ADAS, EV components | ~43 |

| Denso | Thermal, Powertrain, Mobility, Electrification | ~49 |

SSubstitutes Threaten

The threat of substitutes for Denso's traditional automotive components is significant, particularly from emerging alternative technologies. Rapid advancements in battery technology and electric powertrains directly challenge the market for internal combustion engine (ICE) parts, a core area for Denso. For instance, the global electric vehicle (EV) market share is projected to reach approximately 25% by 2025, impacting demand for traditional engine components.

Denso is proactively addressing this by investing heavily in electrification and future mobility systems. In fiscal year 2023, Denso allocated a substantial portion of its research and development budget towards these areas, aiming to pivot its product portfolio. This strategic investment is crucial for mitigating the impact of substitute technologies and capitalizing on the evolving automotive landscape.

The growing popularity of ride-sharing services and the anticipated widespread adoption of autonomous vehicles represent a significant threat of substitution for Denso. These shifts away from traditional car ownership could reduce the demand for individual automotive components, impacting Denso's established revenue streams. For instance, by 2024, the global ride-sharing market is projected to reach over $200 billion, indicating a substantial portion of the population opting for alternatives to personal vehicle use.

The rise of software-defined vehicles (SDVs) presents a significant threat of substitution. As vehicles become more reliant on software, the value proposition shifts from traditional hardware components to the underlying code and connectivity services.

This evolution could see revenue streams traditionally generated by hardware sales being replaced by recurring software subscriptions and feature updates. For instance, companies that excel in developing and integrating advanced driver-assistance systems (ADAS) or in-car infotainment through software could capture market share previously held by hardware manufacturers.

Denso is actively addressing this by investing heavily in AI and software development, recognizing that its future competitiveness hinges on its ability to transition from a hardware-centric supplier to a provider of integrated software solutions. In 2024, Denso announced significant investments in areas like advanced driver assistance systems and connected services, aiming to bolster its software capabilities.

Changes in Consumer Preferences

Shifting consumer tastes, particularly a growing demand for eco-friendly and digitally integrated vehicles, can accelerate the adoption of alternative technologies. For example, a significant move towards fully autonomous driving might lessen the need for specific driver-assistance hardware if these functions are consolidated into standard, advanced systems.

This evolution directly impacts the threat of substitutes. As consumers increasingly value sustainability, connectivity, and self-driving capabilities, they may opt for vehicle architectures that render traditional components obsolete. For instance, the rise of over-the-air software updates for vehicle features could reduce the demand for certain physical upgradeable components.

- Consumer Preference Shift: Growing interest in electric vehicles (EVs) is a prime example, potentially reducing demand for traditional internal combustion engine (ICE) components. In 2024, EV sales continued to climb, representing a significant portion of new vehicle registrations in many key markets.

- Technological Integration: The push for advanced driver-assistance systems (ADAS) and eventually fully autonomous driving could lead to integrated sensor suites, potentially substituting individual, less sophisticated components.

- Software-Defined Vehicles: The trend towards software-defined vehicles means functionalities previously reliant on hardware could be delivered via software, creating a substitute for hardware upgrades.

- New Mobility Services: The expansion of ride-sharing and subscription-based mobility services might decrease overall private vehicle ownership, thereby reducing the demand for individual vehicle components.

Non-Automotive Transportation Alternatives

The threat of substitutes for Denso's automotive components extends beyond direct vehicle-to-vehicle competition to encompass broader shifts in transportation. Enhanced public transportation systems, for instance, could reduce the overall demand for private vehicles, thereby impacting the need for components like Denso's advanced engine management systems or climate control units. Globally, public transit ridership saw a significant rebound in 2023, with many major cities reporting passenger numbers nearing pre-pandemic levels, indicating a growing preference for shared mobility in certain contexts.

Micromobility solutions, such as electric scooters and shared bicycles, also represent a growing alternative for short-distance urban travel. Companies are investing heavily in these areas; by the end of 2024, it's projected that the global micromobility market will exceed $200 billion, a testament to their increasing adoption. This trend could indirectly reduce the demand for certain automotive components, particularly those related to personal vehicle ownership for shorter commutes.

Furthermore, advancements in urban planning that prioritize walkability, cycling infrastructure, and integrated transit hubs can diminish the reliance on individual car use. While this is a more gradual, long-term influence, it necessitates that Denso and its peers consider how their product portfolio aligns with future mobility ecosystems. For example, the increasing development of integrated mobility platforms that combine various transport options could see a shift in component demand towards solutions that support shared and electric fleets rather than solely private ownership.

The threat of substitutes for Denso's traditional automotive components is substantial, driven by technological shifts and evolving consumer preferences. The burgeoning electric vehicle (EV) market, which saw global sales surpass 10 million units in 2023, directly substitutes demand for internal combustion engine (ICE) parts. Furthermore, the rise of integrated software solutions and new mobility services like ride-sharing, projected to exceed $200 billion by 2024, offers alternatives to traditional vehicle ownership and component needs.

| Substitute Category | Key Drivers | Impact on Denso | Example Data (2023-2024) |

|---|---|---|---|

| Electric Vehicle Powertrains | Battery technology advancements, environmental regulations | Reduces demand for ICE components (e.g., fuel injection systems, exhaust parts) | EV market share reached ~15% of global new car sales in 2023. |

| Software-Defined Vehicles (SDVs) | Advancements in AI, connectivity, and autonomous driving | Shifts value from hardware to software; potential for integrated systems to replace discrete components | Significant investments in ADAS and connected services by automakers in 2024. |

| New Mobility Services | Ride-sharing, car-sharing, micromobility | Decreases private vehicle ownership, impacting overall component demand | Global ride-sharing market projected to exceed $200 billion by 2024. |

Entrants Threaten

The automotive component manufacturing sector, especially for sophisticated technologies, demands immense capital. Denso, for instance, invests heavily in research and development, state-of-the-art production plants, and extensive global supply chains. This significant financial outlay creates a formidable barrier for any newcomers aiming to enter the market.

Established automotive suppliers like Denso leverage substantial economies of scale, reducing per-unit costs in manufacturing, sourcing raw materials, and research and development. For instance, Denso's global production network, with operations spanning numerous countries, allows for bulk purchasing power and efficient logistics, making it difficult for newcomers to compete on price.

The deep-seated experience accumulated over decades in delivering automotive-grade quality and reliability presents another significant hurdle. New entrants would struggle to replicate Denso's established reputation and proven track record in meeting stringent industry standards for safety and performance, which often requires years of investment and iterative improvement.

Denso's formidable intellectual property portfolio, featuring numerous patents on cutting-edge automotive technologies, acts as a significant barrier to entry. This extensive patent protection means new entrants would need substantial R&D investment or costly licensing agreements to replicate Denso's technological capabilities, hindering their ability to compete effectively.

Access to Distribution Channels and Customer Relationships

The automotive supply industry, particularly for components like those Denso provides, is heavily reliant on deeply entrenched relationships with major Original Equipment Manufacturers (OEMs). Securing contracts with these established automakers is paramount, and new entrants would find it incredibly difficult to displace incumbent suppliers who have cultivated trust and proven reliability over many years. For instance, in 2024, the top 10 global automotive suppliers, including companies like Denso, collectively generated hundreds of billions in revenue, highlighting the scale and established nature of these partnerships.

Building and maintaining effective global distribution channels is another significant barrier. These networks are not only costly to establish but also require extensive logistical expertise and established relationships with dealerships and service centers worldwide. A new entrant would need substantial capital and time to replicate the reach and efficiency of existing supply chain infrastructure. In 2023, the global automotive aftermarket distribution network represented a multi-billion dollar industry, underscoring the complexity and investment required.

- Established OEM Relationships: Incumbent suppliers have decades-long partnerships with major automakers, built on trust and consistent performance, making it hard for new players to break in.

- Global Distribution Networks: The cost and complexity of creating a worldwide logistics and service infrastructure are substantial deterrents for potential new entrants.

- Supplier Loyalty and Integration: OEMs often prefer to work with a smaller, trusted group of suppliers, leading to deep integration and making it challenging for newcomers to gain a foothold.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants in the automotive sector. Strict safety, environmental, and emissions standards, such as those mandated by the EPA in the United States or Euro 7 in Europe, impose substantial compliance costs and intricate certification procedures. For instance, the development of a new vehicle model can involve millions of dollars in testing and validation to meet these evolving requirements.

These regulatory hurdles act as a formidable barrier, particularly for emerging companies lacking established infrastructure and expertise in navigating complex compliance landscapes. The sheer investment required to meet these standards can deter potential new players, thereby protecting incumbent firms. In 2024, the ongoing discussions and potential implementation of stricter carbon dioxide emission targets for new vehicles across major markets like the EU continue to underscore this challenge.

- High Compliance Costs: Meeting stringent safety and environmental regulations requires significant capital investment in research, development, and testing.

- Complex Certification Processes: Navigating the approval pathways for new vehicles is time-consuming and resource-intensive, demanding specialized knowledge.

- Deterrent to New Entrants: These barriers effectively limit the number of new companies that can realistically enter the automotive manufacturing market.

- 2024 Regulatory Focus: Continued emphasis on emissions reduction and vehicle safety standards worldwide maintains these barriers for potential market entrants.

The threat of new entrants in the automotive component sector, particularly for advanced technologies, is generally low due to substantial barriers. These include the immense capital required for R&D and manufacturing facilities, as seen in Denso's significant investments. Furthermore, established players benefit from strong economies of scale, deep-seated OEM relationships, and extensive intellectual property, all of which are difficult for newcomers to overcome. In 2024, the automotive industry continued to see consolidation, reinforcing the dominance of established suppliers.

| Barrier Type | Description | Impact on New Entrants | Example (Denso Focus) |

|---|---|---|---|

| Capital Requirements | High investment in R&D, advanced manufacturing, and global supply chains. | Significant hurdle; deters undercapitalized entrants. | Denso's continuous investment in electrification and autonomous driving technologies. |

| Economies of Scale | Lower per-unit costs through large-scale production and sourcing. | New entrants struggle to match pricing competitiveness. | Denso's global production network enables bulk purchasing and efficient logistics. |

| Brand Loyalty & OEM Relationships | Long-standing trust and integration with major automakers. | Difficult for new suppliers to displace incumbents. | Denso's multi-decade partnerships with leading car manufacturers. |

| Intellectual Property | Extensive patent portfolios on critical technologies. | Requires costly licensing or significant R&D to replicate. | Denso's patents in areas like thermal management and powertrain components. |

| Regulatory Compliance | Meeting stringent safety and environmental standards. | Adds substantial costs and complexity for new market entrants. | Navigating evolving emissions standards like Euro 7 or US EPA regulations. |

Porter's Five Forces Analysis Data Sources

Our Denso Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Denso's annual reports, investor presentations, and official company statements. We also leverage industry-specific market research reports and data from reputable automotive sector analysts to capture a holistic view of the competitive landscape.