Denso Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denso Bundle

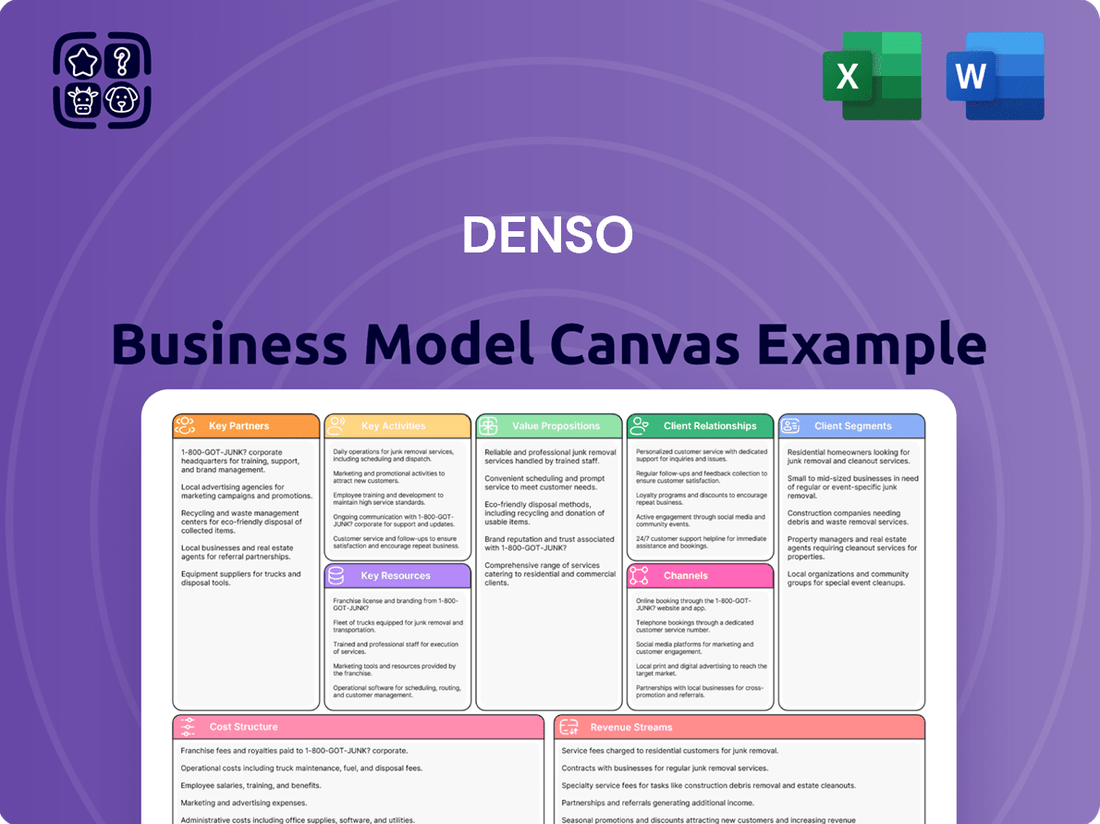

Unlock the strategic DNA of Denso's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how Denso effectively manages its customer relationships, key resources, and revenue streams to maintain its industry leadership. Perfect for anyone seeking to understand the mechanics of a global automotive supplier.

Want to deeply understand how Denso innovates and delivers value? Our full Business Model Canvas provides a granular view of their customer segments, value propositions, and cost structure, offering actionable insights for your own strategic planning. Download it now to gain a competitive edge.

Partnerships

Denso's key partnerships are with leading automotive manufacturers worldwide, providing them with critical components and sophisticated systems. These alliances are fundamental to Denso's operations, facilitating the integration of its technologies into new vehicle designs and driving advancements in the automotive sector. For instance, Denso has a deeply entrenched relationship with Toyota, which is also a major shareholder, highlighting the strategic importance of these manufacturer collaborations.

Denso strategically collaborates with technology and semiconductor companies to bolster its capabilities in key automotive growth areas. This includes advancements in electrification, automated driving systems, and connected vehicle technologies.

A prime example of this is Denso's exploration of a partnership with ROHM, focusing on semiconductor development. This collaboration aims to ensure a consistent and high-quality supply of essential components for electric and intelligent vehicles, critical for future automotive innovation.

Denso's collaborations with universities and research institutions are a cornerstone of its innovation strategy. These partnerships allow Denso to tap into emerging technologies and cultivate the next generation of mobility solutions, ensuring a pipeline of future-ready innovations.

These academic alliances bolster Denso's advanced research and development capabilities across its global operations. For instance, in 2024, Denso announced joint research projects with several leading universities focusing on areas like artificial intelligence for autonomous driving and advanced battery technologies, accelerating the pace of innovation and agile development.

Suppliers and Raw Material Providers

Denso's success hinges on a strong supply chain, with key partnerships with raw material providers and component manufacturers. These relationships are critical for securing the high-quality inputs needed for their advanced automotive technologies. For instance, in 2023, Denso continued to foster these vital links, recognizing the need for resilience in a dynamic global market.

Denso actively cultivates these supplier relationships, often acknowledging outstanding partners through awards. This practice highlights their commitment to collaboration and mutual growth, understanding that supplier performance directly impacts Denso's product quality and delivery timelines. This focus on partnership is particularly important as Denso navigates evolving industry demands and technological shifts.

- Supplier Recognition: Denso's supplier awards underscore the value placed on strong, reliable partnerships.

- Quality Assurance: Access to high-quality raw materials and components is paramount for Denso's manufacturing excellence.

- Market Adaptability: Robust supplier networks are essential for navigating market uncertainties and ensuring continuity of supply.

Energy and Infrastructure Companies

Denso's strategic expansion into areas such as hydrogen supply chains and sustainable energy solutions hinges on robust collaborations with energy and infrastructure titans. These partnerships are crucial for developing and deploying advanced technologies. For instance, Denso secured a manufacturing license for Solid Oxide Electrolysis Cell (SOEC) stacks from Ceres Power Holdings in 2024. This move directly supports Denso's ambition to be a key player in hydrogen production.

These alliances enable Denso to leverage existing infrastructure and expertise, accelerating the adoption of new energy systems. By integrating their technological capabilities with the operational scale of energy companies, Denso can effectively bring innovative solutions to market. This synergy is vital for building out the necessary infrastructure for a greener energy future.

- Hydrogen Production: Denso's 2024 licensing agreement with Ceres Power Holdings for SOEC stack manufacturing is a prime example of partnering for hydrogen production capabilities.

- Sustainable Energy Solutions: Collaborations with energy infrastructure firms are essential for deploying Denso's innovations in areas like renewable energy storage and smart grids.

- Technology Integration: Partnerships facilitate the seamless integration of Denso's advanced components into larger energy systems, ensuring efficiency and reliability.

- Market Access: Aligning with established energy players provides Denso with critical market access and distribution channels for its sustainable energy technologies.

Denso's key partnerships extend to technology providers and research institutions, crucial for innovation in areas like AI and electrification. For example, in 2024, Denso announced joint research with universities on AI for autonomous driving, underscoring these vital academic collaborations.

| Partner Type | Focus Area | Example/Impact |

|---|---|---|

| Automotive Manufacturers | Component integration, system development | Deep relationships with Toyota, enabling technology adoption. |

| Technology/Semiconductor Companies | Electrification, automated driving, connectivity | Collaboration with ROHM for semiconductor development for EVs. |

| Universities/Research Institutions | Emerging technologies, next-gen mobility | Joint research in 2024 on AI for autonomous driving, battery tech. |

| Suppliers | Raw materials, components | Awarding outstanding partners for quality and reliability. |

| Energy/Infrastructure Firms | Hydrogen supply chains, sustainable energy | 2024 licensing of SOEC technology from Ceres Power Holdings. |

What is included in the product

A detailed breakdown of Denso's operational strategy, illustrating how they deliver value to automotive manufacturers and the aftermarket through their extensive product portfolio and global reach.

The Denso Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategies, enabling clearer communication and faster decision-making.

It alleviates the pain of information overload by condensing Denso's intricate operations into a single, easily digestible page for efficient analysis and strategic alignment.

Activities

Denso's commitment to Research and Development is a cornerstone of its strategy, with substantial annual investments fueling innovation in automotive technologies. In fiscal year 2024, Denso reported R&D expenses of approximately ¥429.2 billion (around $2.9 billion USD), underscoring its dedication to pioneering advancements in key areas.

This significant R&D focus is directed towards critical domains such as vehicle electrification, the development of automated driving systems, and the expansion of connected vehicle technologies. Denso actively works on creating integrated platforms, advanced semiconductors, sophisticated sensors, and high-performance electric motors to meet the evolving demands of the automotive industry.

Denso's core activity revolves around the efficient manufacturing of a vast array of sophisticated automotive components and systems. This global production network is a cornerstone of their business, ensuring a steady supply of high-quality parts to automakers worldwide.

To maintain cost-effectiveness and streamline operations, Denso focuses on minimizing the scale of individual production lines and standardizing components across its product portfolio. This approach, coupled with global procurement strategies, significantly reduces facility costs and optimizes inventory management, contributing to their competitive edge.

In 2024, Denso continued to invest heavily in advanced manufacturing technologies, aiming to enhance efficiency and reduce waste. For instance, their commitment to smart factories and automation has been a key driver in achieving production targets and maintaining high quality standards across their diverse manufacturing sites.

Denso's supply chain management is a critical activity, focused on the efficient movement of automotive parts globally. This involves meticulous planning and execution to ensure timely delivery and quality control across a vast network of suppliers and manufacturing sites.

In 2024, Denso continued to emphasize sustainability, aiming to reduce environmental impact across its supply chain. This commitment is reflected in their efforts to source materials responsibly and optimize logistics to minimize carbon emissions, a key factor in the automotive industry's evolving landscape.

Building and maintaining robust relationships with a diverse supplier base is paramount for Denso. These partnerships are essential for securing high-quality components and fostering innovation, ensuring Denso remains competitive in the rapidly changing automotive market.

Sales and Distribution

Denso's sales and distribution are crucial for connecting with its wide array of customers, from major car makers to aftermarket service providers worldwide. The company strategically targets growth in key segments like electric vehicle components and advanced safety systems, aiming to bolster its market presence.

In 2024, Denso continued to emphasize its global sales network, ensuring efficient delivery of its advanced automotive technologies. The company's focus on electrification saw significant traction, with sales in this area showing robust growth, reflecting the industry's shift towards sustainable mobility solutions.

- Global Reach: Denso serves automotive manufacturers and aftermarket clients across continents, adapting its distribution strategies to regional demands.

- Electrification Focus: Sales efforts are increasingly concentrated on components for electric vehicles, a rapidly expanding market.

- Safety Systems Growth: The company is also prioritizing the distribution of its advanced driver-assistance systems (ADAS) and other safety technologies.

- Strategic Partnerships: Denso leverages partnerships to strengthen its distribution channels and reach new customer bases.

Strategic Investments and Acquisitions

Denso actively pursues strategic investments and acquisitions to fuel expansion into promising new sectors. This includes significant capital allocation towards factory automation, agricultural technology, and emerging new energy solutions, areas identified for future growth and innovation.

Notable investments, such as those made in Coherent, JASM, and the Certhon Group, underscore Denso's commitment to enhancing its corporate value. These moves are designed to integrate new technologies and market access, bolstering its competitive position.

- Factory Automation: Denso's investment in this sector aims to leverage advanced robotics and AI for more efficient manufacturing processes.

- Agricultural Technology: By investing in AgTech, Denso seeks to contribute to sustainable food production through innovative solutions.

- New Energy Solutions: Capital is being directed towards developing and acquiring technologies in areas like battery systems and hydrogen power.

- Strategic Partnerships: Denso’s investment strategy often involves forming alliances to accelerate development and market penetration in key growth areas.

Denso's key activities encompass extensive research and development, focusing on automotive advancements like electrification and automated driving. They also excel in efficient, global manufacturing of automotive components, supported by streamlined production lines and component standardization. Furthermore, Denso manages a sophisticated global supply chain, prioritizing sustainability and strong supplier relationships to ensure quality and timely delivery.

Sales and distribution are critical, with Denso strategically targeting growth in electric vehicle components and safety systems, leveraging a global network to serve diverse customers. The company also actively engages in strategic investments and acquisitions, particularly in factory automation, agricultural technology, and new energy solutions, to foster expansion and integrate new technologies.

| Key Activity | Description | Fiscal Year 2024 Data/Focus |

|---|---|---|

| Research & Development | Innovation in automotive technologies | ¥429.2 billion (approx. $2.9 billion USD) invested in R&D |

| Manufacturing | Efficient production of automotive components | Investment in advanced manufacturing technologies and smart factories |

| Supply Chain Management | Global logistics and supplier relations | Emphasis on sustainability and responsible sourcing |

| Sales & Distribution | Connecting with automotive manufacturers and aftermarket | Robust growth in electric vehicle component sales |

| Investments & Acquisitions | Expansion into new sectors | Focus on factory automation, AgTech, and new energy solutions |

What You See Is What You Get

Business Model Canvas

The Denso Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at its complete structure and content. This is not a sample or mockup; it's a direct snapshot of the professional, ready-to-use file you'll download. You'll gain full access to this exact Business Model Canvas, allowing you to immediately begin analyzing and refining Denso's strategic framework.

Resources

Denso's intellectual property, particularly its vast patent portfolio, is a cornerstone of its business model, especially in cutting-edge automotive technologies. This extensive collection of over 10,000 patents worldwide underscores its dedication to innovation and provides a significant competitive edge in the market.

These patents protect Denso's proprietary advancements, allowing it to maintain leadership in areas such as electrification, advanced driver-assistance systems (ADAS), and connected car technologies. This strong IP position is vital for securing licensing agreements and deterring competitors from replicating its unique solutions.

Denso operates a vast global network of advanced manufacturing facilities, a cornerstone of its business model. These sites are equipped with cutting-edge production technologies, allowing for the efficient and high-quality manufacturing of complex automotive components.

These state-of-the-art facilities are instrumental in Denso's ability to produce its diverse product portfolio, including critical components for electrification, advanced powertrain systems, thermal management solutions, and mobility electronics. For instance, in 2024, Denso continued to invest heavily in upgrading its facilities to support the growing demand for electric vehicle (EV) components, with a significant portion of its capital expenditure directed towards these advanced manufacturing capabilities.

Denso's highly skilled and diverse workforce, encompassing engineers, researchers, and production specialists, forms the bedrock of its innovation and manufacturing prowess. This human capital is indispensable for developing cutting-edge automotive technologies and maintaining efficient production processes.

Denso actively invests in human resource development, fostering a culture of continuous learning and skill enhancement. This commitment ensures its employees remain at the forefront of technological advancements in the automotive sector.

With a global workforce of approximately 170,000 employees as of March 2024, Denso prioritizes diversity and inclusion, recognizing people as its most valuable management capital. This diverse talent pool fuels creativity and problem-solving, crucial for navigating the complexities of the automotive industry.

Financial Capital

Denso's financial capital is the bedrock of its operations, enabling significant investments in innovation and expansion. This includes substantial revenue generated from its global sales, which reached ¥7,144.7 billion for the fiscal year ending March 31, 2024.

These funds are crucial for supporting Denso's ambitious research and development initiatives, as well as its capital expenditures required for advanced manufacturing facilities and infrastructure. Furthermore, the company leverages retained earnings and maintains access to capital markets to secure the necessary financing for strategic acquisitions and long-term growth projects.

- Revenue Generation: Denso's primary financial resource stems from its extensive sales network, with revenues reaching ¥7,144.7 billion in FY2024.

- Retained Earnings: Profits reinvested back into the business provide a stable source of internal funding for ongoing operations and development.

- Access to Capital Markets: Denso can raise additional funds through debt or equity financing to support large-scale projects and strategic investments.

- Investment in R&D and CapEx: Financial capital directly fuels Denso's commitment to technological advancement and maintaining state-of-the-art production capabilities.

Global Sales and Service Network

Denso's global sales and service network is a cornerstone of its business model, enabling it to connect with customers across the globe. This vast infrastructure includes sales offices, service centers, and distribution channels strategically located to ensure efficient market penetration and customer support.

This extensive network is crucial for delivering after-sales service and maintaining stringent quality control, which in turn builds and reinforces customer trust. By having a strong local presence, Denso can better understand and respond to regional market needs and preferences.

- Global Reach: Denso operates in over 35 countries and regions, with a significant presence in North America, Europe, Asia, and other key markets.

- Service Infrastructure: The company maintains a robust network of service centers, providing essential maintenance, repair, and technical support to its diverse clientele.

- Distribution Efficiency: Its distribution channels are optimized to ensure timely delivery of products and parts, supporting the operational continuity of its customers.

- Customer Engagement: This network facilitates direct customer interaction, allowing for feedback collection and continuous improvement of products and services.

Denso's physical resources are its advanced manufacturing facilities and extensive global network of sales and service centers. These tangible assets are critical for producing high-quality automotive components and ensuring efficient customer support worldwide.

In 2024, Denso continued to invest in modernizing its production sites, particularly those focused on electric vehicle components, reflecting the evolving automotive landscape. The company's commitment to maintaining state-of-the-art infrastructure supports its capacity to deliver innovative solutions across its product lines.

Denso's commitment to research and development is a critical intangible resource, driving its innovation in automotive technology. This includes its significant patent portfolio, which protects its proprietary advancements and provides a competitive edge.

The company's brand reputation and strong customer relationships are also key intangible assets, built upon decades of delivering reliable and high-performance automotive systems.

| Resource Type | Key Aspects | Significance |

| Physical | Manufacturing Facilities | High-quality production, capacity for EV components |

| Physical | Global Sales & Service Network | Market reach, customer support, distribution efficiency |

| Intangible | Intellectual Property (Patents) | Competitive advantage, protection of innovation |

| Intangible | Brand Reputation & Customer Relationships | Trust, market loyalty, feedback loop |

Value Propositions

Denso's value proposition centers on delivering advanced automotive technology that propels innovation. They provide cutting-edge components and systems designed to boost vehicle performance, enhance safety, and promote environmental responsibility.

This commitment to innovation is evident in their pioneering work across key automotive trends. Denso is actively developing solutions for electrification, automated driving, and connected vehicle technologies, aiming to redefine the future of mobility.

For instance, in 2024, Denso continued to invest heavily in R&D for electrified powertrains and advanced driver-assistance systems (ADAS). Their contributions are vital for automakers striving to meet increasingly stringent emissions standards and consumer demand for safer, more intelligent vehicles.

Denso consistently delivers high-quality, durable automotive components, a cornerstone of its value proposition. This commitment is crucial in an industry where reliability directly impacts safety and performance.

The company's rigorous quality control processes ensure that its products meet and exceed the demanding standards of global automakers, fostering trust and brand loyalty among consumers seeking dependable vehicles.

Denso's dedication to 'Peace of Mind' value, evident in its product longevity, translates into reduced maintenance costs and enhanced user experience, reinforcing its reputation for excellence.

Denso is actively contributing to a greener future by developing advanced electrification systems and thermal management solutions. These technologies are designed to significantly enhance energy efficiency and minimize environmental impact across various industries.

The company has set ambitious goals to lead the automotive sector in achieving carbon-neutral manufacturing processes. By 2024, Denso aims to reduce its CO2 emissions by 10% compared to 2018 levels as part of its broader sustainability strategy.

Enhanced Safety and Peace of Mind

Denso's commitment to enhanced safety and peace of mind is a cornerstone of its value proposition. The company develops cutting-edge safety systems and technologies designed to significantly reduce or even eliminate traffic accidents. This dedication translates into a tangible benefit for drivers and passengers alike, fostering a sense of security on the road.

Innovations like advanced driver-assistance systems (ADAS) and autonomous emergency steering are central to this offering. For instance, Denso’s radar sensors and camera systems are integral to ADAS features that can detect potential hazards and intervene to prevent collisions. In 2024, the automotive industry continued to see a strong demand for these safety technologies, with ADAS penetration rates rising across new vehicle sales.

- Advanced Driver-Assistance Systems (ADAS): Denso's ADAS solutions, including adaptive cruise control and lane-keeping assist, aim to mitigate human error, a leading cause of accidents.

- Autonomous Emergency Steering: This technology actively steers a vehicle away from a potential collision when braking alone is insufficient, further enhancing occupant safety.

- Traffic Accident Reduction: By integrating these sophisticated systems, Denso directly contributes to the goal of zero traffic fatalities and serious injuries.

- Consumer Trust: The tangible improvements in vehicle safety driven by Denso's technologies build consumer confidence and a greater sense of peace of mind for drivers.

Diversified Solutions Beyond Automotive

Denso is actively expanding its reach beyond the automotive sector, leveraging its deep manufacturing and technological expertise. This strategic diversification allows the company to offer innovative solutions in areas like factory automation and agricultural technology, creating new avenues for value creation.

By applying its core competencies, Denso is developing advanced systems for industrial efficiency and agricultural productivity. For instance, in factory automation, Denso’s technologies contribute to smarter manufacturing processes, enhancing output and reducing operational costs for businesses across various industries.

In the agricultural technology space, Denso's innovations aim to address global food security challenges. This includes developing solutions that improve crop yields and optimize resource management, demonstrating a commitment to broader societal impact. In 2024, Denso reported significant investments in these non-automotive growth areas, signaling a clear strategic direction.

- Factory Automation: Denso's automation solutions enhance manufacturing efficiency and precision.

- Agricultural Technology: Innovations in this sector focus on increasing crop yields and sustainable farming practices.

- Cross-Industry Expertise: Core manufacturing and technology skills are transferable to diverse markets.

- Revenue Diversification: Expansion into non-automotive sectors reduces reliance on the automotive market.

Denso provides advanced automotive technologies that enhance vehicle performance, safety, and environmental sustainability. Their commitment to innovation is evident in their work on electrification, automated driving, and connected vehicle systems, aiming to shape the future of mobility.

The company's value proposition also includes delivering high-quality, durable components, fostering trust and reliability for automakers and consumers. This focus on longevity contributes to reduced maintenance costs and an improved user experience.

Furthermore, Denso is dedicated to creating a greener future through its electrification and thermal management solutions, actively working towards carbon-neutral manufacturing. They are also diversifying into factory automation and agricultural technology, leveraging their expertise for broader societal impact.

Customer Relationships

Denso cultivates robust, collaborative relationships with Original Equipment Manufacturers (OEMs) in the automotive sector. This partnership extends beyond simple supplier-customer dynamics, focusing on joint product development and seamless integration to precisely match OEM vehicle specifications.

These aren't fleeting associations; Denso engages in long-term partnerships, often involving joint development initiatives for cutting-edge technologies and next-generation vehicle platforms. For instance, Denso's commitment to co-creation was evident in its work with Toyota on advanced driver-assistance systems (ADAS), contributing to Toyota's 2024 model year safety feature advancements.

Denso ensures customers receive dedicated sales and technical support, facilitating smooth product integration and peak performance. Their specialized sales teams and engineers collaborate directly with clients to meet specific requirements.

Denso prioritizes customer loyalty through comprehensive after-sales service and maintenance, ensuring their automotive components function optimally long after purchase. This commitment extends to providing readily available spare parts and expert repair services, fostering trust and repeat business.

In 2024, Denso's focus on robust after-sales support directly contributes to customer retention, a critical factor in the competitive automotive aftermarket. Their extensive network of service centers and commitment to quality parts helps maintain product longevity, a key driver of satisfaction for both individual vehicle owners and fleet managers.

Long-Term Strategic Partnerships

Denso focuses on cultivating enduring strategic alliances with its core clientele and significant industry collaborators. This approach transcends simple buyer-seller exchanges, aiming to nurture environments conducive to reciprocal advancement and pioneering solutions. These deep-seated connections are critical for successfully navigating market volatility and attaining collective objectives.

- Customer Retention: Denso’s emphasis on long-term partnerships contributes to high customer retention rates, a key indicator of relationship strength.

- Collaborative Innovation: These partnerships facilitate joint development projects, accelerating the introduction of new technologies and products. For example, Denso's collaborations in the automotive sector often lead to co-developed advanced driver-assistance systems (ADAS).

- Market Insight: Strategic partners provide invaluable feedback and market intelligence, enabling Denso to adapt its offerings and strategies more effectively.

- Risk Mitigation: By aligning with key partners, Denso can share the risks associated with new market entries or technological investments, fostering greater stability.

Stakeholder Engagement and Transparency

Denso prioritizes open communication with its diverse stakeholders, fostering strong relationships through clear and consistent dialogue. This approach is central to their customer relationships, ensuring a shared understanding of values and goals.

The company actively shares its progress and commitment to societal impact via integrated reports and dedicated sustainability initiatives. For example, Denso's 2023 integrated report detailed their efforts in reducing CO2 emissions across their value chain, a key area of interest for many stakeholders.

This dedication to transparency and ongoing dialogue is instrumental in building and maintaining trust. It underscores Denso's commitment not just to business success, but also to its broader role in contributing positively to society.

- Transparent Communication: Denso utilizes integrated reports and sustainability reports to share progress and commitments with customers and other stakeholders.

- Trust Building: This open dialogue fosters trust, a critical component of successful customer relationships.

- Societal Contribution: Denso highlights its dedication to societal contributions, aligning with stakeholder expectations for corporate responsibility.

- Stakeholder Dialogue: The company actively engages in dialogue to understand and address stakeholder needs and concerns.

Denso's customer relationships are built on deep collaboration, long-term partnerships, and dedicated support, fostering loyalty and joint innovation.

These relationships are crucial for co-creating advanced technologies, as seen in their work on 2024 ADAS features, and ensuring seamless product integration through specialized sales and technical teams.

Denso also prioritizes customer retention via comprehensive after-sales service and transparent communication, as highlighted in their 2023 sustainability reports, building trust and societal alignment.

| Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| OEM Partnerships | Joint product development and integration with automotive manufacturers. | Co-creation of next-gen vehicle platforms and technologies. |

| Customer Support | Dedicated sales and technical assistance for product integration. | Ensuring peak performance and client satisfaction. |

| After-Sales Service | Comprehensive maintenance and spare parts availability. | Driving customer loyalty and product longevity. |

| Communication & Transparency | Open dialogue and sharing of progress via reports. | Building trust and aligning with stakeholder values. |

Channels

Denso's primary sales channel involves direct sales to automotive OEMs, facilitating deep partnerships for component and system supply. This approach ensures seamless integration and co-development, crucial for the complex automotive supply chain.

In 2024, Denso continued its strategy of direct engagement with global automotive giants like Toyota, Ford, and Volkswagen. This direct relationship allows for tailored solutions and early involvement in new vehicle platform development, a key differentiator in the competitive automotive parts market.

Denso's global manufacturing and sales network is a cornerstone of its business model, enabling it to serve a vast customer base. In 2024, the company operated over 170 consolidated subsidiaries and affiliates worldwide, a testament to its extensive reach.

This expansive network, comprising numerous manufacturing plants and sales offices, ensures efficient product delivery and localized customer support across diverse geographical markets. Denso's ability to maintain this widespread presence is critical for its strategy of providing tailored solutions and responsive service to automotive manufacturers and aftermarket customers globally.

Denso's aftermarket distribution channels are crucial for reaching vehicle owners needing replacement parts. They leverage a multi-tiered network including independent distributors, large wholesalers, and authorized service centers to ensure their automotive components are readily available for vehicles already in use.

This extensive network is vital for maintaining vehicle uptime and customer satisfaction. For instance, Denso's commitment to the aftermarket is underscored by its broad product portfolio, covering over 98% of all vehicle makes and models globally, a testament to the reach of its distribution strategy.

In 2024, the automotive aftermarket sector continued its robust growth, with global sales projected to exceed $800 billion. Denso's participation in this market, facilitated by its established distribution infrastructure, allows it to capitalize on this expanding demand for repair and maintenance services.

Online Platforms and Digital Engagement

Denso leverages its corporate website and various digital platforms to share crucial information, manage investor relations, and facilitate business-to-business (B2B) interactions. These online avenues are vital for communicating with a broad spectrum of stakeholders.

In 2024, Denso's digital presence is a cornerstone for stakeholder engagement. Their corporate website serves as a primary hub for news, financial reports, and sustainability initiatives, ensuring transparency and accessibility for investors and the public alike.

- Corporate Website: Acts as the central information repository, detailing company performance, product information, and career opportunities.

- Digital Engagement: Utilizes social media and online forums for direct communication and feedback gathering from customers and partners.

- Investor Relations Portal: Provides dedicated sections for financial results, shareholder information, and corporate governance updates, enhancing investor confidence.

- B2B E-commerce: Explores and implements digital solutions for streamlined procurement and partnership management with other businesses.

Trade Shows and Industry Events

Denso actively participates in major international trade shows like CES and the Tokyo Motor Show, alongside numerous automotive exhibitions and industry conferences. These events are crucial for demonstrating their cutting-edge innovations in areas such as electrification and autonomous driving, directly engaging with a global audience of potential clients and partners.

These platforms facilitate invaluable face-to-face interactions, enabling Denso to gather immediate market feedback and understand evolving customer needs. For instance, at the 2024 Consumer Electronics Show (CES), Denso highlighted its advancements in cockpit systems and advanced driver-assistance systems (ADAS), receiving significant interest from automotive manufacturers and technology providers.

- Showcasing Innovation: Denso uses trade shows to unveil new products and technologies, attracting media attention and potential business leads.

- Customer Engagement: Direct interaction at events allows for personalized demonstrations and the building of stronger client relationships.

- Market Intelligence: Observing competitor activities and gathering feedback from attendees provides crucial insights into market trends and demands.

- Partnership Opportunities: Industry events are key venues for identifying and fostering collaborations with other companies in the automotive ecosystem.

Denso's channels extend beyond direct OEM sales to include a robust aftermarket distribution network. This strategy ensures their components are accessible for vehicle repairs and maintenance globally.

In 2024, Denso continued to strengthen its aftermarket presence, recognizing the sector's growth. The company's broad product availability, covering over 98% of global vehicle makes, highlights the effectiveness of its multi-tiered distribution approach.

Digital platforms and participation in key industry events are also vital channels for Denso. These avenues facilitate stakeholder communication, showcase technological advancements, and foster new business relationships.

| Channel Type | Primary Function | 2024 Focus/Data |

|---|---|---|

| Direct OEM Sales | Component and system supply to vehicle manufacturers | Continued partnerships with major global OEMs; early involvement in new platform development. |

| Aftermarket Distribution | Supplying replacement parts to vehicle owners | Leveraging extensive network of distributors and service centers; capitalizing on global aftermarket growth (projected >$800 billion in 2024). |

| Digital Platforms | Information dissemination, investor relations, B2B interaction | Enhancing corporate website for transparency; utilizing online forums for stakeholder feedback. |

| Trade Shows & Conferences | Innovation showcase, customer engagement, market intelligence | Demonstrating advancements in electrification and ADAS at events like CES 2024. |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Denso's most significant customer base, accounting for a substantial portion of its revenue. These are the major players in the automotive industry, including giants like Toyota, Honda, Ford, Volkswagen, and General Motors, spread across key markets worldwide.

Denso's relationship with these OEMs involves supplying a vast array of sophisticated automotive components and integrated systems. These products are crucial for the assembly of new vehicles, covering everything from powertrain and chassis systems to electronic control units and advanced driver-assistance systems (ADAS).

For instance, in 2023, Denso's sales to major Japanese OEMs, particularly Toyota, remained a cornerstone of its business, reflecting the deep integration and long-standing partnerships. The company's ability to innovate and deliver high-quality, reliable components is paramount to meeting the evolving demands of these global automotive leaders.

The automotive aftermarket segment is crucial for Denso, encompassing independent repair shops, auto parts retailers, and individual vehicle owners. These customers rely on Denso for replacement parts and service components to maintain their existing vehicles. For instance, in 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the significant demand Denso serves.

Denso’s commitment extends beyond passenger cars to the robust commercial vehicle sector. They supply critical components and advanced systems to manufacturers of trucks, buses, and other heavy-duty vehicles, tailoring solutions for demanding applications. This strategic focus significantly broadens Denso's influence and revenue streams within the global mobility market.

Agricultural and Industrial Equipment Manufacturers

Denso is actively expanding its reach into the agricultural and industrial equipment manufacturing sectors. This strategic move leverages Denso's deep-seated expertise in advanced manufacturing processes and its commitment to ongoing innovation. By focusing on these segments, Denso aims to provide cutting-edge solutions that drive efficiency and progress in both factory automation and agricultural technology.

The company's offerings for these markets are designed to address critical needs for enhanced productivity and technological integration. For instance, Denso's contributions to agricultural technology can help improve crop yields and operational efficiency for farmers. Similarly, its industrial automation solutions are geared towards optimizing manufacturing workflows and reducing operational costs for factories.

- Targeting growth: Denso identifies agricultural and industrial equipment manufacturers as key growth areas for diversification.

- Leveraging expertise: The company capitalizes on its strong background in manufacturing excellence and technological development.

- Solution provision: Denso offers specialized solutions for factory automation and advancements in agricultural technology.

- Market impact: In 2024, the global agricultural machinery market was valued at over $100 billion, with significant growth projected in automation technologies. The industrial automation market also saw robust expansion, driven by Industry 4.0 initiatives.

Government and Public Sector (for Mobility Infrastructure)

Denso collaborates with government and public sector entities to develop and implement smart city initiatives, focusing on advanced mobility infrastructure. These partnerships are crucial for deploying intelligent transportation systems and traffic management solutions, aiming to improve urban living and sustainability.

In 2024, global smart city investments are projected to reach over $250 billion, with a significant portion allocated to mobility and transportation projects. Denso's engagement in this sector directly supports its vision of enhancing quality of life through technological innovation.

- Traffic Management: Denso's solutions contribute to optimizing traffic flow and reducing congestion in urban areas.

- Intelligent Transportation Systems (ITS): The company provides technology for connected vehicles and infrastructure, enhancing safety and efficiency.

- Public Sector Partnerships: Collaborations with city governments are key to piloting and scaling new mobility technologies.

- Quality of Life Enhancement: The ultimate goal is to create more livable and sustainable urban environments.

Denso's customer base is broadly segmented, with Global Automotive Original Equipment Manufacturers (OEMs) forming its largest and most critical segment. This includes major car manufacturers worldwide, who rely on Denso for a vast array of sophisticated components and integrated systems essential for new vehicle assembly. The automotive aftermarket is another significant segment, catering to independent repair shops, retailers, and vehicle owners needing replacement parts. Denso also strategically targets the commercial vehicle sector, supplying components for trucks and buses, and is expanding into agricultural and industrial equipment manufacturing, leveraging its expertise in automation and advanced technologies.

| Customer Segment | Key Characteristics | 2024 Market Relevance/Data |

|---|---|---|

| Global Automotive OEMs | Major car manufacturers (Toyota, Ford, GM, etc.) | Core revenue driver; demand for ADAS and electrification components is high. |

| Automotive Aftermarket | Repair shops, retailers, vehicle owners | Global aftermarket projected over $500 billion in 2024; demand for reliable replacement parts. |

| Commercial Vehicles | Truck, bus, and heavy-duty vehicle manufacturers | Supplies critical components for demanding applications; growing market for efficiency. |

| Agricultural & Industrial Equipment | Manufacturers of farm machinery and factory automation systems | Targeted growth area; agricultural machinery market over $100 billion in 2024, with automation focus. |

| Government & Public Sector | Entities involved in smart city initiatives | Partnerships for intelligent transportation systems; smart city investments projected over $250 billion in 2024. |

Cost Structure

Research and Development (R&D) represents a substantial cost for Denso, underscoring its dedication to pioneering new automotive technologies. For the fiscal year concluding on March 31, 2024, Denso invested ¥550.9 billion in R&D activities.

Manufacturing and production costs are a significant part of Denso's business model, encompassing raw materials, direct labor, factory overhead, and depreciation of its extensive global machinery. In fiscal year 2023, Denso reported that its cost of sales, which includes these manufacturing expenses, was approximately ¥5.7 trillion (roughly $38 billion USD at an average exchange rate for that period).

Denso actively manages these expenses by focusing on optimizing production line scale and standardizing components across its product lines. This strategy helps achieve economies of scale and reduces complexity, contributing to cost efficiency in its manufacturing operations.

Selling, General, and Administrative (SG&A) expenses for Denso are a significant component of their cost structure, covering sales and marketing efforts, the operational backbone of their administrative functions, and broader corporate overhead. In fiscal year 2024, Denso reported SG&A expenses amounting to approximately ¥480 billion, reflecting investments in brand building, customer support, and the administrative infrastructure necessary to manage a global automotive supplier.

The effective management of these SG&A costs is paramount for Denso's profitability. By optimizing sales channels, streamlining administrative processes, and controlling corporate expenditures, Denso can enhance its bottom line. For instance, a focus on digital marketing and efficient supply chain logistics for sales support can directly impact the cost-effectiveness of their market penetration strategies.

Quality-Related Costs

Denso allocates significant resources to quality-related costs, a necessity given the safety-critical nature of automotive components. These expenses encompass rigorous testing, inspection processes, and the management of potential defects. For the fiscal year ending March 31, 2024, these quality costs notably impacted profitability, contributing to a decrease in operating profit.

The financial strain from quality issues is evident. Denso's operating profit for the fiscal year ended March 31, 2024, saw a decline, with incurred quality costs being a primary factor. This highlights the substantial financial implications of maintaining high product standards in the automotive sector.

- Quality Control and Assurance: Investment in systems and personnel to prevent defects.

- Testing and Validation: Costs associated with rigorous product testing to meet industry standards.

- Remediation and Recalls: Expenses incurred when quality issues necessitate product fixes or recalls.

- Supplier Quality Management: Costs related to ensuring the quality of components sourced from third parties.

Capital Expenditures

Denso's commitment to innovation and efficiency is reflected in its significant capital expenditures. These investments are crucial for maintaining its competitive edge in the automotive industry.

The company directs substantial funds towards expanding and modernizing its manufacturing plants, ensuring they are equipped with the latest automation and production technologies. This focus on infrastructure upgrades is key to meeting growing global demand and improving output quality.

Furthermore, Denso strategically allocates capital to acquire cutting-edge technologies, particularly in areas like electrification, advanced driver-assistance systems (ADAS), and connected car solutions. These acquisitions are vital for future growth and product development.

- Manufacturing Facility Expansion & Upgrades: Enhancing production capacity and efficiency.

- Technology Acquisition: Investing in future-oriented automotive technologies.

- Operational Efficiency Improvements: Streamlining processes and reducing costs.

- Fiscal Year 2024 Capital Expenditures: ¥394.6 billion.

Denso's cost structure is heavily influenced by its substantial investments in research and development, aiming to stay at the forefront of automotive technology. Manufacturing and production expenses, including raw materials and labor, form another significant outlay, as seen in their fiscal year 2023 cost of sales exceeding ¥5.7 trillion. Selling, General, and Administrative (SG&A) costs, reported at approximately ¥480 billion for fiscal year 2024, support global operations and market presence.

| Cost Category | Fiscal Year (Ending March 31) | Amount (Billions of JPY) |

|---|---|---|

| Research and Development (R&D) | 2024 | 550.9 |

| Cost of Sales (Manufacturing) | 2023 | ~5,700 (approx. $38 billion USD) |

| Selling, General, and Administrative (SG&A) | 2024 | 480 |

| Capital Expenditures | 2024 | 394.6 |

Revenue Streams

Denso's core revenue comes from selling a vast array of sophisticated automotive parts and integrated systems. These sales target both original equipment manufacturers (OEMs) and the independent aftermarket sector.

For the fiscal year concluding on March 31, 2024, Denso reported a significant uplift in revenue, reaching ¥7,144.7 billion from these component and system sales.

Denso's revenue from electrification systems, encompassing components like inverters and motor generators, is a significant and expanding sector. This growth is directly tied to the automotive industry's accelerating transition to electric vehicles.

In fiscal year 2023, Denso reported that its electrified powertrain systems business, which includes these components, saw substantial increases, reflecting strong market demand. The company is actively investing in expanding its production capacity for these critical EV parts to meet future needs.

Sales of advanced safety and automated driving systems are a substantial revenue driver for Denso, encompassing technologies like Advanced Driver-Assistance Systems (ADAS) and autonomous emergency steering. This segment represents a critical area for the company's ongoing expansion and future revenue generation.

Non-Automotive Business Solutions

Denso generates revenue beyond its core automotive business through a strategic diversification into industrial sectors. This includes income from factory automation solutions, which are designed to enhance manufacturing efficiency and productivity for various industries.

Furthermore, Denso is tapping into the agricultural technology market, developing and selling solutions that aim to improve crop yields and farming practices. These non-automotive ventures represent a significant expansion of their revenue base.

For the fiscal year ending March 31, 2024, Denso reported total net sales of ¥5,779.8 billion. While specific segment breakdowns for these non-automotive solutions aren't always granularly detailed in public summaries, their growth indicates a positive contribution to this overall figure.

- Factory Automation: Denso's offerings in this area include robots, control systems, and integrated solutions for manufacturing processes.

- Agricultural Technology: This segment encompasses precision farming tools, sensors, and data management systems for the agricultural sector.

- Other Industrial Solutions: Denso also provides various other industrial components and services catering to a broader range of business needs.

Licensing and Technology Royalties

Denso leverages its significant research and development investments by licensing its proprietary technologies and patents to other automotive manufacturers and technology firms. This stream generates income through upfront licensing fees and ongoing royalties based on the usage of its intellectual property. For example, Denso's advancements in areas like electric vehicle components or advanced driver-assistance systems (ADAS) are prime candidates for such agreements.

These royalty agreements allow Denso to monetize its innovation without directly manufacturing the end product for every partner. It's a strategic way to expand the reach of its technological expertise across the global automotive ecosystem. In 2023, Denso reported substantial investments in R&D, indicating a continued focus on developing and protecting intellectual property that can be monetized through licensing.

- Licensing Fees: Upfront payments received for granting access to Denso's patented technologies.

- Technology Royalties: Ongoing payments based on the volume or value of products manufactured using Denso's licensed IP.

- Strategic Partnerships: Collaborations that involve technology sharing and revenue generation through joint ventures or licensing deals.

- Intellectual Property Monetization: Capitalizing on R&D expenditures by making innovations available to a wider market.

Denso's revenue streams are multifaceted, primarily driven by the sale of automotive components and systems to both original equipment manufacturers (OEMs) and the aftermarket.

The company also generates significant income from its expanding electrification systems business, crucial for the EV transition, and from advanced safety and automated driving technologies.

Beyond automotive, Denso diversifies revenue through industrial automation solutions and agricultural technology, broadening its market reach.

Furthermore, Denso monetizes its substantial research and development through licensing its proprietary technologies and patents, earning fees and royalties.

| Revenue Stream | Description | Fiscal Year 2024 (JPY billions) |

| Automotive Components & Systems | Sales to OEMs and aftermarket | 7,144.7 (Total Net Sales) |

| Electrification Systems | Components for EVs (inverters, motor generators) | Included within Total Net Sales |

| Safety & Automated Driving Systems | ADAS, autonomous driving technologies | Included within Total Net Sales |

| Industrial Automation | Robots, control systems for manufacturing | Included within Total Net Sales (Non-automotive) |

| Agricultural Technology | Precision farming tools, sensors | Included within Total Net Sales (Non-automotive) |

| Technology Licensing & Royalties | Monetizing R&D and patents | Not explicitly broken out, but supported by R&D investment |

Business Model Canvas Data Sources

The Denso Business Model Canvas is meticulously constructed using a blend of internal financial statements, detailed market research reports, and extensive competitive analysis. These diverse data sources ensure each component of the canvas accurately reflects Denso's current operational reality and strategic direction.