Darden Restaurants SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darden Restaurants Bundle

Darden Restaurants boasts a strong portfolio of popular brands and a robust supply chain, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for navigating the competitive restaurant landscape.

Want the full story behind Darden's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Darden Restaurants boasts a strong and varied collection of well-loved casual dining establishments, featuring names like Olive Garden and LongHorn Steakhouse, alongside recent additions such as Ruth's Chris Steak House and Chuy's. This wide array of brands effectively serves diverse customer tastes and dining needs, mitigating risk across different market segments and bolstering overall brand equity and customer loyalty.

Darden Restaurants has showcased impressive financial resilience, achieving consistent revenue growth and maintaining healthy profit margins. For instance, in fiscal year 2023, Darden reported total sales of $10.49 billion, a significant increase from the previous year, demonstrating their ability to navigate economic headwinds effectively.

The company's adept cost management strategies, coupled with strategic pricing initiatives, have been instrumental in bolstering its financial stability. This financial strength translates into a robust free cash flow generation, providing Darden with the necessary capital to pursue expansion opportunities and invest in operational enhancements, ensuring continued growth and market competitiveness.

Darden Restaurants' unwavering commitment to operational excellence is a significant strength. The company diligently focuses on cost control, optimizing its supply chain, and refining service delivery across its extensive restaurant portfolio. This dedication to efficiency is crucial for maintaining robust profit margins, especially when faced with increasing input costs.

For instance, in fiscal year 2024, Darden reported a 6.1% increase in total sales to $10.49 billion, a testament to their ability to manage operations effectively amidst economic fluctuations. This operational prowess allows them to adapt swiftly to changing consumer demands while preserving their competitive advantage.

Commitment to Customer Experience and Loyalty

Darden Restaurants places a significant emphasis on creating exceptional customer experiences, which directly translates into strong brand loyalty. They consistently invest in initiatives designed to elevate the dining journey across their portfolio of brands.

This commitment is evident in their ongoing efforts to refine menus and forge strategic delivery partnerships, all aimed at deepening customer engagement and encouraging repeat business. For instance, in fiscal year 2023, Darden reported that approximately 50% of sales at Olive Garden, their largest brand, came from repeat customers, highlighting the success of their loyalty-focused strategies.

- Customer-Centric Investments: Darden allocates resources to ensure consistent quality and service across all dining occasions.

- Brand-Specific Marketing: Targeted campaigns foster emotional connections and drive repeat visits, reinforcing brand loyalty.

- Enhanced Dining Journey: Menu revitalizations and delivery partnerships aim to improve convenience and overall customer satisfaction.

- Loyalty Metrics: A substantial portion of sales from key brands like Olive Garden originates from repeat customers, underscoring the effectiveness of their customer experience focus.

Strategic Growth Initiatives and Adaptability

Darden Restaurants demonstrates robust strategic growth through both organic expansion and key acquisitions. In fiscal year 2023, the company successfully integrated Ruth's Chris Steak House and Chuy's, significantly broadening its brand portfolio and targeting a wider customer base. This strategic move, alongside continued new restaurant openings across its existing brands, underscores a commitment to expanding market share and diversifying revenue streams.

The company's adaptability is further evidenced by its substantial investments in technology. Darden has prioritized enhancing digital ordering and delivery capabilities, recognizing the shift in consumer behavior towards convenience. This focus on innovation, including investments in data analytics to personalize customer experiences, positions Darden to effectively navigate evolving market demands and maintain a competitive edge.

- Acquisition Integration: Successful integration of Ruth's Chris and Chuy's in FY23.

- Digital Investment: Continued focus on enhancing digital ordering and delivery platforms.

- Brand Diversification: Expansion of portfolio through strategic acquisitions and new openings.

- Market Reach: Extended market presence through diverse brand offerings and geographic expansion.

Darden's extensive and well-recognized brand portfolio, including Olive Garden and LongHorn Steakhouse, allows it to cater to a broad spectrum of consumer preferences and dining occasions. This diversification across different casual dining segments significantly reduces reliance on any single concept and strengthens overall market positioning.

The company's financial performance remains a key strength, marked by consistent revenue growth and healthy profitability. For example, Darden reported total sales of $10.49 billion in fiscal year 2023, demonstrating its ability to generate substantial revenue and manage its business effectively even in dynamic economic conditions.

Darden Restaurants excels in operational efficiency, a critical factor for success in the competitive restaurant industry. Their focus on cost management, supply chain optimization, and service delivery ensures strong profit margins and the ability to reinvest in growth initiatives.

Customer loyalty is a significant asset, with initiatives focused on enhancing the dining experience driving repeat business. In fiscal year 2023, approximately 50% of sales at Olive Garden, Darden's largest brand, came from repeat customers, highlighting the effectiveness of their customer-centric approach.

| Brand | FY23 Sales (Approx.) | Key Strength |

|---|---|---|

| Olive Garden | $4.7 billion | Strong brand recognition, repeat customer base |

| LongHorn Steakhouse | $2.4 billion | Consistent performance, popular menu |

| Ruth's Chris Steak House | $0.5 billion (post-acquisition) | Premium positioning, acquisition synergy |

What is included in the product

Delivers a strategic overview of Darden Restaurants’s internal and external business factors, highlighting its brand portfolio strength and market expansion opportunities while acknowledging operational challenges and competitive pressures.

Darden Restaurants' SWOT analysis offers a clear roadmap to address operational inefficiencies and competitive pressures.

Weaknesses

While Darden Restaurants has seen overall sales growth, certain brands, like Olive Garden, have faced challenges with declining same-restaurant sales and guest counts. For instance, in the fiscal third quarter of 2024, Olive Garden's same-restaurant sales were flat, a notable slowdown compared to previous periods.

This trend extends to Darden's fine dining segment as well, which has also reported decreases in traffic. These specific segment weaknesses highlight an ongoing need for strategic adjustments and potential brand revitalization efforts to re-engage customers and boost performance.

Darden Restaurants, like others in the industry, grapples with the volatility of commodity prices and labor expenses. These fluctuations can significantly impact profitability, as seen in the ongoing upward pressure on food costs. For instance, the average cost of beef, a key ingredient for Darden's brands like LongHorn Steakhouse, experienced notable increases throughout 2023 and early 2024, driven by supply chain issues and demand.

While Darden demonstrates adeptness in negotiating with suppliers and implementing cost-control measures, these external market forces remain a constant challenge. The restaurant sector's sensitivity to these variables means that even strong operational execution can be tested by unpredictable shifts in the cost of doing business. This inherent exposure necessitates continuous strategic adjustments to maintain healthy profit margins.

Darden Restaurants, as a full-service dining establishment, faces significant vulnerability to economic downturns. When consumers experience financial strain, discretionary spending, such as dining out, is often among the first areas to be curtailed. This directly impacts Darden's revenue streams, making its performance closely tied to the health of the broader economy.

For instance, during periods of economic contraction, a noticeable decrease in customer traffic and average check sizes can occur. In the fiscal year 2023, Darden reported total sales of $10.49 billion. While this represents growth, the underlying sensitivity to consumer sentiment during economic uncertainty remains a key weakness.

Intense Competition in the Casual Dining Sector

The casual dining sector is a crowded marketplace, presenting Darden Restaurants with significant competitive headwinds. They contend not only with other established full-service chains but also with the burgeoning quick-service segment and the ever-increasing popularity of food delivery platforms. This intense rivalry demands constant vigilance and strategic adjustments to retain customers and market share.

For instance, in 2024, the U.S. restaurant industry saw continued growth in off-premise dining, with delivery and digital orders accounting for a substantial portion of sales for many casual dining operators. Darden itself has invested heavily in its digital capabilities and off-premise operations to combat this trend. However, the sheer number of dining options available to consumers means Darden must consistently differentiate its brands through unique dining experiences, menu innovation, and value propositions.

- Intense Rivalry: Darden competes with a wide array of casual dining, fine dining, and quick-service restaurants.

- Delivery Trend: The rise of third-party delivery services and direct-to-consumer ordering intensifies competition by expanding consumer choices beyond physical locations.

- Innovation Imperative: To maintain its edge, Darden must continually innovate its menus, service models, and guest experiences.

- Market Saturation: In many markets, the casual dining segment is mature and saturated, making it challenging to gain significant new market share.

Limited International Presence

Darden Restaurants' operational footprint is largely concentrated within the United States and Canada, leaving it with a comparatively limited international presence. This geographic concentration means the company is more susceptible to fluctuations in the North American economy and shifts in domestic consumer preferences. For instance, in fiscal year 2023, the vast majority of Darden's over 1,900 restaurants were located in the U.S., highlighting this reliance on its home market.

This heavy dependence on a single region, primarily the U.S., presents a significant weakness by limiting global diversification. Economic downturns, changes in consumer spending habits, or even adverse regulatory shifts within the United States could disproportionately impact Darden's overall financial performance. While international expansion offers growth opportunities and risk mitigation, Darden's current limited reach in this area restricts its ability to offset potential domestic challenges.

- Geographic Concentration: Darden's operations are heavily weighted towards the U.S. and Canada, with fewer than 10% of its locations outside these two countries as of early 2024.

- Vulnerability to Regional Shocks: Reliance on the U.S. market makes Darden more exposed to domestic economic slowdowns or changes in American consumer behavior.

- Limited Diversification: The lack of a robust international presence hinders Darden's ability to spread risk across different economic environments and consumer bases.

Darden's reliance on a few core brands, particularly Olive Garden, exposes it to risks if those brands falter. While Olive Garden is a powerhouse, its recent flat same-restaurant sales in Q3 fiscal 2024 indicate potential saturation or evolving consumer preferences that need careful management. This concentration means a slowdown in a key brand can significantly impact overall company performance.

The restaurant industry is highly sensitive to economic downturns, and Darden is no exception. During periods of economic contraction, consumers tend to reduce discretionary spending, directly affecting dining-out habits. Darden's $10.49 billion in total sales for fiscal year 2023, while strong, still reflects this inherent vulnerability to consumer confidence and disposable income levels.

Intense competition from various dining segments, including fast-casual and delivery-focused options, presents a constant challenge. The increasing preference for off-premise dining, a trend that saw significant growth in 2024, requires Darden to continually innovate its digital and delivery capabilities to remain competitive against a wider array of choices.

Darden's significant concentration in the U.S. and Canada makes it susceptible to regional economic shifts and changing consumer tastes. With over 1,900 restaurants primarily in the U.S. as of fiscal 2023, the company lacks the geographic diversification that could buffer against localized economic slowdowns or regulatory changes.

Preview Before You Purchase

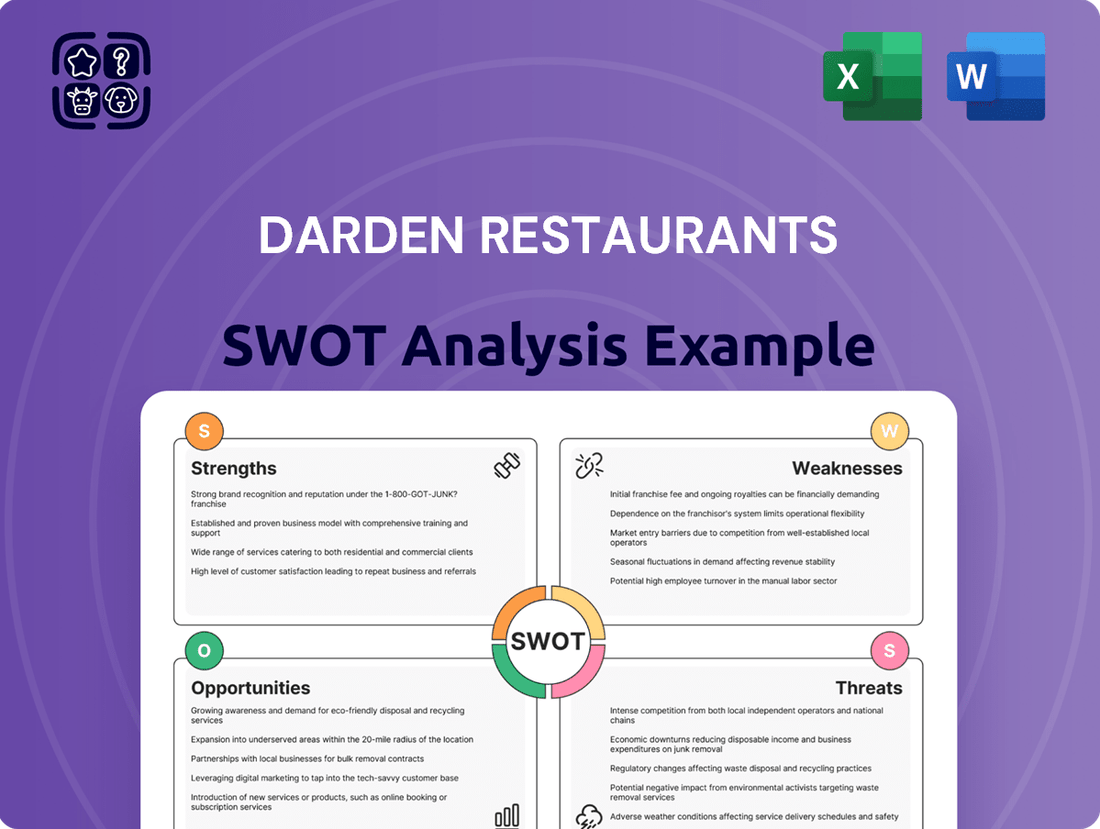

Darden Restaurants SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Darden Restaurants' Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Darden's strategic positioning.

Opportunities

Darden Restaurants is actively pursuing market expansion through new restaurant openings, a key growth driver. The company has a clear strategy to increase its physical footprint, with a particular focus on high-performing brands such as LongHorn Steakhouse and Olive Garden. This expansion is designed to capture new customer bases and enhance market presence.

For fiscal year 2024, Darden projected approximately 50 new restaurant openings across its portfolio. This continued investment in physical expansion underscores their commitment to reaching more consumers and solidifying their market leadership in the casual dining sector.

Darden Restaurants has a proven track record of successful strategic acquisitions, notably the 2023 purchase of Ruth's Chris Steak House for $715 million. This move, along with the earlier acquisition of Chuy's Holdings, significantly diversifies their brand portfolio, tapping into different dining segments and customer bases. These acquisitions are key to unlocking new revenue streams and strengthening their overall market presence.

Darden Restaurants is significantly boosting its off-premise business by investing heavily in technology and digital platforms. This includes strategic alliances with popular delivery services such as Uber Eats, which is crucial for meeting the growing consumer demand for convenience.

This digital push is already showing results, with off-premise sales representing a substantial portion of Darden's revenue. For instance, in fiscal year 2024, digital sales, including online ordering and delivery, accounted for over 40% of total sales for the company's casual dining brands, demonstrating a clear shift in consumer behavior.

By enhancing its digital ordering systems and delivery partnerships, Darden is well-positioned to capture a larger share of the off-premise market. This strategic focus not only addresses current consumer trends but also creates new avenues for sustained growth and revenue diversification in the coming years.

Catering to Evolving Consumer Preferences

Darden Restaurants has a significant opportunity to align its menu and offerings with shifting consumer demands, especially with the growing interest in healthier choices and budget-friendly meals, a trend amplified by inflationary pressures. The company's strategic pricing, deliberately kept below inflation, serves to underscore its value proposition and encourage consistent customer traffic.

In the fiscal year 2024, Darden demonstrated this adaptability. For instance, during periods of economic uncertainty, their focus on value resonated with diners, contributing to a robust performance. This strategy helps them capture market share by appealing to a broader customer base seeking affordability without compromising on quality.

- Menu Innovation: Developing and promoting healthier, plant-based, or lighter fare options to meet growing consumer health consciousness.

- Value Perception: Continuing to offer competitive pricing and promotional deals that highlight affordability, especially in the face of rising costs for consumers.

- Data-Driven Insights: Leveraging customer data to identify emerging trends in taste and dietary preferences, allowing for proactive menu adjustments.

- Operational Efficiency: Streamlining operations to maintain cost controls, which enables the company to pass on value to customers and protect margins.

Enhancing Sustainability Initiatives

Darden Restaurants is actively engaged in sustainability, focusing on responsible sourcing, energy and water conservation, and waste reduction. For instance, their commitment to responsible sourcing means that by the end of fiscal year 2023, 100% of their wild-caught seafood was verified by a third-party sustainability standard. This dedication extends to operational efficiencies, with many of their locations seeking or achieving LEED certification, demonstrating a tangible commitment to environmental stewardship.

Expanding these sustainability efforts and providing transparent reporting offers significant opportunities. This can bolster Darden's brand image, appealing to the growing segment of consumers who prioritize eco-friendly practices. Furthermore, investments in energy and water conservation, such as their ongoing initiatives to reduce water usage by 15% across their portfolio by 2025, can translate into substantial cost savings and improved operational efficiencies, positively impacting the bottom line.

- Responsible Sourcing: Darden aims for 100% of its seafood to be sourced from fisheries that meet third-party sustainability standards.

- Energy & Water Conservation: The company is working towards a 15% reduction in water usage across its operations by fiscal year 2025.

- Waste Management: Initiatives include food donation programs and increased recycling efforts, aiming to divert a significant portion of waste from landfills.

- LEED Certification: Several Darden restaurants have achieved or are pursuing Leadership in Energy and Environmental Design (LEED) certification for their buildings.

Darden Restaurants is strategically expanding its physical footprint, projecting around 50 new restaurant openings in fiscal year 2024, with a focus on strong brands like LongHorn Steakhouse and Olive Garden. This aggressive expansion aims to capture new customer bases and solidify market leadership.

The company is also enhancing its off-premise business, with digital sales accounting for over 40% of casual dining revenue in fiscal year 2024, driven by investments in technology and delivery partnerships like Uber Eats. This focus capitalizes on the growing consumer demand for convenience.

Darden is adept at aligning its offerings with consumer trends, such as the demand for healthier and budget-friendly options, as evidenced by its value-driven pricing strategies which helped maintain customer traffic during economic uncertainty in fiscal year 2024.

Furthermore, Darden's commitment to sustainability presents an opportunity to appeal to eco-conscious consumers and achieve cost savings. By fiscal year 2023, 100% of its wild-caught seafood met third-party sustainability standards, and the company aims for a 15% reduction in water usage by fiscal year 2025.

| Opportunity Area | Key Initiatives | Fiscal Year 2024/2025 Data/Projections |

|---|---|---|

| Market Expansion | New restaurant openings | Projected ~50 new openings |

| Digital & Off-Premise Growth | Investment in technology, delivery partnerships | Digital sales >40% of casual dining revenue |

| Menu Adaptation & Value | Focus on healthier options, competitive pricing | Value-driven pricing to maintain traffic |

| Sustainability | Responsible sourcing, resource conservation | 15% water usage reduction target by FY2025; 100% sustainable seafood by FY2023 |

Threats

The restaurant sector is incredibly crowded, with many businesses fighting for the same customers. This intense competition means Darden constantly faces pressure from rivals trying to capture market share.

Competitors often engage in aggressive price wars and heavy discounting to attract diners. If Darden sticks to its strategy of avoiding deep discounts, it could see its market share and profitability squeezed, especially if consumers are drawn to lower-priced alternatives.

For instance, during the 2024 holiday season, many casual dining chains offered significant discounts, a trend that could continue into 2025, directly challenging Darden's premium positioning.

Ongoing macroeconomic uncertainties, particularly persistent inflation, pose a significant threat to Darden Restaurants. For instance, the Consumer Price Index (CPI) for food away from home saw a 5.1% increase year-over-year as of April 2024, directly impacting Darden's cost of goods sold and potentially reducing consumer discretionary spending on dining out.

While Darden has demonstrated an ability to navigate these challenges, sustained high inflation in key areas like food and labor could continue to pressure profit margins. This could lead to reduced consumer traffic, especially from more price-sensitive customer segments, as the cost of dining out remains elevated.

Shifting consumer dining habits present a significant threat. A continued move towards home-cooked meals, meal kits, or even fast-casual dining could reduce traffic at Darden's full-service establishments. For instance, the meal kit market, valued at over $10 billion globally in 2023, continues to grow, offering convenience that competes with traditional sit-down dining.

Labor Availability and Wage Increases

Darden Restaurants, like many in the hospitality sector, faces significant challenges with labor availability and rising wages. The restaurant business is inherently people-powered, making Darden particularly susceptible to difficulties in finding and retaining staff, as well as the persistent upward pressure on compensation. For instance, in late 2023 and early 2024, the U.S. Bureau of Labor Statistics reported continued growth in average hourly earnings for leisure and hospitality workers, a trend that directly impacts Darden's operating costs.

These increasing labor expenses pose a direct threat to Darden's bottom line. If the company cannot offset higher wage bills through improved operational efficiencies, such as technology investments or streamlined workflows, or by adjusting menu prices, its profitability will inevitably suffer. This delicate balance requires constant strategic management to maintain healthy margins in a competitive market.

- Labor Shortages: The industry-wide struggle to attract and retain employees remains a critical concern for Darden.

- Wage Inflation: Rising minimum wages and competitive market pressures continue to drive up labor costs.

- Profitability Impact: Unmanaged increases in labor expenses can significantly erode Darden's operating margins.

- Operational Efficiency Needs: Darden must continually seek ways to enhance productivity to mitigate the impact of higher labor costs.

Supply Chain Disruptions and Food Safety Risks

Supply chain disruptions remain a significant threat for Darden Restaurants. For example, in early 2024, weather events impacted the availability and cost of key ingredients like seafood and produce, directly affecting menu pricing and availability. These disruptions can lead to increased operational costs and impact customer satisfaction if menu items are unavailable.

Food safety concerns also present a considerable risk. A single foodborne illness outbreak linked to one of their establishments could severely damage Darden's reputation, which is built on trust and quality. In 2023, the restaurant industry as a whole saw a slight uptick in reported food safety incidents, underscoring the need for Darden's rigorous quality control measures.

- Supply chain volatility: Adverse weather and geopolitical events in 2024 continued to strain the availability and pricing of essential food commodities.

- Food safety incidents: The potential for foodborne illnesses necessitates constant vigilance and robust preventative protocols across all Darden locations.

- Reputational damage: Operational failures in supply chain or food safety can lead to significant negative publicity and loss of consumer confidence.

Darden faces stiff competition from a crowded restaurant market, with rivals frequently employing aggressive pricing strategies. Persistent inflation, evidenced by a 5.1% year-over-year increase in food away from home costs as of April 2024, directly impacts Darden's cost of goods sold and consumer spending power. Shifting consumer preferences towards home-cooked meals or meal kits, a market valued over $10 billion globally in 2023, also pose a threat to Darden's full-service dining model.

Labor shortages and rising wages continue to pressure Darden, with average hourly earnings in leisure and hospitality growing in late 2023 and early 2024. Supply chain disruptions, like those affecting seafood and produce availability in early 2024, increase operational costs and can impact menu availability. Furthermore, food safety remains a critical concern, as even a single outbreak can severely damage Darden's reputation, with industry-wide incidents showing a slight increase in 2023.

| Threat | Description | Impact | Data Point |

|---|---|---|---|

| Intense Competition | Numerous restaurants vie for customer attention, often through discounts. | Market share and profitability pressure. | Competitors offered significant discounts during the 2024 holiday season. |

| Inflationary Pressures | Rising costs for food and labor squeeze margins. | Reduced consumer spending, lower profit margins. | CPI for food away from home increased 5.1% YoY as of April 2024. |

| Changing Consumer Habits | Shift towards home cooking, meal kits, or fast-casual. | Reduced traffic at full-service restaurants. | Meal kit market valued over $10 billion globally in 2023. |

| Labor Market Challenges | Difficulty in staffing and increasing wage demands. | Higher operating costs, potential impact on service quality. | Average hourly earnings in leisure/hospitality grew late 2023-early 2024. |

| Supply Chain & Food Safety | Disruptions to ingredient availability and potential health incidents. | Increased costs, reputational damage, menu item unavailability. | Weather events impacted seafood/produce in early 2024; slight uptick in industry food safety incidents in 2023. |

SWOT Analysis Data Sources

This Darden Restaurants SWOT analysis is built upon a foundation of credible data, including their official financial filings, comprehensive market research reports, and expert commentary from industry analysts.