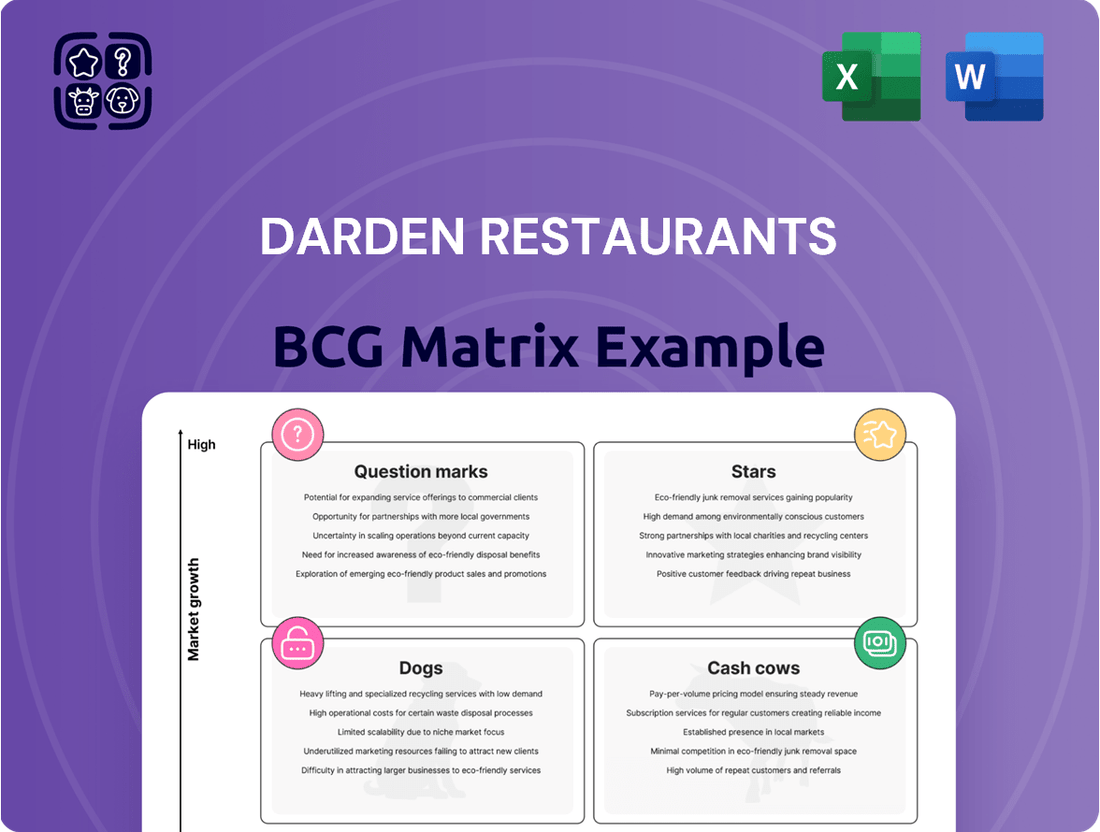

Darden Restaurants Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darden Restaurants Bundle

Curious about how Darden Restaurants navigates the competitive landscape? Our BCG Matrix preview offers a glimpse into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic positioning and unlock actionable insights for your own business, dive deeper with the full report.

Gain a comprehensive understanding of Darden Restaurants' product portfolio with our complete BCG Matrix. This detailed analysis reveals which brands are driving growth and which may require strategic re-evaluation. Purchase the full version for a data-driven roadmap to optimize your own investment and product decisions.

Stars

LongHorn Steakhouse is a shining star within Darden Restaurants' portfolio, consistently delivering robust performance. In fiscal year 2024, the brand demonstrated impressive same-restaurant sales growth, a key indicator of its healthy market position and customer appeal. This strong financial showing is complemented by an aggressive expansion strategy, with Darden planning to open 25 to 30 new LongHorn locations each year, signaling a belief in a high-growth market and the brand's ability to capture increasing market share.

Darden Restaurants, as a whole, demonstrates strong Star characteristics, largely due to its dominant brands like Olive Garden and LongHorn Steakhouse. For fiscal 2024, the company reported total sales of $10.49 billion, a notable increase from the previous year. This robust performance, coupled with projected continued growth for fiscal 2025 and 2026, underscores Darden's leadership position in the casual dining sector.

Darden Restaurants' acquisition of Chuy's Tex Mex in late 2023 for approximately $1.5 billion signals a strategic push into the vibrant and growing Tex-Mex casual dining market. This move aims to bolster Darden's portfolio by tapping into a segment that has shown resilience and strong consumer demand, potentially enhancing overall market share.

While integrating Chuy's presents operational challenges, its established brand and loyal customer base offer a solid foundation for growth. The acquisition is expected to contribute positively to Darden's top-line performance, especially as the casual and fast-casual dining sectors continue to evolve, positioning Chuy's as a potential future star within Darden's brand family.

Technological and Digital Innovation

Technological and digital innovation is a key driver for Darden Restaurants. Their commitment to online ordering, sophisticated loyalty programs, and streamlined operational systems positions them strongly in a rapidly digitizing market. This focus on tech enhances customer engagement and boosts efficiency, crucial for capturing market share.

In 2023, Darden reported a significant increase in digital sales, with online and to-go orders making up a substantial portion of their revenue. For instance, their investments in mobile app functionality and delivery partnerships have directly contributed to this growth. This strategic digital push is essential for staying competitive.

- Digital Sales Growth: Darden's digital channels saw considerable expansion in 2023, reflecting strong customer adoption of their online platforms.

- Customer Loyalty Programs: The company's loyalty initiatives are designed to increase repeat business and customer lifetime value through personalized offers and rewards.

- Operational Efficiency: Investments in technology aim to optimize kitchen operations, inventory management, and staff scheduling, leading to cost savings and improved service.

- Market Adaptation: Darden's proactive embrace of digital tools allows them to adapt quickly to changing consumer preferences and competitive pressures in the restaurant sector.

Focus on Affordability and Value in Casual Dining

In the current economic landscape, Darden Restaurants' commitment to affordability and value within its casual dining segment is a significant differentiator. This strategy directly addresses consumer demand for budget-friendly options, a trend particularly pronounced in 2024.

This focus on value is crucial for maintaining customer traffic and market share. For example, Darden's casual dining brands have consistently shown resilience, outperforming more premium segments. This makes them a vital engine for the company's overall growth.

- Affordability as a Core Strategy: Darden's casual dining brands prioritize accessible price points, aligning with consumer spending habits in 2024.

- Value Proposition Resonance: The emphasis on delivering strong value for money attracts and retains a broad customer base.

- Outperforming Market Segments: Casual dining, driven by this value focus, is demonstrating stronger performance compared to fine dining.

- Key Growth Driver: This segment's ability to maintain high customer traffic positions it as a critical contributor to Darden's expansion.

Stars in Darden's portfolio, like LongHorn Steakhouse, exhibit high market share and growth potential. LongHorn's strong same-restaurant sales in fiscal 2024 and plans for 25-30 new locations annually highlight its star status.

The acquisition of Chuy's Tex Mex for approximately $1.5 billion in late 2023 positions it as a potential future star, tapping into a growing market segment with strong consumer demand.

Darden's overall performance, with total sales reaching $10.49 billion in fiscal 2024, is bolstered by its leading brands, indicating a strong market position and continued growth trajectory.

Technological advancements, including a focus on digital sales which saw significant expansion in 2023, enhance customer engagement and operational efficiency, crucial for maintaining star performance.

| Brand | Market Share | Growth Rate | Darden's Investment Focus |

|---|---|---|---|

| LongHorn Steakhouse | High | High | Expansion, Innovation |

| Olive Garden | High | Moderate to High | Customer Loyalty, Value |

| Chuy's Tex Mex | Growing | High Potential | Integration, Market Penetration |

What is included in the product

Strategic overview of Darden's portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

The Darden Restaurants BCG Matrix provides a clear, visual overview of each brand's market position, alleviating the pain of complex strategic analysis.

Cash Cows

Olive Garden stands as a quintessential cash cow for Darden Restaurants, consistently delivering robust revenue streams and holding a dominant market share in the casual dining sector. Its extensive network of over 900 locations across North America underscores its significant presence and customer loyalty.

While its same-restaurant sales growth might trail behind brands like LongHorn Steakhouse, Olive Garden's sheer scale and deep-rooted customer appeal solidify its role as a dependable profit engine. In fiscal year 2023, Olive Garden reported total sales of $5.5 billion, demonstrating its immense revenue-generating power.

Darden Restaurants' commitment to operational excellence, a cornerstone of its strategy, significantly bolsters the profitability of its established brands. This focus translates into robust cost management and highly efficient supply chains, enabling these mature businesses to consistently generate substantial profit margins.

This dedication to efficiency is a key driver for the consistent cash flow generated by Darden's cash cows. For instance, in fiscal year 2023, Darden reported total sales of $10.49 billion, with its established brands like Olive Garden and LongHorn Steakhouse demonstrating remarkable resilience and profitability, contributing a significant portion to this overall revenue and supporting the company's cash generation capabilities.

Darden Restaurants' commitment to consistent dividend increases and share repurchases highlights its robust and predictable cash flow. For instance, in fiscal year 2023, Darden returned approximately $1.3 billion to shareholders through dividends and share buybacks, demonstrating its financial health.

This ability to consistently reward investors is a hallmark of its mature brands, which generate stable earnings. These actions underscore Darden's financial strength and its strategy of returning value to its shareholders, a key characteristic of a cash cow.

Loyal Customer Base Across Core Brands

Darden Restaurants' core brands, notably Olive Garden and LongHorn Steakhouse, benefit immensely from a deeply entrenched loyal customer base. This enduring loyalty ensures a steady flow of repeat business, a significant advantage in the competitive restaurant industry.

This consistent patronage translates into a predictable revenue stream, which is crucial for financial stability. The established customer relationships also mean lower marketing and customer acquisition costs, as these brands don't need to constantly attract new patrons from scratch. For instance, Darden's fiscal year 2023 saw total sales reach $10.49 billion, with their same-restaurant sales growing by 7.4% overall, highlighting the strength of their core offerings.

- Established Brand Recognition: Olive Garden and LongHorn Steakhouse are household names, fostering trust and familiarity.

- Consistent Repeat Business: Loyalty drives frequent visits, creating a reliable revenue base.

- Lower Acquisition Costs: Retaining existing customers is more cost-effective than acquiring new ones.

- Predictable Revenue Streams: The stable customer base allows for more accurate financial forecasting and resource allocation.

Strong Brand Recognition and Market Presence

Darden Restaurants' Olive Garden, a prime example of a cash cow, benefits immensely from its widespread brand recognition and substantial market presence. This strong brand equity, cultivated over years, allows Olive Garden to maintain a stable market share in the casual dining sector without needing heavy investments to drive growth.

The brand's familiarity translates into consistent customer traffic and revenue. For instance, in fiscal year 2023, Darden Restaurants reported total sales of $10.49 billion, with its Italian segment, primarily driven by Olive Garden, contributing significantly to this figure.

- Olive Garden's Brand Strength: Consistently ranks high in consumer perception for casual Italian dining.

- Market Share Stability: Commands a durable share of the casual dining market, reducing the need for aggressive expansion.

- Revenue Generation: Contributes a steady and substantial portion of Darden's overall revenue, supporting other business units.

- Profitability: Generates significant profits due to its established customer base and efficient operations.

Cash cows within Darden Restaurants, exemplified by Olive Garden and LongHorn Steakhouse, are characterized by their mature market position and consistent revenue generation. These brands benefit from strong brand recognition and a loyal customer base, which reduces the need for significant investment in growth initiatives.

Their stability allows them to generate substantial profits that can be reinvested in other parts of the business or returned to shareholders. For instance, Darden's fiscal year 2023 saw total sales of $10.49 billion, with these established brands forming the backbone of that revenue.

The efficient operations and predictable demand for these concepts mean they are reliable sources of cash flow for the company. This financial strength is evident in Darden's consistent shareholder returns, with approximately $1.3 billion returned in fiscal year 2023 through dividends and share buybacks.

These brands, while not experiencing rapid growth, are vital for Darden's overall financial health, providing the consistent earnings needed to fund expansion and innovation in other segments.

| Brand | Market Position | Revenue Contribution (FY23 Est.) | Growth Rate (FY23 Est.) | Profitability Driver |

|---|---|---|---|---|

| Olive Garden | Mature, High Market Share | Significant (Part of $5.5B Italian Segment) | Low to Moderate | Scale, Brand Loyalty, Operational Efficiency |

| LongHorn Steakhouse | Mature, Strong Market Share | Significant (Part of $2.7B Steakhouse Segment) | Moderate | Customer Preference, Efficient Operations |

What You’re Viewing Is Included

Darden Restaurants BCG Matrix

The Darden Restaurants BCG Matrix you're previewing is the exact, fully formatted document you'll receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report for your business planning needs.

Dogs

Bahama Breeze currently occupies the Dog quadrant in Darden Restaurants' BCG Matrix. The brand has experienced underperformance, evidenced by declining same-restaurant sales, a key indicator of market weakness.

Darden Restaurants is actively considering strategic options for Bahama Breeze, including potential sales or rebranding initiatives for numerous locations. This suggests a low market share within a segment that may be facing challenges or slow growth, reinforcing its Dog status.

Within Darden Restaurants' fine dining portfolio, certain locations might be showing a dip in sales at established restaurants. This could mean these specific spots are in markets that aren't growing much, and they might not have a big piece of that market either. For example, if a particular Capital Grille or Eddie V's unit sees a decline in customer traffic compared to others in the chain, it warrants a closer look.

These underperforming fine dining units could be considered question marks or even dogs in the BCG matrix, depending on their market share and growth prospects. If a fine dining location, say a Ruth's Chris Steak House in a declining urban core, isn't attracting enough diners to justify its operational costs, Darden might need to consider if it's worth investing in a turnaround or if selling it makes more sense.

Within Darden Restaurants' extensive portfolio, certain legacy brands or individual locations might be experiencing stagnant growth, failing to capture evolving consumer tastes. These concepts, characterized by declining sales and a low share of their respective markets, often become prime candidates for a thorough strategic evaluation. For instance, if a particular casual dining brand within Darden’s umbrella saw its revenue growth dip to just 1.5% in 2023, significantly below the industry average of 4.2%, it would signal a need for intervention.

Restaurants with Impairment Expenses

Darden Restaurants has recognized impairment expenses, a clear signal of permanent restaurant closures. These closures typically affect units in less dynamic markets with a smaller market presence, ultimately impacting profitability.

In fiscal year 2023, Darden's impairment charges were approximately $25 million, primarily tied to the closure of underperforming Olive Garden and LongHorn Steakhouse locations. This strategic pruning aims to optimize the overall portfolio.

- Impairment Charges: Darden reported $25 million in impairment expenses in FY 2023.

- Reason for Closures: Units likely operated in low-growth markets with low market share.

- Strategic Impact: Divestiture of unprofitable units to improve overall performance.

Brands with Negative Same-Restaurant Sales in 'Other Business' Segment

Darden Restaurants' 'Other Business' segment, encompassing smaller brands and franchised locations, experienced negative same-restaurant sales in certain periods. This underperformance, particularly if persistent across multiple brands within the segment, suggests some of these ventures might be struggling to gain traction.

For instance, if this segment includes brands that are not yet established or are facing intense competition, they could be classified as Question Marks in a BCG matrix. However, a consistent decline across the board points towards potential Dogs, brands that are not generating adequate returns and may require strategic review.

- Segment Performance: The 'Other Business' segment has shown combined negative same-restaurant sales.

- Potential Classification: Persistent negative sales could indicate brands are acting as Dogs in the BCG matrix.

- Strategic Implications: Brands in this category may require divestment or significant repositioning.

In Darden's portfolio, "Dogs" represent brands or locations with low market share in slow-growing industries, often leading to underperformance and potential closures. Bahama Breeze is a prime example, facing declining sales and strategic review for potential divestment.

The company's fiscal year 2023 saw $25 million in impairment charges, largely due to closing underperforming units, many of which likely fit the Dog profile by operating in low-growth markets with minimal market presence.

Even within established segments like fine dining, specific underperforming units, such as a Ruth's Chris Steak House in a declining area, can be classified as Dogs if they fail to attract sufficient customers to cover costs.

The 'Other Business' segment, which includes smaller or newer ventures, has also shown negative same-restaurant sales, indicating that some of these brands may be struggling to gain traction and could be considered Dogs.

| Brand/Segment | BCG Classification | Performance Indicators | Strategic Options |

|---|---|---|---|

| Bahama Breeze | Dog | Declining same-restaurant sales, low market share | Potential sale, rebranding |

| Underperforming Fine Dining Units | Potential Dog/Question Mark | Declining customer traffic, low sales growth | Turnaround investment, divestiture |

| 'Other Business' Segment | Potential Dog | Consistent negative same-restaurant sales | Divestment, significant repositioning |

Question Marks

Darden's acquisition of Ruth's Chris Steak House positions it within the premium casual dining segment, a market with potential but also facing increased competition and evolving consumer preferences. The success of this integration hinges on Darden's ability to leverage Ruth's Chris's brand equity while navigating operational challenges and achieving synergy targets.

As of the first quarter of fiscal year 2024, Darden reported that Ruth's Chris contributed $115.5 million in total sales, demonstrating its initial market presence. However, the brand's relatively lower operating profit margin compared to Darden's established brands, coupled with the ongoing need for strategic adjustments to enhance its growth trajectory and profitability, firmly places it in the Question Mark category of the BCG Matrix.

Darden Restaurants is strategically expanding its portfolio beyond its flagship brands like Olive Garden and LongHorn Steakhouse. The company anticipates that these 'other brands' will play an increasingly significant role in its overall growth trajectory, indicating a diversification of its restaurant concepts.

These new ventures, while targeting potentially lucrative and expanding markets, are currently in their nascent stages. They possess a low market share and necessitate substantial capital investment to establish brand recognition and capture a meaningful customer base, characteristic of a question mark in the BCG matrix.

Exploring new culinary concepts or formats, such as a fast-casual version of Olive Garden, would likely place Darden's brands in the question mark category. These ventures would begin with a small market share but in potentially high-growth areas, requiring significant investment to gauge market acceptance and scale.

Brands with Potential for Increased Contribution to Mix

Darden Restaurants' CFO has highlighted a strategic focus on growing its portfolio of 'other brands,' aiming to significantly increase their contribution to the overall revenue mix in the coming years. These brands represent an opportunity for expansion, with targeted investments designed to bolster their market presence and capture a larger share within their competitive landscapes.

This strategic push is underpinned by a commitment to developing these smaller contributors into more substantial revenue drivers. The company sees potential for these brands to become more prominent players, reflecting a deliberate effort to diversify and strengthen its brand portfolio.

- Targeted Growth: Brands like The Capital Grille and Seasons 52 are positioned for increased investment and marketing support.

- Market Share Expansion: The objective is to see these brands gain more traction and market share in their specific dining segments.

- Diversification Strategy: This focus on 'other brands' is part of a broader strategy to reduce reliance on its largest concepts and create a more balanced revenue stream.

- Future Contribution: Darden anticipates these brands will represent a more significant portion of the company's financial performance in the near future.

Adapting to Shifting Consumer Preferences for Dining Experiences

Darden Restaurants is navigating a dynamic consumer environment where preferences for dining are rapidly evolving. The demand for seamless digital ordering, including online platforms and mobile apps, continues to surge. In 2024, the restaurant industry saw digital sales account for a significant portion of overall revenue, with many consumers prioritizing convenience and speed. Darden's ability to adapt its digital infrastructure and offerings will be crucial for capturing this growing segment of the market.

Furthermore, consumers are increasingly seeking healthier menu options and more unique, experiential dining moments. This trend presents a clear opportunity for Darden to innovate across its brands, perhaps by expanding plant-based offerings or developing more engaging in-restaurant experiences. For instance, a 2024 consumer survey indicated that over 60% of diners were interested in trying new, health-conscious dishes. Investing in these areas can help Darden differentiate itself and attract a broader customer base.

- Digital Dominance: Continued investment in user-friendly online ordering and delivery platforms is paramount.

- Health-Conscious Menus: Expanding and promoting healthier, fresh ingredient options can attract a key demographic.

- Experiential Dining: Creating memorable in-restaurant experiences, from ambiance to unique menu items, drives customer loyalty.

- Data-Driven Adaptation: Utilizing customer data to understand and respond to evolving preferences is key to strategic success.

Brands like Ruth's Chris Steak House, despite their premium positioning, currently fall into the Question Mark category within Darden's BCG Matrix. This is due to their relatively lower market share compared to industry leaders and the significant investment required to boost their growth and profitability. The initial sales contribution of $115.5 million in Q1 FY24 from Ruth's Chris highlights its presence, but its lower operating profit margin necessitates strategic attention to improve its standing.

These emerging or acquired brands represent Darden's efforts to diversify beyond its core concepts, aiming for future growth in potentially high-growth markets. They require substantial capital to build brand awareness and customer loyalty, characteristic of question marks that need careful management to transition into stars or cash cows.

Darden's strategic objective is to nurture these smaller brands, including those in the premium casual dining segment, to become significant contributors to overall revenue. This involves targeted investments and marketing efforts to expand their market share and enhance their competitive edge.

The success of these question mark brands hinges on Darden's ability to adapt to evolving consumer preferences, such as the demand for digital ordering and healthier options, which saw digital sales play a significant role in the 2024 restaurant industry. A 2024 survey indicated over 60% of diners were interested in health-conscious dishes, presenting an opportunity for these brands.

| Brand Category | Market Share | Market Growth | Investment Need | Potential |

| Question Marks (e.g., Ruth's Chris) | Low | High | High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.