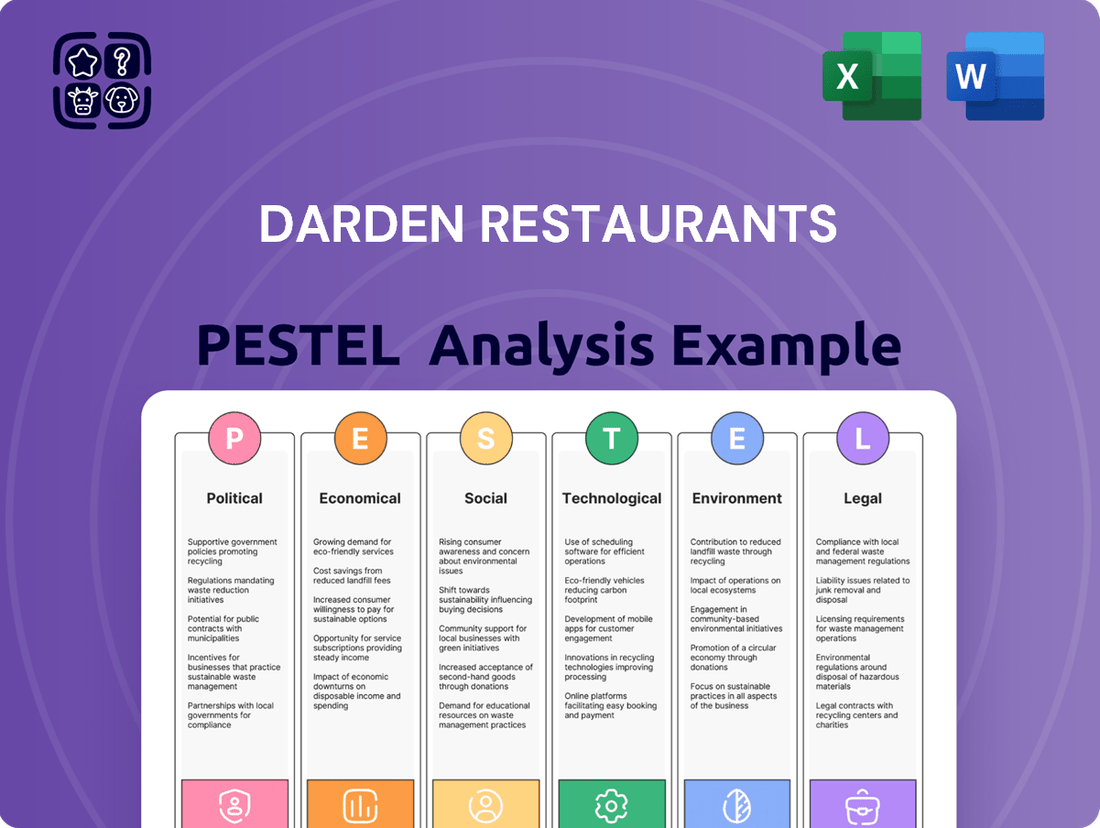

Darden Restaurants PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darden Restaurants Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Darden Restaurants's future. Our comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and identify strategic opportunities. Don't get left behind – download the full report now and gain a competitive edge.

Political factors

Darden Restaurants navigates a complex web of government regulations spanning food safety, labor standards, and general business operations at federal, state, and local levels. Shifts in these policies, like adjustments to minimum wage laws or evolving health and safety mandates, can significantly influence operational expenses and strategic approaches. For example, in the fourth quarter of 2024, Darden actively participated in lobbying concerning workforce issues, minimum wage proposals, and tax policies, underscoring the direct impact of these governmental actions on their business.

Darden Restaurants actively participates in the political arena to shape policies affecting its operations. In the fourth quarter of 2024, the company reported $90,000 in lobbying expenditures, primarily concerning workforce and minimum wage legislation.

The company also contributes to political campaigns and organizations across different governmental levels. Darden emphasizes transparency in its political engagement, providing disclosures on these contributions.

International trade policies and tariffs directly influence Darden Restaurants' operational costs, especially for ingredients and supplies sourced globally. For instance, changes in import duties on key food items or beverages could significantly alter their cost of goods sold. In 2024, ongoing trade negotiations and potential adjustments to existing agreements, such as those involving agricultural imports, represent a persistent risk that could impact profit margins if not effectively managed through strategic sourcing or price adjustments.

Political Stability and Geopolitical Events

Political stability and geopolitical events significantly impact consumer sentiment, which in turn affects discretionary spending on dining out. For Darden Restaurants, operating primarily in the U.S. and Canada, major global conflicts or political shifts can still create economic uncertainty. For instance, disruptions in global supply chains due to geopolitical tensions can lead to increased food costs, directly impacting Darden's operating margins.

The U.S. political landscape also plays a crucial role through regulations and government policies. Changes in tax laws, minimum wage requirements, and food safety regulations can directly influence Darden's profitability and operational strategies. For example, potential increases in the federal minimum wage could raise labor costs for Darden's numerous hourly employees.

- Geopolitical instability: Events like the ongoing conflicts in Eastern Europe (as of mid-2025) can contribute to inflation and supply chain disruptions, affecting ingredient costs for Darden.

- Domestic policy shifts: Potential changes in U.S. federal or state labor laws, such as adjustments to overtime rules or benefit mandates, could impact Darden's significant workforce expenses.

- Consumer confidence indicators: National surveys on consumer confidence, often influenced by political stability and economic outlook, directly correlate with restaurant traffic. A dip in confidence can lead to reduced dining-out frequency.

Public Policy Changes on Health and Nutrition

Evolving public policy concerning health and nutrition directly impacts Darden Restaurants. For instance, the push for clearer nutritional information, like calorie labeling on menus, which became a significant focus in the late 2010s and continues to be refined, necessitates menu redesigns and staff training. Darden must remain agile, adapting its offerings and operational procedures to comply with these regulations and align with consumer demands for healthier choices, which are increasingly shaped by government initiatives.

These policy shifts can influence ingredient sourcing and preparation methods. For example, potential future regulations on sugar content or saturated fats, building on existing trends, might require Darden to reformulate popular dishes or introduce new, health-conscious options. Staying ahead of these legislative trends is crucial for maintaining brand reputation and market share in a competitive landscape where consumer health awareness is paramount.

- Menu Adaptation: Darden may need to adjust menu item descriptions and nutritional information to meet evolving labeling requirements.

- Ingredient Sourcing: Policies affecting specific ingredients could necessitate changes in Darden's supply chain and procurement strategies.

- Consumer Preference Alignment: Public health campaigns and policies can steer consumer choices, pushing Darden to offer more perceived healthy alternatives.

Governmental actions significantly shape Darden's operational landscape, from labor costs to sourcing. In Q4 2024, Darden spent $90,000 on lobbying, focusing on minimum wage and workforce policies, demonstrating a direct engagement with legislative processes. These efforts highlight the company's proactive approach to mitigating the financial impact of potential policy changes.

International trade policies and tariffs can directly affect Darden's cost of goods sold, particularly for globally sourced ingredients. For instance, ongoing trade discussions in 2024 concerning agricultural imports pose a risk that could necessitate strategic sourcing adjustments or price increases to maintain profit margins.

Political stability influences consumer confidence and discretionary spending on dining out. Geopolitical events, such as ongoing conflicts as of mid-2025, can lead to inflation and supply chain disruptions, increasing ingredient costs for Darden and impacting operating margins.

Evolving public health policies, such as menu labeling requirements, necessitate operational adaptations. Darden must remain agile in reformulating dishes and updating nutritional information to comply with regulations and align with consumer demand for healthier options.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Darden Restaurants, providing a comprehensive overview of the external landscape.

A concise PESTLE analysis for Darden Restaurants that highlights key external factors, serving as a readily available tool to inform strategic decisions and mitigate potential risks during fast-paced planning sessions.

Economic factors

Darden Restaurants' financial success is intrinsically linked to consumer spending habits and the amount of disposable income available. Even with ongoing inflation, consumers have demonstrated a continued appetite for dining out, which directly benefits Darden's various restaurant concepts.

For instance, in the first quarter of fiscal year 2025, Darden reported total sales of $2.7 billion, a 9.4% increase year-over-year, reflecting robust consumer demand. This resilience in spending highlights the sector's ability to capture consumer discretionary budgets.

The company's strategic advantage lies in its broad portfolio, encompassing brands like Olive Garden, LongHorn Steakhouse, and The Capital Grille. This diversity allows Darden to appeal to a wide range of consumers, from those seeking value-oriented casual dining to patrons looking for more upscale experiences, effectively navigating different economic capacities.

The restaurant sector, including Darden Restaurants, is grappling with escalating food and labor expenses. These rising costs directly impact profitability and can necessitate price adjustments for consumers.

Darden has proactively addressed these inflationary headwinds through strategic cost management initiatives and menu engineering. These efforts aim to optimize operational efficiency and maintain competitive pricing.

Looking ahead, Darden's fiscal 2025 projections indicate an anticipated total inflation rate of around 3.0%. This forecast highlights the ongoing economic challenge of managing price increases across the business.

Changes in interest rates directly impact Darden Restaurants' cost of capital. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, Darden's expenses for borrowing money for new restaurant openings or renovations will rise. This can put pressure on profit margins.

Access to affordable capital is vital for Darden's ambitious growth strategy. The company aims to open 45 to 50 new locations in fiscal year 2025, a plan that requires significant investment. Favorable borrowing terms are essential to execute this expansion without unduly burdening the company's finances.

Darden's financial flexibility is further demonstrated by its engagement in share repurchase programs. These buybacks signal confidence in the company's financial stability and its ability to generate sufficient cash flow, even amidst fluctuating interest rate environments and ongoing capital needs for growth.

Employment Rates and Labor Market Conditions

A strong employment market is a significant tailwind for Darden Restaurants, as it typically correlates with increased consumer confidence and a greater propensity for dining out. For instance, the U.S. unemployment rate remained low in early 2024, hovering around 3.7%, which generally supports consumer spending on discretionary items like restaurant meals.

However, Darden's reliance on a large service workforce makes it particularly susceptible to labor market dynamics. Wage pressures are a key concern; the average hourly earnings for leisure and hospitality workers saw an increase in late 2023 and into 2024, impacting labor costs. The availability of skilled staff is also critical for maintaining service quality across its brands.

Darden actively addresses these challenges through strategic human capital management:

- Internal Growth: The company emphasizes internal promotion pathways, offering career advancement opportunities to retain its workforce.

- Competitive Compensation: Darden aims to offer competitive wages and benefits to attract and keep qualified employees in a tight labor market.

- Training and Development: Investments in training programs help ensure a skilled labor pool capable of delivering the company's service standards.

Economic Growth and Recessionary Risks

Economic growth is a critical driver for the restaurant sector, directly influencing consumer confidence and spending on dining out. Darden Restaurants, for instance, demonstrated notable resilience through fiscal year 2024 and into early fiscal 2025, navigating a complex economic landscape. However, the persistent threat of a recession or a significant economic slowdown poses a substantial risk, potentially curtailing discretionary spending and negatively impacting Darden's revenue streams.

Darden's performance in fiscal 2024 highlighted this dynamic. The company reported total sales of $10.5 billion for fiscal year 2024, a 9.7% increase compared to fiscal year 2023. This growth, however, was achieved amidst inflationary pressures and evolving consumer spending habits. Looking ahead into fiscal 2025, the company has provided guidance suggesting continued sales growth, but the underlying economic uncertainties remain a key factor to monitor.

- Darden's Total Sales (FY 2024): $10.5 billion, up 9.7% from FY 2023.

- Economic Sensitivity: Restaurant spending is highly discretionary, making it vulnerable to economic downturns.

- Recessionary Impact: A recession could lead to reduced traffic and lower average checks for Darden's brands.

- Forecasting Challenges: Macroeconomic volatility makes precise sales forecasting more challenging for fiscal 2025 and beyond.

Darden Restaurants' performance is closely tied to the broader economic climate, with consumer discretionary spending being a primary driver. Despite inflationary pressures, consumers have shown a continued willingness to dine out, as evidenced by Darden's robust sales figures. For example, in the first quarter of fiscal year 2025, total sales reached $2.7 billion, a 9.4% increase year-over-year, underscoring consumer resilience.

However, rising costs for food and labor remain a significant challenge, directly impacting profit margins and potentially leading to price adjustments. Darden's strategy involves proactive cost management and menu engineering to mitigate these effects. The company anticipates a total inflation rate of around 3.0% for fiscal year 2025, highlighting the ongoing need for careful financial navigation.

Interest rates also play a crucial role, influencing Darden's cost of capital for expansion initiatives. With plans to open 45 to 50 new locations in fiscal year 2025, favorable borrowing terms are essential for executing this growth strategy effectively. The company's financial health is further supported by its share repurchase programs, signaling confidence in its cash flow generation capabilities.

A strong labor market generally supports consumer spending, but Darden faces wage pressures due to its reliance on a large service workforce. The U.S. unemployment rate remained low in early 2024, around 3.7%, which is beneficial. However, increased wages in the leisure and hospitality sector require Darden to focus on competitive compensation and employee retention through internal growth and development programs.

| Economic Factor | Darden's Performance/Strategy | Data/Fact |

| Consumer Spending & Disposable Income | Resilient demand for dining out | Q1 FY25 Total Sales: $2.7 billion (+9.4% YoY) |

| Inflation (Costs) | Rising food & labor expenses; strategic cost management | FY25 Inflation Forecast: ~3.0% |

| Interest Rates | Impact on cost of capital for expansion | Planned new locations FY25: 45-50 |

| Labor Market | Strong employment supports spending but creates wage pressure | US Unemployment Rate (early 2024): ~3.7% |

Preview the Actual Deliverable

Darden Restaurants PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Darden Restaurants delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into market dynamics and potential challenges.

Sociological factors

Consumer dining habits are in constant flux, with a noticeable shift towards digital ordering and delivery. This trend accelerated significantly in recent years, with the off-premise dining sector experiencing robust growth. For instance, the US online food delivery market was projected to reach over $30 billion in 2024, highlighting a substantial consumer preference for convenience.

Darden Restaurants has proactively addressed these changing preferences by forging partnerships, such as their collaboration with Uber Eats. This strategic move allows them to expand their off-premise dining capabilities, offering customers more ways to enjoy their meals without necessarily dining in. The goal is to maintain the high quality associated with Darden's brands, even when meals are delivered.

Growing consumer focus on health and wellness significantly influences dining decisions. Darden Restaurants needs to cater to evolving dietary preferences, including the rising demand for plant-based meals and generally healthier options to attract a wider audience.

For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating a substantial shift in consumer behavior that Darden can leverage by expanding its healthier and plant-forward menu items across brands like Olive Garden and LongHorn Steakhouse.

Demographic shifts, like the increasing number of millennials and Gen Z entering their prime spending years and the ongoing aging of the Baby Boomer generation, significantly impact dining habits. These groups often have different preferences for casual versus fine dining, dietary needs, and technology integration in their restaurant experience.

Darden's strategic brand portfolio, which includes concepts like Olive Garden, LongHorn Steakhouse, and The Capital Grille, is well-positioned to address these evolving demographics. For instance, in fiscal year 2023, Darden reported strong performance, with total sales increasing by 14.1% year-over-year, indicating their ability to resonate with a broad customer base across various age groups and lifestyle preferences.

Social Media and Customer Feedback

Social media’s omnipresence means customer sentiment, both positive and negative, can spread like wildfire, directly influencing Darden Restaurants' brand image. A single viral post can significantly sway public perception, making proactive reputation management crucial.

Darden actively uses AI-powered chatbots to gather customer feedback, aiming to improve the dining experience and manage its digital footprint. This technological integration allows for quicker responses and data collection on customer satisfaction.

- Brand Reputation: In 2023, over 70% of consumers reported that social media influences their purchasing decisions, highlighting the direct link between online sentiment and Darden's sales.

- Customer Engagement: Darden's brands, like Olive Garden and LongHorn Steakhouse, saw a combined social media following exceeding 15 million in early 2024, indicating a significant platform for feedback and interaction.

- AI in Service: The implementation of AI chatbots for feedback collection is part of a broader trend; by mid-2024, restaurant industry adoption of AI for customer service was projected to increase by 25%.

Cultural Preferences and Culinary Innovation

Cultural preferences significantly shape Darden's menu development and brand appeal, influencing everything from ingredient choices to dining atmosphere. The company actively invests in culinary innovation to deliver diverse and engaging experiences across its portfolio, aiming to connect with a wide range of consumer tastes and expectations.

Darden's strategic approach includes expanding into new culinary territories. For instance, the potential acquisition discussions or market entries into segments like Tex-Mex, exemplified by interest in chains like Chuy's, highlight a deliberate effort to cater to evolving cultural dining trends and broaden market reach. This allows Darden to tap into different consumer demographics and preferences.

- Menu Adaptation: Darden's brands often tailor menus to local tastes, a strategy that proved successful in 2024 with regional specials driving traffic.

- Innovation Investment: The company allocated $150 million in capital expenditures in fiscal year 2024, partly for restaurant renovations and culinary advancements.

- Brand Diversification: Darden's portfolio, including brands like Olive Garden and LongHorn Steakhouse, reflects a strategy to capture various cultural dining preferences.

Societal shifts towards convenience and digital integration continue to shape dining. Darden's investment in off-premise options and digital ordering platforms reflects this, with the US online food delivery market projected to exceed $30 billion in 2024. Furthermore, a growing emphasis on health and wellness is driving demand for plant-based and healthier menu items, a trend supported by the global plant-based food market's projected growth to $162 billion by 2030.

Demographic changes, including the spending power of younger generations and the preferences of an aging population, influence Darden's brand strategy. In fiscal year 2023, Darden reported a 14.1% increase in total sales, demonstrating its ability to appeal across diverse age groups.

Social media's influence on consumer perception is paramount, with over 70% of consumers reporting it impacts purchasing decisions in 2023. Darden's proactive use of AI chatbots for feedback collection, aiming to enhance customer experience and manage its online reputation, aligns with the projected 25% increase in AI adoption for customer service in the restaurant industry by mid-2024.

| Sociological Factor | Trend/Impact | Darden's Response/Data Point |

| Convenience & Digitalization | Increased demand for delivery and digital ordering | US online food delivery market projected over $30B in 2024; Darden partners with Uber Eats. |

| Health & Wellness | Growing preference for plant-based and healthier options | Global plant-based market projected to reach $162B by 2030; Darden expanding healthier menu items. |

| Demographic Shifts | Varying preferences across age groups (Millennials, Gen Z, Boomers) | Darden's FY23 sales increased 14.1%; portfolio includes brands appealing to different demographics. |

| Social Media Influence | Significant impact on brand reputation and purchasing decisions | Over 70% of consumers influenced by social media (2023); Darden uses AI chatbots for feedback (25% AI adoption projected by mid-2024). |

Technological factors

Darden Restaurants is heavily investing in digital transformation, evidenced by its significant partnership with Uber Eats. This collaboration, set to be fully implemented across the country by May 2025, is designed to capitalize on the growing consumer preference for off-premise dining and to provide greater convenience.

A key aspect of this digital push is ensuring transparent pricing, with delivery menu prices aligning directly with in-restaurant prices, a move that builds trust and simplifies the customer experience. This strategic shift is crucial for Darden to remain competitive in an evolving market where digital ordering and delivery are increasingly dominant.

Darden Restaurants is strategically investing in upgrading its point-of-sale (POS) systems across its diverse brand portfolio. This initiative is a significant technological push aimed at streamlining operations and boosting efficiency. These advanced systems are expected to accelerate order taking, a critical factor in restaurant service, and also reduce the time needed to train new employees on the technology.

The key benefits of these POS upgrades extend to enhanced data collection and analytical capabilities. By strengthening these insights, Darden can better understand customer preferences and operational performance. Ultimately, this technological advancement is geared towards creating a smoother, more satisfying experience for every guest dining at Darden's establishments.

Darden Restaurants is actively integrating artificial intelligence and automation across its operations. For instance, AI-powered chatbots are being deployed to handle customer interactions like managing reservations, answering menu questions, and gathering feedback, streamlining customer service.

The company is also exploring AI for more sophisticated applications such as dynamic pricing strategies and personalized menu recommendations, aiming to optimize revenue and enhance the dining experience. Furthermore, Darden is experimenting with voice recognition technology to facilitate easier and faster ordering processes for customers.

Data Analytics and Customer Personalization

Technological advancements are fundamentally reshaping how Darden Restaurants interacts with its customers. The ability to collect and analyze vast amounts of data allows for unprecedented personalization of the dining experience. This means everything from menu recommendations to targeted promotions can be tailored to individual preferences, significantly boosting marketing effectiveness and fostering deeper customer loyalty.

Darden is actively investing in these capabilities. For instance, their ongoing partnership with Infosys, a global leader in technology consulting, is a clear indicator of their commitment to leveraging data analytics for enhanced guest engagement. This strategic alliance aims to refine customer relationship management and optimize operational efficiencies through digital transformation.

The impact of data-driven personalization is substantial. By understanding customer behavior and preferences, Darden can anticipate needs and offer more relevant experiences. This approach is crucial in today's competitive landscape, where customer retention is as vital as customer acquisition.

- Data-Driven Personalization: Leveraging customer data to tailor dining experiences and promotions.

- Strategic Tech Partnerships: Collaborating with firms like Infosys to enhance guest engagement and digital capabilities.

- Marketing Effectiveness: Utilizing analytics to optimize marketing spend and improve campaign ROI.

- Customer Loyalty: Building stronger customer relationships through personalized interactions and offers.

Supply Chain Technology and Efficiency

Technology is a cornerstone for Darden Restaurants' supply chain, impacting everything from how they track inventory to how food travels to their kitchens. Advanced systems allow for real-time monitoring, ensuring ingredients are fresh and available when needed across their extensive network. This technological integration is vital for cost control and minimizing waste.

For instance, Darden's investment in supply chain technology directly supports its operational efficiency. In fiscal year 2024, the company continued to refine its distribution network, leveraging technology to improve delivery accuracy and reduce transit times. This focus on efficiency is critical for maintaining the quality and consistency customers expect from brands like Olive Garden and LongHorn Steakhouse.

- Inventory Management: Darden utilizes sophisticated software to forecast demand and manage stock levels, reducing spoilage and ensuring product availability.

- Logistics Optimization: Technology aids in route planning and fleet management, leading to more efficient deliveries and lower transportation costs.

- Food Safety and Traceability: Advanced tracking systems enhance food safety by providing end-to-end visibility of ingredients, crucial for compliance and consumer trust.

- Data Analytics: Darden leverages data analytics from its supply chain operations to identify trends, predict potential disruptions, and make informed decisions for continuous improvement.

Darden Restaurants is significantly enhancing its digital infrastructure, with a key focus on improving the guest experience through technology. The company's investment in advanced point-of-sale (POS) systems across its brands aims to speed up order processing and simplify staff training, contributing to operational efficiency. These upgrades also bolster data collection, enabling Darden to better understand customer preferences and refine its service delivery.

Legal factors

Darden Restaurants operates under a complex web of federal, state, and local food safety and health regulations. Compliance is non-negotiable, directly impacting consumer trust and avoiding significant legal repercussions like fines or closures. For instance, adhering to FDA Food Code standards, which are updated periodically, is crucial for all their establishments.

The company actively promotes its commitment to food safety and quality, integrating it into its broader sustainability initiatives. This focus aims to not only meet but exceed regulatory requirements, positioning Darden as a leader in responsible food handling and preparation practices across its brands, which include Olive Garden and LongHorn Steakhouse.

Darden Restaurants operates under a complex web of labor laws, encompassing minimum wage, overtime pay, workplace safety, and employee benefits. These regulations, which vary by state and locality, significantly influence operational costs and staffing strategies.

Anticipated shifts in labor legislation, such as the Department of Labor's proposed overtime rule set to take effect in January 2025, which could raise the salary threshold for overtime eligibility, present a direct challenge. This change is projected to increase labor expenses for companies like Darden, potentially impacting their human resource management and compensation structures.

Darden Restaurants' expansion and daily operations are heavily shaped by licensing and zoning regulations. These laws determine where restaurants can be built, what building standards must be met, and how land can be used, directly affecting Darden's growth strategies and how adaptable its operations can be.

Navigating these local and state-level requirements is crucial for Darden. For instance, securing liquor licenses, which are essential for many of its brands like Olive Garden and LongHorn Steakhouse, involves a complex and often lengthy approval process that varies significantly by jurisdiction. In 2024, Darden continued to manage these diverse regulatory landscapes across its vast portfolio of over 2,000 locations.

Data Privacy and Cybersecurity Laws

Darden Restaurants, like all businesses handling customer data, faces increasing scrutiny under data privacy and cybersecurity laws. The company must navigate a complex web of regulations such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which grant consumers more control over their personal information. Failure to comply can result in significant fines and legal challenges, impacting both financial performance and brand trust.

Protecting customer information and maintaining a robust cybersecurity infrastructure is paramount for Darden. In 2023, the restaurant industry, like many others, experienced a rise in data breaches. A breach at Darden could expose sensitive customer details, leading to severe reputational damage and loss of customer loyalty. Proactive measures, including regular security audits and employee training, are essential to mitigate these risks.

- CCPA/CPRA Compliance: Darden must ensure its data collection, usage, and deletion practices align with California's stringent privacy laws, impacting how customer data is managed across its brands like Olive Garden and LongHorn Steakhouse.

- Cybersecurity Investment: The company continues to invest in advanced cybersecurity technologies and protocols to safeguard its digital networks and customer databases against evolving threats.

- Reputational Risk: A significant data breach could severely damage Darden's brand image, potentially leading to a decline in customer traffic and sales, as seen in other hospitality sector breaches.

Intellectual Property Protection

Darden Restaurants relies heavily on its portfolio of well-known brands like Olive Garden and LongHorn Steakhouse. Protecting these brand names through trademarks is crucial for maintaining customer recognition and loyalty. In 2023, Darden continued to invest in marketing and brand building, underscoring the value of its intellectual property.

Safeguarding culinary innovations and unique recipes also forms a key part of Darden's legal strategy. While specific recipes are often trade secrets, the company actively works to prevent others from copying their core menu items or restaurant concepts, which is vital for their competitive edge. This focus on intellectual property protection helps prevent dilution of their brand value and ensures they can continue to differentiate themselves in the crowded casual dining market.

- Brand Protection: Darden's trademarks for brands like Olive Garden and Capital Grille are legally protected to prevent unauthorized use.

- Recipe Secrecy: Key recipes and culinary processes are maintained as trade secrets, a form of intellectual property.

- Competitive Advantage: Robust IP protection directly supports Darden's ability to maintain its market position and prevent competitors from unfairly benefiting from its innovations.

Darden Restaurants navigates a complex legal landscape, from food safety and labor laws to data privacy and intellectual property protection. Compliance with regulations like the FDA Food Code and varying state labor laws, such as potential overtime rule changes effective January 2025, directly impacts operational costs and brand reputation.

Licensing and zoning laws dictate expansion and operational feasibility, with liquor license acquisition being a key example of jurisdiction-specific legal hurdles. In 2024, Darden managed these diverse requirements across over 2,000 locations.

Data privacy laws, including CCPA and CPRA, necessitate robust cybersecurity measures to protect customer information and avoid significant fines. The company's investment in protecting its valuable brands, like Olive Garden and LongHorn Steakhouse, through trademarks and trade secrets is also a critical legal and strategic imperative.

Environmental factors

Darden Restaurants is actively pursuing waste reduction through comprehensive recycling programs. They aim for zero waste to landfills, a significant environmental commitment. In 2023, Darden reported that 69% of their restaurants had robust solid waste recycling programs, demonstrating progress towards their ambitious goals.

A key element of their strategy involves recycling 100% of used cooking oil, transforming a potential waste product into a valuable resource. Furthermore, their Harvest food donation program plays a crucial role in sustainability by diverting surplus food to local non-profits, addressing both waste and food insecurity.

Darden Restaurants, operating over 2,100 locations, prioritizes energy and water conservation as a key environmental strategy. These efforts directly address climate risks and resource availability fluctuations, aligning with their broader sustainability objectives.

In 2023, Darden reported a 12% reduction in energy intensity and a 7% decrease in water intensity per restaurant compared to their 2019 baseline, demonstrating tangible progress in resource management across their portfolio.

Darden Restaurants places significant emphasis on sustainable sourcing and supply chain management, aligning with growing consumer demand for ethical and environmentally conscious practices. The company's commitment extends to ensuring food safety and quality, upholding animal welfare standards, and requiring suppliers to adhere to their established food principles.

In 2023, Darden continued its efforts to assess environmental risks within its commodity spending, actively engaging with suppliers to address critical issues such as climate change. This proactive approach reflects a broader industry trend where companies are increasingly held accountable for the environmental impact of their entire value chain.

Climate Change and Natural Disasters

Darden Restaurants recognizes climate change and the increasing frequency of natural disasters as significant environmental risks. These events, such as hurricanes and severe storms, can disrupt supply chains, impact ingredient availability, and directly affect customer traffic at their dining locations, potentially leading to decreased sales and operational challenges. For instance, during the 2023 hurricane season, several coastal regions where Darden operates experienced disruptions, though the company has not publicly quantified the exact financial impact on its Q4 2023 or early 2024 performance.

The company's commitment to conservation efforts and robust business continuity planning are key strategies to navigate these environmental uncertainties. Darden has invested in initiatives aimed at reducing its carbon footprint and promoting sustainable practices across its restaurant portfolio. Their business continuity plans are designed to ensure operational resilience, allowing for swift recovery and continued service even in the face of adverse weather events or natural disasters. This proactive approach is crucial for maintaining stable operations and protecting revenue streams in an increasingly unpredictable climate.

Looking ahead, the environmental landscape presents ongoing challenges. The National Oceanic and Atmospheric Administration (NOAA) has projected an active Atlantic hurricane season for 2024, with an above-normal number of storms predicted. This forecast underscores the continued importance of Darden's environmental risk management strategies. The company's ability to adapt to changing weather patterns and mitigate the impact of natural disasters will be critical for sustained success and financial stability in the coming years.

- Climate Risk Acknowledgment: Darden identifies climate change and natural disasters as material risks impacting sales and operations.

- Operational Impact: Severe weather can disrupt supply chains, affect ingredient sourcing, and reduce customer foot traffic.

- Mitigation Strategies: Conservation initiatives and business continuity planning are in place to manage environmental risks.

- Future Outlook: Projections for an active 2024 hurricane season highlight the ongoing need for environmental resilience.

Green Building and Restaurant Design

Adopting green building practices and sustainable restaurant design offers Darden Restaurants a pathway to reduce its environmental footprint. This involves incorporating energy-efficient appliances, utilizing sustainable building materials, and optimizing layouts to minimize resource consumption. For instance, the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) certification encourages such practices, with many companies aiming for LEED certification for new constructions or renovations.

The financial benefits of these strategies are becoming increasingly evident. Energy-efficient equipment can lead to significant operational cost savings. For example, ENERGY STAR certified commercial kitchen equipment can use 20% less energy than standard models. Furthermore, the use of recycled or rapidly renewable materials can reduce initial construction costs and contribute to a positive brand image, appealing to environmentally conscious consumers.

- Energy Efficiency: Implementing ENERGY STAR certified appliances can cut energy usage by up to 20% in kitchen operations.

- Sustainable Materials: Sourcing recycled content for flooring, countertops, and furniture can lower material costs and reduce waste.

- Water Conservation: Low-flow fixtures and water-efficient dishwashers can decrease water bills, a key operational expense.

- Waste Reduction: Designing for efficient waste sorting and composting can minimize landfill contributions and potentially create revenue streams from recycling.

Darden Restaurants actively manages environmental factors by focusing on waste reduction, energy and water conservation, and sustainable sourcing. Their commitment is evident in programs like recycling 100% of used cooking oil and diverting surplus food through their Harvest program. These initiatives directly address resource availability and align with growing consumer demand for ethical practices.

The company acknowledges climate change and natural disasters as significant risks, impacting supply chains and customer traffic. For instance, the projected active 2024 Atlantic hurricane season underscores the need for robust business continuity planning and resilience strategies to maintain stable operations and protect revenue.

Darden's environmental strategy includes adopting green building practices and sustainable design, such as utilizing ENERGY STAR certified appliances which can reduce energy usage by up to 20%. These efforts not only lower operational costs but also enhance brand image among environmentally conscious consumers.

| Environmental Initiative | 2023 Progress/Data | Impact |

|---|---|---|

| Solid Waste Recycling Programs | 69% of restaurants | Waste reduction, resource recovery |

| Used Cooking Oil Recycling | 100% | Waste diversion, resource utilization |

| Energy Intensity Reduction | 12% decrease (vs. 2019 baseline) | Operational cost savings, reduced carbon footprint |

| Water Intensity Reduction | 7% decrease (vs. 2019 baseline) | Operational cost savings, resource conservation |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Darden Restaurants is built on a robust foundation of data from leading economic indicators, government policy updates, and reputable industry research firms. We also incorporate insights from environmental impact reports and technology adoption trends to ensure comprehensive coverage.