Darden Restaurants Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darden Restaurants Bundle

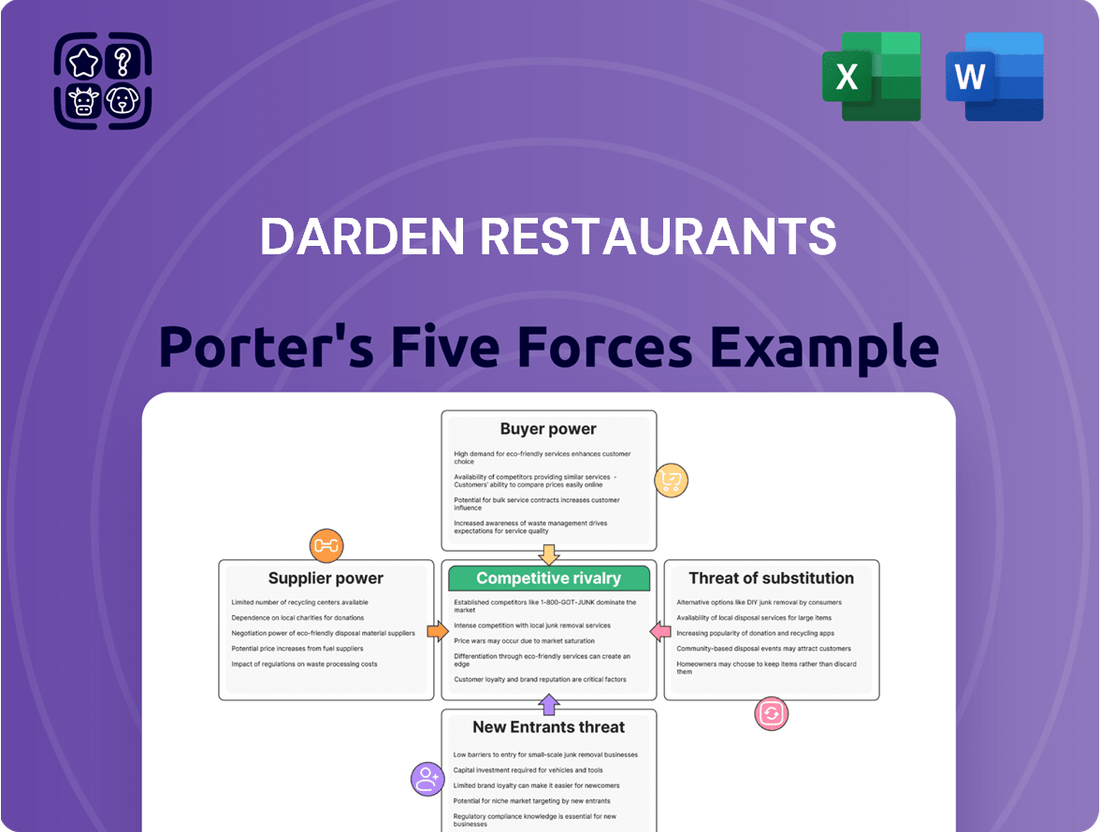

Darden Restaurants navigates a complex competitive landscape, where the bargaining power of buyers and the threat of substitutes significantly shape its market position. Understanding these forces is crucial for any stakeholder looking to grasp Darden's strategic challenges and opportunities.

The complete report reveals the real forces shaping Darden Restaurants’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Darden Restaurants' reliance on a concentrated supplier base, with major players like Sysco Corporation and US Foods handling a substantial share of its food and beverage procurement, grants these suppliers considerable bargaining power. This can translate into less favorable pricing and terms for Darden, particularly for critical ingredients that are difficult to substitute.

Commodity price volatility significantly impacts Darden Restaurants' profitability. Fluctuations in the cost of key ingredients like beef and chicken can squeeze margins. For instance, beef prices experienced a range between $4.80 and $5.60 per pound in 2023, demonstrating this inherent instability.

Furthermore, the restaurant sector faces upward pressure on produce costs, with a reported year-over-year increase of 5.3% impacting operational expenses. This volatility in essential inputs directly affects Darden's ability to maintain consistent pricing and profitability without absorbing these cost increases.

Ongoing supply chain challenges, such as port congestion and a persistent truck driver shortage, directly impact Darden Restaurants' ability to secure necessary ingredients. These disruptions, expected to persist through 2025, can lead to increased ingredient costs and potential limitations on menu availability.

For instance, the global shipping crisis in 2023 saw container shipping rates surge significantly, directly affecting the cost of imported goods. This translates to higher input costs for restaurants like Darden, potentially squeezing profit margins if these costs cannot be fully passed on to consumers.

Long-Term Contracts and Diversification

Darden Restaurants actively manages the bargaining power of its suppliers by entering into strategic long-term contracts. These agreements are crucial for securing a stable supply of key ingredients and mitigating price volatility. For instance, a significant portion, around 65%, of Darden's critical ingredient contracts have durations of three to five years. This forward-looking approach helps lock in favorable pricing and ensures consistent availability, directly impacting cost of goods sold.

Furthermore, Darden emphasizes diversification within its supplier base. This strategy is designed to prevent over-reliance on any single supplier, thereby reducing vulnerability to supply chain disruptions or unilateral price increases. By cultivating relationships with multiple vendors for essential items, Darden enhances its negotiating leverage and builds greater resilience into its operations. This dual approach of long-term contracts and supplier diversification is a cornerstone of their supply chain management.

- Long-Term Contracts: Approximately 65% of Darden's critical ingredient contracts are secured for 3-5 year terms, providing pricing stability.

- Supplier Diversification: Darden actively cultivates a broad supplier network to minimize dependence on any single source.

- Risk Mitigation: These strategies collectively reduce the risk of supply chain disruptions and enhance negotiating power with suppliers.

- Cost Control: Stable ingredient pricing through long-term agreements directly supports Darden's efforts to manage food costs effectively.

Logistics and Cold Chain Integrity

For Darden Restaurants, the ability of suppliers to maintain logistics and cold chain integrity is paramount. This directly impacts the freshness and quality of perishable ingredients, a cornerstone of their dining experience. Suppliers who can consistently guarantee temperature-controlled delivery and efficient transport have significant leverage.

Failures in the cold chain, such as temperature fluctuations during transit, can result in spoilage and substantial financial losses for Darden. For instance, a disruption in the supply of fresh produce or seafood could lead to stockouts or the need to discard compromised inventory. This vulnerability empowers suppliers with robust cold chain capabilities, as they become essential partners in minimizing waste and ensuring product quality. In 2024, the global cold chain logistics market was valued at over $250 billion, highlighting the significant investment and expertise required in this sector, which directly translates to supplier bargaining power.

- Supplier Dependence: Darden's reliance on suppliers for timely, temperature-controlled deliveries of fresh ingredients like produce, meats, and seafood.

- Impact of Disruptions: Spoilage and financial losses due to breaches in cold chain integrity during transportation.

- Supplier Leverage: Suppliers demonstrating superior cold chain management and reliable delivery services gain increased bargaining power.

- Market Context: The growing global cold chain logistics market underscores the specialized capabilities and associated costs that suppliers bring.

Darden Restaurants faces significant bargaining power from its suppliers due to the concentrated nature of its procurement for essential food and beverage items. Major distributors like Sysco and US Foods handle a large portion of Darden's needs, giving them leverage in pricing and terms. This is particularly true for critical ingredients that lack easy substitutes, directly impacting Darden's cost of goods sold.

Commodity price volatility, such as the 2023 range of $4.80-$5.60 per pound for beef, and a 5.3% year-over-year increase in produce costs in early 2024, further empowers suppliers who can offer more stable pricing through long-term contracts. Darden mitigates this by securing approximately 65% of its critical ingredient contracts for three to five years, aiming to lock in favorable terms and ensure supply continuity.

| Supplier Factor | Impact on Darden | Mitigation Strategy |

|---|---|---|

| Concentrated Supplier Base | Increased leverage for major distributors (e.g., Sysco, US Foods) | Supplier diversification |

| Commodity Price Volatility (e.g., Beef $4.80-$5.60/lb in 2023) | Pressure on profit margins | Long-term contracts (approx. 65% for 3-5 years) |

| Cold Chain Integrity Requirements | Dependence on suppliers for quality and reliability | Partnering with suppliers demonstrating robust logistics |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Darden Restaurants' diverse casual dining portfolio.

Quickly identify and mitigate competitive threats with a visual breakdown of Darden's industry landscape.

Customers Bargaining Power

Customers in the casual dining sector are quite aware of pricing, particularly when economic conditions are uncertain. For instance, in the first quarter of 2024, Darden Restaurants reported that while sales at its core brands like Olive Garden and LongHorn Steakhouse grew, the overall consumer environment remained a key consideration.

Darden's success in maintaining customer loyalty, even with rising operational costs, hinges on its consistent delivery of a compelling value proposition. Olive Garden's "Never Ending Pasta Bowl" and LongHorn Steakhouse's focus on quality ingredients at accessible price points are prime examples of this strategy, which helps mitigate the impact of price sensitivity.

Darden Restaurants' diverse brand portfolio, including Olive Garden, LongHorn Steakhouse, and Ruth's Chris Steak House, effectively mitigates customer bargaining power. This strategy allows Darden to serve a wide array of consumer preferences and budgets, from casual dining to upscale experiences. By offering distinct value propositions across its brands, Darden reduces the likelihood of any single customer segment holding significant sway over pricing or service terms.

Customers increasingly expect convenience, with digital ordering and fast delivery becoming standard. This shift significantly boosts their bargaining power as they can easily choose restaurants offering seamless online experiences and prompt service. Darden's strategic move to partner with Uber Eats nationwide by May 2025 directly addresses this trend, aiming to capture a larger share of these high-value delivery orders.

Customer Loyalty Programs and Experience

Darden Restaurants actively cultivates customer loyalty through its focus on consistent, high-quality dining experiences. This commitment to excellent service, appealing menu options, and a strong brand image directly combats the bargaining power of customers.

By fostering repeat business and reducing customer churn, Darden lessens the likelihood that patrons will switch to competitors. This retention strategy diminishes the leverage customers have to demand lower prices or better terms, as their loyalty is already secured through positive experiences and brand affinity.

- Customer Retention: Darden's efforts aim to keep customers coming back, reducing their need to seek alternatives.

- Brand Strength: A strong brand identity and consistent quality make customers less price-sensitive.

- Menu Innovation: Regularly updated and appealing menus encourage continued patronage.

- Reduced Switching Propensity: Loyal customers are less likely to be swayed by competitor offers, thus lowering their bargaining power.

Impact of Macroeconomic Conditions on Spending

The bargaining power of customers within Darden Restaurants is significantly influenced by prevailing macroeconomic conditions, particularly the divergence in spending habits between different income groups. Higher-income consumers are still dining out, but those with lower incomes are noticeably pulling back on discretionary spending, including restaurant visits.

This creates a complex environment where Darden needs to appeal to a broad customer base. The company must carefully craft value-oriented promotions to attract budget-conscious diners without devaluing its brand through excessive discounting. This balancing act directly reflects the varying leverage customers wield based on their economic circumstances.

- Consumer Spending Trends: In early 2024, while overall consumer spending remained relatively robust, a clear bifurcation emerged. Data from sources like the Bureau of Economic Analysis indicated that while higher-income households continued to allocate funds to services like dining out, lower-income households showed a marked reduction in discretionary expenditures.

- Impact on Restaurant Choice: This economic divide means that customers with less disposable income have increased bargaining power, as they are more sensitive to price and actively seek out deals or opt for less expensive dining alternatives.

- Darden's Strategic Response: Darden's approach in 2024 has involved leveraging its diverse brand portfolio to cater to different segments, offering value propositions at brands like Olive Garden and LongHorn Steakhouse while maintaining premium experiences at others.

The bargaining power of customers is a significant force, especially given economic shifts. In early 2024, a noticeable split in consumer spending emerged, with higher-income individuals continuing to dine out while lower-income consumers reduced discretionary spending. This economic divergence directly impacts how much leverage customers have, particularly those more sensitive to price points.

Darden Restaurants navigates this by offering diverse value propositions across its brands. For instance, Olive Garden's "Never Ending Pasta Bowl" remains a draw for value-seeking customers, while brands like LongHorn Steakhouse focus on quality at accessible price points. This strategy aims to retain customers and reduce their inclination to switch based solely on price.

The increasing demand for convenience, fueled by digital ordering and delivery, further empowers customers. Darden's nationwide partnership with Uber Eats by May 2025 is a direct response to this trend, aiming to capture a larger share of this growing market segment and maintain customer engagement.

| Brand | Customer Value Proposition | 2024 Performance Highlight (Illustrative) |

|---|---|---|

| Olive Garden | Value-driven, family-friendly Italian dining | Consistent same-restaurant sales growth, driven by traffic and value offerings. |

| LongHorn Steakhouse | Quality steaks at accessible prices | Strong performance, appealing to value-conscious consumers seeking a premium casual experience. |

| The Capital Grille | Upscale dining experience | Maintained strong average checks, indicating resilience among higher-income diners. |

Same Document Delivered

Darden Restaurants Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces analysis for Darden Restaurants you'll receive immediately after purchase, detailing the competitive landscape and strategic implications. You'll gain a comprehensive understanding of the industry's bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the restaurant sector. This document is fully formatted and ready for your immediate use.

Rivalry Among Competitors

The casual dining market is intensely competitive and highly fragmented, with a vast number of restaurants, including large chains and independent establishments, all striving for customer attention. This intense rivalry means Darden Restaurants must consistently innovate its offerings and maintain superior operational efficiency to stand out.

In 2024, the casual dining segment continues to be a battleground. For instance, Darden's own brands like Olive Garden and LongHorn Steakhouse compete with a multitude of other casual dining chains, as well as a growing number of fast-casual and even quick-service restaurants that are expanding their menus and dining experiences. This broad competitive set demands ongoing investment in marketing, menu development, and customer service to retain and attract diners.

Competitors in the casual dining sector frequently employ price wars and promotional discounts to capture market share, particularly when overall industry growth slows. This can put pressure on margins for all players.

Darden Restaurants has strategically navigated this by emphasizing its value proposition rather than resorting to deep, across-the-board discounting. For instance, in its fiscal year 2023, Darden reported total sales of $10.49 billion, demonstrating resilience even amidst competitive pressures.

This approach aims to protect operating margins while still attracting a consistent customer base. The company's focus remains on delivering a strong dining experience that justifies its pricing, rather than engaging in a race to the bottom on price.

Competitive rivalry in the casual dining sector is significantly fueled by the imperative to manage escalating operational expenses, particularly concerning food and labor costs. Darden Restaurants has consistently demonstrated a strong commitment to cost management and driving productivity improvements, which translates into robust restaurant-level profit margins when benchmarked against many of its competitors. For instance, in fiscal year 2023, Darden reported a 7.3% operating margin, showcasing their ability to control costs effectively amidst inflationary pressures.

Brand Differentiation and Customer Experience

Darden Restaurants stands out by offering a diverse array of brands, each designed to provide a distinct and reliable dining experience. This strategy effectively differentiates them from rivals who may focus on a narrower market segment.

The company's significant brand equity, especially evident with popular chains like Olive Garden and LongHorn Steakhouse, fosters strong customer loyalty. This loyalty acts as a crucial buffer, mitigating the impact of intense competition within the casual dining sector.

- Brand Portfolio Diversification: Darden operates multiple restaurant concepts, catering to various tastes and occasions, which broadens its customer base and reduces reliance on any single brand.

- Customer Experience Consistency: A focus on delivering a predictable and positive dining experience across its brands builds trust and encourages repeat business, a key differentiator in a crowded market.

- Brand Equity and Loyalty: Strong brand recognition and customer affection, particularly for flagship brands like Olive Garden, translate into higher customer retention rates and a more resilient market position. For example, Olive Garden reported a comparable sales increase of 4.0% in the first quarter of fiscal year 2024.

- Competitive Buffering: The established loyalty and consistent experience provide a competitive advantage, allowing Darden to better withstand pricing pressures and aggressive marketing from competitors.

Expansion and Market Penetration

Competitive rivalry is fierce as rivals actively expand their restaurant portfolios and test innovative dining concepts to capture market share. This constant push for growth means Darden must remain agile and strategic in its own expansion efforts to stay ahead.

Darden's proactive approach to expansion, including its recent acquisitions, underscores its commitment to maintaining a strong competitive edge. For instance, the acquisition of Ruth's Chris Steak House in 2023, a deal valued at approximately $715 million, significantly broadened Darden's fine-dining segment. This move, alongside potential future acquisitions like Chuy's, demonstrates a clear strategy to increase market penetration and diversify its brand offerings.

- Strategic Acquisitions: Darden's purchase of Ruth's Chris Steak House for $715 million in 2023 expanded its presence in the premium dining sector.

- New Unit Growth: Darden plans to open approximately 50 new restaurants in fiscal year 2024, further solidifying its market footprint across its various brands.

- Market Share Defense: Competitors are also investing heavily in new locations and concept development, intensifying the need for Darden's strategic expansion to defend its market share.

- Brand Diversification: The integration of acquired brands like Ruth's Chris, alongside the potential for others, allows Darden to cater to a wider range of consumer preferences and dining occasions.

The competitive rivalry within the casual dining sector is exceptionally intense, with numerous players vying for consumer attention. Darden Restaurants, operating a diversified portfolio including Olive Garden and LongHorn Steakhouse, faces competition not only from direct casual dining rivals but also from fast-casual and quick-service establishments enhancing their offerings.

Competitors frequently engage in promotional activities and price adjustments to gain market share, which can impact industry-wide profit margins. Darden, however, has focused on its value proposition and dining experience to maintain its market position. For instance, in fiscal year 2023, Darden reported $10.49 billion in total sales, indicating strong performance despite these pressures.

Darden's strategy of brand diversification and consistent customer experience, supported by strong brand equity like Olive Garden's 4.0% comparable sales increase in Q1 FY24, helps buffer against aggressive competitive tactics.

The company's strategic expansion, including the $715 million acquisition of Ruth's Chris Steak House in 2023 and plans for approximately 50 new unit openings in fiscal year 2024, aims to further solidify its market presence and counter competitors' growth initiatives.

| Competitor Action | Darden's Response | Impact on Darden |

|---|---|---|

| Price promotions by rivals | Emphasis on value proposition and dining experience | Protects operating margins, maintains customer loyalty |

| Expansion of fast-casual concepts | Brand diversification (e.g., Ruth's Chris acquisition) | Broadens customer appeal, increases market penetration |

| New unit openings by competitors | Planned 50 new unit openings (FY24) | Defends market share, strengthens brand presence |

| Menu innovation and concept testing | Consistent investment in menu development and operational efficiency | Maintains competitive edge, drives customer traffic |

SSubstitutes Threaten

The growing popularity of fast-casual and quick-service restaurants (QSRs) presents a notable threat to Darden Restaurants. These establishments provide consumers with faster and generally more budget-friendly dining experiences, directly competing for customer spending. For instance, the QSR segment in the U.S. alone was projected to reach over $300 billion in sales in 2024, indicating a substantial market share that can divert customers from casual dining chains.

The threat of substitutes for Darden Restaurants, particularly from home cooking and meal kits, remains a significant factor. Consumers increasingly turn to preparing meals at home, often driven by economic considerations or a desire for healthier options. For instance, the meal kit market, while experiencing some consolidation, still offers convenience that competes directly with casual dining. In 2024, the global meal kit delivery service market was valued at approximately $15 billion, indicating a substantial consumer preference for at-home meal solutions.

Grocery stores have significantly expanded their prepared foods sections, offering a competitive threat to Darden Restaurants. These offerings provide consumers with convenient, ready-to-eat meals that can be a more budget-friendly alternative to dining out. For instance, by late 2023, many major grocery chains reported substantial growth in their prepared food sales, with some seeing double-digit increases year-over-year, indicating a strong consumer shift towards these options.

Food Delivery Services (Non-Restaurant Specific)

Beyond direct restaurant delivery, broader food delivery services that source from various food providers, including ghost kitchens or commissary kitchens, offer diverse culinary options that can substitute for traditional restaurant meals. These platforms aggregate a wide range of cuisines and price points, making it easier for consumers to find alternatives to Darden's specific offerings.

The growth of these non-restaurant specific delivery services presents a significant threat. For instance, the overall food delivery market in the US was projected to reach over $30 billion in 2024, indicating a substantial and growing consumer preference for convenient, diverse meal solutions outside of traditional restaurant dining.

- Broadened Choice: Services like DoorDash, Uber Eats, and Grubhub offer access to a vast array of food options from non-traditional restaurant sources, directly competing with Darden's menu variety.

- Price Sensitivity: Consumers can often find competitive pricing or promotional deals on these aggregated platforms, potentially diverting customers seeking value.

- Convenience Factor: The ease of ordering from multiple food providers through a single app further intensifies the substitution threat, appealing to consumers prioritizing convenience.

Shift in Consumer Lifestyle and Time Constraints

Modern consumers are increasingly time-poor, leading to a reduced appetite for lengthy, sit-down dining. This lifestyle shift directly fuels the demand for quicker meal solutions, forcing Darden Restaurants to adapt. For instance, the rise of fast-casual dining, a segment that grew significantly in 2024, presents a direct substitute for Darden's full-service offerings.

Darden must therefore focus on enhancing the speed and efficiency of its service across brands like Olive Garden and LongHorn Steakhouse to remain competitive. Failure to do so risks losing customers to more convenient alternatives. In 2024, the quick-service restaurant (QSR) sector continued its strong performance, with many brands reporting double-digit revenue growth, highlighting the consumer preference for speed.

- Time Constraints: Busy schedules mean less time for traditional sit-down meals.

- Demand for Speed: Consumers are actively seeking faster dining experiences.

- Competitive Landscape: Fast-casual and QSR segments offer viable alternatives.

- Darden's Response: Need to optimize service pace to retain market share.

The threat of substitutes for Darden Restaurants is multifaceted, encompassing everything from home-cooked meals to faster dining formats. Consumers are increasingly prioritizing convenience and value, leading them to explore alternatives that offer quicker service or a lower price point.

The rise of meal kits and enhanced prepared food sections in grocery stores offers convenient, at-home dining solutions. For example, the U.S. prepared foods market saw significant growth in 2023, with some chains reporting double-digit increases, indicating a strong consumer shift. This trend directly challenges Darden's traditional sit-down dining model.

Furthermore, the booming food delivery market, valued at over $30 billion in the U.S. for 2024, provides access to a vast array of culinary options from various providers, including ghost kitchens. This broadens consumer choice beyond Darden's specific brands and menus, intensifying the substitution threat.

| Substitute Category | Key Characteristics | 2024 Market Projection (US) | Impact on Darden |

|---|---|---|---|

| Fast-Casual/QSR | Speed, Value | QSR segment > $300 billion | Direct competition for dining occasions |

| Home Cooking/Meal Kits | Convenience, Health, Cost | Meal Kit Market ~$15 billion (Global) | Reduces frequency of restaurant visits |

| Grocery Prepared Foods | Convenience, Affordability | Strong YoY growth reported by major chains | Offers quick, budget-friendly alternatives |

| Food Delivery Platforms | Variety, Convenience | Food Delivery Market > $30 billion | Expands consumer options beyond Darden's offerings |

Entrants Threaten

The significant capital outlay needed to establish a new full-service restaurant, encompassing prime real estate acquisition or leasing, construction, kitchen and dining equipment, and initial inventory and staffing, presents a formidable barrier. For example, opening a single casual dining restaurant can easily cost upwards of $500,000 to $1 million, with some larger or uniquely designed establishments requiring several million dollars before the first customer is served.

Darden's established brands, such as Olive Garden and LongHorn Steakhouse, command significant brand recognition and deep customer loyalty. This makes it difficult for newcomers to attract diners away from these trusted names, as consumers often prefer the familiarity and perceived quality associated with established restaurants.

New companies entering the casual dining sector, like Darden Restaurants, face significant hurdles in building robust supply chain and distribution networks. Establishing efficient, reliable, and cost-effective logistics for a wide range of ingredients, especially those that are perishable, is a complex undertaking that requires substantial investment and expertise. For instance, securing consistent access to quality produce, meats, and seafood at competitive prices across numerous locations is a major barrier.

Darden Restaurants, with its extensive portfolio including brands like Olive Garden and LongHorn Steakhouse, already possesses well-established relationships with major food distributors and suppliers. These existing partnerships allow Darden to leverage economies of scale, negotiate favorable pricing, and ensure a consistent supply of goods. In 2023, Darden reported over $10.5 billion in total revenue, underscoring the sheer volume and complexity of its supply chain operations, which would be incredibly difficult for a new entrant to replicate quickly or efficiently.

Regulatory and Compliance Hurdles

The restaurant industry is heavily regulated, with significant health, safety, and labor laws that new entrants must meticulously follow. Navigating these complex requirements, from food handling permits to wage and hour laws, can be a substantial barrier, demanding considerable time and financial investment before a business can even open its doors. For instance, in 2024, compliance with evolving labor laws, such as minimum wage adjustments and scheduling regulations, continued to add operational complexity and cost for new restaurant businesses across the United States.

These regulatory and compliance hurdles act as a significant deterrent to new entrants. The sheer volume of permits, licenses, and inspections required by federal, state, and local authorities can be overwhelming and costly. For example, obtaining all necessary health permits and liquor licenses can take months and involve substantial fees, effectively slowing down the pace at which new competitors can enter the market and challenge established players like Darden Restaurants.

- Health and Safety Regulations: Strict adherence to food safety standards, sanitation protocols, and building codes is mandatory, often requiring specific certifications and ongoing inspections.

- Labor Laws: Compliance with minimum wage laws, overtime rules, employee benefits, and workplace safety standards is critical, with penalties for non-compliance being severe.

- Licensing and Permitting: Obtaining various licenses, including business permits, liquor licenses, and zoning approvals, can be a lengthy and expensive process, varying significantly by location.

- Environmental Regulations: Increasingly, restaurants must also consider waste disposal, energy efficiency, and other environmental compliance measures, adding another layer of complexity for new businesses.

Operational Complexity and Management Expertise

Darden Restaurants' diverse portfolio, encompassing brands like Olive Garden and LongHorn Steakhouse, presents a significant barrier to new entrants due to the sheer operational complexity. Successfully managing multiple distinct restaurant concepts, each with unique culinary demands, supply chains, and customer service expectations, requires deep-seated management expertise and established systems that are not easily replicated.

This complexity is amplified by the need for continuous culinary innovation and effective marketing strategies to maintain brand relevance in a competitive market. Newcomers would face immense challenges in building the necessary infrastructure and acquiring the specialized knowledge to compete across Darden's varied brand segments simultaneously. For instance, in 2023, Darden reported over $10.5 billion in total revenue, a testament to the scale and efficiency of its established operations.

- Operational Scale: Darden's extensive network of over 1,900 company-owned restaurants provides significant economies of scale in purchasing, distribution, and marketing, which are difficult for new entrants to match.

- Brand Management Expertise: The company's long history has cultivated specialized knowledge in managing diverse restaurant brands, from casual dining to fine dining, requiring distinct operational and marketing approaches.

- Supply Chain Integration: Darden benefits from integrated supply chains that ensure quality and cost efficiency across its various brands, a complex system that new entrants would need considerable time and investment to establish.

- Talent Acquisition and Retention: Attracting and retaining skilled management and culinary talent across multiple brands is a significant undertaking, creating a further hurdle for potential new competitors.

The threat of new entrants in the casual dining sector, where Darden Restaurants operates, is generally considered moderate. Significant capital investment for real estate, equipment, and initial operations, often exceeding $1 million for a single casual dining establishment, acts as a primary barrier. Furthermore, Darden's established brand equity and customer loyalty, cultivated through decades of operation, make it challenging for newcomers to capture market share. For example, in 2023, Darden's brands like Olive Garden and LongHorn Steakhouse continued to be popular choices, demonstrating the strength of their existing customer base.

New competitors also face substantial hurdles in building efficient supply chains and navigating complex regulatory environments. Darden's established relationships with suppliers and its ability to leverage economies of scale, evidenced by its over $10.5 billion in total revenue in 2023, provide a significant cost advantage. Moreover, the time and expense associated with obtaining necessary licenses and permits, coupled with ongoing compliance with labor and health regulations, further deter potential entrants.

The operational complexity of managing multiple restaurant concepts, as Darden does, also serves as a barrier. Replicating Darden's expertise in brand management, talent acquisition, and integrated supply chains requires considerable time, investment, and specialized knowledge. This multi-faceted challenge means that while new restaurants do enter the market, few can immediately compete at the scale and efficiency of an established player like Darden Restaurants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for real estate, equipment, and initial operations. | Significant financial hurdle, requiring substantial funding. |

| Brand Loyalty | Established customer preference for well-known brands. | Difficult for new brands to attract and retain customers. |

| Supply Chain & Distribution | Need for robust, cost-effective logistics. | Complex and expensive to build, especially for perishable goods. |

| Regulatory Compliance | Adherence to health, safety, labor, and licensing laws. | Time-consuming and costly, demanding expertise. |

| Operational Complexity | Managing multiple brands and diverse operations. | Requires deep expertise and established systems, hard to replicate. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Darden Restaurants is built upon comprehensive data from Darden's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista. This blend of primary and secondary sources ensures a robust understanding of competitive dynamics, supplier power, and buyer influences within the casual dining sector.