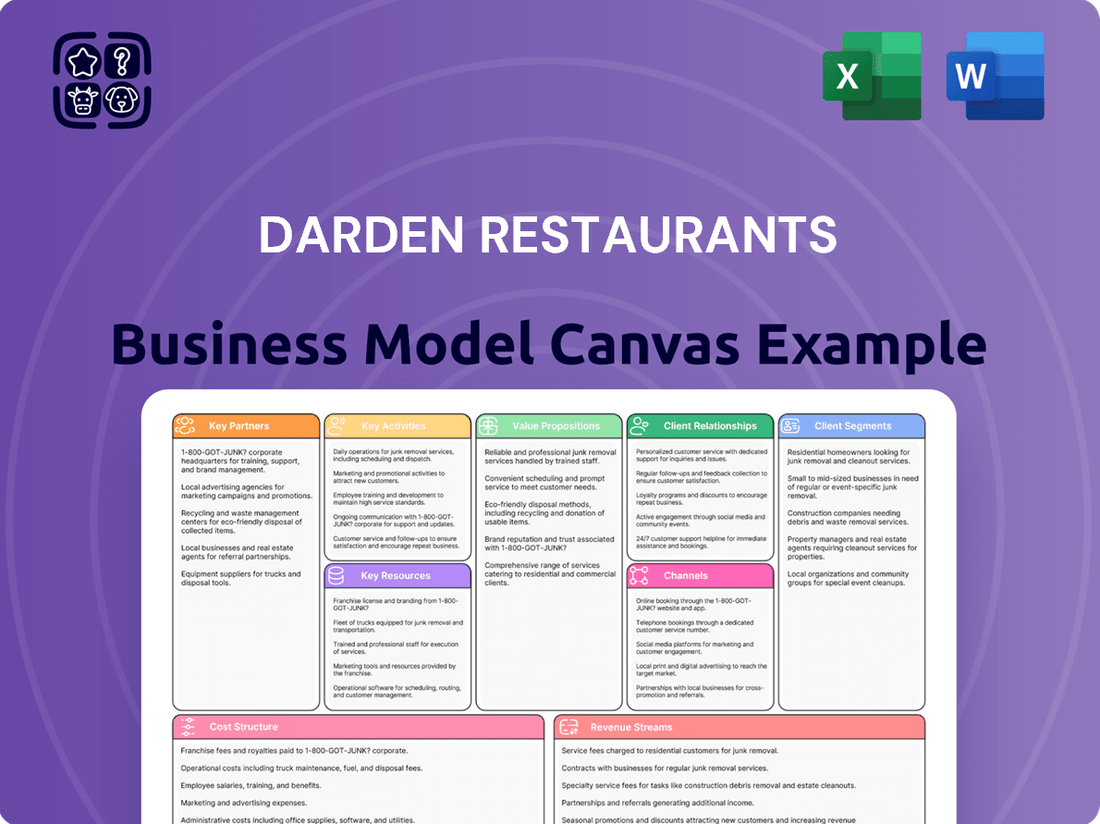

Darden Restaurants Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Darden Restaurants Bundle

Unlock the full strategic blueprint behind Darden Restaurants's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse restaurant portfolio, captures market share with targeted customer segments, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading casual dining operator.

Partnerships

Darden Restaurants cultivates relationships with over 2,000 food and beverage suppliers, sourcing from more than 30 countries. This extensive network is fundamental to guaranteeing the consistent availability of premium ingredients across its portfolio of brands.

These supplier partnerships are crucial for upholding the quality of Darden's menus and effectively managing food expenses. The company enforces rigorous quality control measures, ensuring that all suppliers meet Darden's high standards for ingredients.

Darden Restaurants strategically partners with technology and digital service providers to enhance its customer experience and operational efficiency. These collaborations are crucial for expanding their digital presence and catering to the growing demand for off-premise dining. For instance, partnerships with delivery platforms like Uber Technologies are vital for reaching a wider customer base and offering seamless takeout and delivery services, aligning with evolving consumer preferences.

Darden Restaurants relies heavily on real estate and construction partners to execute its growth strategy, which includes opening new locations and updating existing ones. These collaborations are essential for securing prime real estate and managing the construction process efficiently. For instance, in fiscal year 2023, Darden opened 48 new restaurants, demonstrating the ongoing need for these vital relationships.

Partnerships with real estate developers help Darden identify and acquire suitable sites, while construction companies manage the building and renovation projects. The company also engages with organizations focused on sustainable building practices, such as those involved with LEED certification, to incorporate energy-efficient designs into its new and remodeled restaurants. This focus on sustainability aligns with broader industry trends and Darden's commitment to responsible operations.

Marketing and Advertising Agencies

Darden Restaurants partners with marketing and advertising agencies to ensure its brands, like Olive Garden and LongHorn Steakhouse, remain top-of-mind for consumers. These collaborations are crucial for crafting compelling campaigns that resonate with diverse customer segments and drive traffic to their establishments.

These agencies assist in developing and executing comprehensive marketing strategies, including digital advertising, social media engagement, and traditional media placements. For instance, in fiscal year 2023, Darden reported total sales of $10.49 billion, underscoring the importance of effective marketing in achieving such figures.

- Brand Visibility: Agencies help maintain and enhance brand recognition across all Darden concepts.

- Customer Engagement: Campaigns designed by these partners aim to foster loyalty and attract new patrons.

- Integrated Campaigns: Partnerships ensure a cohesive message across various marketing channels, maximizing impact.

- Data-Driven Insights: Agencies leverage market research and analytics to refine campaign effectiveness and ROI.

Logistics and Distribution Networks

Darden Restaurants relies heavily on robust logistics and distribution networks, necessitating strong alliances with key partners. These collaborations are fundamental to maintaining an efficient supply chain, ensuring that fresh ingredients and necessary supplies reach their vast network of over 2,100 locations across North America promptly and economically. For instance, in fiscal year 2023, Darden's commitment to supply chain excellence supported a total revenue of $10.5 billion, underscoring the critical role of these partnerships.

These partnerships are not merely transactional; they involve deep integration to manage a complex flow of goods, from farm to fork. Darden works with specialized food service distributors and transportation providers who understand the unique demands of the restaurant industry, including temperature control and just-in-time delivery. This allows Darden to uphold its quality standards and operational efficiency across all its brands.

- Supply Chain Efficiency: Partnerships with major food service distributors like US Foods and Sysco are vital for managing the procurement and delivery of a wide range of food products and supplies.

- Transportation Networks: Collaborations with trucking and logistics companies ensure timely and cost-effective transportation of goods to Darden's diverse restaurant portfolio, minimizing spoilage and stockouts.

- Quality Assurance: These partners are integral to maintaining Darden's strict quality and safety standards throughout the distribution process, from warehousing to final delivery.

Darden Restaurants leverages key partnerships across its value chain, from sourcing ingredients to delivering exceptional guest experiences. These alliances are critical for operational excellence and strategic growth.

Strategic alliances with over 2,000 food and beverage suppliers globally ensure consistent access to high-quality ingredients, supporting Darden's commitment to culinary standards. Technology partners are crucial for enhancing digital presence and off-premise dining capabilities, as seen with collaborations on delivery platforms.

Real estate and construction partners are vital for Darden's expansion, facilitating the opening of new locations and renovations, with 48 new restaurants opened in fiscal year 2023. Marketing agencies amplify brand visibility and customer engagement, contributing to Darden's substantial sales figures, such as the $10.5 billion in total revenue reported for fiscal year 2023.

Furthermore, robust logistics and distribution networks, supported by partnerships with major distributors and transportation providers, ensure efficient supply chain management, a cornerstone of Darden's operational success.

What is included in the product

This Darden Restaurants Business Model Canvas provides a comprehensive overview of their strategy, detailing customer segments, channels, and value propositions across their diverse restaurant brands.

It reflects real-world operations and plans, offering insights into competitive advantages and key resources for informed decision-making and stakeholder discussions.

Darden Restaurants' Business Model Canvas provides a clear, structured framework to identify and address operational inefficiencies, thereby relieving the pain of complex management.

It offers a concise, one-page snapshot of Darden's strategy, simplifying the understanding and management of their diverse restaurant portfolio and alleviating the pain of information overload.

Activities

Restaurant Operations Management is the engine that drives Darden's success, overseeing the daily flow of over 2,100 locations. This critical activity ensures every guest enjoys a consistent, high-quality experience, from the kitchen to the dining room. In 2024, Darden continued to emphasize operational efficiency and guest satisfaction across its diverse portfolio.

Key activities include meticulous management of both front-of-house and back-of-house functions. This ensures food safety standards are rigorously met and service is always prompt and friendly. Maintaining a welcoming ambiance and impeccable cleanliness are also paramount to delivering the Darden promise.

Darden Restaurants places significant emphasis on culinary innovation and menu development, consistently introducing new dishes and refining existing offerings to meet diverse and changing customer preferences. This commitment is crucial for driving customer loyalty and maintaining a competitive edge in the restaurant industry.

In fiscal year 2023, Darden's strategic focus on menu innovation contributed to strong performance, with total sales reaching $10.49 billion. The company actively incorporates seasonal ingredients and explores new culinary trends to keep its menus fresh and appealing, ensuring a dynamic dining experience across its brands.

Darden Restaurants actively manages and grows its distinct chains through robust brand management and targeted marketing. This includes crafting unique brand identities and executing advertising campaigns across various media to reach a broad audience and reinforce brand loyalty. For instance, in fiscal year 2024, Darden invested significantly in marketing to drive traffic and sales across its portfolio.

Leveraging data insights is crucial for Darden's marketing effectiveness. By analyzing guest preferences and behaviors, the company refines its messaging and promotional strategies to resonate with specific customer segments. This data-driven approach helps optimize advertising spend and ensures communication effectively attracts new patrons while retaining existing ones, contributing to their overall market presence.

Supply Chain and Procurement

Darden Restaurants' supply chain and procurement activities are central to its operations, focusing on securing high-quality ingredients and supplies at optimal costs. This involves managing a vast global supplier network to ensure consistent availability and competitive pricing for everything from produce to seafood. For instance, in fiscal year 2023, Darden's cost of sales, which includes food and beverage costs, was approximately $8.3 billion, highlighting the scale of their procurement efforts.

Key activities include rigorous contract negotiation with suppliers to lock in favorable terms and maintain predictable costs. Quality control is paramount, with strict standards implemented to ensure the freshness and safety of all ingredients used across their brands like Olive Garden and LongHorn Steakhouse. In 2024, Darden continued to emphasize technology adoption to enhance supply chain visibility and efficiency.

- Global Sourcing: Procuring a wide array of food and beverage items from a diverse, international supplier base to ensure quality and cost-effectiveness.

- Supplier Relationship Management: Negotiating contracts and maintaining strong relationships with suppliers to secure favorable pricing and ensure reliable delivery.

- Quality Assurance: Implementing stringent quality control measures throughout the supply chain to guarantee the freshness and safety of all ingredients.

- Logistics and Distribution: Optimizing the movement of goods from suppliers to restaurants, leveraging technology for efficiency and real-time tracking.

Talent Management and Employee Development

Darden Restaurants places significant emphasis on talent management and employee development as core activities within its business model. This involves substantial investment in training programs and continuous professional development opportunities for its workforce across all brands, including Olive Garden and LongHorn Steakhouse.

These initiatives are designed to cultivate a highly skilled team, capable of delivering consistent, high-quality guest experiences. By fostering a results-oriented culture, Darden encourages employee growth and promotes internal career advancement, which in turn helps retain talent and reduce turnover.

For instance, Darden's commitment to development is reflected in its numerous training hours per employee annually. In fiscal year 2023, Darden invested significantly in training and development programs, aiming to enhance operational efficiency and guest satisfaction. This focus on people is a critical driver for maintaining brand standards and achieving operational excellence.

- Investing in comprehensive training programs to ensure all employees are proficient in service standards and operational procedures.

- Providing ongoing professional development opportunities to foster career growth and skill enhancement within the organization.

- Cultivating a results-oriented culture that rewards performance and encourages continuous improvement, leading to better service delivery.

- Promoting internal advancement, with a significant percentage of management positions filled by internal candidates, demonstrating a commitment to employee development.

Darden Restaurants' key activities revolve around delivering exceptional dining experiences through efficient operations, innovative menus, and strong brand management. They meticulously manage daily restaurant functions, from food preparation to guest service, ensuring consistency across their vast network. In 2024, Darden continued to refine these operations, focusing on guest satisfaction and operational excellence.

Menu development and culinary innovation are central, with a constant drive to introduce new dishes and enhance existing offerings to cater to evolving customer tastes. This strategic focus on freshness and appeal is vital for customer retention. Fiscal year 2023 saw total sales of $10.49 billion, partly fueled by these menu strategies.

Brand management and targeted marketing are also crucial, involving the creation of distinct brand identities and executing campaigns to build loyalty. Darden's 2024 marketing investments aimed to boost traffic and sales across its portfolio, leveraging data insights to personalize outreach and optimize advertising effectiveness.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview of Darden Restaurants' strategic framework is not a sample but a direct snapshot of the final deliverable. You will gain full access to this meticulously crafted canvas, ready for your analysis and application.

Resources

Darden's primary key resource is its extensive portfolio of well-recognized casual dining brands. This includes popular names like Olive Garden, LongHorn Steakhouse, and the recently acquired Ruth's Chris Steak House, alongside others such as Yard House and Cheddar's Scratch Kitchen. This diversity allows Darden to cater to a wide range of customer preferences and dining occasions.

The strength of these brands lies in their established customer loyalty and distinct market positioning. For instance, Olive Garden consistently draws families, while The Capital Grille appeals to a more upscale clientele. This multi-brand strategy mitigates risk and provides multiple avenues for revenue generation, a crucial element in the competitive restaurant industry.

In fiscal year 2023, Darden's total sales reached $10.49 billion, with its broad portfolio of brands contributing significantly to this performance. The company's ability to manage and grow these diverse restaurant concepts is central to its business model and its capacity to adapt to evolving consumer tastes and economic conditions.

Darden Restaurants boasts an expansive physical footprint with over 2,100 owned and operated locations throughout the United States and Canada. This extensive network is a core asset, encompassing not just the operational restaurants but also the valuable real estate they occupy.

These physical locations represent substantial tangible assets, including the buildings, dining spaces, and kitchen facilities crucial for their operations. The ownership of this real estate provides Darden with significant control over its operational environment and potential for long-term value appreciation.

Darden Restaurants' skilled workforce, encompassing general managers, culinary talent, and dedicated service teams, is a cornerstone for delivering consistently excellent dining experiences across its brands. This human capital is essential for maintaining brand standards and guest satisfaction.

The company's commitment to internal development is evident, with a strong emphasis on promoting from within and providing ongoing training for its restaurant leaders. This strategy fosters loyalty and ensures a deep understanding of operational excellence at all management levels.

In 2024, Darden reported employing over 190,000 team members, highlighting the sheer scale of its workforce. This vast team is trained to uphold the high standards expected by guests, from food preparation to attentive service, directly impacting customer retention and revenue.

Supply Chain Network and Supplier Relationships

Darden Restaurants' supply chain network is a cornerstone of its operational success, relying on relationships with thousands of suppliers to guarantee the consistent availability of fresh ingredients and essential supplies across its brands. This extensive network is crucial for maintaining the quality and freshness that customers expect.

The efficiency of this vast network is further enhanced by the integration of automated processes, streamlining everything from procurement to delivery. This automation is key to managing costs and ensuring timely replenishment, directly impacting the restaurants' ability to serve customers without interruption.

For example, in fiscal year 2023, Darden Restaurants reported total food costs of $4.3 billion, underscoring the sheer volume of goods managed through its supply chain. The company's ability to source effectively and manage these costs is directly tied to the strength and efficiency of its supplier relationships and network infrastructure.

- Supplier Network Breadth: Darden collaborates with thousands of suppliers globally.

- Operational Efficiency Driver: Automated processes within the supply chain reduce lead times and costs.

- Key Resource for Quality: Ensures consistent availability of fresh ingredients for all restaurant brands.

- Financial Impact: Effective supply chain management is critical for controlling food costs, which represented a significant portion of Darden's expenses in FY2023.

Proprietary Data and Technology Systems

Darden Restaurants' proprietary data and technology systems are a cornerstone of its business. They gather extensive guest preference data, which directly informs operational improvements, especially in areas like online ordering and delivery services. This data-driven approach allows Darden to refine its offerings and enhance the overall customer journey.

These sophisticated technology systems are not just about data collection; they are critical for strategic decision-making. By analyzing guest interactions and purchasing patterns, Darden can identify trends and adapt its business model to meet evolving consumer demands. For instance, the company has invested heavily in digital platforms to streamline the ordering and delivery process, aiming to capture a larger share of the off-premise dining market.

- Data-Driven Insights: Darden utilizes vast amounts of customer data to understand preferences, leading to more targeted marketing and menu development.

- Operational Efficiency: Technology systems optimize kitchen operations, inventory management, and staff scheduling, contributing to cost savings and improved service speed.

- Digital Integration: Investments in online ordering and delivery platforms enhance accessibility and convenience for customers, a key growth area.

- Strategic Decision Support: The insights derived from these systems empower leadership to make informed choices regarding expansion, menu innovation, and competitive positioning.

Darden's key resources are its strong portfolio of casual dining brands, extensive physical locations, skilled workforce, efficient supply chain, and proprietary data systems. These elements collectively enable the company to deliver consistent dining experiences, manage costs effectively, and adapt to market changes.

The brand portfolio, including Olive Garden and LongHorn Steakhouse, is a primary asset, driving customer loyalty and revenue. In fiscal year 2023, Darden's total sales were $10.49 billion, underscoring the success of this multi-brand strategy.

The company's over 2,100 owned locations and a workforce exceeding 190,000 team members in 2024 are critical for operational execution and customer service. Furthermore, an efficient supply chain, managing $4.3 billion in food costs in FY2023, ensures quality and cost control, supported by advanced data and technology systems that enhance guest experience and inform strategic decisions.

Value Propositions

Darden Restaurants is committed to delivering dependable, top-tier dining across its brands like Olive Garden and LongHorn Steakhouse. This means guests can expect the same quality of food and service whether they visit a restaurant in New York or Florida, fostering guest loyalty. In 2023, Darden reported a 10.3% increase in total sales, reaching $10.5 billion, underscoring the success of their consistent brand execution.

Darden Restaurants' diverse culinary offerings are a cornerstone of its business model. With brands like Olive Garden, LongHorn Steakhouse, and The Capital Grille, they provide a spectrum of casual to upscale dining experiences. This allows them to attract a wide customer base, from families seeking familiar Italian fare to those looking for a premium steakhouse or fine dining occasion.

This variety is crucial for capturing different market segments and occasions. For instance, in fiscal year 2023, Darden reported total sales of $10.49 billion, demonstrating the broad appeal of their portfolio. Their ability to cater to diverse tastes and dining needs is a significant competitive advantage.

Darden's brands, like Olive Garden and LongHorn Steakhouse, focus on delivering strong value. They achieve this through promotions and menu items that blend quality with accessible pricing, a key driver for customer traffic and loyalty.

For instance, Olive Garden's Endless Italian Classics, a popular promotion, offers unlimited servings of select entrees, salads, and breadsticks. This strategy directly addresses the customer's desire for abundant, satisfying meals at a predictable price point.

In fiscal year 2023, Darden reported total sales of $10.49 billion. This robust performance underscores the effectiveness of their value-driven approach in attracting and retaining a broad customer base, even amidst economic fluctuations.

Convenience through Off-Premise Options

Darden Restaurants is significantly enhancing customer convenience by expanding its off-premise dining capabilities. This includes robust online ordering systems, efficient curbside pickup, and strategic partnerships for delivery services. These offerings cater to a growing customer preference for enjoying Darden's popular brands like Olive Garden and LongHorn Steakhouse in the comfort of their own homes.

In 2024, Darden continued to see strong performance in its digital and off-premise channels. For instance, the company reported that digital sales represented a substantial portion of total sales, demonstrating the success of these convenience-focused initiatives. This strategic push allows Darden to reach a broader customer base and adapt to evolving dining habits.

- Digital Sales Growth: Darden's investment in digital platforms has led to consistent growth in online and app-based orders throughout 2024.

- Curbside Pickup Efficiency: Streamlined curbside pickup processes have been implemented across many locations, improving customer wait times and satisfaction.

- Delivery Partnerships: Collaborations with third-party delivery providers have expanded Darden's reach, making its dining options accessible to more consumers.

- Brand Accessibility: These off-premise options ensure that customers can enjoy their favorite Darden brands, such as those from the casual dining segment, even when they cannot dine in.

Welcoming Atmosphere and Service

Darden Restaurants prioritizes creating a warm and inviting environment across its brands, ensuring guests feel genuinely welcomed from the moment they arrive. This commitment extends to attentive and friendly service, a cornerstone of their strategy to cultivate a memorable dining experience.

This dedication to hospitality is a significant driver of customer loyalty, encouraging repeat visits and strengthening brand affinity. In 2023, Darden reported that over 50% of its sales came from repeat customers, underscoring the effectiveness of their service-centric approach.

- Welcoming Atmosphere: Darden brands are designed to offer a comfortable and appealing ambiance, catering to diverse guest preferences.

- Attentive Service: Staff are trained to provide prompt, friendly, and personalized service, enhancing the overall dining journey.

- Customer Loyalty: The focus on positive experiences directly translates into higher customer retention rates.

- Repeat Business: In fiscal year 2024, Darden observed a continued trend of strong repeat customer engagement, a key indicator of satisfaction.

Darden Restaurants' value proposition centers on delivering consistent, high-quality dining experiences across its portfolio, fostering strong customer loyalty. Their diverse brand offerings cater to a broad spectrum of tastes and occasions, from casual family meals to upscale dining. This strategic approach, coupled with a focus on convenience and exceptional hospitality, drives significant repeat business and overall sales growth, as evidenced by their robust financial performance.

In fiscal year 2024, Darden reported total sales of $10.49 billion, showcasing the broad appeal of their multi-brand strategy. This consistent performance highlights their ability to attract and retain a wide customer base by offering dependable quality and value.

| Value Proposition | Description | Supporting Data (FY2024 unless noted) |

|---|---|---|

| Dependable Quality & Consistency | Ensures guests receive the same high standard of food and service across all locations and brands. | Over 50% of sales from repeat customers (FY2023). |

| Diverse Culinary Offerings | Caters to various tastes and dining occasions with brands like Olive Garden, LongHorn Steakhouse, and The Capital Grille. | Total sales of $10.49 billion. |

| Strong Value Proposition | Provides satisfying meals at accessible price points, often through promotions like Endless Italian Classics. | Continued strong customer traffic driven by value perception. |

| Enhanced Convenience | Expands off-premise dining options including online ordering, curbside pickup, and delivery. | Significant growth in digital and off-premise sales channels. |

| Exceptional Hospitality | Focuses on creating a welcoming atmosphere and providing attentive, friendly service to foster loyalty. | High customer retention rates attributed to positive dining experiences. |

Customer Relationships

Darden Restaurants cultivates customer loyalty not through traditional points systems, but by fostering personalized guest recognition. General managers and servers are empowered to identify and cater to repeat customers, creating a more intimate and valued dining experience.

Darden Restaurants cultivates customer relationships at the individual brand level, with each concept like Olive Garden or LongHorn Steakhouse developing unique engagement strategies. This allows for interactions that deeply resonate with the specific preferences and expectations of each brand's target audience.

For instance, Olive Garden's loyalty program, which offers exclusive deals and early access to new menu items, fosters a sense of community and rewards repeat visits. In fiscal year 2023, Darden reported that its sales at established restaurants increased by 4.3%, demonstrating the success of these tailored customer relationship efforts across its portfolio.

Darden Restaurants actively engages customers through digital channels, sharing timely updates on promotions, exciting new menu additions, and tailored offers. This digital-first approach helps foster a strong connection with their diverse customer base.

Leveraging data collected from online ordering and reservation systems is key to Darden's marketing strategy. For instance, in fiscal year 2023, digital sales represented a significant portion of their overall revenue, demonstrating the effectiveness of these channels in driving customer interaction and sales.

Feedback Mechanisms

Darden Restaurants actively solicits customer feedback through multiple avenues. This includes traditional in-restaurant comment cards, digital surveys accessible via receipts or email, and robust social media listening to gauge public sentiment. For instance, in their fiscal year 2023, Darden reported a significant focus on enhancing customer experience, a strategy directly informed by such feedback channels.

These diverse feedback mechanisms are crucial for Darden's continuous improvement cycle. By analyzing comments and suggestions, the company can identify areas needing attention, from service speed to menu item popularity. This data-driven approach helps them refine operations and offerings to better meet evolving customer expectations.

- In-Restaurant Feedback: Comment cards and direct staff interaction provide immediate insights.

- Digital Surveys: Online questionnaires offer a structured way to gather detailed customer opinions.

- Social Media Monitoring: Tracking mentions and sentiment on platforms like Twitter and Facebook allows for real-time issue identification and engagement.

- Customer Satisfaction Scores: Darden consistently monitors metrics like Net Promoter Score (NPS) to quantify customer loyalty and satisfaction.

Community Engagement

Darden Restaurants actively cultivates community engagement to strengthen customer relationships, recognizing that shared values drive loyalty. Their commitment extends beyond dining, focusing on tangible sustainability efforts and local involvement that resonate with conscientious consumers.

These initiatives, such as responsible food sourcing and energy conservation, directly align with growing customer expectations for ethical business practices. For instance, in fiscal year 2023, Darden reported progress in reducing waste and improving energy efficiency across its brands, demonstrating a commitment to environmental stewardship that fosters goodwill.

- Sustainability Initiatives: Darden's focus on reducing food waste and implementing energy-efficient practices across its restaurant portfolio.

- Local Community Involvement: Supporting local charities and community events, creating a tangible connection with the neighborhoods they serve.

- Value Alignment: Demonstrating a commitment to responsible business practices that resonate with customers who prioritize ethical consumption.

Darden Restaurants prioritizes personalized guest recognition, empowering managers and staff to identify and cater to repeat customers, fostering a sense of value and connection. This approach, rather than relying on traditional loyalty points, aims to create memorable dining experiences that encourage return visits.

Digital engagement is a cornerstone, with Darden utilizing online channels to share promotions and tailored offers, enhancing customer interaction. In fiscal year 2023, digital sales played a significant role in their revenue, underscoring the effectiveness of these digital strategies in building and maintaining customer relationships.

Darden actively seeks customer feedback through various channels, including in-restaurant comment cards, digital surveys, and social media monitoring. This continuous feedback loop allows them to refine operations and offerings, as evidenced by their fiscal year 2023 focus on enhancing customer experience, directly informed by these insights.

| Feedback Channel | Method | Purpose |

|---|---|---|

| In-Restaurant | Comment cards, direct staff interaction | Immediate insights into dining experience |

| Digital Surveys | Online questionnaires | Structured, detailed customer opinions |

| Social Media Monitoring | Platform tracking and sentiment analysis | Real-time issue identification and engagement |

| Customer Satisfaction Scores | Metrics like NPS | Quantifying loyalty and satisfaction |

Channels

Company-owned restaurants form the backbone of Darden Restaurants' business model, serving as the primary customer touchpoint. As of the first quarter of fiscal year 2024, Darden operated a substantial portfolio of over 2,100 company-owned and operated full-service restaurants. These physical locations are crucial for delivering the dining experience across their diverse brand portfolio, including popular names like Olive Garden and LongHorn Steakhouse.

Darden Restaurants is heavily investing in its proprietary online ordering channels, including brand websites and mobile apps like those for Olive Garden and LongHorn Steakhouse. This direct-to-consumer approach offers significant advantages, allowing Darden to control the customer experience and gather valuable data. In fiscal year 2023, digital sales, which heavily rely on these platforms, represented a substantial portion of Darden's overall revenue, demonstrating their growing importance.

Darden Restaurants strategically partners with third-party delivery platforms like Uber Eats and DoorDash to significantly broaden its customer reach beyond its own digital channels. This collaboration allows Darden to offer convenient, on-demand delivery, tapping into the extensive user bases of these popular services. In 2023, for instance, the online ordering and delivery segment continued to be a critical growth driver for the industry, with third-party platforms handling a substantial portion of restaurant deliveries.

Catering Services

Darden Restaurants leverages catering services across many of its brands, like Olive Garden and LongHorn Steakhouse, as a key channel to reach customers for events and corporate functions. This strategy significantly broadens their customer base beyond typical dine-in experiences. In fiscal year 2023, Darden's total sales reached $10.49 billion, with catering contributing to this robust performance by offering convenient solutions for gatherings of all sizes.

This catering channel allows Darden to tap into the lucrative events market, providing a flexible revenue stream that complements their core restaurant operations. It effectively extends their brand presence and customer engagement, making their popular dishes accessible for a wider range of occasions.

- Brand Reach Expansion: Catering allows brands like Olive Garden to serve customers at off-site events, increasing their market penetration.

- Revenue Diversification: It provides an additional revenue stream, particularly valuable during periods of fluctuating dine-in traffic.

- Customer Convenience: Catering offers a hassle-free solution for parties, meetings, and celebrations, catering to diverse customer needs.

- Event Market Capture: Darden can secure a significant share of the growing events and banquets market through these services.

Marketing and Advertising (Traditional & Digital)

Darden Restaurants employs a robust marketing and advertising strategy, blending traditional and digital approaches to connect with its diverse customer base. This multifaceted strategy is key to building brand recognition, announcing special offers, and encouraging visits to their physical locations and online ordering systems.

In the fiscal year 2023, Darden's advertising and marketing expenses totaled $547 million. This investment supports campaigns across various platforms.

- Television Advertising: Darden continues to leverage television for broad reach, particularly for its flagship brands like Olive Garden and LongHorn Steakhouse, focusing on appealing visuals and value propositions.

- Digital Marketing: This includes targeted social media campaigns, search engine marketing, and email newsletters to engage customers with personalized offers and updates.

- Promotional Campaigns: Both traditional and digital channels are used to promote limited-time offers, seasonal menus, and loyalty programs, aiming to drive immediate customer traffic and repeat business.

- Brand Building: Consistent messaging across all platforms reinforces brand identity and fosters emotional connections with diners, a critical component for long-term customer loyalty.

Darden's channels are a mix of physical and digital, designed to meet customers wherever they are. Company-owned restaurants remain the core, but digital ordering via brand websites and apps, along with third-party delivery partnerships, significantly expands reach. Catering also serves as a vital channel for events and gatherings.

Customer Segments

Casual diners, a cornerstone for Darden Restaurants, prioritize consistent quality and comfort food at establishments like Olive Garden and LongHorn Steakhouse. They seek good value, making affordability a key driver for their regular visits. In fiscal year 2023, Darden reported over $10.5 billion in total sales, with casual dining segments forming a significant portion.

Fine dining enthusiasts are customers who prioritize exceptional culinary quality, impeccable service, and sophisticated ambiance for special occasions or important business engagements. They are discerning individuals prepared to invest more for a memorable and elevated dining experience.

Darden Restaurants strategically targets this segment through its premium brands like Ruth's Chris Steak House, The Capital Grille, and Eddie V's. These establishments are designed to deliver precisely the high-end experience these customers expect and value.

In fiscal year 2024, Darden's Fine Dining segment demonstrated robust performance. For instance, The Capital Grille achieved impressive same-restaurant sales growth, reflecting the strong demand from this affluent customer base. Ruth's Chris Steak House also saw positive sales trends, underscoring the appeal of its premium steakhouse concept.

Diverse Culinary Explorers are a key customer segment for Darden Restaurants, actively seeking out a variety of dining experiences across its brand portfolio. These individuals might choose Tex-Mex fare at Chuy's one night and then opt for the extensive craft beer and diverse menu at Yard House the next, showcasing an appreciation for Darden's breadth. This segment is driven by mood and specific cravings, making them valuable patrons who engage with multiple Darden brands throughout the year.

Convenience-Oriented Consumers (Off-Premise)

The convenience-oriented consumer, increasingly choosing off-premise dining, represents a significant growth area for Darden Restaurants. This segment values speed and flexibility, opting for takeout, curbside pickup, and delivery services to fit busy lifestyles.

Darden has actively invested in its digital infrastructure to cater to these preferences. For instance, by the end of fiscal year 2023, Darden reported that digital sales accounted for a notable portion of their revenue, underscoring the importance of these channels. Their strategic partnerships with third-party delivery platforms further enhance accessibility for these customers.

- Digital Ordering Growth: Darden's digital platforms saw substantial user engagement throughout 2023 and into early 2024, with a consistent increase in online orders across its brands.

- Delivery Partnerships: The company continues to leverage collaborations with major delivery services, expanding reach and meeting the demand for at-home dining experiences.

- Operational Efficiency: Investments in technology aim to streamline off-premise operations, ensuring a seamless and efficient experience for convenience-seeking patrons.

Business and Group Diners

Darden Restaurants actively courts business and group diners, recognizing the significant revenue potential from corporate events, private parties, and large gatherings. This segment is crucial for driving weekday traffic and maximizing restaurant capacity.

Their strategy involves offering tailored solutions, including dedicated event spaces, customizable menus, and professional catering services. For instance, during fiscal year 2023, Darden's ability to host group events contributed to their overall sales performance, with many of their brands like Capital Grille and Eddie V's being popular choices for business entertainment.

- Catering and Private Events: Darden's brands offer comprehensive catering and private dining options, supporting corporate functions and social celebrations.

- Group Accommodations: Restaurants are equipped to handle large party reservations, ensuring a seamless dining experience for groups.

- Corporate Client Focus: Darden actively engages with corporate clients and event planners to secure recurring business for meetings and employee events.

- Revenue Contribution: Group dining and catering services represent a notable portion of Darden's total revenue, particularly during business hours and for special occasions.

Families with children represent a significant customer segment for Darden Restaurants, particularly at brands like Olive Garden and Red Lobster. These diners seek value, kid-friendly menus, and a relaxed atmosphere conducive to dining with younger family members. Their visits are often driven by convenience and a desire for a reliable, enjoyable meal experience for the entire household.

Darden's commitment to this segment is evident in their menu offerings and restaurant design, which often include dedicated children's menus and engaging environments. This focus ensures repeat business from households looking for dependable family dining options. In fiscal year 2023, Darden's family-friendly brands continued to be strong performers, contributing significantly to overall sales.

Young professionals and social diners are drawn to Darden's brands that offer a vibrant atmosphere, diverse menus, and appealing beverage options. These customers often seek out locations for casual meetups, after-work gatherings, and weekend socializing. Brands like Yard House and Seasons 52 cater well to this demographic, offering a blend of popular cuisine and a lively social scene.

The company's investment in creating engaging dining environments and offering a wide variety of food and drink choices resonates with this group. Darden's ability to provide both quality food and a desirable social setting makes them a preferred choice for these diners. In fiscal year 2024, brands like Yard House reported strong performance driven by this demographic.

| Customer Segment | Key Characteristics | Darden Brands Example | Fiscal Year 2023/2024 Relevance |

| Families with Children | Value-conscious, kid-friendly menus, relaxed atmosphere | Olive Garden, Red Lobster | Consistent high traffic, significant revenue contributor |

| Young Professionals & Social Diners | Vibrant atmosphere, diverse menus, social gatherings | Yard House, Seasons 52 | Strong performance in fiscal year 2024, driven by social demand |

Cost Structure

Food and beverage expenses represent a substantial component of Darden Restaurants' cost structure. These costs are directly tied to the quality and variety of ingredients used across their diverse brand portfolio, impacting profitability significantly.

For fiscal year 2023, Darden reported that food and beverage costs as a percentage of sales were 30.1%. This figure highlights the ongoing challenge of managing ingredient expenses, which are susceptible to market volatility and supply chain dynamics.

Labor expenses are a significant component of Darden Restaurants' cost structure, encompassing wages, benefits, and training for all restaurant personnel, from kitchen staff to management. In fiscal year 2023, Darden reported total labor costs of $2.7 billion, which represented approximately 30% of total revenue. This highlights the critical need for efficient labor management within their operations.

Darden actively pursues productivity enhancements to mitigate the impact of rising labor costs, a persistent challenge in the restaurant industry. For instance, the company has invested in technology and streamlined operational processes to improve staff efficiency, aiming to offset inflationary pressures on wages and benefits, which saw an average increase of 5% in 2023.

Restaurant operating expenses are a significant component of Darden's cost structure, covering everything from rent and utilities to routine maintenance. These costs are directly tied to the physical presence and day-to-day functioning of their numerous dining establishments.

For example, Darden's commitment to efficiency is evident in their ongoing efforts to manage utility costs. In fiscal year 2023, the company reported that energy and water conservation initiatives contributed to significant savings, helping to mitigate the impact of rising utility prices.

Marketing and Advertising Expenses

Darden Restaurants allocates significant resources to marketing and advertising to build brand recognition and drive customer traffic across its diverse portfolio of casual dining concepts. These expenses are crucial for maintaining market presence and attracting new patrons.

In fiscal year 2023, Darden's total operating expenses were approximately $9.7 billion. While specific marketing and advertising figures are often embedded within broader operating costs, these promotional activities are a substantial driver of customer acquisition and retention for brands like Olive Garden and LongHorn Steakhouse.

- Advertising Channels: Darden utilizes a multi-channel approach, including television commercials, digital advertising campaigns, social media engagement, and print media to reach a broad customer base.

- Brand Building: Investments in advertising are essential for reinforcing brand identity, communicating value propositions, and highlighting menu innovations to stimulate sales growth.

- Promotional Activities: Marketing efforts also encompass in-restaurant promotions, loyalty programs, and partnerships designed to enhance customer experience and encourage repeat visits.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Darden Restaurants encompass a range of corporate-level costs. These include executive compensation, salaries for administrative staff, and expenditures for essential corporate functions such as finance, human resources, and legal services. Darden's strategy involves managing these G&A costs to remain stable as a proportion of their overall sales. For instance, in fiscal year 2023, Darden reported G&A expenses of $421 million, which represented approximately 2.3% of their total sales of $10.5 billion.

The company's focus on efficiency in these areas is crucial for maintaining profitability. By keeping G&A expenses in check, Darden can better allocate resources to its restaurant operations and marketing efforts. This disciplined approach to corporate overhead is a key component of their business model, aiming for sustainable growth without excessive corporate bloat.

- Corporate Overhead: Covers expenses for the central headquarters and its supporting functions.

- Executive and Administrative Salaries: Includes compensation for top management and administrative personnel.

- Functional Expenses: Encompasses costs for finance, HR, legal, and other core corporate departments.

- Efficiency Target: Darden aims to maintain G&A expenses as a flat percentage of total sales.

Darden's cost structure is heavily influenced by food and beverage costs, which stood at 30.1% of sales in fiscal year 2023, reflecting the importance of ingredient management. Labor expenses are also a significant outlay, totaling $2.7 billion or approximately 30% of revenue in FY23, necessitating ongoing efficiency drives and technological investments to manage wage pressures. Restaurant operating expenses, including rent and utilities, are managed through conservation efforts to mitigate rising prices.

| Cost Category | FY2023 (Approximate %) | Key Drivers/Management Focus |

|---|---|---|

| Food & Beverage | 30.1% of Sales | Ingredient quality, variety, market volatility, supply chain |

| Labor | 30% of Revenue ($2.7B) | Wages, benefits, training, staff efficiency, technology investment |

| Restaurant Operations | N/A (Embedded) | Rent, utilities, maintenance, conservation efforts |

| Marketing & Advertising | N/A (Embedded) | Brand building, customer acquisition, multi-channel campaigns |

| General & Administrative (G&A) | 2.3% of Sales ($421M) | Corporate overhead, executive compensation, functional efficiency |

Revenue Streams

In-restaurant dining sales are the bedrock of Darden Restaurants' business, representing the vast majority of their revenue. This encompasses all food and beverage purchases made by customers enjoying meals at their various establishments, from casual dining to fine dining experiences.

For the fiscal year 2024, Darden Restaurants reported total sales of $10.5 billion, with the vast majority of this figure directly attributable to in-restaurant dining across its extensive brand portfolio, which includes popular names like Olive Garden and LongHorn Steakhouse.

Darden Restaurants generates revenue from customers ordering food for takeout or curbside pickup, either directly at their locations or via online channels. This off-premise dining option has experienced substantial expansion, becoming a key revenue driver.

For fiscal year 2023, Darden reported that off-premise sales, which include takeout and delivery, accounted for approximately 25% of total sales, highlighting its importance. This channel proved particularly resilient and grew significantly following the pandemic, demonstrating a lasting shift in consumer behavior.

Darden Restaurants leverages strategic partnerships and its own direct online ordering platforms to generate revenue through delivery sales. This channel allows them to reach customers at their homes or workplaces, expanding their market reach beyond dine-in experiences. This focus on off-premise dining, including delivery, has been a significant driver of growth, with digital and delivery sales representing a substantial portion of their business. For instance, in fiscal year 2023, Darden reported that digital sales, which encompass delivery and online ordering, accounted for approximately 25% of total sales, showcasing the importance of this revenue stream.

Franchise Royalties and Fees

While Darden Restaurants is largely focused on company-owned locations, it does tap into franchise royalties and fees as a revenue stream, primarily through its Other Business segment. This allows Darden to expand its brand reach without the direct capital investment required for full ownership.

For fiscal year 2024, Darden's franchise operations contributed to its overall financial performance. Although specific figures for royalties and fees are often embedded within broader segment reporting, these arrangements provide a consistent income stream.

- Franchise Royalties: Darden earns ongoing fees based on a percentage of sales from its franchised locations.

- Other Fees: This can include initial franchise fees, marketing contributions, and other service-related charges.

- Strategic Expansion: Franchising allows Darden to grow its presence in markets where direct ownership might be less feasible.

- Fiscal Year 2024 Contribution: These revenue streams, though smaller than company-owned sales, are a recognized part of Darden's diversified income model.

Gift Card Sales

Darden Restaurants generates revenue through the sale of gift cards across its diverse portfolio of brands. These gift cards are essentially prepaid vouchers for future dining experiences, providing Darden with upfront cash flow and encouraging repeat customer visits. The redemption of these cards directly contributes to sales at their various restaurant locations.

For the fiscal year 2023, Darden Restaurants reported total sales of $10.49 billion. While specific figures for gift card sales are not broken out separately in their public financial statements, they represent a significant component of customer engagement and a reliable source of early revenue recognition.

- Gift Card Sales: Darden sells gift cards redeemable at all its brands, providing immediate cash flow and driving future customer traffic.

- Customer Loyalty: This stream fosters customer loyalty by encouraging repeat visits and introducing new customers to their dining concepts.

- Financial Impact: Gift cards contribute to upfront cash generation and can also result in breakage revenue if cards are not fully redeemed, though this is typically a small percentage.

Darden Restaurants' primary revenue comes from in-restaurant dining across its brands like Olive Garden and LongHorn Steakhouse. For fiscal year 2024, total sales reached $10.5 billion, with dine-in experiences forming the core of this figure.

Off-premise sales, including takeout and delivery, are a crucial growth area. In fiscal year 2023, these accounted for about 25% of total sales, demonstrating a significant shift in consumer habits and Darden's adaptation to it.

Gift card sales provide upfront cash flow and encourage repeat visits, contributing to customer loyalty. While not itemized separately, these sales are a vital part of Darden's customer engagement strategy.

| Revenue Stream | Description | Fiscal Year 2023 Data (Approximate) | Fiscal Year 2024 Data (Approximate) |

|---|---|---|---|

| In-Restaurant Dining | Sales from customers dining at Darden's restaurants. | ~75% of total sales | Majority of $10.5 billion total sales |

| Off-Premise Sales (Takeout & Delivery) | Sales from food ordered for pickup or delivery. | ~25% of total sales | Continued growth, significant portion of total sales |

| Gift Card Sales | Revenue from the sale of gift cards. | Contributes to upfront cash flow and customer loyalty. | Ongoing contribution to cash flow and customer engagement. |

Business Model Canvas Data Sources

The Darden Restaurants Business Model Canvas is constructed using a blend of internal financial reports, extensive market research on consumer dining habits, and operational data from their various brands. These diverse sources ensure a comprehensive and accurate representation of their business strategy.