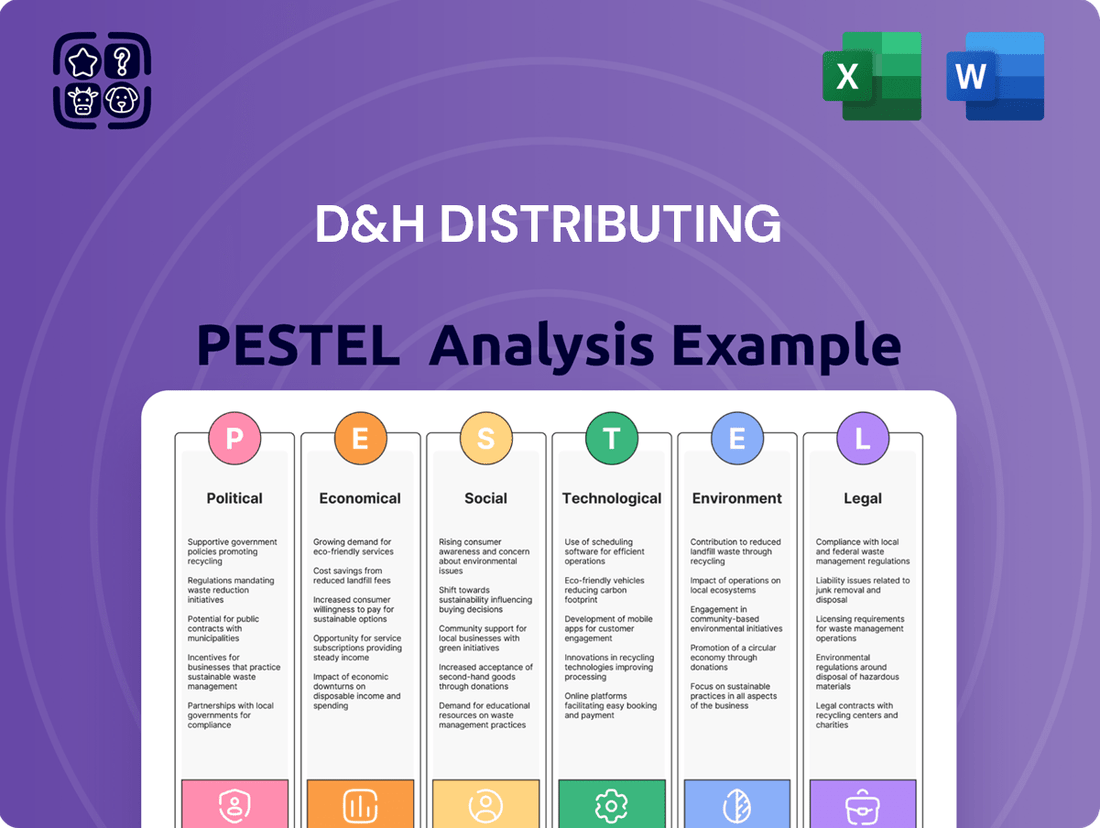

D&H Distributing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D&H Distributing Bundle

Unlock the strategic advantages of D&H Distributing's market position with our thorough PESTLE analysis. We dissect the political, economic, social, technological, legal, and environmental factors influencing their operations, providing you with actionable intelligence to refine your own business strategy. Don't just react to market shifts; anticipate them. Get the full PESTLE analysis now and gain a critical competitive edge.

Political factors

Government trade policies and tariffs directly influence D&H Distributing's operational landscape. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, aimed to modernize trade rules for North America. Any adjustments or new tariffs on IT and consumer electronics, whether imports from Asia or exports within North America, can significantly alter D&H's supply chain expenses and the availability of goods.

Changes in tariff rates can have a swift impact on product pricing. For example, a 25% tariff on certain Chinese goods, previously imposed by the US, could increase the cost of electronics D&H imports, potentially forcing price adjustments for their retail partners. This necessitates careful inventory management and strategic sourcing to mitigate margin erosion.

Governments worldwide are increasingly scrutinizing technology, impacting how businesses operate and what tech solutions are in demand. For D&H Distributing, this means staying ahead of evolving regulations concerning data privacy, cybersecurity, and the use of emerging technologies. For instance, the European Union's General Data Protection Regulation (GDPR) continues to shape data handling practices globally, influencing the types of software and hardware partners require.

Cybersecurity mandates are becoming more stringent, with many governments implementing or strengthening requirements for businesses to protect critical infrastructure and sensitive data. In the US, the Cybersecurity and Infrastructure Security Agency (CISA) regularly updates its guidance and best practices, which can influence the security solutions D&H's partners need to offer their clients. This regulatory environment directly affects the market for network security products and managed security services.

Government procurement preferences can also steer market demand. Policies favoring domestically produced technology or specific security certifications can create opportunities or challenges for D&H and its vendor partners. For example, a government initiative to boost domestic semiconductor manufacturing could shift the supply chain dynamics for computing hardware.

Political stability in key manufacturing hubs, particularly in Asia, directly impacts D&H Distributing's ability to secure inventory. For instance, ongoing trade policy shifts and regional conflicts, such as those in Eastern Europe, can create significant logistical hurdles and increase shipping costs, as seen with the 2024 fluctuations in global shipping rates which saw container prices surge by an average of 150% on major East-West routes due to capacity constraints and geopolitical risks.

Geopolitical tensions can also dampen consumer and business confidence, leading to reduced spending on technology. This ripple effect can slow down sales for D&H and its partners. For example, heightened global uncertainty in 2024 contributed to a cautious approach in business capital expenditures, with many companies delaying non-essential tech upgrades, impacting the overall demand D&H experiences.

Government Spending on IT Infrastructure

Government initiatives and spending on IT infrastructure, particularly in areas like education technology and public sector digital transformation, create substantial market opportunities for D&H Distributing's reseller partners. For instance, the US government's commitment to modernizing federal IT systems, as highlighted by the ongoing implementation of the Federal Information Technology Acquisition Reform Act (FITARA) reforms, aims to improve efficiency and security, driving demand for updated hardware and software solutions. This increased public investment directly fuels the need for the very products D&H supplies, from networking equipment to cloud services.

Understanding these government spending priorities is crucial for D&H to effectively tailor its product portfolio and provide targeted support to its partners. By aligning with initiatives such as the Biden-Harris administration's focus on cybersecurity and digital equity, D&H can better equip its resellers to capitalize on these government contracts. For example, the Infrastructure Investment and Jobs Act, enacted in 2021, allocated significant funds towards broadband expansion and digital infrastructure upgrades, presenting a clear avenue for D&H's partners to secure business.

- Increased Government IT Spending: The US federal government's IT budget is projected to reach over $115 billion in fiscal year 2024, with a significant portion dedicated to modernization and cybersecurity efforts.

- Education Technology Focus: Federal programs like the E-Rate program continue to support technology deployment in schools and libraries, fostering demand for educational hardware and software solutions.

- Digital Transformation Initiatives: Public sector digital transformation projects are accelerating, with agencies actively seeking solutions for cloud migration, data analytics, and improved citizen services.

Antitrust and Competition Policies

Antitrust and competition policies are increasingly shaping the technology distribution landscape, directly influencing companies like D&H Distributing. Regulatory bodies are keenly observing market consolidation and dominant practices within the sector, aiming to foster a level playing field for all participants. For instance, in 2024, the US Federal Trade Commission (FTC) continued its robust enforcement of antitrust laws, examining potential monopolistic behaviors across various industries, including those that impact technology supply chains. This heightened scrutiny means D&H must be particularly mindful of how its growth strategies, including potential mergers or acquisitions, align with these regulations.

Navigating these complex legal frameworks is crucial for D&H Distributing's ability to expand its operations and maintain strong partnerships. Failure to comply with antitrust regulations could result in significant fines or operational restrictions, hindering market penetration and innovation. The company's success hinges on its capacity to operate within these guidelines while simultaneously pursuing strategic growth and fostering trust with both its manufacturing partners and its extensive network of resellers. By proactively addressing competition concerns, D&H can solidify its market position and ensure sustainable growth in the dynamic tech distribution market.

- Increased antitrust enforcement globally: Many countries, including the US and EU, have intensified their focus on tech sector competition in 2024 and projections for 2025.

- Potential impact on M&A activity: D&H Distributing's acquisition plans could face more rigorous review, potentially delaying or blocking deals that could be perceived as anti-competitive.

- Focus on platform dominance: Regulators are scrutinizing companies that hold significant market power, which could affect how large distributors interact with manufacturers and smaller resellers.

Government trade policies, such as tariffs and trade agreements like the USMCA, directly impact D&H Distributing's costs and product availability, with tariff adjustments in 2024 affecting electronics imports. Regulatory scrutiny on data privacy and cybersecurity, exemplified by GDPR, influences the demand for specific tech solutions D&H distributes.

Government procurement, including initiatives like the US federal government's IT modernization efforts, creates significant market opportunities for D&H's partners, with the federal IT budget exceeding $115 billion in FY2024. Antitrust enforcement, intensified globally in 2024-2025, could impact D&H's M&A strategies and market interactions.

What is included in the product

This D&H Distributing PESTLE analysis offers a comprehensive examination of how Political, Economic, Social, Technological, Environmental, and Legal factors impact the company's operations and strategic positioning.

It provides actionable insights for identifying market opportunities and mitigating potential risks within the IT distribution sector.

The D&H Distributing PESTLE analysis provides a clear, summarized version of external factors, offering easy referencing during meetings and helping to alleviate the pain point of information overload.

Economic factors

The overall health of the North American economy significantly impacts D&H Distributing's sales, as it directly affects business and consumer spending on IT and electronics. For instance, in 2024, projections for US GDP growth hovered around 2.5%, indicating a generally positive environment for technology investments. Conversely, a slowdown or recessionary period, like the mild contraction experienced in some sectors in early 2023, can lead to delayed purchases and dampened demand for D&H's products.

D&H Distributing's performance is intrinsically linked to these macroeconomic cycles. During economic expansions, businesses tend to increase their IT spending for upgrades and growth initiatives, boosting sales for distributors like D&H. However, during economic downturns, companies often cut back on discretionary spending, including technology, which directly reduces sales volumes for D&H.

Rising inflation in 2024 and projected into 2025 directly impacts D&H Distributing by increasing operational expenses. Costs for fuel, warehousing, and wages are likely to climb, potentially reducing the company's profit margins if these increases cannot be fully passed on to customers. For example, the U.S. CPI was 3.4% in April 2024, indicating persistent inflationary pressures.

Higher interest rates, a common response to inflation, also present challenges. D&H Distributing may face increased borrowing costs for managing its extensive inventory, impacting its working capital. Furthermore, higher rates can deter D&H's value-added resellers (VARs) and retail partners from taking on new debt for expansion or technology upgrades, indirectly affecting sales volume.

Consumer confidence, as measured by the Conference Board Consumer Confidence Index, reached 102.0 in May 2024, a slight dip from April's revised 104.7, indicating a cautious but generally stable outlook. This sentiment directly influences discretionary spending on technology, a key area for D&H Distributing's partners. Similarly, business confidence, reflected in surveys like the NFIB Small Business Optimism Index, showed a reading of 89.7 in April 2024, suggesting ongoing concerns about economic conditions, which can temper IT investment.

When consumers feel secure about their financial future and job prospects, they are more likely to upgrade personal electronics or invest in home office technology, directly boosting sales for D&H's retail and e-commerce clients. Conversely, economic uncertainty or rising inflation can cause consumers to delay purchases of non-essential tech items, leading to slower sales cycles for D&H's product lines.

Businesses also adjust their technology spending based on confidence levels. High confidence encourages capital expenditures on new IT infrastructure, software, and hardware, creating significant demand for distributors like D&H. However, during periods of low business confidence, companies tend to cut back on discretionary IT projects and focus on maintaining existing systems, which can reduce the volume of new sales for D&H's B2B channels.

Global Supply Chain Costs and Efficiency

Global supply chain costs are a significant concern for D&H Distributing. Fluctuations in international shipping rates, which saw considerable volatility in 2023 and early 2024 due to geopolitical events and demand shifts, directly impact the cost of goods. For instance, the Drewry World Container Index, a benchmark for global shipping prices, experienced a notable surge in late 2023 and continued to show upward pressure in early 2024, impacting the landed cost of electronics and other products D&H distributes.

The efficiency of D&H's internal supply chain operations, encompassing warehousing and last-mile delivery, is paramount for maintaining competitive pricing and timely fulfillment. In 2024, many logistics companies are investing in automation and route optimization software to combat rising labor and fuel costs. D&H's ability to manage these internal efficiencies will be a key differentiator.

External economic shocks, such as potential energy crises or sudden spikes in fuel prices, pose a direct threat to D&H's operational costs. For example, a sustained increase in diesel prices, which impacts transportation expenses, could erode profit margins if not effectively passed on or absorbed through greater efficiency. The International Energy Agency (IEA) has projected continued volatility in oil markets through 2025, underscoring this risk.

- Global shipping costs: The Drewry World Container Index averaged around $1,700 per 40ft container in early 2024, a significant increase from pandemic lows but still subject to rapid change.

- Fuel prices: Diesel prices in major transportation hubs in the US and Europe have seen fluctuations, with average prices in the $3.50-$4.50 per gallon range in early 2024, impacting freight costs.

- Manufacturing expenses: Raw material costs, particularly for semiconductors and other electronic components, continue to be influenced by global demand and production capacity, affecting D&H's procurement expenses.

- Logistics efficiency: Companies are increasingly adopting AI-driven logistics platforms, with the global logistics market projected to grow significantly, indicating a push for greater operational efficiency.

Currency Exchange Rates

Currency exchange rates significantly impact D&H Distributing, a company that sources products globally and operates across North America. Fluctuations between the US dollar, Canadian dollar, and other major currencies directly affect the cost of imported goods. For instance, a stronger US dollar can make goods sourced from countries with weaker currencies cheaper, potentially boosting D&H's margins or allowing for more competitive pricing. Conversely, a weaker US dollar would increase the cost of these imports.

These currency movements are not just theoretical; they have tangible financial consequences. In 2024, the US dollar experienced volatility against several major currencies. For example, the USD/CAD exchange rate saw periods of strength and weakness, impacting D&H's Canadian operations and cross-border trade. Similarly, shifts in the value of the Euro or Chinese Yuan could alter the landed cost of electronics and other goods distributed by the company.

- Impact on Cost of Goods: A stronger USD relative to the Canadian dollar or Euro can lower the cost of imported inventory for D&H.

- Pricing Strategy: Exchange rate volatility necessitates flexible pricing strategies to maintain competitiveness in different markets.

- Profitability: Unfavorable currency movements can erode profit margins on international sales or increase the cost of goods sold.

- 2024 Trends: Anticipated interest rate differentials between the US and other major economies in 2024 could continue to drive currency fluctuations impacting D&H's international sourcing and sales.

Economic factors significantly shape D&H Distributing's operational landscape, influencing everything from consumer spending to the cost of goods. In 2024, a projected US GDP growth of around 2.5% generally supported IT investments, though inflationary pressures, with the US CPI at 3.4% in April 2024, increased operational costs. Higher interest rates, a consequence of inflation, also posed challenges by increasing borrowing costs for inventory and potentially slowing partner investment.

Consumer and business confidence levels directly correlate with technology purchasing decisions. For example, the Conference Board Consumer Confidence Index at 102.0 in May 2024 indicated cautious optimism, impacting discretionary tech spending. Similarly, the NFIB Small Business Optimism Index at 89.7 in April 2024 suggested ongoing business concerns that could temper IT investments, directly affecting D&H's sales channels.

Global economic trends, including supply chain costs and currency fluctuations, are critical. The Drewry World Container Index, averaging around $1,700 per 40ft container in early 2024, highlighted the impact of shipping costs. Currency volatility, such as the USD/CAD exchange rate movements in 2024, also directly affected the cost of imported goods and D&H's international profitability.

| Economic Factor | 2024/2025 Data/Trend | Impact on D&H Distributing |

|---|---|---|

| US GDP Growth Projection | ~2.5% (2024) | Supports IT investment and consumer spending. |

| US CPI (Inflation) | 3.4% (April 2024) | Increases operational costs (fuel, wages); potential margin pressure. |

| Interest Rates | Elevated (Response to inflation) | Higher borrowing costs for inventory; may slow partner investment. |

| Consumer Confidence Index | 102.0 (May 2024) | Influences discretionary tech spending. |

| NFIB Small Business Optimism | 89.7 (April 2024) | Affects business IT investment and purchasing. |

| Global Shipping Costs (Drewry Index) | ~$1,700/40ft container (early 2024) | Impacts cost of goods sold for imported electronics. |

| USD/CAD Exchange Rate | Volatile (2024) | Affects cost of Canadian imports and cross-border trade. |

Preview Before You Purchase

D&H Distributing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for D&H Distributing provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping their business landscape.

Sociological factors

The shift towards remote and hybrid work models, accelerated by events in 2020, continues to reshape the technology landscape. By early 2025, an estimated 30% of the U.S. workforce is expected to be working remotely at least part-time, driving sustained demand for collaboration software and home office peripherals. D&H Distributing's ability to supply these evolving needs directly impacts its relevance to businesses and educational institutions equipping their distributed workforces.

Digital learning environments are also a significant driver, with many universities and K-12 schools adopting blended learning approaches. This necessitates ongoing investment in laptops, tablets, and network infrastructure for students and educators. D&H Distributing's channel partners are crucial in meeting this demand, ensuring educational institutions have the technology to support flexible learning models.

Growing digital literacy fuels demand for D&H Distributing's products. In 2024, a significant portion of the global population, estimated at over 5.3 billion people, are internet users, highlighting a broad base for technology adoption. This increasing comfort with digital tools directly translates into a larger addressable market for D&H's partners, from consumer electronics to business IT solutions.

The accelerating adoption of new technologies by both businesses and consumers is a key driver for D&H. For instance, the global PC market saw shipments increase by 8.1% in the first quarter of 2024 compared to the previous year, indicating a strong resurgence and demand for hardware. This trend means more businesses are upgrading their infrastructure and consumers are seeking the latest devices, expanding the sales opportunities D&H can facilitate.

Consumer demand for smart home devices and Internet of Things (IoT) enabled products is rapidly increasing. In 2024, the global smart home market was valued at over $100 billion, with projections showing significant growth through 2025. This trend directly impacts D&H Distributing by shaping the product mix retailers expect, pushing for more connected personal electronics and integrated solutions.

This evolving preference for interconnected ecosystems means D&H must strategically curate its inventory. For instance, sales of smart speakers and connected security cameras saw double-digit growth in 2024. By stocking these in-demand items, D&H supports its retail partners in capturing market share and meeting consumer expectations for seamless, integrated technology experiences.

Cybersecurity Awareness and Data Privacy Concerns

Growing public and business awareness of cyber threats and data privacy is a major driver for the cybersecurity market. This heightened concern directly fuels demand for secure hardware, advanced security software, and services that ensure regulatory compliance. For instance, a 2024 report indicated that 75% of consumers are more concerned about their data privacy than they were a year prior, a trend expected to continue through 2025.

D&H Distributing is positioned to capitalize on this trend by facilitating the distribution of these essential security technologies. By supplying its channel partners with the necessary products and solutions, D&H enables them to offer robust protection to end-users, safeguarding their digital assets. This creates a substantial and growing market segment for the company.

- Cybersecurity Market Growth: The global cybersecurity market was valued at approximately $217 billion in 2024 and is projected to reach over $300 billion by 2027, reflecting the increasing societal demand for protection.

- Data Privacy Regulations: Stricter data privacy regulations, such as GDPR and CCPA, continue to influence business practices and technology adoption, creating a need for compliance-oriented solutions that D&H can supply.

- Consumer Trust: A recent survey found that 68% of consumers are more likely to do business with companies that demonstrate strong data privacy practices, highlighting the societal importance of these concerns.

Social Impact and Brand Perception

Consumers and businesses alike are placing a higher premium on a company's social responsibility and ethical conduct. This trend directly impacts purchasing decisions, making a company's commitment to social causes a significant factor in its market appeal. D&H Distributing's efforts in corporate social responsibility, particularly its diversity, equity, and inclusion (DEI) programs, are crucial for shaping its brand perception among partners and potential employees.

A strong positive social impact can significantly bolster D&H Distributing's reputation, leading to more robust relationships across the industry. For instance, companies with strong ESG (Environmental, Social, and Governance) scores often see better financial performance and investor confidence. While specific 2024/2025 data for D&H's social impact metrics isn't publicly detailed, the broader industry trend shows that companies actively engaging in community support and ethical labor practices, such as those highlighted in the 2024 Global CSR Report, are experiencing enhanced brand loyalty.

- Growing Consumer Demand for Ethical Brands: Studies in late 2024 indicated that over 60% of consumers consider a company's social and environmental impact when making purchasing choices.

- Impact of DEI on Talent Acquisition: In 2025, job seekers, particularly millennials and Gen Z, are prioritizing workplaces with demonstrated commitment to diversity and inclusion, with over 70% stating it influences their employment decisions.

- Brand Reputation and Partnerships: A positive social footprint can lead to preferential treatment from business partners and a stronger competitive edge, as seen in the 2024 supply chain resilience reports where ethical sourcing was a key differentiator.

Societal expectations regarding corporate responsibility and ethical operations are increasingly influencing consumer and business purchasing decisions. By early 2025, over 60% of consumers reported considering a company's social and environmental impact, a trend D&H Distributing must acknowledge. Furthermore, a company's commitment to diversity, equity, and inclusion (DEI) is becoming paramount for talent acquisition, with over 70% of job seekers in 2025 prioritizing inclusive workplaces.

Technological factors

The IT and electronics sectors are characterized by an incredibly fast pace of innovation, meaning new products and technologies emerge constantly, making older ones quickly outdated. D&H Distributing needs to stay agile, ensuring its product offerings, which reached $5.1 billion in revenue in 2023, reflect the newest advancements to remain competitive.

To maintain market relevance and meet the demands of its value-added resellers (VARs) and retailers, D&H must actively update its product catalog and forge strong partnerships with leading manufacturers. This proactive approach ensures they can offer cutting-edge solutions, crucial for their partners' success in a rapidly evolving market.

The rapid integration of AI, IoT, and cloud technologies is reshaping market demands, driving a need for specialized IT infrastructure. D&H Distributing must adapt by broadening its portfolio to include solutions supporting these burgeoning fields, enabling partners to offer advanced capabilities.

For instance, the global AI market is projected to reach $1.8 trillion by 2030, growing at a CAGR of 37.3%, according to Statista. Similarly, the IoT market is expected to surpass $1.5 trillion by 2027. This presents a substantial opportunity for D&H to capitalize on the increasing demand for devices, software, and services that power these transformative technologies.

The cybersecurity landscape is becoming increasingly intricate and aggressive, with cyber threats escalating in both complexity and frequency. This trend directly influences the types of security hardware, software, and services that companies like D&H Distributing must offer. For instance, ransomware attacks, which saw a significant surge in 2023 and are projected to continue their upward trajectory into 2024 and 2025, demand sophisticated endpoint protection and data recovery solutions.

D&H Distributing plays a crucial role in equipping its partners with the necessary tools to safeguard their clients' sensitive data and critical infrastructure. This means their product portfolio must consistently feature cutting-edge cybersecurity solutions, from advanced firewalls to AI-driven threat detection software. The ongoing evolution of threats, such as zero-day exploits and sophisticated phishing campaigns, fuels a perpetual demand for new and improved security technologies.

Automation and Supply Chain Digitization

The increasing adoption of automation and digitization in logistics is a significant technological factor for D&H Distributing. These advancements can dramatically improve operational efficiency, impacting everything from how inventory is managed to how orders are fulfilled. For instance, by 2024, the global warehouse automation market was projected to reach over $30 billion, highlighting the widespread investment in these technologies.

Implementing advanced analytics, robotics, and digital platforms allows D&H Distributing to streamline complex processes, leading to reduced operational costs and enhanced service levels for its partners. This digital transformation is not just about efficiency; it's about creating a more responsive and agile supply chain. Gartner predicted in 2023 that companies with highly digitized supply chains were 1.7 times more likely to achieve significant revenue growth compared to their less digitized peers.

To maintain a competitive edge in the rapidly evolving distribution landscape, embracing these technological shifts is crucial. D&H Distributing's ability to leverage these tools will directly influence its capacity to meet customer demands quickly and cost-effectively. The ongoing digital transformation in the IT distribution sector, with companies like D&H investing in cloud-based solutions and data analytics, underscores this trend.

- Enhanced Efficiency: Automation in warehousing and logistics can reduce order processing times by up to 40%.

- Cost Reduction: Digitizing supply chain operations can lead to savings of 10-20% on logistics costs.

- Improved Accuracy: Automated systems minimize human error in inventory tracking and order fulfillment.

- Competitive Advantage: Early adopters of supply chain digitization often see improved customer satisfaction and market share.

Evolution of Connectivity (5G, Wi-Fi 6E/7)

The rapid evolution of wireless connectivity, notably with 5G and Wi-Fi 6E, and the anticipation of Wi-Fi 7, directly fuels demand for new devices and network hardware. D&H Distributing needs to stock these advanced solutions to meet customer needs for faster, more stable internet. For instance, global 5G subscriptions were projected to surpass 1.5 billion by the end of 2024, highlighting the significant market shift.

These technological advancements aren't just about speed; they unlock innovative applications and services, from enhanced IoT capabilities to more immersive augmented and virtual reality experiences. D&H Distributing's product catalog must reflect this, offering the networking equipment that powers these next-generation technologies. The rollout of Wi-Fi 7 promises even greater speeds and lower latency, expected to significantly impact home and enterprise networking in 2025.

- 5G Adoption: Global 5G subscriptions are expected to exceed 1.5 billion by the end of 2024, creating a strong market for compatible devices.

- Wi-Fi 6E Growth: Wi-Fi 6E adoption continues to grow, offering businesses and consumers access to less congested spectrum.

- Wi-Fi 7 Anticipation: The upcoming Wi-Fi 7 standard promises multi-gigabit speeds and improved reliability, driving upgrade cycles for networking infrastructure.

- Device Demand: These connectivity advancements directly correlate with increased sales of smartphones, laptops, routers, and other networking equipment.

The relentless pace of technological innovation necessitates D&H Distributing's constant adaptation to remain competitive, with its 2023 revenue of $5.1 billion underscoring the need to align with market advancements. The company must actively update its product offerings and cultivate strong manufacturer relationships to provide cutting-edge solutions, crucial for its value-added resellers and retailers. Emerging technologies like AI, IoT, and cloud computing are reshaping market demands, requiring D&H to expand its portfolio to support these growth areas.

The increasing sophistication of cyber threats, such as ransomware, demands that D&H Distributing continuously offers advanced security hardware, software, and services to protect its partners and their clients. Furthermore, the digitization of logistics, with the warehouse automation market projected to exceed $30 billion by 2024, presents opportunities for D&H to enhance operational efficiency and cost savings through robotics and digital platforms. Companies with highly digitized supply chains were 1.7 times more likely to achieve significant revenue growth in 2023, highlighting the strategic importance of these investments.

The widespread adoption of 5G and Wi-Fi 6E, with 5G subscriptions expected to surpass 1.5 billion by the end of 2024, is driving demand for new networking equipment. D&H must stock these advanced solutions to meet customer needs for faster connectivity, which also enables new applications like enhanced IoT and immersive AR/VR experiences. The anticipation of Wi-Fi 7 further signals an impending upgrade cycle for networking infrastructure, presenting a significant opportunity for distributors.

| Technology Trend | Market Impact | D&H Opportunity |

| AI and IoT Integration | Reshaping market demands, driving need for specialized infrastructure. Global AI market projected at $1.8 trillion by 2030. | Expand portfolio to include solutions supporting AI and IoT, capitalizing on device, software, and service demand. |

| Cybersecurity Evolution | Escalating threats require sophisticated protection. Ransomware attacks surged in 2023 and continue into 2024-2025. | Offer cutting-edge security solutions, from firewalls to AI-driven threat detection, to meet partner needs. |

| Logistics Automation | Improving operational efficiency and reducing costs. Warehouse automation market over $30 billion by 2024. | Streamline operations, enhance service levels, and gain a competitive edge through digital transformation. |

| Advanced Connectivity (5G/Wi-Fi 7) | Fueling demand for new devices and network hardware. 5G subscriptions to exceed 1.5 billion by end of 2024. | Stock advanced networking equipment to meet demand for faster, more stable internet and enable new applications. |

Legal factors

Data privacy and security regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly shape how D&H Distributing manages customer information and the solutions it offers. These laws mandate stringent data protection measures, transparent data handling practices, and secure IT systems, impacting D&H's distribution of cybersecurity and compliance-focused products. Failure to adhere can result in substantial financial penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

D&H Distributing must navigate a complex web of product safety and compliance standards for the IT and consumer electronics it handles. This includes ensuring products meet certifications like UL for electrical safety and FCC for electromagnetic interference. Failure to comply can lead to costly product recalls and significant legal liabilities, as seen in past instances across the electronics industry where non-compliant products faced market removal.

Staying ahead of evolving environmental regulations, such as those concerning hazardous substances (like RoHS directives), is also paramount. For a wholesale distributor like D&H, maintaining rigorous compliance processes and regularly auditing supplier adherence is crucial for safeguarding its reputation and avoiding penalties. This proactive approach is essential to maintaining consumer trust in an increasingly regulated market.

Antitrust and competition laws are crucial for D&H Distributing, a significant wholesale distributor, as they aim to foster a fair marketplace and prevent monopolistic practices. These regulations directly impact D&H's dealings with manufacturers, its pricing structures, and any future consolidation activities like mergers or acquisitions.

Adherence to these laws is vital for D&H to maintain a competitive edge and steer clear of potential legal repercussions from governing bodies or rival firms. For instance, in 2024, the U.S. Department of Justice continued its robust enforcement of antitrust laws across various sectors, signaling a heightened regulatory environment for distributors.

Import/Export Regulations and Trade Compliance

D&H Distributing navigates a complex web of import and export regulations, crucial for its U.S. and Canadian operations. Staying compliant with customs duties and trade laws is paramount to avoid costly penalties and disruptions. For instance, in 2024, the U.S. International Trade Administration reported that trade compliance failures can lead to fines averaging 15% of the declared value of goods, underscoring the need for meticulous attention to detail.

Key areas of focus for D&H include:

- Accurate Harmonized System (HS) Classification: Ensuring correct product codes are used to determine applicable tariffs and duties.

- Documentation Accuracy: Meticulously preparing and submitting all required paperwork, such as bills of lading and certificates of origin.

- Embargo and Sanction Compliance: Verifying that goods and trading partners do not fall under any U.S. or international sanctions or embargoes.

- Trade Facilitation Agreements: Leveraging international agreements to streamline customs procedures and reduce transit times.

Intellectual Property Rights and Licensing

Protecting intellectual property rights (IPR) is paramount for D&H Distributing in the IT sector. This involves safeguarding software, hardware designs, and proprietary technologies. Ensuring that distributed products are correctly licensed and do not infringe on existing patents, copyrights, or trademarks is a key responsibility. For example, in 2024, the global IT market saw a significant number of patent disputes, highlighting the importance of due diligence in licensing agreements.

Compliance with intellectual property laws is not just about avoiding legal trouble; it's about building trust and security within D&H's partner ecosystem. Failure to adhere to these regulations can lead to costly litigation and damage to brand reputation. In 2025, reports indicate that companies with robust IPR protection strategies experienced fewer supply chain disruptions related to technology sourcing.

- IPR Protection: D&H must actively protect its own intellectual property and that of its vendors.

- Licensing Compliance: Ensuring all distributed software and hardware has valid and appropriate licenses is critical.

- Risk Mitigation: Adherence to IPR laws prevents legal disputes and safeguards against unauthorized technology use.

- Market Stability: Strong IPR practices contribute to a more stable and predictable IT distribution environment.

D&H Distributing operates within a legal framework that mandates strict adherence to data privacy and security regulations, such as GDPR and CCPA. These laws influence how D&H handles customer data and distributes cybersecurity solutions, with non-compliance potentially leading to fines up to 4% of global annual revenue. The company must also ensure all distributed IT and electronics products meet safety certifications like UL and FCC, as product recalls due to non-compliance can incur significant liabilities.

Environmental factors

Growing concerns over electronic waste (e-waste) are shaping the operational landscape for distributors like D&H Distributing. Stricter recycling regulations, such as the EU's Waste Electrical and Electronic Equipment (WEEE) directives and various state-level e-waste laws in the US, are increasingly impacting the electronics supply chain. For instance, by the end of 2024, many US states will have comprehensive e-waste recycling programs in place, requiring manufacturers and distributors to take responsibility for product end-of-life management.

This regulatory pressure necessitates that D&H Distributing carefully consider the end-of-life management of the products it distributes. The company may find itself influenced to favor product selections that are more easily recyclable or designed with sustainability in mind, a trend that gained momentum in 2024 with a reported 15% increase in consumer demand for eco-friendly electronics.

Compliance with these evolving e-waste regulations is no longer just a matter of avoiding penalties; it's becoming a critical component of corporate social responsibility and brand reputation. As of early 2025, companies demonstrating robust e-waste management practices are seeing a measurable improvement in customer loyalty and investor confidence, with some reports indicating a 10% uplift in market valuation for leaders in this area.

Stakeholders, including customers and partners, are increasingly demanding that companies like D&H Distributing reduce their carbon footprint, especially in logistics and supply chain activities. This pressure translates into expectations for optimizing transportation routes, adopting fuel-efficient fleets, and collaborating with environmentally conscious logistics partners to cut down on emissions.

For D&H Distributing, this means a growing need to measure and transparently report on its environmental impact, as these practices become industry standards. For instance, the global logistics industry emitted approximately 1.5 billion metric tons of CO2 in 2023, highlighting the scale of the challenge and the importance of proactive environmental management.

Customers and partners are increasingly scrutinizing the environmental and ethical practices of manufacturers in the technology supply chain. For instance, a 2024 survey by Accenture found that 62% of consumers consider sustainability when making purchasing decisions. This growing awareness puts pressure on companies like D&H Distributing to ensure their vendors adhere to responsible sourcing and manufacturing standards.

D&H Distributing may face pressure to prioritize sourcing products from manufacturers committed to sustainable materials, reduced energy consumption during production, and fair labor practices. This trend directly influences vendor selection processes and shapes the overall product portfolio D&H offers to its diverse customer base.

Energy Consumption of IT Products

The energy consumption of IT products is a significant environmental consideration, fueling a demand for more sustainable technology. D&H Distributing is well-positioned to meet this by offering energy-efficient hardware and solutions, helping clients lower their power usage and operational expenses. This strategic focus resonates with increasing corporate sustainability mandates and evolving customer expectations for eco-friendly options.

The IT sector's energy footprint is substantial. For instance, data centers alone accounted for approximately 1% of global electricity consumption in 2023, a figure projected to rise. This trend underscores the market’s readiness for greener IT solutions.

- Growing Demand for Energy Efficiency: Consumers and businesses are increasingly prioritizing products with lower energy consumption.

- Cost Savings for Clients: Promoting energy-efficient IT directly translates to reduced electricity bills for D&H's customers.

- Alignment with ESG Goals: Distributing greener tech supports both D&H's and its clients' Environmental, Social, and Governance (ESG) objectives.

- Market Differentiation: Offering a strong portfolio of energy-efficient products can set D&H apart in a competitive market.

Climate Change Impact on Supply Chain Resilience

The escalating physical impacts of climate change, including more frequent and intense extreme weather events, pose a significant threat to global supply chains. For a distributor like D&H Distributing, this translates to potential disruptions in receiving inventory and fulfilling customer orders, impacting their operational continuity. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a stark increase from previous years, highlighting the growing vulnerability of logistics networks.

Mitigating these climate-related risks is paramount for D&H Distributing's supply chain resilience. Strategies such as diversifying sourcing locations to reduce reliance on single, weather-vulnerable regions or implementing robust disaster recovery plans are essential. The company must also consider the increased complexity this factor adds to logistics planning, requiring more agile and adaptable transportation and warehousing strategies to navigate potential weather-related delays or damage.

- Increased Frequency of Extreme Weather: 2023 saw a record number of billion-dollar weather and climate disasters in the U.S., impacting transportation routes and warehousing.

- Supply Chain Vulnerability: D&H Distributing faces risks of inventory delays and delivery disruptions due to climate-driven events affecting production and transit.

- Strategic Adaptation: Diversifying suppliers and enhancing disaster preparedness are critical for maintaining operational stability in the face of climate uncertainty.

Environmental regulations, particularly concerning electronic waste (e-waste), are increasingly impacting distributors like D&H Distributing. By the end of 2024, many US states will have comprehensive e-waste recycling programs, requiring companies to manage product end-of-life. This trend is supported by a 15% increase in consumer demand for eco-friendly electronics observed in 2024, pushing companies to adopt more sustainable practices and vendor selection.

The pressure to reduce carbon footprints extends to logistics, with global logistics emitting approximately 1.5 billion metric tons of CO2 in 2023. D&H must optimize routes and fleets to meet stakeholder expectations. Furthermore, 62% of consumers consider sustainability in purchasing decisions as of a 2024 survey, influencing D&H to prioritize vendors with responsible sourcing and manufacturing standards.

The IT sector's energy consumption, with data centers alone using about 1% of global electricity in 2023, drives demand for energy-efficient hardware. D&H can leverage this by offering such solutions, aligning with ESG goals and market differentiation. Finally, climate change-induced extreme weather events, such as the 28 billion-dollar disasters in the US in 2023, pose supply chain risks, necessitating diversification and robust disaster recovery plans for operational continuity.

| Environmental Factor | Impact on D&H Distributing | Relevant Data/Trend (2023-2025) |

|---|---|---|

| E-waste Regulations | Increased responsibility for product end-of-life management; influences product selection. | Many US states implementing comprehensive e-waste programs by end of 2024. |

| Consumer Demand for Sustainability | Drives preference for eco-friendly products and sustainable vendor practices. | 15% increase in demand for eco-friendly electronics (2024); 62% of consumers consider sustainability (2024 survey). |

| Carbon Footprint Reduction | Need to optimize logistics, transportation, and collaborate with green partners. | Global logistics emitted 1.5 billion metric tons of CO2 in 2023. |

| Energy Efficiency in IT | Opportunity to offer energy-efficient hardware, reducing client costs and aligning with ESG. | Data centers accounted for ~1% of global electricity consumption in 2023. |

| Climate Change Impacts | Risk of supply chain disruptions from extreme weather events; need for resilience. | US experienced 28 billion-dollar weather/climate disasters in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for D&H Distributing is built on a robust foundation of data from leading market research firms, industry-specific publications, and government economic reports. We analyze trends in technology adoption, regulatory changes, and consumer behavior to provide actionable insights.