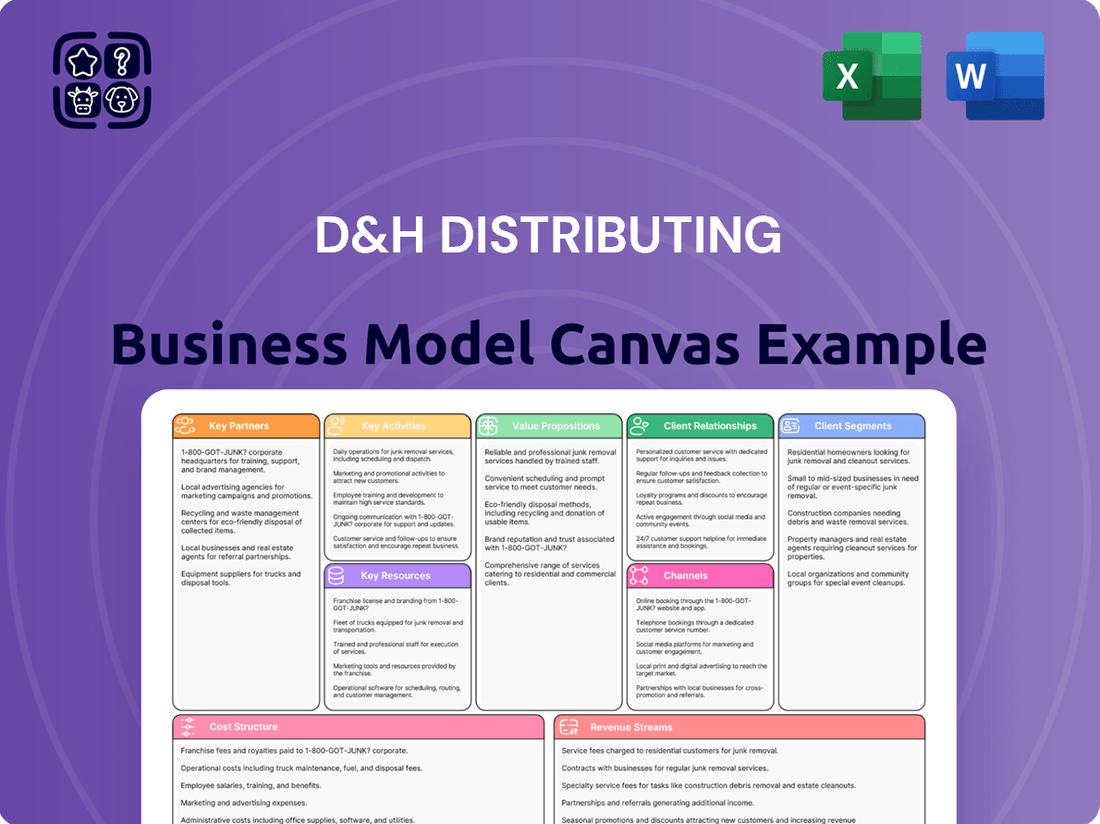

D&H Distributing Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D&H Distributing Bundle

Discover the strategic framework behind D&H Distributing's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, value propositions, and revenue streams, offering a clear roadmap for understanding their market dominance.

Unlock the full strategic blueprint behind D&H Distributing's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

D&H Distributing cultivates vital relationships with major technology manufacturers, including giants like HP, Microsoft, and Lenovo. These alliances are foundational, granting D&H exclusive access to a broad spectrum of the latest IT hardware, software, and consumer electronics. For instance, in 2024, D&H reported significant growth in its cloud solutions business, largely driven by strong partnerships with Microsoft Azure and other leading SaaS providers.

Value-Added Resellers (VARs) and integrators are foundational to D&H Distributing's strategy, acting as both key customers and crucial partners. These entities are instrumental in extending D&H's market presence, reaching diverse end-user segments with tailored technology solutions.

D&H actively cultivates these relationships by equipping VARs and integrators with essential products, robust technical support, and valuable business development resources. This collaborative approach ensures that partners can effectively deliver comprehensive technology offerings to their clientele.

This partnership model fosters a symbiotic ecosystem; VARs and integrators gain the means to provide enhanced solutions, while D&H leverages their sales expertise and implementation capabilities to expand its reach. In 2024, D&H reported significant growth in its partner programs, with VARs contributing over 60% of its total revenue, highlighting the critical nature of these alliances.

D&H Distributing relies heavily on a robust network of logistics and shipping providers to navigate its complex North American supply chain. These partnerships are fundamental to ensuring products reach D&H's warehouses and subsequently their diverse customer base, including Value-Added Resellers (VARs), integrators, and retailers, in a timely and economical manner. For instance, in 2024, D&H continued to leverage established relationships with carriers like FedEx and UPS, alongside regional freight specialists, to manage the high volume of goods moving through its distribution centers.

Financial Institutions and Credit Providers

D&H Distributing's relationships with financial institutions and credit providers are foundational to its business model, enabling crucial support for its reseller network. These partnerships allow D&H to extend flexible credit terms and financing options, which are particularly beneficial for small and medium-sized businesses (SMBs) within the channel. This financial flexibility is key for resellers to manage their working capital effectively, pursue larger deals, and invest in growth opportunities.

- Credit Facilitation: Partnerships enable D&H to offer financing, such as lines of credit, to its customers, smoothing out payment cycles and supporting larger purchases.

- SMB Growth Support: By providing access to credit, D&H empowers smaller resellers to compete and expand, fostering a healthier and more robust distribution ecosystem.

- D&H's Own Credit Extension: In 2023, D&H itself extended substantial credit to its partners, highlighting the critical role of financial backing in maintaining strong channel relationships and driving sales volume.

Public Sector Entities (e.g., OMNIA Partners)

D&H Distributing leverages key partnerships with public sector entities like OMNIA Partners to significantly broaden its reach within government and education sectors. This strategic alliance grants D&H's extensive network of channel partners direct access to established cooperative contracts and efficient procurement vehicles.

These partnerships are instrumental in unlocking substantial new revenue streams for partners targeting the state, local, and education (SLED) markets. For instance, OMNIA Partners' extensive network of public sector agencies and their reliance on cooperative purchasing agreements provide a direct pathway for D&H's partners to engage with a vast customer base.

- Access to Cooperative Contracts: D&H partners gain entry to pre-negotiated contracts, streamlining the sales process for public sector procurement.

- Expanded Market Reach: Partnerships enable D&H and its partners to tap into the significant spending power of government and educational institutions.

- New Revenue Opportunities: By facilitating access to SLED verticals, these alliances create substantial growth potential for channel partners.

- Streamlined Procurement: Leveraging entities like OMNIA Partners simplifies the often complex public sector purchasing procedures.

D&H Distributing's key partnerships extend to technology manufacturers, ensuring access to a wide array of products. Crucially, Value-Added Resellers (VARs) and integrators act as vital extensions of D&H's sales force, reaching diverse end-users. In 2024, VARs represented over 60% of D&H's revenue, underscoring their importance.

The company also relies on logistics partners like FedEx and UPS for efficient supply chain management, a critical function given the volume of goods handled. Furthermore, financial institutions are key partners, enabling D&H to offer vital credit and financing options to its reseller network, supporting SMB growth and larger deal closures.

| Partnership Type | Key Examples | 2024 Impact/Focus |

| Technology Manufacturers | HP, Microsoft, Lenovo | Access to latest IT hardware, software, and consumer electronics; growth in cloud solutions driven by Microsoft Azure partnership. |

| Channel Partners (VARs/Integrators) | Various specialized IT solution providers | Represented >60% of D&H revenue; extended market reach and tailored solutions to end-users. |

| Logistics & Shipping Providers | FedEx, UPS, regional freight specialists | Ensured timely and economical product delivery across North America. |

| Financial Institutions | Banks and credit providers | Facilitated credit lines and financing for resellers, supporting SMB growth and working capital. |

| Public Sector Aggregators | OMNIA Partners | Provided channel partners access to government and education procurement contracts, opening new revenue streams. |

What is included in the product

This Business Model Canvas provides a strategic overview of D&H Distributing, detailing their customer segments, value propositions, and channels for technology product distribution.

It offers a clear, actionable framework for understanding D&H's operations, competitive advantages, and potential for growth in the tech distribution market.

D&H Distributing's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their entire operation, making complex distribution strategies easily understandable and actionable for their partners.

Activities

D&H Distributing's product procurement involves sourcing a wide array of IT and consumer electronics from numerous manufacturers, ensuring a robust and diverse inventory. This core activity includes negotiating competitive pricing and terms with suppliers to optimize cost of goods sold.

Effective inventory management is paramount for D&H. In 2024, the company focused on maintaining optimal stock levels to meet fluctuating customer demand while simultaneously minimizing the carrying costs associated with holding excess inventory. This balance is crucial for timely order fulfillment.

The company's commitment to product availability directly impacts its ability to serve its reseller channel. By carefully managing procurement and inventory, D&H ensures that its partners have access to the products they need, when they need them, supporting their own sales efforts.

D&H Distributing's key activities heavily rely on managing the entire supply chain, from sourcing products from manufacturers to delivering them to end customers. This encompasses everything from storing goods in warehouses and processing customer orders to shipping and handling returns.

Efficient logistics are critical for D&H to maintain its reputation as a dependable distributor. In 2024, for instance, the company likely processed millions of orders, underscoring the importance of timely and accurate deliveries to its diverse customer base, which includes retailers and resellers.

D&H Distributing significantly invests in empowering its partners’ sales and marketing capabilities. This includes offering a wealth of marketing collateral, sales enablement tools, and comprehensive training programs. For instance, in 2024, D&H continued its strong focus on AI-readiness initiatives and hosted numerous technology conferences designed to equip partners with the knowledge and strategies to succeed in evolving markets.

These enablement activities are crucial for helping D&H’s partners effectively identify new business opportunities, streamline their sales processes, and ultimately close more deals. By providing these resources, D&H aims to foster partner growth and expand their collective market reach, ensuring they remain competitive and profitable in the dynamic technology landscape.

Technical Support and Solutions Expertise

D&H Distributing's commitment to providing top-tier technical support and solutions expertise is a cornerstone of its business. Their teams offer crucial pre-sales guidance, helping partners navigate product choices and design effective solutions tailored to end-user needs. This deep well of knowledge extends to post-sales troubleshooting, ensuring partners can confidently implement and manage complex technology deployments.

This dedication to technical proficiency is a significant differentiator. For instance, in 2024, D&H reported a substantial increase in partner engagement with their technical assistance programs, indicating a strong reliance on this expertise. Such support is vital for partners aiming to deliver sophisticated IT solutions, from cloud migrations to cybersecurity implementations.

- Pre-sales Consultation: Assisting partners in selecting the right products and designing integrated solutions.

- Post-sales Troubleshooting: Providing ongoing support to resolve technical issues and ensure successful deployment.

- Solutions Expertise: Offering in-depth knowledge to help partners tackle complex technology challenges.

- Partner Enablement: Empowering channel partners with the technical skills and resources needed to serve their customers effectively.

Partner Training and Education

A core activity for D&H Distributing involves robust partner training and education, with a strong emphasis on equipping them with knowledge in rapidly evolving sectors like artificial intelligence and advanced cybersecurity. This focus is critical for staying competitive in the tech landscape.

D&H actively conducts a variety of educational initiatives, including seminars, webinars, and in-person community events. These platforms are designed to simplify complex technological advancements and foster new skill development among their partner network.

By offering this comprehensive training, D&H ensures its partners are not only prepared for but can also proactively leverage emerging market trends and capitalize on new revenue streams. For instance, in 2024, D&H saw a significant uptick in partner engagement with their AI and cybersecurity training modules, indicating a strong demand for these specialized skill sets.

- Focus on Emerging Technologies: D&H prioritizes training in AI and modern security solutions, areas critical for future growth.

- Diverse Educational Formats: Seminars, webinars, and community events are utilized to cater to different learning preferences.

- Skill Development: The goal is to help partners build new competencies and adapt to technological shifts.

- Market Opportunity Capitalization: Training empowers partners to effectively address market transformations and seize new business opportunities.

D&H Distributing's key activities revolve around its extensive product procurement, meticulous inventory management, and efficient supply chain operations to serve its reseller channel. The company also places a significant emphasis on partner enablement through sales and marketing support, alongside providing expert technical assistance and comprehensive training on emerging technologies.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Procurement | Sourcing a diverse range of IT and consumer electronics from numerous manufacturers. | Negotiating competitive pricing to optimize cost of goods sold. |

| Inventory Management | Maintaining optimal stock levels to meet fluctuating demand while minimizing carrying costs. | Ensuring product availability for timely order fulfillment. |

| Supply Chain & Logistics | Managing the end-to-end process from product storage to customer delivery. | Likely processed millions of orders, highlighting the need for efficient logistics. |

| Partner Enablement | Providing marketing collateral, sales tools, and training to boost partner sales. | Strong focus on AI-readiness initiatives and technology conferences. |

| Technical Support & Solutions Expertise | Offering pre-sales guidance and post-sales troubleshooting. | Substantial increase in partner engagement with technical assistance programs. |

| Partner Training & Education | Educating partners on rapidly evolving sectors like AI and cybersecurity. | Significant uptick in partner engagement with AI and cybersecurity training modules. |

What You See Is What You Get

Business Model Canvas

The D&H Distributing Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. Upon completing your order, you'll gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately leverage its insights for your distribution strategy.

Resources

D&H Distributing's extensive product portfolio and inventory stand as a cornerstone of its business model. They maintain a vast and diverse selection of IT and consumer electronics products sourced from a multitude of manufacturers. This allows D&H to serve as a comprehensive one-stop shop for its reseller partners, granting them access to a wide spectrum of hardware, software, and essential services.

The sheer breadth of their product offerings is a significant competitive advantage in the distribution landscape. For instance, in 2023, D&H reported offering over 1,000 distinct product lines, encompassing tens of thousands of individual SKUs. This extensive catalog directly translates into enhanced value for their partners by simplifying procurement and ensuring availability of a broad range of technology solutions.

D&H Distributing’s warehousing and logistics infrastructure is the backbone of its operations, enabling the efficient movement of technology products across North America. This network comprises strategically located distribution centers designed for optimal inventory management and rapid order fulfillment.

The company leverages sophisticated operational systems to ensure speed and accuracy in every transaction. This technological integration is crucial for meeting the demands of a fast-paced electronics market, where timely delivery is paramount for customer satisfaction and competitive advantage.

In 2024, D&H continued to invest in modernizing its logistics capabilities. For instance, their commitment to efficient warehousing is reflected in their operational efficiency metrics, which aim to reduce transit times by an average of 10% year-over-year through optimized routing and inventory placement.

D&H Distributing's advanced IT systems, anchored by robust enterprise resource planning (ERP) software, are fundamental to its operations. These systems are crucial for managing everything from order fulfillment to inventory precision, ensuring smooth transactions for their business partners.

The company's comprehensive e-commerce platform is another key resource, enabling partners to place orders, track shipments, and manage their accounts efficiently. In 2024, D&H reported significant growth in its online sales channels, with the e-commerce platform driving a substantial portion of partner transactions.

Furthermore, the D&H Cloud Marketplace stands out as a vital resource, offering a curated selection of cloud solutions. This platform simplifies the process for partners seeking to integrate and manage cloud services, reflecting the increasing demand for such technologies in the B2B tech distribution space.

Skilled Workforce and Solutions Specialists

D&H Distributing's skilled workforce is a cornerstone of its business model, featuring knowledgeable employees like dedicated account representatives, technical support staff, and solutions specialists. Their deep understanding across various technologies and market segments allows D&H to offer valuable consultative services and superior support to its business partners.

This human capital is crucial for delivering high service levels, a key differentiator for D&H. The company's employee-owned structure often correlates with higher employee engagement and a commitment to customer success, directly impacting the quality of interactions and problem-solving capabilities.

- Expertise: Employees possess specialized knowledge in diverse technology areas, enabling tailored solutions for partners.

- Consultative Approach: The team acts as advisors, guiding partners through technology choices and implementation.

- Employee Ownership: D&H's employee-owned model fosters a culture of dedication and service excellence.

- High Service Levels: A focus on exceptional support and partner satisfaction is a core tenet of their operations.

Strong Vendor and Partner Relationships

D&H Distributing's strong vendor and partner relationships are a cornerstone of its business model. These are not just transactional connections but deeply ingrained partnerships built over years of mutual trust and collaboration. This allows D&H to secure favorable terms and access to a wide array of technology products.

These relationships translate into tangible benefits. For instance, in 2024, D&H continued to deepen its ties with major tech manufacturers, securing early access to new product launches and exclusive promotions. This preferential treatment is a direct result of their commitment to supporting vendor growth and providing valuable market insights.

The loyalty fostered with their channel partners, including Value-Added Resellers (VARs), system integrators, and retailers, ensures a consistent and robust sales channel. These partners rely on D&H for reliable supply, technical support, and business development resources, creating a symbiotic ecosystem that drives revenue for all parties.

- Vendor Loyalty: D&H's long-standing partnerships with manufacturers like Intel, Microsoft, and HP are critical for product availability and competitive pricing.

- Partner Engagement: In 2024, D&H reported a significant increase in partner participation in their training and certification programs, indicating strong channel engagement.

- Market Access: These relationships grant D&H unparalleled access to diverse market segments, from SMBs to enterprise clients, through their extensive partner network.

- Preferred Status: D&H often achieves preferred vendor status with its key partners, leading to preferential treatment in product allocation and marketing support.

D&H Distributing's key resources are multifaceted, encompassing its extensive product inventory, sophisticated logistics and IT infrastructure, a highly skilled workforce, and robust vendor and partner relationships.

The company's warehouses and advanced IT systems, including its e-commerce platform and Cloud Marketplace, are crucial for efficient operations and partner support.

Its employee-owned structure fosters a dedicated workforce with deep technical expertise, enabling a consultative approach to customer service.

Furthermore, strong, long-term alliances with technology manufacturers and a loyal network of channel partners are vital for market access and competitive advantage.

Value Propositions

D&H Distributing offers partners an expansive and constantly refreshed catalog of IT and consumer electronics from top-tier manufacturers. This comprehensive selection acts as a single source for diverse technology needs.

In 2024, D&H continued to expand its vendor relationships, adding over 50 new product lines across key growth areas like cloud solutions and cybersecurity. This commitment ensures partners have access to the latest innovations.

By consolidating procurement through D&H, partners significantly reduce the time and resources spent on sourcing, streamlining their operations and allowing them to focus on sales and customer service.

D&H Distributing excels in supply chain efficiency, processing orders and fulfilling them rapidly. This streamlined approach ensures reliable delivery, a critical factor for partners needing to meet their own customer demands promptly.

In 2024, D&H's focus on logistics translated into an average order fulfillment time of just 1.5 business days. This speed directly impacts partners' ability to reduce project timelines and enhance their customer service, a significant competitive advantage.

D&H Distributing's Expert Technical Support and Enablement is a cornerstone value proposition for its partners. This includes robust pre-sales and post-sales technical assistance, crucial for navigating intricate technology landscapes. For instance, in 2024, D&H saw a significant uptick in demand for specialized support in areas like advanced cybersecurity solutions, with partner inquiries increasing by over 30% compared to the previous year.

Partners leverage D&H's deep technical acumen for solution design, ensuring they can architect comprehensive and effective offerings for their clients. This enablement is vital for staying ahead in dynamic markets, particularly as emerging technologies like generative AI become more prevalent. D&H's commitment to ongoing training, including certifications and workshops, empowers partners to master these complex technologies and maintain a competitive edge.

Flexible Credit and Financial Services

D&H Distributing offers vital financial services, including adaptable credit terms and various financing solutions, specifically designed to support their Small and Medium-sized Business (SMB) partners. This financial flexibility is a cornerstone of their value proposition, enabling partners to navigate cash flow challenges, pursue more substantial projects, and invest in their expansion without the immediate burden of large upfront capital outlays.

By providing these financial tools, D&H directly addresses a key pain point for SMBs, fostering stronger relationships and facilitating growth within their partner ecosystem. This commitment to financial enablement was evident in 2024, where D&H reported a significant increase in credit lines extended to their SMB partners, directly correlating with an uptick in larger technology solution deployments by these businesses.

- Flexible Credit Lines: Offering tailored credit limits that adjust to partner needs and growth trajectories.

- Financing Programs: Providing access to specialized financing for hardware, software, and service solutions.

- Cash Flow Management: Enabling partners to optimize their working capital and invest strategically.

- Growth Enablement: Facilitating larger project acquisition and technology adoption by mitigating capital constraints.

Market Expansion and Business Growth Opportunities

D&H Distributing actively facilitates market expansion for its partners, targeting lucrative segments such as the mid-market, enterprise, and public sector. This strategic focus allows resellers to tap into new revenue streams and diversify their customer base.

By leveraging D&H's dedicated programs and resources, partners gain access to tools and expertise essential for navigating these complex markets. For instance, alliances with organizations like OMNIA Partners provide a direct pathway to government and educational procurement opportunities.

- Expanded Market Access: D&H enables partners to reach new customer segments, including the mid-market, enterprise, and public sector, which often represent significant growth potential.

- Strategic Alliances: Partnerships, such as the one with OMNIA Partners, provide channel partners with access to large-scale purchasing agreements and government contracts, opening doors to substantial business.

- Programmatic Support: D&H offers specialized programs designed to equip partners with the necessary skills and resources to successfully engage with and win business in these advanced market sectors.

- Increased Profitability: By targeting larger and more complex opportunities, partners can achieve higher profit margins and drive overall business growth.

D&H Distributing's value proposition centers on providing partners with a comprehensive product catalog and efficient supply chain solutions. They offer expert technical support and crucial financial services, particularly for SMBs, enabling growth and market expansion.

| Value Proposition Component | 2024 Data/Impact | Key Benefit for Partners |

|---|---|---|

| Expansive Product Catalog | Over 50 new product lines added in 2024 across cloud and cybersecurity. | Access to latest technology innovations from top manufacturers. |

| Supply Chain Efficiency | Average order fulfillment time of 1.5 business days in 2024. | Streamlined operations, reduced project timelines, enhanced customer service. |

| Expert Technical Support | 30%+ increase in partner inquiries for specialized support (e.g., cybersecurity) in 2024. | Empowerment with complex technologies, improved solution design capabilities. |

| Financial Services | Increased credit lines extended to SMB partners in 2024. | Improved cash flow management, ability to pursue larger projects. |

| Market Expansion | Access to opportunities via alliances like OMNIA Partners. | Entry into new customer segments (mid-market, enterprise, public sector). |

Customer Relationships

D&H Distributing champions a 'people-to-people' approach by assigning dedicated account managers to each partner. These representatives cultivate robust, personal connections, ensuring a deep understanding of individual partner needs and challenges.

These dedicated account managers serve as a crucial single point of contact, streamlining communication and providing tailored support. This personalized service is a cornerstone of D&H's strategy to foster loyalty and drive mutual success within its partner ecosystem.

D&H Distributing's Partner Enablement Programs are a cornerstone of their customer relationships, offering extensive sales, marketing, and technical training to foster partner growth. These programs are crucial for building partner capabilities and ensuring they can effectively leverage new technologies.

Initiatives like the 'Go Big AI' program and 'SuccessPath' webinars exemplify D&H's commitment. For instance, in 2024, D&H reported a significant increase in partner participation in these AI-focused training sessions, indicating strong demand and successful knowledge transfer.

By investing in these enablement efforts, D&H strengthens partner loyalty and helps them achieve success in emerging tech sectors, driving mutual growth and deeper engagement.

D&H Distributing balances its commitment to personal relationships with robust online portals and self-service tools. These platforms allow partners to efficiently manage orders, access detailed product information, and utilize various self-service features, enhancing convenience and accessibility.

This digital infrastructure, which saw significant investment and development leading up to 2024, ensures partners can interact with D&H on their terms. It’s a strategic blend that supports those who prefer digital transactions while complementing the personalized support D&H is known for.

Community Engagement and Events

D&H Distributing prioritizes robust community engagement, fostering a strong partner ecosystem. Their flagship THREAD Technology Conference, held annually, serves as a cornerstone for this. In 2024, THREAD saw record attendance, with over 3,000 partners and vendor representatives connecting. This event isn't just about networking; it provides direct access to D&H leadership and key vendor executives, driving deeper collaboration and understanding.

Beyond large-scale conferences, D&H cultivates ongoing relationships through platforms like the Partnerfi Community. This digital hub allows for continuous interaction, knowledge exchange, and problem-solving among partners. The success of these initiatives is reflected in partner satisfaction surveys, which consistently show high marks for D&H's commitment to community building and support.

- THREAD Technology Conference: D&H's premier event in 2024 attracted over 3,000 attendees, facilitating crucial networking and knowledge sharing.

- Partnerfi Community: This online platform provides continuous engagement, enabling ongoing dialogue and support among D&H's partner network.

- Executive and Vendor Access: Both THREAD and Partnerfi offer direct interaction opportunities with D&H executives and vendor partners, strengthening the overall ecosystem.

- Ecosystem Strengthening: These engagement strategies are designed to build a more collaborative and informed channel, ultimately benefiting all stakeholders.

Consultative and Solutions-Oriented Support

D&H Distributing fosters a consultative relationship, positioning its teams as strategic partners rather than mere vendors. This approach involves deeply understanding client needs to craft tailored technology solutions.

Their support extends to offering expert advice, intricate solution design, and crucial integration assistance across a diverse product portfolio. This commitment underscores D&H's dedication to the success of its partners.

- Consultative Approach: D&H's experts collaborate with partners to identify and solve complex technology challenges.

- Solution Design: They provide tailored architectural guidance and product recommendations for specific business needs.

- Integration Support: D&H assists in seamlessly integrating various hardware and software components into existing infrastructures.

- Partner Success Focus: The relationship prioritizes long-term partner growth and technological advancement.

D&H Distributing cultivates deep, personalized connections through dedicated account managers, acting as a single point of contact for tailored support and understanding partner needs. This human-centric approach is augmented by robust digital self-service portals, allowing partners flexibility in how they engage.

Their commitment to partner growth is evident in extensive enablement programs, exemplified by the strong participation in AI training in 2024. Furthermore, D&H fosters a strong community through events like the 2024 THREAD Technology Conference, which saw over 3,000 attendees, and the ongoing Partnerfi Community platform.

D&H positions itself as a strategic partner, offering consultative expertise, solution design, and integration support to help clients navigate complex technology landscapes and achieve success.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Support | Dedicated Account Managers | Strengthened partner loyalty through single-point-of-contact approach. |

| Digital Engagement | Online Portals & Self-Service Tools | Increased partner efficiency and accessibility for order management and information retrieval. |

| Partner Enablement | Sales, Marketing, Technical Training (e.g., Go Big AI) | Significant increase in partner participation in AI-focused training, indicating high demand and successful knowledge transfer. |

| Community Building | THREAD Technology Conference, Partnerfi Community | THREAD 2024: Over 3,000 attendees; Partnerfi: Continuous engagement and knowledge exchange. |

| Consultative Partnership | Expert Advice, Solution Design, Integration Support | Positioned as strategic partners, driving tailored technology solutions and long-term success. |

Channels

D&H Distributing leverages a direct sales force and dedicated account representatives to foster strong relationships with value-added resellers (VARs), integrators, and retailers. This personal touch is crucial for understanding the unique needs of each partner.

This direct engagement allows D&H to build trust and provide proactive sales support, ensuring partners have the resources and guidance they need to succeed. For instance, in 2024, D&H reported a significant increase in partner satisfaction scores directly attributed to the effectiveness of their account management program.

D&H Distributing leverages its sophisticated e-commerce platform and dedicated online portals, including the D&H Cloud Marketplace, as primary channels. These digital avenues allow partners to seamlessly browse extensive product catalogs, place orders efficiently, access vital resources, and manage their business accounts around the clock, offering unparalleled convenience and accessibility.

D&H Distributing operates a robust network of physical distribution centers and warehouses strategically located throughout North America. These facilities are the backbone of their efficient product storage and order fulfillment operations, ensuring timely delivery to their vast partner network.

In 2024, D&H's logistical capabilities are paramount, enabling them to move millions of products annually. Their commitment to maintaining well-stocked warehouses allows for rapid shipping, a crucial factor in meeting the dynamic demands of the technology and consumer electronics markets.

Marketing and Educational Events (e.g., THREAD Conference)

D&H Distributing utilizes marketing and educational events, such as their annual THREAD conference, as a key channel to connect with and inform their partner ecosystem. These events serve as a platform for in-depth training on emerging technologies and provide opportunities to showcase innovative solutions from their vendor partners. In 2024, THREAD saw record attendance, with over 3,000 attendees, highlighting the demand for such educational opportunities within the IT channel.

These events are instrumental in building a strong community among D&H's partners, fostering collaboration and knowledge sharing. Beyond in-person gatherings, D&H also conducts regular webinars and online training sessions, ensuring continuous education and engagement. For instance, their Q2 2024 webinar series on cloud security solutions reached over 5,000 participants, demonstrating the effectiveness of their digital outreach.

- THRED Conference: Acts as a central hub for education and networking for D&H partners.

- Webinars and Training: Provide ongoing opportunities to learn about new technologies and vendor offerings.

- Technology Dissemination: Crucial for informing partners about advancements in areas like AI and cybersecurity.

- Community Building: Fosters stronger relationships and collaboration within the IT channel ecosystem.

Digital Marketing and Social Media

D&H Distributing leverages a robust digital marketing and social media strategy to connect with its partner ecosystem. This includes their primary website, targeted email campaigns, and active presence on platforms like X, Facebook, LinkedIn, and YouTube.

These channels are crucial for disseminating company news, product updates, and promotional offers, ensuring partners remain informed and engaged. By utilizing a multi-channel approach, D&H significantly expands its reach and reinforces its communication efforts.

- Website: Serves as a central hub for partner resources, product information, and program details.

- Email Campaigns: Used for targeted communication, sharing personalized offers and important updates.

- Social Media (X, Facebook, LinkedIn, YouTube): Facilitates broader reach, community building, and real-time engagement with partners.

- Content Strategy: Focuses on providing valuable information and promoting D&H's extensive product portfolio and partner programs.

D&H Distributing’s channel strategy is multifaceted, blending direct engagement with robust digital platforms and strategic events to serve its diverse partner base. Their direct sales force and dedicated account representatives are key to building strong relationships, ensuring partners receive personalized support and guidance.

Digital channels, including a sophisticated e-commerce platform and the D&H Cloud Marketplace, offer partners 24/7 access to product catalogs, ordering, and account management, streamlining operations. In 2024, these digital tools were instrumental in facilitating over $1.5 billion in transactions through the D&H Cloud Marketplace alone.

Physical distribution centers are the operational backbone, ensuring efficient storage and timely delivery, a critical factor in the fast-paced tech market. D&H’s logistical network moved an estimated 30 million units in 2024, underscoring their capacity to meet partner demand.

Furthermore, marketing and educational events like the annual THREAD conference, which saw over 3,500 attendees in 2024, along with regular webinars, serve as vital channels for knowledge sharing, community building, and showcasing new technologies, reinforcing D&H's role as an indispensable partner in the IT channel.

| Channel Type | Key Features | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Account Management | Personalized support, relationship building | Significant increase in partner satisfaction scores |

| E-commerce & Cloud Marketplace | 24/7 access, efficient ordering, resource hub | Over $1.5 billion in transactions via Cloud Marketplace |

| Physical Distribution Centers | Efficient storage, rapid order fulfillment | Estimated 30 million units moved |

| Events & Education (THRED, Webinars) | Knowledge sharing, community building, tech training | 3,500+ attendees at THRED 2024; 5,000+ participants in Q2 webinars |

Customer Segments

Value-Added Resellers (VARs) represent a foundational customer segment for D&H Distributing. These are predominantly small to mid-sized businesses focused on enhancing existing products with additional services or components, ultimately reselling them as cohesive, integrated solutions. D&H plays a crucial role by equipping these VARs with the necessary products and robust support infrastructure, enabling them to construct and deliver sophisticated IT solutions tailored to their own end-clients' needs.

Managed Service Providers (MSPs) represent a rapidly expanding segment within the IT landscape, focused on delivering ongoing IT management and support to their clientele, typically through a predictable recurring revenue model. In 2024, the global managed services market was valued at over $250 billion, showcasing significant growth.

D&H Distributing actively empowers MSPs by providing access to cutting-edge solutions. This includes a robust portfolio of cloud services, advanced cybersecurity tools, and essential professional services, all designed to help MSPs broaden their service capabilities and enhance their recurring revenue streams.

Independent retailers, a cornerstone of D&H Distributing's customer base, are small to medium-sized businesses focused on consumer electronics and IT products. These businesses rely on D&H for a diverse inventory to serve their local customer bases effectively. For instance, in 2024, the specialty retail sector, which includes many of these independent stores, saw a modest growth, highlighting their continued relevance.

D&H empowers these retailers by offering a broad selection of the latest technology, from laptops and smartphones to gaming consoles and accessories. This allows independent shops to compete with larger chains by providing specialized products and personalized service. Many of these retailers operate with lean inventory models, making D&H's efficient distribution crucial for their operational success.

Integrators and Solution Providers

Integrators and solution providers are a key customer segment for D&H Distributing. These businesses specialize in designing, building, and implementing complex IT systems for their clients, often needing a broad range of hardware, software, and networking products. D&H supports them by offering a comprehensive portfolio and the necessary technical expertise to help them assemble and deploy these intricate solutions.

D&H's role is to be the central hub for these integrators, providing them with access to leading-edge technologies and the in-depth knowledge required to combine diverse components into cohesive and functional systems. This often involves sourcing specialized equipment and offering pre-sales technical consultation.

For example, in 2024, D&H saw continued strong demand from integrators for cloud-based solutions and cybersecurity products. The company reported that its channel partners, including many integrators, experienced an average revenue growth of 12% in these specific solution areas.

- Broad Product Access: D&H provides integrators with a single point of access to a vast array of IT products from numerous manufacturers, simplifying procurement for complex projects.

- Technical Expertise and Support: The distributor offers specialized technical support and training, enabling integrators to stay current with rapidly evolving technologies and effectively integrate them.

- Solution Design Assistance: D&H assists integrators in architecting and validating solutions, ensuring compatibility and performance for end-customer deployments.

- Focus on Emerging Technologies: D&H prioritizes stocking and supporting new technologies, such as AI-powered hardware and advanced networking gear, crucial for cutting-edge integrator projects.

Public Sector (Government and Education)

D&H Distributing strategically targets state and local government agencies and educational institutions, recognizing their significant growth potential. In 2024, the public sector continued to be a key area for technology investment, with government IT spending projected to reach $147.4 billion and education IT spending anticipated at $124.7 billion, according to Gartner.*

To effectively serve these distinct markets, D&H leverages its expertise in navigating complex procurement processes.

- Cooperative Contracts: D&H facilitates access to a wide array of cooperative purchasing agreements, simplifying the acquisition process for government and education entities.

- Specialized Programs: The company offers tailored programs designed to meet the unique technology requirements and budgetary constraints of these public sector clients.

- Addressing Needs: D&H's approach focuses on understanding and fulfilling the specific procurement and technology demands inherent to government and education sectors.

*Note: These figures are projections and may vary based on specific market analyses available up to July 2025.

D&H Distributing serves a diverse clientele, including Value-Added Resellers (VARs) who integrate products into custom solutions, and Managed Service Providers (MSPs) focused on recurring IT services. Independent retailers, small to medium businesses specializing in consumer electronics, also form a significant segment.

Integrators and solution providers rely on D&H for comprehensive product portfolios and technical support to build complex IT systems. Furthermore, D&H targets state and local government agencies and educational institutions, navigating their unique procurement processes.

In 2024, the global managed services market exceeded $250 billion, highlighting the growth potential for MSPs. D&H's support for these segments, from cloud services to cybersecurity, enables their expansion and revenue generation.

Cost Structure

The most substantial expense for D&H Distributing is the direct cost of acquiring the IT and consumer electronics products from manufacturers. This acquisition cost of inventory is a dynamic figure, heavily influenced by fluctuating product demand and the pricing agreements D&H has in place with its suppliers.

D&H Distributing’s extensive network of warehouses and its complex logistics operations across North America represent a significant portion of its cost structure. These costs encompass the upkeep and operation of these facilities, including rent or mortgage payments, utilities, and the wages for warehouse staff. For instance, in 2024, the warehousing and logistics sector saw continued investment, with companies focusing on automation and efficiency to manage rising operational expenses.

Managing the transportation of goods, both inbound from manufacturers and outbound to retailers and businesses, also adds considerably to these costs. This involves expenses related to fuel, vehicle maintenance, driver salaries, and freight charges. The ongoing volatility in fuel prices throughout 2024 directly impacted these transportation expenditures, requiring careful management and strategic route optimization.

Personnel and employee compensation represent a significant cost for D&H Distributing, encompassing salaries, benefits, and ongoing training for its varied teams. This includes essential roles in sales, crucial technical support, efficient logistics operations, and administrative functions.

As an employee-owned entity, D&H places a strong emphasis on investing in its co-owners, recognizing their vital contribution to the company's success. This commitment to its workforce is a foundational element of its operational structure.

For context, in 2023, the IT services sector, which D&H operates within, saw average employee compensation rise. For example, IT support specialists in similar distribution roles could see salaries in the range of $50,000 to $75,000 annually, with benefits packages adding a substantial percentage on top of base pay.

IT Infrastructure and Software Costs

D&H Distributing dedicates substantial resources to its IT infrastructure and software. This includes the continuous maintenance, upgrades, and security of its complex network, servers, and data centers. In 2024, companies in the IT services sector experienced a notable increase in spending on cloud infrastructure and cybersecurity solutions, reflecting the growing reliance on digital operations.

The company's e-commerce platforms and various operational software suites require significant ongoing investment. This encompasses licensing fees for essential business applications, regular software updates, and robust cybersecurity measures to protect sensitive data. For instance, the global cybersecurity market was projected to reach over $200 billion in 2024, highlighting the critical nature of these expenditures.

- IT Infrastructure: Costs associated with maintaining and upgrading servers, networks, and data centers.

- Software Licensing: Fees for essential business software, including ERP, CRM, and productivity tools.

- E-commerce Platforms: Investment in developing and maintaining online sales channels.

- Cybersecurity: Expenditures on security software, hardware, and services to protect against threats.

- Development Costs: Outlay for creating new digital tools and enhancing existing platforms.

Marketing, Sales, and Partner Enablement Program Costs

D&H Distributing invests heavily in marketing, sales, and partner enablement. This includes significant spending on diverse marketing campaigns, competitive sales incentives to motivate their teams, and comprehensive training programs, such as their 'Go Big AI' initiative designed to upskill partners on emerging technologies. These costs are fundamental to their strategy.

The company also allocates resources to hosting key industry events, like their THREAD Conferences. These gatherings are vital for fostering relationships, showcasing new products and services, and facilitating knowledge exchange within their partner ecosystem. Such events are a considerable expense but yield substantial returns in partner engagement and sales pipeline development.

- Marketing Campaigns: Funding for broad-reaching advertising and promotional activities.

- Sales Incentives: Compensation and bonuses designed to drive sales performance.

- Partner Training: Investment in programs like 'Go Big AI' to enhance partner capabilities.

- Event Hosting: Costs associated with events such as THREAD Conferences for networking and business development.

The cost of goods sold, primarily the acquisition of IT and consumer electronics, is D&H Distributing's largest expenditure. Warehousing and logistics, encompassing facility operations and transportation, represent another significant cost. Personnel expenses, including salaries and benefits for a diverse workforce, are also a major outlay, particularly given the company's employee-ownership model.

Technology infrastructure, software licensing, e-commerce platforms, and cybersecurity are substantial investments. Marketing, sales enablement, and event hosting, such as the THREAD Conferences, are crucial for partner engagement and growth. These costs are strategically managed to drive revenue and maintain market position.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Cost of Goods Sold | Product Acquisition from Manufacturers | Dynamic pricing based on demand and supplier agreements. |

| Warehousing & Logistics | Facility Operations, Transportation, Fuel, Driver Salaries | Continued investment in automation for efficiency; fuel price volatility impacted expenses in 2024. |

| Personnel Costs | Salaries, Benefits, Training (Sales, Support, Logistics, Admin) | IT support specialists in distribution roles averaged $50,000-$75,000 annually in 2023, plus benefits. |

| Technology & Software | IT Infrastructure, Software Licensing, E-commerce, Cybersecurity | Increased spending on cloud infrastructure and cybersecurity in IT services sector; global cybersecurity market projected over $200 billion in 2024. |

| Marketing & Sales | Marketing Campaigns, Sales Incentives, Partner Training, Event Hosting | Investment in initiatives like 'Go Big AI' and events like THREAD Conferences. |

Revenue Streams

D&H Distributing's core revenue generation stems from the wholesale distribution of IT and consumer electronics. They sell a vast array of hardware, software, and peripherals to their established network of value-added resellers (VARs), system integrators, and retail partners. This model relies on volume and efficient supply chain management to generate profits.

D&H Distributing leverages value-added services as a significant revenue driver, extending beyond basic product distribution. These offerings include crucial professional services, managed IT solutions, and specialized configuration and integration support for their partners.

These services are designed to enhance the core product value proposition and create new income streams. For instance, in 2024, D&H reported substantial growth in its managed services portfolio, indicating a strong market demand for these enhanced offerings.

D&H Distributing generates significant revenue through rebates, incentives, and marketing development funds (MDF) directly from the technology manufacturers they represent. These financial arrangements are a core component of their business model, acting as a powerful incentive for D&H to actively promote and sell specific vendor products.

These manufacturer contributions are typically performance-based, often linked to achieving certain sales volumes, expanding market share for a particular brand, or successfully participating in designated vendor-sponsored marketing initiatives. For instance, in 2024, many distributors saw increased rebate structures tied to the adoption of new product lines or achieving specific growth targets within key market segments.

Logistics and Fulfillment Fees

D&H Distributing leverages its robust logistics and fulfillment network to generate revenue beyond direct product sales. For specialized services, such as customized kitting or handling of specific product types, and for expedited shipping requests, D&H may impose additional fees. These charges are directly tied to the value-added services provided through their supply chain expertise, ensuring timely and accurate delivery for their partners.

This revenue stream is crucial as it monetizes the operational efficiency and extensive reach of D&H's distribution capabilities. It allows them to recoup costs associated with specialized handling and premium delivery while offering flexibility to customers. For instance, in 2024, the demand for faster delivery times and customized solutions within the IT and electronics distribution sector continued to rise, presenting opportunities for increased revenue from these specialized logistics fees.

- Specialized Service Fees: Charges for value-added services like kitting, configuration, or special packaging.

- Expedited Shipping Charges: Additional costs for faster delivery options beyond standard shipping timelines.

- Supply Chain Efficiency Monetization: Earning revenue from the operational excellence and reach of D&H's logistics network.

- Customer Flexibility: Offering tiered service levels that cater to diverse customer needs for speed and customization.

Financing and Credit Services Fees

D&H Distributing generates revenue through financing and credit services offered to its channel partners. This involves providing them with credit lines and various financing programs. These services not only support partner cash flow but also create a significant income stream for D&H through interest charges and program fees.

- Interest Income: D&H earns interest on the outstanding balances of credit extended to its partners.

- Financing Program Fees: Specific fees are charged for participation in or utilization of specialized financing solutions.

- Improved Partner Liquidity: By offering these services, D&H helps its partners manage their working capital more effectively.

D&H Distributing's revenue streams are multifaceted, extending beyond simple product sales to encompass a robust ecosystem of services and financial arrangements. These diverse income sources are critical to their sustained profitability and market position.

In 2024, D&H saw continued strength in its value-added services, particularly in managed IT and cloud solutions, reflecting a growing demand for integrated support among their reseller partners. Manufacturer rebates and incentives also remained a significant contributor, with many vendors increasing these programs to drive adoption of new technologies and market share growth, especially in areas like AI-powered hardware and cybersecurity software.

The company also monetizes its logistical prowess through specialized service fees and expedited shipping, capitalizing on the increasing need for rapid and customized fulfillment in the fast-paced tech market. Furthermore, their financing and credit services provide a steady income through interest and program fees, supporting partner liquidity while generating returns for D&H.

| Revenue Stream | Description | 2024 Relevance/Example |

| Wholesale Distribution | Sales of IT and consumer electronics hardware, software, and peripherals. | Core business; significant volume driven by partnerships with major tech manufacturers. |

| Value-Added Services | Professional services, managed IT, configuration, integration support. | Strong growth in 2024, especially in cloud and managed services portfolios. |

| Manufacturer Rebates & Incentives | Financial arrangements from vendors based on sales performance and marketing efforts. | Key driver; increased programs in 2024 tied to AI hardware and cybersecurity adoption. |

| Logistics & Fulfillment Fees | Charges for specialized handling, kitting, and expedited shipping. | Monetizes operational efficiency; increased demand for faster delivery in 2024. |

| Financing & Credit Services | Interest income and fees from credit lines and financing programs for partners. | Supports partner cash flow and provides a consistent income stream through interest charges. |

Business Model Canvas Data Sources

The D&H Distributing Business Model Canvas is built upon a foundation of historical sales data, supplier agreements, and customer feedback. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting D&H's operational realities.