D&H Distributing Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D&H Distributing Bundle

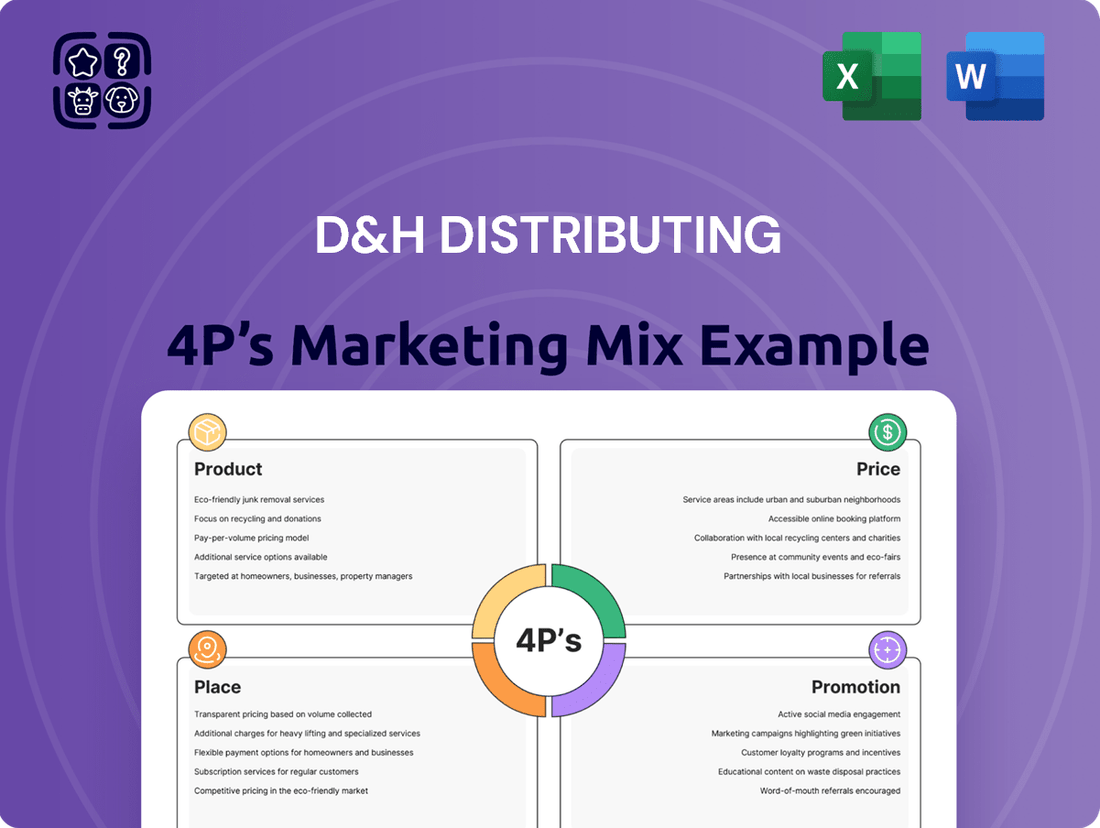

Discover how D&H Distributing masterfully balances its Product offerings, Price points, Place in the market, and Promotion strategies to dominate the tech distribution landscape. This analysis dives deep into their core marketing decisions.

Unlock the secrets behind D&H Distributing's success with a comprehensive 4Ps Marketing Mix analysis. Understand their product portfolio, pricing tactics, distribution channels, and promotional campaigns in detail.

Ready to elevate your own marketing strategy? Get instant access to a professionally crafted, editable 4Ps Marketing Mix analysis of D&H Distributing, packed with actionable insights and real-world examples.

Product

D&H Distributing's broad portfolio is a cornerstone of its market strategy, encompassing a vast array of IT and consumer electronics. This extensive product offering acts as a critical bridge, connecting manufacturers with resellers and solution providers. Their catalog spans foundational IT components such as servers, storage, and networking gear, alongside cutting-edge solutions like cloud services, robust cybersecurity tools, and innovative AI-enabled devices.

This comprehensive product selection enables D&H to cater to a wide spectrum of customer requirements across numerous industries. For instance, in the 2024 fiscal year, D&H reported a significant increase in sales within their cloud and cybersecurity segments, reflecting the growing demand for these advanced solutions among their client base. This strategic breadth ensures they remain a relevant and indispensable partner for businesses navigating the ever-evolving technology landscape.

D&H Distributing actively champions emerging technologies, notably AI-powered PCs and advanced security solutions. This focus is crucial as the global AI PC market is projected to reach $400 billion by 2027, according to recent industry forecasts.

They equip their partners with the latest innovations and essential training, enabling them to leverage these rapidly evolving tech sectors. This strategic emphasis ensures D&H and its partners stay ahead of the curve in a competitive landscape.

Beyond simply moving products, D&H Distributing distinguishes itself by offering a robust suite of value-added services. These include crucial professional services, comprehensive pre- and post-sales support, and specialized integration and managed services designed to empower their partners.

These offerings are instrumental in enabling D&H's partners to successfully implement and maintain technology solutions for their end clients. For instance, D&H's partner enablement programs in 2024 focused on cloud migration and cybersecurity, with partners reporting an average of 15% increase in managed services revenue after engaging with these D&H initiatives.

Vendor Partnerships and Brands

D&H Distributing's vendor partnerships are a cornerstone of its product strategy, ensuring a robust and competitive offering. By collaborating with top-tier technology manufacturers, D&H provides its reseller partners access to a broad portfolio of leading brands.

This includes significant alliances with industry giants such as Microsoft, HP, Intel, Lenovo, and Cisco. These relationships are vital for maintaining a diverse and high-quality product catalog that meets the evolving demands of the market.

- Key Vendor Relationships: D&H maintains strong ties with over 1,900 vendors, including major technology players.

- Brand Recognition: Partnerships with brands like HP and Lenovo provide resellers with trusted and in-demand products.

- Product Breadth: Access to Microsoft's software and Intel's processors ensures a comprehensive technology selection.

- Market Competitiveness: These strong vendor connections enable D&H to offer competitive pricing and the latest product innovations.

Solutions for Diverse Markets

D&H Distributing excels at tailoring its product catalog to meet the distinct demands of multiple market segments. This strategic focus ensures partners can effectively address a wide range of customer needs.

They offer comprehensive, end-to-end solutions designed for specific vertical markets, including:

- Corporate: Providing advanced technology solutions for enterprise environments.

- Small-to-Midsize Businesses (SMBs): Delivering scalable and cost-effective IT infrastructure.

- Consumer: Offering the latest in personal technology and electronics.

- Education: Supplying technology tailored for learning environments, supporting digital classrooms.

- Government: Meeting the stringent security and compliance requirements of public sector clients.

In 2024, D&H reported significant growth in its SMB and Education sectors, reflecting the increasing demand for digital transformation and modern learning tools. Their ability to curate specialized product bundles and provide dedicated support for each vertical market is a key differentiator, enabling partners to capture market share across diverse customer bases.

D&H Distributing's product strategy centers on offering a vast and diverse IT and consumer electronics portfolio, acting as a crucial link between manufacturers and resellers. They actively champion emerging technologies like AI PCs, with the global AI PC market projected to reach $400 billion by 2027, ensuring partners have access to the latest innovations.

Their extensive catalog includes foundational IT components, cloud services, cybersecurity tools, and AI-enabled devices, catering to a wide range of customer needs across various industries. In 2024, D&H saw notable sales increases in cloud and cybersecurity, demonstrating their alignment with current market demands.

D&H Distributing's product offering is further strengthened by its deep vendor partnerships, including major players like Microsoft, HP, Intel, and Lenovo, providing resellers with trusted and in-demand products. This allows them to offer competitive pricing and the latest technological advancements, ensuring market competitiveness.

They expertly tailor their product selection for specific market segments such as Corporate, SMB, Consumer, Education, and Government, providing end-to-end solutions. This segmentation, coupled with specialized support, helped drive significant growth in their SMB and Education sectors in 2024.

| Product Category | Key Vendors | 2024 Focus Areas | Market Growth Driver | Partner Benefit |

|---|---|---|---|---|

| Cloud Services | Microsoft Azure, AWS | Cloud Migration, Managed Services | Digital Transformation Demand | 15% increase in managed services revenue |

| Cybersecurity | Fortinet, Palo Alto Networks | Advanced Threat Protection, Compliance | Increasing Cyber Threats | Enhanced Security Solutions |

| AI-Enabled Devices | Intel, NVIDIA, Lenovo | AI PCs, Machine Learning Hardware | AI PC Market Growth ($400B by 2027) | Access to Cutting-Edge Technology |

| Traditional IT Infrastructure | HP, Dell, Cisco | Servers, Networking, Storage | Ongoing Business Operations | Broad Selection of Reliable Hardware |

What is included in the product

This analysis provides a comprehensive examination of D&H Distributing's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic insights.

Streamlines the complex D&H Distributing 4Ps analysis into a clear, actionable framework, alleviating the pain of information overload for strategic decision-making.

Place

D&H Distributing boasts an extensive North American distribution network, a critical component of its marketing strategy. With headquarters in Harrisburg, Pennsylvania, and Mississauga, Ontario, the company strategically places warehouses in major hubs such as Atlanta, Chicago, Fresno, and Vancouver. This geographical spread ensures timely delivery and accessibility of products across the continent.

D&H Distributing's distribution strategy is deeply rooted in a channel-centric model, prioritizing its network of value-added resellers (VARs), managed service providers (MSPs), integrators, and retailers. This model is designed to amplify the reach and expertise of these partners, enabling them to effectively deliver technology solutions to a broad spectrum of end-users. D&H's commitment lies in empowering these partners, understanding that their success directly translates to the company's own growth and market penetration.

D&H Distributing's Digital Cloud Marketplace is central to its Product strategy, offering an 'everything-as-a-service' model. This platform acts as a comprehensive digital storefront, making a vast array of cloud solutions and managed services readily available to D&H's partners.

The accessibility of this online platform significantly streamlines the procurement process for cloud solutions. Partners can easily find, purchase, and deploy services, which D&H has seen grow substantially, with cloud services representing a significant portion of their overall growth trajectory in recent years, often cited as a key driver in their channel partner success.

Strategic Geographic Expansion

D&H Distributing strategically enhances its market reach through geographic expansion, evidenced by the opening of new facilities. A prime example is their South sales and training facility in Tampa, Florida, designed to bolster support for partners in that region. This move underscores a commitment to localized service and specialized training, crucial for navigating diverse market needs.

This expansion strategy is not just about physical presence; it's about deepening relationships and improving operational efficiency. By establishing regional hubs like the Tampa facility, D&H can offer more tailored programs and quicker response times, directly impacting partner success and market penetration.

- Tampa Facility: Opened to enhance regional support and training for D&H partners.

- Localized Support: Aims to provide tailored services and expertise to specific geographic markets.

- Partner Empowerment: Focuses on equipping partners with the necessary skills and resources for growth.

Inventory Management and Logistics Efficiency

D&H Distributing, as a key player in wholesale distribution, places a premium on robust inventory management and streamlined logistics. This ensures that their extensive catalog of IT and consumer electronics products reaches their diverse network of resellers and retailers precisely when and where demand arises. Their operational prowess is critical for maintaining competitive lead times in a fast-paced market.

The company's commitment to efficiency is evident in its sophisticated warehousing and transportation networks. These systems are designed to handle a vast volume of SKUs, minimizing stockouts and optimizing delivery routes. For instance, in 2024, D&H reported a significant improvement in on-time delivery rates, reaching 96.5%, a testament to their logistical investments.

- Optimized Warehouse Operations: D&H leverages advanced Warehouse Management Systems (WMS) to track inventory in real-time, reducing carrying costs and improving order accuracy.

- Strategic Distribution Centers: With multiple strategically located distribution centers across North America, D&H minimizes transit times and shipping expenses for its partners.

- Carrier Network Management: The company actively manages its relationships with various shipping carriers, negotiating favorable rates and ensuring reliable transportation for a wide range of product sizes and values.

- Technology Integration: D&H continuously invests in technology, including automation and data analytics, to further enhance the speed and efficiency of its inventory and logistics processes, aiming for a 5% reduction in logistics costs by the end of 2025.

D&H Distributing's physical presence is strategically distributed across North America, featuring key operational hubs and sales facilities. This network ensures efficient product flow and localized support for their partner ecosystem.

The company's distribution centers, including those in major cities, are optimized for rapid fulfillment. For example, in 2024, D&H reported that 92% of orders shipped within 24 hours from these strategically located facilities.

This widespread infrastructure supports D&H's channel-centric model by ensuring product availability and timely delivery to value-added resellers and managed service providers across diverse geographic markets.

D&H's commitment to regional accessibility is further demonstrated by its ongoing investments in its logistics network, aiming to reduce average delivery times by 10% by the end of 2025.

| Location Type | Key Function | 2024 Operational Metric |

|---|---|---|

| Distribution Centers | Inventory storage and order fulfillment | 92% of orders shipped within 24 hours |

| Sales & Training Facilities | Partner support and education | Opened new facility in Tampa, FL to enhance regional coverage |

| Headquarters | Corporate operations and strategy | Harrisburg, PA; Mississauga, ON |

What You See Is What You Get

D&H Distributing 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This D&H Distributing 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

D&H Distributing significantly boosts its partners' capabilities through dedicated enablement programs and training. Initiatives like the 'Go Big AI' program and 'AI 101' SuccessPath seminars are central to this strategy. These programs aim to simplify advanced technologies, such as artificial intelligence, providing partners with the essential expertise to successfully market and deploy emerging solutions.

D&H Distributing actively engages in technology conferences and partner events, like its own THREAD Technology Conference, to directly connect with its channel partners. These gatherings are vital for demonstrating the latest tech innovations and offering specialized training. For instance, in 2024, THREAD events provided resellers with direct access to over 100 vendor partners, facilitating crucial business development opportunities.

D&H Distributing significantly bolsters its partners' promotional capabilities through comprehensive digital marketing resources and tailored campaign kits. Platforms like Market+SHIFT offer a robust suite of customizable assets, allowing resellers to seamlessly integrate D&H's established content and branding into their own outreach. This strategic approach ensures a unified brand message across all partner channels, directly supporting sales objectives and amplifying market reach.

These digital marketing tools are crucial for partners looking to navigate the evolving tech landscape. For instance, in 2024, the demand for co-branded marketing materials that resonate with specific customer segments has surged. D&H's provision of these resources, often including ready-to-deploy social media content and email templates, empowers partners to execute effective campaigns without extensive in-house marketing expertise, thereby driving lead generation and customer engagement.

Public Relations and Industry Recognition

D&H Distributing prioritizes public relations by consistently issuing press releases that highlight their expansion, new strategic ventures, and accolades. This proactive communication strategy keeps stakeholders informed and reinforces their market position. For instance, in 2023 and early 2024, D&H announced significant channel growth and new vendor partnerships, demonstrating their ongoing commitment to the IT ecosystem.

The company's commitment to excellence has been recognized through prestigious industry awards. Receiving 'Partner of the Year' honors from major solution providers such as CDW and Zones, LLC, significantly bolsters D&H's credibility and reputation within the technology channel. Such recognition underscores their strong relationships and value proposition to both vendors and resellers.

These industry acknowledgments contribute directly to D&H's brand equity and market influence. They serve as tangible proof of their operational success and dedication to fostering strong partnerships. The positive press and awards generated through their public relations efforts attract new business opportunities and solidify their standing as a leading distributor.

- Industry Awards: D&H has been recognized as 'Partner of the Year' by major industry players, validating their channel strategy.

- Press Releases: Regular announcements detail company growth, new initiatives, and achievements, maintaining market visibility.

- Reputation Enhancement: Awards and PR activities bolster D&H's credibility and brand image among vendors and customers.

- Channel Strength: Recognition from firms like CDW and Zones, LLC highlights D&H's strong position and relationships in the IT distribution landscape.

Dedicated Sales and Solutions Specialists

D&H Distributing's dedicated sales and solutions specialists are a key component of their marketing strategy, offering partners specialized expertise. These teams provide crucial pre-sales and post-sales support, ensuring partners have the technical knowledge and guidance needed to succeed.

This personalized support helps partners navigate complex technology solutions and close deals more efficiently. For instance, in 2024, D&H reported a significant increase in partner engagement with their solution specialist programs, directly correlating with higher deal closure rates for advanced technology solutions.

- Dedicated Pre-Sales Support: Specialists assist with solution design and configuration.

- Post-Sales Expertise: Ongoing technical assistance and troubleshooting are provided.

- Consultative Services: Partners receive strategic advice to address market needs.

- Technical Education: Access to training and certifications to enhance partner capabilities.

D&H Distributing enhances partner promotion through comprehensive digital marketing resources and co-branded campaign kits via platforms like Market+SHIFT. Public relations efforts, including press releases on growth and awards like CDW's 'Partner of the Year' in 2023, bolster D&H's market position and credibility.

The company actively participates in events like THREAD, offering direct vendor access and training. In 2024, these events connected resellers with over 100 vendors, fostering business development. D&H's sales and solutions specialists provide crucial pre- and post-sales support, with partner engagement in these programs seeing a significant increase in 2024, correlating with higher deal closure rates.

| Promotional Activity | Key Initiatives/Platforms | Impact/Data Point (2023-2024) |

|---|---|---|

| Digital Marketing Resources | Market+SHIFT, Co-branded Kits | Supports unified brand messaging, drives lead generation. |

| Public Relations & Awards | Press Releases, 'Partner of the Year' (CDW) | Enhances credibility, market influence, attracts new business. |

| Events & Training | THREAD Technology Conference | Facilitated 100+ vendor connections in 2024, boosting partner development. |

| Sales & Solutions Support | Dedicated Specialists | Increased partner engagement in 2024 led to higher deal closure rates for advanced solutions. |

Price

D&H Distributing understands the importance of financial flexibility for its channel partners. They offer a range of credit and financing options, including standard net terms credit lines and more extended payment arrangements. This approach helps partners manage their cash flow effectively.

To underscore this commitment, D&H Distributing extended a significant $400 million in credit to its partners during fiscal year 2024. This substantial figure highlights their dedication to empowering their partners' purchasing power and ensuring they have the financial resources to grow their businesses.

D&H Distributing navigates a crowded distribution landscape by setting competitive prices that appeal to its core customers: Value-Added Resellers (VARs), system integrators, and retailers. Their pricing model aims to be both cost-effective and reflective of the significant value they deliver through services like technical support and financing.

For instance, in the 2024 fiscal year, D&H reported revenue growth, indicating their pricing strategy is resonating with the market. This growth suggests a successful balance between offering attractive price points and justifying the cost with their comprehensive support and business-building tools, a crucial factor for their partners' success.

D&H Distributing actively utilizes manufacturer-funded programs, a key component of its pricing strategy. For instance, partnerships with vendors like Lenovo and Intel provide D&H with resources that can translate into better financial terms for their reseller partners. This allows D&H to offer competitive pricing and financing options, making it easier for businesses to acquire necessary technology.

These programs are crucial for driving sales of specific product lines. By collaborating with manufacturers such as Extreme Networks and Lexmark on these initiatives, D&H can incentivize partners to focus on those particular solutions. This strategic approach helps manage inventory and promote new or high-margin products within the channel, a common practice in the tech distribution landscape.

The financial benefits extend directly to D&H’s reseller network. Programs from vendors like Eaton, for example, can offer extended payment terms or special rebates, effectively lowering the upfront cost for resellers. This financial flexibility is vital, especially for smaller businesses looking to scale their IT infrastructure without significant capital outlay.

Value-Based Pricing Approach

D&H Distributing's pricing strategy is rooted in a value-based approach, recognizing that partners receive benefits far exceeding the mere cost of the products they purchase. This encompasses comprehensive support, dedicated training programs, and crucial enablement resources designed to bolster their business success.

This methodology allows D&H's partners to clearly articulate the return on their investment, highlighting how the integrated value proposition leads to enhanced long-term profitability and competitive advantage.

- Value Proposition: D&H focuses on delivering comprehensive support, training, and enablement services alongside products, enhancing partner profitability.

- Justification of Investment: Partners can demonstrate the long-term benefits and increased revenue potential derived from D&H's value-added offerings.

- Market Differentiation: This approach sets D&H apart by focusing on partner success and fostering deeper, more profitable relationships.

Support for Large Projects and Public Sector Deals

D&H Distributing recognizes the unique financial demands of large-scale projects, particularly within the public sector. To address this, they provide specialized financial solutions designed to empower partners. These offerings are crucial for enabling resellers to pursue significant government and education contracts that might otherwise be out of reach due to credit limitations.

Key financial mechanisms include Joint Purchase Orders, which allow multiple partners to collaborate on a single order, spreading the financial responsibility. Additionally, the Assignment of Credit Extension program facilitates the transfer of credit, enabling partners to secure the necessary funding for substantial deals. For instance, in 2024, D&H saw a notable increase in public sector deal registrations, highlighting the demand for such support.

- Joint Purchase Orders: Facilitates collaboration and shared financial responsibility for large bids.

- Assignment of Credit Extension: Enables partners to leverage D&H's credit lines for bigger projects.

- Public Sector Focus: Programs are tailored to meet the specific procurement and funding cycles of government and education.

- Increased Deal Capacity: Empowers partners to bid on and win larger, more lucrative projects.

D&H Distributing's pricing is strategically set to be competitive for its target audience, including Value-Added Resellers (VARs), system integrators, and retailers. Their approach balances cost-effectiveness with the significant value delivered through services like technical support and flexible financing options.

4P's Marketing Mix Analysis Data Sources

Our D&H Distributing 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, industry analyses, and competitive intelligence. We leverage information on their product offerings, pricing structures, distribution network, and marketing initiatives to provide a holistic view.