D&H Distributing Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D&H Distributing Bundle

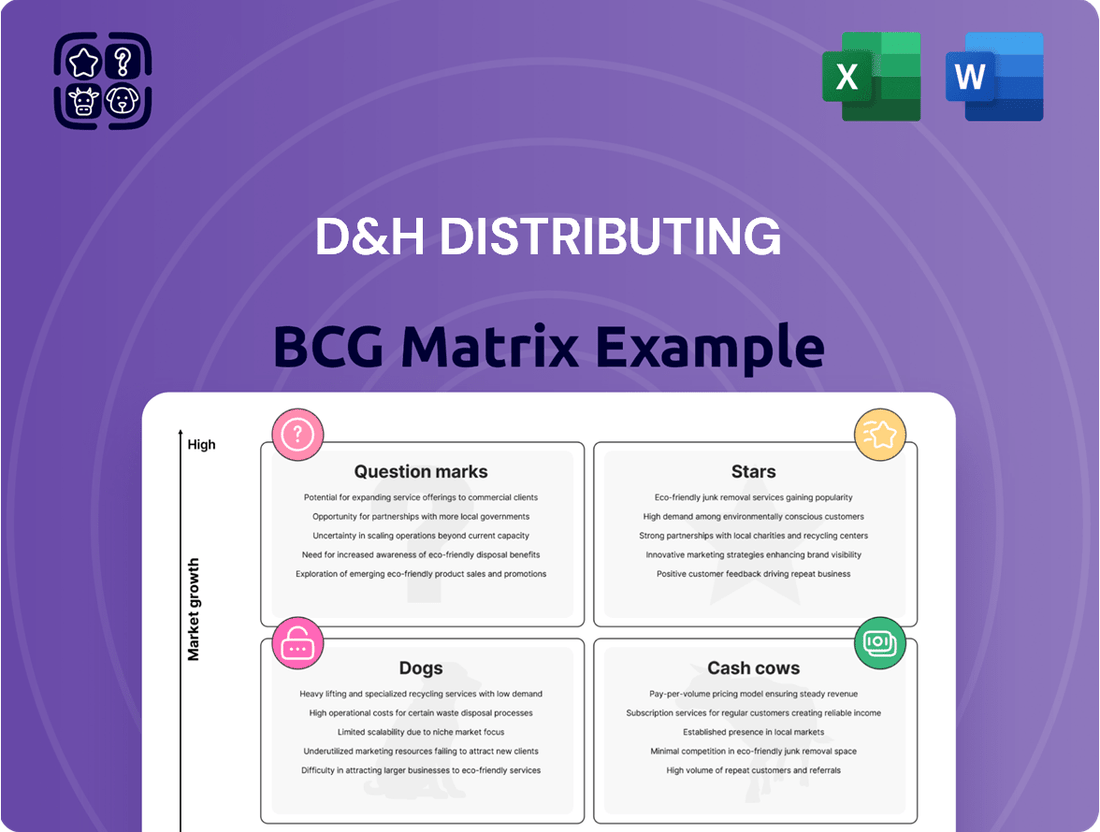

Curious about D&H Distributing's product portfolio performance? This snapshot offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and a comprehensive understanding of their market strategy, dive into the full BCG Matrix.

Gain a clear view of where D&H Distributing's products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

D&H Distributing is strategically positioning itself in the burgeoning AI-powered solutions and AI PCs market. Their significant investment in partner training, exemplified by programs like 'Go Big AI' and 'AI 101' SuccessPath seminars, highlights a commitment to equipping their channel with the necessary expertise. This focus on AI readiness is crucial for capturing market share in a sector projected for substantial growth.

Modern Security Solutions represent a significant Star within D&H Distributing's BCG Matrix. The company experienced an impressive 63% year-over-year growth in this segment during 2024, underscoring its strong performance. This expansion is fueled by an increasing demand for managed security services, a key component of their evolving portfolio.

Cybersecurity has firmly established itself as a paramount enterprise technology priority, positioning it as a sustained growth driver for the IT channel. D&H is capitalizing on this trend, demonstrating robust market share gains in a high-growth sector. This strategic focus allows D&H to leverage its expertise and expand its reach in a critical and expanding market.

Cloud solutions and Everything-as-a-Service (XaaS) are booming in the IT distribution sector. D&H Distributing saw a remarkable 29% surge in their cloud solutions business during their Fiscal Year 2025. This growth highlights a significant industry trend towards cloud-based services and recurring revenue models.

D&H is actively investing in and expanding its cloud and XaaS portfolio. This strategic focus is designed to meet the evolving demands of the market, which increasingly favors subscription-based IT consumption. The company's commitment to this high-growth segment positions them well for future success.

Advanced Infrastructure Solutions

D&H Distributing's Advanced Infrastructure Solutions are positioned as a strong contender in the market. The company saw impressive growth, exceeding 20% in areas like networking, ProAV, and power products during Fiscal Year 2024. This performance highlights a significant market presence in a rapidly expanding sector of the IT landscape.

These investments are crucial for meeting the increasing demand for resilient and scalable IT infrastructure among businesses. D&H's focus on these segments reflects a strategic move to capitalize on current market trends and future technological needs.

- Market Growth: D&H experienced over 20% growth in advanced infrastructure solutions like networking and ProAV in FY2024.

- Strategic Focus: Investments in these areas align with the growing business need for robust and scalable IT environments.

- Segment Strength: This segment demonstrates a strong market position for D&H within a key IT growth area.

Public Sector Growth (Government and Education)

D&H Distributing is strategically growing its presence in the public sector, a high-growth market for the company. This expansion is significantly bolstered by their partnership with OMNIA Partners, initiated in early 2024.

This collaboration has directly contributed to a noticeable increase in channel projects specifically within the government and education segments. These efforts underscore D&H's commitment to its State and Local Government/Education (SLED) initiatives, demonstrating their success in capturing a larger share of this expanding market.

- Public Sector Focus: D&H is actively targeting government and education markets.

- OMNIA Partners Alliance: A key relationship established in early 2024 drives public sector growth.

- SLED Initiatives: D&H's State and Local Government/Education programs are gaining traction.

- Market Share Growth: The company is successfully increasing its footprint in this high-potential sector.

D&H Distributing's AI-powered solutions and AI PCs represent a significant Star. The company's proactive investment in partner training, seen in programs like Go Big AI and AI 101, is equipping the channel for this high-growth area. This strategic focus on AI readiness is crucial for capturing market share in a sector poised for substantial expansion.

Modern Security Solutions are a clear Star for D&H, evidenced by a remarkable 63% year-over-year growth in 2024. This surge is driven by increasing demand for managed security services, a vital part of their expanding portfolio and a critical enterprise technology priority.

Cloud solutions and Everything-as-a-Service (XaaS) are also Stars, with D&H experiencing a 29% surge in their cloud business during Fiscal Year 2025. This reflects a strong industry shift towards subscription-based IT and recurring revenue models.

D&H's Advanced Infrastructure Solutions, including networking and ProAV, are Stars, showing over 20% growth in FY2024. These investments align with business needs for scalable IT and highlight D&H's strong market position in key growth areas.

The Public Sector, particularly SLED initiatives, is another Star segment for D&H, significantly boosted by their early 2024 partnership with OMNIA Partners. This collaboration is directly driving channel projects in government and education, expanding D&H's footprint in this high-potential market.

| Segment | BCG Category | 2024/FY25 Growth Data | Strategic Importance |

|---|---|---|---|

| AI Solutions & PCs | Star | High investment in partner training (Go Big AI, AI 101) | Capturing market share in a high-growth sector. |

| Modern Security Solutions | Star | 63% YoY growth in 2024 | Meeting demand for managed security services. |

| Cloud & XaaS | Star | 29% surge in FY2025 | Capitalizing on subscription-based IT trends. |

| Advanced Infrastructure | Star | >20% growth in FY2024 (Networking, ProAV) | Addressing demand for scalable IT infrastructure. |

| Public Sector (SLED) | Star | Growth driven by OMNIA Partners alliance (early 2024) | Expanding footprint in government and education. |

What is included in the product

This BCG Matrix overview provides tailored analysis for D&H Distributing's product portfolio, highlighting which units to invest in, hold, or divest.

Visualize your product portfolio's health with D&H Distributing's BCG Matrix, turning complex data into actionable insights.

Cash Cows

D&H Distributing's traditional IT hardware, particularly PCs and devices, represents a significant Cash Cow. This segment consistently generates substantial revenue, bolstered by a notable 16.2% year-over-year growth in Q4 2024, largely driven by the demand for AI-enabled PCs.

The ongoing PC replacement cycle, prompted by the end-of-service for Windows 10, ensures a predictable and high-volume revenue stream for D&H, even within a mature IT distribution market.

The Small and Midsize Business (SMB) market segment is a cornerstone for D&H Distributing, acting as the bedrock of their business. This segment achieved a record-breaking revenue year in Fiscal Year 2025, demonstrating impressive growth of 23%.

D&H's deep-rooted presence and extensive history in the SMB market have cultivated strong, enduring relationships with partners. This established network, coupled with specialized support designed to meet the unique needs of SMBs, ensures a consistent and dependable stream of cash flow for the company.

D&H Distributing's core distribution services and logistics represent a classic Cash Cow within their business portfolio. This segment, characterized by its mature market and high market share, consistently generates substantial profits with minimal investment. For instance, in 2024, D&H reported significant revenue contributions from its established distribution channels, reflecting the steady demand for its supply chain solutions.

Existing VAR and MSP Partner Base Support

D&H Distributing leverages its substantial and expanding network of Value-Added Resellers (VARs) and Managed Service Providers (MSPs) as a significant cash cow. This existing partner base is a stable revenue generator, benefiting from the mature distribution market. The company’s commitment to these partners fuels continued business and growth.

The company added over 1,000 new MSP customers in 2024 alone, highlighting the robust expansion of this segment. This influx of new partners, coupled with the loyalty of established ones, solidifies the cash cow status of this business unit. D&H’s focus on nurturing these relationships ensures sustained revenue streams.

- Existing Partner Base: D&H Distributing boasts a large and growing foundation of VARs and MSPs.

- New Customer Acquisition: Over 1,000 new MSP customers were onboarded in 2024, demonstrating strong market penetration.

- Support Mechanisms: D&H offers vital support, including credit extensions and comprehensive pre-sales/post-sales assistance.

- Market Maturity: The established nature of the distribution market makes this partner base a reliable and consistent revenue source.

Consumer Electronics Distribution

D&H Distributing's Consumer Electronics Distribution segment is a classic cash cow within its BCG matrix. Despite the ongoing shift towards online retail, D&H maintains a significant market share in this mature sector, largely due to its established offline distribution networks. This provides a reliable and substantial revenue stream, even if growth is modest.

The global consumer electronics market, valued at approximately $1.1 trillion in 2023, continues to offer consistent, high-volume sales for established players like D&H. Their strength lies in serving traditional retail channels, which, while evolving, still represent a considerable portion of consumer purchasing behavior.

- Stable Revenue: The mature nature of the consumer electronics market ensures predictable sales volumes for D&H.

- High Market Share: D&H's established presence, particularly in offline distribution, secures a strong position.

- Offline Channel Strength: Continued reliance on retail by a segment of consumers benefits D&H's distribution model.

- Mature Market Dynamics: While growth is slower, the sheer size of the market generates consistent cash flow.

D&H Distributing's established IT hardware, particularly PCs and devices, along with its core distribution services and logistics, function as significant Cash Cows. These segments benefit from a mature market and high market share, consistently generating substantial profits with minimal new investment. The company’s strong presence in the SMB market, which saw a 23% revenue growth in FY25, further solidifies these Cash Cow positions.

| Business Segment | BCG Category | Key Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Traditional IT Hardware (PCs, Devices) | Cash Cow | PC replacement cycle (Windows 10 EOL), AI PC demand | 16.2% Q4 2024 YoY growth |

| Core Distribution & Logistics | Cash Cow | Established channels, steady demand for supply chain solutions | Significant revenue contributions reported in 2024 |

| SMB Market Focus | Cash Cow | Deep relationships, specialized support, market leadership | Record-breaking revenue year in FY25, 23% growth |

| VARs & MSPs Network | Cash Cow | Large, loyal partner base, ongoing support | Over 1,000 new MSP customers added in 2024 |

Delivered as Shown

D&H Distributing BCG Matrix

The D&H Distributing BCG Matrix preview you're examining is the identical, fully polished document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use.

Rest assured, the BCG Matrix report you are currently viewing is the exact final version that will be delivered to you upon completing your purchase. This ensures you get a comprehensive, actionable strategic tool without any hidden surprises or the need for further modifications.

What you see here is the definitive D&H Distributing BCG Matrix document that you will own after your purchase. This preview accurately represents the final deliverable, providing you with a complete and ready-to-implement strategic planning resource.

Dogs

Legacy on-premises software and solutions, particularly those with diminishing demand or poor integration with newer technologies, represent a potential weak area for D&H Distributing within the BCG matrix. As the IT landscape rapidly evolves towards cloud-centric architectures and subscription models, these traditional offerings face significant headwinds. For instance, in 2024, the global market for on-premises software continued its decline, with many businesses prioritizing the flexibility and cost-efficiency of cloud alternatives, impacting the growth potential for legacy systems.

Certain consumer electronics categories are finding themselves in the Dogs quadrant due to a lack of innovation or waning consumer demand. Think about older audio and video equipment, or basic non-smart devices that haven't kept pace with technological advancements. These products often struggle to compete in today's market.

The consumer electronics landscape moves incredibly fast. Products that don't embrace new features like AI integration or the widespread adoption of 5G connectivity are particularly vulnerable to losing market share. For instance, in 2024, the global market for feature phones, a category often lacking advanced connectivity, saw a slight decline compared to the previous year, highlighting the shift towards smarter devices.

Commoditized, Low-Margin IT Components are likely to be considered Dogs within D&H Distributing's BCG Matrix. These products, characterized by intense price competition and a lack of unique features, often struggle to generate substantial profits. For instance, basic RAM modules or standard USB drives fall into this category, where differentiation is minimal and margins are razor-thin. In 2023, the global PC components market saw significant price pressures, with average selling prices for many entry-level components declining year-over-year, directly impacting profitability for distributors like D&H.

Niche or Specialized Products with Limited Market Adoption

Niche or specialized products with limited market adoption, often categorized as Dogs in the D&H Distributing BCG Matrix, represent offerings that struggle to gain significant traction. These products cater to very small or stagnant niche markets, or have failed to achieve substantial adoption among D&H's Value-Added Reseller (VAR) and Managed Service Provider (MSP) partners.

These offerings can consume valuable resources for promotion and support without yielding a substantial market share or demonstrating meaningful growth. For instance, a specialized cybersecurity solution designed for a highly specific industry might have limited appeal, leading to low sales volumes despite dedicated marketing efforts.

- Low Sales Volume: Products in this category typically exhibit consistently low sales figures, indicating a weak demand.

- High Support Costs: Despite low sales, these products may require significant investment in technical support and training for partners.

- Stagnant Market Share: They often hold a minimal or declining share of their respective markets, with little prospect for expansion.

- Resource Drain: Continued investment in marketing, inventory, and partner enablement for these products can divert resources from more promising opportunities.

Inefficient or Underutilized Service Offerings

Inefficient or underutilized service offerings at D&H Distributing might include specialized cloud migration support that hasn't gained significant traction among their partner base. Another example could be certain advanced cybersecurity training modules that, despite investment, see low enrollment. These services may not align with the immediate needs of a broad segment of their partners or D&H might not possess a strong competitive edge in these niche areas compared to specialized third-party providers.

These underperforming services represent a drain on resources without a commensurate return. For instance, if a particular managed service offering requires significant technical staff hours but is only utilized by a small fraction of partners, its operational cost could outweigh the generated revenue. This situation is exacerbated if the market demand for that specific service is declining or if competitors offer a more compelling or cost-effective solution.

- Low Partner Adoption Rates: Services with less than 10% of the partner base actively utilizing them.

- High Operational Cost-to-Revenue Ratio: Offerings where the cost of delivery exceeds 75% of the revenue generated.

- Misalignment with Market Trends: Services that address niche or diminishing market demands.

- Limited Competitive Differentiation: Offerings where D&H's unique value proposition is not clear to partners.

Products categorized as Dogs within D&H Distributing's BCG Matrix are those with low market share and low growth potential. These offerings typically generate minimal revenue and often require significant resources for maintenance or support without a clear path to improvement. For example, certain legacy hardware peripherals that have been superseded by newer technologies would fall into this category.

In 2024, the market for older, non-connected home entertainment systems continued its decline, with sales volumes significantly lower than that of smart, internet-enabled devices. This trend underscores the challenge for D&H in distributing products that lack current technological relevance or widespread consumer appeal.

These Dog products can represent a drag on a company's overall portfolio, consuming capital and management attention that could be better allocated to more promising areas. Identifying and managing these offerings effectively is crucial for optimizing resource allocation and driving future growth.

For D&H Distributing, this might include specific lines of printers or scanners that have seen a sharp decrease in demand due to the rise of digital workflows and cloud-based document management solutions.

Question Marks

Beyond the initial AI PC refresh cycle, D&H's deeper ventures into complex AI/ML integrations for enterprise solutions and specialized AI applications represent a strategic move into the question mark quadrant. These advanced integrations, such as custom machine learning models for predictive analytics or AI-powered automation for supply chains, target specific business needs with potentially high growth but also higher initial investment and uncertain market adoption.

D&H Distributing's move into 5G connectivity solutions positions them squarely in the 'Question Mark' category of the BCG Matrix. This strategic expansion targets the high-growth enterprise networking and Internet of Things (IoT) sectors, areas ripe for technological advancement.

While 5G itself represents a significant growth opportunity, D&H's current market penetration and the speed at which their Value-Added Resellers (VARs) and Managed Service Providers (MSPs) are adopting these complex enterprise solutions are still developing. Industry analysts project the global 5G enterprise market to reach over $40 billion by 2027, highlighting the potential, but D&H's specific share within this burgeoning market is yet to be firmly established.

The Internet of Things (IoT) market is experiencing explosive growth, with projections indicating it will reach over $1.5 trillion by 2025, according to various industry analyses. D&H Distributing's focus on providing comprehensive IoT ecosystem solutions positions them within this dynamic sector.

However, given the complexity and fragmentation of the IoT landscape, D&H's current market share in this specific area is likely still developing. This makes IoT solutions a potential 'Question Mark' in their BCG Matrix, requiring substantial investment to build a stronger foothold and capitalize on the high growth potential.

Advanced Professional Services (e.g., Managed Support Services)

D&H Distributing's Advanced Professional Services, including managed support, likely fall into the question mark category of the BCG Matrix. The company experienced a remarkable 283% growth in these services during fiscal year 2025, demonstrating significant market momentum and strategic focus. This rapid expansion signals high growth potential, aligning with the characteristics of a question mark.

However, the market for specialized, often customized, professional services is highly competitive. While D&H is investing heavily, its current market share in these advanced offerings compared to niche, specialized service providers might still be relatively low. This positions them as question marks, requiring substantial and continued investment to capture a larger market share and potentially transition into stars.

- High Growth Area: D&H's professional services saw 283% growth in FY 2025.

- Investment Focus: The company is actively investing in managed support services.

- Market Position: Likely a question mark due to potentially low market share in a competitive, specialized service sector.

- Strategic Imperative: Requires continued investment to build market share and solidify its position.

Expansion into New Vertical Markets with Specialized Solutions

D&H Distributing's strategy to guide SMB partners into mid-market and enterprise segments, with a particular emphasis on vertical markets like government and education, demonstrates a forward-thinking approach. However, success in these specialized sectors, while promising, can be viewed as a question mark within a BCG matrix framework.

Expanding into and capturing substantial market share within new, specialized verticals typically demands significant capital outlay and a highly customized strategy. This is especially true for sectors like government procurement, which often involves complex bidding processes and stringent compliance requirements. For instance, in 2024, government IT spending in the US was projected to reach over $160 billion, highlighting the potential but also the competitive landscape.

- Vertical Market Focus: D&H's emphasis on government and education targets sectors with substantial IT budgets, aiming to leverage specialized solutions.

- Mid-Market/Enterprise Push: The initiative to help SMB partners ascend to larger deals signifies a strategic move to capture higher revenue opportunities.

- Investment & Tailoring: Significant financial investment and tailored go-to-market strategies are crucial for penetrating and gaining traction in these specialized verticals.

- Market Share Challenge: Achieving significant market share in established, specialized verticals presents a considerable hurdle, requiring sustained effort and differentiated offerings.

D&H Distributing's focus on emerging technologies like AI PCs and advanced enterprise AI solutions places them in the question mark quadrant. These areas offer high growth potential but require substantial investment and face uncertain market adoption rates. For example, the AI PC market, while anticipated to grow rapidly, is still in its nascent stages, with adoption dependent on software and hardware ecosystem development.

The company's expansion into 5G connectivity and comprehensive IoT solutions also represents question marks. While the global 5G enterprise market is projected to exceed $40 billion by 2027, D&H's current market share in these complex areas is still developing, necessitating significant investment to gain traction. Similarly, the vast IoT market, estimated to surpass $1.5 trillion by 2025, presents a growth opportunity where D&H's foothold is still being established.

D&H's Advanced Professional Services, including managed support, experienced a remarkable 283% growth in fiscal year 2025, indicating high growth potential. However, the competitive nature of specialized services means their current market share might be relatively low, positioning these services as question marks that require continued investment to capture a larger market presence.

Furthermore, D&H's strategic push into vertical markets like government and education, targeting mid-market and enterprise segments, also falls into the question mark category. Penetrating these specialized sectors, with government IT spending in the US projected to exceed $160 billion in 2024, demands significant capital and tailored strategies to build market share.

BCG Matrix Data Sources

Our D&H Distributing BCG Matrix leverages a blend of internal sales data, market share reports, and industry growth forecasts to accurately position each business unit.