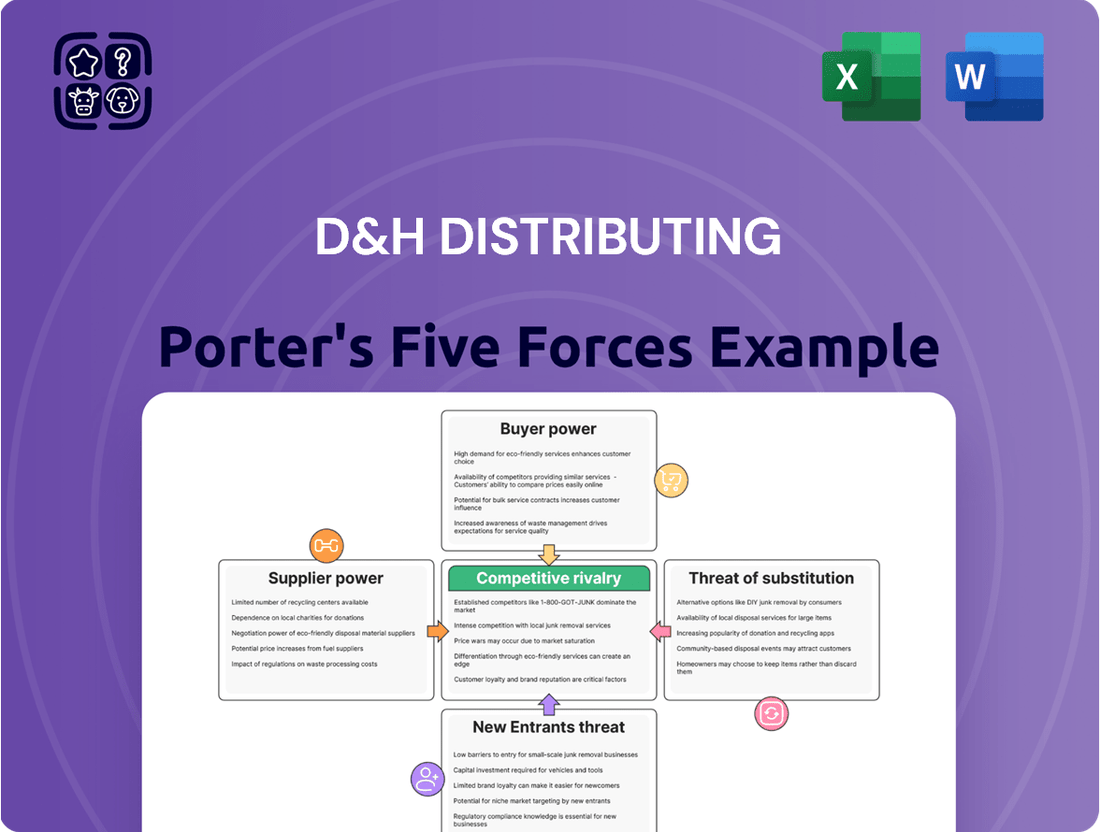

D&H Distributing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

D&H Distributing Bundle

Understanding the competitive landscape for D&H Distributing is crucial for strategic planning. Our analysis reveals how supplier power and the threat of substitutes significantly shape their market. Don't miss out on the full picture.

The complete report reveals the real forces shaping D&H Distributing’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

D&H Distributing's reliance on a concentrated supplier base, primarily major technology manufacturers, is a key factor in assessing supplier power. When a few dominant players control essential IT and consumer electronics products, they can significantly influence pricing and availability for distributors like D&H.

For instance, in 2024, the semiconductor industry, crucial for many of D&H's offerings, remained characterized by a limited number of key manufacturers. Companies like TSMC and Intel, controlling a substantial portion of global chip production, hold considerable leverage. This concentration means D&H must carefully manage relationships to secure favorable terms and consistent supply, as disruptions or price hikes from these few suppliers can directly impact D&H's margins and inventory.

Suppliers who offer unique or proprietary technology that D&H Distributing's value-added resellers (VARs) and integrators absolutely need will naturally hold more sway. If there aren't many other options for these specialized products, D&H's ability to negotiate prices or terms becomes more challenging.

However, D&H Distributing's strength lies in its extensive product catalog, which helps to mitigate the impact of any single unique offering. This broad portfolio means D&H isn't overly reliant on just one supplier or product line, providing a degree of flexibility in sourcing.

The costs D&H Distributing faces when switching between major suppliers can be substantial. These expenses often include the need to reconfigure existing supply chain operations, train staff on new product portfolios, and the intangible but significant loss of deeply entrenched vendor relationships, all of which can tip the scales in favor of suppliers.

For instance, D&H's long-standing partnerships with foundational technology providers such as Intel and HP likely involve intricate integration processes and established credit lines, making a shift to a new supplier a complex and potentially expensive undertaking, reinforcing the bargaining power of these key vendors.

Supplier's Ability to Forward Integrate

A key aspect of supplier bargaining power is their ability to forward integrate, meaning they can bypass distributors like D&H Distributing and sell directly to end customers, such as Value-Added Resellers (VARs), system integrators, and retailers. If this were easily achievable, manufacturers would gain significant leverage.

While some direct sales channels do exist for certain manufacturers, the intricate nature of the IT supply chain often makes distribution networks essential. These networks provide efficiency and reach that many manufacturers find difficult to replicate independently.

- Manufacturer Direct Sales: In 2024, while direct-to-consumer sales models are growing across many industries, the IT hardware and software distribution sector still relies heavily on intermediary channels for broad market penetration.

- Channel Complexity: The IT market involves a wide array of customer segments, each with unique purchasing requirements, making a single direct sales force inefficient for manufacturers compared to leveraging established distribution partners.

- Distribution Value: Distributors like D&H Distributing offer services such as logistics, credit, marketing support, and technical expertise, which are valuable to both manufacturers and their reseller customers, thereby mitigating the threat of direct sales.

Importance of D&H to Suppliers

D&H Distributing's substantial sales volume and extensive reach throughout North America, particularly its robust expansion into the midmarket and enterprise sectors, position it as a crucial distribution channel for numerous technology manufacturers. This significant market presence means that for certain vendors, D&H is increasingly becoming a primary or top-tier distributor.

This growing reliance on D&H by some suppliers directly diminishes their individual bargaining power. When a vendor sees a substantial portion of its sales flowing through D&H, the distributor gains leverage in negotiations regarding pricing, terms, and product allocation.

- D&H's North American reach: Serves as a vital conduit for technology manufacturers seeking broad market penetration.

- Growth in midmarket and enterprise: Highlights D&H's expanding importance beyond its traditional SMB base, making it more attractive to vendors targeting these lucrative segments.

- Becoming a top distributor: For some vendors, D&H's increasing share of their total sales translates to a reduction in the vendor's individual bargaining power against D&H.

The bargaining power of suppliers for D&H Distributing is significant due to the concentrated nature of the IT and consumer electronics manufacturing landscape. Key suppliers, often controlling essential components or proprietary technology, can dictate terms, impacting D&H's profitability and supply chain stability.

For instance, in 2024, the semiconductor shortage continued to highlight the leverage held by major chip manufacturers like TSMC and Intel, directly affecting the availability and cost of numerous products D&H distributes. The high switching costs for D&H, involving complex integration and established relationships with vendors like HP and Dell, further solidify supplier power.

While D&H's growing market presence, particularly in the midmarket and enterprise sectors, can diminish individual vendor leverage, the fundamental concentration of manufacturing power remains a dominant force. This dynamic necessitates careful relationship management and strategic sourcing to mitigate supplier influence.

| Factor | Impact on D&H Distributing | 2024 Context/Data |

|---|---|---|

| Supplier Concentration | High leverage for dominant manufacturers | Limited number of key semiconductor manufacturers (e.g., TSMC, Intel) maintained significant market share. |

| Product Differentiation/Proprietary Tech | Increased supplier power for unique offerings | Essential components or specialized software from single vendors create dependency. |

| Switching Costs | High costs favor existing supplier relationships | Reconfiguration of supply chains, retraining, and loss of established vendor credit lines are substantial barriers. |

| Threat of Forward Integration | Potential for manufacturers to bypass distributors | While IT distribution networks remain vital for reach, some manufacturers explore direct sales channels. |

| D&H's Market Power | Mitigates supplier power through volume and reach | D&H's expansion into midmarket and enterprise sectors increases its importance to certain vendors. |

What is included in the product

This analysis of D&H Distributing's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly visualize competitive intensity across all five forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

D&H Distributing caters to a wide array of customers, including value-added resellers (VARs), system integrators, and retail businesses. This broad and fragmented customer base means that no single client holds significant sway over D&H's pricing or terms. For instance, in 2024, D&H's top customer likely represented a very small percentage of their overall sales, underscoring the lack of concentrated customer power.

In the highly competitive IT and consumer electronics sectors, D&H Distributing's customers, including retailers and value-added resellers, often exhibit significant price sensitivity. They are constantly on the lookout for the most advantageous pricing to preserve their own profit margins in a market where consumer demand can fluctuate. This focus on price means that D&H faces pressure to offer competitive rates, even as it provides valuable services and support.

The bargaining power of these customers can be amplified by the availability of alternative distributors and direct-to-market options from manufacturers, particularly for commoditized products. For instance, in 2024, the average profit margin for IT resellers hovered around 5-10%, underscoring their need to secure favorable wholesale pricing from distributors like D&H. This dynamic forces D&H to balance aggressive pricing strategies with its need to maintain healthy profitability.

The availability of substitute distributors significantly impacts D&H Distributing's customer bargaining power. Major competitors like TD Synnex and Ingram Micro also cater to the North American IT market, offering similar product portfolios and services.

This competitive landscape allows D&H's customers, particularly larger resellers and managed service providers, to easily compare pricing, terms, and product availability across different distributors. For instance, if D&H's pricing for a particular product line, say networking equipment, is higher than a competitor's, a customer can leverage this information to negotiate better terms or simply shift their business. In 2024, the IT distribution market remained highly competitive, with these large players constantly vying for market share through aggressive pricing and value-added services.

Customer's Ability to Backward Integrate

The capacity for customers to backward integrate, meaning they could potentially produce the products themselves, presents a significant factor in assessing their bargaining power. While this is a less frequent consideration for smaller value-added resellers (VARs) and retailers, larger entities might explore sourcing directly from manufacturers, thereby cutting out the distributor.

However, the practicalities of such a move are often substantial. The intricate logistics involved in managing supply chains, meeting stringent credit requirements from manufacturers, and the loss of the specialized value-added services that distributors like D&H provide typically render direct sourcing unfeasible for the majority of D&H's customer base.

- Logistical Hurdles: Managing direct relationships with numerous manufacturers involves significant coordination and infrastructure investment.

- Financial Requirements: Manufacturers often have higher credit thresholds for direct sales compared to distributors.

- Value-Added Services: D&H offers services like inventory management, technical support, and financing, which are difficult for customers to replicate internally.

- Market Concentration: The IT distribution market, while competitive, sees consolidation, meaning fewer direct-to-manufacturer options for many smaller players.

Importance of D&H's Services and Support

D&H Distributing's robust service and support offerings significantly curb customer bargaining power. By providing value-added services such as credit extensions, comprehensive training programs, and dedicated pre- and post-sales support, D&H moves beyond being a mere product vendor. This integrated approach enhances the customer's overall value proposition, making price the sole negotiation point less effective.

These services directly address customer needs and reduce their reliance on alternative suppliers solely based on cost. For instance, D&H's financing options can be crucial for resellers managing cash flow, thereby increasing their loyalty and diminishing their leverage to demand lower prices. In 2024, the IT distribution landscape continues to emphasize service integration, with companies like D&H leveraging these offerings to solidify customer relationships.

- Value-Added Services: D&H provides essential services like credit, training, and technical support.

- Customer Retention: These services increase customer stickiness, reducing their ability to switch based on price alone.

- Differentiation: D&H differentiates itself from competitors by offering a comprehensive support ecosystem.

- Reduced Price Sensitivity: Customers value the convenience and expertise provided, making them less sensitive to price fluctuations.

D&H Distributing's customers, including VARs and retailers, generally have moderate bargaining power. While they are price-sensitive, as evidenced by the 5-10% profit margins common in the IT reseller market in 2024, the fragmented customer base limits the leverage of any single buyer.

The availability of alternative distributors like TD Synnex and Ingram Micro in the competitive North American IT market allows customers to compare pricing and terms. This competition means D&H must remain competitive on price, especially for commoditized products, to retain its clients.

However, D&H's strong value-added services, such as credit extensions, training, and technical support, significantly reduce customer power. These services enhance customer loyalty and make it less likely for clients to switch solely based on price, mitigating the impact of direct-to-manufacturer sourcing or competitor offers.

What You See Is What You Get

D&H Distributing Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The D&H Distributing Porter's Five Forces Analysis you see here thoroughly examines the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive report is ready for your immediate use.

Rivalry Among Competitors

The North American IT distribution landscape is characterized by a few dominant players, creating a concentrated market where D&H Distributing faces intense rivalry. Companies like TD Synnex and Ingram Micro are significantly larger, commanding a substantial portion of the market share. This concentration means D&H must constantly innovate and differentiate itself to compete effectively.

Despite the presence of these larger entities, D&H Distributing has demonstrated impressive growth in recent years, actively working to close the market share gap. For instance, in 2024, D&H reported strong revenue figures, indicating their ability to gain traction. However, the sheer scale of competitors like TD Synnex, which reported over $60 billion in revenue in 2023, highlights the ongoing challenge D&H faces in matching their operational capacity and reach.

The IT distribution market experienced a modest contraction in 2024, with some reports indicating a slight year-over-year decline. However, projections for 2025 show a positive turnaround, with anticipated growth fueled by the increasing integration of artificial intelligence solutions and the anticipated resurgence in PC upgrade cycles.

This projected market expansion is a crucial factor in moderating competitive rivalry. As the overall market size increases, companies like D&H Distributing have a greater opportunity to grow their revenue by capturing new business and expanding their customer base, rather than solely relying on aggressive tactics to steal market share from existing competitors.

D&H Distributing sets itself apart by cultivating robust personal relationships and delivering exceptional service, particularly for its SMB and growing midmarket/enterprise clientele. This focus on specialized support contrasts sharply with competitors leaning towards more automated, self-service platforms.

This relationship-driven approach acts as a buffer against intense price competition. For example, D&H's commitment to dedicated account management and technical expertise helps partners navigate complex IT solutions, fostering loyalty beyond mere cost considerations.

Switching Costs for Customers

While customers can indeed switch distributors, the process isn't always seamless for them. There are often practical hurdles to overcome, such as the need to re-establish credit lines with a new vendor, learn new ordering platforms, and adapt to different customer support structures. These factors create a degree of friction, making immediate switching less appealing.

These switching costs, though potentially moderate, do play a role in tempering the intensity of rivalry. They introduce a slight barrier, meaning that while competition is present, it's not entirely frictionless. This can provide a small measure of stability for distributors like D&H Distributing.

- Re-establishing Credit Lines: This can involve credit checks and a waiting period, impacting cash flow.

- New Ordering Processes: Learning new interfaces and workflows adds an operational burden.

- Adapting to Support Systems: Different technical support and account management styles require adjustment.

Exit Barriers

High fixed costs associated with warehousing, logistics, and IT infrastructure in the IT distribution sector, like that of D&H Distributing, can make exiting the market a costly endeavor. Companies might continue operating even with slim margins to recoup these investments.

The presence of specialized assets, such as dedicated distribution centers or proprietary software systems, further entrenches businesses. These assets have limited alternative uses, making liquidation difficult and expensive, thereby increasing exit barriers.

Long-term contracts with suppliers and customers also contribute to exit barriers. Breaking these agreements can incur penalties, forcing companies to remain in the market longer than they might otherwise choose, which can intensify competitive rivalry.

- High Fixed Costs: Companies in IT distribution often have significant investments in physical infrastructure and technology.

- Specialized Assets: The need for specific warehousing and logistics capabilities can tie companies to the industry.

- Long-Term Contracts: Commitments to partners can make a swift exit impractical or financially damaging.

Competitive rivalry within the IT distribution sector is fierce, with D&H Distributing operating in a concentrated North American market dominated by larger players like TD Synnex and Ingram Micro. These larger competitors boast significant market share and financial resources, exemplified by TD Synnex's over $60 billion in revenue in 2023.

D&H distinguishes itself through a personalized, relationship-driven approach, focusing on dedicated account management and technical expertise, particularly for its SMB and midmarket clients. This strategy aims to build loyalty and mitigate direct price competition, contrasting with competitors' more automated platforms.

While switching distributors involves moderate friction for customers, including re-establishing credit and learning new systems, the overall market is projected for growth in 2025, driven by AI and PC upgrades. This expansion offers opportunities for D&H to grow organically, potentially easing some of the pressure from direct rivalry.

| Competitor | Approximate 2023 Revenue (USD) | Market Focus |

|---|---|---|

| TD Synnex | $60 billion+ | Broad IT solutions, services, and distribution |

| Ingram Micro | $50 billion+ | Global IT supply chain, cloud, and mobility solutions |

| D&H Distributing | Undisclosed (but growing) | Value-added distribution, SMB and midmarket focus |

SSubstitutes Threaten

The most significant substitute for a distributor like D&H Distributing is the ability of value-added resellers (VARs), integrators, and retailers to source IT and consumer electronics products directly from manufacturers. This bypasses the distributor entirely.

While theoretically possible, especially for larger players, direct sourcing often presents considerable challenges. These include the complexities of managing logistics, warehousing inventory, and establishing credit lines with numerous individual manufacturers, tasks that distributors like D&H are equipped to handle efficiently.

In 2024, the trend of large enterprises seeking direct relationships with manufacturers continued, particularly for high-volume purchases. However, the overhead and specialized expertise required for effective supply chain management remain a significant barrier for many smaller to mid-sized businesses, reinforcing the value proposition of distributors.

The rise of cloud-based as-a-Service (XaaS) models presents a significant threat of substitution for traditional hardware and perpetual software sales. Customers increasingly opt for subscription-based access to computing power, software applications, and IT infrastructure, reducing the need for upfront capital expenditures on physical equipment. For instance, the global XaaS market was projected to reach over $1 trillion in 2024, demonstrating a clear shift in customer preference away from ownership models.

Larger Managed Service Providers (MSPs) could potentially develop in-house procurement and integration capabilities, lessening their need for traditional distributors like D&H Distributing for certain technology solutions. This poses a threat as these MSPs might bypass distributors altogether. For instance, a significant MSP could negotiate direct deals with hardware manufacturers or cloud service providers, thereby cutting out the intermediary.

However, D&H actively works to mitigate this threat by providing extensive support and training to MSPs. By empowering MSPs to effectively leverage D&H's broad product catalog and value-added services, the company encourages continued partnership rather than replacement. D&H's investment in MSP enablement, including technical certifications and business development resources, aims to make them a more valuable partner than going it alone.

Retailers and E-commerce Platforms Directly Selling to End-Users

For D&H Distributing, the threat of substitutes comes from large retailers and e-commerce platforms that sell directly to consumers. While D&H focuses on the B2B market, these direct-to-consumer channels can impact product availability and pricing across the entire consumer electronics landscape. For instance, in 2024, major online retailers continued to dominate consumer electronics sales, capturing a significant share of the market by offering convenience and competitive pricing.

These direct sales channels act as substitutes for the traditional distribution model that D&H operates within. When consumers can easily purchase products directly from manufacturers' websites or large online marketplaces, it reduces the reliance on intermediaries like D&H. This trend is particularly pronounced in the fast-moving consumer electronics sector, where brand loyalty and direct engagement with customers are increasingly prioritized.

- Direct-to-Consumer (DTC) Growth: E-commerce platforms and large retailers increasingly bypass traditional distribution, impacting B2B players.

- Market Share Impact: In 2024, online retail giants continued to gain market share in consumer electronics, influencing overall pricing and product availability.

- Consumer Preference Shift: Consumers often opt for the convenience and perceived value of direct purchases, a trend that can indirectly affect D&H's B2B partners.

- Pricing Pressures: The competitive pricing strategies of direct sellers can create downward pressure on prices throughout the supply chain.

Open-Source Software and Hardware Alternatives

The threat of substitutes for D&H Distributing's offerings is relatively low in many core areas, particularly for mainstream IT and consumer electronics where brand reliability and integrated ecosystems are valued. However, in specific niches, the growing availability of open-source software or less proprietary hardware solutions could present a substitute. For example, businesses looking for cost-effective server solutions might opt for Linux-based systems instead of Windows, or utilize custom-built hardware components rather than pre-packaged solutions, potentially impacting demand for commercially distributed products.

While open-source software has seen significant adoption, its impact on D&H's primary market segments is often limited by the need for comprehensive support, integration services, and the established user base of proprietary systems. For instance, in 2024, while open-source operating systems like Linux continue to gain traction, particularly in server environments, the vast majority of desktop and enterprise deployments still rely on commercial solutions from companies like Microsoft and Apple, which D&H actively distributes.

- Limited Impact in Mainstream Markets: For the majority of D&H's customer base, particularly in consumer electronics and standard business IT, readily available, reliable substitutes that match the convenience and functionality of proprietary products are scarce.

- Niche Open-Source Adoption: In specific technical or cost-sensitive segments, open-source software (e.g., Linux for servers) and alternative hardware configurations can serve as substitutes, though these often require specialized expertise for implementation and support.

- Focus on Value-Added Services: D&H's business model often emphasizes the value-added services and integrated solutions that proprietary products provide, making direct substitution by open-source alternatives less appealing for many of their clients.

- Hardware Proprietary Ecosystems: The strong proprietary ecosystems built around major hardware manufacturers, such as Apple and Microsoft, create significant switching costs and reduce the attractiveness of generic or open-source hardware alternatives for many end-users.

The threat of substitutes for D&H Distributing is most pronounced in the direct-to-consumer (DTC) space, where large online retailers and manufacturers' own e-commerce platforms offer consumers direct access to products. In 2024, these channels continued to capture significant market share in consumer electronics, influencing pricing and availability for all players in the supply chain. This direct engagement bypasses intermediaries, impacting the traditional distribution model.

Furthermore, the growing adoption of cloud-based as-a-Service (XaaS) models presents a substantial substitution threat to traditional hardware and software sales. Customers are increasingly favoring subscription-based access over outright ownership, reducing the demand for physical IT equipment. The global XaaS market's projected growth to over $1 trillion in 2024 highlights this significant shift in customer preference and spending patterns.

| Threat Type | Description | 2024 Impact/Trend |

| Direct Sourcing by Large VARs/Resellers | Bypassing distributors to buy directly from manufacturers. | Continued for high-volume enterprise deals, but logistical complexities remain a barrier for many. |

| Cloud Services (XaaS) | Subscription-based access replacing hardware/software ownership. | Global XaaS market projected over $1 trillion, indicating a strong shift away from traditional sales. |

| Direct-to-Consumer (DTC) Channels | Online retailers and manufacturer websites selling directly to end-users. | Major online retailers continued to dominate consumer electronics sales, impacting overall market dynamics. |

| Open-Source Alternatives | Using open-source software or custom hardware instead of proprietary solutions. | Limited impact in mainstream IT/consumer electronics, but gaining traction in niche server or cost-sensitive segments. |

Entrants Threaten

Entering the IT and consumer electronics distribution space, like D&H Distributing operates in, demands substantial upfront investment. Companies need significant capital to acquire and maintain a diverse inventory, secure and operate warehousing facilities, manage complex logistics networks, and establish essential credit lines with both manufacturers and a broad customer base. For instance, in 2023, the global IT distribution market was valued at hundreds of billions of dollars, indicating the sheer scale of capital needed to even establish a foothold.

Established distributors like D&H Distributing leverage significant economies of scale, particularly in bulk purchasing power and optimized logistics networks. This allows them to secure lower unit costs for products and reduce transportation expenses. For instance, in 2024, major IT distributors often operate with gross margins in the low to mid-single digits, underscoring the critical importance of volume to profitability.

New entrants face a substantial hurdle in replicating these cost efficiencies. Without the same purchasing volume, they cannot negotiate favorable terms with manufacturers or achieve the same level of operational efficiency in warehousing and delivery. This disparity makes it challenging for newcomers to compete on price, a key factor in the competitive IT distribution landscape.

D&H Distributing's century-long history has fostered incredibly strong relationships and extensive networks across the IT channel. This deep-rooted trust with manufacturers, value-added resellers (VARs), integrators, and retailers acts as a formidable barrier for any new distributor attempting to enter the market.

Regulatory and Compliance Hurdles

The IT distribution sector, while not as intensely regulated as some, still presents significant barriers to entry due to a web of trade regulations, import/export laws, and product certification requirements. New entrants must invest considerable resources and expertise to understand and comply with these often intricate legal frameworks, which can slow down market entry and increase initial operating costs.

Navigating these regulatory complexities is a key challenge. For instance, compliance with evolving data privacy laws like GDPR or CCPA, depending on the target markets, adds another layer of operational overhead. Furthermore, specific product certifications, such as those for cybersecurity or environmental standards, can be time-consuming and expensive to obtain, effectively limiting the number of new companies that can readily enter the market.

- Regulatory Compliance Costs: New entrants face substantial costs in ensuring adherence to trade, import/export, and product certification laws.

- Legal Expertise Required: Understanding and navigating complex and evolving regulations necessitates significant legal and compliance expertise.

- Time to Market Impact: The process of obtaining necessary certifications and approvals can significantly delay a new entrant's ability to bring products to market.

Access to Technology and Expertise

New entrants into D&H Distributing's market would face a significant hurdle in rapidly acquiring the deep expertise needed across a diverse and rapidly evolving technology landscape. This includes understanding complex areas like artificial intelligence, robust cybersecurity measures, scalable cloud infrastructure, and emerging edge computing solutions. Without this specialized knowledge, a new player would struggle to offer the comprehensive support and solutions that D&H provides.

D&H Distributing's continuous and substantial investments in training programs and the development of dedicated, specialized teams create a formidable barrier for potential competitors. For instance, in 2023, D&H reported significant spending on partner enablement and technical training, equipping its staff to handle the intricacies of modern IT solutions. This ongoing commitment to upskilling makes it exceptionally difficult for newcomers to match the existing level of technical proficiency and market understanding.

- Technological Acumen: New entrants require immediate expertise in AI, cybersecurity, cloud, and edge computing.

- Investment in Talent: D&H's ongoing investment in training and specialized teams is a key differentiator.

- Market Entry Cost: The cost to acquire comparable technological and human capital is substantial for new entrants.

The threat of new entrants in the IT and consumer electronics distribution sector, where D&H Distributing operates, is generally considered moderate. The significant capital investment required for inventory, logistics, and establishing credit lines, coupled with the substantial economies of scale enjoyed by incumbents like D&H, creates a considerable financial barrier. For example, the global IT distribution market's multi-billion dollar valuation in 2023 highlights the scale of investment needed.

Furthermore, established players benefit from deep-rooted customer and supplier relationships, extensive channel networks, and specialized technical expertise, which are difficult and time-consuming for newcomers to replicate. Navigating complex regulatory landscapes and obtaining necessary product certifications also adds to the cost and time to market, further deterring potential new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for D&H Distributing is built upon a foundation of comprehensive data, including D&H's own annual reports and investor relations materials, alongside industry-specific market research from firms like IDC and Gartner. We also leverage macroeconomic data and trade publications to capture broader market trends and competitive pressures.