Dai-ichi Life PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dai-ichi Life Bundle

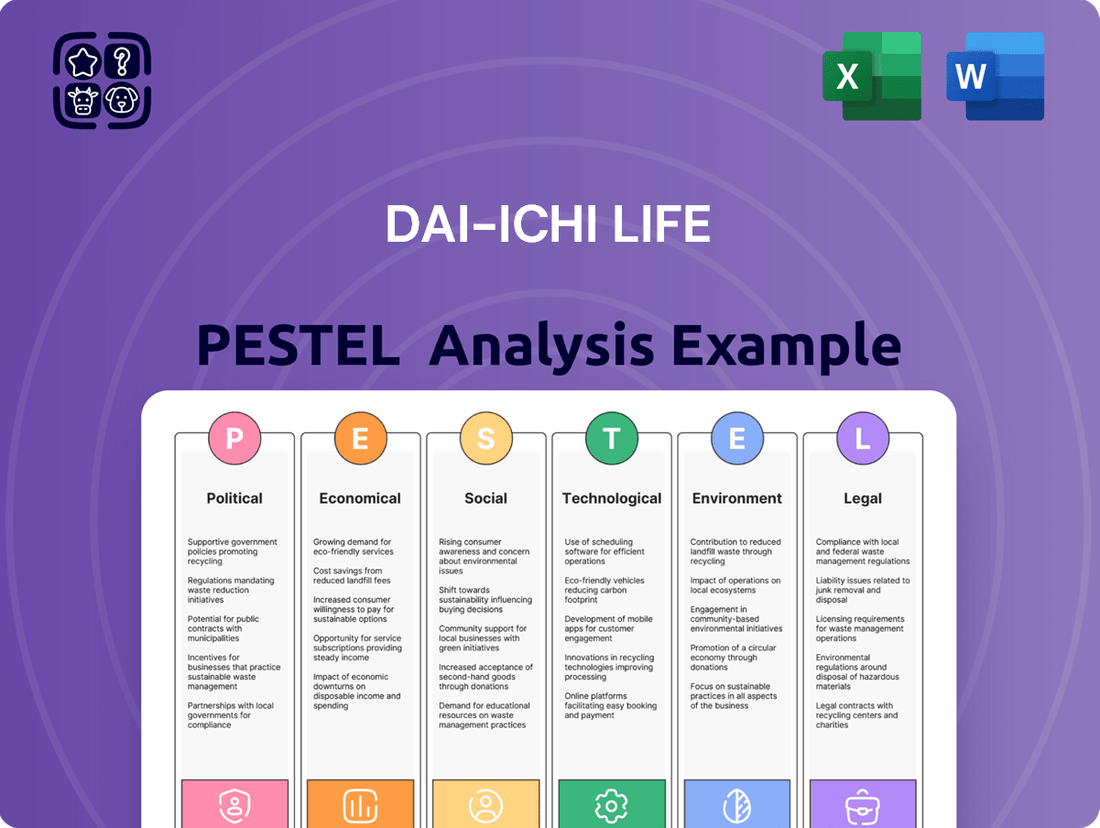

Dai-ichi Life operates within a complex global environment, shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable insights tailored for Dai-ichi Life.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for Dai-ichi Life. Uncover the critical political, economic, social, technological, legal, and environmental trends impacting the company's trajectory. Download the full version now to equip yourself with the intelligence needed to make informed decisions and strengthen your market position.

Political factors

The Japanese Financial Services Agency (FSA) is a key influencer of Dai-ichi Life's operating environment. New economic value-based solvency regulations, aligned with the IAIS Insurance Capital Standard (ICS), are slated for implementation in 2025. This shift will fundamentally alter how Dai-ichi Life approaches asset and liability valuation.

Furthermore, the FSA's directive in January 2024 to restrict foreign-currency-denominated insurance products has redirected consumer interest towards yen-based policies. This regulatory adjustment directly impacts Dai-ichi Life's product innovation and sales strategies, necessitating a greater focus on domestic currency offerings.

Global geopolitical uncertainties, including ongoing conflicts and trade tensions, present substantial risks to the worldwide economy and the insurance sector. These factors can trigger energy price shocks, elevated global inflation, and market volatility, directly impacting Dai-ichi Life's investment income and profitability, especially in its international markets.

Dai-ichi Life's cautious outlook for fiscal year 2025 acknowledges this uncertain business environment, partly influenced by potential shifts in US economic policies. For instance, the International Monetary Fund (IMF) revised its global growth forecast for 2024 down to 3.2% in April 2024, citing persistent geopolitical risks and tighter financial conditions.

Dai-ichi Life's international trade and investment policies are crucial for its global reach. For instance, its strategic partnership with AIA Group in China, announced in late 2023, highlights its commitment to expanding in key Asian markets, navigating diverse regulatory landscapes.

Shifts in global trade agreements or the imposition of new tariffs can create market volatility, directly impacting Dai-ichi Life's overseas operations and capital allocation strategies. The company's decision to establish a Global Capability Center in India in 2024 underscores its proactive approach to leveraging global economic trends and talent pools.

Government Initiatives for Financial Stability

The Japanese government's commitment to financial stability, notably through the Bank of Japan's monetary policies, plays a pivotal role in shaping the investment landscape for insurers like Dai-ichi Life. The Bank of Japan maintained its ultra-loose monetary policy in early 2024, keeping short-term interest rates at minus 0.1% and continuing its yield curve control program, aiming to foster economic recovery.

These government efforts are anticipated to bolster economic activity and increase demand for yen-denominated financial products. For instance, a stable and growing economy encourages consumers to invest in long-term savings and insurance products, directly benefiting Dai-ichi Life's domestic operations.

Key government initiatives impacting Dai-ichi Life's domestic performance include:

- Monetary Policy: The Bank of Japan's sustained accommodative stance, despite some speculation of policy shifts in 2024, aims to support corporate earnings and consumer spending.

- Fiscal Stimulus: Government spending packages designed to boost domestic demand and infrastructure development can indirectly improve the investment returns for insurance companies by fostering a healthier economic environment.

- Regulatory Framework: Ongoing regulatory adjustments aimed at ensuring the solvency and stability of the financial sector provide a predictable operating environment for Dai-ichi Life.

Political Stability in Operating Markets

The political stability of countries where Dai-ichi Life operates is a cornerstone for its global strategy. For instance, in Japan, a mature and stable political environment under the Kishida administration generally supports long-term economic planning. However, shifts in government policy, though infrequent, can impact the financial sector.

In markets like Vietnam, where Dai-ichi Life has a significant presence through Dai-ichi Life Vietnam, political stability has been a key driver of economic growth. Vietnam's consistent policy framework has fostered investor confidence, contributing to the nation's steady economic expansion. This stability is crucial for Dai-ichi Life's continued investment and operational continuity in the region.

Conversely, operating in regions with less predictable political climates presents challenges. Unstable political situations can lead to sudden regulatory changes, impacting insurance product development and sales. This unpredictability also affects consumer confidence, potentially slowing down demand for financial services. Dai-ichi Life must therefore continually assess and adapt to these evolving political landscapes to safeguard its global operations and profitability.

- Japan: Continued political stability under the current administration provides a predictable operating environment for Dai-ichi Life's domestic business.

- Vietnam: A stable political framework has supported Vietnam's economic growth, benefiting Dai-ichi Life Vietnam's market expansion.

- Global Risk Assessment: Dai-ichi Life actively monitors political developments in all operating markets to mitigate risks associated with regulatory shifts and economic disruptions.

Political stability in key markets like Japan and Vietnam underpins Dai-ichi Life's strategic planning and operational continuity, fostering investor confidence and economic growth. The company's proactive monitoring of global political developments is crucial for navigating potential regulatory shifts and economic disruptions across its international operations.

Government policies, particularly monetary stances like the Bank of Japan's continued accommodative approach in early 2024, directly influence the investment landscape and demand for financial products. Fiscal stimulus measures also create a healthier economic environment that can indirectly boost investment returns for insurers.

Regulatory frameworks, such as the upcoming economic value-based solvency regulations in Japan for 2025, are reshaping how Dai-ichi Life values assets and liabilities. Directives like the January 2024 restriction on foreign-currency-denominated insurance products also steer product development towards domestic offerings.

| Country | Political Stability Assessment | Impact on Dai-ichi Life | Key Policy/Regulation | Date/Period |

|---|---|---|---|---|

| Japan | Stable | Predictable operating environment, supports long-term planning | Bank of Japan monetary policy (accommodative stance) | Early 2024 |

| Vietnam | Stable | Fosters investor confidence, supports market expansion (Dai-ichi Life Vietnam) | Consistent policy framework | Ongoing |

| Global | Uncertain (geopolitical risks) | Market volatility, impacts investment income and profitability | International trade agreements, geopolitical events | 2024-2025 |

What is included in the product

This Dai-ichi Life PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential impacts for Dai-ichi Life's strategic decision-making.

Offers a clear, actionable framework for Dai-ichi Life to proactively address external challenges and capitalize on emerging opportunities, thereby mitigating potential business disruptions.

Economic factors

Rising interest rates, particularly in Japan, are creating a more favorable environment for life insurers like Dai-ichi Life. This trend is boosting demand for savings-oriented life insurance products as consumers seek better returns on their money.

The Bank of Japan's decision to increase its policy interest rate in March 2024, the first such move in 17 years, has been a significant catalyst. This shift is bolstering demand for yen-denominated life insurance, a core offering for Dai-ichi Life's domestic operations.

Beyond product demand, higher interest rates generally translate to improved investment yields for life insurance companies. This means the premiums collected can be invested at a higher rate of return, which can enhance profitability and solvency margins for Dai-ichi Life.

Elevated inflation, particularly in food prices, remains a significant concern in Japan, directly impacting consumers' real purchasing power and potentially slowing down personal consumption. For instance, Japan's core inflation rate, excluding volatile fresh food, stood at 2.8% year-on-year in April 2024, a slight decrease from previous months but still above the Bank of Japan's 2% target.

While the non-life insurance sector anticipates a deceleration in claims costs due to moderating inflation, sustained high inflation can still negatively affect consumer sentiment and, consequently, the demand for insurance products. This is because consumers may find it harder to afford premiums when their disposable income is squeezed by rising everyday costs.

Dai-ichi Life actively monitors these inflationary trends to understand their implications on consumer affordability and the overall demand for its insurance offerings. The company's ability to adapt its product pricing and value propositions will be crucial in navigating this challenging economic environment.

Japan's economy is expected to see modest growth in fiscal years 2024 and 2025, though it may face some plateaus. A projected slowdown in 2024 is anticipated to be followed by a recovery in the latter half of the year and into 2025, which should bolster the life insurance sector.

Dai-ichi Life's international business is also shaped by global economic expansion. Emerging markets, in particular, are showing more robust forecasts for premium growth, suggesting opportunities for the company's overseas ventures.

Currency Exchange Rate Volatility

Fluctuations in currency exchange rates, especially the yen against major currencies like the US dollar and Euro, directly influence Dai-ichi Life's financial performance from its international business. A weaker yen generally benefits the company by increasing surrender profits and boosting investment income when translated back into yen. For instance, during fiscal year 2023, a depreciating yen contributed positively to Dai-ichi Life's reported earnings from overseas operations.

However, this volatility also presents challenges. It impacts how overseas earnings are translated into yen and affects the pricing and appeal of products denominated in foreign currencies. Dai-ichi Life must carefully manage these currency exposures to mitigate potential negative impacts on its global competitiveness and profitability.

- Yen Depreciation Benefit: A weaker yen can inflate the yen-denominated value of foreign assets and income streams for Japanese companies like Dai-ichi Life.

- Translation Risk: Conversely, a strengthening yen can reduce the yen value of overseas profits, negatively impacting reported financial results.

- Product Competitiveness: Exchange rate movements can alter the price competitiveness of Dai-ichi Life's insurance and investment products in international markets.

- Hedging Strategies: Companies often employ currency hedging strategies to manage the financial risks associated with exchange rate volatility, though these can incur costs.

Consumer Spending and Disposable Income

Stagnant personal consumption, driven by persistent inflation and a lag in real wage growth, poses a challenge to the recovery of consumer spending on insurance products in Japan. For instance, while inflation averaged around 3.1% in 2023, real wages saw a decline, impacting households' purchasing power.

Despite this, there is a noticeable uptick in demand for particular insurance offerings. Yen-denominated savings insurance and long-term care insurance are seeing increased interest, reflecting a growing awareness of financial security and aging populations. However, the overall health of consumer sentiment and the actual disposable income available to households remain critical determinants for new premium sales and the crucial aspect of policy persistency.

- Consumer Spending Impact: Rising prices and stagnant real wages in Japan have dampened overall consumer spending, directly affecting the purchase of insurance.

- Product Demand Shift: While general spending is down, there's a clear rise in demand for yen-denominated savings and long-term care insurance products.

- Disposable Income Influence: The level of disposable income directly correlates with insurers' ability to secure new policy sales and maintain existing policyholders.

- Insurers' Response: Companies like Dai-ichi Life must focus on offering flexible and value-driven insurance products to navigate these economic conditions effectively.

The Bank of Japan's shift towards higher interest rates, commencing in March 2024, is a significant tailwind for Dai-ichi Life, enhancing the appeal of savings-oriented insurance products and improving investment yields on collected premiums.

While inflation, particularly in food prices, remains elevated at 2.8% year-on-year in April 2024, it continues to pressure consumer purchasing power, potentially impacting overall demand for insurance despite a slight moderation from previous months.

Japan's economy is projected for modest growth in fiscal years 2024-2025, with a recovery anticipated in the latter half of 2024, which should support the life insurance sector, while international markets, especially emerging ones, offer robust premium growth prospects.

Currency fluctuations, particularly the yen's depreciation against the US dollar and Euro, positively impact Dai-ichi Life's overseas earnings translation and investment income, as seen in fiscal year 2023, though this volatility also presents risks to product competitiveness.

| Economic Factor | Data Point (2024/2025 Projection/Actual) | Impact on Dai-ichi Life |

|---|---|---|

| Bank of Japan Policy Rate | Increased in March 2024 (first hike in 17 years) | Favorable for savings products, improved investment yields |

| Core Inflation (Japan) | 2.8% YoY (April 2024) | Pressures consumer purchasing power, potential impact on demand |

| Real Wage Growth (Japan) | Declined in 2023 | Dampens consumer spending on insurance |

| Yen Exchange Rate | Depreciating against USD/EUR (observed in FY2023) | Boosts overseas earnings translation and investment income |

| Global Economic Growth | Modest in Japan (FY2024-2025), Robust in Emerging Markets | Opportunities for international business expansion |

Same Document Delivered

Dai-ichi Life PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Dai-ichi Life PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report, providing actionable insights for strategic planning.

Sociological factors

Japan's demographic landscape is characterized by a rapidly aging population. As of 2024, individuals aged 65 and over represent over 30% of the total population, a figure projected to climb further. This substantial and growing segment of seniors directly fuels demand for life insurance, particularly products addressing longevity risks and long-term care needs.

This demographic trend presents Dai-ichi Life with a dual opportunity and challenge. On one hand, there's a clear market for specialized insurance products designed for seniors, such as annuities and health insurance with long-term care riders. Conversely, an increasing number of policyholders reaching advanced ages will likely lead to higher payouts for longevity-related benefits and healthcare claims, impacting the company's financial projections and risk management strategies.

Societal shifts like declining marriage rates and lower birth rates are significantly impacting the life insurance landscape. For instance, in Japan, the total fertility rate hovered around 1.26 in 2022, well below the replacement level, indicating fewer potential new families to insure. This trend, coupled with an increase in dual-income households, means traditional, one-size-fits-all insurance products may no longer resonate with a broad customer base.

Dai-ichi Life must adapt by offering more adaptable and customized insurance solutions. Policies need to acknowledge diverse family arrangements, including single-parent households or childless couples, and cater to the unique financial planning needs of dual-income earners. This flexibility is key to maintaining relevance and capturing market share in a dynamic demographic environment.

Dai-ichi Life is well-positioned to capitalize on the escalating health consciousness across its markets. In 2024, global health and wellness spending is projected to reach over $5.8 trillion, indicating a significant consumer shift towards proactive health management. This growing awareness directly fuels demand for insurance products that offer more than just financial protection, such as those incorporating wellness programs and preventative care benefits.

The company can leverage this trend by integrating digital health platforms and preventative care initiatives into its core insurance offerings. For example, offering incentives for healthy lifestyle choices, like regular exercise or health screenings, can differentiate Dai-ichi Life's products. This approach not only adds value for customers but also aligns with the industry's move towards holistic well-being solutions, potentially reducing long-term claims and enhancing customer loyalty.

Shifting Consumer Preferences for Digital Channels

Younger generations, especially Gen Z and Millennials, are increasingly gravitating towards digital platforms for all their needs, including insurance. For instance, a 2024 survey indicated that over 70% of individuals aged 18-34 prefer researching and purchasing financial products online. This trend directly impacts insurers like Dai-ichi Life, necessitating a robust digital strategy to meet these evolving consumer expectations.

The momentum behind digital channels for insurance distribution and claims processing is undeniable. By 2025, it's projected that digital sales will account for nearly half of all new insurance policies sold in developed markets. Dai-ichi Life must therefore prioritize enhancing its online presence and digital customer experience to remain competitive and accessible to this growing segment.

This societal shift underscores the critical need for insurers to adopt comprehensive omnichannel engagement strategies. Consumers now expect seamless transitions between online research, mobile apps, and in-person interactions. Dai-ichi Life's success will hinge on its ability to provide a consistent and personalized experience across all touchpoints.

- Digital Preference: Over 70% of 18-34 year olds prefer online research and purchase of financial products (2024 data).

- Digital Sales Growth: Digital channels are expected to represent almost 50% of new insurance policy sales by 2025.

- Omnichannel Imperative: Consumers demand consistent experiences across online, mobile, and physical channels.

Financial Literacy and Awareness

Financial literacy significantly shapes consumer engagement with financial products. In 2024, a significant portion of the population, particularly younger demographics, still exhibits lower levels of financial understanding, impacting the uptake of complex insurance and annuity products. Dai-ichi Life's success hinges on its ability to bridge this knowledge gap.

Targeted educational initiatives can directly boost demand for Dai-ichi Life's portfolio. For instance, campaigns highlighting the long-term benefits of life insurance and retirement planning can resonate with individuals seeking financial security. By simplifying complex financial concepts, Dai-ichi Life can empower more people to make informed decisions.

Understanding the nuances in financial literacy across different age groups and socioeconomic backgrounds is crucial for effective marketing and product development. Research from late 2024 indicates that while digital channels are prevalent, a segment of the population still prefers in-person guidance for financial matters. Tailoring approaches to these varying needs will be key.

- Financial Literacy Gap: A 2024 survey found that only 35% of adults felt highly confident in managing their finances.

- Demand Driver: Increased financial awareness is directly correlated with higher demand for long-term savings and protection products.

- Marketing Implications: Dai-ichi Life must segment its audience based on financial literacy levels to optimize product messaging.

- Product Design: Simplified product structures and clear benefit explanations are essential for broader market penetration.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and holistic well-being. This trend, evident in 2024 consumer behavior, translates into increased demand for insurance products that offer more than just financial protection, such as those incorporating health management programs.

Dai-ichi Life can capitalize on this by integrating digital health platforms and incentivizing healthy lifestyle choices, thereby differentiating its offerings and potentially reducing long-term claims. This aligns with the broader shift towards value-added services in the insurance sector.

Technological factors

Dai-ichi Life is actively integrating AI and data analytics to enhance its offerings, aiming for more personalized insurance products and a superior customer journey. This strategic move is crucial in today's competitive landscape.

The company is investing in advanced software development and AI solutions to bolster its internal digital expertise. This focus allows for more sophisticated data analysis, precise risk assessment, and deeper understanding of customer needs, driving innovation across the business.

Digital transformation is paramount for Dai-ichi Life to boost efficiency and deepen customer relationships. By implementing omnichannel strategies, the company ensures smooth, consistent interactions across all customer touchpoints. This digital push is essential for catering to modern customers who expect convenience and immediate service availability.

Dai-ichi Life is actively accelerating its digital transformation initiatives worldwide, with a particular emphasis on utilizing digital platforms for both product distribution and claims processing. This strategic shift is driven by the need to align with evolving customer expectations for accessible and on-demand financial services, a trend that has only intensified in recent years.

Dai-ichi Life, like all insurers, faces escalating cybersecurity threats as its operations become more digitized. The increasing reliance on digital platforms for customer interactions, policy management, and data storage exposes the company to sophisticated cybercrime and the risk of data breaches. This is a critical technological factor impacting the insurance sector.

The global landscape of cyberattacks is intensifying. For instance, reports indicate a significant year-over-year increase in ransomware attacks targeting financial institutions, with some estimates suggesting a rise of over 100% in the past two years leading up to 2024. Protecting sensitive customer information, such as personal details and financial records, is paramount for maintaining customer trust and adhering to evolving data privacy regulations.

Consequently, Dai-ichi Life must prioritize continuous and substantial investment in its cybersecurity infrastructure. This includes implementing advanced threat detection systems, regular security audits, and employee training to mitigate risks. As of early 2025, the average cost of a data breach for a financial services firm is estimated to be in the millions of dollars, underscoring the financial imperative for robust defenses.

Development of Insurtech Innovations

Insurtech innovations are rapidly reshaping the insurance landscape, presenting Dai-ichi Life with opportunities to adopt new business models and enhance service offerings. Technologies like blockchain for secure and transparent transactions, and telematics for more accurate risk assessment, are at the forefront of this transformation. For instance, the global Insurtech market was valued at approximately $10.8 billion in 2023 and is projected to grow significantly, reaching an estimated $54.1 billion by 2028, with a compound annual growth rate (CAGR) of 38.1% during this period. This indicates a strong market appetite for digitally enabled insurance solutions.

Dai-ichi Life must actively monitor and consider integrating these advancements to maintain its competitive edge and deliver innovative products. The ability to leverage data analytics and AI, also key components of Insurtech, can lead to personalized customer experiences and more efficient operational processes. By embracing these technological shifts, Dai-ichi Life can better meet evolving customer expectations and unlock new revenue streams in a dynamic market.

- Blockchain: Enhances transparency and security in claims processing and policy management.

- Telematics: Utilizes data from vehicles or wearables to personalize premiums based on actual behavior.

- AI and Machine Learning: Improves underwriting accuracy, fraud detection, and customer service through chatbots.

- Digital Platforms: Streamlines policy acquisition, management, and claims submission for a seamless customer journey.

Automation in Operations and Customer Service

Automation, particularly through advancements like AI-powered chatbots and Robotic Process Automation (RPA), is significantly reshaping operational efficiency and customer engagement. These technologies offer immediate responses to customer inquiries, a crucial factor in today's fast-paced digital environment. For Dai-ichi Life, this translates to a powerful opportunity to boost both efficiency and customer satisfaction by automating repetitive tasks and standard queries.

By offloading routine inquiries to automated systems, Dai-ichi Life can empower its human agents to dedicate their expertise to resolving more complex customer issues. This strategic allocation of resources allows for a more nuanced and effective customer service approach, seamlessly integrating the speed of digital solutions with the empathy and problem-solving capabilities of human interaction. For instance, a study by McKinsey in 2024 indicated that companies leveraging RPA saw an average reduction of 25-50% in process execution times for automated tasks.

The impact of automation extends to internal operations as well. Dai-ichi Life can leverage these technologies to streamline back-office processes, such as data entry, policy processing, and claims management. This not only reduces the potential for human error but also frees up valuable employee time, allowing them to focus on strategic initiatives and higher-value activities. Gartner predicted in late 2024 that RPA adoption would continue to grow, with a significant portion of financial services firms planning to expand their automation initiatives.

- Streamlined Operations: Automation reduces processing times for routine tasks, improving overall business agility.

- Enhanced Customer Service: Immediate responses via chatbots improve customer satisfaction and query resolution rates.

- Resource Optimization: Human agents can focus on complex issues, leading to better problem-solving and customer experience.

- Cost Efficiency: Automating tasks can lead to significant cost savings in labor and operational overhead.

Dai-ichi Life's technological focus is on leveraging AI and data analytics for personalized insurance and improved customer journeys. The company is investing in advanced software and AI to enhance its digital expertise, enabling more sophisticated data analysis, precise risk assessment, and a deeper understanding of customer needs, thereby driving innovation.

The ongoing digital transformation is crucial for Dai-ichi Life to boost efficiency and strengthen customer relationships through omnichannel strategies. This digital acceleration is vital for meeting customer expectations for accessible, on-demand financial services.

The company faces escalating cybersecurity threats due to its increased digitization, with a notable rise in ransomware attacks targeting financial institutions. Protecting sensitive customer data is paramount, especially as the average cost of a data breach for financial services firms in early 2025 is estimated to be in the millions of dollars.

Insurtech innovations, such as blockchain and telematics, are reshaping the insurance sector, offering Dai-ichi Life opportunities to adopt new business models. The global Insurtech market, valued at approximately $10.8 billion in 2023, is projected to reach $54.1 billion by 2028, indicating strong growth.

Legal factors

Japan's upcoming economic value-based solvency regulations, effective in 2025, will mandate insurers like Dai-ichi Life to value assets and liabilities based on their current economic worth. This aligns with global trends and may necessitate Dai-ichi Life exploring new reinsurance strategies to manage capital effectively under these stricter requirements.

In January 2024, Japan's Financial Services Agency (FSA) introduced new regulations restricting the sale of foreign currency-denominated insurance products. This significant policy shift aims to protect domestic consumers and prevent potential currency risks, prompting a noticeable move back towards yen-based offerings in the market.

Dai-ichi Life, like other insurers, must adapt its product development and sales strategies in response to these new restrictions. The company will likely prioritize the creation and promotion of yen-denominated insurance products to cater to the evolving domestic demand and comply with the FSA's updated guidelines.

Dai-ichi Life's increasing reliance on digital platforms necessitates strict adherence to data protection laws, such as Japan's Act on the Protection of Personal Information (APPI). Failure to comply, especially with cross-border data transfers, can lead to substantial fines; for instance, GDPR violations in Europe have seen penalties reaching up to 4% of global annual revenue.

Maintaining robust data governance is crucial for Dai-ichi Life to safeguard sensitive customer information, mirroring the global trend towards enhanced privacy rights. This commitment is vital for preserving customer trust, a cornerstone of the insurance industry where data security is paramount.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

The global financial sector, including insurance, is under intense pressure to strengthen Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance. Dai-ichi Life, operating internationally, must navigate a complex web of regulations that differ by country, ensuring robust systems are in place to detect and report suspicious activities. Failure to comply can result in substantial fines and significant damage to its reputation.

Dai-ichi Life's commitment to AML/CTF is crucial for maintaining trust and operational integrity. For instance, the Financial Action Task Force (FATF) recommendations, continuously updated, set the global standard. Many jurisdictions have implemented stringent reporting requirements, such as the Bank Secrecy Act in the United States, which mandates detailed transaction monitoring and customer due diligence. These measures are not merely legal obligations but are fundamental to preventing illicit financial flows.

- Regulatory Landscape: Dai-ichi Life must comply with evolving AML/CTF laws in all its operating regions, including Japan, the United States, Australia, and India.

- Compliance Costs: Significant investments are required in technology and personnel for robust Know Your Customer (KYC) and transaction monitoring systems.

- Risk Mitigation: Strict adherence to AML/CTF regulations helps Dai-ichi Life avoid penalties, which can reach millions of dollars, and protects its brand image.

- Global Standards: Adherence to FATF recommendations and local implementations is essential for seamless international operations and partnerships.

International Insurance Standards and Compliance

Dai-ichi Life's global operations necessitate strict adherence to a diverse array of international insurance standards and compliance mandates. This involves navigating varying local licensing prerequisites, consumer protection legislation, and financial reporting frameworks across its operating regions. For instance, in 2024, the International Association of Insurance Supervisors (IAIS) continued to emphasize robust capital requirements and solvency standards, which Dai-ichi Life must integrate into its global strategy.

Maintaining a comprehensive and adaptable compliance architecture is paramount for the seamless functioning of Dai-ichi Life's international business. This ensures operational integrity and mitigates regulatory risks in markets such as Japan, the United States, and Australia, each with its unique regulatory landscape. The firm's commitment to these diverse legal frameworks underpins its ability to foster trust and stability in its international ventures.

- Regulatory Alignment: Dai-ichi Life must align with evolving international capital adequacy standards, such as those influenced by Solvency II principles in Europe, even if not directly operating there, to maintain global investor confidence.

- Consumer Protection Laws: Compliance with differing consumer protection laws, including data privacy regulations like GDPR equivalents in various jurisdictions, is critical for customer trust and avoiding penalties.

- Financial Reporting Standards: Adherence to International Financial Reporting Standards (IFRS) or local GAAP equivalents is essential for transparent financial reporting across its global subsidiaries.

- Licensing and Market Access: Securing and maintaining necessary operating licenses in each country is a fundamental legal requirement for market entry and continued business.

Japan's upcoming economic value-based solvency regulations, effective in 2025, will require insurers like Dai-ichi Life to value assets and liabilities based on their current economic worth, potentially influencing reinsurance strategies. Furthermore, new FSA regulations from January 2024 restrict foreign currency-denominated insurance sales, pushing companies like Dai-ichi Life towards yen-based products to protect domestic consumers from currency risks.

Dai-ichi Life must navigate stringent data protection laws, such as Japan's APPI, to safeguard customer information on its digital platforms; non-compliance, akin to GDPR violations with penalties up to 4% of global revenue, poses significant financial and reputational risks.

The company also faces increasing global pressure to strengthen Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance across its international operations, demanding robust systems to detect and report suspicious activities to avoid substantial fines and reputational damage.

Dai-ichi Life's global presence necessitates adherence to diverse international insurance standards and local compliance mandates, including varying licensing, consumer protection, and financial reporting frameworks, with entities like the IAIS continuing to emphasize robust capital requirements in 2024.

Environmental factors

Japan's vulnerability to natural disasters, exacerbated by climate change, presents a significant challenge for Dai-ichi Life. The increasing frequency and intensity of events like typhoons and heavy rainfall, as seen in the record-breaking rainfall across parts of Japan in July 2023 which caused widespread flooding and landslides, directly translate to higher insurance claims.

This escalating risk necessitates a proactive approach from insurers. Dai-ichi Life, like its peers, must continuously refine its risk assessment methodologies and potentially adjust premium structures to reflect the heightened probability of substantial payouts.

Adapting underwriting practices and bolstering disaster preparedness and response capabilities are crucial for Dai-ichi Life to maintain financial stability and effectively serve its policyholders amidst these evolving environmental conditions.

The global investment landscape is increasingly shaped by Environmental, Social, and Governance (ESG) considerations. Dai-ichi Life is strategically positioning itself in this trend, targeting substantial capital accumulation for sustainability-themed investments by 2030. This initiative specifically targets environmental and climate change solutions, reflecting a deep commitment to responsible investment practices.

This commitment translates into tangible actions; Dai-ichi Life aims to achieve ¥1 trillion (approximately $7 billion USD as of mid-2024) in sustainability-themed investments by fiscal year 2030. This ambitious target underscores the company's dedication to integrating ESG principles into its core investment strategy and contributing to a more sustainable future.

Dai-ichi Life acknowledges that climate change poses significant risks, including physical threats from extreme weather events and transition risks stemming from decarbonization policies. These factors can impact its investment portfolios and operational stability.

The company is actively working to mitigate these risks and capitalize on opportunities, aiming to contribute to environmental sustainability through its core business and investment strategies. This involves assessing climate-related impacts on its long-term plans.

Dai-ichi Life is exploring avenues in green finance, recognizing the growing market for sustainable investments. For instance, as of early 2024, global sustainable bond issuance was projected to reach new highs, reflecting investor demand for environmentally conscious financial products.

Sustainability Reporting Requirements and Public Scrutiny

Dai-ichi Life faces growing pressure for transparency in its environmental, social, and governance (ESG) efforts, driving more rigorous sustainability reporting. This heightened public scrutiny necessitates clear communication of its commitment to environmental stewardship and other material issues. In 2023, Dai-ichi Life's Sustainability Report detailed progress on climate action, biodiversity, and circular economy initiatives, reflecting a strategic focus on these areas.

The company's inclusion in the Dow Jones Sustainability World Index for 2023 underscores its dedication to robust ESG practices and transparent disclosure. This recognition is a testament to Dai-ichi Life's proactive approach to integrating sustainability into its core business strategy and operations, demonstrating a commitment that resonates with stakeholders increasingly prioritizing responsible corporate behavior.

- Increased Demand for ESG Transparency: Stakeholders, including investors and customers, are demanding greater clarity on corporate sustainability performance.

- Annual Sustainability Reporting: Dai-ichi Life publishes an annual Sustainability Report, providing detailed insights into its environmental leadership and other key ESG initiatives.

- Recognition for Sustainability: The company's inclusion in the Dow Jones Sustainability World Index for 2023 highlights its strong commitment to transparency and responsible business practices.

Development of Green Insurance Products

Dai-ichi Life is positioned to capitalize on the burgeoning demand for green insurance products, fueled by increasing environmental consciousness and the tangible risks posed by climate change. This trend is evident globally, with the sustainable insurance market showing significant growth. For instance, preliminary data for 2024 indicates a substantial rise in investments directed towards climate-resilient infrastructure and renewable energy projects, sectors ripe for specialized insurance coverage.

The company can develop innovative offerings such as policies designed for solar farm installations, wind turbine operations, or even coverage for businesses adopting sustainable supply chains. These products not only address emerging risks but also align with corporate social responsibility goals. By 2025, it's projected that the global green insurance market will see continued expansion, driven by regulatory pressures and consumer preference for eco-friendly solutions.

- Growing Demand: Increased public awareness of climate change is driving a higher demand for insurance solutions that address environmental risks and promote sustainable practices.

- Product Innovation: Opportunities exist to create specialized policies for renewable energy projects, carbon capture initiatives, and businesses committed to reducing their environmental footprint.

- Market Expansion: The green insurance sector is an emerging market with significant growth potential, offering Dai-ichi Life a chance to diversify its product portfolio and capture new market share.

- Risk Mitigation: By offering coverage for climate-related events, Dai-ichi Life can help clients mitigate losses and build resilience, fostering stronger client relationships.

Japan's susceptibility to natural disasters, amplified by climate change, presents a direct challenge for Dai-ichi Life through increased insurance claims. The company is strategically investing in sustainability, targeting ¥1 trillion (approximately $7 billion USD as of mid-2024) in sustainability-themed investments by fiscal year 2030 to address climate risks and opportunities.

Dai-ichi Life is also seeing a growing demand for green insurance products, with the global sustainable insurance market showing significant growth, and is poised to develop innovative offerings for sectors like renewable energy.

The company's commitment to ESG is recognized, as evidenced by its inclusion in the Dow Jones Sustainability World Index for 2023, underscoring its focus on transparent sustainability reporting and environmental stewardship.

| Environmental Factor | Impact on Dai-ichi Life | Strategic Response |

|---|---|---|

| Natural Disasters & Climate Change | Increased insurance claims due to extreme weather events. | Refining risk assessment, potentially adjusting premiums, and enhancing disaster preparedness. |

| ESG Investment Trend | Growing investor and stakeholder demand for sustainable practices. | Targeting ¥1 trillion in sustainability-themed investments by FY2030; contributing to environmental solutions. |

| Demand for Green Products | Opportunity to offer specialized insurance for climate-resilient infrastructure and renewable energy. | Developing innovative policies for solar, wind, and sustainable supply chains; capitalizing on market expansion. |

PESTLE Analysis Data Sources

Our Dai-ichi Life PESTLE analysis is grounded in comprehensive data from official government reports, reputable financial institutions like the IMF and World Bank, and leading industry research firms. These sources provide current insights into political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks impacting the life insurance sector.