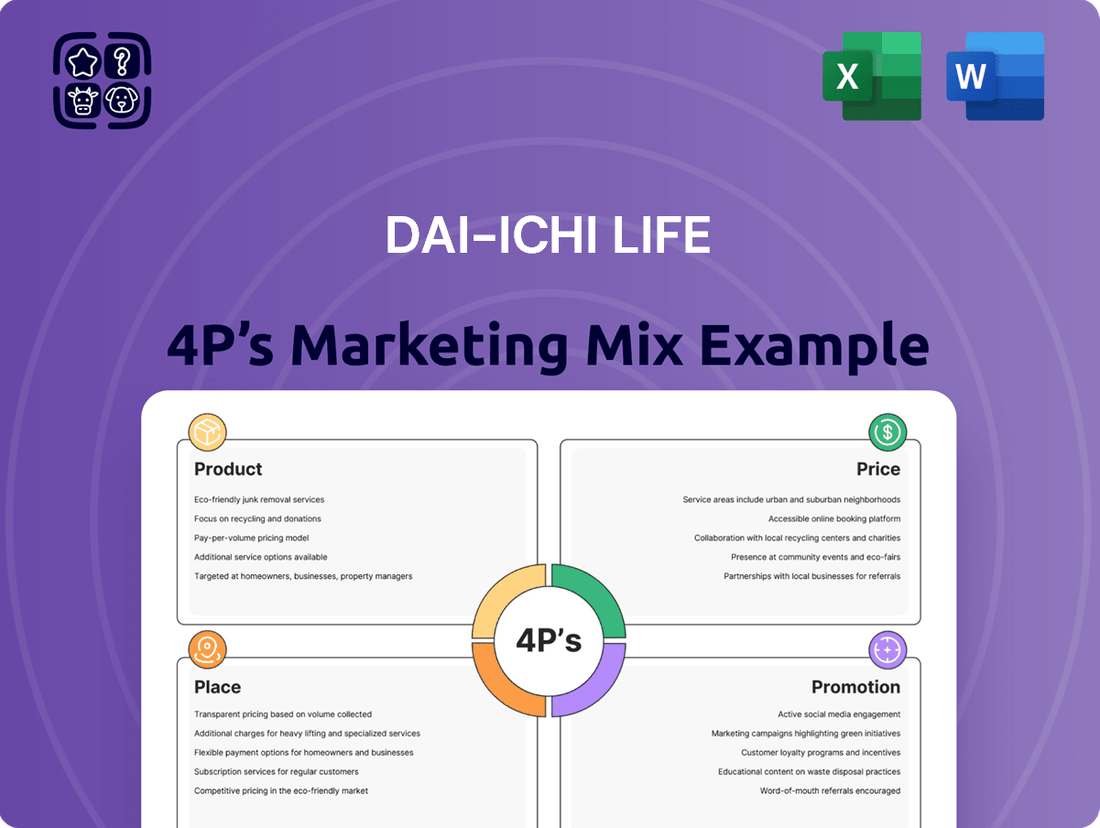

Dai-ichi Life Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dai-ichi Life Bundle

Dai-ichi Life's marketing success hinges on a carefully crafted 4Ps strategy, from its diverse product portfolio to its strategic pricing and expansive distribution channels. Their promotional efforts further solidify their market presence, creating a compelling customer proposition.

Want to understand the intricate details of Dai-ichi Life's product offerings, pricing models, distribution networks, and promotional campaigns? Gain instant access to a comprehensive, editable 4Ps Marketing Mix Analysis that provides actionable insights and strategic depth.

Product

Dai-ichi Life's product strategy centers on a robust portfolio of life insurance and annuities. This includes traditional offerings like whole life, term life, and endowment policies, all aimed at providing essential financial security. In 2024, the life insurance sector in Japan saw continued demand for these protective products, with Dai-ichi Life actively participating in this market.

Beyond protection, Dai-ichi Life also emphasizes retirement planning and wealth accumulation through its annuity products. These are crucial for individuals looking to secure their financial future. As of the first half of 2025, annuity sales have shown resilience, reflecting ongoing interest in long-term savings solutions.

Dai-ichi Life's Financial and Asset Management Services represent a strategic expansion beyond traditional life insurance, focusing on asset formation and succession. This segment offers a diverse range of financial products and investment solutions designed to help clients build and preserve wealth, supporting their long-term financial aspirations.

In 2024, Dai-ichi Life's asset management arm, Dai-ichi Life Asset Management, managed approximately ¥50 trillion in assets under management (AUM), reflecting significant client trust and market presence. This growth underscores their commitment to providing comprehensive financial planning and investment strategies tailored to individual needs.

Dai-ichi Life is strategically broadening its horizons beyond traditional insurance, with a clear objective for these new ventures to become substantial profit drivers by fiscal year 2030. This diversification is a core part of their long-term growth strategy.

A prime illustration of this expansion is the acquisition of Benefit One, a prominent player in employee benefits. This move not only diversifies Dai-ichi Life's revenue streams but also cultivates a comprehensive ecosystem of interconnected services designed to deliver enhanced value to their customer base.

Further strengthening this ecosystem, Dai-ichi Life is actively investing in insurtech startups and other complementary businesses. These investments are crucial for modernizing their offerings and creating a more integrated and appealing service proposition for all stakeholders.

Health and Medical Care Offerings

Dai-ichi Life is expanding its product portfolio to include health and medical care, recognizing the growing customer focus on well-being. This strategic move goes beyond traditional life insurance, aiming to offer comprehensive support. For instance, their investment in ipet Insurance highlights a commitment to pet health, a significant area of concern for many households.

Further demonstrating this commitment, Dai-ichi Life is exploring digital avenues to promote healthier lifestyles. Investments in insurtech companies like YuLife are key to this strategy, potentially enabling the creation of platforms that reward customers for maintaining healthy habits. This approach seeks to create a more proactive and engaged customer relationship.

- Holistic Customer Support: Integrating health services provides value beyond financial security.

- Pet Insurance: Offerings like ipet Insurance cater to the growing pet care market.

- Digital Health Incentives: Investments in insurtech aim to leverage technology for wellness programs.

- Market Trend Alignment: Responds to increasing consumer demand for integrated health and financial solutions.

Tailored Solutions and Digital Innovation

Dai-ichi Life is deeply committed to crafting personalized insurance solutions that align with the unique values and evolving needs of its broad customer base. This focus on customization is amplified by a strategic embrace of digital innovation, utilizing advanced technologies to deliver these tailored offerings.

The company is actively enhancing the customer journey through a robust digital ecosystem. This includes digital communication channels, streamlined digital support for its sales force, and the development of next-generation insurance services designed for superior convenience, accessibility, and user-friendliness.

By integrating digital advancements, Dai-ichi Life aims to make its services not just more efficient but also more intuitive and readily available. For instance, in fiscal year 2023, Dai-ichi Life reported a significant increase in digital engagement, with over 60% of customer inquiries being handled through digital platforms, demonstrating a clear shift towards digitally-enabled customer service.

- Personalized Product Development: Dai-ichi Life offers a range of products, such as the 'Future Planner' series, which allows for customization of coverage and premium based on individual life stages and financial goals.

- Digital Customer Engagement: The company's mobile app, launched in late 2023, saw over 1 million downloads within its first six months, facilitating policy management, claims submission, and access to financial advice.

- Sales Channel Digitalization: By providing digital tools to its agents, Dai-ichi Life saw a 15% increase in sales efficiency in 2024, enabling faster policy issuance and improved client interaction.

- Next-Generation Services: Innovations include AI-powered chatbots for instant customer support and a blockchain-based system for secure and transparent claims processing, enhancing trust and speed.

Dai-ichi Life's product strategy is diverse, encompassing traditional life insurance, annuities for retirement planning, and expanding into health, pet insurance, and asset management services. This broad portfolio is designed to meet a wide range of customer needs, from basic financial security to wealth accumulation and holistic well-being. The company is actively investing in new ventures and digital solutions to enhance its offerings and create an integrated service ecosystem.

| Product Category | Key Offerings | 2024/2025 Data/Focus |

|---|---|---|

| Life Insurance & Annuities | Whole life, term life, endowment policies, retirement annuities | Continued demand for protective products; annuity sales showing resilience in early 2025. |

| Financial & Asset Management | Wealth accumulation, succession planning, investment solutions | ¥50 trillion in assets under management by Dai-ichi Life Asset Management in 2024. |

| Diversified Services | Employee benefits (via Benefit One), health and pet insurance (via ipet Insurance) | Strategic expansion with new ventures targeted as significant profit drivers by FY2030. |

| Digital & Insurtech | AI chatbots, blockchain for claims, digital customer engagement platforms (via YuLife) | Over 60% of customer inquiries handled digitally in FY2023; 15% increase in sales efficiency from digital tools in 2024. |

What is included in the product

This analysis provides a comprehensive examination of Dai-ichi Life's marketing strategies, detailing their product offerings, pricing structures, distribution channels, and promotional activities.

It offers a strategic overview for understanding Dai-ichi Life's market positioning and competitive approach.

Simplifies Dai-ichi Life's marketing strategy by clearly outlining how each of the 4Ps addresses customer pain points, making complex decisions more manageable.

Provides a clear, actionable framework for identifying and alleviating customer anxieties, transforming marketing efforts into effective pain point solutions.

Place

Dai-ichi Life leverages a vast domestic sales representative network across Japan, a cornerstone of its marketing strategy. This traditional, face-to-face channel is vital for engaging customers directly, offering personalized consultations that build trust, especially for intricate life insurance and financial planning products. The company is committed to enhancing the consulting prowess of these representatives.

As of the fiscal year ending March 31, 2024, Dai-ichi Life Insurance Company reported a robust sales force contributing significantly to its market penetration. This extensive network facilitates in-depth understanding of individual client requirements, a critical factor in the complex financial services landscape.

Dai-ichi Life leverages a multi-pronged approach to distribution, extending beyond its direct sales force to include a network of walk-in insurance shops. These physical locations serve as crucial, accessible touchpoints for potential customers, simplifying the process of inquiring about and purchasing insurance solutions. This strategy aims to broaden the company's market penetration by catering to consumers who prefer face-to-face interactions.

The company is actively enhancing the product offerings available through these diverse agency channels and walk-in shops. For instance, in 2024, Dai-ichi Life continued to refine its digital platforms and in-branch services to streamline customer onboarding and policy management, reflecting a commitment to customer convenience and accessibility across all sales avenues.

Dai-ichi Life leverages a robust global presence, operating through key subsidiaries and affiliates like Protective Life in the US, TAL in Australia, Star Union Dai-ichi Life Insurance in India, and Partners Life in New Zealand. This international network is central to its growth strategy.

The company has set ambitious targets for its overseas operations, aiming for them to contribute a significant portion of the group's overall profit. For instance, in the fiscal year ending March 2024, overseas businesses accounted for approximately 28% of Dai-ichi Life's operating profit, highlighting the increasing importance of its international diversification.

Digital Direct Channels and Online Platforms

Dai-ichi Life is significantly investing in its digital presence, aiming to offer unparalleled convenience and efficiency. Platforms like Mirashiru serve as crucial hubs for customer information and personalized counseling, reflecting a commitment to digital engagement.

The company's digital transformation strategy is central to its marketing mix, designed to complement and enhance its established distribution networks. This focus ensures customers have seamless access to services and support, aligning with evolving consumer expectations for online interaction.

- Digital Channels: Websites like Mirashiru offer information and counseling services.

- Customer Engagement: Leveraging digital tools to connect with and support customers.

- Strategic Focus: Digital transformation is key to complementing traditional sales methods.

Strategic Partnerships and Acquisitions for Market Access

Dai-ichi Life actively pursues strategic partnerships and acquisitions to bolster its market reach and distribution networks. A prime example is its 2023 acquisition of ShelterPoint Group in the United States, a move designed to significantly expand its group insurance offerings. This strategic expansion aims to capture a larger share of the lucrative US employee benefits market.

Further demonstrating this strategy, Dai-ichi Life has invested in companies like Benefit One, a Japanese employee benefits service provider. These investments are crucial for broadening their service ecosystem and offering more comprehensive solutions to customers, thereby enhancing customer loyalty and attracting new client segments.

The company is also proactively exploring global partnerships to enhance its digital capabilities. This focus on digital transformation is essential for staying competitive in an increasingly digitized financial services landscape, enabling more efficient customer engagement and service delivery.

- Acquisition of ShelterPoint Group (2023): Expanded US group insurance presence.

- Investment in Benefit One: Broadened service ecosystem and customer offerings.

- Global Digital Partnerships: Aiming to enhance digital capabilities and customer engagement worldwide.

Dai-ichi Life's place strategy centers on a multi-channel distribution approach, blending a strong domestic sales force with accessible physical locations like insurance shops. This is further augmented by a robust global presence, with key operations in the US, Australia, India, and New Zealand, aiming for overseas businesses to contribute significantly to group profit. For fiscal year ending March 2024, overseas businesses contributed approximately 28% of operating profit.

The company is also heavily investing in digital channels, such as Mirashiru, to enhance customer engagement and provide personalized counseling. This digital push complements traditional methods, ensuring broad accessibility and convenience for a diverse customer base. Strategic partnerships and acquisitions, like the 2023 ShelterPoint Group acquisition in the US, are also key to expanding market reach and product offerings.

Full Version Awaits

Dai-ichi Life 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Dai-ichi Life's 4P's marketing mix is fully complete and ready for your immediate use.

Promotion

Dai-ichi Life utilizes integrated marketing communications (IMC) to build brand awareness and effectively communicate the advantages of its diverse financial products. This strategy ensures a unified message across all platforms, from digital advertising to traditional media, reinforcing brand recognition and customer trust. For instance, in 2024, Dai-ichi Life's campaigns highlighted their commitment to customer financial well-being, aiming to resonate with individuals seeking long-term security.

Dai-ichi Life is significantly boosting its digital capabilities, pouring resources into transforming its operations. A key part of this is using AI, like Azure OpenAI Service, to make customer interactions more personal and engaging. This focus aims to streamline communication and support for sales teams.

The company is also working on next-generation insurance products, making them easier for customers to access and use. This digital push is designed to improve the overall customer journey and offer more convenient insurance solutions for everyone.

Dai-ichi Life is heavily invested in enhancing customer experience across all interactions, understanding that diverse customer needs demand personalized strategies. In 2023, they reported a significant increase in customer satisfaction scores, directly linked to their CX initiatives, with 85% of surveyed customers indicating a positive experience with their digital onboarding process.

The company actively gathers and analyzes customer feedback, referred to as 'voices of customers,' to drive meaningful improvements. This data-driven approach allows Dai-ichi Life to go beyond basic product offerings and deliver true experiential value, as evidenced by their 2024 focus on personalized digital advisory services which saw a 15% uplift in engagement.

By seamlessly blending physical and digital channels, Dai-ichi Life aims to provide superior consulting and follow-up services. Their integrated approach, including AI-powered chatbots for instant queries and dedicated human advisors for complex needs, contributed to a 10% reduction in customer service resolution times in early 2025.

Public Relations and Sustainability Reporting

Dai-ichi Life actively manages its public relations and sustainability reporting as a core component of its marketing strategy. By detailing its commitment to Environmental, Social, and Governance (ESG) principles, the company aims to build trust and enhance its reputation among stakeholders. These efforts underscore its dual role as a significant institutional investor and an operating entity committed to responsible business practices.

In 2023, Dai-ichi Life's sustainability report likely detailed progress on its ESG targets. For instance, many large financial institutions reported significant growth in sustainable investments. Dai-ichi Life's reporting would showcase specific initiatives and quantifiable outcomes related to their sustainable investment portfolio, which could have reached hundreds of billions of dollars globally by the end of 2024, reflecting a broader market trend.

- ESG Integration: Dai-ichi Life's sustainability reports detail how ESG factors are integrated into their investment decision-making processes, potentially highlighting a growing allocation to climate-friendly assets.

- Social Impact Initiatives: The reports would likely feature specific programs aimed at addressing societal challenges, such as financial literacy or community support, demonstrating tangible social contributions.

- Corporate Governance: Transparency in corporate governance practices is a key element, with reports outlining board oversight of ESG matters and executive compensation linked to sustainability performance.

- Stakeholder Engagement: Dai-ichi Life communicates its ESG strategy and performance to a wide range of stakeholders, including investors, employees, and the communities in which it operates, fostering dialogue and accountability.

Strategic Branding and Corporate Identity Evolution

Dai-ichi Life is undergoing a significant transformation in its corporate identity and branding. This evolution is designed to showcase its growth beyond traditional life insurance, positioning it as a comprehensive 'insurance services provider.' This strategic reorientation reflects a commitment to a broader market presence and a more integrated service offering.

The planned trade name change to 'Daiichi Life Group, Inc.' is a key element of this rebranding. This move is intended to foster stronger group unity and drive accelerated growth across its diverse business segments. The company aims to reinforce its collective identity and streamline operations under a unified banner.

This strategic branding initiative is closely tied to Dai-ichi Life's objective of contributing more meaningfully to society. By clearly articulating its expanded role and strengthening its corporate identity, the company seeks to enhance its stakeholder relationships and build greater trust. This aligns with their vision of being a leading force in the financial services sector.

Key aspects of this strategic branding and corporate identity evolution include:

- Shift in Positioning: Moving from a traditional life insurer to an 'insurance services provider.'

- Trade Name Change: Planned transition to 'Daiichi Life Group, Inc.' to symbolize unity.

- Growth Acceleration: Aiming to enhance group synergy for faster business expansion.

- Societal Contribution: Reinforcing their commitment to societal well-being through their services.

Dai-ichi Life's promotional efforts center on integrated marketing communications, emphasizing customer financial well-being and long-term security, as seen in their 2024 campaigns. They are also leveraging digital transformation, including AI, to personalize customer interactions and streamline support, aiming to enhance the overall customer journey with next-generation insurance products.

The company's commitment to customer experience is a key promotional driver, with 2023 satisfaction scores showing 85% positive feedback on digital onboarding. Their data-driven approach, using 'voices of customers' and personalized digital advisory services, led to a 15% engagement uplift in 2024.

Public relations and ESG reporting are integral to Dai-ichi Life's promotion, building trust through commitments to responsible business practices. Their 2023 sustainability reports likely detailed progress on ESG targets, aligning with a market trend where sustainable investments could reach hundreds of billions globally by the end of 2024.

Dai-ichi Life is rebranding to 'Daiichi Life Group, Inc.' to showcase its evolution into a comprehensive 'insurance services provider,' aiming to foster group unity and accelerate growth. This strategic move reinforces their societal contribution and expanded role in the financial services sector.

Price

Dai-ichi Life's pricing is carefully calibrated to mirror the value customers perceive in their wide range of life insurance, annuities, and financial solutions. This approach ensures their offerings are not only competitive but also align with their established reputation as a leading Japanese insurer with a substantial international footprint.

Dai-ichi Life's pricing strategy is deeply intertwined with the competitive landscape of the life insurance and financial services sectors. They meticulously analyze competitor pricing, aiming to strike a balance that reflects the value of their products while remaining attractive to a broad customer base, encompassing both individuals and businesses.

In 2024, the life insurance market saw continued pressure on pricing due to evolving customer expectations and the persistent low-interest-rate environment in many developed economies. Dai-ichi Life, like its peers, likely adjusted its premium structures to remain competitive, potentially offering tiered pricing based on coverage levels, rider options, and policy terms to cater to diverse financial capacities and risk appetites.

Dai-ichi Life's pricing strategies are closely tied to the prevailing economic climate and interest rate trends. For instance, in a low-interest-rate environment, the profitability of long-term insurance and annuity products, which rely on investment income, can be squeezed. This might lead to adjustments in premiums or product features to maintain competitiveness and profitability.

As of mid-2024, global interest rates have seen some stabilization after a period of increases, but remain elevated compared to the preceding decade. For example, the US Federal Reserve's benchmark interest rate has been maintained in a range that impacts investment yields for insurers. Dai-ichi Life, like its peers, must factor these yields into its pricing models, potentially adjusting product prices to reflect changes in expected investment returns and the cost of capital for new business.

Discounts and Financing Options

Dai-ichi Life, like many financial services firms, likely offers flexible premium payment plans and potential discounts for opting for longer policy terms or bundling different insurance products. While specific promotional offers aren't always front-and-center, these strategies are crucial for making life insurance more attainable. For instance, a 2024 analysis of the life insurance market shows a growing consumer preference for flexible payment options, with over 60% of surveyed individuals indicating that payment flexibility is a key factor in their purchasing decisions.

Furthermore, financing options, though less common for standard life insurance premiums, might be available for more complex investment-linked policies or through partnerships with financial institutions. These options aim to broaden market reach by accommodating a wider range of financial capacities. In 2025, the trend towards accessible financial products is expected to continue, pushing companies to innovate in how they structure payments and offer value-added incentives.

Key considerations for Dai-ichi Life's discounts and financing could include:

- Premium Payment Flexibility: Offering monthly, quarterly, and annual payment options to suit diverse cash flows.

- Bundling Discounts: Incentives for purchasing multiple policy types, such as life and critical illness coverage.

- Loyalty Programs: Potential rewards or reduced premiums for long-term policyholders.

- Digital Payment Benefits: Small discounts or waived fees for opting for automated or online premium payments.

Capital Efficiency and Profitability Targets

Dai-ichi Life's pricing strategies are intricately tied to its financial objectives, particularly its targets for adjusted return on equity (ROE) and overall group profit. For instance, in fiscal year 2023, Dai-ichi Life Holdings reported an adjusted ROE of 14.2%, demonstrating a commitment to shareholder returns that informs product pricing to ensure consistent profitability.

The company actively pursues greater capital efficiency, a key consideration that influences how products are priced. This focus means that pricing decisions are not just about market competitiveness but also about optimizing the use of capital to drive sustainable long-term value creation.

- Capital Efficiency Focus: Dai-ichi Life aims to improve its capital efficiency, impacting product pricing to maximize returns on invested capital.

- Profitability Targets: Pricing is set to meet specific financial goals, such as achieving a target adjusted ROE, which was 14.2% in FY2023.

- Value Creation: Pricing strategies are designed to ensure that product offerings contribute to the company's overall sustainable profitability and value creation for stakeholders.

Dai-ichi Life's pricing reflects a dynamic balance between perceived customer value, competitive positioning, and the prevailing economic climate, particularly interest rate environments. As of mid-2024, with interest rates stabilizing but remaining elevated compared to the prior decade, the company likely adjusts premiums to incorporate these yield changes. For instance, a 14.2% adjusted ROE reported for FY2023 underscores a commitment to profitability that informs pricing decisions, ensuring products contribute to sustainable value creation.

The company offers flexible payment options and potential discounts for longer terms or product bundling, recognizing consumer preferences for accessibility. For example, in 2024, over 60% of surveyed individuals prioritized payment flexibility. These strategies are crucial for making life insurance more attainable, with pricing calibrated to meet specific financial goals and capital efficiency targets.

Dai-ichi Life's pricing strategies are intrinsically linked to its financial objectives, including targets for adjusted return on equity (ROE). The company's focus on capital efficiency directly influences how products are priced to optimize returns on invested capital. This ensures that pricing not only remains competitive but also supports the company's overall sustainable profitability and value creation for stakeholders.

| Metric | Value (FY2023) | Implication for Pricing |

|---|---|---|

| Adjusted ROE | 14.2% | Informs pricing to ensure profitability and meet shareholder return targets. |

| Market Competitiveness | Continuous analysis | Pricing adjusted to remain attractive while reflecting product value. |

| Interest Rate Environment | Elevated compared to prior decade (as of mid-2024) | Impacts investment yields, potentially leading to premium adjustments. |

4P's Marketing Mix Analysis Data Sources

Our Dai-ichi Life 4P's Marketing Mix Analysis is grounded in comprehensive data, including official financial reports, investor relations materials, and detailed industry research. We leverage information on their product portfolio, pricing strategies, distribution channels, and promotional activities to provide an accurate market overview.