Dai-ichi Life Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dai-ichi Life Bundle

Dai-ichi Life operates within a dynamic insurance landscape, where the bargaining power of buyers and the intensity of rivalry significantly shape its strategic decisions. Understanding these forces is crucial for navigating the competitive environment effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dai-ichi Life’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For Dai-ichi Life, the bargaining power of suppliers in the asset management space is a key consideration, as these entities manage substantial investment portfolios. Suppliers like external asset management firms and fund managers wield moderate to high power, particularly when offering specialized or top-performing investment strategies crucial for meeting policyholder obligations. Dai-ichi Life's own significant asset base and growing internal investment capabilities, including strategic acquisitions of asset management companies, help to counterbalance this power.

Reinsurance providers act as crucial suppliers for Dai-ichi Life, enabling the transfer of a portion of its insurance risk. This risk transfer is vital for managing capital and mitigating financial volatility. For instance, in 2023, the global reinsurance market experienced significant price increases, with property catastrophe rates rising by an average of 20-50% in some segments, demonstrating the leverage reinsurers can hold, especially during market hardening periods.

The bargaining power of these reinsurers can be substantial, particularly when dealing with complex or high-value risks. Dai-ichi Life's strategic reinsurance transaction with Protective Life Corp. in 2021, which involved transferring a block of annuity business, highlights the company's reliance on reinsurers for effective risk management and capital optimization. This reliance can shift power towards the reinsurer, especially in specialized or capacity-constrained markets.

Technology and software vendors hold significant bargaining power in the insurance sector, particularly for Dai-ichi Life, as digital transformation is essential. Companies like those providing core insurance platforms, advanced data analytics, and AI/ML solutions are critical for efficiency and customer experience.

The increasing reliance on specialized software and the high cost of switching vendors amplify their influence. For instance, the global IT spending in the insurance industry was projected to reach over $200 billion in 2024, highlighting the substantial investment in these technologies and the vendors that supply them.

Healthcare Providers and Medical Networks

For life and health insurance products, healthcare providers and medical networks act as crucial suppliers of essential services. Their bargaining power is considerable, stemming from the highly specialized nature of their offerings and their indispensable role in claims processing and the delivery of wellness programs. In 2024, the increasing focus on value-based care models and integrated health solutions means that providers are in a stronger position to negotiate terms with insurers.

Insurers like Dai-ichi Life are actively forging deeper collaborations with healthcare providers. These partnerships aim to introduce value-added services and champion preventive health initiatives, which in turn can modulate the bargaining leverage these providers hold. For instance, a provider network that demonstrably improves patient outcomes and reduces long-term healthcare costs gains more influence in negotiations.

- Specialized Services: Medical expertise and advanced treatment options are not easily replicated, giving providers significant leverage.

- Claims Processing Necessity: Insurers rely on providers for accurate and timely claims data, making cooperation essential.

- Wellness Program Integration: Providers offering comprehensive wellness and preventative care services can command better terms as insurers seek to reduce future claims.

- Value-Based Care Influence: The shift towards paying for outcomes rather than services empowers providers who can demonstrate superior results.

Distribution Channel Partners

Dai-ichi Life leverages a diverse network of distribution channel partners, including insurance brokers, financial advisors, and banks, to reach its customer base. These partners are crucial suppliers of market access, and their bargaining power can be significant.

Larger, more established partners, with their extensive client networks and broad market reach, often command greater leverage. This can translate into demands for higher commissions or more favorable terms, impacting Dai-ichi Life's profitability.

- Distribution Channel Reliance: In 2024, Dai-ichi Life continued to rely on a mix of direct sales and intermediaries, with approximately 60% of new business premiums in key markets originating from agency and bancassurance channels.

- Partner Leverage: The bargaining power of major bancassurance partners, for instance, is amplified by their ability to offer bundled financial products, potentially giving them an edge in negotiating distribution fees.

- Market Concentration: In markets where a few large financial institutions dominate the distribution landscape, their collective bargaining power increases, forcing insurers like Dai-ichi Life to carefully manage these relationships.

The bargaining power of suppliers for Dai-ichi Life is multifaceted, encompassing asset managers, reinsurers, technology vendors, healthcare providers, and distribution partners.

Suppliers of specialized investment strategies and top-tier reinsurance capacity can exert considerable influence due to their critical role in portfolio performance and risk management.

Technology providers, especially those offering essential digital transformation solutions, also hold significant leverage, amplified by high switching costs and the insurance industry's increasing IT spending, projected to exceed $200 billion in 2024.

Healthcare providers, vital for claims processing and wellness programs, gain power through value-based care models, while dominant distribution channels like bancassurance partners can negotiate favorable terms due to their extensive client networks.

| Supplier Type | Power Level | Key Factors Influencing Power |

|---|---|---|

| Asset Managers | Moderate to High | Specialized strategies, performance, portfolio size |

| Reinsurers | Substantial | Risk complexity, market capacity, price increases (e.g., 20-50% for property catastrophe in 2023) |

| Technology Vendors | Significant | Digital transformation necessity, switching costs, IT spending ($200B+ projected for insurance in 2024) |

| Healthcare Providers | Considerable | Specialized services, claims data necessity, value-based care models |

| Distribution Partners | Significant | Client networks, market reach, bancassurance leverage |

What is included in the product

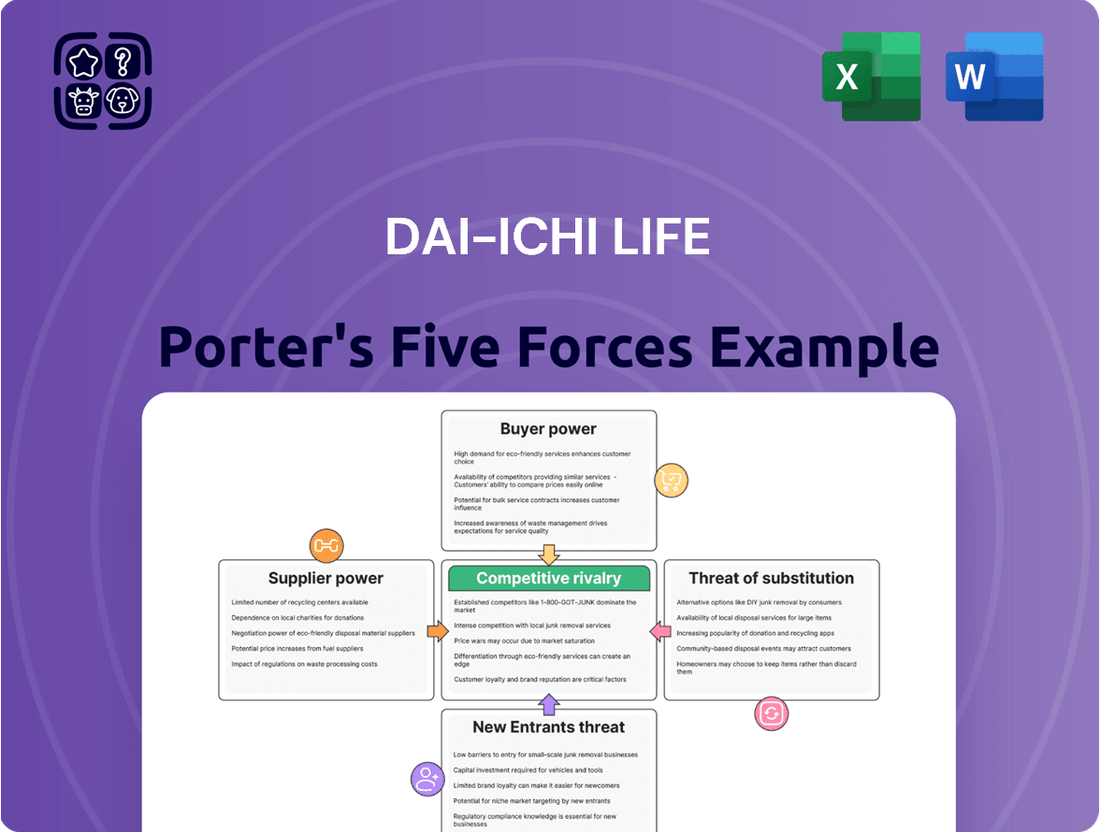

Analyzes the competitive intensity within the life insurance industry, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals, specifically for Dai-ichi Life.

Quickly identify and address competitive threats with a visual breakdown of market power, enabling proactive strategy adjustments.

Customers Bargaining Power

Individual policyholders, while a vast group, typically wield limited individual bargaining power. This is largely because many insurance products are standardized, making it difficult for a single customer to negotiate terms. The complexity involved in comparing different policies further diminishes their ability to exert significant leverage on an individual basis.

However, the collective bargaining power of these policyholders is on the rise. Increased market transparency, facilitated by online comparison tools and aggregators, allows customers to more easily switch providers. This ease of switching, coupled with a growing demand for personalized and digitally accessible insurance solutions, empowers customers to expect more and influence product development and pricing.

Corporate clients, particularly large enterprises seeking group life and employee benefits, wield significant bargaining power. These clients often procure policies in substantial volumes, possess specialized procurement teams, and can effectively negotiate terms tailored to their unique requirements and the sheer scale of their business. For instance, in 2024, the demand for comprehensive employee benefits packages remained robust, with companies actively seeking cost-effective solutions that align with their financial strategies.

Japan's aging population, with a life expectancy reaching 81.05 years for men and 87.09 years for women as of 2023, significantly increases customer bargaining power in the life insurance sector. This demographic trend fuels a strong demand for products like annuities and long-term care insurance, empowering customers to seek out specialized solutions that meet their evolving retirement and healthcare needs.

Increasing Digital Literacy and Access to Information

Customers' increasing digital literacy and readily available online information significantly boost their bargaining power. They can effortlessly compare insurance policies, features, and pricing across various providers using digital platforms and aggregators. This transparency forces companies like Dai-ichi Life to offer more competitive rates and user-friendly digital services to attract and retain clients.

This trend is evident in the growing adoption of online insurance comparison tools. For instance, in 2024, a significant percentage of insurance shoppers utilized online channels to research and compare policies before making a purchase decision. This allows them to identify the best value propositions, directly impacting insurers' pricing strategies and product development.

- Enhanced Information Access: Customers can easily access product details, customer reviews, and pricing from multiple insurers online.

- Price Sensitivity: Increased transparency leads to greater price sensitivity among consumers.

- Demand for Digital Experience: Customers expect seamless online interactions and digital policy management.

- Competitive Pressure: Insurers face pressure to differentiate through value-added services and competitive pricing.

Regulatory Environment and Consumer Protection

Regulatory bodies frequently step in to safeguard consumers, which inherently boosts their sway. Rules mandating clear product disclosures, ethical sales practices, and simplified processes for changing providers equip customers with better information and more options.

For example, in 2024, the Financial Services Agency (FSA) in Japan continued its focus on consumer protection in the insurance sector. This has led to greater transparency in foreign currency-denominated insurance products, a move that directly enhances the bargaining power of policyholders by making it easier to compare and understand complex offerings.

- Enhanced Information Access: Regulations often require insurers to provide more detailed and understandable information about policies, reducing information asymmetry.

- Facilitated Switching: Rules that simplify the process of moving between insurance providers give customers the power to switch if they find better terms or service elsewhere.

- Fair Practice Enforcement: Regulatory oversight ensures that companies adhere to fair practices, preventing predatory behavior and giving consumers confidence in their choices.

The bargaining power of customers for Dai-ichi Life is a significant factor, particularly with large corporate clients who negotiate substantial group insurance policies. Individual policyholders, while numerous, have limited individual leverage due to standardized products and complexity in comparison, though digital tools are increasing their collective power. Japan's demographic shift towards an older population also strengthens customer demand for specific products, enhancing their negotiating stance.

| Customer Segment | Bargaining Power Drivers | Impact on Dai-ichi Life |

|---|---|---|

| Individual Policyholders | Limited individual power; growing collective power via digital comparison tools. | Pressure on pricing and service innovation; need for user-friendly digital platforms. |

| Corporate Clients | High volume purchases, specialized procurement, tailored needs. | Significant negotiation leverage on pricing, coverage, and service level agreements. |

| Demographic Trends (Aging Population) | Increased demand for specific products (annuities, long-term care). | Opportunity for specialized product development; customers seek best-fit solutions. |

Full Version Awaits

Dai-ichi Life Porter's Five Forces Analysis

This preview shows the exact, comprehensive Dai-ichi Life Porter's Five Forces Analysis you'll receive immediately after purchase. You'll gain a deep understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the life insurance industry. This professionally formatted document is ready for your immediate use, offering actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The Japanese life insurance market is quite mature, meaning growth is slower, and competition is fierce among established companies. Dai-ichi Life operates within this landscape, facing strong rivalry from other major players. This concentration means that companies are constantly working to attract and retain customers.

Key competitors in this space include Nippon Life, MetLife, Japan Post Insurance, Sony Life Insurance, and Aflac Life Insurance. For instance, as of fiscal year 2023, Nippon Life reported total assets of approximately ¥76.7 trillion, showcasing its significant market presence. This dense field of major players intensifies the battle for market share, making differentiation and customer loyalty crucial for success.

Competitive rivalry within the life insurance sector, particularly for companies like Dai-ichi Life, is intensely fueled by a constant drive for product innovation and differentiation. Insurers are actively developing unique features, compelling benefits, and value-added services to capture and hold onto market share. This goes beyond simply competing on price.

For instance, the introduction of new lump-sum payment whole life insurance products or the creation of innovative wellness-linked policies are key strategies insurers employ to stand out. In 2024, the global life insurance market saw significant investment in digital transformation and personalized product offerings, reflecting this trend.

Competition among insurers like Dai-ichi Life intensely focuses on securing and optimizing various distribution channels. This includes direct sales forces, independent insurance brokers, financial advisors, and even banks acting as intermediaries.

Building and maintaining strong relationships with these channels is crucial for maximizing reach and driving sales volumes. Insurers vie for the attention and loyalty of these partners to ensure their products are effectively presented to potential customers.

In Japan, the preference for direct purchases from insurers saw a notable increase in 2024, underscoring the growing importance of direct-to-consumer strategies and the need for insurers to excel in managing these relationships alongside traditional intermediary channels.

Global Presence and International Expansion

Dai-ichi Life, like its major Japanese insurance peers, is actively pursuing global expansion to counter slower growth in its home market. This outward push means increased competition not just locally but across international arenas. Companies are vying for customers and market share through various channels, including setting up new subsidiaries, partnering with existing firms, and acquiring businesses. For instance, Dai-ichi Life's acquisition of Protective Life in the United States for $5.7 billion in 2015 significantly bolstered its North American presence and intensified rivalry in that key market.

The competitive landscape is further shaped by how these insurers establish their international footprint. This includes:

- Strategic Acquisitions: Purchasing existing insurers to gain immediate market access and customer bases.

- Joint Ventures and Affiliations: Partnering with local entities to navigate regulatory environments and leverage local expertise.

- Organic Growth: Establishing new subsidiaries and branches to build market presence from the ground up.

This global reach means Dai-ichi Life is not just competing with other Japanese giants like Tokio Marine and MS&AD Insurance Group on the international stage, but also with established global players in each target market. The drive for diversification and revenue growth fuels aggressive strategies, making cross-border competition a defining characteristic of the industry.

Technological Adoption and Digital Transformation

The insurance industry is seeing intense competition driven by rapid technological adoption and digital transformation. Companies are racing to implement AI, advanced data analytics, and user-friendly digital platforms. This focus aims to significantly improve customer experiences, make internal operations more efficient, and develop highly personalized insurance products. For example, in 2024, many insurers are investing heavily in AI-powered chatbots for customer service, with some reporting a significant reduction in response times.

This digital race is fundamentally reshaping how insurers compete. Those that successfully integrate these technologies can offer more competitive pricing, faster claims processing, and more engaging customer interactions. The ability to leverage data effectively for risk assessment and product development is becoming a critical differentiator. By mid-2024, a notable trend is the rise of insurtech startups challenging established players with innovative digital-first solutions.

- AI in Customer Service: Many insurers are deploying AI chatbots, with some reporting up to a 30% improvement in customer query resolution speed in early 2024 trials.

- Data Analytics for Personalization: Advanced analytics are being used to tailor policies, with companies seeing a 15% increase in customer retention for personalized offerings in Q1 2024.

- Digital Platform Investment: A survey of major insurance firms in late 2023 indicated an average increase of 20% in IT spending dedicated to digital transformation initiatives for 2024.

- Insurtech Disruption: The market share of insurtech companies, though still growing, is forcing traditional insurers to accelerate their own digital strategies to remain competitive.

Dai-ichi Life faces intense competition from established domestic and international insurers, with rivals like Nippon Life and MetLife actively vying for market share. This rivalry is characterized by a strong emphasis on product innovation, such as wellness-linked policies, and a strategic focus on optimizing diverse distribution channels, including direct sales and independent brokers.

The drive for global expansion further intensifies this rivalry, as companies like Dai-ichi Life compete not only in Japan but also in international markets through acquisitions and organic growth. Technological adoption, particularly AI and advanced data analytics, is a key battleground, with insurers investing heavily in digital platforms to enhance customer experience and operational efficiency.

In 2024, the life insurance sector saw a significant push towards digital-first solutions and personalized offerings, forcing traditional players to accelerate their innovation cycles to remain competitive. This intense rivalry necessitates continuous adaptation and strategic investment to maintain and grow market presence.

SSubstitutes Threaten

Individuals and corporations often consider direct investments in financial markets, like stocks and bonds, or traditional savings accounts as viable alternatives to life insurance and annuity products. The appeal of these substitutes hinges significantly on prevailing interest rates and overall market performance.

When interest rates climb, as they have in the United States, it can create a situation where consumers are more inclined to move funds out of annuities, a phenomenon sometimes referred to as a 'run on annuities.' Simultaneously, higher rates make direct savings vehicles more attractive, presenting a competitive challenge to insurers.

Government social security programs, including pensions and healthcare, act as a significant substitute for private insurance offerings. These public systems provide a foundational safety net, potentially diminishing the demand for comparable private products. For instance, Japan's robust public healthcare system, which covered approximately 73% of medical expenses in 2023 according to the Ministry of Health, Labour and Welfare, directly substitutes for private health insurance.

Large corporations increasingly explore self-insurance or establishing captive insurance companies as a direct substitute for traditional insurance policies. This strategy allows them to retain risk, particularly for predictable or manageable liabilities, potentially leading to significant cost savings. For instance, in 2024, a growing number of Fortune 500 companies were actively evaluating or implementing captive insurance solutions to manage their escalating insurance premiums, which had seen an average increase of 8-15% across various sectors by late 2023.

Alternative Financial Products and Services

The threat of substitutes for Dai-ichi Life is significant, as a wide array of alternative financial products and services can fulfill similar customer needs. Wealth management services, for instance, offered by banks and independent advisors, directly compete with life insurance products for a share of consumer savings and investment dollars. In 2024, the global wealth management market was projected to reach over $50 trillion, highlighting the substantial competition.

Retirement planning products from non-insurance entities, such as mutual funds, exchange-traded funds (ETFs), and pension plans managed by asset management firms, also present a strong substitute. These options often provide flexibility and potentially higher returns, drawing customers away from traditional annuity and life insurance-based retirement solutions. The ETF market alone saw significant inflows in 2024, with global assets under management in ETFs approaching $10 trillion.

Emerging fintech solutions, including embedded insurance and peer-to-peer lending platforms, further diversify the competitive landscape. These innovations offer convenient, often digital-first alternatives that can bypass traditional insurance channels, catering to evolving consumer preferences for speed and simplicity. Embedded finance, a rapidly growing sector, saw its market size expand considerably in 2024, with projections indicating continued strong growth as more non-financial companies integrate financial services into their offerings.

- Wealth Management Services: Global wealth management market size projected to exceed $50 trillion in 2024.

- Retirement Planning Alternatives: Global ETF assets under management approaching $10 trillion in 2024.

- Fintech Innovations: Rapid growth in embedded finance, offering digital-first alternatives to traditional insurance.

- Customer Needs: Substitutes address similar financial planning, investment, and protection needs as life insurance.

Changing Consumer Preferences and Lifestyle Choices

Shifting consumer preferences, particularly a move towards shorter-term financial commitments and subscription-based services, can significantly impact demand for traditional life insurance. For instance, a growing segment of younger consumers may prioritize immediate financial needs over long-term planning, making them less receptive to conventional, long-duration policies. This trend, observed across various consumer markets, indicates a potential threat to insurers if they fail to adapt their product offerings.

The focus on immediate gratification over long-term financial planning is another powerful driver of this threat. As consumers increasingly seek instant rewards, the appeal of life insurance, which offers benefits far in the future, may diminish. This necessitates insurers to innovate by offering more flexible and adaptable products that align with these evolving consumer behaviors and expectations.

In 2024, the demand for flexible financial solutions continued to rise. Data from industry reports indicated that over 60% of consumers surveyed expressed a preference for financial products with adjustable terms. This suggests a clear market signal for life insurers to explore innovative product designs.

- Changing Consumer Preferences: A notable shift towards shorter-term financial commitments and subscription models is evident.

- Lifestyle Choices: Increased focus on immediate gratification over long-term financial planning impacts demand for traditional life insurance.

- Market Data (2024): Over 60% of consumers surveyed showed a preference for financial products with adjustable terms.

- Insurer Response: A critical need for innovation to offer more flexible and adaptable life insurance products.

The threat of substitutes for Dai-ichi Life is substantial, with direct investments in financial markets like stocks and bonds, as well as traditional savings accounts, offering compelling alternatives. When interest rates rise, as seen in the US, consumers may shift funds from annuities to more attractive savings vehicles, impacting insurers. Furthermore, government social security programs, such as pensions and healthcare, provide a baseline safety net that can reduce demand for private insurance. For example, Japan's public healthcare covered about 73% of medical expenses in 2023, directly substituting for private health insurance.

Large corporations are increasingly turning to self-insurance or captive insurance companies to manage risks and potentially save costs, bypassing traditional policies. In 2024, many Fortune 500 companies were exploring these options to counter rising insurance premiums, which had seen an average increase of 8-15% by late 2023. The wealth management sector, projected to exceed $50 trillion in 2024, and retirement planning alternatives like ETFs, with nearly $10 trillion in assets under management in 2024, also present significant competition by offering flexibility and potentially higher returns.

Emerging fintech solutions, including embedded insurance and peer-to-peer lending, offer convenient, digital-first alternatives that bypass traditional insurance channels. This diversification caters to evolving consumer preferences for speed and simplicity. As consumers increasingly favor shorter-term financial commitments and immediate gratification over long-term planning, traditional life insurance faces challenges. In 2024, over 60% of consumers surveyed preferred financial products with adjustable terms, signaling a need for insurers to innovate with more flexible offerings.

| Substitute Category | Example | Market Size/Growth (2023-2024 Data) | Impact on Dai-ichi Life |

|---|---|---|---|

| Direct Financial Investments | Stocks, Bonds, Savings Accounts | US interest rates saw increases throughout 2023-2024. | Attracts consumer savings away from insurance products. |

| Government Programs | Public Healthcare, Social Security | Japan's public healthcare covered ~73% of medical expenses in 2023. | Reduces the need for private insurance for basic needs. |

| Corporate Risk Management | Self-Insurance, Captive Insurance | Average insurance premium increases of 8-15% by late 2023. | Corporations may reduce reliance on external insurers. |

| Wealth Management | Investment Advisory Services | Global wealth management market projected >$50 trillion in 2024. | Competes for consumer savings and investment capital. |

| Retirement Alternatives | ETFs, Mutual Funds | Global ETF assets under management approaching $10 trillion in 2024. | Offers flexible and potentially higher-return retirement solutions. |

| Fintech Innovations | Embedded Insurance, P2P Lending | Embedded finance market showing rapid growth in 2024. | Provides convenient, digital-first alternatives. |

Entrants Threaten

The life insurance sector, including companies like Dai-ichi Life, faces significant barriers to entry due to substantial capital requirements. Operating an insurance business necessitates considerable financial reserves to meet policyholder obligations and comply with solvency regulations. For instance, in 2024, regulatory capital requirements for insurers remain robust, demanding substantial upfront investment.

Furthermore, stringent regulatory hurdles present a formidable challenge for potential new entrants. The industry is overseen by numerous government agencies that enforce strict rules regarding product development, sales practices, and financial management. The upcoming implementation of International Insurance Capital Standards (ICS) in 2025 will likely further elevate these capital demands, making it even more difficult for new companies to establish a foothold and compete effectively with established players like Dai-ichi Life.

Established insurers like Dai-ichi Life benefit from strong brand recognition and deep-seated customer trust, which new entrants find challenging to replicate. In 2024, for instance, Dai-ichi Life's robust reputation, built over decades, continues to be a significant barrier. Building this trust and brand loyalty in the sensitive life insurance sector requires substantial time and investment, making it difficult for newcomers to quickly capture market share.

For Dai-ichi Life, the threat of new entrants is significantly shaped by the immense challenge of building a comparable distribution network. Insurance companies rely heavily on agents, brokers, and increasingly, digital platforms to reach customers. Existing players, like Dai-ichi Life, have cultivated these networks over many years, creating a substantial barrier for newcomers.

Consider the sheer scale: in 2024, the global insurance market is valued in the trillions, and establishing a presence requires significant investment in sales force training, technology, and marketing to even begin competing with established distribution channels. For instance, building a direct sales force comparable to Dai-ichi Life's existing infrastructure would likely cost hundreds of millions of dollars, a prohibitive sum for most startups.

Data and Analytics Capabilities

Incumbent insurers like Dai-ichi Life hold a significant advantage due to their extensive historical data. This data, accumulated over years of policyholder interactions, risk assessments, and claims processing, is crucial for precise underwriting and competitive pricing. For instance, in 2024, major insurers continued to leverage advanced analytics on these vast datasets to refine risk models and personalize product offerings.

New entrants face a substantial hurdle in replicating this depth of data and analytical sophistication. Building comparable data infrastructure and expertise requires considerable investment and time, making it difficult for newcomers to match the incumbents’ ability to accurately assess and price risk from day one. This data moat is a key barrier to entry.

The threat of new entrants is therefore moderated by the significant upfront investment required to develop robust data and analytics capabilities. Without this, new players would struggle to compete on pricing and risk management, areas where established firms have a clear, data-driven edge.

- Data Accumulation: Incumbents benefit from decades of policyholder data, enabling sophisticated risk modeling.

- Analytical Sophistication: Advanced analytics on this data allow for more accurate underwriting and pricing strategies.

- New Entrant Challenge: Newcomers must invest heavily and rapidly to build comparable data and analytics infrastructure.

- Competitive Disadvantage: Lack of historical data and analytical prowess puts new entrants at a significant disadvantage in pricing and risk assessment.

Technological Innovation by Fintech and Insurtechs

While significant capital investment and stringent regulatory frameworks typically act as strong deterrents for new entrants in the insurance sector, the rapid pace of technological innovation driven by fintech and insurtech companies presents a notable threat. These nimble players are adept at utilizing digital channels, artificial intelligence, and innovative distribution models, such as embedded insurance, to carve out specific market niches.

These advancements allow new entrants to offer specialized products and optimize operational efficiencies, potentially lowering the traditional barriers to entry in certain segments of the insurance market. For instance, by mid-2024, the global insurtech market was projected to reach over $11 billion, demonstrating the significant growth and disruptive potential of these technology-focused firms. Their ability to streamline customer journeys and provide personalized offerings challenges incumbent insurers like Dai-ichi Life to adapt quickly.

- Technological Disruption: Fintech and insurtech firms leverage digital platforms and AI to create more efficient and customer-centric insurance solutions.

- Niche Market Penetration: These entrants often focus on underserved or specialized market segments, offering tailored products that traditional insurers may overlook.

- Lowered Entry Barriers: Digitalization and agile business models can reduce the capital and operational overheads traditionally associated with entering the insurance industry.

- Embedded Insurance Growth: The integration of insurance into non-insurance products and services, facilitated by technology, opens new distribution avenues for new players.

The threat of new entrants for Dai-ichi Life remains relatively low due to significant capital requirements and extensive regulatory compliance, demanding substantial upfront investment for new players. For example, in 2024, solvency capital requirements for life insurers continued to be stringent, necessitating robust financial reserves to meet policyholder obligations and regulatory mandates.

Furthermore, the established brand loyalty and trust that Dai-ichi Life has cultivated over decades present a formidable barrier. Building similar customer confidence in the sensitive life insurance market requires considerable time and investment, making it difficult for newcomers to quickly gain market share.

New entrants also face the challenge of replicating Dai-ichi Life's well-established distribution networks, which include agents, brokers, and digital platforms, a process that demands significant investment in training and technology.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Substantial financial reserves needed for solvency and regulatory compliance. | High upfront investment, limiting the number of potential entrants. |

| Regulatory Hurdles | Strict government oversight on product development, sales, and financial management. | Complex and costly compliance procedures. |

| Brand Recognition & Trust | Decades of operation build customer loyalty and confidence. | Difficult for new firms to establish credibility and attract customers. |

| Distribution Networks | Extensive established networks of agents, brokers, and digital channels. | Challenging and costly to build comparable reach. |

| Historical Data & Analytics | Accumulated data for sophisticated risk assessment and pricing. | New entrants lack the data sophistication for competitive underwriting. |

Porter's Five Forces Analysis Data Sources

Our Dai-ichi Life Porter's Five Forces analysis leverages data from Dai-ichi Life's annual reports, investor presentations, and financial filings, supplemented by industry-specific market research and reports from financial data providers like Bloomberg and S&P Capital IQ.